Board Recommends that Shareholders REJECT the

Hostile Bid and TO NOT TENDER THEIR SHARES

All dollar figures are in USD, except share prices noted as “C$”

which are in CAD.

Sierra Metals Inc. (TSX: SMT | OTCQX: SMTSF | BVL: SMT)

(“Sierra” or the “Company”) today announced that its Board of

Directors (the “Board”), following careful consideration and

receipt of the unanimous recommendation of a special committee of

its independent directors (the "Special Committee"), and after

consultation with its financial and legal advisors, has recommended

that Sierra shareholders reject the unsolicited all-cash take-over

bid by an affiliate of Alpayana S.A.C. (“Alpayana”), to acquire all

of the issued and outstanding common shares (“Common Shares”) of

Sierra for C$0.85 per share (the "Hostile Bid").

The Board unanimously recommends that Sierra shareholders

REJECT the Hostile Bid and not tender their Common Shares to

the Hostile Bid. Shareholders simply need to TAKE NO ACTION

in order to REJECT the Hostile Bid.

Miguel Aramburu, Chair of the Board, commented:

“Alpayana is offering to buy your Common Shares at a price that

undervalues the Company and is well below where prior transactions

of a similar nature have transacted. At a time of growing worldwide

demand for copper, Sierra owns two thriving copper-producing mines

in proven jurisdictions. The Company has increased production

significantly at both of the Yauricocha and Bolivar mines and

expects to continue to grow mineral resources and production in

2025. As a result, the Company is positioned to deliver

improvements in its operational results and create meaningful

shareholder value by a significant expected increase in

EBITDA.”

Significant Expected EBITDA Increase in 2025

The Company has introduced a projection of approximately US$130

million of EBITDA1 in 2025, as described in the Director’s Circular

(as defined herein). This represents significant year-over-year

growth in EBITDA from US$72 million in 2024 (expected) and US$50

million in 20232, representing an approximate 80% increase relative

to 2024 (expected) EBITDA and an approximate 158% increase relative

to 2023 EBITDA. This increase is expected to be driven by increased

production at both Yauricocha and Bolivar and careful management of

costs. While the Company does not typically provide EBITDA

guidance, the Board determined that the information is essential to

shareholders in the unique circumstances of the Hostile Bid. The

EBITDA projection provides support for the Board’s recommendation

to reject the Hostile Bid.

Mr. Aramburu continued, “The Board’s view is that selling your

shares at the low price offered by Alpayana would deprive you of

significant upside potential in your investment. One need not look

further than the collective view of greater than fifty percent of

Sierra’s shareholders who have informed the Company that they are

aligned with the view of the Board.”

Reasons to Reject Alpayana’s Inadequate Hostile Bid

The basis for the Board's recommendation that shareholders

reject the Hostile Bid is set forth in the Sierra Directors'

Circular (the “Directors’ Circular”), which was filed today with

Canadian securities regulatory authorities, is being mailed to

shareholders, and is available on the Company's website and SEDAR+

(www.sedarplus.ca) under the Company’s profile. The reasons for the

Board's recommendation include, among other things, the

following:

- The Hostile Bid is dead on

arrival.

The Hostile Bid has already been rejected by a majority of

shareholders, rendering the bid incapable of completion based on

its non-waivable condition.

As announced by the Company on December 26, 2024, shareholders

holding cumulatively more than 50% of the outstanding Common Shares

have each informed the Company that the proposed C$0.85 per Common

Share bid price is inadequate and that they do not intend to

support the Hostile Bid. Accordingly, Sierra believes that Alpayana

will not be able to satisfy the minimum tender condition to acquire

control of the Company.

- The Hostile Bid attributes no value to

commodity and jurisdiction upside.

The Hostile Bid fails to recognize the strategic value of a

copper producing company operating in proven mining

jurisdictions.

The price of copper has been increasing due to global demand and

tight supply conditions. With new copper supply constrained by the

challenges of developing new mines, there has been an increase in

valuations of copper-focused equities as well as proposed mergers

and acquisitions. Mexico and Peru, where Sierra operates, are both

globally established mining jurisdictions hosting some of world’s

largest producing metals deposits. As one of the Western world’s

few publicly traded copper producers operating in proven

jurisdictions, Sierra is a highly strategic and coveted company in

which to hold equity.

- Shareholders should continue to

capture the growth at Sierra.

Sierra has a high-quality portfolio of assets with

significant upside potential.

Sierra’s two copper producing assets, the Yauricocha mine in

Peru and the Bolivar mine in Mexico, both contain significant near

mine, brownfield and greenfield exploration potential that could be

leveraged to drive significant long-term value for the Company. At

Yauricocha, the Company obtained the permit to mine below level

1120 where 95% of the mine’s current mineral reserves sit, allowing

the mine to operate at full capacity (currently 3,600 tonnes per

day (“tpd”)) since Q4 2024. The Company believes there is

significant exploration opportunity below level 1120 as the geology

appears open in all directions. Sierra is also confident in its

exploration efforts at Bolivar and its ability to deliver

additional resources to support the Company’s plan to increase

production capacity from 5,000 tpd to 7,500 tpd in the

mid-term.

- Sierra’s plan to create value is

working, Shareholders should keep the upside.

The Hostile Bid is opportunistic and clearly timed to deprive

Sierra shareholders of a potential near-term uplift in the share

price.

In the two years since current management was appointed, Sierra

has successfully stabilized, optimized and improved its operations,

resulting in a lower cost structure, increased efficiencies, higher

production levels and profitability across the Company. The Board

believes there is an opportunity for significant share price

appreciation in 2025 based on the projected EBITDA growth. Applying

the Company’s existing EV / LTM EBITDA3 multiple of 3.6x to the

CIBC Capital Market’s 2025 EBITDA estimate of US$130 million would

imply an increase of 200% in share price at the end of next year,

and an opportunity for further appreciation as Sierra approaches a

valuation multiple more closely aligned with industry averages.

Alpayana’s C$0.85 per Common Share bid is opportunistically timed

to deprive shareholders of this potential near-term uplift in the

share price and falls short of the value creation the Board expects

to see in the near term.

- Shareholders should ignore the

misleading statements and enjoy the fruits of fiscal

prudence.

Contrary to Alpayana’s assertion on Sierra’s financial

position, the Company has a manageable debt load and is well

positioned to de-lever in the near-term.

Sierra’s current debt financing has served its purpose by

providing the Company with the time and financial flexibility it

required to turn around its operations when management took over

just two years ago. Management took actions to improve the debt

profile in 2024 through a new credit agreement with enhanced

financing terms that also provided US$20 million of capital

deployed towards operational improvements at Yauricocha. The

Company is now positioned to generate meaningful free cash flow in

2025. The Company’s anticipated net debt / 2025E EBITDA ratio4 of

0.6x is already below the industry median of 0.8x5. In 2025 it is

anticipated that free cash flow (operating cash flow less capital

expenditures) will exceed net debt, providing Sierra with the cash

it will need to quickly re-pay debt should it so choose. Sierra

continues to believe that it has used leverage constructively to

enhance the returns of shareholders and will aim to continue

effectively deploying leverage to amplify returns for shareholders

in the future. In addition, given the Company’s improved financial

performance, the Company intends to pursue opportunities to

refinance its debt on more favorable terms in the near future.

- Alpayana has not made a serious offer

to Sierra shareholders.

The Hostile Bid is significantly below implied premiums of

precedent transactions.

The Board believes that any change of control transaction should

compensate Sierra’s shareholders for the loss of exposure to the

future earnings potential of its asset base, while also reflecting

the relative undervaluation of the Sierra share price prior to the

Hostile Bid announcement. The Hostile Bid price of C$0.85 per

Common Share would represent one of the lowest 1-day and 30-day

volume-weighted average price premiums in the comparable universe

of successful copper-focused corporate transactions since 2011.

Furthermore, the price of the Common Shares has been negatively

affected by persistent selling by funds controlled by Arias

Resource Capital (“Arias”), a significant shareholder that had its

principal voted off the Board and subsequently lost a proxy battle

in 2023. Over the past year, sales of Common Shares by Arias

represent on average, 15% of total Canadian trading volume. The

overhang created by the selling pressure renders the unaffected

share price of C$0.77 not reflective of an appropriate basis to

which a take-over premium should be referenced.

- Sierra should not be sold at markdown

prices while it continues to grow.

The Hostile Bid is significantly below implied multiples of

precedent base metal transactions.

The Hostile Bid price of C$0.85 per Common Share implies a price

to net asset value6 (“P/NAV”) of 0.69x and an enterprise value to

2025E EBITDA ratio7 (“EV/EBITDA”) of 1.9x. Precedent producing

copper asset and corporate deals8 have transacted at a median P/NAV

multiple of 0.9x, and a median EV/EBITDA multiple of 5.9x.

Contested corporate-level transactions9 have been executed at a

significantly higher range, with medians of 1.1x P/NAV and 7.1x

EV/EBITDA. Applying the median EV/EBITDA multiple of 5.9x from

precedent transactions implies a valuation of C$4.34 per Common

Share for Sierra, which is over 400% higher than the Hostile Bid

price.

- Every alternative to the Hostile Bid

promises better value to shareholders.

The standalone case has strong upside potential for

shareholders and superior offers or other alternatives have the

potential to emerge.

The Board, consistent with its fiduciary duties, continuously

reviews and evaluates potential strategic alternatives to maximize

shareholders’ value. While the Board believes in the Company’s

stand-alone plan and the strength of its long-term strategy, the

Board acknowledges that the Hostile Bid may act as a catalyst to

uncover additional opportunities or interested parties. Sierra has

engaged BMO Capital Markets as its financial adviser to manage a

broader strategic review process for Sierra aimed at exploring and

considering potential strategic alternative transactions to the

Hostile Bid. Should a superior proposal or alternative transactions

arise, the Board is fully prepared to evaluate these options and

present them transparently to shareholders.

- Do not give away an asset for pennies

when it is worth dollars.

Independent Equity Research has agreed with the Board’s

assessment that the Hostile Bid is opportunistic and undervalues

the Company.

CIBC Capital Markets provided10 periodic, independent, equity

research coverage on Sierra. In a recent note titled “Unsolicited

Takeover Bid Is Undervalued” dated December 17, 2024 and in

response to the Alpayana proposal, analyst Bryce Adams expressed

the view that “the offer price undervalues the company, at a time

when the company has reported improved production results

highlighted by 3,600 tpd throughput rates at Yauricocha in Q4/24

QTD.”

- Shareholders should not grant free

cash flows to Alpayana.

Alpayana has a strong strategic imperative to secure

Yauricocha for itself and ample ability to pay a significantly

higher purchase price if it so chooses.

The acquisition of Sierra would be a large and transformative

acquisition for Alpayana, a family-owned Peruvian mining company

which has recently embarked on an M&A program to facilitate its

growth ambitions. Alpayana would benefit significantly from

operational synergies and drastically accelerate its growth plans

if it were to acquire Yauricocha. At the Hostile Bid price of

C$0.85, Alpayana would generate an exceptionally high internal rate

of return, an indication that Sierra shareholders are not being

afforded fair value for their Common Shares.

- The Hostile Bid is a free option to

Alpayana with unsatisfiable conditions.

The Hostile Bid contains extraordinary conditionality,

including certain conditions which cannot be satisfied. This calls

into question the seriousness and legitimacy of the Hostile

Bid.

The Hostile Bid contains a significant number of conditions (20)

which must be satisfied or waived before Alpayana is obligated to

take up and pay for any Common Shares tendered. Many of the

conditions are not subject to materiality thresholds or

reasonableness standards or any other objective criteria, but

rather are in Alpayana's sole discretion. Further, certain

conditions of the Hostile Bid, including a minimum tender of

two-thirds of the outstanding Common Shares and there being no

shareholder rights plan adopted by Sierra, cannot be satisfied. As

a result, tendering Common Shares to the Hostile Bid may, in

effect, constitute the grant to Alpayana of a unilateral and

discretionary option to acquire all of the Common Shares at a price

that the Board views as inadequate.

- The Hostile Bid is financially

inadequate.

Sierra has received an inadequacy opinion from BMO Capital

Markets that from a financial point of view the Hostile Bid is not

an adequate offer for shareholders.

Sierra’s financial advisor, BMO Capital Markets has delivered an

opinion to the Board and the Special Committee, to the effect that,

as of the date of the opinion, and based upon and subject to the

assumptions, limitations and qualifications contained therein and

such other matters as BMO Capital Markets considered relevant, the

consideration offered to the shareholders pursuant to the Hostile

Bid is inadequate from a financial point of view to the

shareholders (other than Alpayana and its affiliates).

Take No Action and Reject Alpayana's Hostile Bid

Sierra shareholders are urged to REJECT the Hostile Bid. To do

so, shareholders should TAKE NO ACTION.

Shareholders are encouraged to carefully review the Directors'

Circular in its entirety. This document has been mailed to Sierra

shareholders and is available on SEDAR+ (www.sedarplus.ca) under

the Company’s profile, and on the Company's website

(www.SierraMetals.com).

Sierra shareholders who have already tendered their Common

Shares to the Hostile Bid and who wish to obtain assistance in

withdrawing them are urged to contact their broker or Carson Proxy

Advisors, Sierra’s Information Agent and strategic shareholder

advisor, by North American toll-free phone at 1-800-530-5189, local

and text: 416-751-2066 or by email at info@carsonproxy.com.

Advisors

The Company has engaged BMO Capital Markets as financial

advisor, Mintz LLP as Canadian legal counsel, Miranda & Amado

Law Firm as Peruvian legal counsel, Carson Proxy Advisors as

securityholder communications advisor, and Oakstrom as media

relations advisor. The Special Committee of independent directors

of the Board has engaged Bennett Jones LLP as legal advisor.

Qualified Persons Statement

Ricardo Salazar Milla (AIG #8551), Corporate Manager – Mineral

Resources of Sierra, is a Qualified Person as defined under

National Instrument NI 43-101 - Standards of Disclosure for Mineral

Projects. Mr. Salazar has reviewed and approved the scientific and

technical content of this news release.

About Sierra Metals Inc.

Sierra Metals Inc. is a Canadian mining company focused on

copper production with additional base and precious metals

by-product credits at its Yauricocha Mine in Peru and Bolivar Mine

in Mexico. The Company is intent on safely increasing production

volume and growing mineral resources. Sierra has recently had

several new key discoveries and still has many more exciting

brownfield exploration opportunities in Peru and Mexico that are

within close proximity to the existing mines. Additionally, the

Company has large land packages at each of its mines with several

prospective regional targets providing longer-term exploration

upside and mineral resource growth potential.

Forward-Looking Statements

This news release contains forward-looking information within

the meaning of Canadian securities legislation. Forward-looking

information relates to future events or the anticipated performance

of Sierra and reflect management's expectations or beliefs

regarding such future events and anticipated performance based on

an assumed set of economic conditions and courses of action. In

certain cases, statements that contain forward-looking information

can be identified by the use of words such as "plans", "expects",

"is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", "believes" or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might", or "will be taken", "occur" or

"be achieved" or the negative of these words or comparable

terminology. Forward-looking information in this news release

includes, without limitation, statements regarding: the strategic

value of Sierra’s portfolio; management's expectations regarding

the Company's future share price, production and growth;

management's expectations regarding future EBITDA; future demand

for copper; growth of mineral resources; expectations regarding

future cash flows; maintenance of production at full capacity in

2025; the ability to manage costs; the exploration potential of the

Company's properties; the intention of holders of more than 50% of

the Common Shares not tendering to the Hostile Bid; expectations

regarding debt repayment and capital expenditures; the ability to

refinance existing debt on more favourable terms; the ability to

complete potential strategic alternatives to maximize shareholder

value and the timing thereof; and statements regarding Alpayana and

the Hostile Bid. By its very nature forward-looking information

involves known and unknown risks, uncertainties and other factors

that may cause actual performance of Sierra to be materially

different from any anticipated performance expressed or implied by

such forward-looking information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks described under the heading "Risk

Factors" in the Company's annual information form dated March 15,

2024 for its fiscal year ended December 31, 2023 and other risks

identified in the Company's filings with Canadian securities

regulators, which are available at www.sedarplus.ca.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company's actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company's statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

Non-IFRS Performance Measures

Certain financial measures and ratios within this news release

including "EBITDA", "free cash flow", "net asset value (NAV)",

"IRR", "enterprise value to last twelve months EBITDA", "net debt

to EBITDA", "P/NAV" and "EV/EBITDA" are not measures or ratios

recognized by International Financial Reporting Standards, as

issued by the International Accounting Standards Board ("IFRS").

The non-IFRS measures and ratios presented do not have any

standardized meaning prescribed by IFRS and are therefore unlikely

to be directly comparable to similar measures or ratios presented

by other issuers. EBITDA is a non-IFRS measure that represents an

indication of the Company’s continuing capacity to generate

earnings from operations before taking into account management’s

financing decisions and costs of consuming capital assets, which

vary according to their vintage, technological currency, and

management’s estimate of their useful life. EBITDA comprises

revenue less operating expenses before interest expense (income),

property, plant and equipment amortization and depletion, and

income taxes (and in the case of 2024, 2023 and 2022, excludes the

Cusi Mine which was placed on care and maintenance and subsequently

sold by the Company). Adjusted EBITDA is calculated as net income,

adding back interest, taxes, depreciation, and amortization, and

excluding non-recurring, non-operational or non-cash items, which

the Company believes is useful for investors to assess a company’s

core operational performance without the impact of the capital

structure, tax regime, or non-operational items. Free cash flow is

calculated as operating cash flow minus capital expenditures, which

the Company believes is a useful measure to show how much cash is

available after reinvesting in the business, providing insight into

other capital allocation priorities. Net asset value (NAV) is

calculated as the net present value of future cash flows,

discounted at an appropriate discount rate minus liabilities, which

is a key valuation metric in mining as it is a proxy for intrinsic

value of reserves and resources. Internal Rate of Return (IRR) is

the discount rate that sets the net present value of all cash flows

from an investment to zero, which the Company believes is a useful

measure of profitability of a project, expressed as an annualized

percentage return. Enterprise Value to adjusted EBITDA is

calculated as enterprise value (market capitalization plus net debt

plus minority interest plus preferred equity less cash and cash

equivalents) divided by adjusted EBITDA and measures a company’s

enterprise value relative to its operational profitability. Net

debt to adjusted EBITDA is calculated as total debt minus cash and

cash equivalents divided by adjusted EBITDA and indicates a

company’s leverage and its capacity to service debt using

operational cash flow. Free cash flow / net debt is calculated as

free cash flow divided by debt minus cash and cash equivalents and

shows how efficiently a company generates cash relative to its debt

obligations. Price to Net Asset Value (P/NAV) is calculated as a

company’s market capitalization divided by its Net Asset Value and

helps investors assess whether a company is trading at a premium or

discount relative to its underlying asset value. Investors are

cautioned that non-IFRS financial measures and ratios should not be

construed as alternatives to other measures of financial

performance calculated in accordance with IFRS. The foregoing

non-IFRS financial measures and ratios are provided to assist

investors with their evaluation of Sierra. Management considers

these non-IFRS financial measures to be important indicators in

assessing its performance. See the "Non-IFRS Performance Measures"

section in Sierra's management's discussion and analysis for the

three and nine months ended September 30, 2024 for further

information on the definition, calculation and reconciliation of

certain non-IFRS financial measures.

Financial Outlook

This news release contains financial outlooks about Sierra's

prospective results of operations including, without limitation,

anticipated EBITDA for the 12 months ended December 31, 2024 and

December 31, 2025, which are subject to the same assumptions, risk

factors, limitations, and qualifications as set forth under

"Forward-Looking Statements" above. Readers are cautioned that the

assumptions used in the preparation of such financial outlooks,

although considered reasonable at the time of preparation, may

prove to be imprecise and, as such, undue reliance should not be

placed on financial outlooks. Sierra's actual results, performance

or achievement could differ materially from those expressed in, or

implied by, these financial outlooks. Sierra has included the

financial outlooks in order to provide readers with a more complete

perspective on Sierra's future operations and such information may

not be appropriate for other purposes. Sierra and the Board

disclaim any intention or obligation to update or revise any

financial outlooks, whether as a result of new information, future

events or otherwise, except as required by law.

Third Party Information

This press release includes market and industry data that has

been obtained from third party sources, including industry

publications. The Company believes that the industry data is

accurate and that its estimates and assumptions are reasonable, but

there is no assurance as to the accuracy or completeness of this

data. Third party sources generally state that the information

contained therein has been obtained from sources believed to be

reliable, but there is no assurance as to the accuracy or

completeness of included information. Although the data is believed

to be reliable, the Company has not independently verified any of

the data from third party sources referred to in this press release

or ascertained the underlying economic assumptions relied upon by

such sources. This press release has quoted from a publicly

available analyst report of CIBC Capital Markets. Such analyst has

not consented to the inclusion of all or any portion of its report

in this document. CIBC Capital Markets, the firm employing such

analyst, was not an advisor to Sierra as at the date of such

analyst report.

1 This is a non-IFRS performance measure and based on the

following consensus pricing: 2025 (US$4.34 / lb Cu, US$0.95 / lb

Pb, US$1.25 / lb Zn, US$31.14 / oz Ag, US$2,600 / oz Au). Please

refer to "Non-IFRS Financial Measures" and "Financial Outlook".

2 Reflects EBITDA from continuing operations and excludes the

Cusi Mine which was placed on care and maintenance and subsequently

sold by the Company.

3 This is a non-IFRS performance measure. Please refer to

"Non-IFRS Financial Measures" and "Financial Outlook".

4 This is a non-IFRS performance measure. Please refer to

"Non-IFRS Financial Measures" and "Financial Outlook".

5 Trading peers include 29 Metals, Adriatic, Aeris, Atalaya,

Buenaventura, Capstone, Centerra, Ero, Hudbay, Lundin, MAC, Nexa,

Sandfire and Taseko as at January 7, 2025.

6 This is a non-IFRS performance measure. Please refer to

"Non-IFRS Financial Measures" and "Financial Outlook".

7 This is a non-IFRS performance measure. Please refer to

"Non-IFRS Financial Measures" and "Financial Outlook".

8 Reflects producing copper corporate and asset transactions

since 2016.

9 Reflects contested copper corporate transactions over the last

15 years. Contested transactions include transactions that were

launched (a) without target board support; (b) with a public

release, either formally or informally, without target board

support; or (c) where a board-supported deal faced significant

shareholder resistance.

10 CIBC Capital Markets suspended coverage of Sierra due to a

re-allocation of analyst resources in December 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250114641631/en/

For further information regarding Sierra, please visit

www.SierraMetals.com or contact:

Investor Relations Sierra Metals Inc. +1 (866) 721-7437

info@sierrametals.com

Securityholder Communications Advisor Christine Carson

President & CEO Carson Proxy Advisors +1 (416) 804-0825

christine@carsonproxy.com

Media Relations John Vincic Principal Oakstrom Advisors

+1 (647) 402-6375 john@oakstrom.com

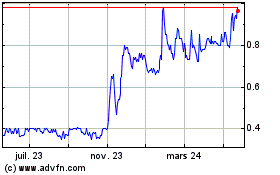

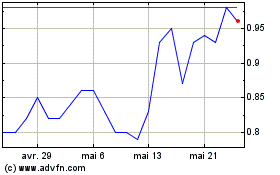

Sierra Metals (TSX:SMT)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Sierra Metals (TSX:SMT)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025