A.I.S. Resources Limited (TSX.V: AIS, OTCQB: AISSF) (the “Company”

or “AIS”) announces that Recharge Resources has exercised its

option to acquire Pocitos 1 from Spey Resources (Spey). In

accordance with AIS’ option agreement with Spey and AIS’ underlying

option agreement with Ekeko S.A., AIS will receive net proceeds as

follows:

|

POCITOS 1 |

Cash (80%) |

Value of Shares (20%) |

Total Consideration |

|

Receive from Spey |

$ |

800,000 |

$ |

200,000 |

$ |

1,000,000 |

|

Pay to Ekeko |

$ |

640,000 |

$ |

160,000 |

$ |

800,000 |

|

Net proceeds to AIS |

$ |

160,000 |

$ |

40,000 |

$ |

200,000 |

Martyn Element, CEO of AIS stated, “This further

positive news bears well for a very busy and productive spring for

AIS as we move forward with our activities in Argentina.”

AIS Underlying Option Agreement with

Ekeko S.A

On June 10, 2021, the Company entered into an

Option Agreement with Ekeko to acquire a 100% interest in five

mining tenements with a total area of 4,257 hectares (the

“Project”) located in Salta province, Argentina. Under the terms of

the Option Agreement, the Company paid USD $125,000 for an 18-month

option period entitling it to conduct exploration, sampling,

chemistry and drilling to determine the commercial viability of the

Project. The option period was extended to June 30, 2023 at no

additional cost. The purchase price of each tenement is USD $1,000

per hectare specifically Pocitos 1 – USD $800,000, Pocitos 2 – USD

$532,000 Pocitos 7 - USD $800,000, Pocitos 9 – USD $600,000 and

Yareta XIII – USD $1,525,000. The purchase price is payable 80% in

cash and 20% in shares of AIS calculated based on the volume

weighted average price (VWAP) of the AIS shares during the sixty

days prior to the date of AIS’ communication of the exercise of the

purchase of the mining properties to Ekeko.

Ekeko is a ‘related party’ of the Company

insofar as one of Ekeko’s controlling shareholders is also an

officer of the Company’s subsidiary in Argentina. The Company is

relying upon exemptions from the formal valuation and minority

shareholder approval requirements available under MI 61-101

Protection of Minority Securityholders in Special Transactions. The

Company is exempt from the formal valuation requirement in section

5.4 of MI 61-101 in reliance on sections 5.5(a) and (b) of MI

61-101 and the Company is exempt from the minority shareholder

approval requirement in section 5.6 of MI 61-101 in reliance on

section 5.7(1)(a) of MI 61-101.

AIS Option Agreement with Spey

Resources

On June 22, 2021, the Company entered into an

Option Agreement granting Spey the right to acquire a 100% interest

in Pocitos 1 covering 800 hectares and Pocitos 2 covering 532

hectares on the Pocitos Salar located just outside of Salta,

Argentina (see news release dated June 24, 2021). Under the terms

of the Option Agreement, Spey paid USD $200,000 to the Company upon

signing the Option Agreement and issued 2,500,000 shares of Spey to

the Company. In addition, Spey was required to expend USD $500,000

on the property within 12 months from the Option Agreement date

(Incurred). The option period was extended to June 30, 2023 at no

additional cost. The purchase price of Pocitos 1 is USD $1,000,000

and of Pocitos 2 is USD $732,000. Spey has the option to pay the

purchase price 100% in cash or 80% in cash and 20% in shares of

Spey at the 5-day volume weighted price of Spey’s common shares on

the CSE prior to the date of exercise. Upon Spey’s acquisition of a

100% interest in the mining tenements, AIS will retain a 7.5%

royalty on the sales revenue of lithium carbonate or other lithium

compounds from the mining tenements, net of export taxes.

If the Pocitos 2 option is exercised AIS will

receive additional net proceeds as follows:

|

POCITOS 2 |

Cash (80%) |

Value of Shares (20%) |

Total Consideration |

|

Receive from Spey |

$ |

585,600 |

$ |

146,400 |

$ |

732,000 |

|

Pay to Ekeko |

$ |

425,600 |

$ |

106,400 |

$ |

532,000 |

|

Net proceeds to AIS |

$ |

160,000 |

$ |

40,000 |

$ |

200,000 |

About Pocitos 1 & 2

Previous surface sampling, trenching and VTEM

Geophysics carried out in 2018 suggest the continuity of the

targeted lithium brine aquifer continuing from the Pocitos 1 block

through the Pocitos 2 block with Pit 10 from trenching on the

Pocitos 2 block having the highest trench sample at 181 PPM

lithium, the highest lithium value found on the Pocitos salar to

date.

Drilling from the Recharge’s 2022 drill campaign

at Pocitos 1 assayed 169 PPM and over a two-week period averaging

161 PPM Lithium. The 2022 well exceeded Recharge’s technical team’s

expectations and that of the measured lithium content of the 2018

discovery wells. Pocitos 2 is permitted to drill two additional

wells immediately at Recharge’s go ahead (see Recharge’s news

release dated February 27, 2023).

AIS Option Agreement with C29 Metals

Limited

On October 14, 2022, the Company entered into an

Option Agreement granting C29 Metals Limited (C29) the right to

acquire an 80% interest in Pocitos 7 covering 800 hectares and

Pocitos 9 covering 600 hectares, of the Pocitos Project (see news

release dated October 19, 2022). Under the terms of the Option

Agreement, C29 paid USD $50,000 to the Company upon signing the

Option Agreement and USD $230,000 to extend the option to March 30,

2023. C29 must pay USD $75,000 per licence to extend the option to

June 30, 2023. The purchase price for an 80% interest of Pocitos 7

is USD $1,360,000 and of Pocitos 9 is USD $1,020,000. C29 has the

right to buy out AIS’ 20% interest at a price determined by the FOB

lithium carbonate price multiplied by 2% of the indicated and

measured resource and 0.5% of the inferred resource of the

contained lithium carbonate equivalent (“LCE”).

If the Pocitos 7 and 9 options are exercised AIS

will receive additional net proceeds as follows:

|

Pocitos 7 |

Cash |

Value of Shares |

Total |

|

Receive from C29 |

$ |

1,360,000 |

$ |

- |

$ |

1,360,000 |

|

Pay to Ekeko |

$ |

640,000 |

$ |

160,000 |

$ |

800,000 |

|

Net proceeds |

$ |

720,000 |

-$ |

160,000 |

$ |

560,000 |

|

|

|

|

|

|

Pocitos 9 |

Cash |

Value of Shares |

Total |

|

Receive from C29 |

$ |

1,020,000 |

$ |

- |

$ |

1,020,000 |

|

Pay to Ekeko |

$ |

480,000 |

$ |

120,000 |

$ |

600,000 |

|

Net proceeds |

$ |

540,000 |

-$ |

120,000 |

$ |

420,000 |

About Pocitos 7 and 9

C29’s January 2023 drill campaign on the Pocitos

7 property concluded at 420m with a packer test intercepting a +30

m brine aquifer from 370-400m, at Hole (PCT-23-01). A flow test was

conducted through a 49mm pipe with a submersible pump and achieved

a pumping rate in excess of 2,000L an hour. (See C29’s news release

dated March 14, 2023).

The average grade of three packer assay results

was 129 ppm lithium with a maximum assay of 142 ppm lithium

indicating a trend that lithium is concentrating at the 400m depth

level above a clay layer with low porosity.

The next step for Pocitos 7 and 9 is to

undertake a magnetotellurics (MT) geophysical survey to locate the

most prospective position for the next hole. Existing available

geophysical data has penetrated only to depths of circa 250m, and

an MT survey will allow mapping of geologic structures to depths of

at least 500m.

The two concessions which comprise the Pocitos 7

and 9 projects are located in the southern central part of the

Salar de Pocitos. Pocitos 9 is approximately 2.6 kilometres to the

south of Pocitos 7.

About Yareta XIII

AIS has retained the option to acquire Yareta

XIII which covers 1,525 Has, located in the south of the Cauchari

Salar in Jujuy Province. Key features are:

- Substantially explored by Orocobre

– sampling drilling and geophysics nearby

- VTEM geophysics shows low

(<0.02ohm-m) aquifers with K,Mg,Li brines (not saltwater which

is >0.026) nearby by Orocobre in 2010

- Drill hole data suggests the

lithium brines are at depth and concentrated

- 50km from San Antonio de la Cobre

(2,000 people)

- Easily accessible by road – highway

goes through Northern section

- Friendly pro lithium indigenous

communities closeby at Olocapto

To acquire 100% interest is Yareta XIII, AIS

must pay the following by June 30, 2023.

|

Yareta XIII |

Cash (80%) |

Value of Shares (20%) |

Total Consideration |

|

Pay to Ekeko |

$ |

1,220,000 |

$ |

305,000 |

$ |

1,525,000 |

Resignation of Anthony Balme,

Director

The Company also announces that Anthony Balme

has resigned from the board of directors effective March 15, 2023.

The Company would like to thank Mr. Balme for his contribution and

wishes him well in his future endeavours.

About A.I.S. Resources

LimitedA.I.S. Resources Limited is a publicly traded

investment issuer listed on the TSX Venture Exchange focused on

lithium, gold, precious and base metals exploration. AIS’ value add

strategy is to acquire prospective exploration projects and enhance

their value by better defining the mineral resource with a view to

attracting joint venture partners and enhancing the value of our

portfolio. The Company is managed by a team of experienced

geologists and investment bankers, with a track-record of

successful capital markets achievements.

AIS has a 20% carried interest with Spey

Resources Corp. in the Incahuasi lithium brine project in

Argentina. AIS has further options to acquire four lithium

concessions in the Pocitos Salar and one lithium concession in the

Cauchari Salar in Argentina. AIS has granted the option to acquire

the Pocitos 1 and 2 licences to Spey Resources by June 30, 2023

(subsequently optioned by Spey to Recharge). If exercised AIS will

retain a 7.5% royalty. AIS has granted an option to acquire an 80%

interest in the Pocitos 7 and 9 licences to C29 Resources by June

30, 2023. AIS owns 100% of the 28 sq km Fosterville-Toolleen Gold

Project located 9.9 km from Kirkland Lake’s Fosterville gold mine,

a 60% interest in the 57 sq km Bright Gold Project (with the right

to acquire 100%), a 40% interest in the 58 sq km New South Wales

Yalgogrin Gold Project, and 100% interest in the 167 sq km Kingston

Gold Project in Victoria Australia near Stawell and

Navarre.

On Behalf of the Board of Directors,A.I.S.

Resources LimitedMartyn ElementPresident, CEO, Chairman

Corporate ContactFor further information, please

contact:Martyn Element, ChairmanT:

+1-604-220-6266E:melement@aisresources.comWebsite:www.aisresources.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

ADVISORY: This press release contains

forward-looking statements. Although the Company believes that the

expectations reflected in these forward-looking statements are

reasonable, undue reliance should not be placed on them because the

Company can give no assurance that they will prove to be correct.

Since forward-looking statements address future events and

conditions, by their very nature they involve inherent risks and

uncertainties. The forward-looking statements contained in this

press release are made as of the date hereof and the Company

undertakes no obligations to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws. Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

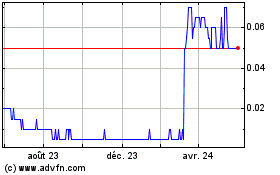

AIS Resources (TSXV:AIS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

AIS Resources (TSXV:AIS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024