Sales of VuduMobile assets from ATW TECH

18 Juillet 2019 - 7:30PM

ATW Tech Inc. (the "Company" or "ATW Tech") (

TSX-V:

ATW) today announces the signature of a letter of Intent

for the sale of its VuduMobile division to an arm’s length third

party. The letter of intent provides for a cash purchase price of

$1,350,000, payable as follows: $300,000 as an advance upon

signature of the letter of intent, $500,000 payable 30 days after

closing, and $550,000 payable 60 days after closing. The future

payments will be secured by a lien charging the purchased assets.

"This transaction is profitable for ATW Tech, since the purchase

price represents more than two-and-a-half times the VuduMobile

division’s revenues in 2018, as well a multiple of more than 8

times its EBIT forecast for 2019. This selling price also compares

very favourably with the price paid for VuduMobile by ATW Tech in

the fall of 2017, being $600,000 ($288,560 in cash and $311,440 in

shares). In addition, ATW Tech will remain a preferred distributor

of VuduMobile products following the transaction," said Michel

Guay, President and CEO of ATW Tech.

Mr. Guay further added: "Representing the culmination of a

detailed strategic review and an in-depth assessment of our

activities in recent months, the proceeds of this sale will allow

ATW Tech and its VoxTel division to focus on its key activities and

resources related to its integrated payment solutions platforms

("fintech") via telecom operators (more commonly known as “Direct

Carrier Billing”) and other payment mechanisms (such as mobile

cellular payments) as well as its innovative voting products via

the web and telephony. These proceeds will also provide us with

greater financial flexibility to continue our organic growth in

these flagship businesses as well as our acquisitions growth

initiatives as part of our expansion and geographic diversification

plan. In that regard, discussions and due diligence relating to the

acquisition of Greywolf Entertainment Group, for which the

signature of a letter of intent was announced on November 6, 2018,

continue between the two groups."

The completion of the transaction is subject to certain

conditions, including satisfactory due diligence and the

negotiation and signature of definitive purchase and sale

agreement. Closing of the transaction is expected on July 31, 2019.

The parties are coordinating between them to see to a rigorous

operational transition period, to ensure smooth business continuity

for VuduMobile, its customers, suppliers and employees.

The TSX Venture Exchange and its Regulatory Services provider

(as per meaning assigned to this term in TSX Venture Exchange’s

policies) bear no liability as to the relevance or accuracy of this

press release.

ABOUT ATW TECH ATW Tech is a leader in

financial technologies (‘fintech’), owner of several web platforms

including VoxTel, VuduMobile, Option.vote and Bloomed. VoxTel

offers various interactive communication, landline and mobile

carrier billing phone solutions. VuduMobile is specialized in text

messaging for enterprises through its unique, user-friendly and

bilingual text messaging application and turnkey solutions.

Option.vote offers a large scale, customizable, and secure

multi-method voting system for unions, political parties,

professional associations, and others looking for a way to reduce

their voting costs and to improve their participation rates.

Bloomed is a cloud-based platform to manage data (smart data) on

consumers and their behaviors which is developed for marketing

agencies and their campaigns for the consumer and corporate

markets.

Forward-Looking Statements DisclaimerCertain statements in this

press release may be forward-looking. Such statements include those

with respect to the closing of the sale of the VuduMobile division

and ATW Tech’s growth and business strategy. Although ATW Tech

believes that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, it can give no

assurances that its expectations will be achieved. Such

assumptions, which may prove incorrect, include the following: (i)

the conditions for the transaction will be met, (ii) ATW Tech will

successfully negotiate and enter into a purchase agreement and

other documents relating to the transaction, and (iii) ATW Tech

will successfully use the proceeds of sale for the purposes

described above and will succeed in implementing its business plan

for the VoxTel division. A description of other risks affecting ATW

Tech’s business and activities appears under the heading “Risk

Factors and Uncertainty” on pages 14 and 15 of ATW Tech’s 2018

annual management’s discussion and analysis, which is available on

SEDAR at www.sedar.com. No assurance can be given that any events

anticipated by the forward-looking information in this press

release will transpire or occur, or if any of them do so, what

benefits that ATW Tech will derive therefrom. ATW Tech disclaims

any intention or obligation to update or revise any forward-looking

statements in order to account for any new information or any other

event, except as required under applicable law. The reader is

warned against undue reliance on these forward-looking

statements.

|

SOURCE: |

|

|

|

ATW TECHMichel GuayFounder, president and CEOTel.: 514.985.2570

ext. 301mguay@atwtech.comwww.atwtech.com |

Denis ArchambaultInterim CFOTel.: 514.985.2570 ext.

304darchambault@atwtech.com |

|

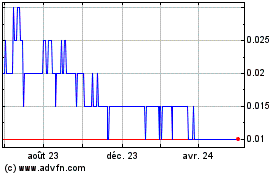

ATW Tech (TSXV:ATW)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

ATW Tech (TSXV:ATW)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025