Goodman Announces Q1 Operational Update and Reaffirms Earnings Guidance for FY2012

09 Novembre 2011 - 7:02PM

PR Newswire (Canada)

SYDNEY, Nov. 10, 2011 /CNW/ -- Goodman Group (Goodman or Group) has

today announced an operational update for the quarter ended 30

September 2011 and reaffirms its earnings guidance for the 2012

financial year. Key operational highlights: -- Leased 0.4 million

sqm for the quarter across the Group and managed funds,

representing A$42.9 million of annual rental income -- Occupancy

maintained at 96% across the Group and managed funds, achieving an

overall weighted average lease expiry of 5.0 years -- Development

work in progress at A$2.0 billion across 47 projects, with a

forecast yield on cost of 8.9% -- A$350 million of new development

commitments secured, and A$226 million of completions -- 89% of new

developments pre-committed and 55% pre-sold (Note1) -- External

assets under management (AUM) increased to A$15.4 billion (2%

increase on a constant currency basis from June 2011) -- Goodman

European Logistics Fund (GELF) launched a euro400 million

underwritten rights issue and an euro800 million debt package --

Continued focus on capital management initiatives at a Group and

Fund level, including asset recycling and extending debt facilities

-- Maintained liquidity at A$1.1 billion sufficient to repay all

outstanding maturities to FY2015 Goodman Group Chief Executive

Officer, Mr Greg Goodman said: "We have delivered a solid operating

performance in the first quarter of FY2012, with good contributions

made by all parts of our business. Leasing activity across the

Group and managed funds has remained robust, which is reflected in

our high occupancy levels of 96% and retention rates." Goodman's

development business continues to experience significant customer

demand across a number of industry sectors including third party

logistics, retail, e-commerce and automotive, which has driven the

growth of the current development work book to more than A$2

billion. "Our development activities in Europe and China have been

particularly strong. We have more than 345,000 sqm of projects

currently underway in Greater China, with the strategic procurement

of land sites growing our land bank to in excess of 2 million sqm

and positioning the Group to capitalise on the shortage of prime

logistics space. In Europe, the continued strong customer demand is

providing us with a number of quality pre-committed opportunities

and we have secured an additional 291,000 sqm of new projects

across Europe to date in FY2012. Consequently, we have good

visibility into our development earnings not only in FY2012, but

continuing into FY2013." Mr Goodman said. During the quarter,

Goodman continued to focus on maintaining a sound financial

position at a Group level and across its managed fund platform.

A$290 million of assets were recycled, providing capital to

redeploy within the business and enhance the quality of the overall

portfolio. The initiatives were also undertaken to further

strengthen the financial position of Goodman's managed funds and

provide greater flexibility and liquidity to pursue new investment

opportunities. Mr Goodman added: "The recent euro1.2 billion

capital management initiatives undertaken by GELF demonstrate our

focus on a prudent capital management strategy and highlight the

quality of our capital partner relationships. Debt capital markets

also remain open to the Group as evidenced by Goodman Australia

Industrial Fund's US$300 million US Private Placement." Strategy

and outlook Goodman Group is well positioned in the current

environment as a leading specialist provider of prime quality

industrial property and business space. The Group is focused on

leveraging the strong competitive position provided by its proven

expertise, extensive international operating platform and support

from significant capital partners, and will continue to assess a

broad range of initiatives to drive earnings growth and meet the

substantial customer and investor demand for our product. Mr

Goodman noted: "The Group has made a strong start to FY2012 and we

are committed to the prudent yet active delivery of our business

strategy. Our focus on capital management, active asset management

and increasing the contribution from our development and management

activities are expected to be key earnings drivers over the coming

year. Accordingly, we reaffirm our full year operating EPS guidance

of 6.0 cents and operating profit after tax of A$460 million."

(Note 1): Including developments offered to managed funds, the

percentage of pre-sold new commitments increases to 88%. About

Goodman For more information please visit www.goodman.com. For

further information, please contact Goodman: Gregory GoodmanGroup

Chief Executive OfficerTel: +61-2-9230-7400 Goodman Group CONTACT:

Web Site: http://www.goodman.com

Copyright

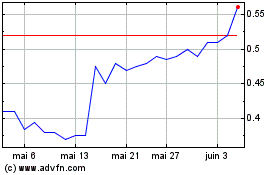

Graphene Manufacturing (TSXV:GMG)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Graphene Manufacturing (TSXV:GMG)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025