Omni-Lite Industries Canada Inc. (the "Company" or “Omni-Lite”;

TSXV: OML) today reported results for the fourth quarter and fiscal

year ending December 31, 2023. Full financial results are available

at sedar.com.

Fourth Quarter Fiscal 2023

Results

Revenue for the fourth quarter of fiscal 2023

was approximately US$3.3 million, an increase of 6% as compared to

the fourth quarter of fiscal 2022. The increase in revenue was

largely due to organic growth in our electronic components

business.

Adjusted EBITDA (1) was approximately US$78,000

as compared to approximately US$(270,000) in the fourth quarter of

fiscal 2022. The Company’s balance sheet remains strong with US$1.1

million in cash and no debt outstanding.

Net income for the quarter was US$477,000, or

US$0.03 per diluted share, which was impacted by two non-recurring

items. In the quarter, the Company recorded a US$467,000 reduction

in the goodwill associated with its acquisition of Designed

Precision Casting (“DP Cast”) in 2021. The Company also recorded a

net income inclusion of US$852,000 related to its loan to

California Nanotechnologies (“Cal Nano”). The Cal Nano loan was

fully reserved for in 2019 due to Cal Nano’s uncertain outlook at

that time. Since then, Cal Nano has demonstrated much improved

performance and financial results and reduced the loan outstanding.

Accordingly, the valuation of the reserve was reversed which

reflects the current outstanding loan balance.

Bookings in the fourth quarter of 2023 were

approximately US$4.3 million, up 48% as compared to the fourth

quarter of fiscal 2022. As a result, the backlog at December 31,

2023, was approximately US$7.0 million, a historic high for the

Company and a 91% increase from US$3.7 million as at December 31,

2022.

Fiscal Year 2023 Results

Revenue for the fiscal year ending December 31,

2023, was approximately US$12.4 million, as compared to US$11.1

million in the prior year, an increase of 11%. Adjusted EBITDA(1)

was approximately US$445,000 as compared to approximately

US$(1,128,000) in the prior year. The increase of approximately

US$1.6 million in Adjusted EBITDA(1) was primarily due to higher

utilization of direct labor, reduction in S,G&A and indirect

labor, as well as better utilization of other fixed costs. Adjusted

Free Cash Flow(1) was US$534,000, which was after capital

expenditures of approximately US$153,000, as compared to

US$(639,000) in 2022.

Omni-Lite reported a 2023 net income of

US$90,000, or US$0.01 per diluted share, as compared to a net loss

of US$2.6 million or US$(0.17) per diluted share in fiscal year

ended December 31, 2022.

Bookings for the year were US$15.7 million,

resulting in a book-to-bill ratio of 1.27:1.

Management

Comments

David Robbins, Omni-Lite’s CEO, stated “2023 was

a turnaround year for Omni-Lite. We achieved solid organic revenue

growth and materially grew our backlog to historically high levels.

Importantly, we returned to both positive Adjusted EBITDA (1) and

positive Adjusted Free Cash Flow (1).

“While we made good progress in 2023 on

profitability, we expect further improvement during 2024. Notably,

DP Cast had a negative financial impact on 2023, but is currently

on an improvement trajectory. We expect DP Cast to make a positive

EBITDA contribution in second or third quarter of 2024. The

decision to reduce the DP Cast goodwill was made based on casting

business not having yet passed a contribution threshold in 2023,

but we see light at the end of the tunnel as DP Cast is on pace to

be an important and durable contributor to Omni-Lite’s

platform.”

"We also anticipate continuing organic revenue

growth driven by conversion of backlog and strength in our bookings

pipeline. We finished 2023 with a well-balanced and record level

backlog of US$7 million. In 2024, we look forward to revenue from

new product production from orders booked in 2023 driving sales

growth and look to capitalize on continued new engineering orders

and anticipated further increases in aerospace and defense bookings

in 2024.”

“We are pleased with Cal Nano’s progress and our

investment, a combination of senior secured loan and common shares

in Cal Nano; it is a very meaningful asset of Omni-Lite. While we

remain supportive of Cal Nano, we’ll continue to monitor and

evaluate our investment in the context of our capital allocation

needs, and to date, our investment has been a positive for

Omni-Lite.”

“We recently completed our first quarter of the

2024 fiscal year. While we will not be in a position to release our

financial results until mid-May, the Company expects to generate

sequential quarterly revenue growth of over 30% from fiscal Q4

2023.”

Financial SummaryAll figures

in (US$000) unless noted.

Investor Conference Call [DIFFERENT DATE

FOR CALL NEEDED]

Omni-Lite will host a conference call for

investors on April 19, 2024, beginning at 11:00 A.M. (EDT) to

discuss the Fiscal 2023 results and review of its business and

operations. To join the conference call, 888-437-3179 in the USA

and Canada, or 862-298-0702 for all other countries. Please call

five to ten minutes prior to the scheduled start time. A replay of

the conference call will be available 48 hours after the call and

archived on the Company’s investors page of the Company’s website

at www.omni-lite.com for 12 months.

(1) Adjusted EBITDA is a non-IFRS

financial measure defined as earnings before interest, taxes,

depreciation, amortization, stock- based compensation provision,

gains (losses) on sale of assets, and non-recurring items, if any.

Free Cash Flow is a non-IFRS financial measure defined as cash flow

from operations minus capital expenditures. Adjusted Free Cash Flow

is a non-IFRS financial measure defined as Free Cash Flow excluding

special items, among others, gains (losses) on sale of assets and

non- recurring items, net of tax effects, if any. These are

non-IFRS financial measures, as defined herein, and should be read

in conjunction with IFRS financial measures and they are not

intended to be considered in isolation or as a substitute for, or

superior to, financial information prepared and presented in

accordance with IFRS. The non-IFRS financial measures used herein

may not be comparable to similarly titled measures reported by

other companies. We believe the use of Adjusted EBITDA, Adjusted

Free Cash Flow and Free Cash Flow along with IFRS financial

measures enhances the understanding of our operating results and

may be useful to investors in comparing our operating performance

with that of other companies and estimating our enterprise.

(2) Excluded items from Fiscal 2022 Adjusted Free Cash

Flow(1) included approximately US$29,000 in transaction costs

associated with the acquisition of DP Cast and a non-recurring

capital gain tax payment of approximately US$560,000 related to the

2021 sale/leaseback of the Company’s Cerritos facility.

Adjusted EBITDA, Adjusted Free Cash Flow and

Free Cash Flow are also useful tools in evaluating the operating

results of the Company given the significant variation that can

result from, for example, the timing of capital expenditures and

the amount of working capital in support of our customer programs

and contracts. We also use Adjusted EBITDA, Adjusted Free Cash Flow

and Free Cash Flow internally to evaluate the operating performance

of the Company, to allocate resources and capital, and to evaluate

future growth opportunities.

Please see 2023 Management Discussion and

Analysis for additional notes and definitions.

About

Omni-Lite Industries

Canada Inc.

Omni-Lite Industries Canada Inc. is an

innovative company that develops and manufactures mission critical,

precision components utilized by Fortune 100 companies in the

aerospace and defense industries.

For further

information, please contact:

Mr. David Robbins Chief Executive OfficerTel. No. (562) 404-8510

or (800) 577-6664Email: d.robbins@omni-lite.com Website:

www.omni-lite.com

Forward Looking Statements

Except for statements of historical fact, this

news release contains certain “forward-looking information” within

the meaning of applicable securities law. Forward-looking

information is frequently characterized by words such as “plan”,

“expect”, “project”, “intent”, “believe”, “anticipate”, “estimate”

and other similar words, or statements that certain events or

conditions “may” or “will” occur. Forward-looking information in

this press release includes, but is not limited to, the expected

future performance of the Company. Although we believe that the

expectations reflected in the forward-looking information are

reasonable, there can be no assurance that such expectations will

prove to be correct. We cannot guarantee future results,

performance, or achievements. Consequently, there is no

representation that the actual results achieved will be the same,

in whole or in part, as those set out in the forward- looking

information. Forward-looking information is based on the opinions

and estimates of management at the date the statements are made and

are subject to a variety of risks and uncertainties and other

factors that could cause actual events or results to differ

materially from those anticipated in the forward-looking

information. Some of the risks and other factors that could cause

the results to differ materially from those expressed in the

forward- looking information include, but are not limited to:

general economic conditions in Canada, the United States and

globally; industry conditions, governmental regulation, including

environmental consents and approvals, if and when required; stock

market volatility; competition for, among other things, capital,

skilled personnel and supplies; changes in tax laws; and the other

risk factors disclosed under our profile on SEDAR at www.sedar.com.

Readers are cautioned that this list of risk factors should not be

construed as exhaustive.

The forward-looking information contained in

this news release is expressly qualified by this cautionary

statement. We undertake no duty to update any of the

forward-looking information to conform such information to actual

results or to changes in our expectations except as otherwise

required by applicable securities legislation. Readers are

cautioned not to place undue reliance on forward-looking

information.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

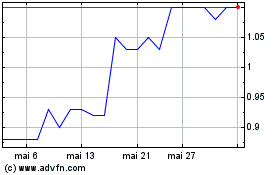

Omni Lite Industries Can... (TSXV:OML)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Omni Lite Industries Can... (TSXV:OML)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024