UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule

13a-16 or

15d-16 of the Securities Exchange Act of 1934

For the month of May 2024

Commission File Number: 333-155412

JBS S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant’s name into English)

Av. Marginal Direita do Tietê

500, Bloco I, 3rd Floor

São Paulo, SP, Brazil

(Address of principal executive offices)

(Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form

20-F: ☒ Form 40-F: ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: May 23, 2024

| |

JBS S.A. |

| |

|

| |

By: |

/s/ Guilherme Perboyre Cavalcanti |

| |

Name: |

Guilherme Perboyre Cavalcanti |

| |

Title: |

Chief Financial and Investment Relations Officer |

2

Exhibit

99.1

Results 1Q24 JBS

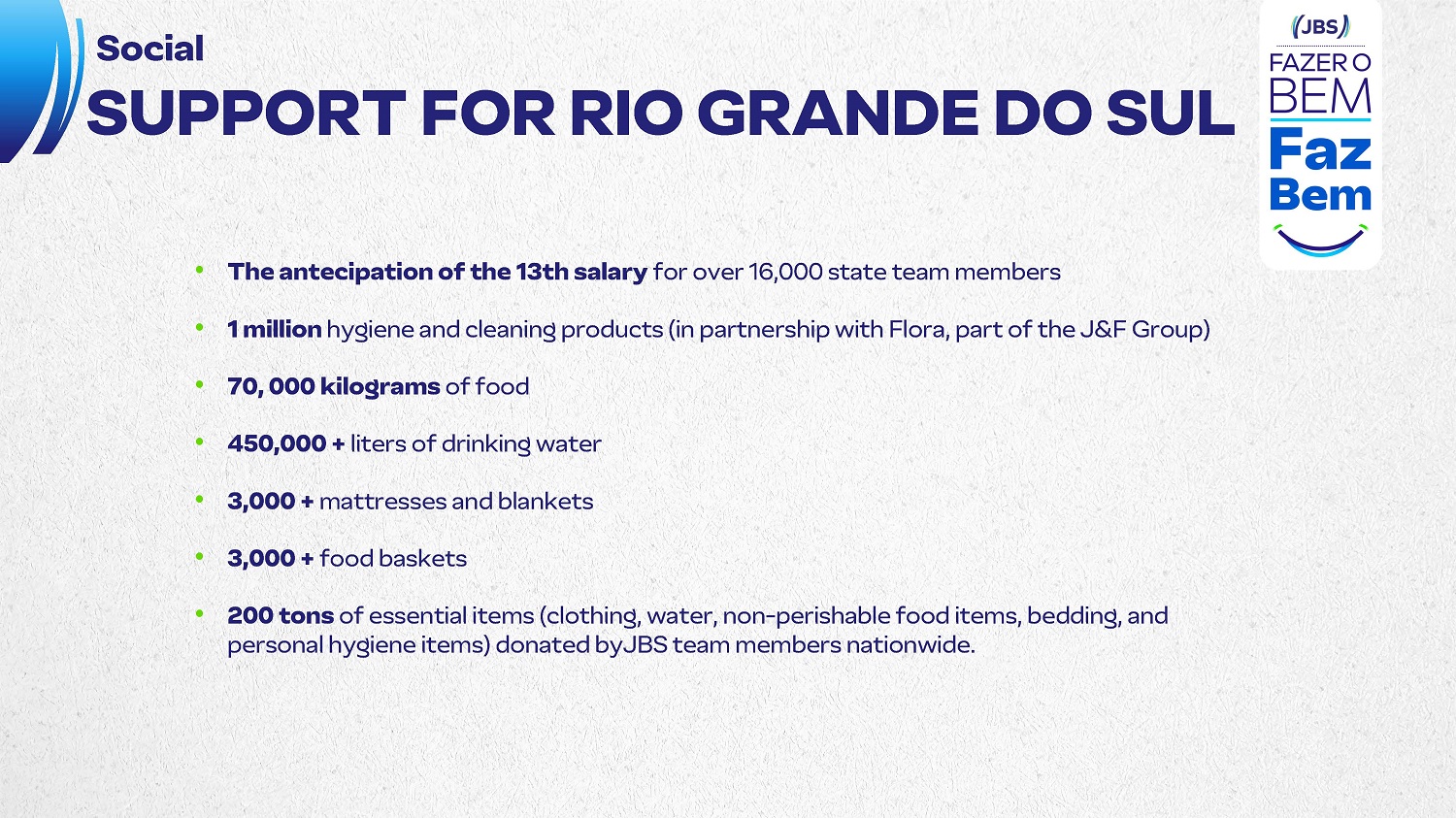

• The antecipation of the 13th salary for over 16,000 state team members • 1 million hygiene and cleaning products (in partnership with Flora, part of the J&F Group) • 70, 000 kilograms of food • 450,000 + liters of drinking water • 3,000 + mattresses and blankets • 3,000 + food baskets • 200 tons of essential items (clothing, water, non - perishable food items, bedding, and personal hygiene items) donated byJBS team members nationwide. Social SUPPORT FOR RIO GRANDE DO SUL

# 1 Global beef producer #1 Global poultry producer #2 Global pork producer Aquaculture Plant - based and alternative proteins business #3 European producer of plant - based protein. #2 salmon producer in Australia . In 2024, we will complete a new cultivated protein facility in Spain. Prepared Foods #1 Brazilian producer of plant - based protein. #2 in prepared foods in Brazil. #1 in prepared foods in the United Kingdom. #1 in prepared foods in Australia and New Zealand. LEADERSHIP NEW AVENUES OF GROWTH Global Leadership 3

1 . Enhance Scale in Existing Categories and Geographies Capture significant synergies 2 . Increase and Diversify Value - Added and Brand Portfolio Long Term Growth Strategy Pursuing additional value - enhancing growth opportunities with financial discipline Improve operational performance Enhance growth and margin profile Realize benefits of vertical integration 3 . New proteins Close to the Final Consumer - Multichannel 4

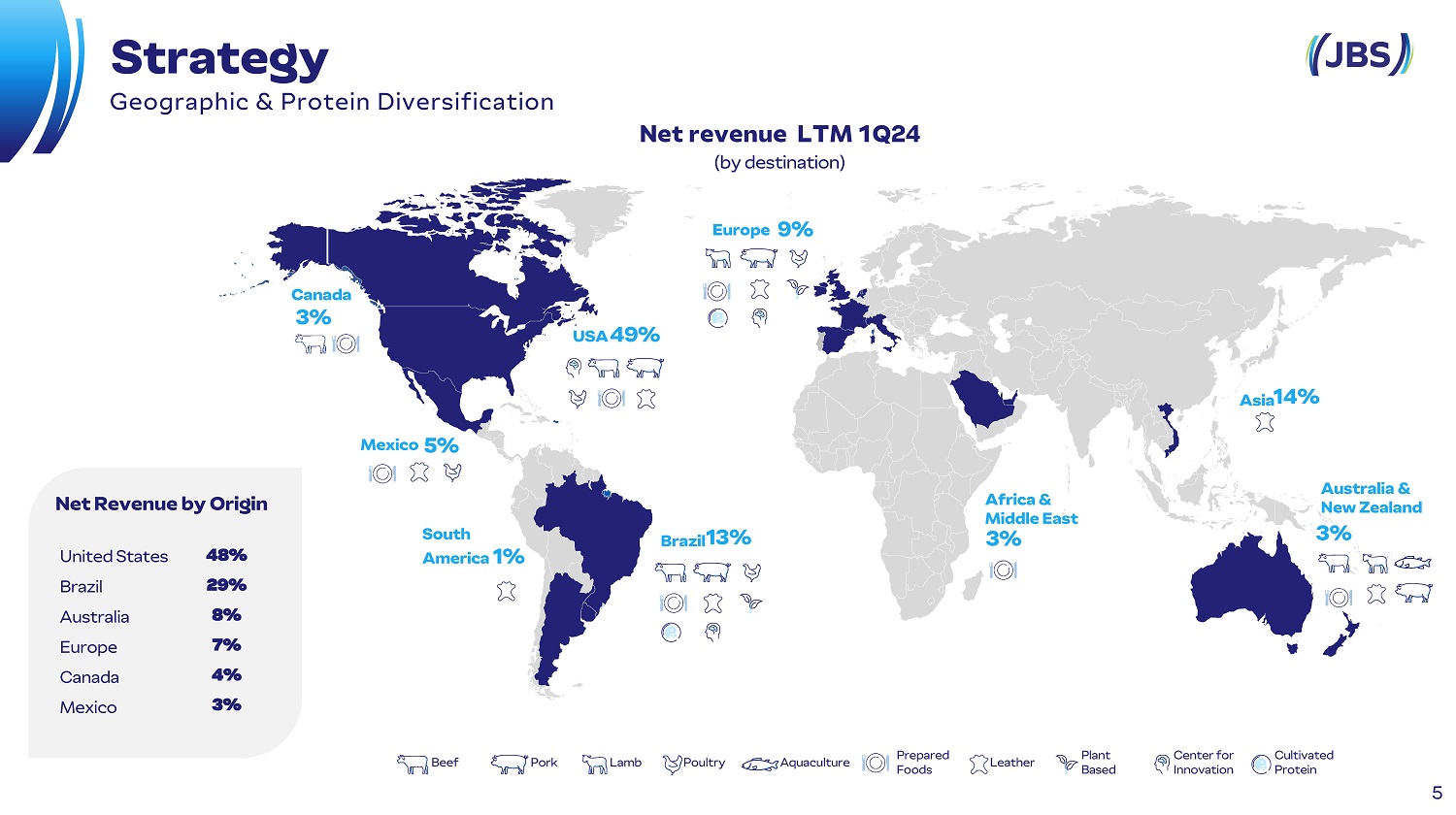

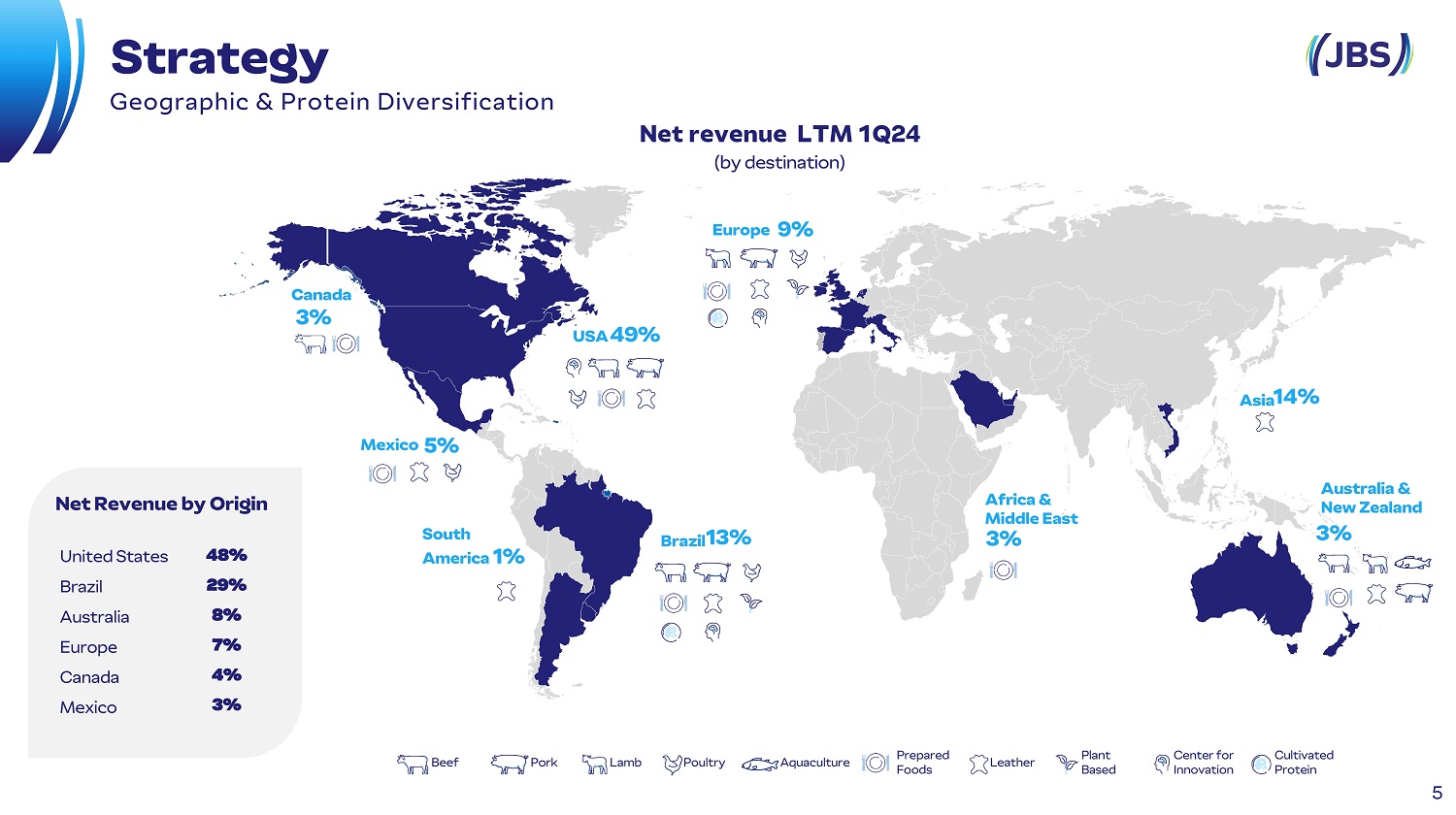

Net Revenue by Origin Canada Mexico 48% United States 29% Brazil 8% Australia 7% Europe 4% 3% Beef Pork Lamb Poultry Aquaculture Leather Plant Based Center for Innovation Cultivated Protein Prepared Foods South America 1% Mexico 5% Brazil 13% Asia 14% Africa & Middle East 3% USA 49% 3% Canada Australia & New Zealand 3% Net revenue LTM 1Q24 (by destination) Europe 9% 5 Strategy Geographic & Protein Diversification

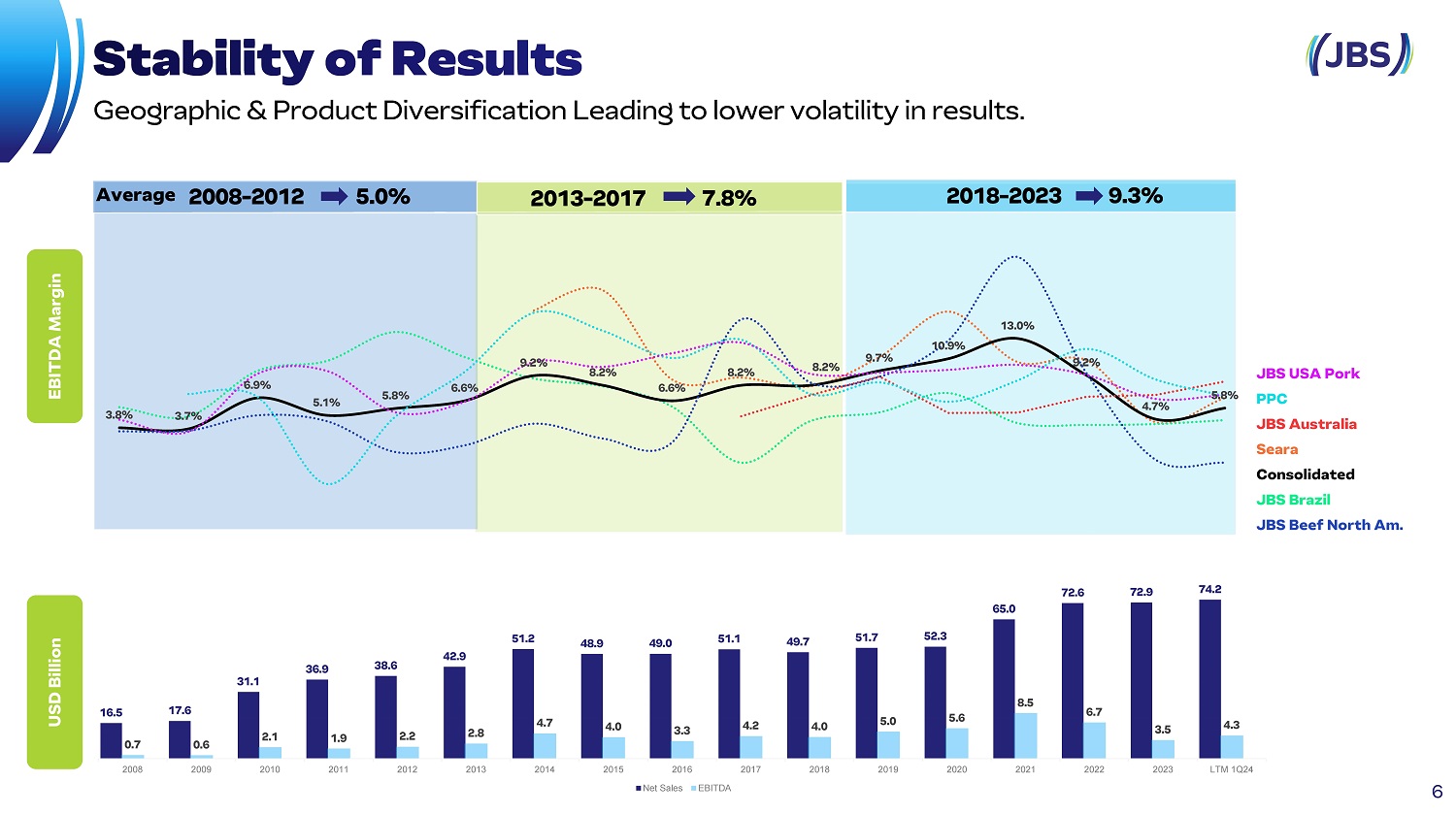

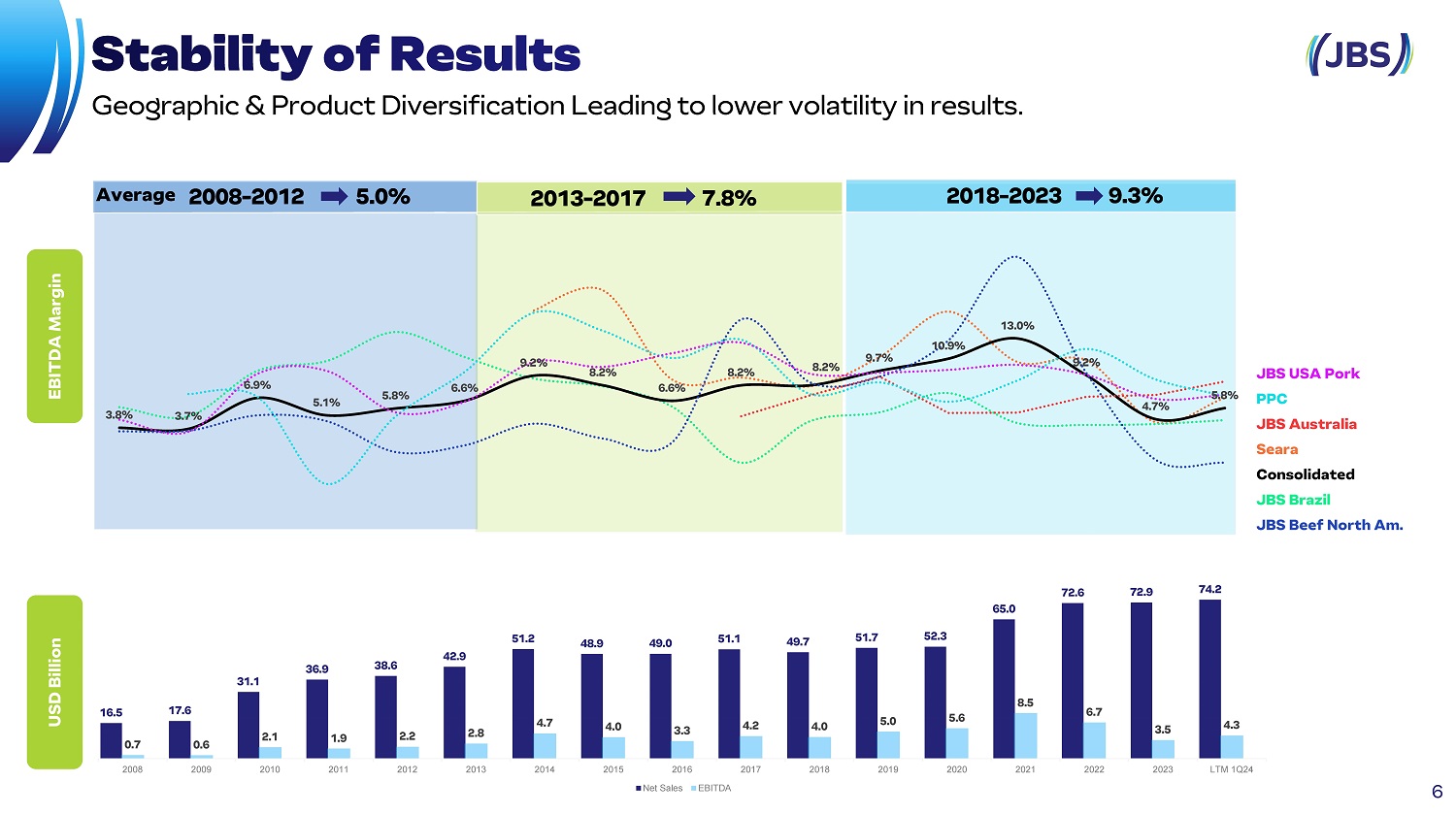

16.5 17.6 31.1 36.9 38.6 42.9 51.2 48.9 49.0 51.1 49.7 51.7 52.3 65.0 72.6 72.9 74.2 0.7 0.6 2.1 1.9 2.2 2.8 4.7 4.0 3.3 4.2 4.0 5.0 5.6 8.5 6.7 3.5 4.3 2008 2009 2010 2011 2012 2013 2014 2015 2016 Net Sales 2017 2018 2019 2020 2021 2022 2023 LTM 1Q24 EBITDA 3.8% 3.7% 6.9% 5.1% 5.8% 6.6% 9.2% 8.2% 6.6% 8.2% 8.2% 9.7% 13.0% 10.9% 9.2% 4.7% 5.8% EBITDA Margin USD Billion Geographic & Product Diversification Leading to lower volatility in results. 6 JBS USA Pork PPC JBS Australia Seara Consolidated JBS Brazil JBS Beef North Am.

Valued Added: Diversified Global Brands Portfolio 7

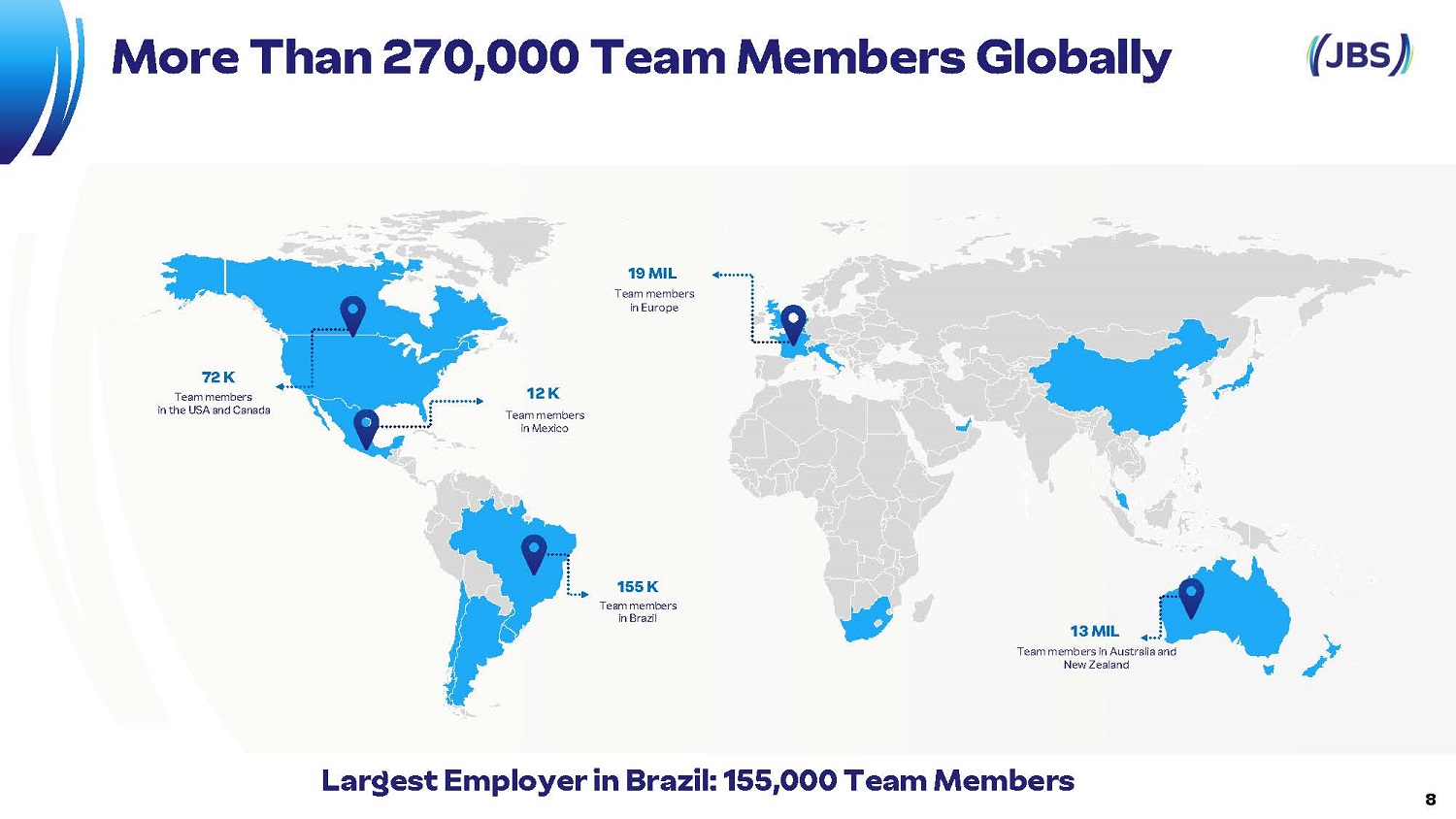

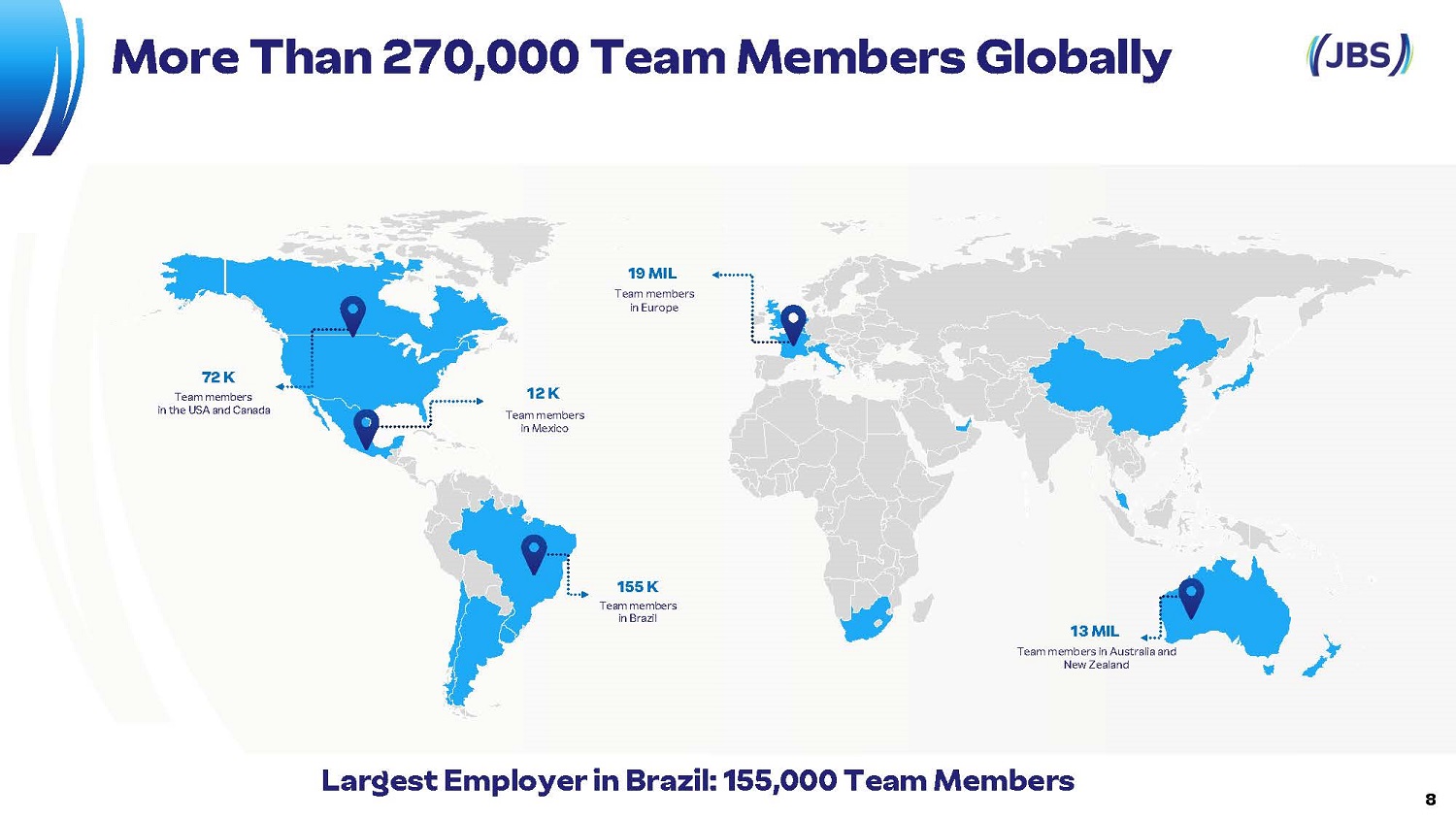

13 MIL Team members in Australia and New Zealand 155 K Team members in Brazil 12 K Team members in Mexico 8 19 MIL Team members in Europe 72 K Team members in the USA and Canada Largest Employer in Brazil: 155,000 Team Members More Than 270,000 Team Members Globally

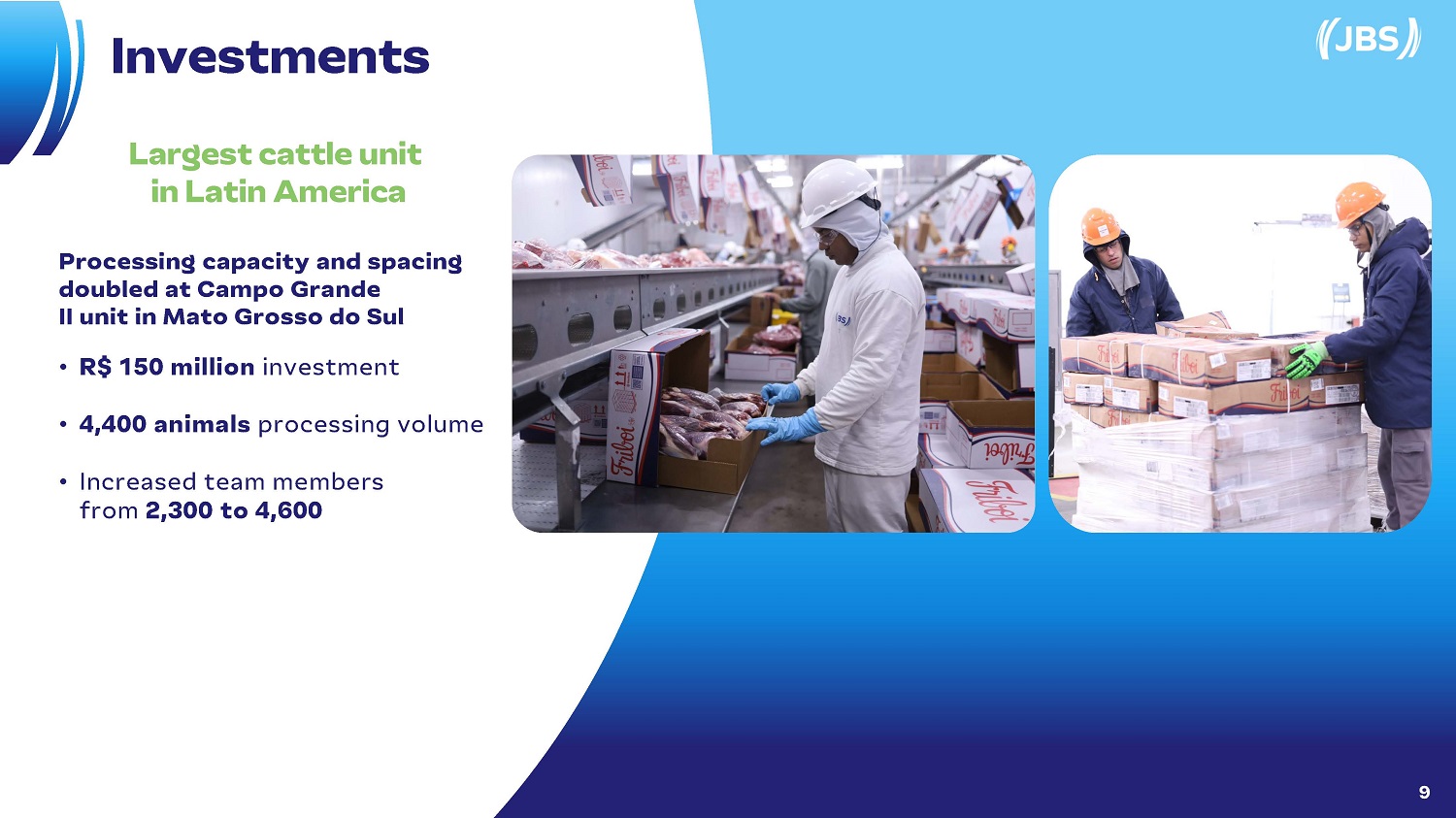

Investments Largest cattle unit in Latin America Processing capacity and spacing doubled at Campo Grande II unit in Mato Grosso do Sul • R$ 150 million investment • 4,400 animals processing volume • Increased team members from 2,300 to 4,600 9

Largest cattle unit in Australia Improvement in the quality and procuctivity of the Dinmore Unit, in Queensland • R$ 250 million investment • 500 new team members hired Investments 10

Investments Sustainability Solar energy in Seara’s broiler farms: • 55% of Seara’s broiler farms already use solar energy in their facilities Generation of energy from methane: • Through the installation of biodigesters that convert methane into energy, integrated producers reduce their electricity bills by 60% • Increase in income for producers through the sale of energy

Through the Beyond Borders program, the Company offers its team members the opportunity to internationalize their professional careers by changing roles or extending their knowledge to another country, strengthening JBS's organizational culture worldwide. 12 Instituto J&F Over 900 students enrolled in the education center, preparing young people for business. Better Futures Tuition - free community college tuition for JBS team members and their dependents. More than 6,000 people signed up. Instituto J&F MASTER Continuous training program for team members on the front line of production. Hometown Strong Community investment projects that support the communities where JBS is located through cash donations, infrastructure improvements and affordable housing. Social JBS projects around the world Beyond Borders Nourishing dreams, generating possibilities

Financial & Operating

JBS announced that it will invest R $ 150 million to double its production at the Campo Grande unit, in Mato Grosso do Sul, transforming it into the largest beef plant in Latin America and one of JBS's three largest worldwide . The Company announced an investment of to improve quality and its beef plant in Dinmore, US$50 million productivity at Australia.

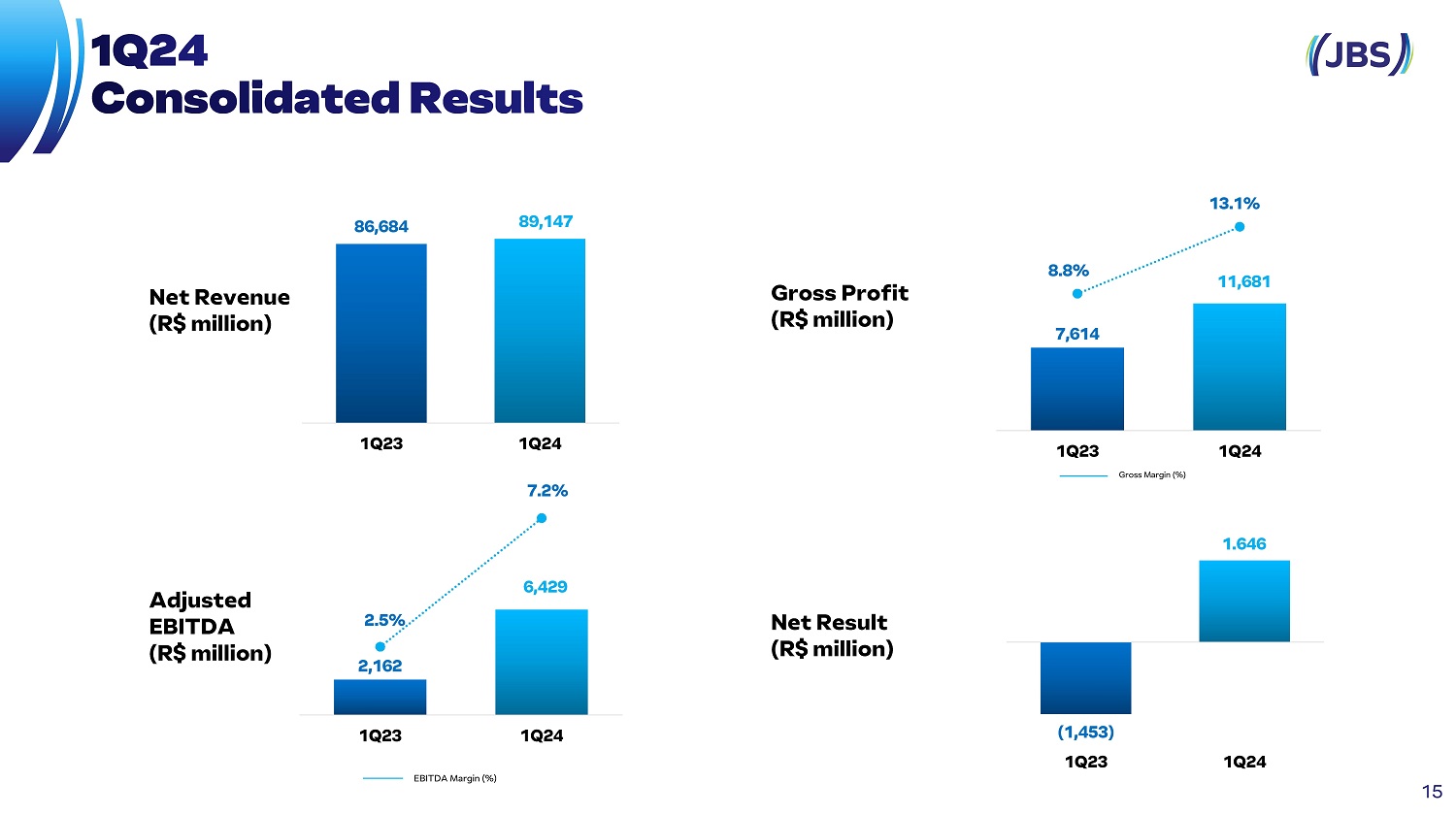

2,162 6,429 2.5% 7.2% 1Q23 1Q24 EBITDA Margin (%) (1,453) 1Q23 1.646 1Q24 86,684 89,147 1Q23 1Q24 7,614 11,681 8.8% 13.1% 1Q23 1Q24 Gross Margin (%) Net Result (R$ million) Adjusted EBITDA (R$ million) Net Revenue (R$ million) Gross Profit (R$ million) 15

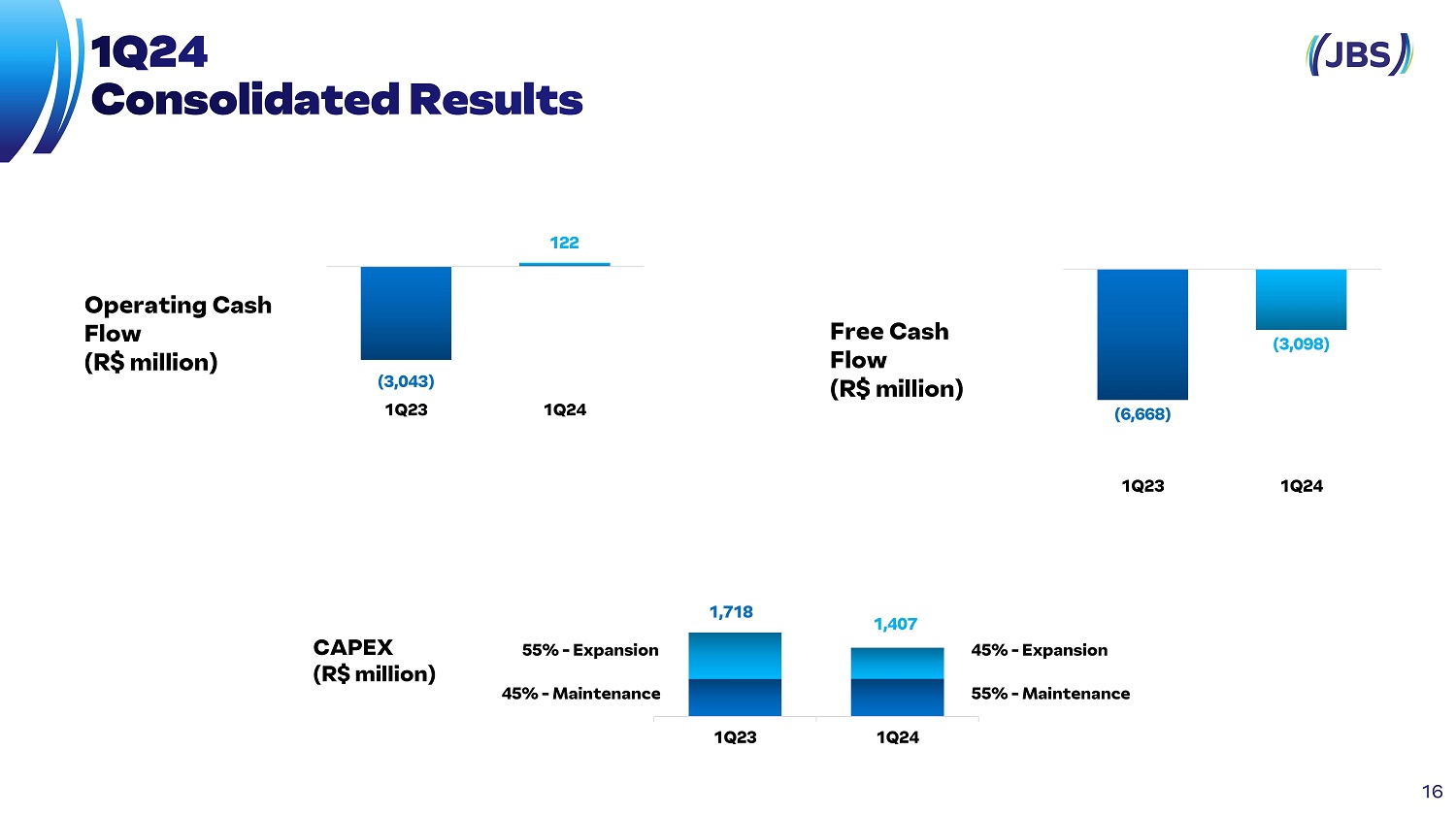

1,718 1,407 1Q23 1Q24 55% - Maintenance 45% - Expansion 45% - Maintenance 55% - Expansion (3,043) 1Q23 122 1Q24 (6,668) (3,098) 1Q23 1Q24 Operating Cash Flow (R$ million) Free Cash Flow (R$ million) CAPEX (R$ million) 16

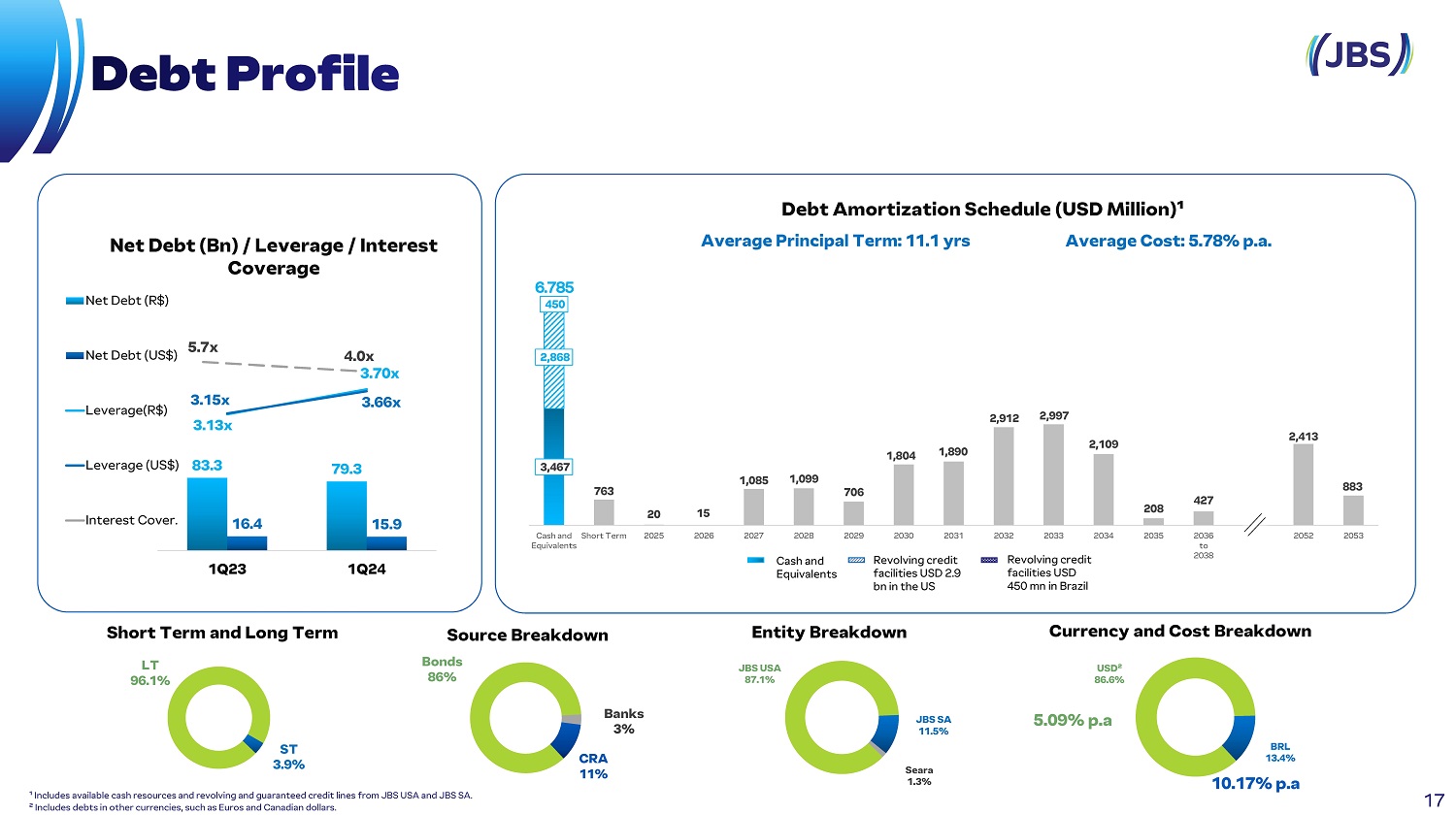

3,467 763 20 15 1,085 1,099 706 1,804 1,890 2,912 2,997 2,109 208 427 2,413 883 2,868 450 Cash and Short Term Equivalents 2025 2026 2027 2028 2029 2034 2035 2036 to 2038 2039 to 2051 2052 2053 5.7x 83.3 79.3 16.4 15.9 3.15x 3.13x 4.0x 3.70x 3.66x 1Q23 1Q24 Net Debt (US$) Leverage(R$) Leverage (US$) Interest Cover. Net Debt (Bn) / Leverage / Interest Coverage Net Debt (R$) ¹ Includes available cash resources and revolving and guaranteed credit lines from JBS USA and JBS SA. ² Includes debts in other currencies, such as Euros and Canadian dollars. Debt Amortization Schedule (USD Million)¹ Average Principal Term: 11.1 yrs Average Cost: 5.78% p.a. Entity Breakdown Currency and Cost Breakdown Short Term and Long Term LT 96.1% ST 3.9% Source Breakdown Bonds 86% Banks 3% CRA 11% JBS USA 87.1% JBS SA 11.5% Seara 1.3% USD² 86.6% BRL 13.4% 5.09% p.a 10.17% p.a Cash and Equivalents 2030 2031 Revolving credit facilities USD 2 . 9 bn in the US 2032 2033 Revolving credit facilities USD 450 mn in Brazil 17

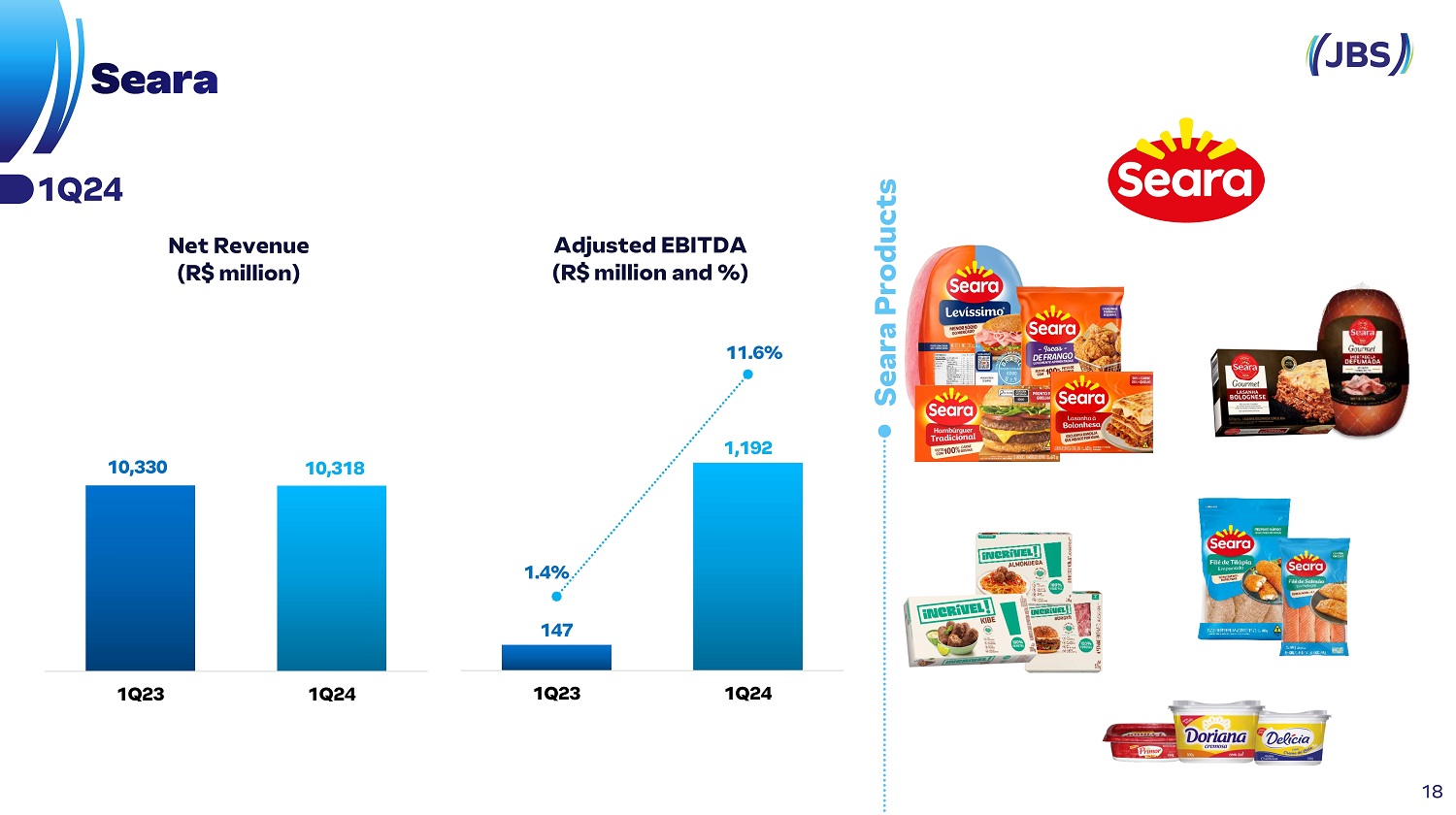

10,330 10,318 1Q23 1Q24 Seara Products 1,192 1.4% 147 11.6% 1Q23 1Q24 1Q24 Net Revenue (R$ million) Adjusted EBITDA (R$ million and %) 18

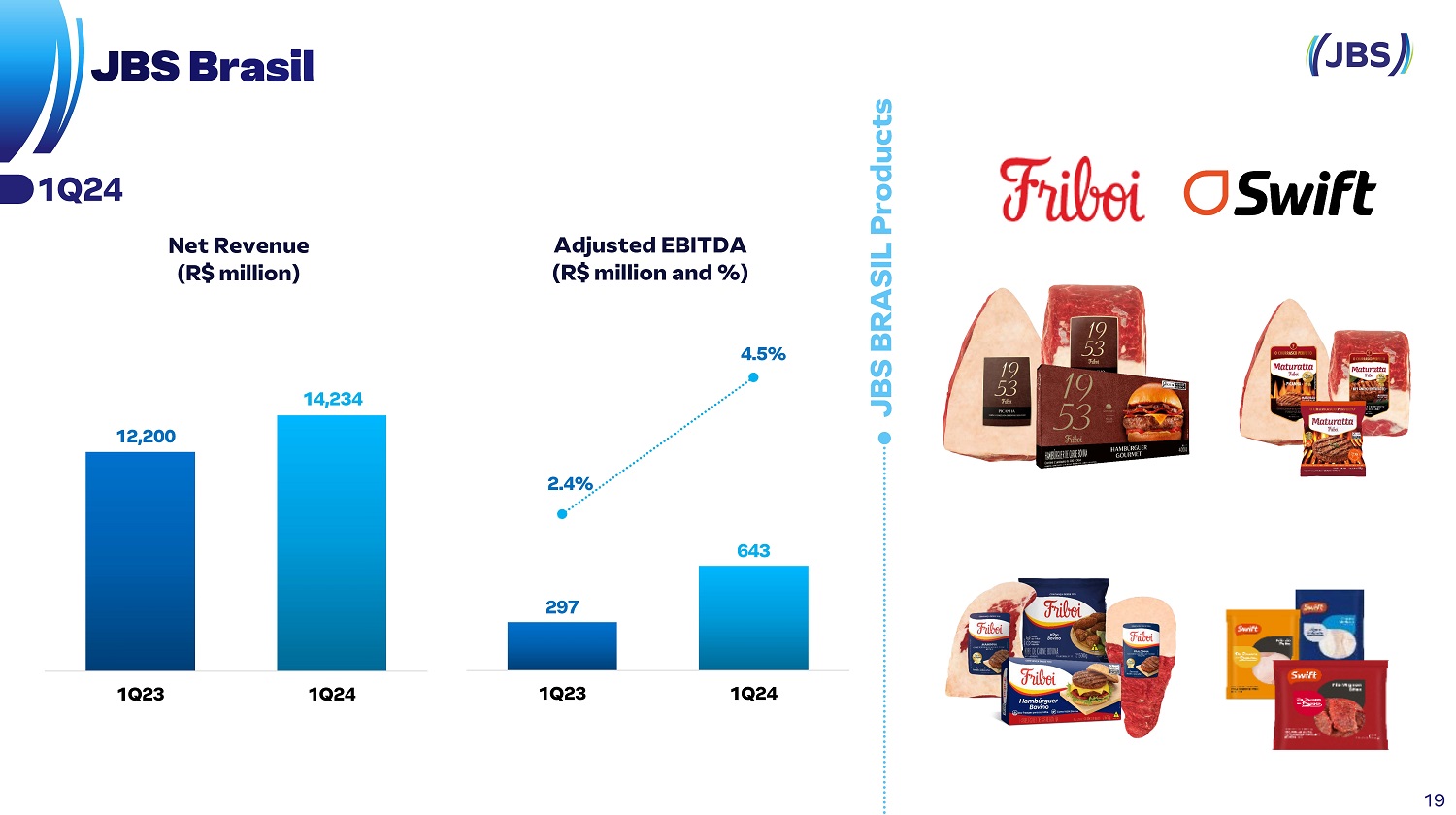

297 643 2.4% 4.5% 1Q23 1Q24 12,200 14,234 1Q23 1Q24 JBS BRASIL Products Net Revenue (R$ million) Adjusted EBITDA (R$ million and %) 1Q24 19

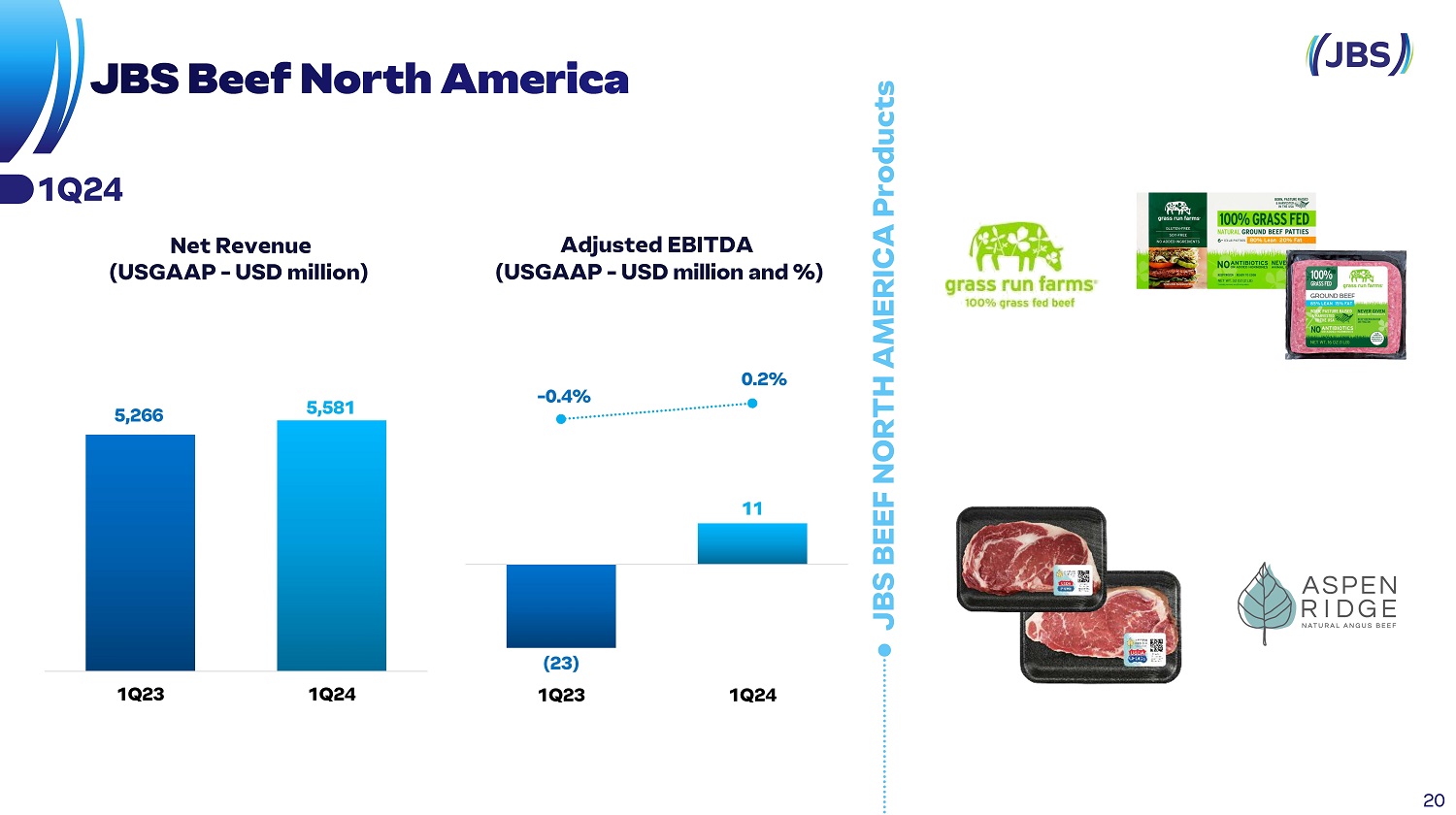

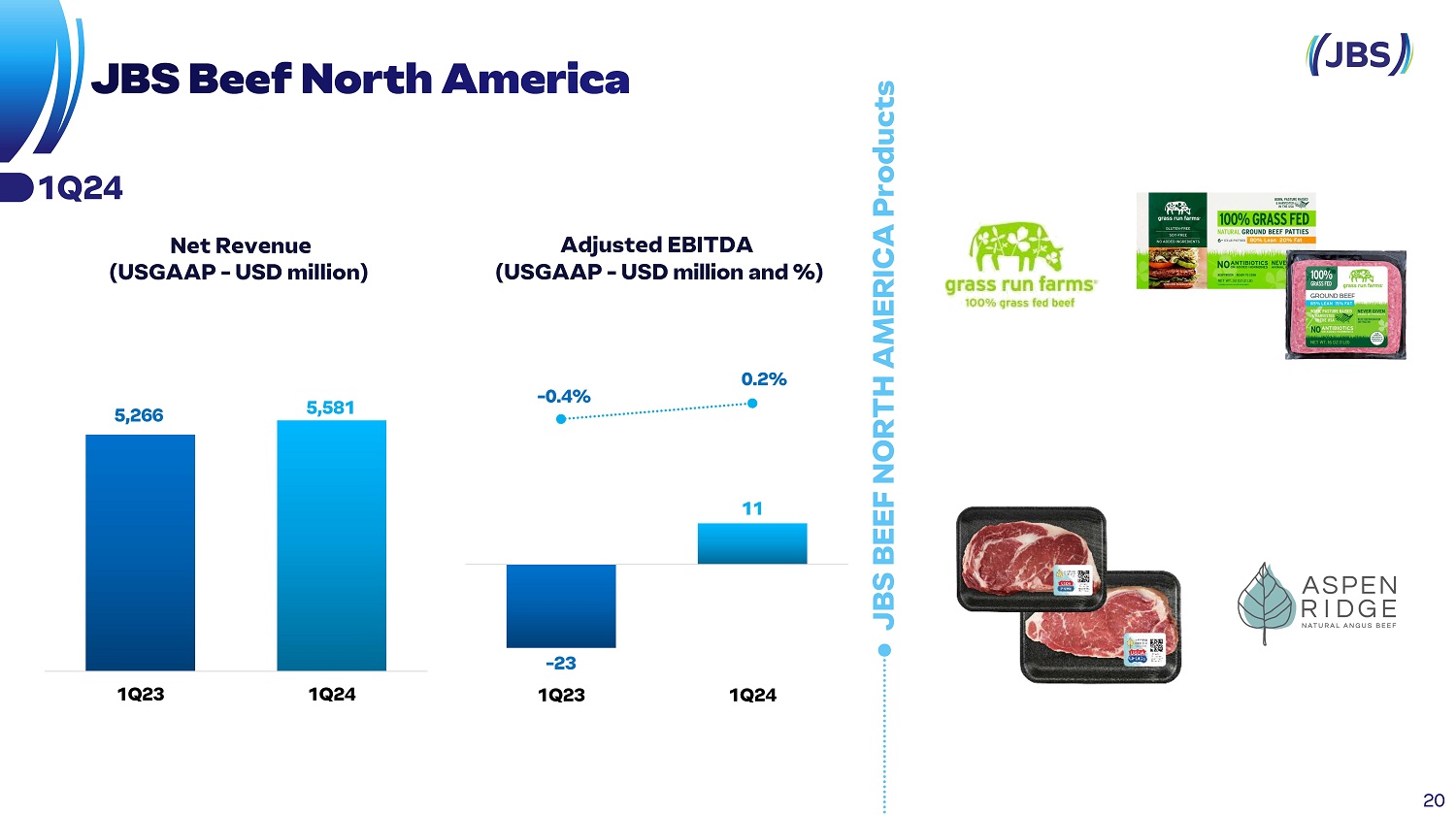

(23) 1Q23 11 - 0.4% 0.2% 1Q24 JBS BEEF NORTH AMERICA Products 5,266 5,581 1Q23 1Q24 Net Revenue (USGAAP - USD million) Adjusted EBITDA (USGAAP - USD million and %) 1Q24 20

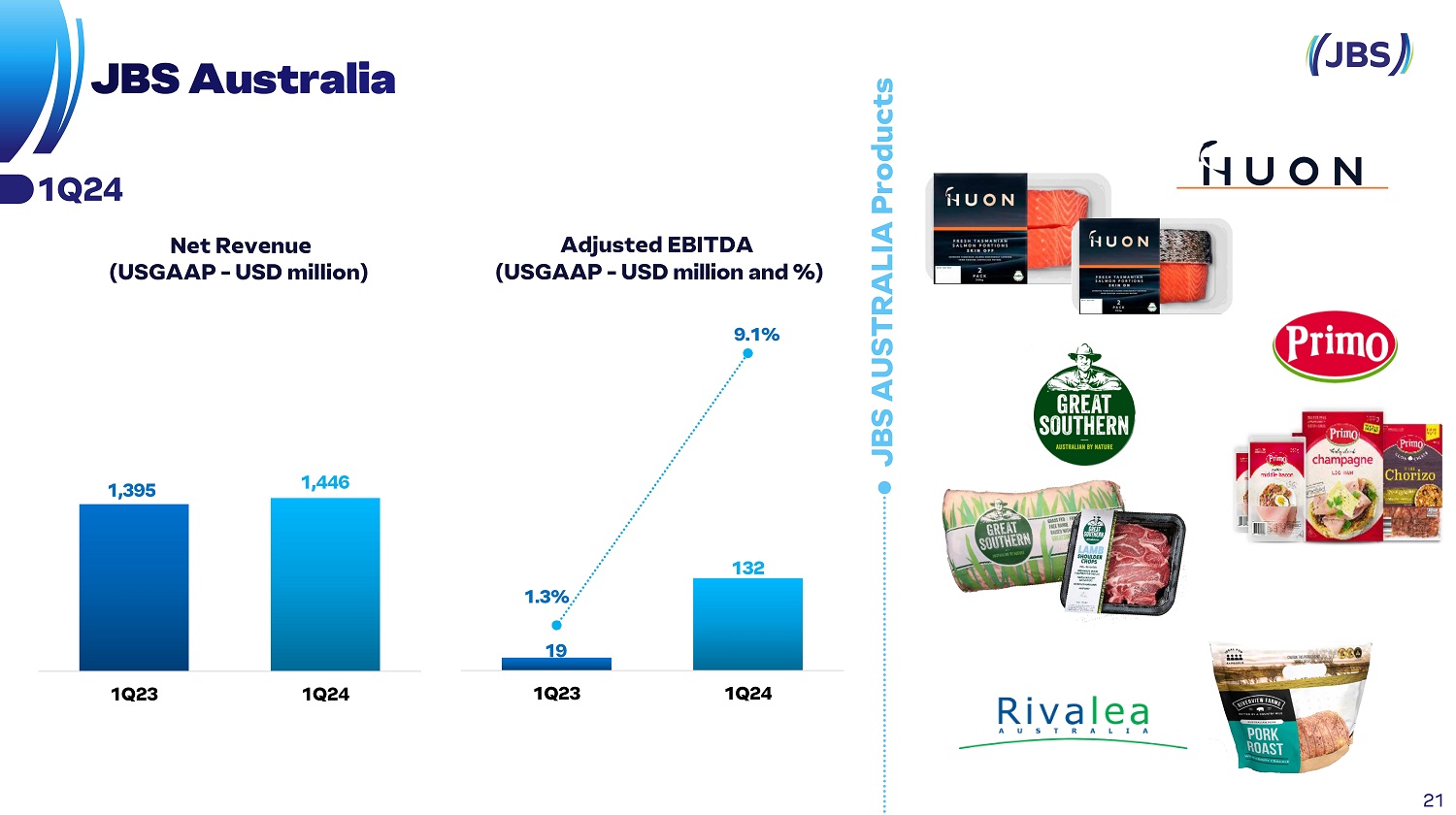

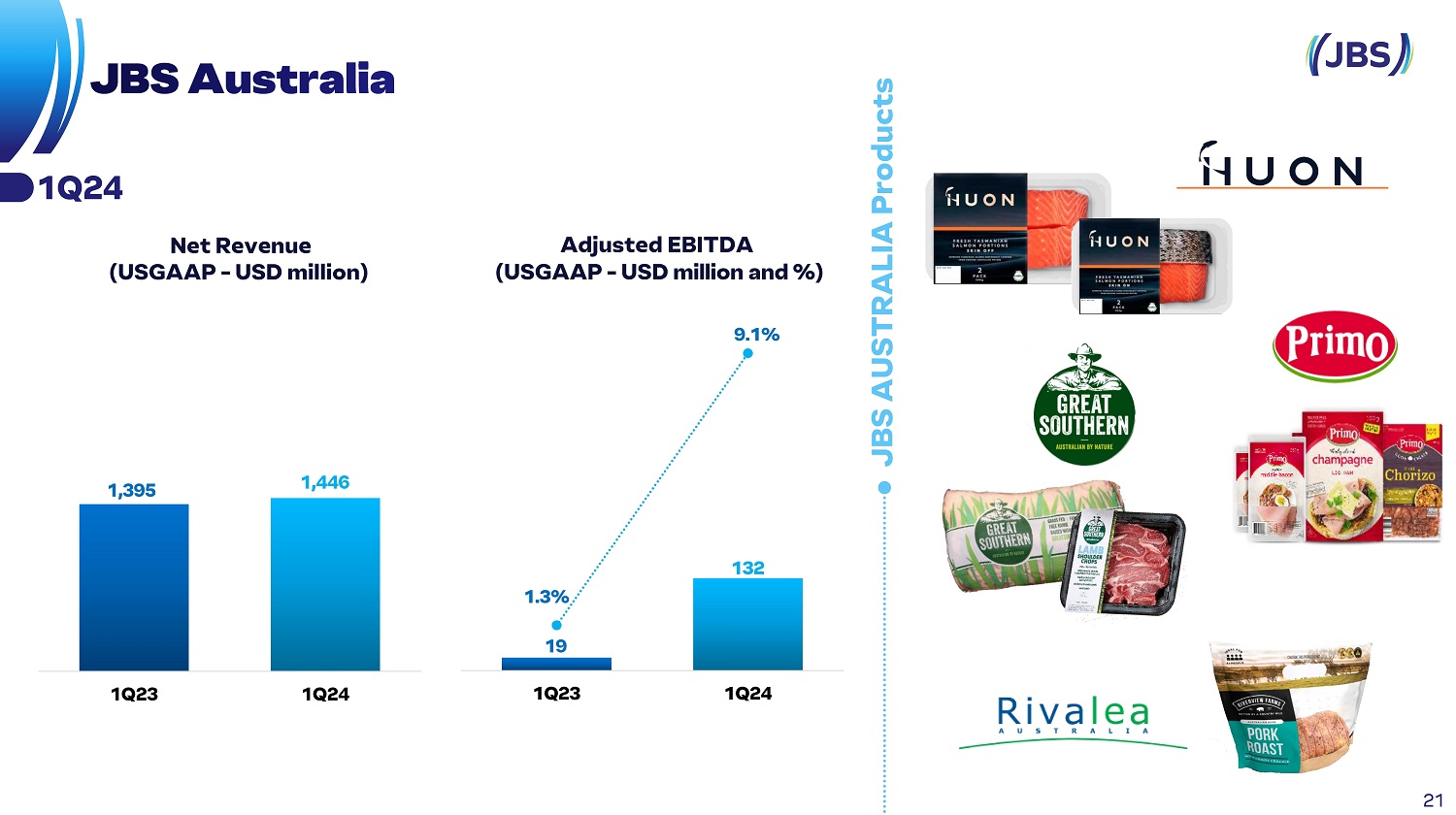

JBS AUSTRALIA Products 19 132 1.3% 9.1% 1Q23 1Q24 1,395 1,446 1Q23 1Q24 Net Revenue (USGAAP - USD million) Adjusted EBITDA (USGAAP - USD million and %) 1Q24 21

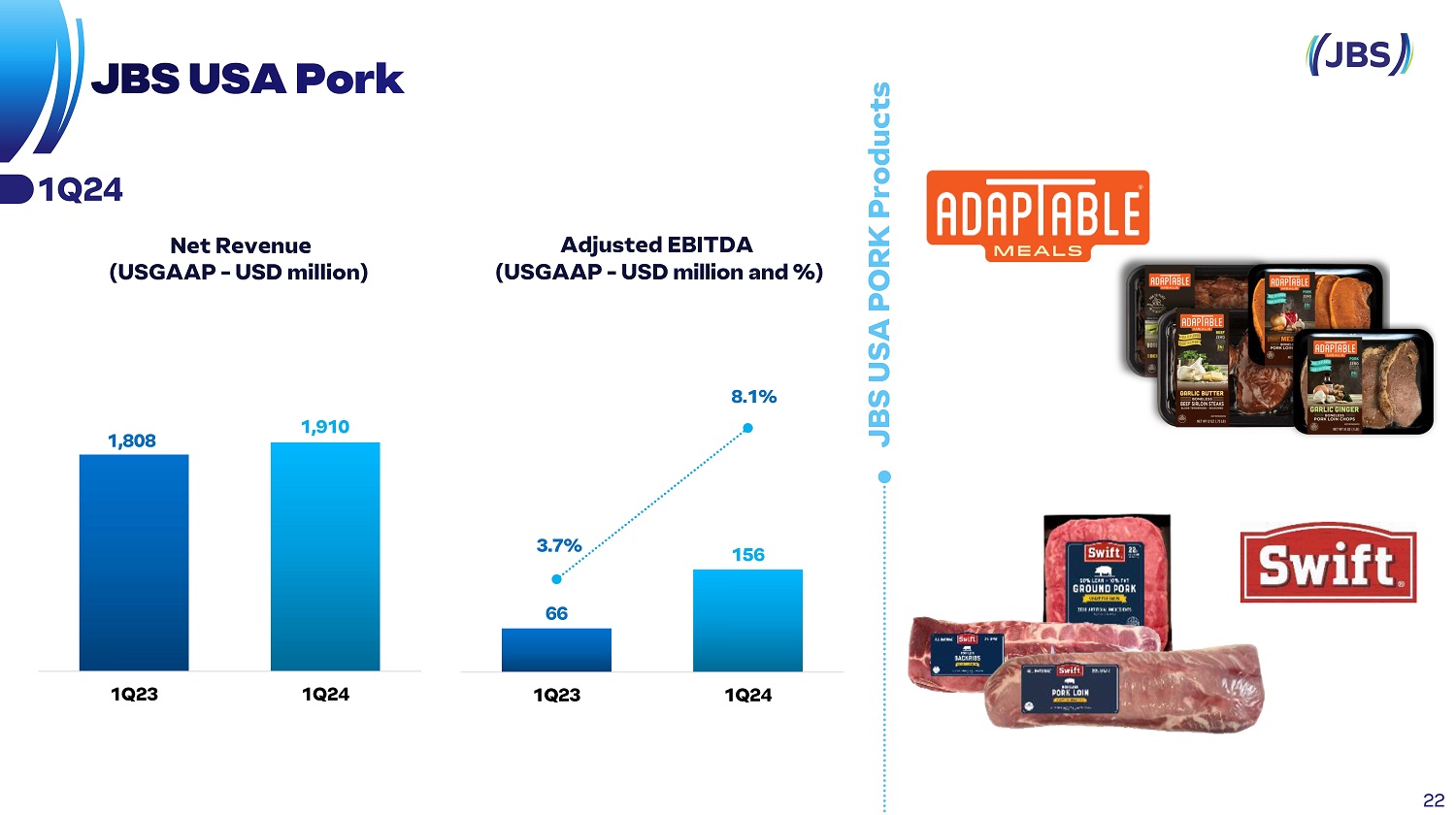

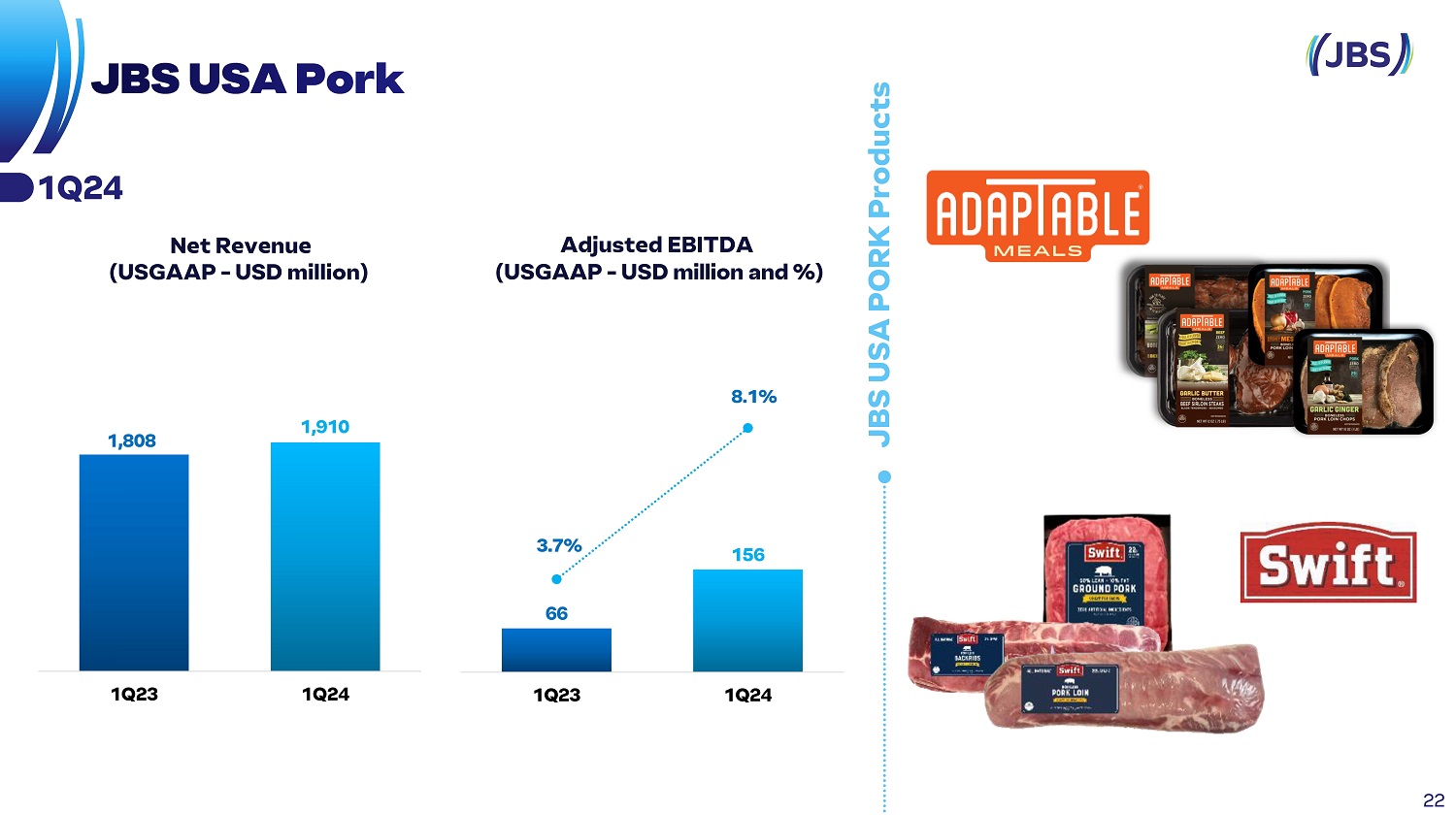

66 156 3.7% 8.1% 1Q23 1Q24 JBS USA PORK Products 1,808 1,910 1Q23 1Q24 Net Revenue (USGAAP - USD million) Adjusted EBITDA (USGAAP - USD million and %) 1Q24 22

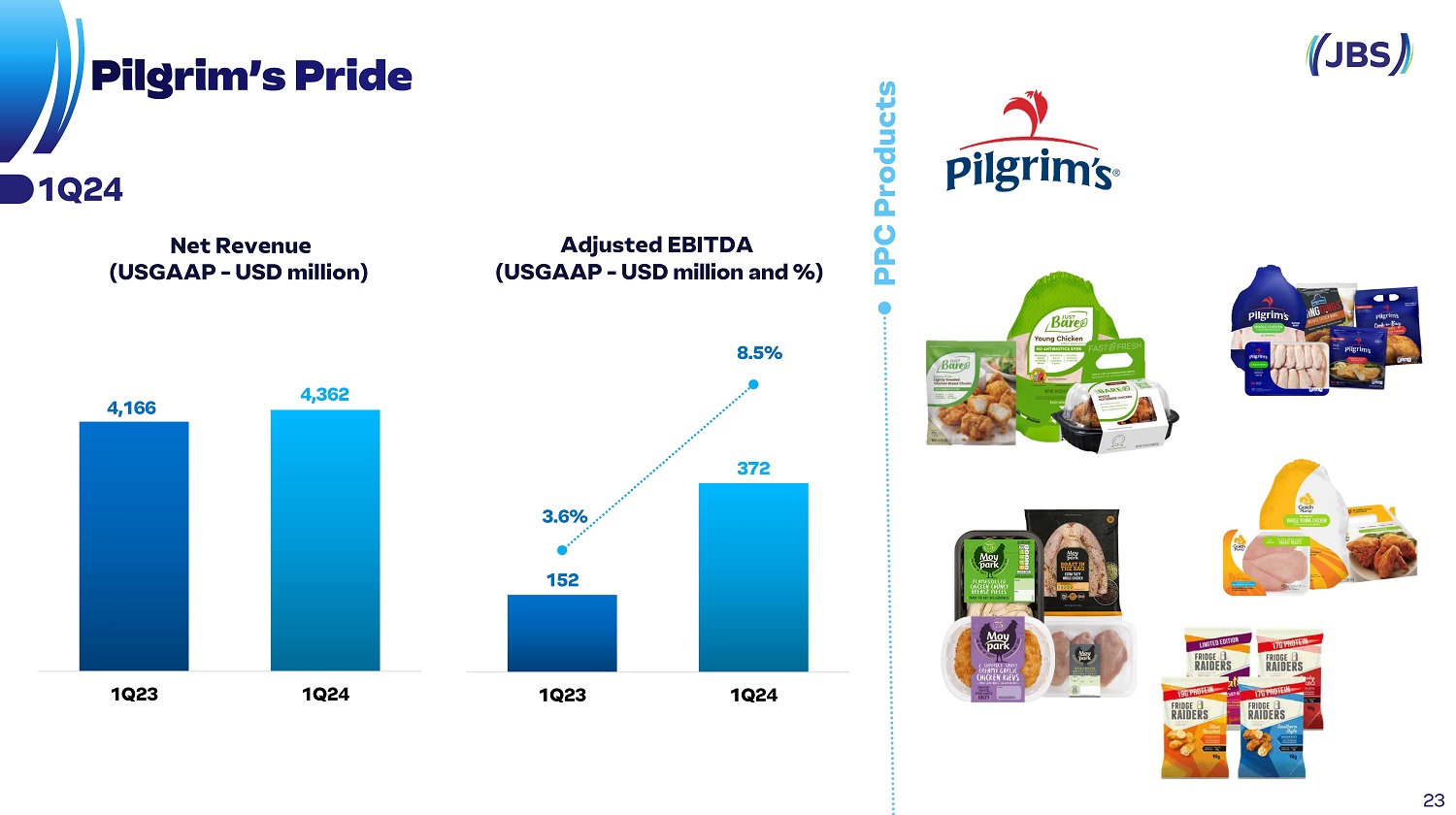

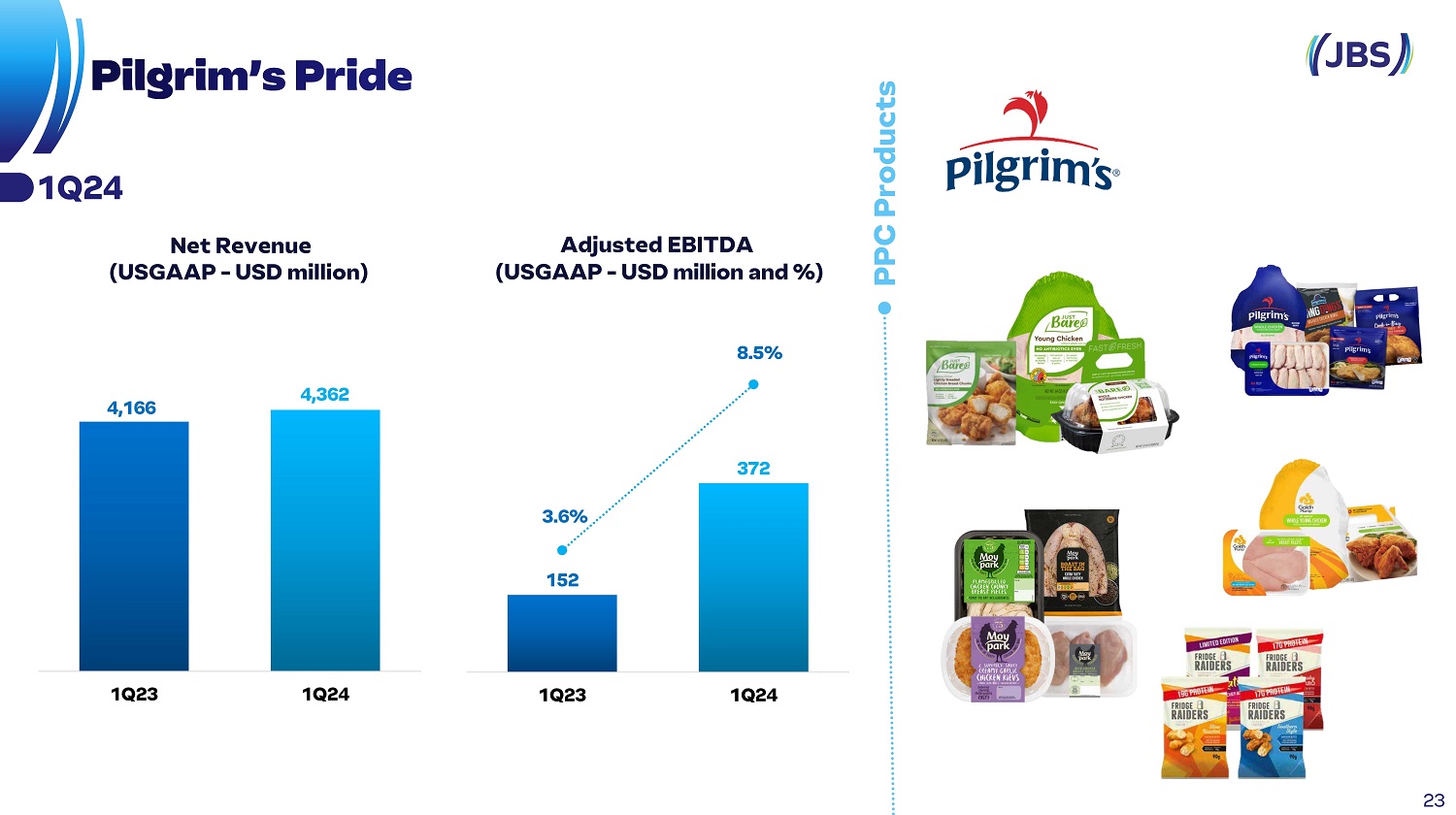

4,166 4,362 1Q23 1Q24 152 372 3.6% 8.5% 1Q23 1Q24 PPC Products Net Revenue (USGAAP - USD million) Adjusted EBITDA (USGAAP - USD million and %) 1Q24 23

Nota 1: Considera China e Hong Kong Export destinations of JBS during 1Q24 Exports Revenue in 1Q24: US$4.5Bi +16.3% vs. 1Q23 Asia corresponded to ~ 46% of total exports 21.7% Greater China¹ 16.3% Africa & Middle East 13.7% USA 8.7% South Korea 7.9% Japan 6.3% Mexico 6.1% E.U. 3.4% South America 2.7% Canada 2.4% Philippines 10.8% Others 24

JBS Bringing more to the table.

Exhibit

99.2

Results 1Q24 JBS

• The antecipation of the 13th salary for over 16,000 state team members • 1 million hygiene and cleaning products (in partnership with Flora, part of the J&F Group) • 70, 000 kilograms of food • 450,000 + liters of drinking water • 3,000 + mattresses and blankets • 3,000 + food baskets • 200 tons of essential items (clothing, water, non - perishable food items, bedding, and personal hygiene items) donated byJBS team members nationwide. Social SUPPORT FOR RIO GRANDE DO SUL

# 1 Global beef producer #1 Global poultry producer #2 Global pork producer Aquaculture Plant - based and alternative proteins business #3 European producer of plant - based protein. #2 salmon producer in Australia . In 2024, we will complete a new cultivated protein facility in Spain. Prepared Foods #1 Brazilian producer of plant - based protein. #2 in prepared foods in Brazil. #1 in prepared foods in the United Kingdom. #1 in prepared foods in Australia and New Zealand. LEADERSHIP NEW AVENUES OF GROWTH Global Leadership 3

1 . Enhance Scale in Existing Categories and Geographies Capture significant synergies 2 . Increase and Diversify Value - Added and Brand Portfolio Long Term Growth Strategy Pursuing additional value - enhancing growth opportunities with financial discipline Improve operational performance Enhance growth and margin profile Realize benefits of vertical integration 3 . New proteins Close to the Final Consumer - Multichannel 4

Net Revenue by Origin Canada Mexico 48% United States 29% Brazil 8% Australia 7% Europe 4% 3% Beef Pork Lamb Poultry Aquaculture Leather Plant Based Center for Innovation Cultivated Protein Prepared Foods South America 1% Mexico 5% Brazil 13% Asia 14% Africa & Middle East 3% USA 49% 3% Canada Australia & New Zealand 3% Net revenue LTM 1Q24 (by destination) Europe 9% 5 Strategy Geographic & Protein Diversification

16.5 17.6 31.1 36.9 38.6 42.9 51.2 48.9 49.0 51.1 49.7 51.7 52.3 65.0 72.6 72.9 74.2 0.7 0.6 2.1 1.9 2.2 2.8 4.7 4.0 3.3 4.2 4.0 5.0 5.6 8.5 6.7 3.5 4.3 2008 2009 2010 2011 2012 2013 2014 2015 2016 Net Sales 2017 2018 2019 2020 2021 2022 2023 LTM 1Q24 EBITDA 3.8% 3.7% 6.9% 5.1% 5.8% 6.6% 9.2% 8.2% 6.6% 8.2% 8.2% 9.7% 13.0% 10.9% 9.2% 4.7% 5.8% EBITDA Margin USD Billion Geographic & Product Diversification Leading to lower volatility in results. 6 JBS USA Pork PPC JBS Australia Seara Consolidated JBS Brazil JBS Beef North Am.

Valued Added: Diversified Global Brands Portfolio 7

13 MIL Team members in Australia and New Zealand 155 K Team members in Brazil 12 K Team members in Mexico 8 19 MIL Team members in Europe 72 K Team members in the USA and Canada Largest Employer in Brazil: 155,000 Team Members More Than 270,000 Team Members Globally

Investments Largest cattle unit in Latin America Processing capacity and spacing doubled at Campo Grande II unit in Mato Grosso do Sul • R$ 150 million investment • 4,400 animals processing volume • Increased team members from 2,300 to 4,600 9

Largest cattle unit in Australia Improvement in the quality and procuctivity of the Dinmore Unit, in Queensland • R$ 250 million investment • 500 new team members hired Investments 10

Investments Sustainability Solar energy in Seara’s broiler farms: • 55% of Seara’s broiler farms already use solar energy in their facilities Generation of energy from methane: • Through the installation of biodigesters that convert methane into energy, integrated producers reduce their electricity bills by 60% • Increase in income for producers through the sale of energy

Through the Beyond Borders program, the Company offers its team members the opportunity to internationalize their professional careers by changing roles or extending their knowledge to another country, strengthening JBS's organizational culture worldwide. 12 Instituto J&F Over 900 students enrolled in the education center, preparing young people for business. Better Futures Tuition - free community college tuition for JBS team members and their dependents. More than 6,000 people signed up. Instituto J&F MASTER Continuous training program for team members on the front line of production. Hometown Strong Community investment projects that support the communities where JBS is located through cash donations, infrastructure improvements and affordable housing. Social JBS projects around the world Beyond Borders Nourishing dreams, generating possibilities

Financial & Operating

JBS announced that it will invest R $ 150 million to double its production at the Campo Grande unit, in Mato Grosso do Sul, transforming it into the largest beef plant in Latin America and one of JBS's three largest worldwide . The Company announced an investment of to improve quality and its beef plant in Dinmore, US$50 million productivity at Australia.

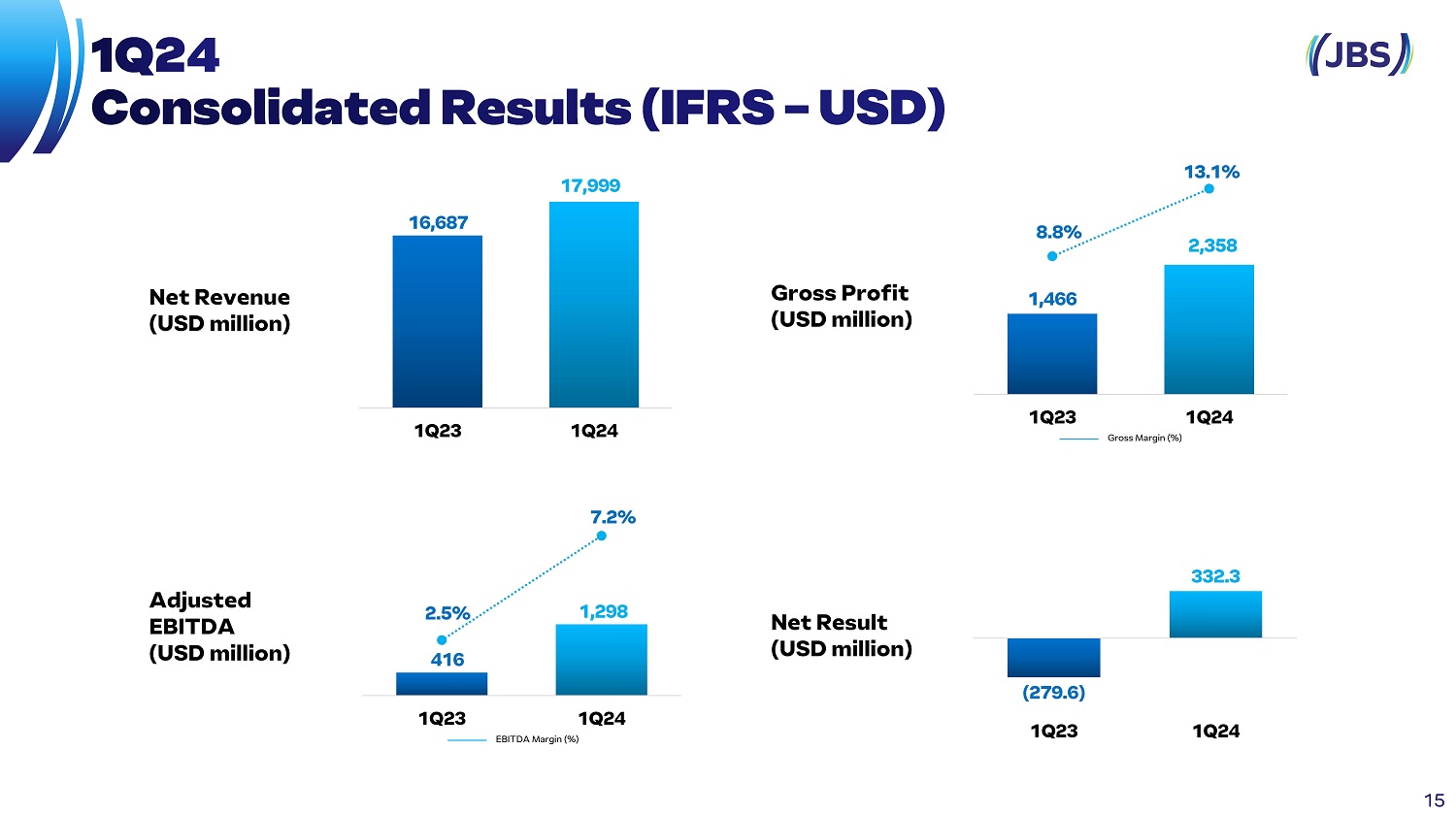

(279.6) 1Q23 332.3 1Q24 16,687 17,999 1Q23 1Q24 1,466 2,358 8.8% 13.1% 1Q23 1Q24 Gross Margin (%) Net Result (USD million) Adjusted EBITDA (USD million) 416 1,298 2.5% 7.2% 1Q23 1Q24 EBITDA Margin (%) Net Revenue (USD million) Gross Profit (USD million) 15

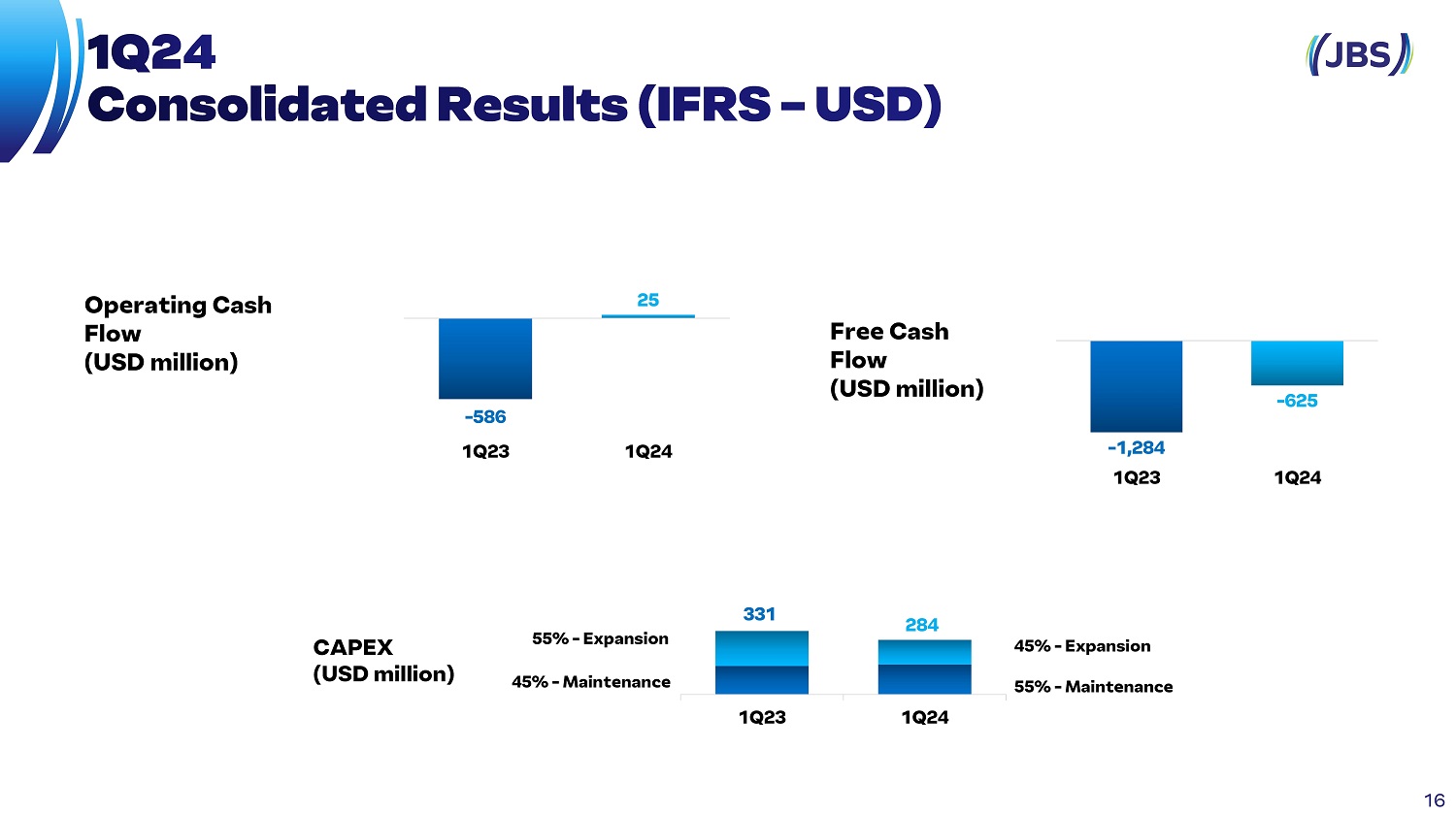

Operating Cash Flow (USD million) Free Cash Flow (USD million) - 586 1Q23 25 1Q24 331 284 1Q23 1Q24 - 625 - 1,284 1Q23 1Q24 55% - Maintenance 45% - Expansion 45% - Maintenance 55% - Expansion CAPEX (USD million) 16

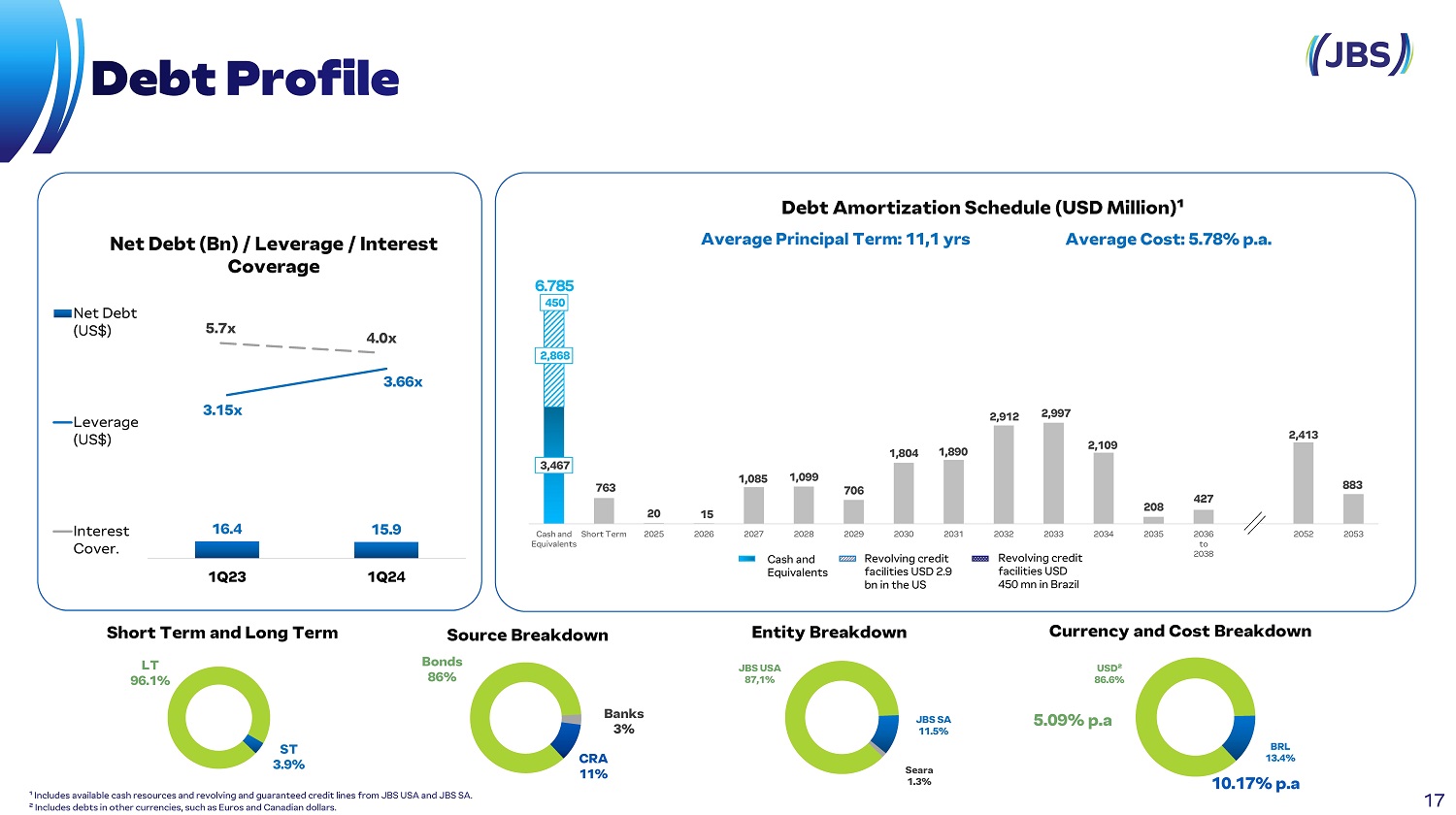

5.7x 4.0x 16.4 15.9 3.15x 3.66x 1Q23 1Q24 Net Debt (US$) Leverage (US$) Interest Cover. 763 20 15 1,085 1,099 706 1,804 1,890 2,912 2,997 2,109 208 427 2,413 883 2,868 3,467 450 Cash and Short Term Equivalents 2025 2026 2027 2028 2029 2034 2035 2036 to 2038 2039 to 2051 2052 2053 ¹ Includes available cash resources and revolving and guaranteed credit lines from JBS USA and JBS SA. ² Includes debts in other currencies, such as Euros and Canadian dollars. Net Debt (Bn) / Leverage / Interest Coverage Debt Amortization Schedule (USD Million)¹ Average Principal Term: 11,1 yrs Average Cost: 5.78% p.a. Entity Breakdown Currency and Cost Breakdown Short Term and Long Term LT 96.1% ST 3.9% Source Breakdown Bonds 86% Banks 3% CRA 11% JBS USA 87,1% JBS SA 11.5% Seara 1.3% USD² 86.6% BRL 13.4% 5.09% p.a 10.17% p.a Cash and Equivalents 2030 2031 Revolving credit facilities USD 2 . 9 bn in the US 2032 2033 Revolving credit facilities USD 450 mn in Brazil 17

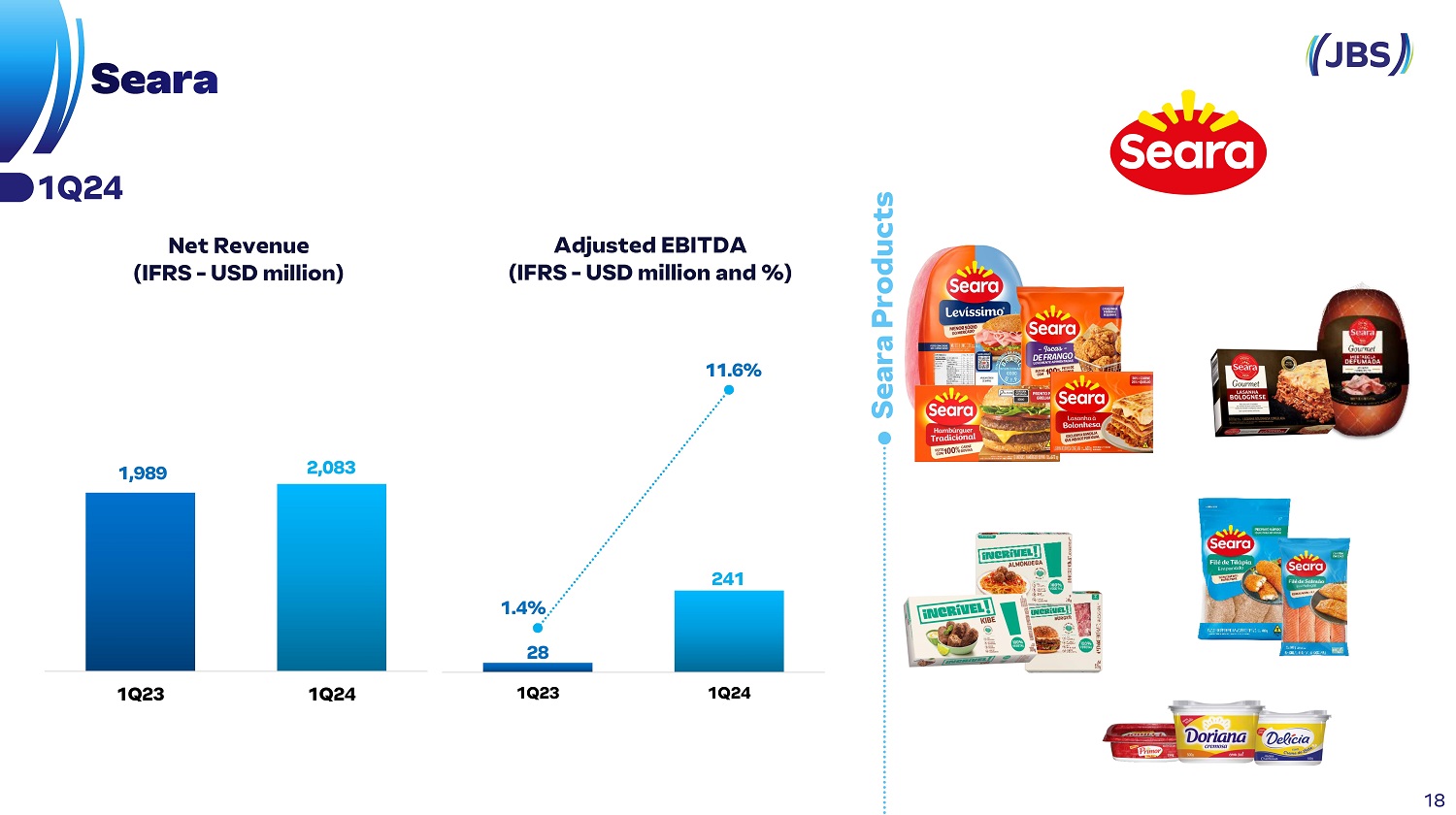

241 1.4% 28 11.6% 1Q23 1Q24 1,989 2,083 1Q23 1Q24 Seara Products Net Revenue (IFRS - USD million) Adjusted EBITDA (IFRS - USD million and %) 1Q24 18

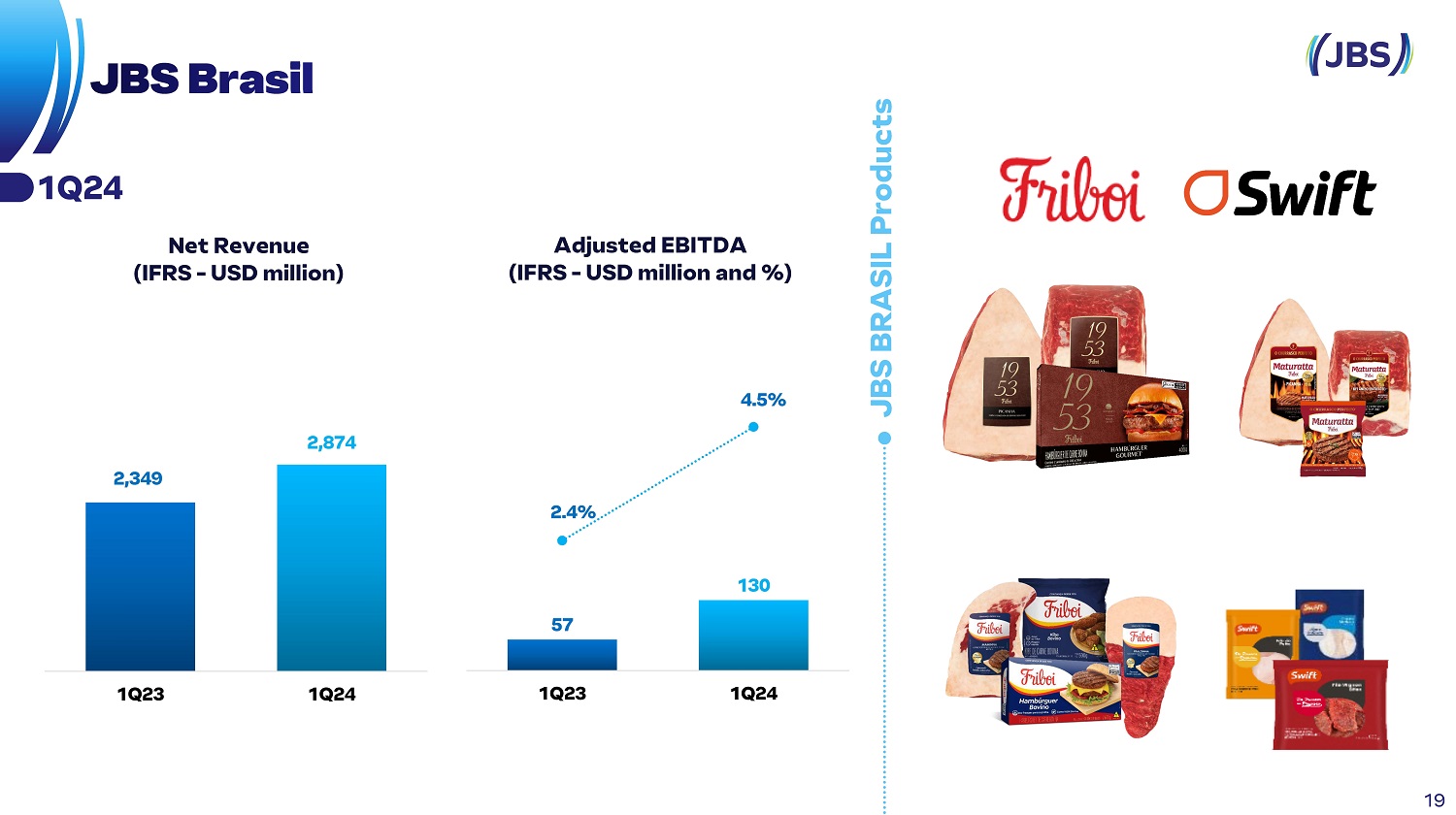

JBS BRASIL Products 57 130 2.4% 4.5% 1Q23 1Q24 2,349 2,874 1Q23 1Q24 Net Revenue (IFRS - USD million) Adjusted EBITDA (IFRS - USD million and %) 1Q24 19

5,266 5,581 1Q23 1Q24 - 23 1Q23 11 - 0.4% 0.2% 1Q24 JBS BEEF NORTH AMERICA Products Net Revenue (USGAAP - USD million) Adjusted EBITDA (USGAAP - USD million and %) 1Q24 20

JBS AUSTRALIA Products 19 132 1.3% 9.1% 1Q23 1Q24 1,395 1,446 1Q23 1Q24 Net Revenue (USGAAP - USD million) Adjusted EBITDA (USGAAP - USD million and %) 1Q24 21

66 156 3.7% 8.1% 1Q23 1Q24 JBS USA PORK Products 1,808 1,910 1Q23 1Q24 Net Revenue (USGAAP - USD million) Adjusted EBITDA (USGAAP - USD million and %) 1Q24 22

4,166 4,362 1Q23 1Q24 152 372 3.6% 8.5% 1Q23 1Q24 PPC Products Net Revenue (USGAAP - USD million) Adjusted EBITDA (USGAAP - USD million and %) 1Q24 23

24 Nota 1: Considera China e Hong Kong Export destinations of JBS during 1Q24 Exports Revenue in 1Q24: US$4.5Bi +16.3% vs. 1Q23 Asia corresponded to ~ 46% of total exports 21.7% Greater China¹ 16.3% Africa & Middle East 13.7% USA 8.7% South Korea 7.9% Japan 6.3% Mexico 6.1% E.U. 3.4% South America 2.7% Canada 2.4% Philippines 10.8% Others

JBS Bringing more to the table.

Exhibit 99.3

International Conference Call

JBS S/A (JBSS3)

1Q24 Earnings Results Transcription

May 15th, 2024

Operator: Good morning. Welcome to the

conference call of JBS S/A and JBS USA to announce their results of the first quarter of 2024. At this time, all participants are in listen-only

mode. Later, we will conduct a questions and answer session and instructions will be given at that time.

As a reminder, this conference is being recorded.

Any statements made during this conference call relative to the company’s business outlook, projections, operational and financial targets

and goals, and growth potential are merely forecasts based on the company’s management expectations in relation to the future of JBS.

Such expectations are highly dependent on market

conditions, on Brazil’s overall economic performance, on the industry and international markets and therefore are subject to change.

Today here with us we have Mr. Gilberto Tomazoni,

Global CEO of JBS, Guilherme Cavalcanti, Global CFO of JBS, Wesley Batista Filho, CEO of JBS USA, and Christiane Assis, Investor Relations

Officer.

Now I would like to turn the conference over to

Mr. Gilberto Tomazoni, who’s going to start the presentation. Mr. Tomazoni, please, you may start.

Gilberto Tomazoni: Good morning, everyone.

Thank you so much for attending our result conference call.

Before delving into the results, I would like

to take the opportunity to express my sympathy towards the victims of the catastrophe caused by the rains in Rio Grande do Sul, especially

to our more than 16,000 team members in the state. The world has been following the situation with sadness and dedication of our entire

team has been essential in helping our team members, partners, along with their families and impacted communities to recover.

Once again, I would like to express my deepest

admiration and gratitude to the extraordinary work that everyone has been doing to offer support during this tragic event. As a company,

we are mobilized to provide donations of essential items for assistance to people in the region, such as food, hygiene, cleaning products,

water, clothing, and blankets.

Now, back to our financials, JBS had a solid first

quarter in the first quarter of 2024. These numbers reinforce that we are on a path of recovery, as we have been indicating to you in

recent quarters. We have added almost 2 percentage points to our consolidated EBITDA margin as compared to the fourth quarter of 2023.

As to the first quarter of 2023, we have reached a margin of 7.2 in a period increasing by 470 basis points.

I would like to highlight the result of Seara,

which delivered double-digit margins in the first quarter already. Its focus on operational excellence is reflected in a significant evolution

of the business margins, which went up from 6.4 in Q423 to 11.6 in Q12024. So, closing the gap of part of the operational gaps and the

cost of grains going back to normal and the growth in volumes, especially in domestic market, reinforce the promising prospects for Seara

this year.

We keep our focus on the pursuit for the preference

of consumers and to capture operational opportunities. Our focus on key customers, brand growth and consolidation of our business in Europe,

and a pursuit for operational excellence are reflected in the strong result of Pilgrims. The business margins had a significant increase

going up from 6.5 in Q1 2023 to 11.5 in Q1 2024.

USA Pork margins grew from 2.5 to 16.4 in the

same period. Our poultry and pork businesses have benefited from the reduction in grain prices, as well as a rebalance in supply and demand.

I would like to highlight that our results are very robust, and once again, this reinforces the importance of our diversification of geographies

and proteins.

In a quarter that is traditionally weaker for

the global protein industry, cattle businesses in Brazil and Australia captured the results of the high cycle in these two countries,

whereas JBS Beef North America goes on with weaker margins as a result of the cattle raising cycle and seasonal conditions, as we had

indicated before.

Once again, I would like to stress our financial

solidity. In the first quarter of 2024, we reached a net income of R$1.6 billion with a net revenue of R$89.1 billion and adjusted EBITDA

of R$6.4 billion. Our priority is still to deleverage a process that has consolidated.

This rate had a reduction of 4.42 times in US

dollars in Q1 2023 and now it’s down to 3.66 times in Q1 2024. If we use the numbers of this quarter as a reference, which is one

of the weakest quarters in the industry, and if we abstract mathematically, we use this information, we will close the year with 2,5 times

our leverage.

And I would like to reinforce this is not a guidance,

this is just a mathematical abstraction that we use as a reference the margins that we had in the first quarter of this year.

The numbers of this quarter reinforce our trust

in the JBS long-term strategy focusing on the expansion of our global multi-protein platform and on the consolidation of our strong brand

portfolio and high-value-added products. In that sense, along recent quarters, we have made several investments that will start to provide

good fruit.

In the Brazilian state of Mato Grosso do Sul,

this year we are going to open Dourados, and industrial or manufacturing complex, a new processing plant for swine in natura, and another

for prepared foods. We also announced that in April we are going to double our capacity in our bovine plant in the Campo Grande in the

same state, one of the units had just been licensed to export to China.

In Jeddah, in Saudi Arabia, we are finalizing

our third plant for halal products. In San Sebastian, in Spain, we are going to start the operations of our cultivated protein plant and

Biotech Foods. We’ll focus on what we can control to become increasingly more competitive in the different markets where we operate. For

this reason, we have absolute focus in cost management, increasing productivity, optimizing our mix, focusing on opportunities in market

and price asymmetries regardless of the geography and economic variations.

We are confident that the strength of our platform

added to our financial soundness and our commitment to excellence innovation will enable JBS to move towards its trajectory of growth,

adding value to all our stakeholders and the communities where we operate.

Once again, I thank you very much for being in

our conference call. And now I give the floor to Guilherme, who’s going to give you details about our numbers. Guilherme, please.

Guilherme Cavalcanti: Thank you, Tomazoni.

Now let’s go to operational financial highlights starting on slide 15. The net revenue was R$89 billion or US$18 billion. The adjusted

EBITDA, R$6.4 billion or US$1.3 billion. This represents a margin of 7.2% of the quarter. Net profit was R$1.6 billion, or US$332.

And now moving to the next slide, the operating

cash flow in the quarter was R$122 million, or US$25 million. This cash flow in the quarter was negative at US$622 million, or 3.1 billion.

As we anticipated in our last earnings conference call, we estimated the cash consumption would be half of the amount reported in the

same period in the year, which happened.

Despite this cash consumption, which is common

for the first quarter due to the seasonality of the period, this is explained by the increase in results in practically all our business

units. CAPEX in the quarter was R$1.4 billion or US$284 million, 55% maintenance CAPEX. This amount is 18% lower than Q123, which is in

line our estimates of US$1.3 billion.

Now moving to slide 17, the net debt ended at

US$15.9 billion, reflecting an increase of US$569 million as compared to the previous quarter, variations explained by the cash burn,

considering the typical seasonality of this time of this year. The leverage in dollars went down from 4.42 to 3.66 times in BRL and 4.32

to 3.70 in US dollars in a quarterly comparison, thereby confirming that they leverage. In the second quarter this year, we are expecting

another significant drop in this indicator to about 3 times.

Now, conducting a leverage exercise and not considering

the guidance for us to reach a leverage of 2.5 times at the end of the year, our consolidated margin in 2024 should be close to 7.5%,

considering that the first quarter is seasonally weaker, and the margin was already 7.2%, it’s reasonable to think at this level of leverage

for the end of the year, thereby staying within our policy of being between 2 and 3 times our net debt along the year.

We reduced our net debt by US$666 million in the

first quarter, especially due to the payment of short and long-term bank debts. We are going to reduce our gross debt in the second quarter.

In this manner, now I’m going to go over each

one of our business units. Starting with Seara on slide 18, the net revenue in the quarter was stable as compared to the same period in

the year before, US$10.3 billion or US$2.1 billion. However, as we had said, the profitability has already gone back to normal two-digit

levels. This improvement is a result of intense focus on operational excellence, management team, cost reduction, specialty grain, better

offer and demand balance, and maturation of new plants. And EBITDA margin grew more than 10 percentage points year on year, reaching 11.6%

in Q124.

Now on slide 19, JBS had a net revenue 17% higher

than Q123 driven by higher volume sold. The favorable capital cycle had a positive impact in sales volumes both in Brazil and internationally

due to the high availability of animals for slaughter. This cycle has also contributed for the reduction of cattle prices bought and as

a consequence had a positive impact on profitability.

On slide 20 – and now dollars USGAAP –

net revenue in US JBS Beef North America grew 6% year and year. Profitability is still pressured, considering a more challenging cattle

cycle because the price of living animals went up more than wholesale.

JBS Australia, we have higher volume sold, both

in the domestic and international markets. The growth and profitability year on year reflected especially the higher availability of cattle

in the market, considering a more favorable cattle cycle and efficiency gains in many business areas in Australia.

Now, JBS USA Pork, the net revenue was 6% compared

to Q123 because of the average prices on the period. In addition to better commercial dynamics, the profitability was positively impacted

by lower grain costs, a drop in average price of swine in Q124 and continual efforts aiming to expand the value-added portfolio in addition

to better commercial execution, operation and logistics too.

So, Pilgrim’s Pride had an increase in net revenue

of 5%. The first quarter showed the results of this strategy, making it possible for the company to grow compared to the market. The product

portfolio with this brand contributed to diversification and still expanding.

As you can see, the results of the first quarter

are very exciting, as we had indicated in our more recent conference calls, and we are optimistic in our deleveraging trajectory and cash

generation for the year.

Now we are going to open for questions and answers.

Question and Answer Session

Operator: Ladies and gentlemen, we are

going to start now our Q&A session. To ask a question, please use the raise hand option. To withdraw it from the list, click lower

hand.

Our first question comes from Isabella Simonato,

Bank of America.

Isabella Simonato: Hello, good morning

Tomazoni and Guilherme. Congrats on the results. I have two questions. The first one is about Seara. We can see, of course, the market

reality, as you’ve pointed out, it is really favorable for the future ahead. And I’d like to know your vision about the external market

for poultry.

We’ve seen some markets performing at price levels

above the average, and now you’re going to have a new plant in Saudi. I would like to hear from you about the external market for poultry

considering Seara’s reality.

The second question concerns the US cycle. The

landscape is still quite challenging, but please tell us a little bit about the beginning of the cycle of the quarter and how you’ve been

analyzing the seasonality for the second and third quarter of the year. Thank you.

Wesley Batista: Good morning, Isabella.

I’m going to start talking about our beef business in US. We expect normal seasonality this year, but weaker than it had been last year.

There is less availability of beef, of cattle. We’ve seen that in the first quarter, about 3% drop of our slaughter, even more than that,

13% in the decrease of cow slaughter, very relevant as you can see.

The demand is more restrict because of inflation.

The price of cattle is higher, the second quarter will have the natural seasonality, with now spring and summertime in the US we may expect

better margins, but it is going to be more challenging than it had been last year.

Gilberto Tomazoni: Isabella, thank you

very much for the question. Concerning poultry in the international market, as you pointed out, our perspective for this business is very

positive for two main reasons: First, we can see more interest for poultry protein in all different markets. US, for example, the USA,

we can see that, and also other international markets. Globally speaking, there is an increased demand for poultry. In addition, the protein

offer is very well balanced, and it has been a challenge, of course, to manage our new genetic lineage that have been developed.

For all different markets and producers, they

are managing that increased productivity based on genetic handling. And you can see, for example, that in the USA, the FDA they are showing

a smaller growth of poultry production. And they have been still having an increased demand.

So, it’s a positive demand all over. That’s the

fact.

Isabella Simonato: Thank you, Tomazoni.

If I can have a follow-up on my question, thinking about regionally and your exposure to the Middle East, what is your outlook there?

Maybe you could increase your market share in the region. And thinking about the new plan, are you thinking about changing your external

market mix?

Gilberto Tomazoni: Well, in Saudi Arabia,

we have very great perspectives. We have two plants, we’ve started developing now our third processed food plants, where we are developing

the brand Seara, especially in retail. The market in the region has been very promising, with high demands. It’s a market also benefit

by the Turkey’s decision to restrict part of the exports it used to do. Turkey used to be a very important player there.

Therefore, we have the focus of developing our

brand all over the region, we focused on Saudi Arabia using our branded added-value product, but we also provide services through food

service also at higher volumes.

Middle East and Asia are extremely relevant markets

to Brazil and Seara is just surfing the same wave. Great.

Isabella Simonato: Thank you very much.

Operator: The next question comes from

Ricardo Alves, Morgan Stanley.

Ricardo Alves: Good morning, everyone.

Thank you very much for the opportunity. I have two brief questions to ask you, building up on what has already been asked, considering

North America Beef, this improvement of the first quarter compared to the fourth quarter 23, was great to see. But when we think about

the second quarter and what Wesley has just said that it’s going to be probably a harder second quarter than previously because of the

whole cycle, livestock cycle.

But thinking about the cutout side, how do you

see that delay in reacting of cutout? We’ve been seeing that the fat cattle price had been impacting the market, it seems that there is

something really bringing down the prices. But do you have any information about higher inventory levels or something like that?

And do you also expect to have a recovery on prices

in a seasonality perspective? We believe so, but we would just like to know if there is anything else that you know, that you’ve been

observing in the market that would impact demand and the price of cutout going from less of cattle and more into beef offer.

For Seara, I would just like to understand whether

we can quantify the sequential improvement of margin, mostly it has come from grain, but does it also have operational adjustments? Have

you been streamlining some of your plants? Just to understand how much of that margin benefit has derived from commercial pricing adjustments

or operational improvement.

And finally, the last question for US pork, is

there still room for your top line to be increased? It’s been great to see that historical range, we like to see stability, but do you

think there is a potential of increasing the top line? China has adjusted its production of pork, so maybe even for exports, the perspective

of US pork can be even better. So that’s it. Thank you very much.

Wesley Batista: Good morning, Ricardo.

Starting about our beef cattle in US, comparing to the same period last year, we’ve observed a delayed demand, but it’s coming into the

market. We can see it now Memorial Day coming, which is a very important holiday in the US for the second quarter. So we’ve been seeing

more activity than in the first part of the second quarter.

We strongly believe that it’s going to be a seasonal

movement but lagging behind somewhat compared to last year. But the current cutout, it’s not bad. Historically, the cutout as we have

today, somewhat below US$3 per pound, it’s not low. But of course, the impression that we have in terms of cost of cattle is very relevant

and compared to last year, it really applies pressure on the spread. But we are going to see that happening.

Something else about beef, the first quarter of

24 was much more challenging than the same period last year. If you analyze USDA data of spread, we can say that the spread was just half

of what it was last year. So the market margin was subject to much compression. And we’ve delivered better results than last year because

of internal improvements.

We’ve been talking about our own internal improvements

in our business, both commercially and industrially speaking. And I would estimate, and it’s important to say, that 2 percentage points

have already been captured, and we are looking for more. We know it’s going to be a very challenging year for beef cattle, but we believe

there are 2 more percentage points of margin to be captured regardless of market, regardless of cutout, price of cattle. We believe there

are still 2 more percentage points in addition to the 2% that we estimate that we have already captured. And I mean that regardless of

the market’s performance.

Now speaking about pork USA, yes, we believe there

is the potential there of increasing our top line. Please bear in mind that within pork business, it’s not only pork beef, but there are

also prepared food businesses, and we’ve made relevant investments of expanding our capacity, bringing new lines. There is a new plant

recently opened in Missouri for salami, prosciutto, Italian specialty of cuts. This is something that has a huge potential to grow.

It’s not going to be huge, of course, in terms

of added revenue, but in terms of adding value, our swine products can really get better. There is a line which is at maturity level,

our cooked bacon line, very much focused on food service. There is also an important performance in retail. So within our businesses of

prepared foods, we see a great potential of increasing top line.

Therefore, the cutout of pork also impact the

top line up or down, depending on the commodity in the market. I’m talking about adding value, because we can see a great possibility

of adding value and with that increasing top line.

Gilberto Tomazoni: Ricardo, this is Tomazoni

speaking. About Seara, you’ve asked us where it comes from in terms of margin improvement quarter over quarter. Margin improvement, as

I pointed out in my opening remarks, it has resulted from grain prices, we’ve been building up on that since the last quarter, in

this last quarter, we can say that mostly the benefit of grain prices have been fully captured. But there was another part resulting from

our operating improvements and that balance between supply and demand.

So it’s a combination of actions. What we are

going to see from now on won’t have a contribution from grain prices anymore because everything has already been absorbed within our cost

structure, but we are going to see that the potential of Seara is to keep on increasing margins, because only part of the operational

improvements that have been identified have already been captured.

Seara has a very long chain, and it takes some

time for improvements to reach the P&L. It takes time. We’re going to keep on seeing Seara with a potential to grow margins.

Ricardo Alves: Great, thank you very much

all of you. Thank you for the level of details. Have a nice day.

Operator: Our next question comes from

Leonardo Alencar, from XP. Leonardo, you may ask your question.

Leonardo Alencar: Good morning, everyone.

Thank you so much all the information about US beef, but I would like to follow up on that topic. Number one, what is your capacity utilization?

Because we are seeing an interesting dynamics. There’s a better demand in the quarter. It’s kind of late, but we see indication. It seems

that retail is carrying a lot of margin. In terms of slaughter, very high. And then we’re wondering if slaughter was lower, maybe the

margins would be better.

Could you tell us about this dynamics and then

talk about your strategies? But what catches the eye is that there is an increase in margins should be expanding faster, and you have

this tool in hand to adjust.

And thinking about JBS Brazil, there was a positive

surprise in terms of slaughter in Q1. Was there any room for higher slaughter and better cost management?

And the other question is related to your leverage

references and guidance. But in the 4Q quarter, there was an expectation of 3 times leverage for the end of this year and shortly afterwards.

You were talking about 2,5 times for the end of this year. So which are the other assumptions that may have changed from last quarter?

So thinking of 3 times for the second quarter, what should we expect in terms of EBITDA?

Wesley Batista: Leonardo, answering first,

the bovine business in US. Capacity utilization, well, yes, this is an estimate. We don’t know the market results, but we can see that

slaughter at the current level of 620, 600-something thousand heads per week, well, it’s well-balanced.

The US, it’s not a very, very high slaughter level.

It’s quite stable in terms of slaughter. It doesn’t surprise us. We can talk about the level of slaughter in the market because we might

be getting into our strategy, but we are seeing this in a very well-balanced way. It’s neither too much nor too little. Below that, the

capacity would be underused, and above that it’s more overworked during the week.

So it’s very well balanced, I don’t think

it’s either end of the scale, neither too much nor too little. So what has gotten better are the operational results.

Guilherme Cavalcanti: So in the first quarter,

we have an EBITDA of US$400 million in 2023, and now we have US$1,300 billion after one month and a half in Q2, so we are confident to

say that once again, our EBITDA is going to be higher. And moreover, after the second half of the year, we are going to have positive

free cash flow.

So the combination between having a higher EBITDA

and cash generation will drive leverage to get to 3 times in the second half, thereby advancing an EBITDA improvement, and continuing

on this trend, we are going to get to the end of the year with 2,5 times already considering the dividends that we have announced in case

our listing is approved.

So, as I said, if you do the math to get to 2.5

times the average of the year, it needs to be 7.5%. We have 7.2 in Q1. So I think that 2.5 times is an estimate that is quite conservative

for this. Of course, everything can change. This is just an expectation, but I think that today this is the most likely scenario of having

this trend of deleveraging and getting to the end of the year within our policy, which is a policy, this is based on keeping our investment

grade, which is our priority.

Leonardo Alencar: Just one follow-up going

back to what Wesley said. So, this issue of dairy cattle and exports to China, are you worried in any way? Maybe your plants in China,

could there be any problems?

Wesley Batista: Well, USDA has been doing

a very, very good work in the US, both domestically and internationally. So we’re not worried about neither demand nor offer. The situation

is well under control, very well monitored, and this is not an issue that we are worried about. It looks to us that it’s well under control

by the USDA.

Leonardo Alencar: So avian flu, considering

it, is it a problem?

Wesley Batista: No, no, no. Nothing new

on that front.

Leonardo Alencar: Thank you so much. Thank

you.

Wesley Batista: And as a reminder, in the

US, things are slightly different than in other countries because all plants in the US are licensed. So there is a difference. China is

slightly different than the US. All our plants are licensed.

Leonardo Alencar: Thank you.

Operator: Our next question comes from

Thiago Duarte, from BTG. Mr. Duarte, please, you may ask your question.

Thiago Duarte: Hello, good morning, everyone.

Thank you so much for the opportunity. I would like to run the risk of being repetitive. I would like to insist on Seara and US Beef.

As to Seara, it is clear, and Tomazoni has mentioned many points to qualify the top line dynamics. But Tomazoni, I would like to ask you

to quantify the top line dynamics. I would imagine that by now, with all the capacity that has been added in terms of processed foods,

breaded foods, that we would be seeing a more significant growth in volume. Could you explain or try to qualify or describe to us how

much of the ramp-up of volume capacities we are already seeing in these numbers?

And a little bit of the success and challenges

that you are having to increase the share of this category of processed foods that may have been one of the most significant in terms

of capacity increase in the latest Seara’s investment cycle.

And question number two for US Beef, if it’s more

of a follow-up, also trying to have more details about the margin improvement quarter on quarter. Wesley, I had understood from the discussion

of the effect of derivatives of the results in the fourth quarter that we would still be seeing part of it this quarter. Have I understood

it wrong? Could you confirm that? And how much could have had an impact in the results that we are seeing in the first quarter? Thank

you.

Gilberto Tomazoni: Thiago, good morning.

Thank you very much for your question. Yes, you’re right to say that Seara should have higher volumes than it does. So we should start

seeing this in the next quarters. When we said that we are adjusting processes, part of adjusting processes is to recalibrate the volumes

that we had in order to be able to accelerate output of processes later on. So Seara does have additional capacity in excess of what it

delivered in Q1.

So, part of it is related to the ramp-up that

we are doing. So, the ramp-up is going very well, answering part of your first question, so the ramp-up is going very well, we are being

able to gain market share, and even in some subcategories, because we have subcategories, this is being very positive, so we are going

back to normal with our operations trying to accelerate the output of our plants.

So from next quarter onwards, we should see an

increase in output in a top line at Seara, as you said.

And now about the beef derivatives, about half

of the difference of the impact that we had in Q4, we recovered. This is going to be much more stable in the future.

Thiago Duarte: Great. Thank you.

Operator: Our next question comes from

Guilherme Palhares, from Santander. Mr. Palhares, please.

Guilherme Palhares: Good morning, everyone.

Thank you for taking my questions. Before anything, I would like to thank everyone for the help to Rio Grande do Sul and all the efforts

and everything that you have done recently. That said, going to the questions, I would like to talk about US Park. So, we saw the prices

of animals, and this led to a difference between IFRS and USGAAP, so this price doubled in the short term, and cutout is still reacting

to adjust to this reality.

So, could you give us a little bit more details,

especially on the commodity scenario? Wesley has talked about processed foods, but I would like to hear more on the short-term dynamics

of all the adjustments that we are seeing.

And number two, could you give us more details

about the dynamics of feedlots in the US? So there are new placements in feedlot in the US, sometimes more or less, maybe as a feed is

cheaper you are having more animals in feedlot. What about female animals? We are going through a moment of reduction, so they are staying

longer until they gain weight until the end. So how do you see that? Thank you.

Wesley Batista: Guilherme, good morning.

As to pork, this IFRS, USGAAP difference, this is beyond our control. There are two accounting methods on a day-to-day. We manage everything

according to USGAAP, this is a number that we have in our day-to-day management. It’s not something that we can control. And obviously,

this quarter, there was a major difference, both the price of hog has gone up as well as grain. But I don’t think that this is something

that is worth focusing on. What really matters is the bottom line according to USGAAP.

Now as to prices of living animals, this has been

going up, and this is a correction. In the beginning, especially in the beginning of the first quarter, the living pork or hogs here in

the US it was kind of in balance, now it’s back to normal, and this really makes the margin narrower, leads to narrower margins, especially

in terms of processing plants. But in the second quarter, we’re not seeing an increase in the prices having a negative effect in terms

of our pork margins.

So we see our pork businesses very, very optimistically

both in terms of cost and supply, and demand is very strong, so the channel is likely to increase, to adjust for higher hog prices in

and the cattle market has better prices than lower values, this helps a lot in the internal demand of pork, and the US is exporting 88%

more of pork. It has gained share in international markets.

So pork business, despite the increase in prices,

both because of our purchasing strategy and as the potential of higher prices for pork, both domestically and internationally, and we

are optimistic about the future.

As to beef cattle, we see that feedlots, they

stay longer, and this is good because it increases our potential, so we have higher quality of the beef. This increases our potential

of transferring higher costs of beef because we have more choice, more prime and this helps the processing plant and naturally the cost

grain is cheaper to feed their cattle and feedlots is higher, and then animals will be longer in the feedlot.

We’ve not seen this in retention. No absurd or

hugely significant indicator in terms of retention, but we see a few things that make us optimistic. I have been saying a few things over

conference calls. Humidity this year is better, well, it’s not yet perfect everywhere where we raise cattle, but it’s better than last

year, so it’s good. And now when we look at slaughter numbers, we see a few things that I think are starting to show a movement in retention.

We see 13% less slaughter of cows and when we look at 3.3 reduction of slaughter of cattle, there is a drop of 3% of male cattle and 3.8%

of calves.

And so this is still a high percentage of slaughter

of female animals, but we are seeing indications that we can see some retention. It’s not really significant, not very dynamic, but they

are initial indications.

Guilherme Palhares: Great. Thank you very

much for your clarification.

Operator: The next question comes from

Renata Cabral, from Citi.

Renata Cabral: Good morning. Thank you

for taking my question. I have two questions. One, it’s a follow-up on US beef. Even though you’ve already talked about that and in details,

but I would like to ask you, Wesley, about the perspective for the progression of the cycle. The cycle is somewhat atypical, we have to

say, compared to previous livestock cycles it was somewhat delayed. There is the expectation, and as you’ve just said, there might be

some signs of retention, it might get stronger in mid-year, in my opinion, and therefore, there might be an increase in cattle prices.

But now inventory levels are low in the US compared

to the historical average. And probably the recovery compared to previous cycles might be slower because of biological renovation, so

to speak, of the chain. We would like to hear from you how would we expect a cycle of improvement? What would be the peak prices?

And secondly, capital allocation. The company

is deleveraging. It had been faster than what we had expected at first, and it might get to the end of the year at a very comfortable

deleveraging level. So what are your perspectives for M&A? In the past, you’ve talked about the possibilities of acquisitions in the

US for processed food plants. What are your ideas on M&As?

Guilherme Cavalcanti: I’m going to start

talking about leverage and then I’ll hand it over to Tomazoni to talk about M&A. Our process of deleveraging has been faster than

expected, indeed. And yes, it does open opportunities because if we get to a margin of 7.5% to the year, which means improvement for upcoming

quarters 2.5 times by the end of the year, it mean it opens space for capital allocation, either for M&A or for dividend sharing.

But we’ll keep on deleveraging. Our goal is to

be between 2.5 and 3 times. If it’s below 2.5 times, then our capital structure is no longer efficient. But, till there, we can have opportunities

for dividend sharing or M&A depending on the process of deleveraging.

Let me hand it over to Tomazoni.

Gilberto Tomazoni: M&A is a natural

process in our company, Renata. If you look back to our history, it has been built through acquisitions. So we constantly analyze opportunities

that have a strategic fit and add value. We’ve already said that we want to build in aquaculture what we’ve done for poultry and pork.

We focus on added value and branded products, and we keep on investing in poultry with Pilgrims.

Nothing new yet. It does not depend on leverage.

Our acquisitions and the analysis of opportunity of acquisitions, the mapping of M&A opportunities that are strategically fit are

a routine, are part of our company everyday business.

Wesley Batista: Concerning the livestock

cycle recovery and prices, you are absolutely right. As we retain female animals, it reduces inventory levels and that’s expected. Whenever

we regrow a cycle before it increases offer, there is inevitably a reduction, a shrinkage. This is expected. And we expect it to happen

as quickly as possible. This reduction of alpha considering the reconstruction of the herds.

In the short term, it brings some additional difficulty,

but it’s difficult to anticipate how long it would take. It depends on climate; it depends on conditions of all the cattle breeders’ conditions.

We constantly focus on, and as we’ve said before, the 2% that we’ve captured in terms of benefits and the 2% more to be captured. This

is what we constantly focus on because we cannot control the livestock cycle or other things.

If I may build up on it, which I think is worth

mentioning, Renata, our business in the US is very relevant and being at this time of the cycle, it deserves further analysis, and we

have to pay constant attention to the market variations. But as we are deleveraging our company and the soundness of our operations, it

really shows that our diversification is very relevant.

If we look back in 2021 and said that the beef

challenge would be as challenging as it is, and we still had good results as we had, very few people in 2021 would believe it to be true.

But our current status shows the strength of JBS, which is our diversification of protein sales in the US and internationally. This quarter

and this year will serve as a very good example of this strategy.

Renata Cabral: Great. Thank you very much.

Operator: The next question comes from

Lucas Ferreira, JP Morgan. Lucas, please. Good morning.

Lucas Ferreira: Good morning. Thank you

for the questions. The first question is about Pilgrim. To understand the level of optimism you have for the year, how do you anticipate

the drivers of supply and demand? Is it going to be well balanced in the US market? Do you think that the second quarter is showing improvement

in seasonality? And what can we expect in terms of profitability for this business?

And I’d like to ask you to tell us a bit more

about Australia. Do you expect to increase slaughter rates in Australia and the margins for cattle? And what about processed foods profitability

rates there, which can be, and what are your expectations for end of year?

Gilberto Tomazoni: Thank you for the question,

Lucas. You’ve asked one question about Pilgrim and about Australia. Well, in the US, broilers, and you’ve been observing it, of course,

it has been presenting an increase in prices, which is related with the demand and very well-controlled supply. I’ve talked about some

of the challenges that we have in the US market, and that’s very clear there. There is new genetics in place, and as such, it requires

learning to increase fertility and production.

According to USDA recent publication, there is

an increase in supply, but not huge. In terms of demand, we see a migration of consumer costs. Consumers therefore prefer to buy more

affordable protein, so pork and poultry. We have controlled supply, we have increase in demand, in other words, results of Pilgrims are

up, and we are very optimistic for the whole process of adjustment of genetics and management. These are all things that lead to improvement

and can be obtained little by little.

The perspective, as Fabio pointed out, Pilgrim’s

CEO, is very positive, especially in the US, and it’s also positive as we are consolidating our 3 business units in Europe. We purchased

them there, it was separated for a while to learn more about the process, and now we are consolidating them. We can see gains of synergy

for G&A and also footprint of having large-scale plants and all that.

This is all very positive. And Mexico, despite

its natural volatility, it’s still a very attracting market to us.

Now, speaking of Australia, in the beginning of

the year, there was a challenge, heavy rain in some regions and that has prevented animal transportation. The slaughters in Australia,

the slaughter rates have been lower than we thought. Now with better climate conditions, things are going back to normal rates.

We see Australia as a very positive region. We

have a favorable cycle there, favorable cycle in Brazil. And our pork business, we’ve made an acquisition, it’s doing great, it’s even

surprising us. We’ve managed to progress very significantly in our productive process, gaining in agriculture productivity.

Now, processed foods in the US, or rather in Australia,

is something very stable. Australia is not an exporting market. We’ve started now to export some processed foods from Australia to Asia.

The focus is on local market, which is very stable. The population in Australia, it’s not a population that’s been growing. It grows just

as a result of immigration.

We are leaders in Australia and New Zealand. We

work focused on brand. It’s a very stable business, we’re betting on it, and we believe we are going to use Australia as our platform

to export further to Asia.

Lucas Ferreira: Thank you very much.

Operator: Our next question comes from

Igor Guedes, from Genial.

Mr. Igor Guedes, you may ask your question.

Our next question comes from Thiago Bortoluci,

from Goldman Sachs. Mr. Bortoluci, please, you may ask your question.

Thiago Bortoluci: Hello, can you hear me?

Wesley Batista: Yes, we can. Good morning,

Thiago.

Thiago Bortoluci: Good morning, Wesley.

Well, thank you very much for taking our questions and congratulations on your performance. I would like to ask two questions about US

beef and Seara. Number one, you answered a question about capacity in US beef and the capacity at a reasonable level. What do you think

in terms of capacity that you need for the adjustment cycle?

Last cycle, we saw some closings, and it’s okay

that the last cycle had some unique features, which doesn’t seem to be the case now. So in this potential adjustment process that is going

on in the industry, where is the industry in terms of capacity and closing of capacity?

And Seara, to Tomazoni, last year, in the middle

of last year and ever since, we surprisingly saw the industry with a well-balanced supply. And this is at a time when you were adding

capacity, and your leading competitor was focusing on getting smaller and focusing on profitability. Probably these two cycles are complete.

So in the estimates in April, we see a high increase. So how do you see supply and demand looking into the future as a rational, and how

do you see it?

Wesley Batista: So, good morning, Thiago.

So we can talk about closing of plants, of course. So the plants that we have, we have nine plants in the US, one in Canada. There are

no studies about closing or capacity reduction. This is not in our plans.

Gilberto Tomazoni: Thiago, about supply

and demand in the market, we are seeing that international markets are under high demand for poultry. So in Brazil, we have more feedlot,

as you can see. So you can see that we have more animals in feedlot, chicken, but the demand in the international market is really driving

this. So we are supposed to have.

We can never make long-term forecasts. We have

shorter cycles. So, so far, as we see it, this increase in demand will offset this increase in supply. We’re going to have a rebalance

now. If supply continues to grow, this naturally has consequences in many different markets. This is something that we can’t control.

What we can control in our case is that we, to

exceed our top efficiency, we are operating at top capacity and what we do in the US touches on different markets and different product

mixes. This makes it possible to be able for us to navigate even in excess supply in a zone of good profitability.

Thiago Bortoluci: Excellent. Thank you

very much.

Operator: Our next question comes from

Igor Guedes, from Genial. Igor, you have the floor.

Igor Guedes: Good morning. Can you all

hear me?

Gilberto Tomazoni: Yes, yes, we can hear

you.

Igor Guedes: Thank you for taking my question.

I think I’m sorry I could not speak the first time you called me. I want to understand the average cost of your debt. It went up to 5.78.

It was 5.73 last quarter, and the average term is stable. The penetration of bonds went up to 86 in dollars. The average cost of dollar

per bond is lower than your debts in real, in Brazilian BRL, so it should have helped you to bring down the average cost rather than bringing

it up.

So I’d like to understand, from your perspective,

what has caused this slow or the minor increase in cost of your debt?

Guilherme Cavalcanti: When we pay anticipated

debts, we pay premium to reduce this debt, therefore it goes into our financial expenses. It doesn’t mean the liability management is

negative, but it does have an impact on our financial expenses and present increased costs.

Secondly, I’ve paid some trade finance lines,

the 666 million spent this quarter. It also depends on the time you made the payment. And some other leverage of balance would go into

our financial expenses. They are not debts.

For the next quarter, we are going to keep on

paying gross debt, but there are other variables. If we rebuy bonds, even though there is additional issuance, we have to pay premium

on the anticipated amortization. It impacts our financial costs, but not when we look ahead. Is it clear?

Igor Guedes: Yes, absolutely. Thank you

very much.

Operator: Well, if there are no further

questions, I would like to hand it over to Gilberto Tomazoni for his closing remarks.

Gilberto Tomazoni: I would like to thank

all of you for having participated with us in this earnings release call. Our team of 270,000 employees have really provided the conditions

to deliver these results. Thank you all very much.

Operator: The call is now closed. Thank

you all very much for your participation. Have a great day. Thank you.

16

Exhibit 99.4

International Conference Call

JBS S/A (JBSS3)

1Q24 Earnings Results Transcription

May 15th, 2024

Operator: Good morning and welcome to the

JBS S/A and JBS USA first quarter of 2024 results conference call. At this time, all participants are in listen-only mode. Later, we will

conduct a questions and answer session and instructions will be given at that time.

As a reminder, this conference is being recorded.

Any statements eventually made during this conference call in connection with the company’s business outlook, projections, operating and

financial targets, or potential growth should be understood as merely forecasts based on the company’s management expectation in relation

to the future of JBS. Such expectations are highly dependent on market conditions, on Brazil’s overall economic performance, and on industry

and international market behavior, and therefore are subject to change.

Are present with us today, Gilberto Tomazoni,

Global CEO of JBS, Guilherme Cavalcanti, Global CFO of JBS, Wesley Batista Filho, CEO of JBS USA, and Christiane Assis, Investor Relations

Officer.

Now, I will turn the conference over to Gilberto

Tomazoni, Global CEO of JBS.

Mr. Tomazoni, you may begin your presentation.

Excuse me, Mr. Tomazoni, you may unmute your microphone,

please.

Gilberto Tomazoni: Good morning, everyone.

Thank you very much for your participation in our results teleconference.

Before delving to the results, I want to take

this opportunity to express my solidarity with the victims on the catastrophe caused by the rain in Rio Grande do Sul, especially our

more than 16,000 team members in the state. The world has been following the situation with sadness, and the dedication of our entire

team has been essential to help our team members, our partners, along with their families, and the impact community recovery.

Once again, I want to express my deep admiration

and gratitude for this extraordinary work that everyone has been doing to offer support during this tragic event.

As a company, we have mobilized them to provide

donations of essential items for assistance to people in the region, such as food, hygiene and cleaning products, water, clothing and

blankets.

Shifting to our results that were release today,

JBS’s solid first quarter reinforced that we are in the path to recover as indicated in the previous periods. We added nearly 2%

points to our consolidated EBITDA margins compared to the fourth quarter of 2023, and almost 5 points compared to the first quarter of

2023, achieving a margin of 70.2 for the period.

I would like to highlight Seara’s results

with a double-digit margin already achieved in the first quarter. The closing of some operation gaps, the normalization of grain costs,

and the growth in volume in domestic market reinforce a promise prospect for Seara this year. We maintain our focus of identifying consumer

preference and capturing operational opportunities.

The focus on key customers, brand growth and consolidation

of the business in Europe along with the pursuit of operational excellence are reflected in the Pilgrim’s strong performance. Business

margins saw a significant increase, jumping from 6.5% in the first quarter in 2023 to 11% in the first quarter of 2024.

US Pork margins similarly increased from 2.5%

to 16.4% over the same period. Both the poultry and pork business are benefited from reduction of grain price, as well as the rebalance

of supply and demand.

I want to highlight that the strength of our results

once again reinforces the importance of geographical and protein diversification. In a traditional weaker quarter of the global protein

industry, the beef business in Brazil and Australia captured cattle cycle high in both countries, while JBS beef North America continues

to experience weak margins due to where we are in the region’s cattle cycle in season conditions, as previously noted.

We achieved net profit of US$332.3 million for

the period with net revenue of US$18 billion and adjusted EBITDA of US$1.3 million. Our priority remains the leverage. The leverage rate

decreased from 40.42 times in dollar in the fourth quarter of 2022 to 3.66 in dollars in the first quarter of 2024. The results from the

quarter emphasize our confidence in JBS long-term strategy, focus on expanding our global multi-protein platform and consolidation our

portfolio of strong brands and value-added products.

In this regard, we have made numerous investments

over the past few years that will begin the yield results. Brazil, we will open a new in natura pork plant and prepared food plant this

year in Dourados, an industrial complex in Mato Grosso do Sul. We also announced in April that we will double the capacity of our Campo

Grande beef facility in the same state, one of the recently approved China export facilities.

In Jeddah, Saudi Arabia, we are finalizing our

third Halal value-added products facility. And in San Sebastian, Spain, we will begin operation at the Biotech Food cultivated protein

plant.

We remain focused on what we control to become

increasingly competitive in each market where we operate. For this reason, we have an absolute focus on our operation, cost management,

productivity increase, portfolio optimization, and prices, regardless of geographically or economic situation. We are confident that the

strength of our platform combined with our financial performance and our commitment to excellence and innovation will allow JBS to continue

its growth trajectory, generate value for our stakeholders and the communities in which we operate.

Thank you again for your participation in this

result call and now I will pass the floor to Guilherme, who will detail our numbers. Guilherme, please.

Guilherme Cavalcanti: Thank you, Tomazoni.

Let’s now move to the operational and financial highlights of the first quarter of 2024.

Starting on slide 15, please, net revenue in the

first quarter of 2024 was US$18 billion. Adjusted EBITDA totaled US$1.3 billion and represents a margin of 7.2% for the quarter. Net profit

was US$332 million in the first quarter.

Moving on to the next slide, operating cash flow

in the quarter was US$25 million. Free cash flow for the quarter was negative at US$625 million. As we anticipated in the last earnings

conference call, we estimated that the cash consumption would be half of the amount reported in the same period last year, which happened.

Despite this cash consumption, which is common

to the first quarter due to the seasonality of the period, the improvement is mainly explained by the increase in results from practically

all of our business units. Also on this slide, capital expenditures in the quarter was approximately US$284 million, 55% of each was maintenance

CAPEX. This amount is 26% lower than the first quarter 2023 and is in line with our estimate of the year of US$1.3 billion.

Now moving to slide 17, net debt ended up the

first quarter at US$15.9 billion, reflecting an increase in US$569 million compared to the previous quarter. A change that is in line

with the cash consumption of the quarter and expected considering the seasonality of this time of the year. Leverage in dollars reduced

from 4.32 to 3.7, and in Reais from 4.32 to 3.7 in the quarterly comparison, confirming that deleveraging path that we had indicated in

previous calls.

For the second quarter, we expect another significant

decrease in this indicator to around 3 times. A simple leverage exercise – without considering guidance –, to achieve a leverage

at the end of the year of 2.5 times, our consolidated margin for 2024 should be close to 7.5%. Considering that the first quarter is seasonally

weaker, and the margin was already 7.2%, it is reasonable to think about this level of leverage for the end of the year. Thus, aligned

with our policy of maintaining leverage rate between 2 and 3 times in the long term.

It’s worth mentioning that we reduced gross debt

in US$666 million in the first quarter, mainly due to the payment of short and long-term bank debts. We will continue to reduce gross

debt in the second quarter.

So I will now briefly go through the business

units. Starting with Seara on slide 18, net revenue for the quarter remained stable in relation to the same period of the previous years

at US$2.1 billion. However, as we had indicated, profitability has already returned to normalized double-digit levels.

This improvement is the result of the intense

focus on operational excellence, on the management team, on reducing costs, especially grains, and on better balance of global supply

and demand, on commercial execution, and on the maturation process of Seara’s new plants. Thus, the EBITDA the margin grew by more

than 10 percentage points in the annual comparison, reaching 11.6% in the first quarter.

Moving now to slide 19, JBS Brazil recorded net

revenue 22% higher than the first quarter last year, driven by higher volumes sold. The favorable cattle cycle had a positive impact on

sales volume, both in domestic and international markets, due to the greater availability of animals for slaughter. This cycle has also

contributed to reduce the prices of live cattle. As a consequence, has boosted profitability in a positive way.

Moving to the slide 20 and now we’re speaking

in dollars and in USGAAP. JBS Beef North America net revenue grew 6% year over year in the quarter as a result of the increase in average

prices and volumes. However profitability was still under pressure considering the more challenging cattle cycle given that the price

of live cattle increased more than wholesale price.

In slide 21, JBS Australia in the quarter, the

growth in revenue in the annual comparison is the result of higher volume sold in both domestic and international markets. The growth

in profitability in the annual comparison mainly reflected the greater availability of cattle in the market given the more favorable cattle

cycle and efficiency gains in several areas of our business in Australia.

Turning now to you, JBS USA Pork, net revenue

for the quarter was 6% higher compared to the first quarter last year due to the increase in average prices in the period. In addition

to the improvement in commercial dynamics, profitability in the quarter was positively impacted by lower average grain costs, reduction

in the average pork price, and continuous efforts aimed at expanding value-added portfolio in addition to improving commercial operational

and logistic execution.

Pilgrim’s Pride, highlighted on the slide

23, recorded an increase in net revenues of 5% in the first quarter of 2024 compared to the last year. The first quarter brought the fruits

of the strategy already implemented, allowing the company to grow ahead of the markets together with the key customers.

The portfolio of branded products continue to

expand and contribute to the diversification. These efforts combined with an intense focus on operational excellence resulted in an increased

profitability in the period.

As you can see, the results for the first quarter

were very encouraging, as we had indicated in the last earnings conference calls. Therefore, we are optimistic about our deleveraging

and free cash flow generation trajectory for the year.

At this time, I would like to open for our question-and-answer

session.

Question and Answer Session

Operator: Ladies and gentlemen, we will

now begin the question-and-answer session. If you have a question, click the “raise hand” button. If at any point your question

is answered, you can remove yourself from the queue by clicking “lower hand”.

And our first question comes from Priya Ohri-Gupta,

with Barclays. Please Priya, you may proceed.

Priya Ohri-Gupta: Great, thank you so much

for taking the questions. Guilherme, congratulations on the deleveraging so far. It sounds like you expect to continue to pay down debt

in the second quarter. Given where your cash balance is and typically second quarter starting when you seasonally generate free cash flow

or positive free cash flow, how should we think about, first, the amount of debt that you would look to bring down in second quarter to

get to that 3 times level that you had mentioned on the call?

And then secondly, as you think about repaying

this debt, what type of an approach do you take? Do you look to sort of maximize your deleveraging by thinking about the price of the

bonds and going for lower, or do you think about NPV benefits that taking out certain bonds could bring? Thank you.

Guilherme Cavalcanti: Thank you, Priya,

for your question. First, the payment of the debt that we intend to do in the second quarter has not impacted on the 3 times that I mentioned,

because I mentioned 3 times net debt. So that less cash. So the amount, how much I will pay in the second quarter won’t affect this estimate

for 3 times in the second quarter.

Now, in terms of paying down that, you’re right.

I finished the first quarter with US$3.5 billion in cash on hand, plus US$3.2 billion in revolving facilities. This cash on hands I have

access, I don’t need all that cash to operate, even in a more volatile scenario. But of course, we are always more conservative.

We paid US$660 million in debt in the first quarter.

In the second quarter, we intend to pay at least US$500 million in gross debt. So currently, I’m working with the payment of US$500 million

in gross debt.

If you look at our debt breakdown, we have 13%

local debentures in Brazil. In fact, 11% of our debt is local debentures in Brazil, which I just announced a repurchase of R$1.8 billion,

and an issuance of R$1.5 to 1.8 billion. So just I’m getting better rates and better tenors in making this exchange in the local debentures.

The US$500 million that I intend to pay in the

second quarter, given that our commercial banks now it’s only 3% of all debt and this is rural credit, which has a very low cost of that

and in fact a positive carry, you’re right that I have to think about repurchasing bonds.

And the strategy we are still analyzing, which

what will be, NPV or gross debt or average cost of that, I would say that having a lower average cost of that improves our free cash flow

for the period. So I would say that this would be a parameter to decrease the average cost of that because then I decrease my financial

expenses and increase my free cash flow for the years, giving me even more flexibility going forward.

But of course, this will all depend on the studies