Golden Minerals Signs Binding Agreement to Sell Yoquivo Gold-Silver Project

25 Octobre 2024 - 11:00PM

Business Wire

Golden Minerals Company (“Golden Minerals”, “Golden” or the

“Company”) (NYSE-A: AUMN and TSX: AUMN) today announced it has

signed a binding agreement (the “Agreement”) to sell its Yoquivo

gold-silver project (located in Chihuahua State, Mexico) (the

“Yoquivo Project”) to Advance Metals Limited (ASX: AVM) (“AVM”) an

ASX-listed entity focused on the acquisition, discovery, and

advancement of high-quality metals projects (the

“Transaction”).

Under the terms of the Agreement, AVM shall purchase 100% of the

Yoquivo Project from Minera de Cordilleras S. de R.L. de C.V., a

wholly-owned subsidiary of Golden Minerals, for total consideration

of US$570,000 (the “Purchase Price”), payable in cash, plus value

added tax (“VAT”) as follows:

- A non-refundable cash payment of US$20,000, plus VAT, for AVM

to have the right to carry out due diligence for a seven-day

exclusive period, beginning on October 24, 2024.

- On November 1, 2024, AVM shall make a US$275,000 cash payment,

plus VAT, to Golden.

- On November 21, 2024, AVM shall make a final US$275,000 cash

payment, plus VAT, to Golden (collectively, the “Transaction

Payments”).

Closing of the Transaction will be subject to additional

conditions, including receipt of regulatory approvals and

completion of due diligence review by AVM. In the event that AVM

decides not to complete the Transaction, AVM will be subject to a

breakup fee of 20% of the Purchase Price.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and forward-looking information within the meaning of

applicable Canadian securities legislation (collectively,

“forward-looking statements”), including statements regarding the

Company receiving the Transaction Payments contemplated by the

Agreement and Transaction and AVM’s payment of a breakup fee in the

amount of 20% of the Purchase Price if AVM decides not to complete

the Transaction.

These statements are subject to risks and uncertainties

including the Company’s receipt of the Transaction Payments; the

ability of the Company to sell or realize value from the sale of

the Yoquivo Project or its other assets, or from equity or other

external financings; receipt of regulatory approvals required to

complete the Transaction; the satisfaction or waiver of the

Transaction’s closing conditions; increases in costs and declines

in general economic conditions; changes in political conditions, in

tax, royalty, environmental and other laws in the United States,

Mexico or Argentina and other market conditions; and fluctuations

in silver and gold prices. Golden assumes no obligation to update

this information. Additional risks relating to Golden may be found

in the periodic and current reports filed with the Securities &

Exchange Commission by Golden, including the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023.

For additional information please visit

http://www.goldenminerals.com/

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241025226396/en/

Golden Minerals Company (303) 839-5060

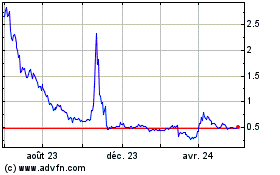

Golden Minerals (AMEX:AUMN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

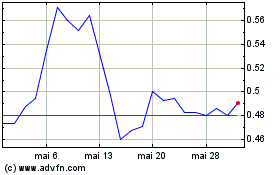

Golden Minerals (AMEX:AUMN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024