Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 Février 2024 - 4:35PM

Edgar (US Regulatory)

Ellsworth

Growth

and

Income

Fund

Ltd.

Schedule

of

Investments

—

December

31,

2023

(Unaudited)

Principal

Amount

Market

Value

CONVERTIBLE

CORPORATE

BONDS

—

68.3%

Automotive:

Parts

and

Accessories

—

0.9%

$

1,250,000

Rivian

Automotive

Inc.,

3.625%,

10/15/30(a)

.............

$

1,541,375

Business

Services

—

1.8%

2,000,000

BigBear.ai

Holdings

Inc.,

6.000%,

12/15/26(a)

.............

1,355,000

2,000,000

Perficient

Inc.,

0.125%,

11/15/26

...............

1,666,200

3,021,200

Cable

and

Satellite

—

0.6%

1,415,000

fuboTV

Inc.,

3.250%,

02/15/26

...............

1,040,025

Communications

Equipment

—

1.2%

2,000,000

Lumentum

Holdings

Inc.,

1.500%,

12/15/29(a)

.............

1,993,000

Computer

Software

and

Services

—

13.2%

1,500,000

Akamai

Technologies

Inc.,

1.125%,

02/15/29(a)

.............

1,629,750

4,000,000

Bandwidth

Inc.,

0.250%,

03/01/26

...............

3,330,200

1,625,000

Cardlytics

Inc.,

1.000%,

09/15/25

...............

1,015,625

2,500,000

CSG

Systems

International

Inc.,

3.875%,

09/15/28(a)

.............

2,523,500

1,915,000

Edgio

Inc.,

3.500%,

08/01/25

...............

1,699,093

2,590,000

i3

Verticals

LLC,

1.000%,

02/15/25

...............

2,429,744

1,250,000

PagerDuty

Inc.,

1.500%,

10/15/28(a)

.............

1,361,000

1,750,000

PAR

Technology

Corp.,

2.875%,

04/15/26

...............

2,128,525

2,000,000

Progress

Software

Corp.,

1.000%,

04/15/26

...............

2,117,000

1,430,000

PROS

Holdings

Inc.,

2.250%,

09/15/27

...............

1,618,760

2,000,000

Shift4

Payments

Inc.,

Zero

Coupon,

12/15/25

...........

2,228,800

2,170,000

Veritone

Inc.,

1.750%,

11/15/26

...............

655,703

22,737,700

Consumer

Products

—

0.8%

1,325,000

Post

Holdings

Inc.,

2.500%,

08/15/27

...............

1,345,537

Principal

Amount

Market

Value

Consumer

Services

—

5.0%

$

1,900,000

Live

Nation

Entertainment

Inc.,

3.125%,

01/15/29(a)

.............

$

2,162,390

2,350,000

Marriott

Vacations

Worldwide

Corp.,

3.250%,

12/15/27

...............

2,090,325

NCL

Corp.

Ltd.

720,000

5.375%,

08/01/25

...............

927,360

682,000

1.125%,

02/15/27

...............

626,144

1,600,000

Stride

Inc.,

1.125%,

09/01/27

...............

2,033,600

640,000

Uber

Technologies

Inc.,

Ser.

2028,

0.875%,

12/01/28(a)

.............

699,200

8,539,019

Energy

and

Utilities

—

15.3%

1,900,000

Alliant

Energy

Corp.,

3.875%,

03/15/26(a)

.............

1,895,250

2,026,000

Array

Technologies

Inc.,

1.000%,

12/01/28

...............

2,000,168

800,000

Bloom

Energy

Corp.,

3.000%,

06/01/28(a)

.............

856,000

2,000,000

CMS

Energy

Corp.,

3.375%,

05/01/28(a)

.............

1,988,000

2,000,000

Duke

Energy

Corp.,

4.125%,

04/15/26(a)

.............

2,010,000

950,000

Nabors

Industries

Inc.,

1.750%,

06/15/29(a)

.............

690,555

NextEra

Energy

Partners

LP

2,000,000

Zero

Coupon,

06/15/24(a)

.........

1,939,000

2,500,000

2.500%,

06/15/26(a)

.............

2,252,500

1,600,000

Northern

Oil

and

Gas

Inc.,

3.625%,

04/15/29

...............

1,894,400

2,625,000

Ormat

Technologies

Inc.,

2.500%,

07/15/27

...............

2,706,375

2,634,000

PG&E

Corp.,

4.250%,

12/01/27(a)

.............

2,773,602

3,000,000

PPL

Capital

Funding

Inc.,

2.875%,

03/15/28(a)

.............

2,920,500

1,500,000

Stem

Inc.,

4.250%,

04/01/30(a)

.............

1,096,500

1,990,000

Sunnova

Energy

International

Inc.,

2.625%,

02/15/28

...............

1,327,330

26,350,180

Entertainment

—

1.1%

1,815,000

Liberty

Media

Corp.-Liberty

Formula

One,

2.250%,

08/15/27

...............

1,850,260

Financial

Services

—

4.2%

1,500,000

Bread

Financial

Holdings

Inc.,

4.250%,

06/15/28(a)

.............

1,606,950

1,250,000

HCI

Group

Inc.,

4.750%,

06/01/42

...............

1,550,000

Ellsworth

Growth

and

Income

Fund

Ltd.

Schedule

of

Investments

(Continued)

—

December

31,

2023

(Unaudited)

Principal

Amount

Market

Value

CONVERTIBLE

CORPORATE

BONDS

(Continued)

Financial

Services

(Continued)

$

2,750,000

LendingTree

Inc.,

0.500%,

07/15/25

...............

$

2,296,250

2,100,000

SoFi

Technologies

Inc.,

Zero

Coupon,

10/15/26(a)

.........

1,777,650

7,230,850

Food

and

Beverage

—

0.8%

1,500,000

The

Chefs'

Warehouse

Inc.,

2.375%,

12/15/28

...............

1,431,325

Health

Care

—

9.3%

1,500,000

Amphastar

Pharmaceuticals

Inc.,

2.000%,

03/15/29(a)

.............

1,826,250

1,500,000

Coherus

Biosciences

Inc.,

1.500%,

04/15/26

...............

850,789

2,125,000

CONMED

Corp.,

2.250%,

06/15/27

...............

2,134,350

750,000

Cytokinetics

Inc.,

3.500%,

07/01/27

...............

1,320,000

750,000

Dexcom

Inc.,

0.375%,

05/15/28(a)

.............

771,750

375,000

Evolent

Health

Inc.,

3.500%,

12/01/29(a)

.............

439,125

1,950,000

Exact

Sciences

Corp.,

2.000%,

03/01/30(a)

.............

2,348,775

3,000,000

Halozyme

Therapeutics

Inc.,

1.000%,

08/15/28

...............

2,794,500

1,015,000

Invacare

Corp.,

Escrow,

Zero

Coupon,

05/08/28(b)

.........

0

100,000

Merit

Medical

Systems

Inc.,

3.000%,

02/01/29(a)

.............

111,150

3,000,000

TransMedics

Group

Inc.,

1.500%,

06/01/28(a)

.............

3,401,400

15,998,089

Real

Estate

Investment

Trusts

—

2.5%

317,000

Pebblebrook

Hotel

Trust,

1.750%,

12/15/26

...............

283,905

Redwood

Trust

Inc.

2,000,000

5.625%,

07/15/24

...............

1,979,996

1,000,000

7.750%,

06/15/27

...............

921,875

1,330,000

Summit

Hotel

Properties

Inc.,

1.500%,

02/15/26

...............

1,185,695

4,371,471

Security

Software

—

0.1%

175,000

Rapid7

Inc.,

1.250%,

03/15/29(a)

.............

195,353

Principal

Amount

Market

Value

Semiconductors

—

6.5%

$

2,000,000

Impinj

Inc.,

1.125%,

05/15/27

...............

$

2,187,600

1,500,000

indie

Semiconductor

Inc.,

4.500%,

11/15/27(a)

.............

1,810,500

2,000,000

ON

Semiconductor

Corp.,

0.500%,

03/01/29(a)

.............

2,135,000

2,500,000

Semtech

Corp.,

1.625%,

11/01/27

...............

2,148,750

4,275,000

Wolfspeed

Inc.,

1.875%,

12/01/29

...............

2,929,444

11,211,294

Telecommunications

—

4.2%

2,060,000

8x8

Inc.,

0.500%,

02/01/24

...............

2,039,243

Infinera

Corp.

1,250,000

2.500%,

03/01/27

...............

1,147,248

325,000

3.750%,

08/01/28

...............

320,743

1,600,000

InterDigital

Inc.,

3.500%,

06/01/27

...............

2,351,040

1,500,000

Liberty

Latin

America

Ltd.,

2.000%,

07/15/24

...............

1,447,500

7,305,774

Transportation

—

0.8%

1,600,000

Air

Transport

Services

Group

Inc.,

3.875%,

08/15/29(a)

.............

1,428,000

TOTAL

CONVERTIBLE

CORPORATE

BONDS

....................

117,590,452

Shares

CONVERTIBLE

PREFERRED

STOCKS

—

0.4%

Business

Services

—

0.0%

809,253

Amerivon

Holdings

LLC,

4.000%(b)

....................

0

272,728

Amerivon

Holdings

LLC,

common

equity

units

(b)

..........................

3

3

Health

Care

—

0.4%

31,218

Invacare

Holdings

Corp.,

Ser.

A,

9.000%(b)

....................

702,405

TOTAL

CONVERTIBLE

PREFERRED

STOCKS

...................

702,408

Ellsworth

Growth

and

Income

Fund

Ltd.

Schedule

of

Investments

(Continued)

—

December

31,

2023

(Unaudited)

Shares

Market

Value

MANDATORY

CONVERTIBLE

SECURITIES(c)

—

2.4%

Diversified

Industrial

—

1.8%

55,606

Chart

Industries

Inc.,

Ser.

B,

6.750%,

12/15/25

...............

$

3,090,581

Energy

and

Utilities

—

0.6%

30,000

NextEra

Energy

Inc.,

6.926%,

09/01/25

...............

1,143,600

TOTAL

MANDATORY

CONVERTIBLE

SECURITIES

................

4,234,181

COMMON

STOCKS

—

19.6%

Business

Services

—

0.5%

13,000

PayPal

Holdings

Inc.†

..............

798,330

Computer

Software

and

Services

—

2.7%

12,300

Microsoft

Corp.

..................

4,625,292

Consumer

Products

—

0.7%

24,000

Unilever

plc,

ADR

.................

1,163,520

Energy

and

Utilities

—

0.6%

18,775

NextEra

Energy

Inc.

................

1,140,394

Entertainment

—

0.6%

12,500

The

Walt

Disney

Co.

...............

1,128,625

Health

Care

—

2.8%

13,970

Invacare

Holdings

Corp.†(b)

.........

0

22,651

Merck

&

Co.

Inc.

..................

2,469,412

80,000

Pfizer

Inc.

......................

2,303,200

4,772,612

Real

Estate

Investment

Trusts

—

5.7%

10,000

American

Tower

Corp.

..............

2,158,800

16,100

Crown

Castle

Inc.

.................

1,854,559

5,000

Equinix

Inc.

.....................

4,026,950

7,000

SBA

Communications

Corp.

..........

1,775,830

9,816,139

Semiconductors

—

2.0%

3,058

Broadcom

Inc.

...................

3,413,492

Telecommunications

—

4.0%

60,000

AT&T

Inc.

.......................

1,006,800

24,619

T-Mobile

US

Inc.

..................

3,947,164

50,000

Verizon

Communications

Inc.

.........

1,885,000

6,838,964

TOTAL

COMMON

STOCKS

.........

33,697,368

Principal

Amount

Market

Value

U.S.

GOVERNMENT

OBLIGATIONS

—

9.3%

$

16,150,000

U.S.

Treasury

Bills,

5.263%

to

5.446%††,

01/11/24

to

05/30/24

......................

$

16,040,936

TOTAL

INVESTMENTS

—

100.0%

....

(Cost

$157,003,092)

.............

$

172,265,345

(a)

Securities

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

may

be

resold

in

transactions

exempt

from

registration,

normally

to

qualified

institutional

buyers.

(b)

Security

is

valued

using

significant

unobservable

inputs

and

is

classified

as

Level

3

in

the

fair

value

hierarchy.

(c)

Mandatory

convertible

securities

are

required

to

be

converted

on

the

dates

listed;

they

generally

may

be

converted

prior

to

these

dates

at

the

option

of

the

holder.

†

Non-income

producing

security.

††

Represents

annualized

yields

at

dates

of

purchase.

ADR

American

Depositary

Receipt

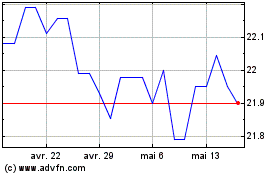

Ellsworth Growth and Inc... (AMEX:ECF-A)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Ellsworth Growth and Inc... (AMEX:ECF-A)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024