UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of May 2024

Commission

File Number 001-40099

GOLD

ROYALTY CORP.

(Registrant’s

name)

1188

West Georgia Street, Suite 1830

Vancouver,

BC V6E 4A2

(604)

396-3066

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

INCORPORATION

BY REFERENCE

EXHIBIT

99.1, INCLUDED WITH THIS REPORT, IS HEREBY INCORPORATED BY REFERENCE AS AN EXHIBIT TO THE REGISTRANT’S REGISTRATION STATEMENTS

ON FORM F-3, AS AMENDED AND SUPPLEMENTED (FILE NOS. 333-276305, 333-265581, 333-267633, 333-270682) AND FORM S-8 (FILE NO. 333-267421),

AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS SUBMITTED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY

FILED OR FURNISHED.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GOLD

ROYALTY CORP. |

| |

|

|

| Date:

June 3, 2024 |

By: |

/s/

Andrew Gubbels |

| |

Name: |

Andrew

Gubbels |

| |

Title: |

Chief

Financial Officer |

EXHIBIT

INDEX

Exhibit

99.1

FORM

51-102F3

MATERIAL

CHANGE REPORT

| 1. |

Name

and Address of Company: |

GOLD

ROYALTY CORP.

1830-1188

West Georgia Street

Vancouver,

British Columbia V6E 4A2

| 2. |

Date

of Material Change: |

The

material change described in this report occurred on May 31, 2024.

On

May 31, 2024, Gold Royalty Corp. (the “Company”) issued a news release through the facilities of Canada Newswire,

a copy of which has been filed on SEDAR+.

| 4. |

Summary

of Material Change: |

On

May 31, 2024, the Company closed its previously announced public offering (the “Offering”) of units of the Company

(the “Units”). Pursuant to the Offering, the Company issued, on a bought deal basis, an aggregate of 20,058,300 Units,

including 2,616,300 Units pursuant to the full exercise of the over-allotment option, at a price of US$1.72 per Unit for aggregate gross

proceeds of US$34,500,276.

| 5. |

Full

Description of Material Change: |

On

May 31, 2024, the Company closed Offering of the Units. Pursuant to the Offering, the Company issued, on a bought deal basis, an aggregate

of 20,058,300 Units, including 2,616,300 Units pursuant to the full exercise of the over-allotment option, at a price of US$1.72 per

Unit for aggregate gross proceeds of US$34,500,276. of Units.

The

Offering was completed pursuant to an underwriting agreement dated May 28, 2024, between the Company and a syndicate of underwriters

led by National Bank Financial Inc. and BMO Capital Markets Corp. as joint bookrunners, and including H.C. Wainwright & Co., LLC,

Haywood Securities Inc., Raymond James Ltd. and Scotia Capital Inc.

Each

Unit consists of one common share of the Company (each, a “Common Share”) and one common share purchase warrant (each,

a “Warrant”). Each Warrant is exercisable to acquire one Common Share of the Company for a period of thirty-six months

after closing at an exercise price of US$2.25. The Common Shares issued pursuant to the Offering have been listed on the NYSE American

LLC (“NYSE American”). The Company has applied to list the Warrants on the NYSE American under the symbol “GROY.WS”

following closing of the Offering. Listing will be subject to fulfilling all listing requirements of the NYSE American. As a result,

the Warrants are not yet tradeable over the facilities of the NYSE American.

The

Company intends to use the net proceeds of the Offering to fund a portion of the consideration under its previously announced proposed

acquisition of a copper stream in respect of the Vares Silver Project, operated by a subsidiary of Adriatic Metals plc and located in

Bosnia and Herzegovina pursuant to a purchase and sale agreement between the Company and OMF Fund III (Cr) Ltd., an entity managed by

Orion Mine Finance Management LP.

Certain

directors and officers of the Company (the “Insiders”) purchased an aggregate of 796,514 Units pursuant to the Offering,

representing approximately 4.0% of the total number of Units issued under the Offering.

Participation

by the Insiders in the Offering was considered a “related party transaction” pursuant to Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The sale of Units to the Insiders was

exempt from the requirements to obtain a formal valuation or minority shareholder approval in connection with the Insiders’ participation

in the Offering pursuant to sections 5.5(a) and 5.7(1)(a) of MI 61-101 as neither the fair market value of any securities issued to,

nor the consideration paid by, the Insiders exceeded 25% of the Company’s market capitalization. The board of directors of the

Company has approved the Offering, the related party transaction with the Insiders and all ancillary matters. The Company did not file

this material change report 21 days prior to closing the Offering as the Company was not aware of the level of insider participation

in the Offering at such time and the Company wished to close the transaction as soon as practicable for sound business reasons.

| 6. |

Reliance

on Subsection 7.1(2) of National Instrument 51-102 |

Not

applicable.

Not

applicable.

The

following executive officer of the Company is knowledgeable about the material change and this report and may be contacted respecting

the material change and this report:

Andrew

Gubbels

Chief

Financial Officer

Telephone:

(604) 396-3066

May

31, 2024

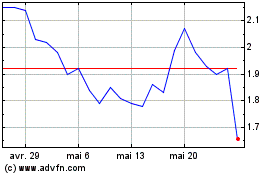

Gold Royalty (AMEX:GROY)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Gold Royalty (AMEX:GROY)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025