SIFCO Industries, Inc. (NYSE American: SIF) today announced

financial results for its second quarter of fiscal 2024, which

ended March 31, 2024.

Second Quarter Results

- Net sales in the second quarter of fiscal 2024 increased 37.9%

to $26.5 million, compared with $19.2 million for the same period

in fiscal 2023.

- Net loss for the second quarter of fiscal 2024 was $(1.6)

million, or $(0.26) per diluted share, compared with net loss of

$(2.4) million, or $(0.40) per diluted share, in the second quarter

of fiscal 2023.

- EBITDA was $0.9 million in the second quarter of fiscal 2024,

compared with $(0.4) million in the second quarter of fiscal

2023.

- Adjusted EBITDA in the second quarter of fiscal 2024 was $1.3

million, compared with Adjusted EBITDA of $0.0 million in the

second quarter of fiscal 2023.

Year to Date Results

- Net sales in the first six months of fiscal 2024 increased

17.4% to $47.6 million, compared with $40.5 million for the same

period in fiscal 2023.

- Net loss for the first six months of fiscal 2024 was $(5.0)

million, or $(0.84) per diluted share, compared with net loss of

$(5.0) million, or $(0.84) per diluted share, in the first six

month of fiscal 2023.

- EBITDA was $(0.5) million in the first six month of fiscal

2024, compared with $(1.1) million in the first six months of

fiscal 2023.

- Adjusted EBITDA in the first six month of fiscal 2024 was $0.5

million, compared with Adjusted EBITDA of ($0.1) million in the

first six months of fiscal 2023.

Other Highlights

CEO Peter W. Knapper stated, “EBITDA, at $926k, turned positive

for the quarter as we ramp up deliveries. Our backlog continued to

grow and stands at $137.8 million. We are pleased with the progress

and continue to focus on customer satisfaction.

Use of Non-GAAP Financial Measures

The Company uses certain non-GAAP measures in this release.

EBITDA and Adjusted EBITDA are non-GAAP financial measures and are

intended to serve as supplements to results provided in accordance

with accounting principles generally accepted in the United States.

SIFCO Industries, Inc. believes that such information provides an

additional measurement and consistent historical comparison of the

Company’s performance. A reconciliation of the non-GAAP financial

measures to the most directly comparable GAAP measures is available

in this news release.

Forward-Looking Language

Certain statements contained in this press release are

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, such as statements

relating to financial results and plans for future business

development activities, and are thus prospective. Such

forward-looking statements are subject to risks, uncertainties and

other factors, which could cause actual results to differ

materially from future results expressed or implied by such

forward-looking statements. Potential risks and uncertainties

include, but are not limited to, economic conditions, concerns with

or threats of, or the consequences of, pandemics, contagious

diseases or health epidemics, including COVID-19, competition and

other uncertainties the Company, its customers, and the industry in

which they operate have experienced and continue to experience,

detailed from time to time in the Company’s Securities and Exchange

Commission filings.

The Company's Annual Report on Form 10-K for the year ended

September 30, 2023 and other reports filed with the Securities and

Exchange Commission can be accessed through the Company's website:

www.sifco.com, or on the Securities and Exchange Commission's

website: www.sec.gov.

SIFCO Industries, Inc. is engaged in the production of forgings

and machined components primarily for the aerospace and energy

markets. The processes and services include forging, heat-treating,

coating, and machining.

Second Quarter ended March 31,

(Amounts in thousands, except per share

data)

(Unaudited)

Three Months Ended

March 31,

Six Months Ended

March 31,

2024

2023

2024

2023

Net sales

$

26,543

$

19,242

$

47,595

$

40,541

Cost of goods sold

23,816

17,522

44,132

37,560

Gross profit

2,727

1,720

3,463

2,981

Selling, general and administrative

expenses

3,208

3,849

6,789

7,129

Amortization of intangible assets

41

63

81

124

Gain on disposal of operating assets

3

14

3

3

Operating loss

(525

)

(2,206

)

(3,410

)

(4,275

)

Interest expense, net

963

339

1,393

614

Foreign currency exchange loss, net

3

12

7

9

Other expense, net

52

(218

)

105

(35

)

Loss before income tax expense

(1,543

)

(2,339

)

(4,915

)

(4,863

)

Income tax expense

47

28

98

93

Net loss

$

(1,590

)

$

(2,367

)

$

(5,013

)

$

(4,956

)

Net loss per share

Basic

$

(0.26

)

$

(0.40

)

$

(0.84

)

$

(0.84

)

Diluted

$

(0.26

)

$

(0.40

)

$

(0.84

)

$

(0.84

)

Weighted-average number of common shares

(basic)

6,009

5,940

5,983

5,918

Weighted-average number of common shares

(diluted)

6,009

5,940

5,983

5,918

Consolidated Condensed Balance

Sheets

(Amounts in thousands, except per share

data)

(Unaudited)

March 31, 2024

September 30,

2023

(unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

747

$

368

Short-term investments

1,730

—

Receivables, net of allowance for credit

losses of $131 and $242, respectively

23,125

20,196

Contract assets

9,976

10,091

Inventories, net

13,847

8,853

Refundable income taxes

84

84

Prepaid expenses and other current

assets

2,112

1,882

Total current assets

51,621

41,474

Property, plant and equipment, net

34,861

36,287

Operating lease right-of-use assets,

net

13,911

14,380

Intangible assets, net

203

278

Goodwill

3,493

3,493

Other assets

99

81

Total assets

$

104,188

$

95,993

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities:

Current maturities of long-term debt

$

6,364

$

3,820

Promissory note - related party

3,256

—

Revolver

17,518

16,289

Short-term operating lease liabilities

894

869

Accounts payable

17,683

13,497

Accrued liabilities ($760 is related

party)

7,067

6,477

Total current liabilities

52,782

40,952

Long-term debt, net of current maturities,

net of unamortized debt issuance costs

4,075

2,457

Long-term operating lease liabilities, net

of short-term

13,561

14,020

Deferred income taxes, net

—

142

Pension liability

3,457

3,417

Other long-term liabilities

657

670

Shareholders’ equity:

Serial preferred shares, no par value,

authorized 1,000 shares; 0 shares issued and outstanding at March

31, 2024 and September 30, 2023

—

—

Common shares, par value $1 per share,

authorized 10,000 shares; issued and outstanding shares 6,190 at

March 31, 2024 and 6,105 at September 30, 2023

6,190

6,105

Additional paid-in capital

11,663

11,626

Retained earnings

18,252

23,264

Accumulated other comprehensive loss

(6,449

)

(6,660

)

Total shareholders’ equity

29,656

34,335

Total liabilities and shareholders’

equity

$

104,188

$

95,993

Non-GAAP Financial Measures

Presented below is certain financial information based on the

Company's EBITDA and Adjusted EBITDA. References to “EBITDA” mean

earnings (losses) from continuing operations before interest,

taxes, depreciation and amortization, and references to “Adjusted

EBITDA” mean EBITDA plus, as applicable for each relevant period,

certain adjustments as set forth in the reconciliations of net

income to EBITDA and Adjusted EBITDA.

Neither EBITDA nor Adjusted EBITDA is a measurement of financial

performance under generally accepted accounting principles in the

United States of America (“GAAP”). The Company presents EBITDA and

Adjusted EBITDA because management believes that they are useful

indicators for evaluating operating performance and liquidity,

including the Company’s ability to incur and service debt and it

uses EBITDA to evaluate prospective acquisitions. Although the

Company uses EBITDA and Adjusted EBITDA for the reasons noted

above, the use of these non-GAAP financial measures as analytical

tools has limitations. Therefore, reviewers of the Company’s

financial information should not consider them in isolation, or as

a substitute for analysis of the Company's results of operations as

reported in accordance with GAAP. Some of these limitations

include:

- Neither EBITDA nor Adjusted EBITDA reflects the interest

expense, or the cash requirements necessary to service interest

payments on indebtedness;

- Although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often have to be

replaced in the future, and neither EBITDA nor Adjusted EBITDA

reflects any cash requirements for such replacements;

- The omission of the amortization expense associated with the

Company’s intangible assets further limits the usefulness of EBITDA

and Adjusted EBITDA; and

- Neither EBITDA nor Adjusted EBITDA includes the payment of

taxes, which is a necessary element of operations.

Because of these limitations, EBITDA and Adjusted EBITDA should

not be considered as measures of discretionary cash available to

the Company to invest in the growth of its businesses. Management

compensates for these limitations by not viewing EBITDA or Adjusted

EBITDA in isolation and specifically by using other GAAP measures,

such as net income (loss), net sales, and operating income (loss),

to measure operating performance. Neither EBITDA nor Adjusted

EBITDA is a measurement of financial performance under GAAP, and

neither should be considered as an alternative to net loss or cash

flow from operations determined in accordance with GAAP. The

Company’s calculation of EBITDA and Adjusted EBITDA may not be

comparable to the calculation of similarly titled measures reported

by other companies.

The following table sets forth a reconciliation of net loss to

EBITDA and Adjusted EBITDA:

Dollars in thousands

Three Months Ended

Six Months Ended

March 31,

March 31,

2024

2023

2024

2023

Net loss

$

(1,590

)

$

(2,367

)

$

(5,013

)

$

(4,956

)

Adjustments:

Depreciation and amortization expense

1,506

1,626

3,068

3,198

Interest expense, net

963

339

1,393

614

Income tax expense

47

28

98

93

EBITDA

926

(374

)

(454

)

(1,051

)

Adjustments:

Foreign currency exchange loss (gain), net

(1)

3

12

7

9

Other expense, net (2)

52

(328

)

105

(146

)

Gain on disposal of assets (3)

3

14

3

3

Equity compensation (4)

85

85

171

207

LIFO impact (5)

58

(461

)

351

(199

)

IT incident costs, net (6)

24

1,086

23

1,087

Strategic alternative expense (7)

133

—

321

—

Adjusted EBITDA

$

1,284

$

34

$

527

$

(90

)

(1)

Represents the gain or loss from

changes in the exchange rates between the functional currency and

the foreign currency in which the transaction is denominated.

(2)

Represents miscellaneous

non-operating income or expense, such as pension costs or grant

income (prior year included $0.1 million in loss on insurance

recovery, separately reclassed to IT incident costs, net line).

(3)

Represents the difference between

the proceeds from the sale of operating equipment and the carrying

value shown on the Company's books.

(4)

Represents the equity-based

compensation expense recognized by the Company under the 2016 Plan

due to granting of awards, awards not vesting and/or

forfeitures.

(5)

Represents the change in the

reserve for inventories for which cost is determined using the

last-in, first-out ("LIFO") method.

(6)

Represents incremental

information technology costs as it relates to the cybersecurity

incident and loss on insurance recovery (prior year balance

includes reclassed amount of $0.1 million from footnote two

above).

(7)

Represents expense related to

evaluation of strategic alternatives.

Reference to the above activities can be found in the

consolidated financial statements included in Item 8 of the

Company's Annual Report on Form 10-K.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509836901/en/

SIFCO Industries, Inc. Thomas R. Kubera, 216-881-8600

www.sifco.com

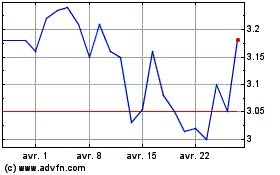

Sifco Industries (AMEX:SIF)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Sifco Industries (AMEX:SIF)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025