UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

| For the month of |

May 2024 |

|

| |

|

|

| Commission File Number |

001-40569 |

|

| Standard Lithium Ltd. |

| (Translation of registrant’s name into English) |

| |

Suite 1625, 1075 W Georgia Street

Vancouver, British Columbia, Canada V6E 3C9 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨ Form 40-F x

INCORPORATION BY REFERENCE

Exhibit 99.1 of this Report on Form 6-K is incorporated

by reference into the Registration Statements on Form F-10 (File No. 333-273462) and Form S-8 (File No. 333-262400) of the Registrant,

as amended or supplemented.

DOCUMENTS INCLUDED AS PART OF THIS REPORT

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Standard Lithium Ltd. |

| |

(Registrant) |

| |

|

| Date: |

May 17, 2024 |

|

By: |

/s/ Robert Mintak |

| |

|

|

|

Name: |

Robert Mintak |

| |

|

|

|

Title: |

CEO and Director |

Exhibit 99.1

STANDARD LITHIUM LTD.

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING

OF SHAREHOLDERS

AND

MANAGEMENT INFORMATION CIRCULAR

Dated: May 15, 2024

Meeting Details

| |

Date: |

June 27, 2024 |

| |

Time: |

10:00 a.m. (Pacific time) |

| |

Place: |

Virtual |

MESSAGE FROM OUR

CEO

Dear Valued Shareholders:

The past year has presented the lithium sector with

significant challenges, from market specific headwinds to broader economic uncertainty. Despite these obstacles, Standard Lithium has

remained focused on advancing our mission to develop a reliable and sustainable U.S. supply of this critical mineral. We have made substantial

progress across our project portfolio and taken proactive measures to position the company for long-term success.

Throughout the year, we made substantial progress

across our project portfolio. This includes completing a Preliminary Feasibility Study (PFS) for our South West Arkansas project in September

2023, followed by the commencement of Front-End Engineering Design (FEED) and Definitive Feasibility Study (DFS) work in January 2024.

In October 2023, we achieved a major milestone with the completion of a definitive feasibility study for our Phase 1A project, marking

a key step towards commercial production using Direct Lithium Extraction (DLE).

Our goal is to create significant value for our shareholders

by building a portfolio of high-quality lithium brine projects in the Smackover Formation, which is ideally suited for our industry leading

DLE technology. Three years of focused data collection, sampling, and leasing efforts in East Texas culminated in a successful exploration

drilling program, confirming the region's exceptional potential and yielding a significant discovery: the highest reported lithium-in-brine

grade in North America. These results underscore our team's expertise in identifying and securing the best areas for resource expansion

within the Smackover Formation, specifically those with optimal brine conditions for lithium extraction through our DLE technology.

Technological Innovation: Commercial-Scale

DLE Success

In a demonstration of our industry leadership, Standard

Lithium, in partnership with Koch Technology Solutions, achieved a major milestone in February 2024 by installing and commissioning the

first commercial-scale DLE column in North America at our demonstration plant at the LANXESS South Plant. The successful operation of

this column, identical in design and scale to those planned for our commercial facilities, marks a critical step in de-risking our path

to production and validating our approach to sustainable lithium extraction.

Strengthening Our Leadership for the

Future

To support our ambitious growth plans, we've strengthened

our leadership team with key appointments. Salah Gamoudi, our new Chief Financial Officer, brings extensive experience in financial strategy

and investor relations. With the addition of Mike Barman as Chief Development Officer, we've also significantly enhanced our capabilities

in corporate development, offtake agreements, commercial partnerships, and strategic alliances.

Together, Salah and Mike's leadership is already

driving greater efficiency and effectiveness across our operations. Their combined expertise reinforces our ability to execute our strategic

plan and create significant value for our shareholders.

Community and Stakeholder Engagement:

Our commitment to community engagement is evident

in our ongoing support for STEM education, workforce development programs like the Catalyst Program, and local sponsorships. We believe

these initiatives are crucial for building strong relationships and contributing to the long-term success of both our company and the

communities we operate in. We are also proud to have spearheaded the Arkansas Lithium Innovation Summit, which brought together industry

leaders and policymakers to discuss the future of lithium production in the state. We believe that strong community partnerships and open

dialogue are essential to our long-term success and the sustainable growth of the lithium industry.

Equinor Partnership: A Transformative

Alliance

Standard Lithium has always believed in the power

of strategic partnerships to overcome challenges and create value. In a complex and evolving lithium market, collaborating with partners

who share our vision and bring complementary skills is essential to navigate the path to commercial production.

Our landmark partnership with Equinor is a testament

to this belief. Their project-level strategic investment in our Southwest Arkansas and East Texas projects not only validates our assets

and technical expertise, but also signals a shared commitment to responsible and sustainable lithium development. We are confident that

this strategic alliance will be a catalyst for growth, enabling us to accelerate our projects, unlock the full potential of our resources,

and deliver substantial value to our shareholders.

Gratitude and Continued Commitment

I extend my deepest gratitude to our shareholders

for your continued support and trust. We are excited about the opportunities that lie ahead and remain dedicated to building a sustainable,

innovative, and profitable future for Standard Lithium.

Sincerely,

Robert Mintak

Chief Executive Officer |  |

MESSAGE FROM OUR

CHAIRMAN

Dear Fellow Shareholders:

You are invited to attend our Annual General Meeting

of Shareholders on June 27, 2024, at 10:00 AM (Pacific Time) virtually at https://virtual-meetings.tsxtrust.com/1661.

While the past year has presented a challenging market

environment for the lithium sector, Standard Lithium has remained steadfast in its pursuit of mission-critical initiatives. Our unwavering

focus has been on advancing our role in developing a robust U.S. supply base for critical minerals – essential for the future of

energy and technology.

We have proactively taken steps to not only navigate

these challenges, but to position ourselves for success in the long term. In 2023, we welcomed Claudia D’Orazio and Anca Rusu as

independent directors, bringing invaluable experience and strategic vision to our board. We further strengthened our executive team with

the appointments of Salah Gamoudi as Chief Financial Officer and Michael Barman as Chief Development Officer. Their financial acumen and

development expertise are already proving instrumental as we enter this next phase of growth.

Our commitment to responsible and sustainable development

remains at the forefront of our operations. We work hand-in-hand with local stakeholders and communities, striving to establish our operational

regions as global models for sustainable mining practices.

Our efforts are gaining recognition not only from

the communities where we operate but also from key strategic partners. Most notably, our recently announced partnership with Equinor,

a global leader in energy and low-carbon solutions, validates our strategic approach and the vast potential of our lithium projects in

Arkansas and Texas. The partnership with Equinor, along with our existing partnerships with Koch and Lanxess, puts us in a strong position

for success.

The enclosed Management Information Circular provides

detailed information about the Annual General Meeting, including voting procedures, board nominations, auditor appointments, and our executive

compensation program. I encourage you to review this important document carefully.

Your participation and vote are crucial, and we value

your engagement as we shape the future of Standard Lithium together.

Thank you for your continued support and trust.

Sincerely,

Robert Cross

Chairman

|  |

STANDARD LITHIUM

LTD.

1625 – 1075 West Georgia Street

Vancouver, BC, Canada, V6E 3C9

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING

NOTICE IS HEREBY

GIVEN that the Annual General and Special Meeting (the “Meeting”) of the shareholders of Standard Lithium

Ltd. (the “Company”) will be held virtually on June 27, 2024 at 10:00 a.m. (Pacific time).

The Meeting will

be a virtual meeting conducted via live webcast and accessible online at https://virtual-meetings.tsxtrust.com/1661 at 10:00 a.m. (Pacific

time) on June 27, 2024. Please note that this site may not be fully accessible on all Internet browsers (Note – please do not

use Internet Explorer). If you are unable to join the Meeting through your usual browser, we suggest trying to access the Meeting via

a different browser. Registered and beneficial shareholders entitled to vote may attend and vote at the Meeting. Shareholders will be

able to submit questions during the live webcast.

The Meeting will be held for the following purposes:

| 1. | to receive the audited financial statements of the Company as at and for the financial year ended June 30,

2023, together with the report of the auditor thereon; |

| 2. | to re-appoint PricewaterhouseCoopers LLP, Chartered Professional Accountants, as auditor of the Company

for the ensuing year and to authorize the board of directors to fix the remuneration of the auditor; |

| 3. | to set the number of directors for the ensuing year at seven (7); |

| 4. | to elect directors to hold office for the ensuing year; |

| 5. | to ratify the adoption of the new By-Law No. 1 (the “By-Law No. 1”), as set

out under the heading “Ratifying of By-Law” in the attached management information circular (the “Circular”); |

| 6. | to re-approve the Company’s rolling stock option plan (the “Option Plan”), as

set out under the heading “Approval of Option Plan” in the attached Circular; |

| 7. | to re-approve the Company’s long term incentive plan (the “Incentive Plan”),

as set out under the heading “Approval of Incentive Plan” in the attached Circular; and |

| 8. | to transact such other business as may properly be transacted at the Meeting or at any adjournment thereof. |

The specific details of the foregoing matters

to be put before the Meeting, as well as further information with respect to voting by proxy, are set forth in the accompanying Circular.

The Company has

decided to use the notice and access procedure (“Notice and Access”) available in National Instrument 51-102 –

Continuous Disclosure Obligations and National Instrument 54-101 – Communication with Beneficial Owners of Securities

of a Reporting Issuer for the delivery of the Meeting materials to its shareholders. Under Notice and Access, instead of receiving

printed copies of the Circular, shareholders will receive a notice (the “Notice and Access Notice”) containing instructions

on how to access such materials electronically. Together with the Notice and Access Notice, shareholders will also receive a proxy (“Proxy”)

(in the case of registered shareholders) or a voting instruction form (in the case of non-registered shareholders) (collectively, the

“Meeting Materials”), enabling them to submit their voting instructions ahead of the Meeting. The Meeting Materials

will be posted on the Company’s website at https://www.standardlithium.com/investors/sedar and will remain on the

website for one year. The Meeting Materials will also be available on the Company’s corporate profile of the System for Electronic

Document Analysis and Retrieval Plus (“SEDAR+”) at www.sedarplus.com. Pursuant to Notice and Access provisions,

registered and beneficial shareholders are entitled to request delivery of a paper copy of the Circular at the issuer’s expense.

If you are a shareholder entitled to vote at

the Meeting, you have the right to appoint a person or company other than any of the persons designated in the Proxy, who need not be

a shareholder, to attend and act for you and vote on your behalf at the Meeting.

A shareholder who is unable to attend the Meeting

and who wishes to ensure that such shareholder’s shares will be voted at the Meeting is requested to complete, date and sign the

enclosed Proxy and deliver it in accordance with the instructions set out in the Proxy and in the Circular.

We strongly encourage shareholders to attend

the Meeting and to vote their shares by Proxy prior to the Proxy cut-off at 10:00 a.m. (Pacific time) on June 25, 2024.

As set out in the notes, the enclosed Proxy is

solicited by management; however, you may amend it by striking out the names listed therein and inserting in the space provided the name

of the person you wish to represent you at the Meeting.

DATED

at Vancouver, British Columbia, this 15th day of May, 2024.

| |

By order of the Board of Directors. |

| |

|

| |

STANDARD LITHIUM LTD. |

| |

|

| |

/s/ “Robert Mintak” |

| |

Robert Mintak |

| |

Director and Chief Executive Officer |

STANDARD LITHIUM

LTD.

1625 – 1075 West Georgia Street

Vancouver, BC, Canada V6E 3C9

MANAGEMENT

INFORMATION CIRCULAR

(containing information as at May 15, 2024

unless otherwise stated)

For the Annual

General and Special Meeting

to be held at 10:00 a.m. (Pacific time) on June 27, 2024

SOLICITATION

OF PROXIES

This management information circular (the “Circular”)

is furnished in connection with the solicitation of proxies by management (the “Management”) of Standard Lithium Ltd.

(the “Company”), for use at the Annual General and Special Meeting (the “Meeting”) of the shareholders

(“Shareholders”) of the Company to be held on June 27, 2024, at the time and place and for the purposes set forth

in the accompanying Notice of Meeting and at any adjournment thereof.

The enclosed form of proxy (the “Proxy”)

is solicited by Management. The solicitation will be primarily by mail; however, Proxies may be solicited personally or by telephone by

the regular officers and employees of the Company. The cost of solicitation will be borne by the Company.

VIRTUAL ONLY MEETING FORMAT

The Meeting will be a virtual meeting conducted

via live webcast and accessible online at https://virtual-meetings.tsxtrust.com/1661 starting at 10:00 a.m. (Pacific time) on June 27,

2024. Please note that this site may not be fully accessible on all Internet browsers (Note - please do not use Internet Explorer). If

you are unable to join the Meeting through your usual browser, we suggest trying to access the Meeting via a different browser. Registered

and beneficial Shareholders entitled to vote may attend and vote at the Meeting. Shareholders will be able to submit questions during

the live webcast.

We strongly encourage Shareholders to attend

the Meeting and to vote their shares by Proxy prior to the Proxy cut-off at 10:00 a.m. (Pacific time) on June 25, 2024.

NOTICE AND ACCESS

The Company has

decided to use the notice and access procedure (“Notice and Access”) available in National Instrument 51-102 –

Continuous Disclosure Obligations (“NI 51-102”) and National Instrument 54-101 – Communication with

Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) for the delivery of the Meeting materials

to its Shareholders. Under Notice and Access, instead of receiving printed copies of the Circular, Shareholders will receive a notice

(the “Notice and Access Notice”) containing instructions on how to access such materials electronically. Together

with the Notice and Access Notice, Shareholders will also receive a Proxy (in the case of registered Shareholders) or a voting instruction

form (“VIF”) (in the case of non-registered Shareholders) (collectively, the “Meeting Materials”),

enabling them to submit their voting instructions ahead of the Meeting. The Meeting Materials will be posted on the Company’s website

at https://www.standardlithium.com/investors/sedar and will remain on the website for one year. The Meeting Materials will

also be available on the Company’s corporate profile of the System for Electronic Document Analysis and Retrieval Plus (“SEDAR+”)

at www.sedarplus.com. Pursuant to Notice and Access provisions, registered and beneficial Shareholders are entitled to request

delivery of a paper copy of the Circular at the issuer’s expense.

APPOINTMENT

OF PROXYHOLDERS

The persons named in the Proxy are representatives

of the Company.

A Shareholder entitled to vote at the Meeting

has the right to appoint a person (who need not be a Shareholder) to attend and act on the Shareholder’s behalf at the Meeting other

than the persons named in the accompanying Proxy (the “Proxyholder”). To exercise this right, a Shareholder shall strike out

the names of the persons named in the accompanying Proxy and insert the name of the Shareholder’s nominee in the blank space provided

or complete another suitable form of proxy.

A Proxy will

not be valid unless it is duly completed, signed and deposited with the Company’s registrar and transfer agent, TSX Trust

Company (“TSX Trust”) at P.O Box 721, Agincourt, Ontario, M1S 0A1, Canada, or by fax at 1-416-595-9593, or by

scan and email to proxyvote@tmx.com not less than 48 hours (excluding Saturdays,

Sundays and holidays) before the time of the Meeting or any adjournment thereof. A Proxy must be signed by the Shareholder or by his

or her attorney in writing, or, if the Shareholder is a corporation, it must either be under its common seal or signed by a duly

authorized officer.

VOTING

BY PROXYHOLDER

Manner of Voting

The common shares of the Company (the “Common

Shares”) represented by the Proxy will be voted for, against or withheld from voting in accordance with the instructions of

the Shareholder on any ballot that may be called for and, if the Shareholder specifies a choice on the Proxy with respect to any matter

to be acted upon, the Common Shares will be voted accordingly. On any poll, a Proxyholder will vote the Common Shares in respect of which

they are appointed. Where directions are given by the Shareholder in respect of voting for, withhold or against any resolution, the Proxyholder

will do so in accordance with such direction.

The Proxy, when properly signed, confers discretionary

authority on the Proxyholder with respect to amendments or variations to the matters which may properly be brought before the Meeting.

At the time of printing this Circular, Management is not aware that any such amendments, variations or other matters are to be presented

for action at the Meeting. However, if any other matters which are not now known to Management should properly come before the Meeting,

the Proxies hereby solicited will be exercised on such matters in accordance with the best judgment of the Proxyholder.

In the absence of instructions to the contrary,

the Proxyholders intend to vote the Common Shares represented by each Proxy, properly executed, FOR the motions proposed to be made at

the Meeting as stated under the headings in this Circular.

Revocation of Proxy

A Registered Shareholder

(defined below) who has given a Proxy may revoke it at any time before it is exercised. In addition to revocation in any other manner

permitted by law, a Proxy may be revoked by personally attending the Meeting online, or by instrument in writing executed by the Shareholder

or by his or her attorney authorized in writing, or, if the Shareholder is a corporation, it must either be under its common seal or

signed by a duly authorized officer and deposited with the Company’s registrar and transfer agent, TSX Trust by mail at P.O. Box

721, Agincourt, Ontario, M1S 0A1, Canada, or by fax at 1-416-595-9593, or by scan and email to proxyvote@tmx.com, at any

time up to and including the last business day preceding the day of the Meeting, or any adjournment of it, at which the Proxy is to be

used, or to the Chair of the Meeting on the day of the Meeting or any adjournment of it. A revocation of a Proxy does not affect any

matter on which a vote has been taken prior to the revocation.

If you are a non-registered Shareholder and wish

to revoke or change your prior instructions, you must contact your intermediary well in advance of the Meeting and follow its instructions.

Intermediaries may set deadlines for the receipt of revocations that are further in advance of the Meeting than those set out elsewhere

in this Circular and related Proxy materials and, accordingly, any such revocation should be completed in coordination with your intermediary

well in advance of the deadline for submitting Proxies or VIFs to ensure it can be given effect to at the Meeting.

Voting Thresholds Required for Approval

In order to approve

a motion proposed at the Meeting, a majority of not less than one-half of the votes cast will be required (an “Ordinary Resolution”)

unless the motion requires a special resolution, in which case a majority of not less than two-thirds of the votes cast will be required.

In the event a motion proposed at the Meeting requires disinterested Shareholder approval, Common Shares held by Shareholders of the Company

who have an interest in the subject matter of the resolution, as set out in the TSX Venture Exchange (the “Exchange”)

Corporate Finance Manual, will be excluded from the count of votes cast on such motion.

ADVICE

TO REGISTERED SHAREHOLDERS

Shareholders whose names appear on the records

of the Company as the registered holders of Common Shares (the “Registered Shareholders”) may choose to vote by Proxy

or attend the Meeting and vote virtually.

Registered Shareholders can vote in one of the

following ways:

Internet, Email and Mail

To vote by Internet,

go to www.meeting-vote.com and follow the instructions on screen. You will need your control number, which appears below

your name and address on the Proxy.

To vote by fax

or email, complete both sides of the Proxy, sign and date it and fax both sides to our transfer agent, TSX Trust, Attention: Proxy Department,

to 416-595-9593 or scan and email to proxyvote@tmx.com.

To vote by mail, complete, sign and date the Proxy

and return it in the envelope provided, or send it to: TSX Trust, Attention: Proxy Department, P.O. Box 721, Agincourt, Ontario,

M1S 0A1, Canada.

At the Meeting

Registered Shareholders entitled to vote at the

Meeting may attend and vote at the Meeting virtually by following the steps listed below:

| a) | Type in https://virtual-meetings.tsxtrust.com/1661 on your browser at least 15 minutes before the Meeting

starts; |

| b) | Click on “I have a control number”; |

| c) | Enter your 13-digit control number (on your Proxy); |

| d) | Enter the password: standard2024 (case sensitive); and |

| e) | When the ballot is opened, click on the “Voting” icon. To vote, simply select your voting

direction from the options shown on screen and click on “Submit”. |

Returning your Proxy

Registered Shareholders who choose to submit a

Proxy may do so by completing, signing, dating and depositing the Proxy with TSX Trust not less than 48 hours (excluding Saturdays, Sundays

and holidays) before the time of the Meeting or any adjournment thereof. The Proxy may be signed by the Shareholder or by his or her attorney

in writing, or, if the Registered Shareholder is a corporation, it must either be under its common seal or signed by a duly authorized

officer.

If the Meeting is postponed or adjourned, we must

receive your completed Proxy by 10:00 a.m. (Pacific time), two full business days before any adjourned or postponed Meeting at which

the Proxy is to be used. Late Proxies may be accepted or rejected by the Chair of the Meeting at their discretion and they are under no

obligation to accept or reject a late Proxy. The Chair of the Meeting may waive or extend the Proxy cut-off without notice.

ADVICE

TO BENEFICIAL SHAREHOLDERS

The information set forth in this section is

of significant importance to many Shareholders as a substantial number of Shareholders do not hold Common Shares in their own name.

Shareholders who do not hold their Common Shares

in their own name (the “Beneficial Shareholders”) should note that only Proxies deposited by Registered Shareholders

can be recognized and acted upon at the Meeting.

If Common Shares are listed in an account statement

provided to a Shareholder by an intermediary, such as a brokerage firm, then, in almost all cases, those Common Shares will not be registered

in the Shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the name of the

Shareholder’s intermediary or an agent of that intermediary, and consequently the Shareholder will be a Beneficial Shareholder.

In Canada, the vast majority of such Common Shares are registered under the name CDS & Co. (being the registration name for the

Canadian Depositary for Securities, which acts as nominee for many Canadian brokerage firms). The Common Shares held by intermediaries

or their agents or nominees can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without

specific instructions, an intermediary and its agents are prohibited from voting shares for the intermediary’s clients. Therefore,

Beneficial Shareholders should ensure that instructions respecting the voting of their Common Shares are communicated to the appropriate

person.

Applicable regulatory rules require intermediaries/brokers

to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every intermediary/broker has its

own mailing procedures and provides its own return instructions to clients, which should be carefully followed by Beneficial Shareholders

in order to ensure that their Common Shares are voted at the Meeting. The purpose of the form of proxy or voting instruction form provided

to a Beneficial Shareholder by its broker, agent or nominee is limited to instructing the registered holder of the Common Shares on how

to vote such Common Shares on behalf of the Beneficial Shareholder.

The majority of brokers now delegate responsibility

for obtaining instructions from clients to Broadridge Investor Communications (“Broadridge”). Broadridge typically

supplies the voting instruction forms, mails those voting instruction forms to Beneficial Shareholders and asks those Beneficial Shareholders

to return the voting instruction forms to Broadridge or follow specific telephone or other voting procedures. Broadridge then tabulates

the results of all instructions received by it and provides appropriate instructions respecting the voting of the Common Shares to be

represented at the Meeting. A Beneficial Shareholder receiving a voting instruction form from Broadridge cannot use that voting instruction

form to vote Common Shares directly at the Meeting. Instead, the voting instruction form must be returned to Broadridge or the alternate

voting procedures must be completed well in advance of the Meeting in order to ensure such Common Shares are voted.

There are two kinds of Beneficial Shareholders,

those who object to their name being made known to the issuers of securities which they own (“OBOs” for objecting beneficial

owners) and those who do not object to the issuers of the securities they own knowing who they are (“NOBOs” for non-objecting

beneficial owners). The Company does not intend to pay for intermediaries to deliver these Meeting Materials to OBOs and, as a result,

OBOs will not be sent paper copies unless their intermediary assumes the costs.

Non-Objecting Beneficial Owners

Pursuant to NI 54-101, issuers can obtain a list

of their NOBOs from intermediaries for distribution of proxy-related materials directly to NOBOs. This year, the Company will rely on

those provisions of NI 54-101 that permit it to directly deliver proxy-related materials to its NOBOs. As a result, NOBOs can expect to

receive a scannable VIF from the Company’s transfer agent, TSX Trust. These VIFs are to be completed and returned to TSX Trust in

the envelope provided or by facsimile. In addition, TSX Trust provides both telephone voting and internet voting as described on the VIF

itself which contains complete instructions. TSX Trust will tabulate the results of the VIFs received from NOBOs and will provide appropriate

instructions at the Meeting with respect to the Common Shares represented by the VIFs they receive.

The Meeting Materials are being sent to both Registered

Shareholders and Beneficial Shareholders. If you are a Beneficial Shareholder and the Company or its agent has sent these proxy-related

materials to you directly, please be advised that your name, address and information about your holdings of securities have been obtained

in accordance with applicable securities regulatory requirements from the intermediary holding your securities on your behalf. By choosing

to send these proxy-related materials to you directly, the Company (and not the intermediaries holding securities on your behalf) has

assumed responsibility for (i) delivering the proxy-related materials to you and (ii) executing your proper voting instructions

as specified in the VIF. Please return your voting instructions as specified in the request for voting instructions.

Objecting Beneficial Owners

Beneficial Shareholders who are OBOs should

follow the instructions of their intermediary carefully to ensure that their Common Shares are voted at the Meeting.

Applicable regulatory rules require intermediaries

to seek voting instructions from OBOs in advance of shareholder meetings. Every intermediary has its own mailing procedures and provides

its own return instructions to clients, which should be carefully followed by OBOs in order to ensure that their Common Shares are voted

at the Meeting. The purpose of the form of proxy or voting instruction form provided to an OBO by its broker, agent or nominee is limited

to instructing the registered holder of the shares on how to vote such shares on behalf of the OBO.

The form of proxy provided to OBOs by intermediaries

will be similar to the Proxy provided to Registered Shareholders. However, its purpose is limited to instructing the intermediary on how

to vote your common shares on your behalf. Broadridge typically supplies voting instruction forms on behalf of intermediaries, mails those

forms to OBOs, and asks those OBOs to return the forms to Broadridge or follow specific telephonic or other voting procedures. Broadridge

then tabulates the results of all instructions received by it and provides appropriate instructions respecting the voting of the Common

Shares to be represented at the meeting. An OBO receiving a voting instruction form from Broadridge cannot use that form to vote Common

Shares directly at the Meeting. Instead, the voting instruction form must be returned to Broadridge or the alternate voting procedures

must be completed well in advance of the Meeting in order to ensure that such Common Shares are voted.

INTEREST

OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

Except as otherwise disclosed herein, none of

the directors or officers of the Company, at any time since the beginning of the Company’s last financial year, nor any proposed

nominee for election as a director, or any associate or affiliate of the foregoing persons, has any material interest, direct or indirect,

by way of beneficial ownership of securities or otherwise, in any matters to be acted upon at the Meeting exclusive of the election of

directors or the appointment of auditors. Directors and officers may however be interested in the re-approval of the rolling stock option

plan (the “Option Plan”) and the long term incentive plan (the “Incentive Plan”) as detailed under

the headings “Re-approval of Option Plan” and “Re-approval of Incentive Plan”, respectively, below,

as such persons are entitled to participate in the Option Plan and the Incentive Plan.

RECORD

DATE, VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

A Shareholder of record at the close of business

on May 15, 2024 (the “Record Date”) who either personally attends the virtual Meeting or who has completed and

delivered a Proxy in the manner and subject to the provisions described above, shall be entitled to vote or to have such Shareholder’s

Common Shares voted at the Meeting, or any postponement or adjournment thereof.

The Company’s authorized capital consists

of an unlimited number of Common Shares without par value and an unlimited number of preferred shares (“Preferred Shares”),

without par value. As at the Record Date, the Company has 183,465,256 Common Shares issued and outstanding, with each Common Share

carrying the right to one vote. As at the Record Date, no Preferred Shares are issued and outstanding.

Principal Holders of Voting Securities

To the best of the knowledge of the directors

and officers of the Company, no persons or corporations beneficially own, directly or indirectly, or exercise control or direction over,

Common Shares carrying more than 10% of the voting rights attached to all outstanding Common Shares of the Company.

EXECUTIVE

COMPENSATION

The following information is presented in accordance

with Form 51-102F6 – Statement of Executive Compensation (the “Form”) and sets forth compensation

of the Company for the year ended June 30, 2023.

All amounts represented in this Statement of Executive

Compensation are in Canadian dollars unless stated otherwise.

General

The following terms when used in this section

will have the following meanings:

“CEO” means an individual who

acted as chief executive officer of the Company, or acted in a similar capacity, for any part of the most recently completed financial

year;

“CFO” means an individual who

acted as chief financial officer of the Company, or acted in a similar capacity, for any part of the most recently completed financial

year;

“Director” means an individual

who acted as a director of the Company, or acted in a similar capacity, for any part of the most recently completed financial year;

“equity incentive plan” means

an incentive plan, or portion of an incentive plan, under which awards are granted and that falls within the scope of IFRS 2 Share-based

Payment;

“incentive plan” means any

plan providing compensation that depends on achieving certain performance goals or similar conditions within a specified period;

“incentive plan award” means

compensation awarded, earned, paid, or payable under an incentive plan;

“NEO” or “named executive

officer” means each of the following individuals:

| (c) | each of the three most highly compensated executive officers, or the three

most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed

financial year whose total compensation was, individually, more than $150,000, as determined in accordance with subsection 1.3(6) of

National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102”), for that financial

year; and |

| (d) | each individual who would be an NEO under paragraph (c) but for the fact that the individual was

neither an executive officer of the company, nor acting in a similar capacity, at the end of that financial year; |

“non-equity

incentive plan” means an incentive plan or portion of an incentive plan that is not an equity incentive plan;

“option-based award” means

an award under an equity incentive plan of options, including, for greater certainty, share options, share appreciation rights, and similar

instruments that have option-like features;

“plan” includes any plan, contract,

authorization, or arrangement, whether or not set out in any formal document, where cash, securities, similar instruments or any other

property may be received, whether for one or more persons;

“replacement grant” means an

option that a reasonable person would consider to be granted in relation to a prior or potential cancellation of an option; and

“share-based award” means an

award under an equity incentive plan of equity-based instruments that do not have option-like features, including, for greater certainty,

common shares, restricted shares, restricted share units, deferred share units, phantom shares, phantom share units, common share equivalent

units, and stock.

Compensation Discussion and Analysis

The purpose of this Compensation Discussion and

Analysis is to provide information about the Company’s executive compensation philosophy, objectives and processes and to discuss

compensation decisions relating to the Company’s NEOs.

During the financial

year ended June 30, 2023, the Company had five (5) NEOs: Robert Mintak, CEO and Director; Kara Norman, Former CFO and current

Chief Accounting Officer (“CAO”) and Corporate Secretary; Dr. Andy Robinson, President, Chief Operating

Officer (“COO”) and Director; Steve Ross, Vice President, Resource Development; and Jason Tielker, Vice President,

Project Delivery.

Elements of NEO Compensation

Compensation of

NEOs is reviewed annually and recommended to the board of directors of the Company (the “Board”) for approval by the

compensation committee (the “Compensation Committee”). The level and elements of compensation for NEOs is determined

after consideration of various relevant factors, including the expected nature and quantity of duties and responsibilities, expected time

commitments, past performance and the availability of financial resources.

In the Compensation Committee’s view, there

has previously been no need for the Company to design or implement a formal compensation program for NEOs.

Set forth below is a table that describes the

elements of NEO compensation:

| Element |

Description |

Objectives |

| Base salary |

Base salary is determined through an analysis that considers the expected nature and quantity of duties and responsibilities, past performance, expected time commitments and the availability of financial resources. |

To attract, retain and motivate NEOs. |

Annual cash bonuses

(Short Term Incentives) |

Annual cash bonuses comprise a portion of variable compensation for NEOs and is designed to reward NEOs on an annual basis for achievement of business objectives and individual performance. |

Recognize and pay for performance of NEOs and attract, retain and motivate NEOs. |

Options, RSUs and DSUs

(Long Term Incentives) |

Equity compensation comprises a portion of variable compensation for NEOs and is designed to reward NEOs for achievement of business objectives and individual performance, as well as align NEO performance with those of Shareholders and the long-term objectives of the Company. |

Recognize and compensate performance of NEOs, attract, retain and motivate NEOs, and align performance of NEOs with those of Shareholders and long-term objectives of Company. |

Compensation Risk Considerations

The Compensation Committee takes a balanced approach

by using both short-term and long-term incentives which are based on both business objectives and individual performance as discussed

above. The Company’s compensation strategy identifies the maximum number of awards granted under the Company’s Option Plan

and Incentive Plan (each, as defined below). This strategy achieves the objectives of aligning the interests of NEOs and Company Shareholders

and attracting, motivating, and retaining NEOs who are instrumental to the Company’s success while limiting excessive risk taking.

The Company does not currently prohibit NEOs or

Directors from purchasing financial instruments (which, for greater certainty, include prepaid variable forward contracts, equity swaps,

collars or units of exchange funds) that are designed to hedge or offset a decrease in market value of equity securities granted by the

Company to such individuals as compensation or held, directly or indirectly, by the NEO or Director. However, to the best of the Company’s

knowledge, no NEO or Director of the Company has purchased such financial instruments.

Based on its review of the Company’s compensation

policies and practices, the Compensation Committee has not identified any risks that are reasonably likely to have a material adverse

effect on the Company. The Compensation Committee will continue to review the Company’s compensation strategy, policies and practices

on an annual basis to ensure that risk related to compensation of NEOs and Directors is mitigated.

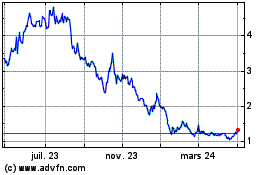

Performance Graph

The following graph compares the percentage change

in cumulative total Shareholder return for CDN$100 invested in the Company’s Common Shares against the cumulative total return of

the S&P/TSX Composite Index and the S&P/TSX Composite Metals and Mining Index for the five-year period beginning July 1,

2018.

The amounts in the graph above and chart below

are as of July 1 and June 30, respectively, in each of the years 2018, 2019, 2020, 2021, 2022 and 2023.

| Index | |

June 30, 2018

(CDN$) | | |

June 30, 2019

(CDN$) | | |

June 30, 2020

(CDN$) | | |

June 30, 2021

(CDN$) | | |

June 30, 2022

(CDN$) | | |

June 30, 2023

(CDN$) | |

| Standard Lithium Ltd. | |

| 100.00 | | |

| 81.82 | | |

| 90.91 | | |

| 462.73 | | |

| 500.00 | | |

| 545.45 | |

| S&P/TSX Composite Index | |

| 100.00 | | |

| 100.64 | | |

| 95.32 | | |

| 123.88 | | |

| 115.87 | | |

| 123.82 | |

| S&P/TSX Composite Metals and Mining Index | |

| 100.00 | | |

| 104.60 | | |

| 151.66 | | |

| 142.57 | | |

| 126.52 | | |

| 150.14 | |

As shown in the graph above, during the fiscal

year ended June 30, 2023, the Company’s Common Share price significantly outperformed both the S&P/TSX Composite Index

and the S&P/TSX Composite Metals and Mining Index. This trend has continued since June 30, 2021. The Company believes that this

outperformance is driven by its strategic focus on developing high-grade lithium brine projects in the United States, particularly our

flagship projects in southern Arkansas: the South West Arkansas project, which encompasses over 27,000 acres of brine leases, and the

Lanxess project, home to our industry-leading Direct Lithium Extraction (“DLE”) demonstration plant. The DLE demonstration

plant is being used for proof-of-concept and commercial feasibility studies. The most advanced initiative within the Lanxess project is

Phase 1A. Additionally, the Company has made significant strides in identifying and securing prospective lithium brine resources in East

Texas, expanding its potential resource base.

Beyond project advancements, broader macroeconomic

developments in North America and globally, along with geopolitical tensions, have supported the development of domestic electric vehicle

and battery production infrastructure, further contributing to the Company’s outperformance relative to the S&P/TSX Composite

Index and the S&P/TSX Composite Metals and Mining Index.

The trend in overall compensation paid to the

Company’s NEOs over this time has not directly tracked to the performance of the Company’s Common Shares or the noted indices.

Given the Company’s stage of development, the Company’s Common Share price can be volatile and is currently not a significant

factor in cash compensation considerations. The value of Option (defined below) and Share Unit (defined below) awards is influenced by

the Company’s Common Share price performance.

Share-Based and Option-Based Awards

The Company currently has two equity incentive

plans: (i) a stock option plan (the “Option Plan”), and (ii) a long-term incentive plan (the “Incentive

Plan”).

The Option Plan is designed to motivate NEOs and

Directors by providing them with the opportunity, through stock options (each, an “Option”), to acquire an interest

in the Company and benefit from the Company’s growth.

The Incentive Plan provides for the grant of rights

to acquire any number of Common Shares (each, a “Share Unit”), from time to time that each represent the right to receive,

subject to adjustments in certain circumstances, one Common Share in consideration for past performance upon expiry of an applicable restricted

period, the holder ceasing to be involved with the Company or the satisfaction of certain established performance conditions.

See “Option Plan” and “Incentive

Plan” below for summaries of the equity incentive plans.

Other than the Option Plan and Incentive Plan,

the Company does not offer any long-term incentive plans, share compensation plans, retirement plans, pension plans, or any other such

benefit programs for NEOs.

As noted above,

compensation of NEOs, including the award of Options and Share Units, is reviewed annually and recommended to the Board for approval

by the Compensation Committee. The number of Options and Share Units is determined after consideration of various relevant factors, including

the expected nature and quantity of duties and responsibilities, past performance, expected time commitments and the availability of financial

resources. The Compensation Committee takes into account the maximum number of awards available for grant under the Option Plan and Incentive

Plan, in addition to previous grants, when considering new grants under any equity incentive plan.

Compensation Committee

The Compensation Committee reviews annually and

recommends to the Board compensation for NEOs. The Compensation Committee may meet more frequently during the year to review compensation

matters and may engage third party consultants to assist in evaluating compensation matters.

The current members of the Compensation Committee

are Robert Cross (Chair), Dr. Volker Berl, Claudia D’Orazio and Jeffrey Barber, all of whom are independent1 and

all of whom have direct experience that is relevant to their responsibilities in executive compensation.

Robert Cross (Chair)

Mr. Cross currently serves as the non-executive

Chairman of the Company and is the Chair of the Compensation Committee. Mr. Cross has more than 30 years of experience as a company

founder, financier, and advisor in the mining and oil & gas sectors. Between 2007 and June 2023 he was a co-founder and

Chairman of B2Gold Corp. Between 2004 and 2016 he was co-founder and Chairman of Bankers Petroleum Ltd. From 2002 until 2007, he served

as Chairman of Northern Orion Resources Inc. Between 1996 and 1998, Mr. Cross was Chairman and Chief Executive Officer of Yorkton

Securities Inc. From 1987 to 1994, he was a Partner, Investment Banking with Gordon Capital Corporation in Toronto. Mr. Cross

has an Engineering Degree from the University of Waterloo and he received his MBA from Harvard Business School in 1987.

1 “Independent” means “independent”

within the meaning of section 1.4 of National Instrument 52-110 – Audit Committees.

Dr. Volker Berl

Dr. Berl serves as an independent Director

of the Company and is also a member of the Compensation Committee, the corporate governance and nominating committee (the “Corporate

Governance and Nominating Committee”) and the audit committee (the “Audit Committee”). Dr. Berl is the

founder, managing partner, and Chief Executive Officer of New Age Ventures. Early in his career, Dr. Berl was head of a Process Development

Laboratory at BASF AG, Germany, teaming up to build the Fine Chemical Division’s pharmaceutical contract manufacturing business

and overseeing the process development for some of BASF’s most important APIs. More recently, Dr. Berl was Vice President of

Equity Research Pharmaceuticals for Deutsche Bank and Chief Technology Officer for the bioscience company Zymes LLC. Dr. Berl holds

an MBA from Concordia University and completed a postdoctoral chemistry fellowship at Stanford University. Before earning his Ph.D. in

Strasbourg, Dr. Berl finished a Masters in Chemical Engineering at the École Nationale Supérieure de Chimie, Polymères

et Matériaux, in France.

Claudia D’Orazio

Ms. D’Orazio serves as an independent

Director of the Company and is also a member of the Compensation Committee, the Audit Committee and the Corporate Governance and Nominating

Committee. Ms. D’Orazio is also Executive Vice President and Chief Human Resources and Technology Officer for Centerra Gold

Inc. Ms. D’Orazio has over 30 years experience as a Senior Executive and has an extensive background in human resources, risk

management, internal audit, information technology, supply chain management, integrations, treasury and finance. Ms. D’Orazio

joined Centerra Gold Inc. in February 2020 as Vice President, Chief Human Resources Officer. Prior to joining Centerra, Ms. D’Orazio

held several executive roles at Pembina Pipeline Corporation from 2006 to 2020 including, Corporate Controller, Vice President &

Treasurer, Vice President Risk and Compliance and most recently, was Vice President Human Resources. Ms. D’Orazio began her

career at KPMG Canada and joined The Royal Bank of Canada for over 10 years in various Accounting and Finance roles. Ms. D’Orazio

holds a Bachelor of Commerce degree, specializing in Accounting & Management Information Systems and a CPA designation from McGill

University.

Jeffrey Barber

Mr. Barber serves as an independent Director

of the Company and is also a member of the Compensation Committee and the Audit Committee. Mr. Barber has worked closely with various

public company boards and executive teams to assist in capital markets initiatives and advise on go-public transactions, valuations and

M&A mandates. Most recently, Mr. Barber was a co-founder and CFO of Hiku Brands until the company’s sale in 2018. From

2012 to 2016, Mr. Barber was a co-founder and managing partner of a boutique M&A advisory firm in Calgary. Prior thereto, Mr. Barber

spent many years covering the energy sector on investment banking and research teams at Canaccord Genuity Corp. and Raymond James Ltd.

Mr. Barber began his career as an economist with Deloitte LLP. Mr. Barber is a CFA charter holder and holds a Masters in Finance

and Economics from the University of Alberta.

Compensation Consultant

During the year

ended June 30, 2023, the Company engaged Lane Caputo Compensation Inc. (“Lane Caputo”), an independent third party,

to review and evaluate compensation paid to the Company’s Board, CEO, COO and President, CFO and key senior management roles. The

Compensation Committee and senior management reviewed Lane Caputo’s findings and recommendations and took such findings and recommendations

into consideration in determining compensation. During the year ended June 30, 2023, the Company paid Lane Caputo an aggregate fee

of $33,000 for the services noted above.

Summary Compensation Table

The following table provides a summary of compensation

paid, directly or indirectly, for each of the three most recently completed financial years to each NEO:

| Table of Compensation(1) |

|

| | |

| |

| |

| |

| |

Non-equity incentive plan

compensation

(CDN$) | |

| |

| |

|

|

| Name and position | |

Year(2) | |

Salary

(CDN$) | |

Share-based

awards

(CDN$) | |

Option-based

awards

(CDN$) | |

Annual

incentive

plans | |

Long-term

incentive

plans | |

Pension

value

(CDN$) | |

All other

compensation

(CDN$) | |

Total

compensation

(CDN$) |

|

Robert Mintak

CEO and Director | |

2023

2022

2021 | |

556,641 454,317 350,000 | (3)

(3)

|

Nil

Nil

Nil | |

1,207,955 Nil 678,728 | (10)

(8) |

400,000 400,000 100,000 | (4)

(5)

(6) |

Nil

Nil

Nil | |

Nil

Nil

Nil | |

Nil

Nil

Nil | |

2,164,596

854,317

1,128,728 |

|

Kara Norman

Former CFO (current CAO) and Corporate Secretary | |

2023

2022

2021 | |

347,901 255,428 138,158 | (3)

(3)

|

Nil

Nil

Nil | |

690,260 Nil 678,728 | (10)

(8) |

250,000 178,200 25,000 | (4)

(5)

(6) |

Nil

Nil

Nil | |

Nil

Nil

Nil | |

Nil

Nil

Nil | |

1,288,161

433,628

841,886 |

|

Dr. Andrew Robinson

President, COO and Director | |

2023

2022

2021 | |

556,641 454,321 350,004 | (3)

(3)

|

Nil

Nil

Nil | |

1,207,955 Nil 678,728 | (10)

(8) |

400,000 400,000 100,000 | (4)

(5)

(6) |

Nil

Nil

Nil | |

Nil

Nil

Nil | |

Nil

Nil

Nil | |

2,164,596

854,321

1,128,732 |

|

Stephen Ross

Vice President, Resource Development | |

2023

2022

2021 | |

454,900

359,288

335,147 | |

Nil

Nil

Nil | |

345,130 Nil Nil | (10)

|

Nil

Nil

Nil | |

Nil

Nil

Nil | |

Nil

Nil

Nil | |

Nil

Nil

Nil | |

800,030

359,288

335,147 |

|

Jason Tielker

Vice President, Project Delivery(7) | |

2023

2022 | |

495,200

313,800 | |

Nil

Nil | |

690,260 970,808 | (10)

(9) |

Nil

Nil | |

Nil

Nil | |

Nil

Nil | |

Nil

Nil | |

1,185,460

1,284,608 |

|

Notes:

| 1. | This table does not include amounts paid as reimbursement for expenses. |

| 3. | Effective January 1, 2022, amounts paid to NEOs were fixed in US dollars and paid to NEOs in Canadian

dollars based on the average Bank of Canada daily exchange rate in the month end immediately prior to payment. |

| 4. | Cash bonus earned for fiscal year ended June 30, 2023 performance in recognition of the continued

service of the NEO and contributions to the ongoing success of the Company. Bonus paid in October 2023. |

| 5. | Cash bonus earned for calendar year ended December 31, 2021 performance in recognition of the continued

service of the NEO and contributions to the ongoing success of the Company. Bonus paid in April 2022. |

| 6. | Cash bonus earned for calendar year ended December 31, 2020 in recognition of the continued service

of the NEO and contributions to the ongoing success of the Company. Bonus paid in February 2021. |

| 7. | Mr. Jason Tielker joined the Company on October 1, 2021. |

| 8. | On January 18, 2021, the Company granted 200,000 Options at an exercise price of CDN$3.39 each to

Mr. Mintak, Mr. Robinson and Ms. Norman. The value of the grant was estimated using the Black-Scholes model with the following

assumptions: 5 year expected life; 147% volatility; 0.35% risk free interest rate; and a nil% dividend rate. Each Option entitles the

holder to one Common Share upon exercise or release and expire on January 18, 2026. The Options vested at grant. |

| 9. | On February 14, 2022, the Company granted 250,000 Options at an exercise price of CDN$7.55 to Mr. Tielker.

The value of the grant was estimated using the Black-Scholes model with the following assumptions: 3 year expected life; 78% volatility;

1.60% risk free interest rate; and a nil% dividend rate. Each Option entitles the holder to one Common Share upon exercise or release

and expire on February 14, 2025. The Options vest as follows: 1/4 on date of grant, 1/4 after three months; 1/4 after six months;

and 1/4 after nine months. |

| 10. | On April 11, 2023, the Company granted 350,000 Options at an exercise of CDN$5.08 each to Mr. Mintak

and Mr. Robinson, 200,000 Options at an exercise price of CDN$5.08 to Ms. Norman and Mr. Tielker and 100,000 Options at

an exercise price of CDN$5.08 to Mr. Ross. The value of the grant was estimated using the Black-Scholes model with the following

assumptions: 5 year expected life; 84% volatility; 3.14% risk free interest rate; and a nil% dividend rate. Each Option entitles to holder

to one Common Share upon the exercise or release and expire on April 11, 2028. The Options vested at grant. |

Incentive Plan Awards – NEOs

The following table sets forth information concerning

all compensation securities granted or issued by the Company to each NEO during the most recently completed financial year:

| Compensation Securities |

| Name

and position | |

Type of

compensation

security | |

Number of

compensation

securities,

number of

underlying

securities,

and

percentage of

class(1)(2) | |

Date of issue

or grant | |

Issue,

conversion or

exercise price

(CDN$) | | |

Closing price

of security or

underlying

security on

date of grant

(CDN$) | | |

Closing price

of security or

underlying

security at

year end

(CDN$)(3) | | |

Expiry Date |

Robert Mintak

CEO and Director | |

Options

DSUs | |

350,000

(4.28

633,071

(31.80 |

)%

)% |

Apr 11, 2023

Apr 11, 2023 | |

$

| 5.08 N/A | | |

$ | 5.08 | | |

$ | 5.95 | | |

Apr 11, 2028

N/A |

Kara Norman

Former CFO (current CAO) and Corporate Secretary | |

Options

DSUs | |

200,000

(2.45

300,669

(15.10 |

)%

)% |

Apr 11, 2023

Apr 11, 2023 | |

$

| 5.08 N/A | | |

$ | 5.08 | | |

$ | 5.95 | | |

Apr 11, 2028

N/A |

Dr. Andrew Robinson

President, COO and Director | |

Options

DSUs | |

350,000

(4.28

633,071

(31.80 |

)%

)% |

Apr 11, 2023

Apr 11, 2023 | |

$

| 5.08 N/A | | |

$ | 5.08 | | |

$ | 5.95 | | |

Apr 11, 2028

N/A |

Stephen Ross

Vice President, Resource Development | |

Options | |

100,000

(1.22 |

)%

|

Apr 11, 2023

| |

$ | 5.08 | | |

$ | 5.08 | | |

$ | 5.95 | | |

Apr 11, 2028 |

Jason Tielker

Vice President, Project Delivery | |

Options | |

200,000

(2.45 |

)% |

Apr 11, 2023 | |

$ | 5.08 | | |

$ | 5.08 | | |

$ | 5.95 | | |

Apr 11, 2028 |

Notes:

| 1. | Option percentages are based on 8,170,000 Options outstanding as at June 30, 2023. |

| 2. | DSU percentages are based on 1,991,004 DSUs outstanding as at June 30, 2023. |

| 3. | Year ended June 30, 2023. |

Outstanding Share-Based Awards and Option-Based

Awards

The following provides a summary of equity incentive

plan awards outstanding for each NEO as of June 30, 2023:

| | |

Option-based awards | |

Share-based awards |

| Name and

position | |

Number of

Common

Shares

underlying

unexercised

Options |

| Option

exercise price

(CDN$) | |

Option expiry

date | |

Value of

unexercised

in-the-money

Options(1)

(CDN$) | |

Number of

Common

Shares or

Share Units

that have not

vested | |

Market or

payout value

of share-

based awards

that have not

vested(2)

(CDN$) | |

Market or

payout value

of vested

share-based

awards not

paid out or

distributed

(CDN$) |

Robert Mintak

CEO and Director | |

350,000

200,000

450,000 |

| $

$

$ |

5.08

3.39

1.40 | |

Apr 11, 2028

Jan 18, 2026

Sep 4, 2023 | |

304,500

512,000

2,047,500 | |

633,071 | |

3,766,772 | |

Nil |

Kara Norman

Former CFO (current CAO) and Corporate Secretary | |

200,000

200,000 |

| $

$ |

5.08

3.39 | |

Apr 11, 2028

Jan 18, 2026 | |

174,000

512,000 | |

300,669 | |

1,788,980 | |

Nil |

Dr. Andrew Robinson

President, COO and Director | |

350,000

200,000

450,000 |

| $

$

$ |

5.08

3.39

1.40 | |

Apr 11, 2028

Jan 18, 2026

Sep 4, 2023 | |

304,500

512,000

2,047,500 | |

633,071 | |

3,766,772 | |

Nil |

Stephen Ross

Vice President, Resource Development | |

100,000 |

| $ |

5.08 | |

Apr 11, 2028 | |

87,000 | |

Nil | |

Nil | |

Nil |

Jason Tielker

Vice President, Project Delivery | |

200,000

250,000 |

| $

$ |

5.08

7.55 | |

Apr 11, 2028

Feb 14, 2025 | |

174,000

Nil | |

Nil | |

Nil | |

Nil |

Notes:

| 1. | The value of Options is based on the difference between the closing price of Common Shares on June 30, 2023 of $5.95 and the

exercise price of the Options. |

| 2. | The value of the DSUs is based on the closing price of Common Shares on June 30, 2023 of $5.95. |

Incentive Plan Awards – Value Vested

or Earned During the Year

The following provides a summary of the value

of all incentive plan awards that vested for each NEO during the year ended June 30, 2023:

| Name

and position | |

Option-based awards – Value

vested during the year

(CDN$) | |

Share-based awards – Value

vested during the year

(CDN$) | |

Non-equity incentive plan

compensation – Value earned

during the year

(CDN$) |

Robert Mintak

CEO and Director | |

Nil | |

Nil | |

Nil |

Kara Norman

Former CFO (current CAO) and Corporate Secretary | |

Nil | |

Nil | |

Nil |

Dr. Andrew Robinson

President, COO and Director | |

Nil | |

Nil | |

Nil |

Stephen Ross

Vice President, Resource Development | |

Nil | |

Nil | |

Nil |

Jason Tielker

Vice President, Project Delivery | |

Nil | |

Nil | |

Nil |

The following provides information relating to

amounts received upon the exercise of Options for each NEO during the year ended June 30, 2023:

| Name and

position | |

Number of Options

exercised | | |

Option exercise price

(CDN$) | | |

Common Share price on

exercise date

(CDN$) | | |

Value realized on exercise

(CDN$) | |

Robert Mintak

CEO and Director | |

| 1,100,000 | | |

$ | 0.76 | | |

$ | 5.55 | | |

| 5,269,000 | |

Kara Norman

Former CFO (current CAO) and Corporate Secretary | |

| 100,000 350,000 | | |

$

$ | 2.10 0.76 | | |

$

$ | 6.25 5.68 | | |

| 415,000 1,722,000 | |

Dr. Andrew Robinson

President, COO and Director | |

| 1,100,000 | | |

$ | 0.76 | | |

$ | 5.25 | | |

| 4,939,000 | |

Stephen Ross

Vice President, Resource Development | |

| 50,000 200,000 | | |

$

$ | 2.10 0.75 | | |

$

$ | 5.80 4.79 | | |

| 185,000 808,000 | |

Jason Tielker

Vice President, Project Delivery | |

| Nil | | |

| N/A | | |

| N/A | | |

| N/A | |

Option Plan

The Company has

adopted the Option Plan pursuant to which the Board or a special committee of the Directors appointed from time to time by the Board may

grant Options to purchase Common Shares of the Company by directors, officers, consultants, and employees of the Company or its

subsidiaries, and employees of a person or company which provides management services to the Company or its subsidiaries.

Subject to the provisions of the Option Plan,

the Board shall have authority to construe and interpret the Option Plan and all option agreements entered into thereunder, to define

the terms used in the Option Plan and in all option agreements entered into thereunder, to prescribe, amend and rescind rules and

regulations relating to the Option Plan and to make all other determinations necessary or advisable for the administration of the Option

Plan.

The purpose of the Option Plan is to advance the

interests of the Company by encouraging the directors, officers, employees and consultants of the Company, and of its subsidiaries and

affiliates, if any, to acquire Common Shares, thereby increasing their proprietary interest in the Company, encouraging them to remain

associated with the Company and furnishing them with additional incentive in their efforts on behalf of the Company in the conduct of

its affairs.

The aggregate number of Common Shares that may

be issued pursuant to the exercise of Options awarded under the Option Plan and all other security-based compensation arrangements of

the Company shall not exceed ten percent (10%) of the issued and outstanding Common Shares as of the date of any grant of Options, subject

to the following additional limitations:

| a) | the aggregate number of Options granted to any one person under the Option Plan within a twelve (12) month

period, together with all other security-based compensation arrangements of the Company, must not exceed five percent (5%) of the then

outstanding number of Common Shares, in the aggregate (on a non-diluted basis); |

| b) | Options shall not be granted if the exercise thereof would result in the issuance of more than two percent

(2%) of the issued Common Shares, in the aggregate, in any twelve (12) month period to any one consultant of the Company (or any of its

subsidiaries); |

| c) | Options shall not be granted if the exercise thereof would result in the issuance of more than two percent

(2%) of the issued Common Shares in any twelve (12) month period to any persons employed to provide investor relations activities; |

| d) | Options granted to consultants performing investor relations activities will contain vesting provisions

such that vesting occurs over at least twelve (12) months with no more than one-quarter of the Options vesting in any three (3) month

period; and |

| e) | the number of Common Shares subject to an Option grant to any directors,

officers, consultants, and employees of the Company or its subsidiaries, and employees of a person or company which provides management

services to the Company or its subsidiaries (such persons hereinafter collectively referred to as “Participants”)

shall be determined by the Board, but no one Participant shall be granted an Option which exceeds the maximum number permitted by the

TSX Venture Exchange (the “Exchange”). |

If any Option granted under the Option Plan shall

expire or terminate for any reason in accordance with the terms of the Option Plan without being exercised, the un-purchased Common Shares

subject thereto shall again be available for the purpose of the Option Plan.

Options may be granted to the Participants exercisable

at a price determined by the Board, subject to applicable Exchange approval, at the time any Option is granted. In no event shall such

exercise price be lower than the exercise price permitted by the Exchange. The Directors of the Company may, by resolution, determine

the time period during which any Option may be exercised, provided that this time period does not contravene any rule or regulation

of such exchange on which the Common Shares may be listed. For greater certainty, in no circumstances shall the maximum term exceed ten

(10) years. Subject to any vesting restrictions imposed by the Exchange, the Board may, in its sole discretion, determine the time

during which Options shall vest and the method of vesting, or that no vesting restriction shall exist. Subject to any vesting restrictions

imposed by the Board, Options may be exercised in whole or in part at any time and from time to time during the option period.

In the event of a Participant ceasing to be a

director, officer or employee of the Company or a subsidiary of the Company for any reason other than death, including the resignation

or retirement of the Participant as a director, officer or employee of the Company or the termination by the Company of the employment

of the Participant, such Participant may exercise their Option to the extent that the Participant was entitled to exercise it at the date

of such cessation, provided that such exercise must occur within thirty (30) days, subject to adjustment at the discretion of the Board.

In the event of the death of a Participant, the Option previously granted to them shall be exercisable only within the one (1) year

after such death and then only: (i) by the person or persons to whom the Participant’s rights under the Option shall pass by

the Participant’s will or the laws of descent and distribution; and (ii) if and to the extent that such Participant was entitled

to exercise the Option at the date of his or her death.

Subject to the foregoing restrictions, and certain

other restrictions set out in the Option Plan, the Board is authorized to provide for the granting of Options and the exercise and method

of exercise of Options granted under the Option Plan.

There are presently

9,920,000 Options outstanding under the Option Plan, 5,750,000 of which are held directly and indirectly by NEOs or Directors of

the Company.

Incentive Plan

The Incentive Plan provides for the issue of Common

Shares to Participants (as defined in the Incentive Plan) for the purpose of advancing the interests of the Company through the motivation,

attraction, and retention of officers, employees, consultants, and directors of the Company and its affiliates and to secure for the Company

and its Shareholders the benefits inherent in the ownership of Common Shares by key officers, employees, consultants, and directors of

the Company and its affiliates; it being recognized generally that equity incentive plans aid in attracting, retaining, and encouraging

officers, employees, consultants and directors due to the opportunity offered to them, to acquire a proprietary interest in the Company.

The Incentive Plan

is administered by the Board or a committee of the Board (the “Committee”), and the Committee has full authority

to administer the Incentive Plan including the authority to interpret and construe any provision of the Incentive Plan and to adopt, amend

and rescind such rules and regulations for administering the Incentive Plan as the Committee may deem necessary in order to comply

with the requirements of the Incentive Plan.

Under the Incentive

Plan, eligible Participants will be granted Share Units to acquire any number of Common Shares, from time to time that each Share Unit

represents the right to receive, subject to adjustments in certain circumstances, one Common Share in consideration for past performance

upon expiry of an applicable restricted period, the holder ceasing to be involved with the Company or the satisfaction of certain established

performance conditions. A Share Unit which is only subject to a time-based restricted period, shall be referred to as a “RSU”,

a Share Unit of which the issuance of the underlying Common Share is subject to any performance condition shall be referred to as a “PSU”,

and a Share Unit of which the issuance of the underlying Common Share is subject to the occurrence of a Termination or Retirement event

(as defined in the Incentive Plan), shall be referred to as a “DSU”. The Committee shall have the discretion to grant

PSUs which allow for the holder thereof receiving a number of Common Shares based on the achievement of performance ratios or multipliers

as the Committee may determine upon such grant. RSUs, PSUs and DSUs are the only Share Units permitted to be issued under the Incentive

Plan.

Participants who are residents of Canada for the

purposes of the Income Tax Act (Canada) and not subject to the provisions of the Internal Revenue Code may elect to defer

receipt of all or any part of their RSUs until a deferred payment date if they elect to do so by written notice to the Company no later

than sixty (60) days prior to the expiry of the applicable restricted period.

The aggregate maximum number of Common Shares

available for issuance from treasury under the Incentive Plan shall not exceed ten percent (10%) of the outstanding Common Shares as of

the date of any grant of share-based compensation unit when combined with any other security-based compensation arrangements of the Company

in place at the time.

The maximum number of Common Shares issuable to

Insiders (as defined in the Incentive Plan), at any time, pursuant to the Incentive Plan and any other share-based compensation arrangements

of the Company, is ten percent (10%) of the total number of Common Shares then outstanding. The maximum number of Common Shares issued

to Insiders, within any one-year period, pursuant to the Incentive Plan and any other share-based compensation arrangements of the Company

is ten percent (10%) of the total number of Common Shares then outstanding.

So long as the Company is subject to Exchange

requirements, no Share Units may be issued to anyone engaged to perform Investor Relations Activities (as defined in the Incentive Plan)

for the Company and in no event can an issuance of Share Units, when combined with any grants made pursuant to any other share-based compensation

arrangements, result in:

| a) | any one person in a twelve (12) months period being granted such number of share-based compensation awards

equaling or exceeding five percent (5%) of the issued Common Shares, calculated on the date a share-based compensation award is granted

to the person (unless the Company has obtained the requisite disinterested shareholder approval); and |

| b) | any one consultant in a twelve (12) months period being granted such number of share-based compensation

awards equaling or exceeding two percent (2%) of the issued Common Shares, calculated at the date the share-based compensation award is

granted to the consultant. |

The maximum term

for Share Units is up to ten (10) years but may be such shorter term as the Company chooses.