UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT TO

§240.13d-1(a) AND AMENDMENT THERETO FILED

PURSUANT TO

§240.13d-1(a)

(Amendment No. 3 )*

FRESH VINE WINE, INC.

(Name of Issuer)

Common Stock, $.001 par

value per share

(Title of Class of Securities)

35804X 101

(CUSIP Number)

Rick Nechio

P.O. Box 5215

Mooresville, NC 28117

Phone: (855) 766-9463

(Name, Address and Telephone

Number of Persons Authorized to Receive Notices and Communications)

January 25, 2024

(Date of Event which Requires

Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box ☐.

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

CUSIP No. 35804X 101

| 1 |

NAME OF REPORTING PERSONS

Rick Nechio |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

1,573,472 (See Item 5) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

1,573,472 (See Item 5) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,573,472 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS)

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.85% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

CUSIP No. 35804X 101

Item 1. Security and Issuer.

This Schedule 13D relates to shares of the Common Stock, $0.001 par

value, of Fresh Vine Wine, Inc. a Nevada corporation (the “Issuer” or the “Company”). The address of the principal

executive offices of the Issuer is P.O. Box 78984, Charlotte, NC 28271.

Item 2. Identity and Background.

(a) This Schedule 13D is being filed by Rick Nechio.

(b) The principal office and place of business

for Mr. Nechio is P.O. Box 5215, Mooresville, NC 28117.

(c) Mr. Nechio serves as President and Head of

Sales of the Issuer.

(d) - (e) During the last five years, the reporting

person has not been convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors) nor has the reporting person

been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which such individual

was or is subject to a judgment, decree, or final order enjoining future violations of, or prohibiting, or mandating activity subject

to, federal or state securities laws or finding any violation with respect to such laws.

(f) The reporting person is citizen of the United

States of America.

Item 3. Source and Amount of Funds or Other

Consideration.

On or around July 20, 2022, Nechio & Novak,

LLC made a ratable distribution of the shares of the Issuer’s common stock held by Nechio & Novak, LLC to Nechio & Novak,

LLC’s members. The shares of the Issuer’s common stock represented founder’s securities that were acquired by Nechio

& Novak, LLC prior to the Issuer’s common stock being registered under Section 12 of the Securities Exchange Act of 1934, as

amended. The reporting person acquired 2,415,472 shares of the Issuer’s common stock in such distribution.

On June 18, 2022, the reporting person acquired

10,000 shares of the Issuer’s common stock upon the vesting of a restricted stock unit grant made to the reporting person in his

capacity as a director of the Issuer.

On December

19, 2022, and in conjunction with the initial issuance by the Issuer of 970,000 shares of the Issuer’s common stock to certain vendors

to the Issuer, the reporting person forfeited and transferred back to the Issuer without consideration 602,000 shares of the Issuer’s

common stock to enable the Issuer to preserve cash by issuing such number of shares to the vendors without subjecting the Issuer’s

other stockholders to dilution therefrom.

On January 27, 2023, the Issuer entered into a Global Mutual Compromise, Release and Settlement Agreement (the

“Settlement Agreement”) pursuant to which a former executive officer of the Issuer (the “Plaintiff”) agreed to

dismiss a lawsuit against the Issuer and the reporting person, among others. Pursuant to the Settlement Agreement, the Issuer and the

Plaintiff entered into a consulting agreement (the “Consulting Agreement”) pursuant to which the Plaintiff agreed to provide

certain consulting services to the Issuer in exchange for being granted 500,000 shares of the Issuer’s common stock. On February

17, 2023, and pursuant to the Settlement Agreement, the reporting person forfeited and transferred back to the Issuer without consideration

250,000 shares of the Issuer’s common stock held by the reporting person to enable the Issuer to issue such number of shares to

the Plaintiff pursuant to the Consulting Agreement without subjecting the Issuer’s other stockholders to dilution with respect thereto.

Item 4. Purpose of Transaction.

All of the shares of the Issuer’s common

stock owned by the reporting person are held solely for investment purposes.

Except for the matters set forth in Item 6 (Contracts,

Arrangement, Understandings or Relationships with Respect to Securities of the Issuer ), the reporting person does not have any plans

or proposals, which relate to, or would result in, any of the matters referred to in paragraphs (a) through (j) of Item 4 of Schedule

13D.

Item 5. Interests in Securities of the Issuer.

| |

(a) |

The reporting person beneficially owns 1,573,472 shares of the outstanding common stock of the Issuer, which represents 9.85% of the Issuer’s outstanding common stock. |

(Percent of class is based upon 15,976,227 shares outstanding

as of November 14, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2023,

filed on November 14, 2023.)

| |

(b) |

The reporting person has sole voting and dispositive power with respect to the common stock of the Issuer held by him. |

| |

(c) |

The reporting person has not effected any transactions in the Issuer’s common stock during the past 60 days except as set forth below: |

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

On January 25, 2024, the Issuer and its direct

wholly-owned subsidiary, FVW Merger Sub, Inc. (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger

Agreement”) with Notes Live, Inc. (“Notes Live”) pursuant to which, among other things, Merger Sub will merge

with and into Notes Live, with Notes Live continuing as a wholly-owned subsidiary of the Issuer and the surviving corporation of the merger

(the “Merger”).

In connection with the execution of the Merger

Agreement, the reporting person entered into a Voting and Support Agreement with Notes Live (the “Support Agreement”)

pursuant to which the reporting person (1) agreed to vote his shares of the Issuer’s common stock in favor of proposals related

to the transactions contemplated by the Merger Agreement that are voted upon at a special stockholders’ meeting of the Issuer called

for such purpose (the “Fresh Vine Proposals”) and against alternative acquisition proposals, (2) granted to Notes Live

a proxy to vote his shares of the Issuer’s common stock in favor of the Fresh Vine Proposals, and (3) agreed not to transfer his

shares of the Issuer’s common stock prior to the expiration of the Support Agreements, subject to certain exceptions.

Also in connection with the execution of the Merger

Agreement, the reporting person (solely in his capacity as a stockholder) entered into a lock-up agreement (the “Lock-Up Agreement”)

pursuant to which, subject to specified exceptions, the reporting person agreed not to transfer 95% of his shares of the Issuer’s

common stock for a period of six months following the closing of the Merger.

The descriptions of the Support Agreement and the

Lock-Up Agreement are qualified in their entirety by reference to the full text of such agreements, forms of which are filed as exhibits

hereto.

On November 30, 2021, the reporting person entered

into stock option agreements with the Issuer pursuant to which he was granted a ten-year to purchase 375,001 shares of Common Stock of

the Issuer at exercise price equal to $10.00, which was the initial public offering price of Common Stock of the Issuer in the Issuer’s

initial public offering (the “IPO”). The options will vest, if at all, during the three year period commencing on the closing

date of IPO and ending on the third anniversary thereof (the “Performance Period”), with 20% of the option shares vesting

upon the average of the closing sale prices of the Issuer’s Common Stock over a period of ten consecutive trading days being equal

to or greater than the applicable price set forth in the following schedule (each a “Trigger Price”):

| Percent of Shares To Be Vested |

|

Trigger Price |

| 20% |

|

200% of the initial public offering price |

| 20% |

|

300% of the initial public offering price |

| 20% |

|

400% of the initial public offering price |

| 20% |

|

500% of the initial public offering price |

| 20% |

|

600% of the initial public offering price |

All portions of the options that have not vested

prior to the expiration of the Performance Period will terminate upon such expiration. In addition, if, prior to any vesting date, the

reporting person ceases to provide services to the Company either as a member of the Issuer’s board of directors or a Company employee,

that portion of the option scheduled to vest on such vesting date, and all portions of such option scheduled to vest in the future, will

not vest and all of his rights to and under such non-vested portions will terminate.

Other than the foregoing agreements and arrangements, there are no

contracts, arrangements, understandings or relationships among the persons named in Item 2 hereof and between such persons and any

person with respect to any securities of the Issuer.

Item 7. Material to be Filed as Exhibits.

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Date: February 7, 2024 |

|

| |

|

|

| By: |

/s/ Rick Nechio |

|

| |

Rick Nechio |

|

6

Exhibit 10.3

LOCK-UP

AGREEMENT

THIS LOCK-UP AGREEMENT (this

“Agreement”) is made and entered into as of January 24, 2024, by and among (i) Fresh Vine Wine, Inc., a Nevada

corporation (“Fresh Vine”); (ii) Notes Live, Inc., a Colorado corporation (the “Company”)

and (iii) each of the undersigned Holders (each a “Holder”).

WHEREAS, this Agreement

is executed in connection with that certain Agreement and Plan of Merger by an among Fresh Vine, the Company and FVW Merger Sub, Inc.,

a Colorado corporation and wholly owned subsidiary of Fresh Vine (“Merger Sub”) (as amended from time to time,

the “Merger Agreement”), pursuant to which, Fresh Vine and the Company intend to effect a merger of Merger Sub

with and into the Company (the “Merger”) in accordance with the Merger Agreement and the CBCA. Upon consummation

of the Merger, Merger Sub will cease to exist, and the Company will become a wholly owned subsidiary of Fresh Vine. Any capitalized term

used but not defined in this Agreement will have the meaning ascribed to such term in the Merger Agreement.

WHEREAS, Holder is,

as of the date hereof, a holder of issued and outstanding capital stock of Fresh Vine or the Company or a director and/or officer of Fresh

Vine or the Company.

WHEREAS, in connection

with, and as an inducement to, each of Fresh Vine, Merger Sub and the Company entering into the Merger Agreement and agreeing to consummate

the transactions contemplated thereby pursuant to the terms and conditions thereof, and for other good and valuable consideration the

receipt and sufficiency of which is hereby acknowledged, the parties desire to enter into this Agreement pursuant to which 95% of the

shares of Fresh Vine Securities (as defined below) beneficially-owned by each Holder immediately following the Effective Time (which beneficially-owned

shares shall, with respect to any Note Live shareholder and for the sake of clarity, include shares of Fresh Vine Common Stock comprising

Holder’s portion of the Merger Consideration issued or to be issued upon Holder’s submission of letter(s) of transmittal in

accordance with the Merger Agreement) (all such securities, together with any securities paid as dividends or distributions with respect

to such securities or into which such securities are exchanged or converted, the “Restricted Securities”), shall

become subject to limitations on disposition as set forth in this Agreement. “Fresh Vine Securities” means any

shares of Fresh Vine Common Stock or any securities convertible into, exercisable or exchangeable for or that represent the right to receive

Fresh Vine Common Stock (including without limitation, Fresh Vine Common Stock which may be deemed to be beneficially owned by Holder

in accordance with the rules and regulations of the SEC and securities of Fresh Vine which may be issued upon exercise of a stock option,

restricted stock unit or warrant) whether now owned or hereafter acquired. Holder’s Fresh Vine Securities beneficially owned as

of the date of this Agreement are identified on the signature page hereto (which, with respect to any Note Live shareholder, shall include

shares of the Company’s capital stock to be exchanged for Fresh Vine common stock in the Merger).

NOW, THEREFORE, in

consideration of the foregoing and of the mutual covenants and agreements contained in this Agreement, the parties agree as follows:

Lock-Up Provisions.

Holder hereby irrevocably agrees

not to, during the period commencing from the Closing and ending on the earliest of (x) six (6) months after the Closing Date and (y)

the date after the Closing on which Fresh Vine completes a liquidation, merger, share exchange, or other similar transaction that results

in all of Fresh Vine’s stockholders having the right to exchange their Restricted Securities for cash, securities, or other property

(the “Lock-Up Period”): (i) sell, offer to sell, contract or agree to sell, hypothecate, pledge, grant any option

to purchase or otherwise dispose of or agree to dispose of, directly or indirectly, or establish or increase a put equivalent position

or liquidation with respect to or decrease a call equivalent position within the meaning of Section 16 of the Securities Exchange Act

of 1934, as amended, and the rules and regulations of the Securities and Exchange Commission promulgated thereunder with respect to, any

Restricted Securities, (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic

consequences of ownership of the Restricted Securities, whether any such transaction is to be settled by delivery of such securities,

in cash or otherwise, or (iii), make any demand for or exercise any right with respect to, the registration of any Restricted Securities

or any security convertible into or exercisable or exchangeable for Restricted Securities (other than such rights set forth in the Merger

Agreement), (iv) except for any voting agreement entered into as of the date hereof by the undersigned with Fresh Vine and the Company,

grant any proxies or powers of attorney with respect to any Restricted Securities, deposit any Restricted Securities into a voting trust

or enter into a voting agreement or similar arrangement or commitment with respect to any Restricted Securities, or (v) publicly disclose

the intention to do any of the foregoing. Holder agrees that the foregoing restrictions preclude the undersigned from engaging in any

hedging or other transaction with respect to any then-subject Restricted Securities which is designed to or which reasonably could be

expected to lead to or result in a sale or disposition of such Restricted Securities even if such Restricted Securities would be disposed

of by someone other than the undersigned. Such prohibited hedging or other transactions would include without limitation any short sale

or any purchase, sale or grant of any right (including without limitation any put or call option) with respect to such Restricted Securities

or with respect to any security that includes, relates to, or derives any significant part of its value from such Restricted Securities.

Notwithstanding the foregoing,

Holder may transfer any of the Restricted Securities: (i) if Holder is a natural person, (1) to any person related to Holder by blood

or adoption who is an immediate family member of Holder, or a family member by marriage or domestic partnership (a “Family

Member”), (2) as a bona fide gift or charitable contribution, (3) to any trust for the direct or indirect benefit of Holder

or any Family Member of Holder, (4) to Holder’s estate, following the death of Holder, by will, intestacy or other operation of

law, (5) by operation of law pursuant to a qualified domestic order or in connection with a divorce settlement, or (6) to any partnership,

corporation, limited liability company, investment fund or other entity which is controlled by the undersigned and/or by any Family Member

of Holder; (ii) if Holder is a corporation, partnership, limited liability company, trust or other business entity, (1) to another corporation,

partnership, limited liability company, trust or other business entity that controls, is controlled by or is under common control with

Holder, or to direct or indirect affiliates (as defined in Rule 405 promulgated under the Securities Act of 1933, as amended) of Holder,

including any investment funds or other entities that controls or manages, or is under common control or management with, or is controlled

or managed by, Holder, (2) to current or former partners (general or limited), members or managers, limited liability company members

or stockholders of Holder or holders of similar equity interests in Holder (including upon the liquidation and dissolution of Holder pursuant

to a plan of liquidation approved by Holder’s stockholders) or to the estates of any of the foregoing, (3) as a bona fide gift,

donation or charitable contribution or otherwise to a trust or entity for the direct or indirect benefit of an immediate family member

of a beneficial owner (as defined in Rule 405 promulgated under the Securities Act of 1933, as amended) of Holder’s Restricted Securities

or (4) transfers of dispositions not involving a change in beneficial ownership; (iii) if the undersigned is a trust, to any grantors

or beneficiaries of such trust; (iv) to a nominee or custodian of a person or entity to whom a disposition or transfer would be permissible

under above clauses (i) through (iii); (v) to Fresh Vine in a transaction exempt from Section 16(b) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”) upon a vesting event of the Restricted Securities or upon the exercise

of options or warrants to purchase Fresh Vine Common Stock, including on a “cashless” or “net exercise” basis

or to cover tax withholding obligations of Holder in connection with such vesting or exercise (but for the avoidance of doubt, excluding

all manners of exercise that would involve a sale in the open market of any securities relating to such options or warrants, whether to

cover the applicable aggregate exercise price, withholding tax obligations or otherwise); (vi) to Fresh Vine in connection with the termination

of employment or other termination of a service provider and pursuant to agreements in effect as of the Effective Time whereby Fresh Vine

has the option to repurchase such shares or securities; (vii) acquired by Holder in open market transactions or in a public offering by

Fresh Vine after the Effective Time; (viii) pursuant to a bona fide third party tender offer, merger, consolidation or other similar transaction

made to all holders of Fresh Vine capital stock involving a change of control of Fresh Vine, provided, that in the event that such tender

offer, merger, consolidation or other such transaction is not completed, the Restricted Securities shall remain subject to the restrictions

contained in this Lock-Up Agreement; or (ix) pursuant to an order of a court or regulatory agency; provided, that in the case of clauses

(i)-(iv), that (A) such transfer shall not involve a disposition for value and (B) the transferee shall have executed and delivered a

Lock-Up Agreement with terms and in a form substantially identical to this Lock-Up Agreement with respect to the Fresh Vine Securities

so transferred. For purposes of this Agreement, “change of control” shall mean the transfer (whether by tender offer, merger,

consolidation or other similar transaction), in one transaction or a series of related transactions, to a person or group of affiliated

persons, of shares of capital stock if, after such transfer, such person or group of affiliated persons would hold a majority of the outstanding

voting securities of Fresh Vine (or the surviving entity).

In addition, the foregoing

restrictions shall not apply to (i) the exercise of warrants granted to service providers for compensatory purposes or stock options granted

pursuant to equity incentive plans existing immediately following the Effective Time, including the “net” or cashless exercise

of such options in accordance with their terms and any related transfers of Fresh Vine Common Stock to Fresh Vine for purposes of paying

the exercise price of such options or for paying taxes (including estimated taxes and withholding taxes) due as a result of such exercise;

provided, that the restrictions set forth in this Lock-Up Agreement shall apply to any of the Fresh Vine Securities issued upon such exercise;

or (ii) the establishment of any contract, instruction or plan (a “Plan”) that satisfies the requirements of

Rule 10b5-1 under the Exchange Act; provided, that such Plan does not provide for the transfer of Restricted Securities or any securities

convertible into or exercisable or exchangeable for Restricted Securities during the Lock-Up Period; provided, further, that with respect

to each of clauses (i) and (ii) above, no filing by any party under Section 16 of the Exchange Act or other public announcement shall

be made voluntarily reporting a reduction in beneficial ownership of shares of Fresh Vine Common Stock or any securities convertible into

or exercisable or exchangeable for Fresh Vine Common Stock in connection with such transfer or disposition during the Lock-Up Period (other

than any exit filings) and if any filings under Section 16(a) of the Exchange Act, or other public filing, report or announcement reporting

a reduction in beneficial ownership of shares of Fresh Vine Common Stock in connection with such transfer or distribution, shall be legally

required during the Lock-Up Period, such filing, report or announcement shall clearly indicate in the footnotes therein, in reasonable

detail, a description of the circumstances of the transfer and that the shares remain subject to the Lock-Up Agreement, including a statement

to the effect that no transfer of Fresh Vine Common Stock may be made under such Plan during the Lock-Up Period.

If any attempted transfer in

violation of this Lock-Up Agreement is made or attempted contrary to the provisions of this Agreement, such purported transfer shall be

null and void ab initio, and Fresh Vine shall refuse to recognize any such purported transferee of the Restricted Securities as one of

its equity holders for any purpose. In order to enforce this Section 1, Fresh Vine may impose stop-transfer instructions with respect

to the Restricted Securities of Holder (and Permitted Transferees and assigns) until the end of the Lock-Up Period.

During the Lock-Up Period, Fresh

Vine may cause the legend set forth below, or a legend substantially equivalent thereto, to be placed upon any certificate or book entry

evidencing any Restricted Securities, in addition to any other applicable legends:

“THE SECURITIES REPRESENTED BY THIS

CERTIFICATE ARE SUBJECT TO RESTRICTIONS ON TRANSFER SET FORTH IN A LOCK-UP AGREEMENT, DATED AS OF [●],

2024, BY AND AMONG THE ISSUER OF SUCH SECURITIES (THE “ISSUER”), AND THE ISSUER’S SECURITY HOLDER. A COPY OF SUCH LOCK-UP

AGREEMENT WILL BE FURNISHED WITHOUT CHARGE BY THE ISSUER TO THE HOLDER UPON WRITTEN REQUEST.”

For the avoidance of any doubt,

Holder shall retain all of its rights as a shareholder of Fresh Vine with respect to the Restricted Securities during the Lock-Up Period,

including the right to vote any Restricted Securities.

Miscellaneous.

Effective Date; Termination

of Merger Agreement. This Agreement shall be binding upon Holder upon Holder’s execution and delivery of this Agreement. Notwithstanding

anything to the contrary, if the Merger Agreement is terminated in accordance with its terms prior to the Closing, this Agreement shall

automatically terminate and become null and void, and the parties shall not have any rights or obligations related to this Agreement.

Binding Effect; Assignment.

Holder hereby represents and warrants that Holder has full power and authority to enter into this Lock-Up Agreement and that upon request,

Holder will execute any additional documents reasonably necessary to ensure the validity or enforcement of this Lock-Up Agreement. This

Agreement shall be binding upon and inure to the benefit of the parties and their respective permitted successors and assigns. This Agreement

and all obligations of Holder are personal to Holder and may not be transferred or delegated by Holder at any time. Fresh Vine may freely

assign any or all of its rights under this Agreement, in whole or in part, to any successor entity (whether by merger, consolidation,

equity sale, asset sale or otherwise) without obtaining the consent or approval of Holder. This Agreement is intended for the benefit

of the parties hereto and their respective successors and permitted assigns and is not for the benefit of, nor may any provision herein

be enforced by, any other person.

Third Parties. Nothing

contained in this Agreement or in any instrument or document executed by any party in connection with the contemplated transactions shall

create any rights in, or be deemed to have been executed for the benefit of, any person or entity that is not a party or a successor or

permitted assign of such a party.

Notice. All notices,

consents, waivers, and other communications hereunder shall be in writing and shall be deemed to have been duly given when delivered (i)

in person, (ii) by facsimile or other electronic means, with affirmative confirmation of receipt, (iii) one Business Day after being sent,

if sent by reputable, nationally recognized overnight courier service, or (iv) three (3) Business Days after being mailed, if sent by

registered or certified mail, pre-paid and return receipt requested, in each case to the applicable party at the following addresses (or

at such other address for a party as shall be specified by like notice):

If to Fresh Vine prior to the Closing

Date, to:

Fresh Vine Wine, Inc.

P.O. Box 78984

Charlotte, NC 28271Attention: Michael

Pruitt

Email: mp@avenelfinancial.com

with a copy to (which shall not constitute

notice):

Taft Stettinius & Hollister LLP

2200 IDS Center

80 South 8th Street

Minneapolis, MN 55402-2157

Attention: Alan M. Gilbert, Esq.

Email: AGilbert@taftlaw.com

if to the Company:

Notes Live, Inc.

1755 Telstar Dr., Suite 501

Colorado Springs, CO 80920

Attention: J.W. Roth

Email: jwroth@noteslive.vip

with a copy to (which shall not constitute

notice):

Dykema Gossett PLLC

111 East Kilbourn Avenue, Suite 1050

Milwaukee, Wisconsin 53202

Attention Peter F. Waltz, Esq.

email: Pwaltz@Dykema.com

If to a Holder, to the address of such

Holder set forth on their signature page.

Governing Law; Jurisdiction.

This Agreement shall be governed by, construed and enforced in accordance with the Laws of the State of Colorado, without regard to its

conflict of laws principles. All actions, suits or proceedings (each an “Action”, and, collectively, “Actions”),

arising out of or relating to this Agreement shall be heard and determined exclusively in any state or federal court located in (or having

original jurisdiction over) El Paso County, Colorado (the “Specified Courts”). Each party (a) submits

to the exclusive jurisdiction of any Specified Court for the purpose of any Action arising out of or relating to this Agreement brought

by any party and (b) irrevocably waives, and agrees not to assert by way of motion, defense or otherwise, in any such Action, any claim

that it is not subject personally to the jurisdiction of the above-named courts, that its property is exempt or immune from attachment

or execution, that the Action is brought in an inconvenient forum, that the venue of the Action is improper, or that this Agreement or

the contemplated transactions may not be enforced in or by any Specified Court. Each party agrees that a final judgment in any Action

shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by Law. Each party

irrevocably consents to the service of the summons and complaint and any other process in any other Action relating to the transactions

contemplated by this Agreement, on behalf of itself, or its property, by personal delivery of copies of such process to such party at

the applicable address set forth in Section 2(d). Nothing in this Section 2(e) shall affect the right of any party to serve

legal process in any other manner permitted by Law.

WAIVER OF JURY TRIAL.

EACH OF THE PARTIES WAIVES TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY WITH RESPECT TO

ANY ACTION DIRECTLY OR INDIRECTLY ARISING OUT OF, UNDER OR IN CONNECTION WITH THIS AGREEMENT OR THE CONTEMPLATED TRANSACTIONS. EACH PARTY

(A) CERTIFIES THAT NO REPRESENTATIVE OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE

EVENT OF ANY ACTION, SEEK TO ENFORCE THAT FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HAVE BEEN INDUCED TO ENTER

INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 2(f).

Interpretation. The titles

and subtitles used in this Agreement are for convenience only and are not to be considered in construing or interpreting this Agreement.

In this Agreement, unless the context otherwise requires: (i) any pronoun used in this Agreement shall include the corresponding masculine,

feminine or neuter forms, and the singular form of nouns, pronouns and verbs shall include the plural and vice versa; (ii) “including”

(and with correlative meaning “include”) means including without limiting the generality of any description preceding or succeeding

such term and shall be deemed in each case to be followed by the words “without limitation”; and (iii) the term “or”

means “and/or”. The parties have participated jointly in the negotiation and drafting of this Agreement. Consequently, in

the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as if drafted jointly by the

parties, and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any provision

of this Agreement.

Amendments and Waivers.

Any term of this Agreement may be amended and the observance of any term of this Agreement may be waived (either generally or in a particular

instance, and either retroactively or prospectively) only with the written consent of Fresh Vine, the Company, and Holder. No failure

or delay by a party in exercising any right shall operate as a waiver. No waivers of or exceptions to any term, condition, or provision

of this Agreement, in any one or more instances, shall be deemed to be or construed as a further or continuing waiver of any such term,

condition, or provision.

Severability. In case

any provision in this Agreement shall be held invalid, illegal or unenforceable in a jurisdiction, such provision shall be modified or

deleted, as to the jurisdiction involved, only to the extent necessary to render the same valid, legal and enforceable, and the validity,

legality and enforceability of the remaining provisions shall not in any way be affected or impaired nor shall the validity, legality

or enforceability of such provision be affected in any other jurisdiction. Upon such determination that any term or other provision is

invalid, illegal or incapable of being enforced, the parties will substitute for any invalid, illegal or unenforceable provision a suitable

and equitable provision that carries out, so far as may be valid, legal and enforceable, the intent and purpose of such invalid, illegal

or unenforceable provision.

Specific Performance.

Holder acknowledges that its obligations under this Agreement are unique, recognizes and affirms that in the event of a breach of this

Agreement by Holder, money damages will be inadequate and Fresh Vine will have no adequate remedy at law, and agrees that irreparable

damage would occur in the event that any of the provisions of this Agreement were not performed by Holder in accordance with their specific

terms or were otherwise breached. Accordingly, Fresh Vine shall be entitled to an injunction or restraining order to prevent breaches

of this Agreement by Holder and to enforce specifically the terms and provisions, without the requirement to post any bond or other security

or to prove that money damages would be inadequate, this being in addition to any other right or remedy to which such party may be entitled

under this Agreement, at law or in equity.

Entire Agreement. This

Agreement, the Merger Agreement, and the Transaction Documents constitute the entire agreement among the parties with respect to the subject

matter, and supersede all prior agreements and undertakings, both written and oral, among the parties, or any of them, with respect to

the subject matter. This Agreement shall not be assigned (whether pursuant to a merger, by operation of law or otherwise) without the

prior written consent of the parties, and any attempt to do so without such consent shall be void ab initio.

Further Assurances. From

time to time, at another party’s request and without further consideration (but at the requesting party’s reasonable cost

and expense), each party shall execute and deliver such additional documents and take all such further action as may be reasonably necessary

to consummate the transactions contemplated by this Agreement.

Counterparts. This Agreement

may also be executed and delivered by facsimile signature or by email in portable document format in two or more counterparts, each of

which shall be deemed an original, but all of which together shall constitute one and the same instrument.

{Remainder of Page Intentionally Left Blank;

Signature Pages Follow}

The parties have executed

this Lock-Up Agreement as of the date first written above.

| |

Fresh Vine: |

| |

|

|

| |

Fresh Vine Wine, Inc. |

| |

|

|

| |

By: |

/s/ Michael Pruitt |

| |

Name: |

Michael Pruitt |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

Company: |

| |

|

|

| |

Notes Live, Inc. |

| |

|

|

| |

By: |

/s/ JW Roth |

| |

Name: |

|

| |

Title: |

|

{Additional Signature on the Following Page}

In addition to the signatures

set forth above or in counterpart documents, the party or parties below have executed this Lock-Up Agreement as of the date first written

above.

| Holder: |

|

| |

|

| /s/ Rick Nechio |

|

| Rick Nechio |

|

| Number and Description of Fresh Vine Securities: |

|

1,573,472 shares of Fresh Vine common stock |

| |

|

__________________________________ |

| Address for Notice in accordance with Section 2(d) |

|

|

| |

|

|

| Rick Nechio |

|

|

| P.O. Box 5215 |

|

|

| Mooresville, NC 28117 |

|

|

7

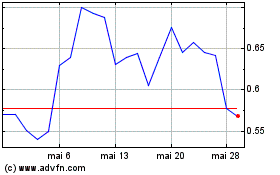

Fresh Vine Wine (AMEX:VINE)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Fresh Vine Wine (AMEX:VINE)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025