Fresh Vine Wine Inc (NYSE: American VINE) today announced that it

has reached a marketing agreement with Splash Wines, Inc., the

highest rated direct-to-consumer digital wine company in the USA.

The agreement is designed to expand purchase opportunities for

customers of both companies where Fresh Vine Wines focuses on sales

of premium low carb wines from California, and Splash features wine

from international sources.

“This is all about the benefits to our customers. Splash is a

great company with a tremendously loyal customer base as evidenced

by over 29,000 five-star reviews,” states Michael Pruitt, Fresh

Vine’s Chairman and CEO. “We are excited that this association will

give our customers broader options to purchase quality wines at

great prices.”

Garrett Imeson, Splash Chief Marketing Officer, echoed the

sentiment. “Our customers have expressed considerable interest in

zero sugar wines from California and, until now, we have not been

able to provide suitable options. We think the Fresh Vines

relationship is a great opportunity to get our customers exactly

what they are looking for and are enthusiastic to start the

program.”

The partnership will launch with an offer today featuring Fresh

Vine Wines together with a selection from Vine Oh!, a Splash owned

brand curated by women, for women that features 5-6 full-sized

beauty, lifestyle and self-care products plus globally sourced

wine. “This offer showcases the benefits of the relationship to

customers of both companies and is the perfect way to honor Leap

Day,” added Pruitt. “We expect it to be very well received.”

Vine Oh! Link: Vine Oh - Fresh Vine Wine

Fresh Vine Wines will also be hosting its Fireside Chat with

Notes Live CEO JW Roth today at 2:00 PM ET. Webinar Registration

Link: https://us06web.zoom.us/webinar/register/WN_72DyyGyLS6-Q4gZIG7zqog

The Merger Agreement sets forth certain conditions precedent to

any closing of the Transaction, including among other things, the

approval of Fresh Vine’s and Notes Live’s shareholders, the receipt

of regulatory approvals that may be required, including approval by

the NYSE American for the continued listing of the combined

company’s common stock after closing, Fresh Vine satisfying minimum

net cash requirements and having no liabilities on its balance

sheet or unpaid or unsatisfied obligations that will require a cash

expenditure by Fresh Vine after the Effective Time, Fresh Vine

completing a sale, license, transfer, disposition, or divestiture,

or winding down of Fresh Vine’s current wine production business in

a manner reasonably acceptable to Notes Live, the absence of

dissenting Notes Live shareholders and the entry by Notes Live into

lock-up and leak-out arrangements with its shareholders to its

satisfaction. There can be no assurance that the proposed

Transaction will be completed as currently contemplated on

anticipated timelines, or at all. Additional information about the

transaction will be provided in a Current Report on Form 8-K that

will be filed by Fresh Vine with the Securities and Exchange

Commission (SEC) and will be available at www.sec.gov.

About Fresh Vine Wine, Inc.

Fresh Vine Wine, Inc. (NYSE American: VINE) is a producer of

lower carb, lower calorie premium wines in the United States. Fresh

Vine Wine positions its core brand lineup as an affordable luxury,

retailing between $14.99 - $24.99 per bottle. Fresh Vine Wine’s

varietals currently include its Cabernet Sauvignon, Chardonnay,

Pinot Noir, Rosé, Sauvignon Blanc, Sparkling Rosé, and a limited

Reserve Napa Cabernet Sauvignon. All varietals have been produced

and bottled in Napa, California.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements generally can be

identified using words such as “anticipate,” “expect,” “plan,”

“could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,”

“project,” and other words of similar meaning. These

forward-looking statements address various matters including

statements regarding the timing or nature of future operating or

financial performance or other events. Forward-looking statements

are subject to risks and uncertainties that could cause actual

results to differ materially from those expressed or implied by

such statements. Among these risks and uncertainties are those set

forth in Fresh Vine’s annual report on Form 10-K for the year ended

December 31, 2022, and subsequently filed documents with the

SEC.

In addition to such risks and uncertainties, risks and

uncertainties related to forward-looking statements contained in

this press release include statements relating to the satisfaction

of the conditions to and consummation of the proposed merger, the

expected timing of the consummation of the proposed Transaction and

the expected ownership percentages of the combined company, Fresh

Vine’s and Notes Live’s respective businesses, the strategy of the

combined company and its future operations. Actual results may

differ materially from those indicated by such forward-looking

statements as a result of various factors, including without

limitation: (i) the risk that the conditions to the closing of the

Transaction are not satisfied in a timely manner or at all,

including, among others, the failure to obtain stockholder approval

of matters related to the Transaction, the existence of dissenting

Notes Live shareholders, or the failure by Notes Live to enter into

lock-up and leak-out arrangements with its shareholders to its

satisfaction; (ii) uncertainties as to the timing of the

consummation of the proposed Transaction and the ability of each of

Fresh Vine and Notes Live to consummate the Transaction; (iii)

risks related to Fresh Vine’s ability to satisfy the minimum net

cash condition to the closing of the Transaction; (iv) risks

related to Fresh Vine’s continued listing on the NYSE American

pending closing of the Transaction; (v) the risk that the combined

company will not satisfy the initial listing standards of the NYSE

American or otherwise be approved for listing on the NYSE American;

(vi) the risk that as a result of adjustments to the merger

exchange ratio, Fresh Vine stockholders or Notes Live shareholders

could own less of the combined company than is currently

anticipated; (vii) uncertainties regarding the impact of any delay

in the closing the Transaction would have on the anticipated cash

resources of the parties prior to closing or of the combined

company upon closing and other events and unanticipated spending

and costs that could reduce the parties’ cash resources; (viii) the

occurrence of any event, change or other circumstance or condition

that could give rise to the termination of the Merger Agreement;

(ix) uncertainties regarding the terms, conditions and timing of a

transaction pursuant to which Fresh Vine sells, licenses,

transfers, disposes, or divests, or winds down its current wine

production business, and Fresh Vine’s ability to complete such a

transaction in a manner reasonably acceptable to Notes Live, (x)

the effect of the announcement, pendency or completion of the

proposed Transaction on Fresh Vine’s or Notes Live’s business

relationships, operating results and business generally; (xi) costs

related to the proposed Transaction; (xii) the outcome of any legal

proceedings that may be instituted against Fresh Vine, Notes Live

or any of their respective directors or officers related to the

Merger Agreement or the transactions contemplated thereby; (xiii)

the sufficiency of Fresh Vine’s cash and working capital to support

continuing operations, to pay transaction costs through a closing

of the Transaction and to satisfy the minimum net cash condition to

the closing of the Transaction; (xiv) Fresh Vine’s ability to

obtain additional financing when and if needed to do so, and the

dilutive impact of any such financing; (xv) risks related to the

impact that the reverse split of Fresh Vine’s outstanding common

stock to be effected prior to closing of the Transaction may have

on the trading price and volume of Fresh Vine’s common stock; (xvi)

risks associated with the possible failure to realize certain

anticipated benefits of the Transaction, including with respect to

future financial and operating results and the ultimate success of

the combined company; and (xvii) legislative, regulatory, political

and economic developments, among other risks and uncertainties. A

further description of the risks and uncertainties relating to the

business of Fresh Vine is contained in Fresh Vine’s most recent

Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q,

as well as any amendments thereto reflected in subsequent filings

with the SEC. Fresh Vine cautions investors not to place

considerable reliance on the forward-looking statements contained

in this press release. You are encouraged to read Fresh Vine’s

filings with the SEC, available at www.sec.gov, for a discussion of

these and other risks and uncertainties. The forward-looking

statements in this press release speak only as of the date of this

document, and Fresh Vine undertakes no obligation to update or

revise any forward-looking statements as a result of new

information, future events or changes in its expectations.

Important Additional Information

In connection with the proposed transaction, Fresh Vine will

file materials with the SEC, including a registration statement on

Form S-4 (Form S-4), which will include a document that serves as a

proxy statement/prospectus of Fresh Vine and an information

statement of Notes Live, and other documents regarding the proposed

transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THESE

MATERIALS, INCLUDING THE FORM S-4 AND THE PROXY

STATEMENT/PROSPECTUS, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND

THE PARTIES TO THE PROPOSED TRANSACTION. Investors and security

holders will be able to obtain the Form S4, the proxy

statement/prospectus and other materials filed by Fresh Vine with

the SEC free of charge from the SEC’s website at www.sec.gov or

from Fresh Vine at the SEC Filings section of

https://ir.freshvinewine.com/invest/.

No Offer or Solicitation

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended. Subject to certain exceptions to be

approved by the relevant regulators or certain facts to be

ascertained, a public offer will not be made directly or

indirectly, in or into any jurisdiction where to do so would

constitute a violation of the laws of such jurisdiction, or by use

of the mails or by any means or instrumentality (including without

limitation, facsimile transmission, telephone or internet) of

interstate or foreign commerce, or any facility of a national

securities exchange, of any such jurisdiction.

Participants in the Solicitation

Fresh Vine and Notes Live and their respective directors,

executive officers and other members of management may be deemed to

be participants in the solicitation of proxies in respect of the

proposed transaction. Information about Fresh Vine’s directors and

executive officers is available in Fresh Vine’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2022 and its

definitive proxy statement dated November 6, 2023 for its 2023

Annual Meeting of Stockholders. Other information regarding the

participants in the proxy solicitation and a description of their

interests in the transaction, by security holdings or otherwise,

will be included in the proxy statement/prospectus and other

relevant materials to be filed with the SEC regarding the proposed

transaction when they become available. Investors should read the

proxy statement/prospectus carefully when it becomes available

before making any voting or investment decisions. You may obtain

free copies of these documents from Fresh Vine or the SEC’s website

as indicated above.

CONTACT: info@freshvinewine.com

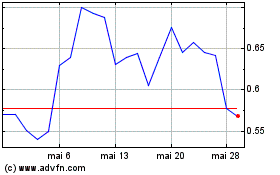

Fresh Vine Wine (AMEX:VINE)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Fresh Vine Wine (AMEX:VINE)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025