Bitcoin Whales Move Out Of Character With This Bull Market, What’s Happening?

05 Octobre 2024 - 7:30PM

NEWSBTC

Ki Young Ju, the founder of the on-chain analytics platform

CryptoQuant, revealed that Bitcoin whales are currently moving out

of character in terms of profit-taking. These whales likely believe

that the bull is far from over, which is why they haven’t secured

as much profit as they have done in previous bull runs.

Bitcoin Whales Have Taken Lesser Profits In This Market Cycle Than

Past Ones Ki Young Ju mentioned in an X post that if the Bitcoin

bull cycle were to end here, it would mean that Bitcoin whales have

just set the record for the least profit-taking across all cycles

ever. Crypto analyst Ali Martinez tried to counter Ki Young Ju’s

point by highlighting how these whales have been distributing their

BTC across different addresses, leading to a drop in the number of

addresses holding between 1,000 and 10,000 BTC. Related

Reading: ‘FLOKI Master Plan’: Crypto Analyst Predicts 2,000% Jump

For The Shiba Inu Competitor However, the CryptoQuant founder

claimed that this is still the lowest return rate across all

cycles, no matter how much these whales sold through those

different wallets. He also revealed that the whales that are

selling now are doing so with little profit, suggesting that they

are likely new whales with weak hands. Meanwhile, Ki Young Ju

noted that the type of transactions that Martinez alluded to cannot

always be considered as sales. He remarked that one must look at

more macro-level aggregated data, such as historical realized

profit, rather than just transactions to get the bigger

picture. These whales are believed to be holding back on

taking profits just yet, considering that the bull run looks to be

far from over. The CryptoQuant CEO also mentioned earlier that

Bitcoin was still in the middle of a bull run based on the market

cap to realized cap metric. Instead of taking profits, these

Bitcoin whales are still accumulating more BTC ahead of the next

leg of the bull run. CryptoQuant recently revealed that there has

been a surge in the outflows from exchanges, the largest since

November 2022. Meanwhile, Ki Young Ju also noted that new whales

are accumulating at a rate the market has never witnessed

before. When Is This Market Cycle Expected To Peak? Crypto

analysts like Rekt Capital have predicted that the Bitcoin market

top could occur sometime in mid-September or mid-October 2025.

However, in a recent report, CoinMarketCap offered a different

opinion, predicting that the cycle top could potentially be between

mid-May and mid-June 2025. Related Reading: Analyst Says PEPE

Bearish Continuation Is Possible For A 50% Price Crash The platform

noted that Bitcoin is currently ahead of historical trends,

especially considering that it hit a new all-time high (ATH) before

the Halving event. CoinMarketCap pointed out that this market cycle

is accelerating by approximately 100 days, which indicates that the

next peak could arrive sooner than expected. Featured image

created with Dall.E, chart from Tradingview.com

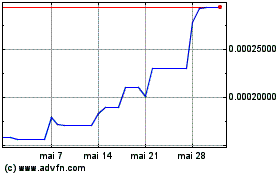

FLOKI (COIN:FLOKIUSD)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

FLOKI (COIN:FLOKIUSD)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024