Here’s what happened in crypto today

11 Mars 2025 - 10:44PM

Cointelegraph

Today in crypto, OKX is reportedly under scrutiny from European

Union regulators for allegedly facilitating the laundering of funds

from the Bybit hack. Meanwhile, analysts warn that Ether’s price

could face further declines as ETF outflows and mounting

macroeconomic concerns put pressure on the market. Additionally,

Mt. Gox has made its second Bitcoin transfer in a week

EU watchdogs scrutinizing OKX over $100M in Bybit laundered

funds: Report

European Union regulators

are reportedly looking into a service offered by crypto

exchange OKX that may have played a role in the laundering of $100

million in funds from the Bybit hack, according to Bloomberg.

A March 11 Bloomberg report citing people

familiar with the matter claims that national watchdogs from the

EU’s member states discussed the issue during a March 6 meeting

hosted by the European

Securities and Markets Authority’s Digital Finance Standing

Committee. The issue appears to be OKX’s decentralized finance

platform and wallet service.

On Jan. 27, OKX announced that it had secured a

full Markets in

Crypto-Assets (MiCA) license to operate across all EU member

states under a unified regulatory framework. The question for EU

regulators is whether two OKX services fall under the MiCA

framework and, if so, whether the exchange could be penalized.

According to Bybit CEO

Ben Zhou, nearly $100 million, or 40,233 Ether (ETH), from the $1.5

billion hack had been laundered through OKX’s Web3 proxy, with a

portion of the funds now untraceable.

In a statement posted to X, OKX refuted the

claim there were any ongoing investigations by the EU, adding that

“Bybit’s statements are spreading misinformation” and defending its

Web3 wallet services.

Source: OKX

Ether risks correction to $1,800 as ETF outflows, tariff fears

continue

Ether is struggling to reverse a near three-month downtrend as

macroeconomic concerns and continued selling pressure from US Ether

exchange-traded funds (ETFs) weigh on investor sentiment.

Ether (ETH) has fallen by

more than 53% since it began its downtrend on Dec. 16, 2024, after

it had peaked above $4,100,

TradingView data shows.

The downtrend has been fueled by global uncertainty around

US import tariffs triggering

trade war concerns and a lack of builder activity on the

Ethereum network, according to Bitfinex analysts.

ETH/USD, 1-day chart, downtrend. Source: Cointelegraph/

TradingView

“A lack of new projects or builders moving to ETH, primarily due

to high operating fees, is likely the principal reason behind the

lackluster performance of ETH. [...] We believe that for ETH,

$1,800 will be a strong level to watch,” the analysts told

Cointelegraph.

“However, the current sell-off is not being seen solely in ETH,

we have seen a marketwide correction as fears over the impact of

tariffs hit all risk assets,” they added.

Crypto investors are also wary of an early bear market cycle

that could break from the traditional four-year crypto market

pattern.

Bitcoin (BTC) is at

risk of falling to $70,000 as cryptocurrencies and global

financial markets undergo a “macro correction” while remaining in a

bull market cycle, said Aurelie Barthere, principal research

analyst at blockchain analytics firm Nansen.

Mt. Gox makes second Bitcoin move in a week as it taps

$76,000

Defunct crypto exchange Mt. Gox moved 11,833 Bitcoin

(BTC), worth $926.2

million, on March 11 —

its second big BTC transfer in a week amid the cryptocurrency’s

price falling to a four-month low of around $76,700.

Arkham Intelligence data analyzed by Lookonchain found that

11,501 BTC was sent to a new wallet. The remaining 332 BTC were

transferred to a warm wallet, which analytics firm Spot On Chain

said could be moved to assist with the repayments.

Mt. Gox

moved 12,000 Bitcoin worth a little over $1 billion on March 6.

The exchange fell into bankruptcy in early 2014 and similar moves

it has made in the past have been a precursor to it paying out its

creditors.

Transaction details of Mt. Gox’s $931 million transfer.

Source: Arkham

Intelligence

Bitcoin has struggled to maintain a rally amid a wider market

rout that has seen investors flee risky assets like crypto. The

sinking US markets saw JPMorgan economists

bump the risk of a recession this year to 40%, up from 30% at

the beginning of 2025.

...

Continue reading Here’s what happened in crypto

today

The post

Here’s what happened in crypto today appeared

first on

CoinTelegraph.

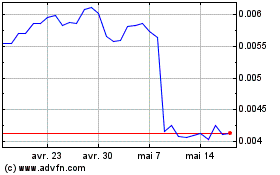

Four (COIN:FOURRUSD)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

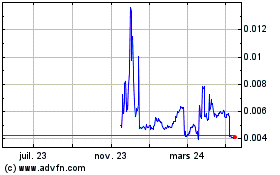

Four (COIN:FOURRUSD)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025