Whale Activity Spikes as Bitcoin Reclaims $102,000—What Investors Need To Know

18 Janvier 2025 - 1:30AM

NEWSBTC

Bitcoin (BTC) has seen a steady price recovery following the recent

release of the US Consumer Price Index (CPI) report. It is now

trading above $103,000. This marks an 8% gain over the past week,

driven by growing interest from large investors and a shift in

market dynamics. According to the latest insights from CryptoQuant

Analysts, some underlying whale activity factors might be

influencing Bitcoin’s current trajectory. Related Reading: Rising

Bitcoin Prices Defy Exchange Inflows: What Investors Need to Know

Bitcoin Price Rebounds Amid Growing Whale Activity CryptoQuant

QuickTake Platform contributor Joao Wedson has recently highlighted

a noteworthy trend in whale behavior on Binance, the world’s

largest crypto exchange. In a recent analysis, Wedson examined the

Exchange Whale Ratio, which measures the share of Bitcoin’s largest

inflow transactions relative to the total exchange volume. This

metric, according to the analyst has now reached historical highs,

signaling that large holders—often referred to as whales—are

transferring significant amounts of Bitcoin to the exchange. The

increased movement of Bitcoin by whales may indicate that they are

preparing for substantial buy or sell actions, potentially

amplifying market volatility. Wedson added: Stay alert! Intense

movements by major players can bring volatility risks but also

unique opportunities for those closely monitoring the market.

Understanding New Whale Movements and Market Cycles In addition to

whale activity on Binance, another CryptoQuant contributor,

KriptoBaykusV2, provided insights into the emergence of new large

investors in the market. According to KriptoBaykusV2, the “New

Whales” indicator highlights the influx of previously inactive

large investors acquiring Bitcoin. Over the past three years, this

metric has grown steadily, suggesting heightened interest in the

cryptocurrency market. However, the entry and exit of new whales

often coincide with price swings, making it a key factor for

understanding market cycles. Related Reading: Bitcoin May Target

$145,000 To $249,000 Under Trump Administration: Report Historical

data shows that peaks in new whale activity often align with

periods of price volatility. For example, during 2021 and 2023,

sharp increases in the number of new large investors were followed

by significant price corrections. KriptoBaykusV2 wrote:

Understanding whether the market is in a bull or bear phase is

crucial for investors. Increases in the number of new whales often

signal the start of bull markets, while the sharp corrections that

follow these movements can indicate the onset of bear markets. This

is especially evident from 2021 onwards, where these fluctuations

are clearly visible Meanwhile, Bitcoin is currently trading at a

price of $103,985, at the time of writing marking not only a 4.9%

increase in the past day but also a nearly 10% surge in the past

two weeks. Featured image created with DALL-E, Chart from

TradingView

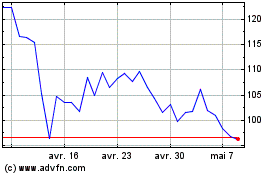

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025