ABN AMRO reports net profit of EUR 870 million for Q2 2023

09 Août 2023 - 7:00AM

ABN AMRO reports net profit of EUR 870 million for Q2 2023

ABN AMRO reports net profit of EUR 870 million for Q2

2023

Highlights of the quarter

- Very strong result, with a net profit of EUR 870

million and an ROE of over 16%, reflecting high NII and impairment

releases. All client units contributed with improved net

profit

- Continued strong NII, benefitting from the higher

interest rate environment

- Expected costs for 2023 now around EUR 5.2 billion; we

do not expect to reach our 2024 cost target as 2023 investments

spill over, inflation is higher and AML costs will reduce more

gradually

- Credit quality remains solid, with impairment releases

of EUR 69 million; buffers remain in place

- Solid capital position; fully-loaded Basel III CET1

ratio of 14.9% and Basel IV CET1 ratio of around 16%. Interim

dividend has been set at EUR 0.62 per share

- Updated financial KPI’s and capital framework to be

presented at publication of Q4 results

Robert Swaak, CEO:

'In the second quarter, we once again delivered a very strong

financial result, driven by high net interest income (NII) and

impairment releases, in an environment where macroeconomic and

geopolitical uncertainty persisted. I am proud of the continued

commitment we demonstrated to our clients in the past quarter. All

client units contributed with improved net profit, and momentum in

the corporate loan book and mortgage portfolio was positive. The

Dutch economy cooled down somewhat, and uncertainty and

persistently high inflation continued to put pressure on our

clients. Despite this slowdown, the labour market remained tight

and corporate and household balance sheets robust. I am pleased the

bank is resilient, with a stable risk profile and a strong balance

sheet. We will present our updated financial KPI’s and capital

framework at publication of the Q4 results.

Net profit in the second quarter was EUR 870 million and the

return on equity (ROE) was over 16%. Net interest income

benefitting from the higher interest rate environment, stood at EUR

1,622 million and fee income was stable. Costs were lower due to

lower regulatory levies, while investments have been delayed in a

tight labour market. We now expect full-year costs for 2023 to be

around EUR 5.2 billion. While we remain focused on cost discipline,

we no longer expect to reach our cost target of EUR 4.7 billion in

2024, as 2023 investments spill over, inflation is higher and AML

costs will reduce more gradually. More effort than expected is

required to ensure that our ongoing AML activities are at a

sustainable and adequate level and meet regulatory

requirements.

Credit quality remained solid in Q2 with impairment releases of

EUR 69 million, reflecting the ending of the Covid management

overlay and net releases in individual client files. The impact of

the economic slowdown on our loan portfolio so far remains limited

and we expect the cost of risk for 2023 to remain well below the

through-the-cycle cost of risk of around 20 basis points. Buffers

remain in place against uncertainties in the economic outlook.

Risk-weighted assets increased by EUR 2.7 billion, mainly due to

model updates as part of our ongoing review of models. Our capital

position remains strong, with a fully-loaded Basel III CET1 ratio

of 14.9% and a Basel IV CET1 ratio of around 16%. In line with our

dividend policy, the interim dividend has been set at EUR 0.62

per share, which amounts to EUR 537 million.

Banks play an important role in society, contributing to the

real economy and creating trust. We support all our clients –

private clients, entrepreneurs and companies – in their daily

banking and with expertise when it matters. Society is facing

climate change, the war in Ukraine and macroeconomic uncertainty,

while technology is evolving very fast. In this rapidly changing

environment our stakeholders value secure banking, sustainable

investment and finance, and a solid business model, all of which

are key elements in our strategy of being a personal bank in the

digital age. Our purpose ‘Banking for better, for generations to

come’ inspires us to support our clients with fair banking and

contributes to society while we remain focused on the execution of

our strategy and continue to transform into a future-proof

bank.

Creating trust is ultimately about people. Our staff are key to

delivering on our strategy and earning the trust of our clients. I

would like to thank them for their commitment. And I would like to

thank our clients, our shareholders and all other stakeholders for

their continued support.'

|

Key figures and indicators (in

EUR millions) |

Q2 2023 |

Q2 2022 |

Change |

Q1 2023 |

Change |

| Operating

income |

2,223 |

1,884 |

18% |

2,142 |

4% |

|

Operating expenses |

1,137 |

1,321 |

-14% |

1,406 |

-19% |

|

Operating result |

1,086 |

563 |

93% |

736 |

48% |

| Impairment

charges on financial instruments |

-69 |

-62 |

-10% |

14 |

|

|

Income tax expenses |

285 |

151 |

|

199 |

43% |

|

Profit/(loss) for the period |

870 |

475 |

83% |

523 |

66% |

| |

|

|

|

|

|

| Cost/income

ratio |

51.1% |

70.1% |

|

65.6% |

|

| Return on

average Equity |

16.2% |

8.8% |

|

9.6% |

|

| CET1

ratio |

14.9% |

15.5% |

|

15.0% |

|

| ABN AMRO

Press OfficeJarco de SwartSenior Press

Officerpressrelations@nl.abnamro.com+31 20 6288900 |

ABN AMRO

Investor RelationsFerdinand VaandragerHead of Investor

Relations investorrelations@nl.abnamro.com+31 20 6282282

|

This press release is published by ABN AMRO Bank N.V. and

contains inside information within the meaning of article 7 (1) to

(4) of Regulation (EU) No 596/2014 (Market Abuse Regulation)

- 20230809 ABN AMRO reports net profit of EUR 870 million for Q2

2023

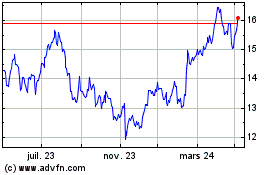

ABN AMRO Bank N.V (EU:ABN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

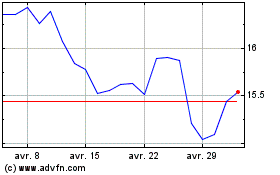

ABN AMRO Bank N.V (EU:ABN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025