Ageas announces its new three-year strategic plan: Elevate27

Regulated information • Inside

information

Ageas announces its new three-year strategic

plan: Elevate27

Today, Ageas announces its next 3-year strategic

plan, Elevate27, for the period 2025-2027. As the name suggests, it

is about taking the Group’s strong performance to the next level,

building on Ageas’s unique growth profile and strong long-term

track record, and the experience it has garnered over the years. A

new chapter in Ageas’s journey, Elevate27 is a

plan for sustained profitable growth and

accelerated progress in key areas of strength, that respond

to the needs of the ageing population and SMEs, with the

ambition to extend the Group’s leadership in technical

insurance and operational excellence while

future-proofing distribution capabilities and

enriching the customer experience.

| |

”As the world continues to change at speed, we will need to

stay agile and alert. This is why our focus is on what comes next.

That means always asking ourselves – can we do better? Or can we do

more? That’s what excites us about Elevate27. It is about further

elevating our performance as a Group, building on our strengths,

embracing technological advancements where they add value, to

deliver on evolving expectations of our stakeholders and on their

hopes and dreams for the future. We’ve successfully delivered and

outperformed in the past and we’re ready to do so again.” |

| |

Hans De Cuyper, CEO Ageas |

|

ELEVATE27 COMMITMENTS |

|

|

AS A BUSINESS AND TO INVESTORS. |

Target by end 2027 |

|

Average earnings per share growth |

6% to 8% |

|

Holding Free Cash Flow |

EUR 2.2+ billion |

|

Shareholder Remuneration |

EUR 1.9+ billion (Progressive Dividend per Share) |

|

TO CUSTOMERS |

|

|

Delivering the best customer experience |

Top quartile NPS scores across all our markets |

|

TO EMPLOYEES |

|

|

Employee NPS |

Top quartile |

|

Women in senior and middle management |

40% |

|

TO SOCIETY |

|

|

Products |

35+ % of GWP from products that stimulate the transition to a more

sustainable and inclusive world. |

|

ESG Ratings |

Top quartile with 3 out of 6 rating agencies we actively engage

with |

Over the past three years, we have successfully

executed our Impact24 growth strategy, delivering

on most targets we have set. This was achieved through strong

commercial progress and robust operational performance, enabling us

to meet our commitments to investors regarding earnings per share

and dividend growth, while meeting Net Operating Result guidance.

Besides our operational and financial achievements, we are

increasingly recognised for our dedication to non-financial goals,

as evidenced by improved scores from ESG rating agencies and

various recognitions we received such as TOP Employer and the

Platinum ECOVADIS label (AG Insurance). We also advanced well

on our commitments to customers and employees, as reflected in our

high NPS and eNPS scores. As we near the end of our three-year

strategic plan, we are confident that we will successfully deliver

on Impact24, providing the Group a solid foundation to start

Elevate27.

Elevate27 is built on three

strategic drivers: driving profitable growth, leading in technical

insurance and operational excellence to sustain and improve

margins, and future-proofing distribution and enriching customer

experience.

By focusing on three strategic

drivers, we aim to leverage the Group's strengths to

elevate our performance in the coming years. Elevate27 will follow

two dynamics: continuing what we already excel at

and accelerating our efforts in areas where we see new potential to

generate additional value for our stakeholders. Central to this

strategy will be our increased emphasis on our People and Tech,

Data & AI capabilities at the level of the Group, which will

enable us to deliver on our ambitions.

Our actions are guided and influenced by a

commitment to sustainability, long-term thinking, and our

partnership DNA.

Drive profitable growth

Leveraging our strong presence in Life

and Non-Life throughout Europe and Asia,

and the successful launch of a fully-fledged

Reinsurance arm that provides a solid cash and

diversification engine, we will continue to focus on market

segments that align with our core competencies, and that open up

new opportunities to create and accelerate profitable growth moving

forward. We will further accelerate the development of our offering

to SMEs, which is already a significant part of

our portfolio and where the market is expected in time to outgrow

the retail market. We will also accelerate the provision of our

solutions for an ageing population, a market

opportunity seen in all markets in which Ageas is active, by

capitalising on our strong position in the Life market and

experience in the over 50 customer segment.

Lead in technical insurance and

operational excellence

Ageas has a strong track record in terms of

technical insurance and operational excellence and wants to grasp

the opportunity to maintain and also elevate its leadership in that

respect. Taking a lead in these areas, including making use of the

new opportunities offered by Technology, Data and AI, ensures

attractive margins for the business and

intrinsically offers customers an efficient and seamless

service.

To achieve leadership in technical insurance and

operational excellence, we will continue to invest in our

systems and processes, supporting at the same time

our partners in their own digital (transformation) journeys. We

want the operational aspect of delivery to be invisible to the

customer, the ultimate beneficiary, and to add value to our

employees. We want to maintain our financial discipline and strong

risk culture, allowing us to sustain and improve our margins. And

we want to step up group empowered synergies by

leveraging assets and expertise across the entities, demonstrating

the power of the Group in this specific area.

And finally, we have a strong expertise in Data

& AI. We want to put these technologies to work for us – adding

value but in a disciplined and controlled way, allowing us to

better serve our customers, and making insurance more accessible

and inclusive.

Future-proof distribution and enrich

customer experience

In a distribution landscape that is continuously

changing, we remain committed to working through all distribution

channels that allow us to best reach our customers and gain access

to new types of customers.

By leveraging on our strong partnership model

and new possibilities offered by AI, we want to develop

innovative propositions and services for customers

by combining the data insights and expertise of Ageas and our

partners. With full confidence in our traditional

distribution partners - Banks, Agents and Brokers - we

will pay special attention to jointly enhancing our digital

capabilities. At the same time, and in the context of continued

diversification, we will further accelerate our engagement with

digital B2B2C sales platforms.

In Impact24 we have successfully implemented

solutions designed to provide the best experience for customers

focusing on CX Culture, Customer Journey Management and

Tech & Data, giving the Group the capabilities to

develop a leading on- and offline customer experience,

while promoting greater efficiency. This will continue to

be our primary focus. We aim to advance even further by reinventing

the way we interact with customers across different channels and

platforms by innovating our client-interaction model, prioritising

self-service solutions and automated

customer assistance, and investing in

hyper-personalised services.

Leveraging on two critical assets to

deliver on our plan: ‘People’ and ‘Tech, Data &

AI’

Through Elevate27 we will reconfirm the

commitment we made to our people to deliver a Great place

to Grow, both today and for future, and we will take

optimal advantage of the opportunities offered by Tech, Data &

AI to meet our ambitions. We have put in place high-quality data

management and established a pipeline of over 300 AI initiatives

group-wide that under Elevate27 will be fully deployed.

The rapid evolutions in these areas require us

to act fast as a Group to maintain a leading position. By

harnessing the collective strength of the Group,

we can offer our entities and partnerships access to

essential resources and skills, generate economies

of scale, increase our speed-to-market and adopt the most

effective approaches and methodologies, that benefit all.

As a prerequisite to delivering on the drivers

of Elevate27, we will continue to invest in our

technological capabilities, such as ensuring our

IT architecture is open and composable to easily integrate with

partners and increase our speed to market. Furthermore, we will

accelerate the adoption of new Data and (Gen)AI solutions

where they add value, as their integration in areas such

as Pricing, Underwriting and Product Development, Claims Processes,

Fraud Management & Customer Journeys will become even more

prominent moving forward.

Sustainability and Long-term thinking as

guiding principles

As a true supporter of the lives of all our

stakeholders, our dedication to sustainability and adopting a

long-term perspective will continue to underpin our actions.

Leveraging 200 years of solid business experience

along with recent successes and learnings from Impact24, we will

further strengthen our group-wide efforts in sustainability and

long-term thinking.

A targeted performance

As a true stakeholder driven company, we hold

ourselves accountable for delivering on our promises by 2027. This

translates to setting clear financial and non-financial targets

that allow us to measure our progress over time.

For investors and our business in

general, we have set out a range of targets that

demonstrate the strength of our balance sheet, our financial

performance, and our ability to drive profitable growth and

attractive returns, providing confidence in the sustainability of

our investment case in the long term. Our commitment to create

value is reflected in 3 financial targets:

- Average earnings per share growth:

6% to 8%

- Holding Free Cash Flow: EUR 2.2+

billion

- Shareholder Remuneration: EUR 1.9+

billion (Progressive Dividend per Share)

For customers, we aim to be

recognised for excellence at every interaction. To underscore our

commitment to delivering the best customer experience, we will

strive to reach top quartile NPS scores across all our markets.

For our partners, we want to be

the partner of choice both for our traditional partners and new

types of partnerships and will closely monitor and actively address

partnership feedback at local level.

For our employees we want to be

recognised as a Great place to Grow. This commitment is

demonstrated through two specific targets:

- Employee NPS: top quartile

- 40% women in senior and middle

management

For society we continue to

place sustainability at the heart of our business, influencing

decisions about products, investments, and emissions, with external

acknowledgment of our ESG initiatives.

- Products: 35+ % of GWP from

products that stimulate the transition to a more sustainable and

inclusive world.

- ESG ratings: top quartile with 3

out of 6 rating agencies we actively engage with.

INVESTOR DAY WEBCAST

23 September 2024 - 17:00 CET (16:00 UK

Time)

Audio webcast via https://ageaspresents.com/aid2024/live

- Pdf version of the press release

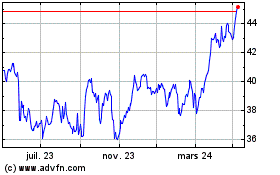

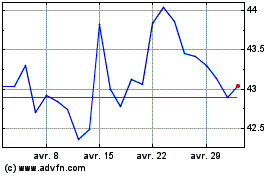

Ageas SA NV (EU:AGS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Ageas SA NV (EU:AGS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024