Sequa Petroleum N.V. Bonds Update

17 Juin 2019 - 8:00AM

Business Wire

Regulatory News:

Further to its press release of 15 April 2019, Sequa Petroleum

N.V. (the “Company”) is taking steps to finalise the

restructuring of the Company’s USD 300,000,000 5.00 per cent

convertible bonds due 2020 of which USD 204,400,000 in principal

amount remain outstanding (ISIN: XS1220076779, SEQ01 PRO EC) issued

by the Company in April 2015 (the “Bonds”). On 14 June 2019

the Company in consultation with bondholders has extended the

expiration date in relation to the consent solicitation regarding

the Bonds (launched on 31 May 2019) and amended the effective date

on which the Bonds will be cancelled if the extraordinary

resolution of the bondholders is passed. The amended consent

expiration date is the date being the earlier of (i) 5:00pm, London

time, on 5 July 2019, or (ii) the date on which the consent

solicitation agent receives the valid electronic instructions from

the holders of the Bonds representing in aggregate not less than

three-fourths in principal amount of the Bonds for the time being

outstanding unless the consent is extended or earlier terminated by

the Company in its sole discretion. The effective date is the date

being three business days (meaning, in relation to any place, a day

(other than a Saturday or Sunday) on which commercial banks and

foreign exchange markets are open for business in the relevant

place) (the “Business Days”) after the consent expiration

date. If the extraordinary resolution of the bondholders is passed,

on the settlement date (being the fifteenth Business Day after the

effective date), each Bondholder will receive 3.660045 ordinary

shares for each U.S. Dollar in principal amount of Bonds it

holds.

Cautionary notice

This press release contains information that qualifies as inside

information within the meaning of Article 7(1) of the EU Market

Abuse Regulation. This communication includes forward-looking

statements. All statements other than statements of historical

facts may be forward-looking statements. Words such as possibly,

expected and value accretive or other similar words or expressions

are typically used to identify forward-looking statements.

Forward-looking statements are subject to risks, uncertainties and

other factors that are difficult to predict and that may cause

actual results of the Company to differ materially from future

results expressed or implied by such forward-looking statements.

Such factors include, but are not limited to, risks relating to the

Company’s ability to acquire new opportunities; generate positive

cash flows; general economic conditions; turbulences in the global

credit markets and the economy; geopolitical events; the

possibility to restructure the Bonds and other factors discussed in

the Company’s public filings and other disclosures. Forward-looking

statements reflect the current views of the Company’s management

and assumptions based on information currently available to the

Company’s management. Forward-looking statements speak only as of

the date they are made, and the Company does not assume any

obligation to update such statements, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190616005052/en/

Jacob Broekhuijsen, Chief Executive Officer+44 (0)20 3728 4450

or info@sequa-petroleum.com

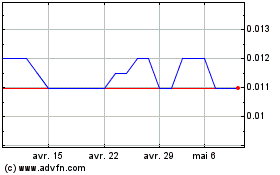

Sequa Petroleum NV (EU:MLSEQ)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

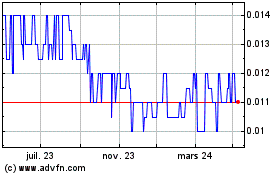

Sequa Petroleum NV (EU:MLSEQ)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024

Real-Time news about Sequa Petroleum NV (Euronext): 0 recent articles

Plus d'articles sur Sequa Petroleum Nv