WINFARM : First-half 2024 results.

PRESS RELEASE

Loudéac, 3 October 2024

FIRST-HALF 2024 RESULTS

-

Return to growth in Q2 2024

-

Gross margin holds up well at 32.4% of revenue

-

Operating profitability bottoming out

H2 2024 OUTLOOK

-

Expected resumption in growth

-

Improvement in EBITDA incorporating the full effect

of measures to stimulate business activity and control costs

WINFARM (ISIN: FR0014000P11 - ticker:

ALWF), the No. 1 French distance-seller for the farming

industry, announced its consolidated results today for the

first half of 2024.

On 3 October 2024, the Board of Directors

approved the consolidated financial statements for the financial

year ended 30 June 2024. These accounts have undergone a limited

review by the statutory auditors. The certification reports are

currently being drawn up.

Consolidated data, French accounting standards,

Unaudited, in €k |

H1 2024 |

H1 2023 |

|

Revenue |

69,976 |

71,383 |

|

Gross margin |

22,674 |

22,788 |

|

As a % of revenue |

32.4% |

31.9% |

|

EBITDA |

196 |

1,631 |

|

As a % of revenue |

0.3% |

2.3% |

|

Depreciation, amortisation and provisions |

(2,700) |

(2,118) |

|

Operating result |

(2,504) |

(488) |

|

Net financial income |

(515) |

(141) |

|

Non-recurring profit (loss) |

237 |

28 |

|

Corporate tax |

21 |

(78) |

|

Group share of net income |

(2,699) |

(689) |

Return to growth in the second quarter

of 2024 after a mixed first quarter in 2024

In the first half of 2024, Group revenue fell

slightly by 2.0% to €70.0m compared with €71.4m at 30 June

2023.

In Farming Supplies, after a

first quarter down 14.8%, characterised by an agricultural crisis

and exceptional rainfall that had impacted seed orders and delayed

the planting of corn plants, the second quarter saw 7.3% growth,

benefiting from a catch-up in sales over the period, and limiting

the decline over the entire half-year to just 4.5% to achieve

revenue of €62.7m.

The Farming Production business

recorded two consecutive quarters of strong double-digit growth,

achieving revenue of €6.3m, up 36%. In the first half of 2024,

Winfarm benefited from the return of strong momentum in Global

Export, the sustained growth in sales in the Asia region and the

full effect of the new production line, which had been commissioned

in April 2023, enabling the Group to meet strong demand while

enhancing its price-volume competitiveness.

“Other activities” combining

Farming Advisory (marketed under the Agritech

brand) and Farming Innovation (marketed by the

pilot farm in Bel-Orient) recorded a slight decrease in their

sales.

The Group continues to roll out commercial

initiatives for the dairy processing unit, having signed new

contracts during the first part of the year.

Gross margin held up well, profitability

bottomed out before the full effect of the measures to stimulate

activity and control costs

In the first half of 2024, gross margin reached

€22.7m, remaining at the same level as in the first half of 2023,

generating a gross margin rate of 32.4%, a slight improvement of

0.5 points, despite an unfavourable price effect in recent quarters

due to the sudden reversal in purchase prices. This performance

reflects the Group's ability to effectively manage its purchasing

volumes while promoting the sale of its most profitable

products.

EBITDA stood at €0.2m, versus €1.6m at the end

of June 2023, due to still high operating costs over the first

half, combined with expenses related to the marketing of

“Au Pré!” totalling €0.5m, without revenue being

able to absorb them in full. However, an improvement in EBITDA is

expected in the second half of the year, driven firstly by the

stimulus measures for the Farming Supplies

business initiated in the first half and which will continue during

the second half of the year, and secondly by better control of

operating expenses (economies of scale in transport costs etc.).

The Group also reduced its workforce, with a decrease of six FTEs

at the end of the period, enabling it to stabilise its payroll

(€10.4m at 30 June 2024 versus €10.3m at 30 June 2023). The Group's

policy of strictly limiting replacements in certain positions will

continue in the coming months to further reduce these costs.

After taking into account depreciation,

amortisation and provisions, operating income came out at €(2.5)m

compared with €(0.5)m in H1 2023. Net income (Group share) came to

€(2.7)m versus €(0.7)m in H1 2023.

Implementation of measures to ease cash

flow pressures

The WCR improvement measures initiated in 2023

began to bear fruit in the first half of 2024, benefiting in

particular from a reduction in inventories, which reached €21.6m

compared with €22.8m in H1 2023.

At 30 June 2024, the Group's cash position stood

at €2.0m, compared with €7.5m at 31 December 2023. This change can

be attributed to the finalisation of investments intended to

enhance the Group's infrastructure (extension of the plant,

extension of administrative buildings, implementation of an ERP

system, acquisition of new trucks and construction of the dairy

processing plant) and to the repayment of financial debt. Financial

debt stood at €36.0m at 30 June 2024, compared with €39.9m at 31

December 2023.

In this context, the Group will rely on the

following elements to mitigate pressure on cash:

- Cash generation

resulting from the return to growth in Farming

Supplies;

- Resale of the fleet

of owned trucks for an estimated €1.2m. These trucks will continue

to be operated but via lease financing;

- Continued

improvement in the Group's WCR through continuous improvement in

customer payment terms.

Return to growth and improvement in

EBITDA expected in H2 2024

As mentioned above, Winfarm has initiated

commercial actions aimed at boosting sales in the Farming

Supplies business, the first results of which began to

materialise in the second quarter and which are expected to

continue in the second half of 2024. In addition to the initiatives

already mentioned (competitive prices on loss leaders, increase in

the average basket by listing new own-brand products), Winfarm

should continue to capitalise on the growth of the web channel,

which has posted solid performances indicative of the site's

adoption by the Group's customers.

The Farming Production business

should also continue to benefit from the positive momentum

initiated in the first half, supported by export sales and the

ramp-up of its production line.

The gradual take-off of sales for “Au

Pré!”, Winfarm's milk recovery concept for a network of

independent farmer members, should foster the gradual contribution

of this activity to the Group's profitability. New tests with

regional key accounts are under way and could help increase the

volumes sold.

The financial discipline initiated by the Group

in the first half of the year to limit the increase in operating

expenses will continue in the coming months.

Given these factors, Winfarm is confident in the

second half of 2024 in terms of business growth, combined with an

improvement in EBITDA compared to the first half of 2024.

Next release:

Q3 2024 revenue, 7 November 2024, end of trading.

About WINFARM

Founded in Loudéac, in the heart of

Brittany, at the beginning of the 1990s, the Winfarm group is today

the leading French player offering the agricultural, livestock,

horse-breeding and landscape markets a range of consultancy,

service and distance selling products and global, unique and

integrated solutions to help them meet the new technological,

economic, environmental and social challenges of the new generation

of agriculture.

With a vast catalogue of more than 35,000

product references (seeds, phytosanitary, harvesting products,

etc.), two-thirds of which are marketed under own brands, WINFARM

has more than 45,000 customers in France, Belgium and the

Netherlands.

For more information about the company:

www.winfarm-group.com

Contacts:

WINFARM

investisseurs@winfarm-group.com |

|

ACTIFIN, Financial Communications

Benjamin Lehari

+33 (0) 1 56 88 11 11

Benjamin.lehari@seitosei-actifin.com |

ACTIFIN, Financial Press Relations

Jennifer Jullia

+33 (0)1 56 88 11 19

Jennifer.jullia@seitosei-actifin.com

|

- WINFARM_PR_H12024_vDEF_EN

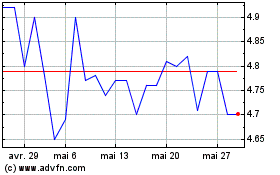

Winfarm (EU:ALWF)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Winfarm (EU:ALWF)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025