Euro Advances Against Majors

13 Mars 2024 - 1:01PM

RTTF2

The euro was higher against its major counterparts in the

European session on Wednesday, as hotter-than-expected U.S.

inflation data failed to hurt expectations of interest-rate cuts in

the coming months.

Traders still expect the Fed to start cutting rates in June even

as data suggested some stickiness in inflation.

Markets now eagerly await U.S. producer price inflation and

retail sales figures this week to gauge the central bank's

potential path for interest rate cuts.

Traders also look ahead to the Federal Open Market Committee

(FOMC) meeting on March 19 and 20 for signals of possible rate cut

timings.

Data from Eurostat showed that Eurozone industrial production

declined for the first time in three months in January largely

reflecting the weakness in capital goods output.

Industrial output fell 3.2 percent on a monthly basis, reversing

December's 1.6 percent increase. This was the first decrease in

three months and also came in weaker than economists' forecast of

1.5 percent fall.

The euro climbed to 5-day highs of 161.95 against the yen and

0.9606 against the franc, off its early lows of 160.89 and 0.9574,

respectively. The euro is seen finding resistance around 164.00

against the yen and 0.995 against the franc.

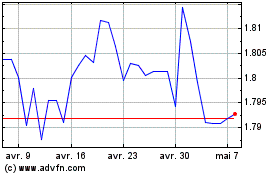

The euro advanced to a 2-day high of 1.0947 against the

greenback and a 6-day high of 1.7784 against the kiwi, off its

previous lows of 1.0919 and 1.7712, respectively. The next possible

resistance for the euro is seen around 1.12 against the greenback

and 1.80 against the kiwi.

The euro reached as high as 0.8552 against the pound. If the

currency rises further, it may find resistance around the 0.88

level.

In contrast, the euro eased to 1.6516 against the aussie and

1.4724 against the loonie, from an early high of 1.6555 and a 2-day

high of 1.4762, respectively. The currency may locate support

around 1.62 against the aussie and 1.46 against the loonie.

Euro vs NZD (FX:EURNZD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs NZD (FX:EURNZD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024