TIDMBGS

RNS Number : 7769T

Baillie Gifford Shin Nippon PLC

22 March 2023

RNS Announcement

Baillie Gifford Shin Nippon PLC (BGS)

Legal Entity Identifier: X5XCIPCJQCSUF8H1FU83

Results for the year to 31 January 2023

Regulated Information Classification: Additional regulated

information required to be disclosed under the applicable laws and

regulations.

The following is the results announcement for the year to 31

January 2023 which was approved by the Board on 21 March 2023.

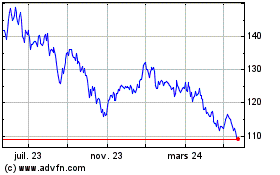

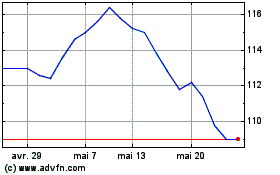

Over the year to 31 January 2023, the Company's net asset value

per share declined by 1.2% and its share price by 8.9%. The

comparative index * appreciated by 5.7%.

In sterling terms over three years, the net asset value was up

by 0.5% and the share price was down 6.8%, while the Company's

comparative index * was up 6.6%. Over the five years to 31 January

2023, the Company's net asset value per share appreciated by 2.9%

and its share price declined by 13.9%. Shin Nippon's comparative

index * return appreciated by 7.6% over this period.

3/4 The Managers' unwavering focus on high-growth smaller

companies is currently out of sync with investor sentiment, so the

recent performance in absolute and relative terms is not

unexpected. The Board recognises that the valuation downgrade of

growth companies does not always correlate with their operational

performance.

3/4 Macro headwinds and the lingering effects of Covid-19 have

led to poor share price performance at many of the portfolio's

internet companies such as Infomart, Japan's leading online food

ordering platform despite growing its sales over the past year and

generating a decent level of profits as well as investing heavily

for future growth, and online legal website Bengo4.com, despite

maintaining a high growth rate in sales and a very significant

increase in profitability.

3/4 Among the positive contributors to performance over the year

were insurance company Lifenet, the leading online life insurer in

Japan, drugstore chain MatsukiyoCocokara and Kamakura Shinsho, an

online platform for funerals and end-of-life related services.

3/4 Nine positions were sold and seven new positions were

initiated in the financial year, including one private company;

plastic recycling company JEPLAN which utilises a novel chemical

method to recycle PET and polyester. There are currently four

private companies in the portfolio accounting for 3.0% of total

assets.

3/4 Growth stocks are now priced at levels that assume barely

any future increase in revenues or profits, which is in stark

contrast to their underlying fundamentals. The Board and Managers

continue to believe that being patient and seeing through market

noise increases the chances of picking exceptional companies that

will deliver attractive long-term returns.

After deducting borrowings at fair value.

* The Company's comparative index is the MSCI Japan Small Cap

Index (total return and in sterling terms). See disclaimer at the

end of this announcement.

Source: Refinitiv/Baillie Gifford and relevant underlying index

providers. See disclaimer at the end of this announcement.

Shin Nippon aims to achieve long term capital growth through

investment principally in small Japanese companies which are

believed to have above average prospects for growth. At 31 January

2023 the Company had total assets of GBP633.5 million (before

deduction of bank loans of GBP88.0 million).

The Company is managed by Baillie Gifford, an Edinburgh based

fund management group with approximately GBP227 billion under

management and advice as at 17 March 2023.

Past performance is not a guide to future performance. The value

of an investment and any income from it is not guaranteed and may

go down as well as up and investors may not get back the amount

invested. The Company has borrowed money to make further

investments. This is commonly referred to as gearing. The risk is

that, when this money is repaid by the Company, the value of these

investments may not be enough to cover the borrowing and interest

costs, and the Company makes a loss. If the Company's investments

fall in value, gearing will increase the amount of this loss. The

more highly geared the Company, the greater this effect will

be.

Investment in investment trusts should be regarded as long term.

You can find up to date performance information about Shin Nippon

at shinnippon.co.uk .

See disclaimer at the end of this announcement.

21 March 2023

For further information please contact:

Anzelm Cydzik, Baillie Gifford & Co

Tel: 0131 275 2000

Jonathan Atkins, Director, Four Communications

Tel: 0203 920 0555 or 07872 495396

Chairman's Statement

Performance

Over the year to 31 January 2023, Shin Nippon's net asset value

('NAV') per share * declined by 1.2% and its share price by 8.9%.

The comparative index (MSCI Japan Small Cap Index, total return in

sterling terms) appreciated by 5.7%. As highlighted in my prior

reports, your Board has historically reviewed performance

principally over rolling three-year periods and it is disappointing

to report relative underperformance over this period. Over the

three years to 31 January 2023, the Company's net asset value per

share appreciated by 0.5% during this period and its share price

declined by 6.8%. Shin Nippon's comparative index return

appreciated by 6.6%.

Following a review and assessment of the Managers' time horizon

for investment, the Board has concluded that, going forward,

performance should be measured principally over rolling five-year

periods. Over the five years to 31 January 2023, the Company's net

asset value per share appreciated by 2.9% and its share price

declined by 13.9%. Shin Nippon's comparative index return

appreciated by 7.6% over this period. As you will note later in my

report, at this year's Annual General Meeting ('AGM') shareholders

are being asked to approve proposed changes to the Company's

Objective and Policy, one of which is to construct the portfolio

through the identification of individual companies which offer long

term growth potential typically over a five rather than

three-to-five year period. Reviewing performance principally over

five-year periods aligns with this. As illustrated on page 6 of the

Annual Report and Financial Statements the Company outperformed the

peer group over a five-year period.

In the Managers' Report below, you will find a more detailed

explanation of the recent performance and commentary on some of the

holdings, as well as performance numbers over five and ten years.

The Board maintains close oversight of the performance of the

Company. Although three year performance has been disappointing and

performance over the last two years has damaged longer-term

returns, we remain satisfied with the ten-year performance of the

Company. The Board recognises that the valuation downgrade of

growth companies does not always correlate with their operational

performance. We remain committed to the Managers' unwavering focus

on high-growth smaller companies and are confident that the Company

is well placed to benefit from the long term prospects of the

companies held in the portfolio.

Growth investing is currently out of sync with investor

sentiment and, as the Managers' fundamental bottom-up investment

approach does not consider the make-up of the comparative index

when constructing the portfolio, the recent performance in absolute

and relative terms is not unexpected and shareholders should expect

periods of underperformance. The Company also dropped back out of

the FTSE 250 index in March 2022, having been promoted in November

2020.

Outlook

The war in Ukraine is continuing to undermine sentiment in many

ways. High inflation is now a real threat to global growth and the

inevitable increases in interest rates will continue to provide

headwinds in many economies. Shin Nippon will not be immune to

these issues.

That said, your Board was very encouraged to meet twenty-four

different companies on its recent trip to Japan. We met companies

already owned in the portfolio as well as some potential new

holdings both in the listed and the unlisted space. It was apparent

that the negative effects of Covid-19 over the last couple of years

have largely dissipated, leading to a more positive outlook with no

visible evidence of any doom and gloom. However, there is no

getting away from the issue of the ageing population in Japan where

people are living longer and, where the economy is trying to grow,

this inevitably puts pressure on the ability to recruit suitable

skilled labour. I have mentioned this structural issue in previous

statements. The companies we met were all aware of these issues and

your Board was left confident that they were being addressed. The

number of foreign workers in Japan continues to grow and this trend

will inevitably continue in the years ahead. There is no doubt that

the companies we met were engaging and confident about their future

growth prospects. We met some highly skilled individuals who are

still trying to disrupt norms and we were left feeling that the

small cap sector in which the Company invests is in good shape.

The Managers have for many years adopted a stock picking

approach when shaping the portfolio. As the Directors discovered on

the trip, opportunities will continue to present themselves and we

are wholly supportive of the Managers in seeking those out and

continuing to strengthen the portfolio. The start-up environment

for companies is changing and Government policies are more

supportive. There is a positive attitude to creating wealth and

starting exciting, disruptive businesses. The Board and the

Managers remain encouraged by the outlook.

Borrowings

The Company's invested gearing increased over the course of the

year from 11% to 15% whilst potential gearing was unchanged at 16%.

Subsequent to the year end, a new secured Yen2,000 million

three-year revolving credit facility was drawn down from ING Bank

N.V. The Board agreed to increase gearing to allow the Managers to

invest in the strong pipeline of current opportunities, bolstering

the high growth nature of the portfolio at the right time and at

attractive valuations.

As at 31 January 2023, the Company had total borrowings of

Yen14.1 billion (GBP88.0 million) at an average interest rate of

1.4%. During the year the yen weakened against sterling by 3.4%.

The Company undertook no currency hedging during the year and has

no plans to do so.

Revenue Return and Ongoing Charges

Revenue return per share was 1.11p compared to 0.29p the prior

year. The revenue reserve remains in deficit therefore the Board is

recommending that no dividend be paid. The Company's ongoing

charges were 0.74% compared to 0.66% a year earlier. Although

expenses decreased during the year the average daily NAV fell from

GBP719.1 million in 2022 to GBP521.3 million in 2023 causing the

increase in the overall ongoing charge percentage. A reconciliation

of this can be found at the end of this announcement.

Share Issuance and Buybacks

Having ranged between a 1.5% premium and 11.6% discount,

averaging a 6.1% discount, the Company's shares ended the period at

an 8.6% discount to the NAV per share, having been at a 0.8%

discount a year earlier.

During the course of the year, 100,000 shares were bought back

at a cost of GBP154,000 and are currently held in treasury. As part

of this year's AGM business, approval is again being sought to

renew the authority to buy back shares. This would enable the

Company to buy back shares if the discount to NAV was substantial

in absolute terms or in relation to its peers, should that be

deemed desirable. Any such activity would enhance the NAV

attributable to existing shareholders.

Although no shares were issued during the year, there will also

be an AGM resolution to authorise the approval of share issuance,

on a non pre-emptive basis, of up to 10% of the Company's issued

share capital. As done in the past, any share issuance would be

undertaken at a premium to NAV per share and therefore be NAV

accretive for existing shareholders. The Board is of the view that

being able to increase the size of the Company, when conditions

permit, helps to improve liquidity, reduces costs per share and

potentially increases the appeal of the Company to a wider range of

shareholders.

Board Composition and Governance

I have thoroughly enjoyed my time as a Director and Chair of

Baillie Gifford Shin Nippon PLC but, as highlighted to the market

back in December, I will not be seeking re-election at the AGM in

May. It has been a pleasure for me to work with such an impressive

Board and also such a talented team at Baillie Gifford. I have

thoroughly enjoyed my time on the Board and am proud of our

achievements over the last nine years.

On my retirement, I am pleased to report that Mr Jamie Skinner

will take on the chairship of the Board and Mr Kevin Troup will

become Chair of the Audit Committee. Ms Abigail Rotheroe has been

appointed as the Chair of the Nomination Committee, effective from

1 February 2023.

The composition of the ongoing Board is appropriate for the

foreseeable future and will be compliant with the pending diversity

rules coming into effect for accounting periods beginning on or

after 1 April 2022.

Environmental, Social and Governance (ESG)

The consideration of ESG factors is part of the long term,

active, patient and growth focused approach to investment by our

Managers. Your Board is pleased with the focus the Managers place

on ESG and the resources applied to it. ESG in its widest sense is

a broad and complex subject and it features as part of every Board

meeting. Some examples of engagement with companies undertaken by

the Managers can be found below.

Annual General Meeting - Objective & Policy and Articles of

Association

In addition to the usual, and also aforementioned, AGM business,

a resolution is being put before shareholders to make a number of,

principally, stylistic changes to the Company's Objective and

Policy, which will also help to clarify some potential unintended

ambiguities in the current wording and to align investment horizons

with the Managers'. A comparison of the proposed and current

wording can be found on pages 7 and 8 of the Annual Report and

Financial Statements. The Board is taking a prudent approach to

these changes and is treating them, in aggregate, as a material

change. Therefore, in accordance with the Listing Rules, the

Company is required to seek shareholder approval for the proposed

amendments.

Furthermore, shareholders are being asked to approve changes to

the Company's Articles of Association, details of which can be

found on pages 33 and 34 of the Annual Report and Financial

Statements. One of the amendments would, if passed, permit the

Company to hold virtual AGMs in the future. This authority is being

sought not as a replacement to in-person AGMs, but as an

alternative in extremis should it be required due to prevailing

circumstances meaning that an in-person meeting was not possible,

as was the case at points during recent years because of

restrictions due to Covid-19.

This year's AGM will take place in person at Baillie Gifford's

offices in Edinburgh at 9:15am on Wednesday 17 May 2023. The

Managers will be presenting and the Board and I look forward to

seeing as many of you there as possible.

M Neil Donaldson

21 March 2023

Past performance is not a guide to future performance.

Source: Refinitiv/Baillie Gifford and relevant underlying index

providers. See disclaimer at the end of this announcement.

* After deducting borrowings at fair value

Alternative Performance Measure - see Glossary of Terms and

Alternative Performance Measures at the end of this

announcement.

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement

Managers' Report

2022 was another difficult year for growth investing. A number

of external events weighed on investor sentiment. Global supply

chains, especially autos and semiconductors, are recovering

gradually but continue to suffer from the after-effects of the

pandemic. The war in Ukraine had global repercussions as Europe

started weaning itself off Russian gas, driving up global energy

prices in the process. This has been a major cause of the high

rates of inflation being witnessed globally. Central banks across

the world have been raising interest rates in a bid to control

inflation. This has resulted in significant weakness in the share

price of high growth stocks as investors worry that higher interest

rates would lead to weak demand for their goods and services in the

future.

Against this challenging backdrop, there have been encouraging

signs. An uptick in inflation is leading to wage growth in real

terms. This is particularly noteworthy as wages have been generally

flat in Japan for the past thirty years due to deflation. Increases

in wages should lead to higher consumer confidence and thus a more

positive outlook for the domestic economy. Japan has now fully

reopened its borders to tourists, having eliminated all

Covid-related entry requirements. More recently, these green shoots

of a return to normality have been reflected in market sentiment.

We are returning to an environment where share prices are driven

more by fundamentals than pure macro developments. Despite

disappointing share price performance, we note that the vast

majority of our holdings have actually exhibited good operational

progress.

Performance

Shin Nippon's focus is, and remains, to invest in fast-growing

smaller companies in Japan which are often run by dynamic founders.

We continue to believe that they are driving much-needed change,

especially in light of an ageing and shrinking workforce. We remain

certain that investing in these companies will enable us to

generate attractive shareholder returns in the long run, despite

short-term turbulence. Companies in more traditional sectors of the

economy continue to face long-term challenges and we, therefore,

prefer to back companies that are disrupting the status quo.

For the year ending 31 January 2023, Shin Nippon's net asset

value ('NAV') decreased by 1.2% compared to an increase of 5.7% in

the MSCI Japan Small Cap Index (all figures total return and in

sterling terms, NAV with borrowings at fair value). Growth stocks

have remained out of favour, reflecting the market's preference for

short-term certainty over long-term opportunity. Encouragingly, the

outlook seems to be getting less myopic. Following continued share

price weakness in the first half of the year, we witnessed a more

encouraging level of performance in the second half. We remain

optimistic regarding the long-term growth prospects of the

high-growth businesses held in Shin Nippon but note that the

Company's weak performance over the past two years has impacted the

long-term numbers, which we consider a fairer way of looking at

performance. Over five years, Shin Nippon's NAV has increased by

2.9% versus an increase of 7.6% in the comparative index. Over ten

years, Shin Nippon's NAV has increased by 310.4% compared to an

increase of 150.1% in the MSCI Japan Small Cap Index.

Numerous macro headwinds and the lingering effects of Covid-19

have led to poor share price performance at many of our internet

companies. Infomart, Japan's leading online food ordering platform,

was one such poor performer. The significant decline in eating out

naturally hit a company that is connecting suppliers with

restaurants. Despite this extraordinarily tough environment,

Infomart has grown its sales over the past year and is returning to

higher profitability. Its recently started electronic invoicing

business is gaining traction as well. We remain attracted by the

opportunities in both segments and are hopeful that the market will

re-evaluate Infomart on the back of its improving fundamentals.

Online legal website Bengo4.com similarly remains out of fashion

despite maintaining a high growth rate in sales and a very

significant increase in profitability. Its electronic signature

segment 'CloudSign' has established itself as the industry standard

in Japan to the extent that management is now focusing on improving

margins rather than just growing sales.

Another detractor to performance was biotech company Healios.

Unfortunately, its main drug failed to show improved patient

outcomes in a clinical trial, so we decided to sell the

holding.

Among the positive contributors was insurance company Lifenet.

It is the leading online life insurer in Japan albeit with a still

very small share of the overall market. Lifenet's sales growth

recently accelerated, and the company is edging closer to

profitability. It continues to partner with major enterprises in

Japan, like mobile provider KDDI and credit card company Sumitomo

Mitsui Card. The opportunity remains significant, and we continue

to believe that Lifenet is much nimbler than incumbent insurance

companies and will therefore be able to take market share for a

long period of time. Drugstore chain MatsukiyoCocokara was another

strong performer. As referenced in the interim report, the company

recently acquired a smaller competitor and is benefitting from the

resultant synergies, leading to increased profitability for the

group as a whole. A large proportion of its sales come from

cosmetics which means that it should benefit from a recovery in

inbound tourism. Japanese cosmetics are highly appreciated,

especially by Chinese consumers, and MatsukiyoCocokara is well

placed to satisfy any future increases in demand.

Another beneficiary of Japan's reopening is Kamakura Shinsho, an

online platform for funerals and end-of-life related services.

In-person funerals have resumed in earnest in Japan following the

removal of all Covid-era restrictions. This has allowed the company

to re-accelerate its sales growth and boost its profitability which

took a significant hit during Covid-19. The funeral industry in

Japan remains deeply conservative and is characterised by very high

prices. Kamakura Shinsho continues to disrupt this unhappy

status-quo to give consumers better choices. Its growth runway

remains significant.

Portfolio

Reflecting our bottom-up stock-picking approach, Shin Nippon's

active share remains high at 94%. This implies only a 6% overlap

with the comparative index. The portfolio turnover for the

financial year was 13.8% which is in line with our long investment

horizon of five to ten years.

We purchased seven new holdings in the financial year, including

one private company. They represent an eclectic range of industries

which illustrates our non-dogmatic approach to investing. Among the

new holdings was Avex, one of Japan's leading music entertainment

businesses. Led by the founder, who remains in the role of chair,

management used the pandemic disruption to aggressively streamline

the business and bolster the balance sheet. With a return to

normality, Avex should benefit from a recovery in the live music

industry and its strong net cash position will allow it to

strengthen its competitive position.

Within cosmetics we discovered and invested in the Osaka-based

company I-ne. The company name stands for "Innovation never ends".

This relatively young business specialises in female haircare

products. Despite entering a competitive market, it has

consistently boasted mid-teen percentage revenue growth. New

products have grown even faster. True to its name, the company is

utilising new and innovative techniques like artificial

intelligence to analyse product-market fit and customer feedback.

This in turn is driving product development and the company has a

good track record of developing hit products. We are attracted by

the growth prospects and believe that margins can significantly

improve in the future. Furthermore, the founder retains a 70% stake

in the company which should provide good alignment.

We also invested in two niche manufacturing businesses: Nittoku

and Kohoku Kogyo. Both have significant global market share in

their respective business areas. Nittoku produces cutting-edge coil

winding machinery. Coils are found in virtually every electronic

product, but the real attraction is a continuous endeavour to

reduce their size and improve performance. The former is

particularly important for mobile handsets, where the number of

coils jumped from eight in a 4G handset to 40 in 5G. The latter is

of significance for electric vehicles as better coils lead to

increased performance. Kohoku Kogyo is similarly exposed to

electric vehicles. The company produces lead terminals for

aluminium electrolytic capacitors. Compared to an internal

combustion engine car, an electric vehicle requires two to four

times as many capacitors. Given the high-performance requirements

and high value-add, Kohoku's products are priced at a premium and

this should allow the company to improve its margins over time. It

also produces optical isolators for undersea internet data cables,

an area in which we have seen increased activity by both nation

states and private companies such as Alphabet and Meta.

In the private company space, we invested in plastic recycling

company JEPLAN. In contrast to conventional mechanical recycling

methods, JEPLAN utilises a novel chemical method to recycle PET and

polyester. JEPLAN's approach is environmentally friendly, scalable

and highly energy efficient. It is working with companies like

Coca-Cola Japan and Nestlé Japan in the food and drink sector as

well as apparel brands like Uniqlo and Snow Peak. Despite being

quite small and private, the company is already generating a decent

level of sales and is close to profitability.

Software company SpiderPlus was another addition to the

portfolio. It offers software as a service ('SaaS') solutions for

the management of construction sites. The construction industry in

Japan is very large and has barely been digitised. Even more

importantly, it is plagued by an ageing and shrinking workforce and

a large number of unfilled positions. Tools to make workers more

efficient are therefore very valuable and Spiderplus' product

enables significant time and cost savings. The company is led by a

dynamic founder with a background in construction subcontracting

and we admire the ambition he has for his company.

We exited nine holdings over the financial year. Among them was

CyberAgent, a media company offering online advertisement, mobile

games and online television. Having been held since 2013, the share

price has increased markedly, and its advertising and gaming end

markets are mature and becoming more competitive. As such, we

struggled to see the company growing its sales and profits

significantly from here. A somewhat idiosyncratic case was

specialist financial software company Uzabase. A private equity

company announced its intention to acquire Uzabase at a 72% premium

which we felt was attractive and therefore decided to tender our

shares. While still somewhat unusual in Japan, we have noted an

increase in private equity activity over the past few years.

We also sold Aeon Delight, a building security and maintenance

company. Contrary to our original investment hypothesis, the

company has been unable to diversify its client base meaningfully

beyond its parent company Aeon. We also had high hopes for the

company in the Chinese market which remains large and fragmented

but even here, management have not shown the drive and dynamism to

seize the opportunity, opting to adopt a more piecemeal approach

instead.

Outlook

Given the scale and speed of the downturn in high growth stocks

post-Covid, we remain very conscious that this has negatively

affected Shin Nippon's short and longer-term performance. However,

this has also meant that growth stocks are now priced at levels

that assume barely any future increase in revenues or profits,

which is in stark contrast to their underlying fundamentals.

Despite the discomfort from volatility, we believe it is important

to stay true to our stated investment philosophy and process which

has served shareholders well over longer periods of time. Being

patient and seeing through market noise increases our chances of

picking exceptional companies that will deliver attractive

long-term returns.

As Japan slowly moves out of Covid-19, the focus will return to

long-term challenges. A shrinking labour force calls for increased

digitalisation and more efficient ways of working. Global warming

and high energy prices provide motivation to decarbonise the

Japanese and global economy. The inexorable shift to electric

vehicles requires a recalibration of the auto industry. Geopolitics

is leading to a reshaping of the semiconductor industry. All these

challenges call for dynamic and nimble enterprises, run by bold

entrepreneurs willing to seize the myriad of opportunities that

these changes are creating. We believe Japanese smaller companies

are at the forefront of enabling many of these industry shifts,

thereby providing an exciting array of investment

opportunities.

Baillie Gifford & Co

21 March 2023

Source: Refinitiv/Baillie Gifford and relevant underlying index

providers. See disclaimer at the end of this announcement.

Past performance is not a guide to future performance.

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement.

Valuing Private Companies

We hold our private company investments at an estimation of

'fair value', i.e. the price that would be paid in an open-market

transaction. Valuations are adjusted both during regular valuation

cycles and on an ad hoc basis in response to 'trigger events'. Our

valuation process ensures that private companies are valued in both

a fair and timely manner.

The valuation process is overseen by a valuations committee at

Baillie Gifford, which takes advice from an independent third party

(S&P Global). The valuations committee is independent from the

portfolio managers, as well as Baillie Gifford's Private Companies

Specialist team, with all voting members being from different

operational areas of the firm, and the portfolio managers only

receive final valuation notifications once they have been

applied.

We revalue the private holdings on a three-month rolling cycle,

with one-third of the holdings reassessed each month. For Baillie

Gifford Shin Nippon, and our other investment trusts, the prices

are also reviewed twice per year by the respective boards and are

subject to the scrutiny of external auditors in the annual audit

process.

Recent market volatility has meant that recent pricing has moved

much more frequently than would have been the case with the

quarterly valuations cycle.

Beyond the regular cycle, the valuations committee also monitors

the portfolio for certain 'trigger events'. These may include

changes in fundamentals, a takeover approach, an intention to carry

out an Initial Public Offering ('IPO'), company news which is

identified by the valuation team or by the portfolio managers or

changes to the valuation of comparable public companies.

The valuations committee also monitors relevant market indices

on a weekly basis and update valuations in a manner consistent with

our external valuer's (S&P Global) most recent valuation report

where appropriate. When market volatility is particularly

pronounced the team does these checks daily. Any ad hoc change to

the fair valuation of any holding is implemented swiftly and

reflected in the next published net asset value. There is no

delay.

Review of Investments

A review of some of the Company's new acquisitions together with

a list of the ten largest investments is given below.

Top Ten

Litalico

2.7% of total assets

Litalico provides training and employment assistance for

disabled people and educational services for children with

developmental difficulties. It targets the roughly five million

adults and children in Japan who suffer from cognitive and mental

disabilities. The Japanese government has put in place policies to

improve access and employment opportunities for disabled people.

This should benefit the likes of Litalico that is one of the few

players with nationwide coverage. The company is also developing

new businesses to support its core operation of providing training

and employment. These include computer programming for kids,

financial planning for families with disabled members, and after

school and day-care services. We think the growth opportunity for

the company could be quite attractive given these tailwinds. It is

run by a young and dynamic President who owns a large stake in the

business.

Nakanishi

2.5% of total assets

Nakanishi manufactures dental equipment, specialising in rotary

cutting tools (handpieces), where it is one among the few leading

players globally. Whilst developed economies are fairly mature in

terms of trends in dental health care, there is significant growth

in emerging economies as standards of living rise and hygiene

regulations are tightened. Nakanishi looks particularly well placed

to exploit growth in the Chinese market where it has a leading

market share at the higher end of the market. The company is very

profitable and has had a good record of growth since listing in

2000. It is also run by the founding Nakanishi family who own a

significant stake in the business, thereby ensuring strong

alignment with minority shareholders.

Shoei

2.5% of total assets

Shoei is the leading manufacturer of premium motorcycle helmets

globally. The market is expanding thanks to growth in emerging

markets and barriers to entry are high given the strict safety

requirements. Shoei has been operating in this niche market for

over four decades and has established a strong and globally

recognised brand. It operates exclusively at the premium end of the

market and therefore, is able to make very high margins and

returns. The company is run by a dynamic and sensible management

team that have sought to maintain the high-end nature of its

products and continue to engage in innovative product

development.

Descente

2.5% of total assets

Descente is a sportswear manufacturer. It has a portfolio of

owned and licensed brands which include names like Descente, Le Coq

Sportif, Umbro and Srixon. Its portfolio of brands varies by price

and category. For example, Descente is predominantly a high-end

skiing and active-wear brand whereas Umbro is more of a mid-market

brand best known for football. It has a heritage in performance

sportswear, backed by research and development, which feeds into

its product range, particularly at the higher end. Roughly 50% of

its revenue comes from South Korea and 40% from Japan. China is a

big opportunity for Descente where it has a joint venture with Anta

Sports, China's largest sportswear brand by revenue. It appointed a

new President in June 2019 signalling less of a reliance on the

founding family. This followed on from trading house Itochu upping

its stake in Descente to around 40%. This rejig should give

Descente fresh impetus and it has set out plans to be more

aggressive in China and refocus on profitability in Japan. It also

seems confident that a downturn in its South Korea business is

temporary in nature. On top of this, Olympic sporting years are

ahead in both Japan and China. This along with health and

well-being increasingly becoming a policy lever should be helpful.

Overall, an improving demand backdrop along with a more focused

strategy should mean sales and profit can grow meaningfully from

here.

TechnoPro

2.5% of total assets

TechnoPro is a technology-focused staffing company. It supplies

engineers to the machinery, electrical, electronics, information

systems, software, biotechnology, construction and energy sectors.

It is well placed to benefit from structural growth drivers such as

the labour shortage in Japan. The IT industry is witnessing severe

shortages of labour and as the leading provider of engineers to

this sector, TechnoPro is well positioned to enjoy strong growth

for many years.

Snow Peak

2.4% of total assets

Snow Peak is Japan's leading brand of high-end camping items

with a line-up of roughly 800 products. It has a strong reputation

within Japan's camping community and has a dedicated and growing

user-base. Camping as a recreational activity is seeing strong

growth in Japan as an increasing number of 'second' baby boomers

(those born in the early 1970s) and young families embrace this

form of recreation. In the US, where the company is expanding

aggressively, roughly 1 in 3 households now undertake camping,

representing a large market for Snow Peak. The company is run by a

father (founder) and daughter duo who between them own nearly 30%

of the company, thereby ensuring strong alignment. The daughter is

the chief designer of Snow Peak's products and has a background in

fashion and design. We think the long-term growth prospects for the

company could be quite exciting given the favourable industry

background and its strong brand.

MatsukiyoCocokara

2.3% of total assets

MatsukiyoCocokara is a leading drugstore in Japan. It was formed

through the merger of Matsumotokiyoshi, a high end cosmetics

retailer, and Cocokara Fine, a drugstore. The combined entity now

holds among the largest market share by number of stores in Japan.

The integration of both businesses has been progressing well and

there are considerable synergies to be had from joint procurement

and operational rationalisation. The combined entity has been

realising these merger benefits, leading to rising margins. In

addition, the cosmetics business should be a big beneficiary of

inbound tourism whereas the drugstore part should have long-term

structural growth opportunities due to Japan's demographics.

Toyo Tanso

2.2% of total assets

Toyo Tanso makes speciality carbon products and has a leading

global share in isotropic graphite used in renewable energy

equipment and semiconductor manufacturing. It also has a leading

global share in silicon carbide coated graphite materials that are

used in the manufacture of compound semiconductors. Due to its

excellent heat resistance and durability, Toyo Tanso's isotropic

graphite is a key consumable part of the heaters and crucibles used

in the manufacturing process of monocrystal silicon which is the

raw material for solar-cell devices and semiconductors. Both

markets are expected to see strong growth in the coming years,

thanks to the proliferation of devices that are using an increasing

number of chips in them as well as the emphasis on increasing the

use of renewable energy. Toyo Tanso's isotropic graphite and

silicon carbide coated devices are high margin products and given

the favourable industry backdrop, we believe this has the potential

of transforming the company's margin and returns profile. This is a

family run business with nearly 30% of the company being held by

the family and related investment vehicles. We think this ensures

strong long-term alignment with minorities.

Lifenet Insurance

2.2% of total assets

Lifenet Insurance is a fast-growing online life insurance

business. It offers plain-vanilla life insurance products and sells

predominantly through its own online platform. Its

direct-to-consumer model allows it to price competitively,

potentially an enduring competitive advantage. Incumbent peers tend

to operate people-heavy distribution channels and are burdened with

an ill-fitting cost base. Lifenet's customer centricity is backed

by skills and expertise in systems development. It is a mix between

an insurer and an internet-services business. We think this

combination is attractive. Indeed, third-party businesses in Japan

are increasingly keen to team up with Lifenet. The regulatory

environment in Japan makes it difficult for new entrants to write

business on their own books, this is further help for Lifenet. We

think Lifenet is an ambitious and nimble business attacking a huge,

rather stale, industry.

Optex

2.1% of total assets

Optex is a global leader in infrared and laser sensors used in

areas such as surveillance systems, intrusion detection and factory

automation. More recently, the company has been successful in

expanding the areas of application for its sensors, a couple of

examples being in remote monitoring of customer facilities and

acceleration sensors that measure how safely people drive cars

(which is then used for calculating insurance premiums for

customers). The number of growing areas of applications for its

sensors means that Optex is well placed to enjoy high growth rates

for many years.

New Buys

GMO Financial Gate

1.6% of total assets

GMO Financial Gate ('GMOFG') is a leading offline digital

payments provider. Unlike online digital payments that happen

exclusively over the internet, offline digital payments take place

either at a physical store or at IoT enabled terminals like vending

machines, ticketing machines, self-checkout terminals and automated

parking meters. Offline transactions also typically involve the use

of a terminal (card reader, QR code scanner etc.) that supports a

wide range of payment methods like credit/debit cards, points cards

and QR codes. While most payments companies in Japan operate in the

online payments space and continue to focus all their energies in

this area, the offline market has basically been left uncontested.

GMOFG has filled this gap and is looking to automate what remains a

very large addressable market, many magnitudes larger than the

market for online payments. Along with offering automated offline

payments solutions like transaction processing and terminal sales,

GMOFG has also partnered with VISA and Sumitomo Mitsui Financial

Group (one of Japan's largest credit card issuers) to build an

alternate offline payments network that is low cost and much faster

compared to traditional networks operated by other card companies.

It has also developed a terminal called 'Stera' that operates

exclusively on this new network and supports an extensive range of

payment methods. Stera also comes with an 'App Store' style option

for merchants from where they can download and install seamlessly a

range of applications that help them with things like inventory

management and electronic invoicing. As part of the GMO group,

GMOFG has a very strong edge in terms of being part of the GMO

ecosystem and can offer end-to-end solutions to the considerable

client base of the GMO Group. The company has been growing rapidly

and given all the attractions mentioned above, growth here could be

sustained for many years to come.

Avex

1.4% of total assets

Avex is one of the largest music entertainment businesses in

Japan. The company has a proven record in discovering domestic

artists and managing and developing their careers. It has

successfully promoted several million-record selling artists in

Japan. Avex is now expanding in other related areas such as visual

software and targeting overseas markets. The pandemic has severely

disrupted the business as no live events or shows have been held

for at least a couple of years. Management have sold some assets to

strengthen their balance sheet and have also managed to sell some

of their treasury shares to longstanding shareholder and business

partner CyberAgent. This has resulted in a significant net cash

position on Avex's balance sheet. As the pandemic-era restrictions

are removed, we should see a strong snap back in sales and profit

growth for Avex, and along with its rock-solid balance sheet, we

feel the company could be in prime position to invest aggressively

to further strengthen its competitive position. The founder is

still involved in the business as the Chair owns about 7% of the

company, and the rest of the management team are longstanding Avex

employees, so overall there appears to be strong alignment.

Nittoku

1.0% of total assets

Nittoku is a leading global manufacturer of coil winding

systems. Its coil winding machines enjoy a high global market share

percentage and the overall industry is characterised by a rational

oligopoly. Coils are used in a number of attractive end markets,

the most prominent of which are the automotive industry and mobile

handsets. In automotive, there is a long standing trend of

motorising parts like windows and doors all of which require an

increasing number of coils. However, the most important development

is the move to electric vehicles. EVs rely on large, complex coils

in the car engine itself. Given Nittoku's expertise in high quality

coil winding the company should see increased demand from

automobile OEMs. In mobile handsets, we can observe a similar

trend: a 5G handset uses far more advanced coils than a 4G handset.

With consumers slowly switching over to better mobile phones we see

a very long growth runway for Nittoku.

JEPLAN

0.9% of total assets

JEPLAN is a private company that has developed a proprietary

chemical recycling technology for polyethylene terephthalate

('PET') plastics. This technology can also be extended to recycling

apparels. JEPLAN's technology is the only production-proven

chemical recycling method that has been certified by the USFDA.

Chemical recycling is superior to existing and conventional

mechanical recycling. It removes significant amounts of impurities

from recycled materials thereby generating high grade virgin PET

that is far superior to that generated by conventional mechanical

recycling. Chemical recycling is also more energy efficient,

environmentally friendly and scalable than existing mechanical

recycling methods. Following an independent external audit, JEPLAN

claim that their novel chemical recycling process contributes to as

much as a 45% reduction in greenhouse gases relative to mechanical

recycling. While the price of chemically recycled virgin PET is not

yet competitive versus mechanical recycled PET, JEPLAN aims to

achieve parity in 3-5 years through additional capacity additions

and further process improvements. JEPLAN already boasts of an

impressive client list that includes the likes of Coca-Cola Japan,

Uniqlo, Snow Peak, Nestlé Japan, Kirin, Suntory and Kao, to name a

few. The global market for recycled PET is sizeable and JEPLAN

currently only has a tiny share, so there should be many years of

growth ahead for the company. It is a founder run company and the

two co-founders own roughly a third of the shares between them.

SpiderPlus

0.8% of total assets

SpiderPlus is aiming to digitise Japan's construction industry.

The company provides architectural drawing and construction site

management software. Foremen on construction sites can use

SpiderPlus' SaaS offering to save significant time previously spent

on administrative duties. SpiderPlus is led by a founder with a

background in the construction industry and the company is

characterised by a closeness to their customers and a keen desire

to solve their problems. The overall construction market in Japan

is massive but IT spend is a tiny fraction of this, meaning that

SpiderPlus potentially has a very long growth runway. Given this

opportunity set, management are unsurprisingly pursuing sales

growth and are willing to incur temporary losses.

Kohoku Kogyo

0.7% of total assets

Kohoku Kogyo is a leading global manufacturer of lead terminals

for aluminium electrolytic capacitors and optical isolators for

undersea cables. The company enjoys a high market share in both

aluminium electrolytic capacitators and optical isolators. Lead

terminals are used in a variety of end products, from home

appliances to electric vehicles. The main growth driver is in

battery electric vehicles, which require 2-4x as many capacitors as

internal combustion engine vehicles. Given the higher requirements

and premium nature of the product, these lead terminals are 5-7x as

profitable as more commoditised terminals. The optical isolator

segment is buoyed by significant investment in undersea cables to

improve global internet connectivity. This is pursued by both

national governments as well as private players such as Alphabet

and Meta.

I-ne

0.5% of total assets

I-ne is a small Osaka-based cosmetics company founded by a young

entrepreneur who owns nearly 70% of the business. The company's

main area of focus is female hair care and for a young company, it

already boasts a very high market share and brand recognition.

Despite being introduced over five years ago and in a market that

is very competitive and saturated with similar products, I-ne's

hair care range has continued to grow at a high rate since launch.

Interestingly, some of the newer products they have launched are

growing at an even faster pace. The company makes extensive use of

AI-driven data analytics, all of which have been developed

in-house, to gather market intelligence and user feedback which

they then feed into their product development process. We believe

the company has good growth prospects given its unique product

development model and a proven track record of developing hit

products on a reasonably consistent basis.

Baillie Gifford Statement on Stewardship

Baillie Gifford's over-arching ethos is that we are 'actual'

investors. We have a responsibility to behave as supportive and

constructively engaged long-term investors. We invest in companies

at different stages in their evolution, across vastly different

industries and geographies and we celebrate their uniqueness.

Consequently, we are wary of prescriptive policies and rules,

believing that these often run counter to thoughtful and beneficial

corporate stewardship. Our approach favours a small number of

simple principles which help shape our interactions with

companies.

Our Stewardship Principles

Prioritisation of long-term value creation

We encourage our holdings to be ambitious and focus their

investments on long-term value creation. We understand that it is

easy to be influenced by short-sighted demands for profit

maximisation but believe these often lead to sub-optimal long- term

outcomes. We regard it as our responsibility to steer holdings away

from destructive financial engineering towards activities that

create genuine economic and stakeholder value over the long run. We

are happy that our value will often be in supporting management

when others don't.

A constructive and purposeful board

We believe that boards play a key role in supporting corporate

success and representing the interests of all capital providers.

There is no fixed formula, but it is our expectation that boards

have the resources, information, cognitive and experiential

diversity they need to fulfil these responsibilities. We believe

that good governance works best when there are diverse skillsets

and perspectives, paired with an inclusive culture and strong

independent representation able to assist, advise and

constructively challenge the thinking of management.

Long-term focused remuneration with stretching targets

We look for remuneration policies that are simple, transparent

and reward superior strategic and operational endeavour. We believe

incentive schemes can be important in driving behaviour, and we

encourage policies which create genuine long-term alignment with

external capital providers. We are accepting of significant payouts

to executives if these are commensurate with outstanding long-run

value creation, but plans should not reward mediocre outcomes. We

think that performance hurdles should be skewed towards long-term

results and that remuneration plans should be subject to

shareholder approval.

Fair treatment of stakeholders

We believe it is in the long-term interests of all enterprises

to maintain strong relationships with all stakeholders - employees,

customers, suppliers, regulators and the communities they exist

within. We do not believe in one-size-fits-all policies and

recognise that operating policies, governance and ownership

structures may need to vary according to circumstance. Nonetheless,

we believe the principles of fairness, transparency and respect

should be prioritised at all times.

Sustainable business practices

We believe an entity's long-term success is dependent on

maintaining its social licence to operate and look for holdings to

work within the spirit and not just the letter of the laws and

regulations that govern them. We expect all holdings to consider

how their actions impact society, both directly and indirectly and

encourage the development of thoughtful environmental practices.

Climate change, environmental impact, social inclusion, tax and

fair treatment of employees should be addressed at board level,

with appropriately stretching policies and targets focused on the

relevant material dimensions. Boards and senior management should

understand, regularly review and disclose information relevant to

such targets publicly, alongside plans for ongoing improvement.

Corporate Governance and Sustainability Engagement

By engaging with companies, we seek to build constructive

relationships with them, to better inform our investment activities

and, where necessary, effect change within our holdings, ultimately

with the goal of achieving better returns for our shareholders. The

two examples below demonstrate our stewardship approach through

constructive, ongoing engagement.

Outsourcing

Outsourcing is a staffing company focused on the manufacturing

and IT sectors. Outsourcing came under scrutiny in 2021 after

accounting irregularities were revealed at a major consolidated

subsidiary. We have had a number of engagements with the company

since that time to better understand the context for the internal

failures in controls and to encourage management and the board to

improve not just processes but also the cultural elements that

created the conditions for the fraudulent behaviour. We have been

encouraged by their progress, and this year was notable for two

reasons. The first is their decision to change their governance to

an internationally recognised board-with-three committees

structure. This places them within a select cohort of approximately

2.5% of quoted companies in Japan (as of 2022). The second is their

observation that as a result of an externally facilitated board

evaluation, they discovered that there were differences in the

information available to internal and external directors. This led

to a rethink about how they increase the external directors'

understanding of the business and facilitate their involvement in

important internal meetings. These are both helpful indications

that not only is the company pursuing proactive changes to address

the specifics of the 2021 controversy, the second and third-order

effects are improving governance overall, in line with a company

whose governance must mature as its business does.

Istyle

Istyle operates in a range of cosmetic beauty segments. They run

a beauty portal, a marketing business, e-commerce sites and a

staffing business for salons. Ahead of their 2022 AGM we engaged

with the company to discuss board independence, their deal with

Amazon and emissions reporting. Board independence has been a

recurring topic of conversation and we were encouraged that they

intended to appoint a new non-Japanese, female outside director in

2022. They were particularly interested in someone who can bring

expertise in diversity and support women's progression within the

company. This recruitment was delayed due to the Amazon deal, but

they expected it to proceed in 2023. On the recent convertible bond

deal with Amazon, board positions and independence were also

discussed, as granting Amazon a seat on the board would have

impacted the independence. Lastly, the discussion covered Istyle's

approach to emissions reporting. They are currently exploring the

ways in which they impact the environment and are undertaking

various sustainability initiatives. The meeting provides an

illustrative example of how our engagements build year on year and

evolve and develop in line with a company's development and market

context.

List of Investments as at 31 January 2023

Name Business 2023 % of Absolute 2022

Value total Performance Value

GBP'000 assets % GBP'000

Provides employment support

and learning

support services for people

Litalico with disabilities 17,296 2.7 (10.3) 17,425

Nakanishi Dental equipment 16,153 2.5 32.7 8,378

Shoei Manufactures motor cycle helmets 15,876 2.5 11.8 14,971

Descente Manufactures athletic clothing 15,573 2.5 (2.4) 17,512

TechnoPro IT staffing 15,571 2.5 36.7 14,269

Designs and manufactures outdoor

lifestyle

Snow Peak goods 14,943 2.4 (10.2) 17,097

MatsukiyoCocokara Retail company 14,731 2.3 61.5 11,067

Toyo Tanso Electronics company 14,181 2.2 38.6 5,301

Lifenet Insurance Online life insurance 13,364 2.2 98.5 4,690

Optex Infrared detection devices 13,314 2.1 37.3 5,606

Raksul Inc Internet based services 12,867 2.0 (27.2) 14,841

Torex Semiconductor Semiconductor company 12,857 2.0 (0.1) 14,020

eGuarantee Guarantees trade receivables 12,543 2.0 26.1 10,002

Katitas Real estate services 12,455 2.0 (10.7) 18,818

Sho-Bond Infrastructure reconstruction 12,445 2.0 8.7 16,518

Manufacturer of automated

Tsugami machine tools 12,250 1.9 8.0 14,359

GA Technologies Interactive media and services 11,594 1.8 29.1 6,282

Manufactures machine tool

OSG equipment 11,135 1.8 0.1 9,915

Nifco Value-added plastic car parts 10,574 1.7 (0.6) 10,837

Develops and markets internet

and intranet

application software for

Cybozu businesses 10,534 1.7 80.7 8,817

------------------------ --------------------------------- -------- ------- ------------ --------

Top 20 270,256 42.8

------------------------ --------------------------------- -------- ------- ------------ --------

Megachips Electronic components 10,209 1.6 (35.7) 16,415

Face-to-face payment terminals

and processing

GMO Financial Gate services 10,181 1.6 31.7 (#) -

Cosmos Pharmaceuticals Drugstore chain 9,900 1.6 (13.9) 8,942

Yonex Sporting goods 9,828 1.6 72.2 5,497

Harmonic Drive Robotic components 9,342 1.5 (5.8) 9,715

Tsubaki Nakashima Industrial machinery 9,069 1.4 (20.6) 11,275

Entertainment management and

Avex distribution 8,960 1.4 65.5 (#) -

Kamakura Shinso Information Processing Company 8,937 1.4 102.7 3,455

Holding company with interests

in biotech and

Noritsu Koki agricultural products 8,886 1.4 24.2 9,440

Asahi Intecc Specialist medical equipment 8,774 1.4 12.0 3,984

Iriso Electronics Specialist auto connectors 8,500 1.4 (8.5) 8,590

Specialised agrochemicals

Kumiai Chemical manufacturer 8,200 1.3 10.2 5,986

Nihon M&A Center M&A advisory services 7,907 1.2 (28.2) 9,201

Manufactures compressors and

painting

Anest Iwata machines 7,852 1.2 12.6 6,658

Drug discovery and development

Peptidream platform 7,829 1.2 (5.1) 6,844

Manufacturer of measuring

Horiba instruments 7,775 1.2 (3.0) 9,719

Internet platform for restaurant

Infomart supplies 7,751 1.2 (39.0) 12,525

Kitanotatsujin Online retailer 7,492 1.2 46.4 5,212

KH Neochem Chemical manufacturer 7,436 1.2 (6.6) 8,172

GMO Payment Gateway Online payment processing 7,351 1.2 18.0 12,520

Seria Discount retailer 7,120 1.1 (2.8) 5,533

Outsourcing Employment placement services 7,076 1.1 (24.9) 8,423

Wealthnavi Digital robo wealth-management 7,074 1.1 (16.0) 8,795

Weathernews Weather information services 6,935 1.1 (11.1) 7,705

Enechange IT service management company 6,922 1.1 (30.7) 7,581

Manufacturer of scientific

Jeol equipment 6,878 1.1 (40.1) 19,044

Inter Action Semiconductor equipment 6,813 1.1 (26.3) 6,193

SIIX Out-sources overseas production 6,579 1.0 6.2 5,448

MonotaRO Online business supplies 6,552 1.0 2.1 10,499

Bengo4.com Online legal consultation 6,488 1.0 (45.9) 8,883

Nabtesco Robotic components 6,449 1.0 4.8 8,622

Nittoku Coil winding machine manufacturer 6,403 1.0 34.6 (#) -

JEPLAN (u) Chemical PET recycling 5,653 0.9 (6.6) (#) -

Gojo & Company Inc Class

D Preferred (u) Diversified financial services 5,650 0.9 7.3 5,266

Crowdworks Crowd sourcing services 5,481 0.9 75.3 2,903

Shima Seiki Machine industry company 5,402 0.9 9.3 1,082

Kitz Industrial valve manufacturer 5,352 0.8 23.9 4,520

Construction project management (28.1)

SpiderPlus platform 5,347 0.8 (#) -

Spiber (u) Synthetic spider silk 5,131 0.8 (27.9) 7,116

Industrial pumps and medical

Nikkiso equipment 5,017 0.8 19.4 3,730

Game testing and internet

Poletowin Pitcrew monitoring 4,948 0.8 (8.9) 5,399

Nippon Ceramic Electronic component manufacturer 4,882 0.8 (0.9) 5,246

WDB Holdings Human resource services 4,465 0.7 (21.9) 5,953

Manufacturer of lead terminals

for aluminium

electrolytic capacitors and

optical isolators for

Kohoku Kogyo undersea cables 4,374 0.7 (6.5) (#) -

Pigeon Baby care products 4,171 0.7 (8.4) 3,742

Freakout Holdings Digital marketing technology 4,097 0.6 5.7 3,309

Demae-Can Online meal delivery service 3,947 0.6 (44.3) 1,942

M3 Online medical services 3,454 0.5 (22.0) 5,733

I-ne Hair care range 3,111 0.5 24.3 (#) -

Calbee Branded snack foods 3,062 0.5 9.8 2,891

Develops and provides enterprise

planning

oRo software 2,991 0.5 (21.5) 5,341

Daikyonishikawa Automobile part manufacturer 2,837 0.4 3.8 3,529

Akatsuki Mobile games developer 2,833 0.4 (14.0) 4,732

Brainpad Business data analysis 2,472 0.4 (36.5) 4,604

Locondo E-commerce services provider 2,401 0.4 (12.7) 3,722

Moneytree K.K. Class B

Preferred (u) AI based fintech platform 2,312 0.4 (45.4) 4,234

Istyle Beauty product review website 1,516 0.2 149.3 2,383

Online platform for buying

Broadleaf car parts 1,292 0.2 26.3 2,930

------------------------ --------------------------------- -------- ------- ------------ --------

Total investments 625,922 98.8

Net liquid assets * 7,544 1.2

Total assets 633,466 100.0

Bank loans (88,013) (13.9)

Shareholders' funds 545,453 86.1

------------------------ --------------------------------- -------- ------- ------------ --------

Absolute performance (in sterling terms) has been calculated on

a total return basis over the period 1 February 2022 to 31 January

2023.

Source: Baillie Gifford/Statpro and relevant underlying data

index providers. See disclaimer at end of this document.

# Figures relate to part period returns where the investment has

been purchased in the period.

u Unlisted holding (private company).

* See Glossary of Terms and Alternative Performance Measures at

the end of this announcement.

Past performance is not a guide to future performance.

Income Statement

For the year ended 31 January

2023 2023 2023 2022 2022 2022

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- ----- -------- -------- -------- -------- --------- ---------

Losses on investments - (12,749) (12,749) - (182,288) (182,288)

Currency gains 2 - 2,214 2,214 - 4,612 4,612

Income 9,617 - 9,617 7,436 - 7,436

Investment management

fee 3 (3,154) - (3,154) (4,048) - (4,048)

Other administrative

expenses (679) - (679) (684) - (684)

---------------------------- ----- -------- -------- -------- -------- --------- ---------

Net return before finance

costs and taxation 5,784 (10,535) (4,751) 2,704 (177,676) (174,972)

---------------------------- ----- -------- -------- -------- -------- --------- ---------

Finance costs of borrowings 4 (1,332) - (1,332) (1,064) - (1,064)

---------------------------- ----- -------- -------- -------- -------- --------- ---------

Net return before taxation 4,452 (10,535) (6,083) 1,640 (177,676) (176,036)

---------------------------- ----- -------- -------- -------- -------- --------- ---------

Tax on ordinary activities (962) - (962) (744) - (744)

---------------------------- ----- -------- -------- -------- -------- --------- ---------

Net return after taxation 3,490 (10,535) (7,045) 896 (177,676) (176,780)

---------------------------- ----- -------- -------- -------- -------- --------- ---------

Net return per ordinary

share 6 1.11p (3.35p) (2.24p) 0.29p (56.95p) (56.66p)

---------------------------- ----- -------- -------- -------- -------- --------- ---------

The total column of this statement is the profit and loss

account of the Company. The supplementary revenue and capital

return columns are prepared under guidance published by the

Association of Investment Companies.

All revenue and capital items in this statement derive from

continuing operations.

A Statement of Comprehensive Income is not required as all gains

and losses of the Company have been reflected in the above

statement.

Balance Sheet

As at 31 January

2023 2023 2022 2022

Notes GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- ----- -------- ----------- -------- -----------

Fixed assets

Investments held at fair value through

profit or loss 7 625,922 610,857

Current assets

Debtors 3,047 2,604

Cash and cash equivalents 6,946 33,505

--------------------------------------- ----- -------- ----------- -------- -----------

9,993 36,109

--------------------------------------- ----- -------- ----------- -------- -----------

Creditors

Amounts falling due within one year 8 (46,154) (3,212)

--------------------------------------- ----- -------- ----------- -------- -----------

Net current (liabilities)/assets (36,161) 32,897

--------------------------------------- ----- -------- ----------- -------- -----------

Total assets less current liabilities 589,761 643,754

--------------------------------------- ----- -------- ----------- -------- -----------

Creditors

Amounts falling due after more than

one year 8 (44,308) (91,102)

--------------------------------------- ----- -------- ----------- -------- -----------

Net assets 545,453 552,652

--------------------------------------- ----- -------- ----------- -------- -----------

Capital and reserves

Share capital 6,285 6,285

Share premium account 260,270 260,270

Capital redemption reserve 21,521 21,521

Capital reserve 257,719 268,408

Revenue reserve (342) (3,832)

--------------------------------------- ----- -------- ----------- -------- -----------

Shareholders' funds 545,453 552,652

--------------------------------------- ----- -------- ----------- -------- -----------

Net asset value per ordinary share 173.6p 175.9p

--------------------------------------- ----- -------- ----------- -------- -----------

Ordinary shares in issue 9 314,152,345 314,252,485

--------------------------------------- ----- -------- ----------- -------- -----------

Statement of Changes in Equity

For the year ended 31 January 2023

Share Capital Capital

Share premium redemption reserve Revenue Shareholders'

capital account reserve * reserve funds

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ----- -------- -------- ----------- -------- -------- -------------

Shareholders' funds at

1 February 2022 6,285 260,270 21,521 268,408 (3,832) 552,652

Ordinary shares bought

back into treasury 9 - - - (154) - (154)

Net return on ordinary

activities after taxation - - - (10,535) 3,490 (7,045)

--------------------------- ----- -------- -------- ----------- -------- -------- -------------

Shareholders' funds at

31 January 2023 6,285 260,270 21,521 257,719 (342) 545,453

--------------------------- ----- -------- -------- ----------- -------- -------- -------------

For the year ended 31 January 2022

Share Capital Capital

Share premium redemption reserve Revenue Shareholders'

capital account reserve * reserve funds

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBPí000

--------------------------- ----- -------- -------- ----------- --------- -------- -------------

Shareholders' funds at

1 February 2021 6,026 229,149 21,521 446,084 (4,728) 698,052

Ordinary shares issued 9 259 31,121 - - - 31,380

Net return on ordinary

activities after taxation - - - (177,676) 896 (176,780)

--------------------------- ----- -------- -------- ----------- --------- -------- -------------

Shareholders' funds at

31 January 2022 6,285 260,270 21,521 268,408 (3,832) 552,652

--------------------------- ----- -------- -------- ----------- --------- -------- -------------

* The capital reserve balance as at 31 January 2023 includes

investment holding gains of GBP60,696,000 (2022 - gains of

GBP55,061,000).

Cash Flow Statement

For the year ended 31 January

2023 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------- --------- -------- --------- --------

Cash flows from operating activities

Net return on ordinary activities

before taxation (6,083) (176,036)

Net losses on investments 12,749 182,288

Currency gains (2,214) (4,612)

Finance costs of borrowings 1,332 1,064

Overseas withholding tax (892) (677)

Increase in debtors, accrued income

and prepaid expenses (681) (591)

Increase/(decrease) in creditors 27 (220)

-------------------------------------------- --------- -------- --------- --------

Cash inflow from operations 4,238 1,216

Interest paid (1,292) (982)

-------------------------------------------- --------- -------- --------- --------

Net cash inflow from operating activities 2,946 234

-------------------------------------------- --------- -------- --------- --------

Cash flows from investing activities

Acquisitions of investments (137,003) (132,308)

Disposals of investments 108,576 90,619

-------------------------------------------- --------- -------- --------- --------

Net cash outflow from investing activities (28,427) (41,689)

-------------------------------------------- --------- -------- --------- --------

Shares issued - 31,995

Ordinary shares bought back into treasury

and stamp duty thereon (154) -

Bank loans repaid - -

Bank loans drawn down - 32,667

-------------------------------------------- --------- -------- --------- --------

Net cash (outflow)/inflow from financing

activities (154) 64,662

-------------------------------------------- --------- -------- --------- --------

(Decrease)/increase in cash and cash

equivalents (25,635) 23,207

Exchange movements (924) (140)

Cash and cash equivalents at 1 February 33,505 10,438

-------------------------------------------- --------- -------- --------- --------

Cash and cash equivalents at 31 January* 6,946 33,505

-------------------------------------------- --------- -------- --------- --------

* Cash and cash equivalents represent cash at bank and deposits

repayable on demand.

Notes to the Financial Statements

1. The Financial Statements for the year to 31 January 2023 have

been prepared in accordance with FRS 102 'The Financial Reporting

Standard applicable in the UK and Republic of Ireland' on the basis

of the accounting policies set out in the Annual Report and

Financial Statements for the year ended 31 January 2023.

2. Currency gains

2023 2022

GBP'000 GBP'000

----------------------------------- -------- --------

Exchange differences on bank loans 3,138 4,752

Other exchange differences (924) (140)

----------------------------------- -------- --------

2,214 4,612

----------------------------------- -------- --------

3. Investment Management Fee

2023 2022

GBP'000 GBP'000

-------------------------- -------- --------

Investment management fee 3,154 4,048

-------------------------- -------- --------

Baillie Gifford & Co Limited, a wholly owned subsidiary of

Baillie Gifford & Co, has been appointed as the Company's

Alternative Investment Fund Manager ('AIFM') and Company

Secretaries. Baillie Gifford & Co Limited has delegated

portfolio management services to Baillie Gifford & Co. Dealing

activity and transaction reporting have been further sub-delegated

to Baillie Gifford Overseas Limited and Baillie Gifford Asia (Hong

Kong) Limited.

The Investment Management Agreement sets out the matters over

which the Managers have authority in accordance with the policies

and directions of, and subject to restrictions imposed by, the

Board. The Management Agreement is terminable on not less than six

months' notice. Compensation fees would only be payable in respect

of the notice period if termination were to occur sooner. The

annual management fee for the year to 31 January 2023 was 0.75% on

the first GBP50m of net assets, 0.65% on the next GBP200m of net

assets and 0.55% on the remainder. The fees are calculated and paid

on a quarterly basis.

4. The Company paid interest of GBP37,000 (2022 - GBP48,000) in

respect of yen deposits held by the custodian bank.