RNS Number:5145N

CML Microsystems PLC

14 June 2005

CML MICROSYSTEMS Plc

PRELIMINARY RESULTS

Results in Line with Expectations; Confident Outlook

CML Microsystems Plc ("CML"), which designs, manufactures and markets a broad

range of semiconductor products, primarily for the global communications market,

announces its Preliminary Results for the year ending 31st March 2005.

CML's semiconductor solutions serve customers in the wire-line telecom, wireless

data, two-way radio, memory card controller and programmable platform markets.

Operations are in the UK, Germany, the US, Singapore, China and Taiwan.

Commenting on the results, George Gurry, Chairman said:

"Achieved the further improvement in performance that had been anticipated.

Turnover and operating profit both moved firmly ahead, despite pressures from

currency and marketplace issues mentioned at the interim stage and second half R

& D expenditure materially higher than originally planned."

Financial Highlights

* Turnover up 43% to #23.46m (2004: #16.32m)

* First full year contribution by Hyperstone, acquired July 2003

* Operating profit before amortisation of goodwill up to #2.1m (#0.2m)

* Pre-tax profit of #3k (2004: Loss #0.97m)

* Earnings per share of 2.66p (2004: Loss 5.28p)

* Net cash reserves increased to #4.07m (2004: #3.86m)

* Annual dividend of 10.5p per share unchanged (2004: 10.5p per share),

payable 5 August 2005

* Research & development expenditure grew 27% to #3.57m (2004: #2.81m).

Business Review

* Increased sales volume and market presence for controller devices for

memory card application produced best revenues; major European memory card

producer secured; competitive margins.

* Expected sales gains of radio and wireless communications market

products, second best performing revenue producer up 10%; improved gross

margins.

* Sales into traditional wireline telecom markets, up 4%, after weak

second half following strong first half.

* Sales in Far East up around 48% on 2004 - gains in Taiwan and PRC

sales.

* Sales in Europe doubled on previous year - progress in Germany,

Spain, Near-East territories.

* Underlying device sales in the Americas up 18%.

* New products / solutions for new sectors introduced second half, set

for imminent release current fiscal year.

Regarding Prospects, George Gurry, Chairman, said:

"I am encouraged by the further progress during the year, and with the

positioning advantages in its marketplaces that the group is progressively

beginning to achieve. I feel quite confident that the forward-looking

strategies employed will produce the expected success.

"Although the present trading year is at an early stage, my expectations are

that subject to unforeseen circumstances, your Company will continue to achieve

firm progress in its markets this year and to secure the consequent benefits. I

remain confident in the successful future of your Company."

ENDS

Enquiries:

CML Microsystems Plc www.cmlmicroplc.com Binns & Co PR

Nigel Clark, Financial Director 020 7786 9600 (today) Peter Binns, 020 7153 1485

Chris Gurry, Business Development Director 01621 875500 (thereafter) Paul McManus, 020 7153 1485

Or 07980 541 893

CHAIRMAN'S STATEMENT

PRELIMINARY RESULTS

I am pleased to report on a year that saw your Company achieve the further

improvement in performance that had been anticipated. Turnover and operating

profit both moved firmly ahead, despite pressures from the currency and

marketplace issues mentioned at the interim stage and R&D expenditure in the

second half that proved materially higher than originally planned. I am

particularly pleased to report that Hyperstone's first full year contribution

formed a healthy component in the Group's overall results.

Group turnover for the year ending 31 March 2005 rose by 43% to #23.46M (2004:

#16.32M), with a large proportion of this gain marked by the progress achieved

with increasing the sales volume and market presence for the Group's controller

devices aimed towards Memory Card applications. A major European memory card

producer is among customers contracted during the year.

Expected gains were also posted in sales of Group products into radio and

wireless communication markets, but sales for products into traditional wireline

telecom market areas were only slightly higher on a full year basis, resulting

from a weaker second half performance following the strong gains reported for

the opening half.

Gross margins returned by products targeted at communications markets may vary

quite widely according to the target market application, but are on average

higher than the gross margins typical in the case of the high volume memory card

products that contributed materially to the sales increase reported.

Although a simplistic direct connection would not be entirely appropriate to the

current Group results, the bias towards including higher volume but lower margin

product strategies has bearing on the overall gross margin achieved, which shows

a 5% reduction to 58% (2004: 63%).

Research and Development expenditure grew by 27% to #3.57M against #2.81M

reported the year earlier, and reflects the strong investment by the Group in

support of its product development strategies. Products announced during the

second half or progressing towards imminent release include solutions for new

market areas, as well as a range of new and uniquely flexible programmable

platform devices. These latter products offer exceptional advantages in

minimising both the cost and time to market of devices for both standard and

custom market applications.

In addition to increased R&D investment during the year, the Group effected the

transfer of the entire operations of Integrated Micro Systems from its location

at Rochester, Kent to the Group's main UK operating centre at Maldon, Essex.

A #420k charge has been taken against the exceptional restructuring costs that

are expected to arise during the current trading year as the result of that

relocation.

Operating profit before amortisation of goodwill is increased to #2.1M (2004:

#0.2M), reducing to #0.54M after amortisation is taken to account (2004: #0.98M

loss). The goodwill in question is the goodwill charge arising through the

acquisition of Hyperstone, which is being written off over a three-year period.

A nominally positive pre-tax outcome of #3k is reported (2004: #0.97M loss)

which, with the benefit of a positive tax charge, translates to earnings of

2.66p per ordinary share (2004: 5.28p loss per ordinary share). Net cash

reserves at the year-end were slightly increased at #4.07M (2004: #3.86M).

Your Directors are recommending payment of an unchanged annual dividend of 10.5p

per ordinary share (2004: 10.5p per ordinary share) payable, if approved by the

shareholders, on 5th August 2005 to shareholders registered on 8th July 2005.

On a geographic basis, sales into the Far East were increased by approximately

48% over the year earlier, with Taiwan and PRC sales recording particularly

pleasing gains. European sales, although lower in total, were more than

doubled when compared with the year earlier on the back of good progress in

Germany, Spain and near-east territories.

Underlying device sales into the Americas posted an 18% rise, although the

figures quoted under "geographical classification" in the full accounts do not

support that increase. This results from the treatment of royalty income

within the full accounts figures due to an arrangement inherited with the

acquisition of Hyperstone. I have referred to this in an earlier Report, and

its effect can be expected to diminish in future years.

In product terms, memory card controller sales led with highest growth rate and

highest total revenue, while radio and wireless category devices were a close

second in combined revenue, albeit posting a more modest 10% growth rate.

Turnover from products aimed at Wireline telecom applications achieved only a 4%

overall rise, with second half sales into Far East markets failing to match the

first half strength as foreseen.

I am encouraged by the further progress your company has demonstrated during the

year just ended, and with the positioning advantages in its marketplaces that

the group is progressively beginning to achieve. I feel quite confident that

the forward-looking strategies with which it has been particularly engaged will

produce the expected success.

Although the present trading year is at an early stage, my expectations are that

subject to unforeseen circumstances, your Company will continue to achieve firm

progress in its markets this year and to secure the consequent benefits. I

remain confident in the successful future of your Company.

I would like to close by joining with your Directors in thanking all of the

Group's employees for their efforts and commitment towards the Company

throughout the year, without which its continuing growth would not have been

achieved.

G. W. Gurry

Chairman

SUMMARY GROUP PROFIT AND LOSS ACCOUNT

for the year ended 31st March 2005

PRELIMINARY RESULTS

Notes Unaudited 2005 Audited 2004

# # # #

Turnover 23,458,744 16,321,691

Cost of sales (9,685,131) (5,998,681)

Gross Profit 13,773,613 10,323,010

Amortisation of goodwill 3 (1,561,024) (1,170,768)

Other distribution costs and administrative (12,255,207) (10,389,572)

expenses

Other operating income 583,102 253,583

Operating profit before amortisation of goodwill 2,101,508 187,021

Amortisation of goodwill (1,561,024) (1,170,768)

Operating Profit/(Loss) 540,484 (983,747)

Exceptional restructuring costs 4 (420,000) -

120,484 (983,747)

Interest receivable 118,210 125,677

Interest payable (235,495) (121,196)

Profit/(Loss) on Ordinary Activities before

Taxation 3,199 (979,266)

Tax on loss on ordinary activities 415,974 208,595

Profit/(Loss) on Ordinary Activities after

Taxation

Parent Company (75,958) 143,779

Subsidiary undertakings 495,131 (914,450)

419,173 (770,671)

Minority interests (24,046) (4,169)

Profit/(Loss) for the Financial Year 395,127 (774,840)

Proposed dividend 2 (1,564,310) (1,554,143)

Retained Loss for the Year (1,169,183) (2,328,983)

Earnings/(Loss) per share

Basic 5 2.66p (5.28)p

Diluted 5 2.64p (5.28)p

Statement of Total Recognised Gains and

Losses

Profit/(Loss) for the financial year 395,127 (774,840)

Currency translation differences on foreign

currency

net investments (62,765) (1,017,390)

Total gains and losses recognised since last

Report

and Accounts 332,362 (1,792,230)

SUMMARY GROUP BALANCE SHEET

at 31st March 2005

PRELIMINARY RESULTS

Unaudited 2005 Audited 2004

# # # #

Fixed Assets

Intangible assets 1,951,281 3,512,305

Tangible assets 10,345,139 9,671,475

12,296,420 13,183,780

Current Assets

Stocks 1,723,106 1,784,261

Debtors 4,093,607 3,387,498

Investments 5,388,449 6,933,510

Cash at bank and in hand 3,060,263 1,479,599

14,265,425 13,584,868

Creditors: Amounts falling due within one year (10,298,782) (9,484,710)

Net Current Assets 3,966,643 4,100,158

Total Assets less Current Liabilities 16,263,063 17,283,938

Provisions for liabilities and charges (724,920) (584,574)

Net Assets 15,538,143 16,699,364

Capital and Reserves

Called up share capital 744,048 740,068

Convertible warrants 120,230 240,433

Share premium account 3,752,510 3,589,606

Capital redemption reserve 254,730 254,730

Revaluation reserve 985,604 985,604

Profit and loss account 9,649,761 10,881,709

Shareholders' Funds 15,506,883 16,692,150

Minority interests 31,260 7,214

15,538,143 16,699,364

SUMMARY GROUP CASH FLOW STATEMENT

for the year ended 31st March 2005

PRELIMINARY RESULTS

Unaudited Audited

2005 2004

#'000 #'000

Net cash inflow/(outflow) from operating activities 3,009 (596)

Returns on investments and servicing of finance (117) 4

Taxation 142 329

Capital expenditure and financial investment (1,252) (166)

Acquisition of Hyperstone AG - (3,228)

Equity dividends paid (1,556) (1,535)

Net cash inflow/(outflow) before financing 226 (5,192)

Financing 46 4,735

Increase/(decrease) in cash 272 (457)

Reconciliation of Operating Profit to Net Cash Inflow/(Outflow) from Operating Activities

Operating profit/(loss) 540 (984)

Depreciation 666 575

Amortisation of goodwill 1,561 1,171

(Profit)/loss on sale of fixed assets (81) 4

Decrease/(increase) in stocks 61 (138)

(Increase)/decrease in debtors (691) 1,266

Increase/(decrease) in creditors 953 (2,490)

3,009 (596)

Reconciliation of Movement of Funds

Funds at start of period 3,868 9,599

Translation difference (69) (896)

Increase/(decrease) in cash 272 (457)

Cash inflow from increase in loans - (4,378)

Funds at close of period 4,071 3,868

Analysis of Funds

Cash at bank and in hand 3,060 1,480

Current asset investments 5,389 6,934

Bank overdrafts - (168)

8,449 8,246

Bank loans due within one year (4,378) (4,378)

Funds at close of period 4,071 3,868

NOTES

1. Presentation of results

This Preliminary Statement was approved by the directors on 13th June 2005.

The results have been prepared using accounting policies and practices

consistent with those adopted in the 2004 Report and Accounts but have not been

audited.

The audited results for the year ended 31st March 2004 are an abridged version

of the Company's Report and Accounts which have been filed with the Registrar of

Companies and on which the auditors gave an unqualified audit option.

The financial information contained in this Preliminary Statement does not

constitute statutory accounts as defined by section 240 of the Companies Act

1985

2. Dividends

A dividend of 10.5p per Ordinary Share (2004: 10.5p per Ordinary Share) is

recommended in respect of the year ended 31st March 2005 and will be paid on 5th

August 2005 to shareholders on the register as at 8th July 2005

3. Exceptional goodwill written off

Goodwill arising on the acquisition of Hyperstone AG is being amortised over a

period of 36 months from 2nd July 2003.

4. Exceptional restructuring costs

Exceptional restructuring costs represents anticipated costs of expenditure that

are expected to be incurred during the next financial year in closing down the

Group's operation in Rocester, Kent and relocating the business to the

purpose-built facility in Maldon, Essex.

5. Basic and diluted earnings/(loss) per share

The calculation of the basic and diluted earnings/(loss) per share is based on

the earnings/(loss) attributable to ordinary shareholders, divided by the

weighted average number of shares in issue during the year.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFDFWDSISEDM

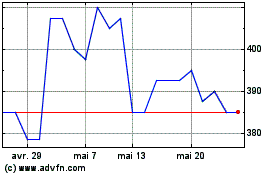

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Sept 2024 à Oct 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024