VAALCO Energy, Inc. (NYSE: EGY; LSE: EGY)

(“

VAALCO” or the “

Company”) today

announced that it has closed the acquisition of Svenska Petroleum

Exploration AB (“

Svenska”), an exploration and

production (“

E&P”) company based in Stockholm,

Sweden (the “

Acquisition”). As previously

disclosed, Svenska’s primary asset is a 27.39% non-operated working

interest in the deepwater producing Baobab field in Block CI-40,

offshore Cote d’Ivoire in West Africa. Net purchase price of $40.2

million was fully funded by cash on hand with no issuance of debt

or equity.

Transaction Highlights:

- Immediately accretive to

shareholders on key metrics:

- Following the planned shutdown for

maintenance in April, the Baobab field is back on production with a

current rate in excess of 5,000 VAALCO working interest

(“WI”) barrels of oil equivalent per day

(“BOEPD”) (99% oil);

- Includes estimated 1P WI CPR

reserves as of October 1, 2023, of 13.0 million barrels of oil

equivalent (“MMBOE”) (99% oil) and total 2P WI CPR

reserves at October 1, 2023, of 21.7 million MMBOE (97% oil);1

and

- Strategically expands West African

focus area with a sizeable producing asset that has significant

upside potential and considerable future development opportunities

in Cote d’Ivoire, a well-established and investment-friendly

country.

George Maxwell, VAALCO’s Chief Executive

Officer commented, “We are very pleased to have closed

this highly accretive acquisition in less than two months. We

continue to enhance our diversified portfolio by building size and

scale that allows VAALCO to generate significant free cash flow and

execute our strategic vision. We are excited to be partnering with

Petroci and Canadian Natural Resources International, and believe

the Baobab field in Cote d’Ivoire is an outstanding asset with

significant upside potential. We will be incorporating the

production, revenue and related operating expenses from the

acquisition into our Q2 2024 and full year 2024 guidance that we

will discuss in our upcoming first quarter earnings release and

conference call in early May. This is highly accretive on key

metrics to our shareholder base and provides another strong asset

to support future growth. We continue to have no bank debt and we

will use our strong balance sheet to fund our growth activities,

all while returning value to our shareholders.”

Advisors

VAALCO retained Stifel as sole financial

advisor, and Mayer Brown International LLP as legal counsel.

Svenska Petroleum Exploration AB retained

Evercore Partners International LLP and GKA Advisors LLP as

financial advisers and Fieldfisher LLP as legal counsel.

About VAALCO

VAALCO, founded in 1985 and incorporated under

the laws of Delaware, is a Houston, Texas, USA based, independent

energy company with a diverse portfolio of production, development

and exploration assets across Gabon, Egypt, Cote d’Ivoire,

Equatorial Guinea and Canada.

For Further Information

| |

|

| VAALCO Energy, Inc.

(General and Investor Enquiries) |

+00 1 713 543 3422 |

| Website: |

www.vaalco.com |

| |

|

| Al Petrie Advisors (US

Investor Relations) |

+00 1 713 543 3422 |

| Al Petrie / Chris Delange |

|

| |

|

| Buchanan (UK Financial

PR) |

+44 (0) 207 466 5000 |

| Ben Romney / Barry Archer |

VAALCO@buchanan.uk.com |

| |

|

| Stifel (Financial

Advisor)Callum Stewart / Simon

Mensley |

+44 (0) 20 7710 7600 |

Endnote

- Reserves estimates in this announcement were prepared in

accordance with the definitions and guidelines set forth in the

2018 Petroleum Resources Management Systems approved by the Society

of Petroleum Engineers. See “Oil and Natural Gas Reserves” for

further information.

Forward Looking Statements

This announcement includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

which are intended to be covered by the safe harbors created by

those laws and other applicable laws. Where a forward-looking

statement expresses or implies an expectation or belief as to

future events or results, such expectation or belief is expressed

in good faith and believed to have a reasonable basis. All

statements other than statements of historical fact may be

forward-looking statements. The words “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “forecast,” “outlook,” “aim,”

“target,” “will,” “could,” “should,” “may,” “likely,” “plan,”

“probably” or similar words may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. Forward-looking statements in

this announcement may include, but are not limited to, statements

relating to (i) expectations and estimates of future drilling,

production and sales of crude oil and natural gas; (ii)

expectations regarding VAALCO’s ability to effectively integrate

assets and properties it has acquired as a result of the

Acquisition into its operations; (iii) expectations of future

balance sheet strength; and (iv) expectations of future plans,

priorities, focus and benefits of the Acquisition. Such

forward-looking statements are subject to risks, uncertainties and

other factors, which could cause actual results to differ

materially from future results expressed, projected or implied by

the forward-looking statements. These risks and uncertainties

include, but are not limited to: risks relating to any unforeseen

liabilities of the Svenska; the outcome of any cost audits

undertaken by the Cote d’Ivoire government; timing and amounts of

any decommissioning or other wind up costs relating to any acquired

Nigerian assets; declines in oil or natural gas prices; the level

of success in exploration, development and production activities;

actions of joint-venture partners; adverse weather conditions that

may negatively impact development or production activities; risks

relating to the timing and costs of completion for scheduled

maintenance of the FPSO servicing the Baobab field; the timing and

costs of exploration and development expenditures; inaccuracies of

reserve estimates or assumptions underlying them; revisions to

reserve estimates as a result of changes in commodity prices;

impacts to financial statements as a result of impairment

write-downs; the ability to generate cash flows that, along with

cash on hand, will be sufficient to support operations and cash

requirements; the ability to attract capital or obtain debt

financing arrangements; currency exchange rates and regulations;

actions by joint venture co-owners; hedging decisions, including

whether or not to enter into derivative financial instruments;

international, federal and state initiatives relating to the

regulation of hydraulic fracturing; failure of assets to yield oil

or gas in commercially viable quantities; uninsured or underinsured

losses resulting from oil and gas operations; inability to access

oil and gas markets due to market conditions or operational

impediments; the impact and costs of compliance with laws and

regulations governing oil and gas operations; the ability to

replace oil and natural gas reserves; loss of senior management or

technical personnel; and other risks described under the caption

“Risk Factors” in the Company’s 2023 Annual Report on Form 10-K,

filed with the U.S. Securities and Exchange Commission (the “SEC”)

on March 15, 2024. There may be additional risks that VAALCO does

not presently know, or that the Company currently believes are

immaterial, that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect VAALCO’s expectations, plans or

forecasts of future events and views as of the date of this

announcement. Should one or more of these risks or uncertainties

materialize, or should any of the assumptions prove incorrect,

actual results may vary in material respects from those projected

in these forward-looking statements. No obligation is being

undertaken to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as may be required under applicable securities laws.

Oil and Natural Gas

Reserves

This announcement contains crude oil and natural

gas metrics which do not have standardized meanings or standard

methods of calculation as classified by the SEC and therefore such

measures may not be comparable to similar measures used by other

companies. Such metrics have been included herein to provide

readers with additional measures to evaluate the proposed

Acquisition; however, such measures may not be reliable indicators

of future performance.

WI CPR Reserves

WI CPR reserves represent proved (1P) and proved

plus probable (2P) estimates as reported by Petroleum Development

Consultants Limited and prepared in accordance with the definitions

and guidelines set forth in the 2018 Petroleum Resources Management

Systems approved by the Society of Petroleum Engineers. The SEC

definitions of proved and probable reserves are different from the

definitions contained in the 2018 Petroleum Resources Management

Systems approved by the Society of Petroleum Engineers. As a

result, 1P and 2P WI CPR reserves may not be comparable to United

States standards. The SEC requires United States oil and gas

reporting companies, in their filings with the SEC, to disclose

only proved reserves after the deduction of royalties and

production due to others but permits the optional disclosure of

probable and possible reserves in accordance with SEC

definitions.

1P and 2P WI CPR reserves, as disclosed herein,

may differ from the SEC definitions of proved and probable reserves

because:

- Pricing for SEC is the average

closing price on the first trading day of each month for the prior

year which is then held flat in the future, while the 1P and 2P WI

CPR pricing is based on pricing assumptions for future Brent oil

pricing for 2023 of $84.5 and up to 2030 the Brent Oil price

follows the average of four available forecasts and assumes flat

real thereafter. Oil price is escalated 2% per year;

- Lease operating expenses are

typically not escalated under the SEC’s rules, while for the WI CPR

reserves estimates, they are escalated at 2% annually beginning in

2024.

Management uses 1P and 2P WI CPR reserves as a

measurement of operating performance because it assists management

in strategic planning, budgeting and economic evaluations and in

comparing the operating performance of Svenska to other companies.

Management believes that the presentation of 1P and 2P WI CPR

reserves is useful to its international investors, particularly

those that invest in companies trading on the London Stock

Exchange, in order to better compare reserve information to other

London Stock Exchange-traded companies that report similar

measures. However, 1P and 2P WI CPR reserves should not be used as

a substitute for proved reserves calculated in accordance with the

definitions prescribed by the SEC. In evaluating VAALCO’s business,

investors should rely on VAALCO’s SEC proved reserves and consider

1P and 2P WI CPR reserves only supplementally. As a result of the

consummation of the Acquisition, VAALCO will report Svenska’s

reserves in accordance with the definitions and regulations

promulgated by the SEC.

Other Oil and Gas Advisories

Investors are cautioned when viewing BOEs in

isolation. A BOE conversation ratio of six thousand cubic feet of

natural gas to one barrel of oil equivalent (6 MCF: 1 Bbl) is based

on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the

wellhead. Given that the value ratio based on the current price of

crude oil as compared to natural gas is significantly different

from the energy equivalency of 6:1, utilizing a conversion on a 6:1

basis may be an incomplete as an indication of value.

Inside Information

This announcement contains inside information as

defined in Regulation (EU) No. 596/2014 on market abuse which is

part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 (“MAR”) and is made in accordance with the

Company’s obligations under article 17 of MAR. The person

responsible for arranging the release of this announcement on

behalf of VAALCO is Matthew Powers, Corporate Secretary of

VAALCO.

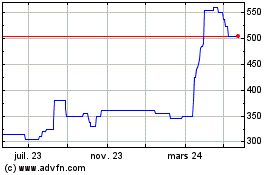

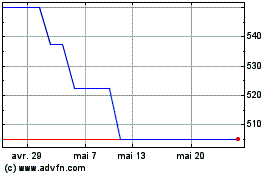

Vaalco Energy (LSE:EGY)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Vaalco Energy (LSE:EGY)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024