TIDMETP

RNS Number : 7031P

Eneraqua Technologies PLC

11 October 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

11 October 2023

Eneraqua Technologies plc

("Eneraqua", the "Company" or the "Group")

Interim Results

Solid performance in H1 with headwinds expected to impact

near-term outlook

Eneraqua Technologies plc, a specialist provider of energy and

water efficiency solutions, is pleased to announce its interim

results for the six months ended 31 July 2023.

Financial Highlights

- Revenue increased 7% to GBP26.0m (H1 23: GBP24.2m), reflecting

contract wins and project completions in the period.

- Gross profit of GBP8.9m (H1 23: GBP9.9m), at a margin of 34.1%

reflecting the project mix in the period.

- Adjusted EBITDA(1) GBP0.79m (H1 23: GBP3.98m) as a result of

continued investment in both the team and ongoing research and

development work.

- Adjusted loss before tax (GBP0.4m) (H1 23: GBP3.0m) which

includes the increased costs of borrowing in H1.

- Adjusted diluted EPS: 0.47p (H1 23: 6.48p).

- Net cash* of GBP0.5m (H1 23: net debt of GBP0.2m) as working

capital investment in FY23 unwound.

- Group's order book(2) across Energy and Water stands at

GBP146.2m and, taking a prudent view, approximately 25% is now

anticipated to be delivered in the remainder of H2 FY24.

Operational and Strategic Highlights

- First major NHS Trust energy project secured with the award of

an GBP11.3m contract with Kingston NHS, following the acquisition

of Mathewson (in 2022), validating Group approach on strategic

acquisitions to unlock new markets.

- Solid performance in Water as a result of new student housing

and care home customer wins in Spain, and greater awareness and

adoption of water technologies in UK.

- Following first agritech contract for the State of

Uttarakhand, two further states have now adopted the solution, with

Indian Government now trialling our technologies in its domestic

water programmes.

- Completed global production facility in Toledo, Spain, where

product assembly is now under way with manufacturing of key

components to commence in Q4.

Post period end and Outlook

We have seen a marked change in some customer behaviours

post-period end as Local Authorities and social housing landlords

have experienced further pressure on their capital budgets, as a

result of continuing increases in building costs and required spend

on Government-mandated cladding and insulation projects.

These challenges are reflected in the recent report by the

Regulator for Social Housing [3] which highlights that

approximately half of all social landlords intend to re-phase

projects.

Since the half-year end the Company has won a number of new

contracts for heat-pump systems including a GBP12.7m contract with

Royal Borough of Kensington & Chelsea and a GBP7.2m contract to

supply a district system for a museum, gallery and leisure

centre.

However, following our clients' half-year budget reviews in

September we have been approached regarding the phasing of work. On

a prudent basis we anticipate that there will be a re-phasing of

work to meet their in-year budget pressures. This is expected to

materially impact second half revenues and margins. No contracts

have been cancelled but the timing of revenues on some is expected

to move into FY25.

Separately as set out in the 31 August trading update, the

unexpected policy decision by the UK Government on net nutrient

neutrality rules has resulted in certain Water customers deferring

investment decisions pending regulatory clarity.

As a result of these challenges and the anticipated delays, we

expect our revenues and profit for FY24 to be substantially below

market expectations. These clients have planned multi-year

programmes, and while no requests to look at phasing have been

made, we believe, given their fixed in-year budgets, the knock-on

impact means it is prudent to expect lower revenues and profits in

FY25 than currently forecast.

The Company returned to a net cash position at the end of H1

FY24. As at 30 September, over 83% of the accrued income had been

collected as cash with the remaining balance due in the coming

weeks. Overall, we expect to end FY24 in profit and with a net cash

positive position.

*excluding IFRS 16 liabilities

Commenting on the results, Eneraqua Technologies CEO, Mitesh

Dhanak, said: "During the period the Group performed in line with

our expectations notwithstanding the inflationary pressure on our

energy client budgets. Post-period end the Group has faced dual

headwinds. The continued and increased budgetary pressures on local

government are leading to discussions on slowing down project

delivery and deferring works into FY25. This compounds the impact

of the recent unexpected Government policy change in relation to

net nutrient neutrality. As a result, the Board now expects some

projects to be delivered more slowly with revenues moving into next

year and reduced operational leverage affecting margins. As a

result we expect to see a material reduction in revenues and

outturn in profitability during FY24. This is extremely

disappointing given the underlying imperative to transition to Net

Zero.

"The Group continues to be cash generative and retain a net cash

position as it manages through these near-term headwinds. The Board

remains confident that the longer-term opportunity for the business

driven by the social and economic imperatives driving the carbon

transition remains in place."

An overview of the interim results is available to watch here:

https://bit.ly/ETP_H12023overview

Analyst Presentation

A presentation for analysts will be held today at 9:00am via

webinar. Analysts wishing to attend should contact

eneraqua@almapr.co.uk.

Investor Presentation

A presentation to retail investors will be hosted at 11am this

morning. Investors are invited to sign up for the presentation via

the PI World platform using the following link:

https://bit.ly/ETP_FY24_H1_webinar. Questions can be submitted

during the presentation.

(1) Adjusted EBITDA - Adjusted for share based payment charges

(prior year also excludes IPO costs).

(2) Order Book defined as Contracted + Secured. Contracted =

project contract issued and signed, with work started or ready to

start. Secured = sum of a) tender process successful, awaiting

project contract, and b) Directors' assumed win rate on Framework

opportunities.

For more information, please contact:

Eneraqua Technologies plc Via Alma PR

Mitesh Dhanak, CEO www.eneraquatechnologies.com

Iain Richardson, CFO

Liberum - Nominated Adviser and Broker +44(0)203 100 2000

Edward Mansfield

Benjamin Cryer

Anake Singh

Singer Capital Markets (Joint Broker) +44 (0)20 7496 3000

Sandy Fraser

Justin McKeegan

Asha Chotai

Alma (Financial PR and IR) +44(0)20 3405 0205

Justine James eneraqua@almapr.co.uk

Sam Modlin

Will Ellis Hancock

Notes to editors

Eneraqua Technologies (AIM:ETP) is a specialist in energy and

water efficiency. The Group designs and delivers improved energy

and water systems which utilise its wholly owned intellectual

property, Control Flow HL2024. Energy was the first market the

Company entered and this is the larger sector, with the Company

focused on clients with end of life gas, oil or electric heating

and hot water systems. The Group provides turnkey retrofit district

or communal heating systems based either on high-efficiency gas or

ground/air source heat pump solutions that support Net Zero and

decarbonisation goals.

Water is a growing service offering focused on water efficiency

upgrades for utilities and commercial clients including hotels and

care homes. It has also expanded into agritech systems.

The activities in both areas are underpinned by the Company's

wholly-owned intellectual property, the Control Flow HL2024 family

of products which reduce water wastage and improve the performance

of heating and hot water systems.

The Company's main country of operation is the United Kingdom.

The Company's head office is in London with additional offices in

Leeds, Washington (Sunderland), India, Spain and the Netherlands.

The Company has 191 employees, with the majority employed within

the UK. Eneraqua Technologies has received the London Stock

Exchange's Green Economy Mark.

To find out more, please visit: www.eneraquatechnologies.com

CEO Statement

The first half of the financial year has been solid and in-line

with our expectations. We have continued to grow revenues and

returned to a net cash position.

The underlying longer term drivers of our end markets clearly

remain strong with significant opportunities in both Energy and

Water in the UK and in our other regions of operation. Cost

effectiveness and energy efficiency remains at the forefront of our

clients' priorities alongside meeting net zero goals. Similarly,

our water efficiency technology offers a proven solution to the

challenges of drought that are being seen in the UK and Europe.

Whilst we delivered a solid performance in water and post period

end secured new student housing and care home customer wins in

Spain , the unexpected UK Government announcement on net nutrient

neutrality at the end of August has impacted our water business, as

announced on 31 August, due to the regulatory uncertainty for

clients and this is discussed in detail below.

On Energy, we previously saw signs of a return to normality for

FY25 with recent contract awards including the Group's first NHS

Trust and the Royal Borough of Kensington & Chelsea being

evidence of renewed commitment from clients.

Notwithstanding this, from the end of September we have seen a

marked change in the behaviour of some customers. Local Authorities

and social housing landlord capital budgets continue to be under

pressure with the Regulator of Social Housing, now reporting that

approximately half of these organisations are planning to re-phase

works to manage their annual budgets. The Regulator also

highlighted that the expected low-point cash position for the

sector will be in mid-2024. The substantial increase in costs on

Government-mandated cladding and insulation projects and other

works has seen landlords over-commit their annual capital budgets

and as a result seek to slow down spend in the second half of their

financial year (October - March) to manage their budgets.

Following their half-year budget reviews at end-September, we

have recently received requests to review delivery plans and

phasing on a number of material contracts due for delivery in our

current financial year. While the final outcomes remain uncertain,

we have taken the prudent view that a number of these contracts

will be re-phased to move spend into FY25.

As a result of these anticipated delays, we envisage that

revenue and profit for the current year will be materially lower

than previously expected. With H1 revenue of GBP26.0m, the Group's

order book stands at GBP146.2m of which taking a prudent view,

approximately 25% is now anticipated to be delivered in the

remainder of H2 FY24. Outturn margins are also expected to fall as

the slowing of project delivery reduces the operational leverage

that we have traditionally benefitted from as teams are required to

stay on the project for longer periods. We continue to see strong

cash conversion and expect to report a net cash position at the

FY24 year end.

Importantly, no contracts have been cancelled and work

continues, but we anticipate that there will be a need to slow down

delivery against initial project plans, to enable a higher

proportion of expenditure to fall into our clients' following

financial year (April 2024 - March 2025).

The clients concerned are all long-term relationships with

planned works across a number of years. While they have not

discussed any changes to their future plans with us, given the

analysis from the Regulator of Social Housing, we believe that it

is prudent to assume there will also be slippage in their spending

plans for FY25 and we are planning accordingly to ensure that both

operating profit and net cash within the business are

protected.

Financial performance

Our half year trading demonstrated the solid performance of the

Group amidst an ongoing challenging economic environment. Revenue

for the half increased by 7% to GBP26.0m (H123: GBP24.2m),

demonstrating the Group's ability to convert our new business

pipeline into contract wins and realised revenue.

In the period, average contract size was GBP2.45m (H123:

GBP3.5m), reflecting growth in our water business, which has

smaller individual contracts. Gross margin at 34.1% is in line with

management expectations, reflecting the project mix in the

period.

Adjusted EBITDA was GBP0.79m (H1 FY22: GBP3.98m), whilst PBT

moved to an adjusted loss before tax of (GBP0.4m) (H123: profit

GBP3.0m) reflecting the expected H2 bias for the year.

As we have noted previously, due to the nature of our customers

and their procurement calendars, our contract delivery and revenues

are traditionally weighted to the second half of our financial

year.

As at 30 September, the Group's order book across Energy and

Water stood at GBP146.2m

The Company remains well capitalised to fund growth in executing

its order book through existing resources and operating cash

generation. The Group saw a cash inflow in the first half of the

year as it saw the unwind of its working capital investment at

FY23. As at 30 September 2023, over 83% of accrued income at the

FY23 year-end had been converted to cash. N et cash (excluding IFRS

16 liabilities) at the H1 period end was GBP0.5m.

Operational and strategic progress

Despite the challenges in the current economic environment,

Eneraqua remains on course to deliver growth, albeit at a reduced

pace to that anticipated in late August. We have seen improved cash

generation as working capital begins to unwind and we expect this

to continue for the remainder of the year. Recent contract awards

evidence the significant opportunity for us to build further

growth, while noting that many clients will continue to navigate

significant budgetary constraints.

We have seen orders from new and existing clients which reflect

the quality of service and value for money that our team

delivers.

We have also completed our global production facility in Toledo,

Spain, where product assembly is now under way with manufacturing

of key components to commence in Q4. As previously outlined, this

production facility will be responsible for the assembly and supply

of the Control Flow product range. Having a central facility allows

us better quality control, and also reduces production costs by 12%

per unit.

Energy

In Energy, our turnkey retrofit district and communal heating

systems, including ground and air source heat pump solutions, are

an important tool for clients in meeting their sustainability and

net zero goals. Ongoing wins across our geographies and product

lines give confidence of continued environmental and political

tailwinds supporting the Group's growth.

The acquisition of Mathewson Holdings in 2022 opened up new

opportunities in the health and commercial sectors, which has

resulted in the Group securing its first NHS Trust award with a

GBP11.3m contract with the Kingston NHS Trust. Delivery will

commence in late Q4 with the majority of revenue recognised in

FY25.

The Mathewson team were instrumental in the winning of the

contract through a competitive tender process. At the time of the

acquisition, we flagged the opportunity to expand into the

healthcare sector as a new opportunity thanks to their expertise in

the area. This contract is a clear demonstration of our successful

acquisition strategy in practice. We continue to pursue further

contracts in healthcare and look forward to further growth in this

sector.

In addition, post period end, we secured a GBP12.7m contract

with the Royal Borough of Kensington & Chelsea for the

replacement of an end of life gas-fired district heating system

with a low-carbon heat-pump based system, underscoring the

continued demand for our solutions in public, multi-occupancy

buildings, where there is a need to retrofit and upgrade

end-of-life heating systems that burn fossil fuels with a green

alternative.

We also secured a GBP7.2m contract with a world-class museum,

art gallery, and leisure centre complex for the replacement of an

old gas-fired system again with a new low-carbon heat pump

solution. These awards reflect the ongoing investment in low-carbon

solutions, and the continued demand from both private and public

bodies to transition towards heating systems that are cleaner,

cost-effective and less damaging to the environment.

Water

Water harnesses the patented Control Flow HL2024 technologies

which reduce water wastage and improve the efficiency of heating

and hot water systems. Clients include water companies, developers,

hotels, schools and leisure centres, with the products installed in

both domestic and commercial applications.

By reducing water wastage, we can cut water consumption by up to

26% in homes and deliver energy bill savings through improved

performance of heating and hot water systems. The benefits of the

technology are becoming better understood by clients and we

experienced growing demand in H1 FY24.

As reported, on 29 August 2023, the UK Government ("Government")

announced its intention to change the legislation that governs

development in nitrate-sensitive areas. While the initial proposals

were blocked in Parliament, the Government has made clear its plan

to press ahead with the proposed changes through a specific

Parliamentary Bill later this year. This is expected to remove

existing responsibilities and instead set up a centralised

management scheme.

As communicated in the trading update, the continuing policy

uncertainty has led clients to pause projects until there is

greater clarity on their responsibilities and the details of the

proposals are finalised. We believe this will be complete during

FY25.

Notwithstanding this, the benefits of our water efficiency

technologies are becoming better understood in terms of both

reducing water wastage and cutting household utility bills. We

expect this to create greater opportunities in the future.

Away from the UK, we have seen success and continued interest in

our water technologies in both India and Spain.

In Spain we have completed installing Control Flow HL2024 in

four hospitals and a number of student accommodation and care home

sites and we have a healthy pipeline of new projects with

interested parties in a variety of sectors.

In India, following our first agritech contract to provide clean

energy, water efficient irrigation systems for the State of

Uttarakhand, two further states have now adopted the solution.

Follow-on discussions with Uttarakhand have been delayed due to the

substantial flooding that has affected that state. Separately, the

Indian Government is trialling our technologies in its domestic

water programmes.

Acquisition Strategy

The acquisition of Mathewson Holdings completed in August 2022

brought complementary technical capability and a market presence in

the health and commercial sectors. As already mentioned, this

facilitated the award of our first major NHS Trust contract award

of GBP11.3m. This substantiates our approach in making acquisitions

that enhance our capabilities and enable access to new markets.

This was followed by our acquisition of the Installatiebedrijf

Vriend B.V ("Vriend") business in Holland. The integration of this

highly skilled and well-established team gives us a springboard for

our Energy and Water solutions in the Netherlands. The growth

opportunity in North Western Europe is large, with strong market

drivers thanks to clearly defined targets and commitments to

achieve Net Zero from governments in the region. Following the

acquisition, we now have the requisite local accreditations which

will enable us to access new tender opportunities and accelerate

our growth strategy in an area where we see exciting potential.

People

The current labour market in the UK and Europe remains tight. We

are increasingly utilising offshore solutions using our engineering

team in India in order to manage workflows and costs.

As noted earlier, there is a risk of potential slippage in our

energy projects due to client budgetary pressures. If these occur,

then we will delay our planned recruitment and review existing

teams to ensure they are right-sized. We maintain a constant review

to ensure that staffing levels reflect our needs.

Outlook

The demand for our energy and water solutions remains strong.

Whilst the recent award of several major contracts indicates that

some client capital budgets are starting to return to normal, the

increased inflation which started to impact in 2022/23 is

continuing to have a negative impact and create budgetary pressures

for others.

As noted above, this is expected to see some clients seek to

delay project delivery resulting in revenue slippage into FY25,

with continuing pressure in that year anticipated given the

cautionary tone of the report from the Regulator of Social Housing.

This is clearly disappointing as it follows the unexpected

Government announcement on nutrient neutrality that affected our

water business.

Despite the impact of these two issues, the Group expects to

remain profitable for FY24 and report a net cash positive position

at year end.

In both energy and water we are well placed to capitalise on

growth, although for both FY24 and FY25 we anticipate this will be

at a slower pace than previously expected. The Board remains

confident that the longer-term opportunity for the business driven

by the social and economic imperatives driving the carbon

transition is unaffected. Our proven expertise in these areas

offers important assurance to clients on the quality and

performance of installations, thereby providing the confidence to

make the move to low-carbon and water efficient solutions. This

remains the inevitable direction of travel given the climate and

water challenges that are now becoming apparent.

CFO Statement

I am pleased to report on Eneraqua's unaudited interim results

for the six months ended 31 July 2023 which marked a return to a

net cash position (excluding IFRS16 liabilities).

KPIs

The Group's financial Key Performance Indicators, which are

aligned with its growth strategy, are revenue growth, adjusted

EBITDA, adjusted EBITDA margin, adjusted PBT, R&D spend, cash

conversion and ROCE.

31 Jul 2023 31 Jul

2022

Revenue GBP26.0m GBP24.2m

============ =========

Revenue growth 7% 92%

============ =========

EBITDA GBP0.74m GBP3.92m

============ =========

Adjusted EBITDA GBP0.79m GBP3.98m

============ =========

Adjusted EBITDA margin 3.0% 16.2%

============ =========

Adjusted PBT (GBP0.4m) GBP3.0m

============ =========

R&D spend GBP0.5m GBP1.07m

============ =========

Cash conversion* 640% (56%)

============ =========

ROCE (0.4%) 13.4%

============ =========

*Cash from operating activities/EBITDA

Revenue

Group revenues increased by 7% to GBP26.0m, (H1 2023: GBP24.2m).

International revenues grew from GBP0.16m in H1 2023 to GBP0.57m in

H1 2024.

As a result of the anticipated delays in both energy and water,

we envisage that revenue and profit for the current year will be

materially lower than previously expected.

The Group's order book stands at GBP146.2m of which, taking a

prudent view, approximately 25% is now anticipated to be delivered

in the remainder of H2 FY24.

Profits

The growth in revenue was offset by investment in headcount and

infrastructure. Adjusted EBITDA was GBP0.8m, (H1 2023: GBP3.9m),

with the Group achieving Adjusted EBITDA margins of 3%.

The Group reported a small statutory operating loss of GBP0.1m

(H1 2023: GBP3.1m operating profit) and a statutory loss before tax

of GBP0.4m (H1 2023: GBP2.9m profit before tax).

Cash flow & net cash

The Group saw a cash inflow in the first half of the year

through the unwind of its working capital investment during FY23.

As at 30 September over 83% of accrued income at the FY23 year-end

had converted to cash.

Capital expenditure was limited in H1, being GBP0.4m of plant

and equipment associated with the establishment of the

manufacturing facility in Toledo, Spain. Intangible asset additions

reflect the continued development of the HL2024 family of products.

In addition, there was a further outflow of GBP0.3m for the

acquisition of Vriend.

The Group ended the period with net cash (excluding IFRS 16

liabilities) of GBP0.5m compared with GBP0.2m of net debt at 31

July 2022 and GBP3.0m of net debt at end-FY23. The Group expects to

end FY24 in a net cash position.

Acquisitions

On 3 April 2023 the Group acquired Vriend a business

incorporated in the Netherlands, for total consideration of

EUR0.522m. Vriend is a multidisciplinary installer of sustainable

energy solutions with a focus on residential and commercial

projects. The acquisition represents the Group's first step on

their European acquisition strategy, providing the necessary

accreditations and foundations to expand the Group offering into

Northern Europe.

Adjusting Items

The only adjusting item in the period was share based payment

charges of GBP0.1m (H1 2023: GBP0.1m).

Headcount

The Group's full time equivalent (FTE) employees at 31 July 2023

were 191 (31 July 22: 144). This growth reflects the addition of

Vriend to the Group as well as continued recruitment in key areas

to support the Group's growth strategy and ensure the management of

key projects during the year.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 31 July

Six months Six months Twelve

to 31 Jul to 31 Jul months to

Note 2023 2022 31 Jan 2023

GBP'000 GBP'000 GBP'000

------------------------------------------------------ ------- ----------- ----------- -------------

Continuing operations

Revenue 3 26,047 24,246 55,074

Cost of sales (17,174) (14,327) (31,995)

------------------------------------------------------ ------- ----------- ----------- -------------

Gross profit 8,873 9,919 23,079

Administrative expenses (8,973) (6,868) (12,774)

Other operating income - - -

------------------------------------------------------ ------- ----------- ----------- -------------

Included within administrative

expenses are:

* Share based payment charge (58) (58) (117)

* Depreciation of property, plant and equipment (297) (666) (655)

* Depreciation of right-of-use assets (204) (14) (196)

* Amortisation of intangible assets (333) (191) (573)

----------- ----------- -------------

Adjusted administrative expenses (8,081) (5,939) (11,233)

----------- ----------- -------------

Adjusted EBITDA(1) 792 3,980 11,846

------------------------------------------------------ ------- ----------- ----------- -------------

Operating profit (100) 3,051 10,305

Interest payable and similar

expenses (341) (100) (370)

------------------------------------------------------ ------- ----------- ----------- -------------

Profit before taxation (441) 2,951 9,935

Income tax 540 (757) (1,420)

------------------------------------------------------ ------- ----------- ----------- -------------

Profit for the period from

continuing operations 99 2,194 8,515

Total profit for the period

attributable to equity holders

of the parent

Total comprehensive income

for the period attributable

to equity holders of the parent 99 2,194 8,515

====================================================== ======= =========== =========== =============

The accompanying notes form part of the condensed interim

consolidated financial statements

(1) Adjusted EBITDA is considered to be a Key Performance

Indicator and consistent with how the Group measures trading and

cash generative performance. Note this is an Alternative

Performance Measure and is a non-IFRS measure.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31 Jul 31 Jul 2022

2023 GBP'000 31 Jan 2023

Note GBP'000 GBP'000

--------------------------------- -----

Non-current assets

Intangible assets 9,255 8,505 8,703

Property, plant and equipment 3,251 2,868 3,441

Right-of-use assets 1,319 207 1,213

Deferred tax asset - - -

--------------------------------- -----

Total non-current assets 13,825 11,580 13,357

--------------------------------- -----

Current assets

Inventory 2,924 1,236 2,557

Trade and other receivables 6 26,825 13,148 29,226

Cash and cash equivalents 5,963 6,521 3,224

--------------------------------- -----

Total current assets 35,712 20,905 35,007

--------------------------------- ----- --------- ------------ ------------

TOTAL ASSETS 49,537 32,485 48,364

================================= ===== ========= ============ ============

Equity attributable to

owners of the parent

Called up share capital 332 344 332

Share premium account 10,113 10,113 10,113

Merger reserve (5,490) (5,490) (5,490)

Other reserves 7 (624) 269

Retained earnings 20,055 13,963 19,791

--------------------------------- ----- --------- ------------ ------------

Total equity 25,017 18,306 25,015

--------------------------------- ----- --------- ------------ ------------

Current liabilities

Borrowings 7 1,457 2,310 2,793

Trade and other payables 16,866 7,248 15,154

Lease liabilities 428 118 543

--------------------------------- ----- --------- ------------ ------------

Total current liabilities 18,751 9,676 18,490

--------------------------------- ----- --------- ------------ ------------

Non-current liabilities

Borrowings 7 4,023 4,404 3,408

Lease liabilities 1,442 32 1,183

Deferred tax liability 305 67 268

Total non-current liabilities 5,769 4,503 4,859

Total liabilities 24,520 14,179 23,349

--------------------------------- ----- --------- ------------ ------------

TOTAL EQUITY AND LIABILITIES 49,537 32,485 48,364

================================= ===== ========= ============ ============

The accompanying notes form part of the condensed interim

consolidated financial statements

CONSOLIDATED STATEMENT OF CASHFLOWS

For the six months ended 31 July

GROUP Six months Six months Twelve

to 31 Jul to 31 Jul months to

2023 2022 31 Jan 2023

GBP'000 GBP'000 GBP'000

----------- ----------- -------------

Cash flow from operating activities

Profit for the financial period 99 2,194 8,515

Adjustments for:

Amortisation of intangible assets 204 191 573

Depreciation of property, plant

and equipment 297 666 655

Depreciation on right-of-use assets 333 14 196

Interest payable 367 100 313

Lease liability finance charge 13 19 57

Taxation charge / (credit) (540) 756 1,420

Corporation tax received / (paid) (61) - 25

Foreign exchange (426) - (392)

Share based payment charge 58 58 117

Changes in working capital:

Increase in inventory (3,150) (50) (1,371)

Decrease / (increase) in trade

and other receivables 8,430 (759) (16,837)

(Decrease) / increase in trade

and other payables (723) (5,386) 3,685

Net (outflow) / increase from

operating activities 4,901 (2,197) (3,044)

------------------------------------------ ----------- ----------- -------------

Cash flow from investing activities

Purchase of intangible assets (393) (285) (269)

Purchase of property, plant and

equipment (425) (113) (882)

Sale of property, plant and equipment - - 3

Acquisition of businesses - net

of cash acquired (312) (1,319) (1,620)

Net cash outflow from investing

activities (1,130) (1,717) (2,768)

------------------------------------------ ----------- ----------- -------------

Cash flows from financing activities

Proceeds from borrowings - 7,340 7,249

Repayment of borrowings (759) (786) (1,369)

Reduction of share capital - - (12)

Interest paid (177) (100) (313)

Repayment of lease liabilities (96) (89) (261)

Dividends paid - - (328)

Net cash (outflow) / inflow from

financing activities (1,032) 6,365 4,966

------------------------------------------ ----------- ----------- -------------

Net increase / (decrease) in

cash and cash equivalents 2,739 2,451 (846)

Cash and cash equivalents at beginning

of period 3,224 4,070 4,070

Cash and cash equivalents at

the end of the period 5,963 6,521 3,224

------------------------------------------ ----------- ----------- -------------

The accompanying notes form part of the condensed interim

consolidated financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 July

Share Share Merger Other Retained Total

Capital Premium Reserve Reserves Earnings Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 February 2022 344 10,113 (5,490) (294) 11,769 16,442

Profit for the period - - - - 2,194 2,194

Total comprehensive

profit for the period - - - - 2,194 2,194

------------------------- --------- --------- --------- ---------- ---------- --------

Other(1) - - - (330) - (330)

------------------------- --------- --------- --------- ---------- ---------- --------

Total transaction

with owners - - - (330) - (330)

------------------------- --------- --------- --------- ---------- ---------- --------

Balance at 31 July

2022 344 10,113 (5,490) (624) 13,963 18,306

========================= ========= ========= ========= ========== ========== ========

At 1 August 2022 344 10,113 (5,490) (624) 13,963 18,306

Profit for the period - - - - 6,321 6,321

Total comprehensive

profit for the period - - - - 6,321 6,321

------------------------- ----- ------- -------- ------ ------- -------

Reduction in share

capital (12) - - - - (12)

Dividends paid - - - - (328) (328)

Other(1) - - - 728 - 728

------------------------- ----- ------- -------- ------ ------- -------

Total transaction

with owners (12) - - 728 (328) 388

------------------------- ----- ------- -------- ------ ------- -------

Balance at 31 January

2023 332 10,113 (5,490) 104 19,956 25,015

========================= ===== ======= ======== ====== ======= =======

At 1 February 2023 332 10,113 (5,490) 104 19,956 25,015

Profit for the period - - - - 99 99

Other comprehensive

income - - - - - -

------------------------- ---- ------- -------- ----- ------- -------

Total comprehensive

profit for the period - - - - 99 99

------------------------- ---- ------- -------- ----- ------- -------

Other(1) - - - (97) - (97)

------------------------- ---- ------- -------- ----- ------- -------

Total transaction

with owners - - - (97) - (97)

------------------------- ---- ------- -------- ----- ------- -------

Balance at 31 July

2023 332 10,113 (5,490) 7 20,055 25,017

========================= ==== ======= ======== ===== ======= =======

(1) Other includes share based payments, foreign exchange and

other items

The accompanying notes form part of the condensed interim

consolidated financial statements.

Notes to the financial information

1. BASIS OF PREPARATION

The figures for the six months ended 31 July 2023 and 31 July

2022 are unaudited and do not constitute statutory accounts.

As permitted, the Company has chosen not to adopt IAS 34

"Interim Financial Statements" in preparing this Interim Financial

Information. The accounting policies adopted are consistent with

those applied by the Group in the preparation of the annual

consolidated financial statements for the year ended 31 January

2023.

The Group has not early adopted any standard, interpretation or

amendment that has been issued but is not yet effective. Several

amendments and interpretations apply for the first time in 2023,

but these do not have a material impact on the interim condensed

consolidated financial statements of the Group. The financial

information for the year ended 31 January 2023 set out in this

interim report does not comprise the Group's statutory accounts as

defined in section 434 of the Companies Act 2006.

The statutory accounts for the year ended 31 January 2023, which

were prepared under international accounting standards in

conformity with the requirements of the Companies Act 2006, have

been delivered to the Registrar of Companies. The auditors reported

on those accounts; their report was unqualified and did not contain

a statement under either Section 498(2) or Section 498(3) of the

Companies Act 2006 and did not include references to any matters to

which the auditor drew attention by way of emphasis.

1.1 Critical accounting judgements and key sources of estimation uncertainty

The preparation of condensed Interim Financial Information

requires the Directors to make judgments, estimates and assumptions

about the carrying amounts of assets and liabilities that are not

readily apparent from other sources. The estimates and associated

assumptions are based on historical experience and other factors

that are considered to be relevant. There are no changes to

critical accounting judgements and key sources of estimation

uncertainty from those disclosed in the annual accounts for the

year ended 31 January 2023.

2. SEGMENT REPORTING

The following information is given about the Group's reportable

segments:

The Chief Operating Decision Maker is the Board of Directors.

The Board reviews the Group's internal reporting in order to assess

performance of the Group. Management has determined the operating

segment based on the reports reviewed by the Board.

The Board considers that during the period ended 31 July 2023

the Group operated in the three business segments according to the

geographical location of its operations and those being:

- United Kingdom

- Europe; and

- India

United

Six months to 31 July 2023 Kingdom Europe India 2023

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------------------- --------- --------- -------- ---------

Revenue 25,476 371 200 26,047

Cost of sales (16,802) (283) (89) (17,174)

--------- --------- -------- ---------

Gross Profit 8,674 89 111 8,873

Administrative expenses (7,722) (1,092) (159) (8,973)

------------------------------------------------------------ --------- --------- -------- ---------

Included within administrative

expenses are:

* Share based payment charge (58) - - (58)

* Depreciation of property, plant and equipment (143) (151) (3) (297)

* Depreciation of right-of-use assets (204) - - (204)

* Amortisation of intangible assets (268) (65) - (333)

--------- --------- -------- ---------

Adjusted administrative expenses (7,049) (876) (156) (8,081)

--------- --------- -------- ---------

Adjusted EBITDA(1) 1,625 (787) (45) 792

------------------------------------------------------------ --------- --------- -------- ---------

Operating profit/(loss) 952 (1,003) (49) (100)

Interest payable and similar

expenses (325) (18) 3 (341)

Profit/(Loss) before tax 626 (1,021) (46) (441)

Taxation 464 82 (6) 540

--------- --------- -------- ---------

Profit/(Loss) after tax 1,090 (940) (51) 99

--------- --------- -------- ---------

Net Assets as at 31 July

2023

Assets: 37,373 11,647 517 49,537

Liabilities (12,254) (11,702) (564) (24,520)

--------- --------- -------- ---------

Net assets / (liabilities) 25,119 (55) (47) 25,017

--------- --------- -------- ---------

United

Six months to 31 July 2022 Kingdom Europe India 2022

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------------------- --------- -------- -------- ---------

Revenue 24,087 66 93 24,246

Cost of sales (14,231) (80) (16) (14,327)

--------- -------- -------- ---------

Gross Profit 9,856 (14) 77 9,919

Administrative expenses (5,976) (801) (91) (6,868)

------------------------------------------------------------ --------- -------- -------- ---------

Included within administrative

expenses are:

* Share based payment charges (58) - - (58)

* Depreciation of property, plant and equipment (348) (306) (12) (666)

* Depreciation of right-of-use assets (14) - - (14)

* Amortisation of intangible assets (191) - - (191)

--------- -------- -------- ---------

Adjusted administrative expenses (611) (306) (12) (929)

--------- -------- -------- ---------

Adjusted EBITDA(1) 4,491 (509) (2) 3,980

------------------------------------------------------------ --------- -------- -------- ---------

Operating profit/(loss) 3,880 (815) (14) 3,051

Interest payable and similar

expenses (83) (17) - (100)

Profit/(Loss) before tax 3,797 (832) (14) 2,951

Taxation (756) - (1) (757)

--------- -------- -------- ---------

Profit/(Loss) after tax 3,041 (832) (15) 2,194

--------- -------- -------- ---------

Net Assets as at 31 July

2022

Assets: 27,679 3,748 242 31,669

Liabilities (11,998) (1,348) (17) (13,363)

--------- -------- -------- ---------

Net assets / (liabilities) 15,681 2,400 225 18,306

--------- -------- -------- ---------

Twelve months to 31 January United

2023 Kingdom Europe India 2023

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------------------- --------- -------- -------- ---------

Revenue 54,546 77 451 55,074

Cost of sales (32,525) 718 (188) (31,995)

--------- -------- -------- ---------

Gross profit 22,021 795 263 23,079

Administrative expenses (11,249) (1,232) (293) (12,774)

------------------------------------------------------------ --------- -------- -------- ---------

Included within administrative

expenses are:

* Share based payment charges (117) - - (117)

* Depreciation of property, plant and equipment (350) (288) (17) (655)

* Depreciation of right-of-use assets (196) - - (196)

* Amortisation of intangible assets (505) (68) - (573)

--------- -------- -------- ---------

Adjusted administrative

expenses (10,081) (876) (276) (11,233)

--------- -------- -------- ---------

Adjusted EBITDA(1) 11,940 (81) (13) 11,846

------------------------------------------------------------ --------- -------- -------- ---------

Operating profit/(loss) 10,772 (437) (30) 10,305

Interest payable and similar

expenses (98) (271) (1) (370)

--------- -------- -------- ---------

Profit/(Loss) before tax 10,674 (708) (31) 9,935

Taxation (1,378) (40) (2) (1,420)

--------- -------- -------- ---------

Profit/(Loss) after tax 9,296 (748) (33) 8,515

--------- -------- -------- ---------

Net Assets

Assets: 36,995 10,840 529 48,364

Liabilities (12,869) (9,955) (525) (23,349)

--------- -------- -------- ---------

Net assets 24,126 885 4 25,015

--------- -------- -------- ---------

3. REVENUE

Six months Six months Twelve months

to 31 Jul to 31 Jul to 31 Jan

2023 2022 2023

GBP'000 GBP'000 GBP'000

-------------------- ----------- ----------- --------------

United Kingdom 25,476 24,087 54,546

Europe 371 66 77

Rest of the World 200 93 451

26,047 24,246 55,074

----------- ----------- --------------

4. OPERATING PROFIT

Operating profit from continued operations is stated after

charging / (crediting):

Twelve

months

Six months Six months to 31 Jan

to 31 Jul to 31 Jul 2023

2023 2022 GBP'000

GBP'000 GBP'000

------------------------------ ----------- ------------- ------------

Depreciation of property,

plant and equipment 297 666 655

Depreciation of right-of-use

assets 333 14 196

Amortisation of fixed assets 204 191 573

Share based payments 58 58 117

Exchange differences - 75 -

5. EARNINGS PER SHARE

The calculation of the basic and diluted earnings per share is

calculated by dividing the profit or loss for the year by the

weighted average number of ordinary shares in issue during the

period.

Six months Six months Twelve months

to 31 Jul to 31 Jul to 31 Jan

2023 2022 2023

------------------------------------ ----------- ----------- --------------

Profit for the period from

continuing operations - GBP'000 99 2,194 8,515

Weighted number of ordinary

shares in issue 33,388,788 34,438,730 33,388,788

Weighted number of fully

diluted ordinary shares in

issue 332,673 332,673 332,673

------------------------------------- ----------- ----------- --------------

Basic earnings per share

from continuing operations

- pence 0.30 6.37 25.50

Diluted earnings per share

from continuing operations

- pence 0.30 6.31 25.25

------------------------------------- ----------- ----------- --------------

6. TRADE AND OTHER RECEIVABLES

31 Jul 2023 31 Jul 2022 31 Jan 2023

GBP'000 GBP'000 GBP'000

--------------------------- ------------ -------------- --------------

Trade receivables 4,895 4,916 3,492

Contract assets 3,119 - 459

Other debtors 2,671 1,894 2,352

Prepayments and accrued

income 16,140 6,338 22,778

Tax recoverable - - 145

26,825 13,148 29,226

------------ -------------- --------------

7. BORROWINGS

31 Jul 2023 31 Jul 2022 31 Jan 2023

GBP'000 GBP'000 GBP'000

--------------- ------------ ------------ ------------

Current 1,457 2,310 2,793

Non-current 4,023 4,404 3,408

5,480 6,714 6,201

------------ ------------ ------------

Analysis of maturity of loans is given below:

31 Jul 2023 31 Jul 2022 31 Jan 2023

GBP'000 GBP'000 GBP'000

----------------------------- ------------ -------------- --------------

Amounts falling due within

one year

Other loans 1,457 2,310 1,469

Amounts falling due 1-2

years

Other loans 1,821 1,612 1,821

Amounts falling due 2-5

years

Other loans 2,202 2,792 2,911

5,480 6,714 6,201

------------ -------------- --------------

Other loans relate to a GBP6,000,000 facility provided by HSBC

to Cenergist Limited and a EUR1,500,000 facility provided to

Cenergist Spain SL by Instituto De Finanzas De Castilla-La Mancha

S.A.U. ("CLM") and are secured by fixed and floating charges over

the assets of the Company and by cross guarantees from the

Company's subsidiary undertakings.

Interest on the HSBC facility is at a rate of 3.450% over the

Bank of England Base Rate with the repayment period being 48 months

from date of individual tranche drawdown.

Interest on the CLM facility is at a rate of 3.50% with the

repayment period being 84 months from date of individual tranche

drawdown.

8. RECONCILIATION OF MOVEMENT IN NET DEBT

At 1 February Non-cash At 31 July

2022 changes Cashflow 2022

--------------------------- -------------- --------- --------- -----------

GBP'000 GBP'000 GBP'000 GBP'000

Cash at bank 4,070 - 2,451 6,521

Borrowings - current - - (2,310) (2,310)

Borrowings - non-current - - (4,404) (4,404)

Lease liability - current

& non current (191) (48) 89 (150)

Net Cash / (Debt) 3,879 (48) (4,174) (343)

--------------------------- -------------- --------- --------- -----------

Adjusted Net Cash /

(Debt)(2) 4,070 - (4,263) (193)

--------------------------- -------------- --------- --------- -----------

At 1 August Non-cash At 31 January

2022 changes Cashflow 2023

--------------------------- ------------ --------- --------- --------------

GBP'000 GBP'000 GBP'000 GBP'000

Cash at bank 6,521 - (3,297) 3,224

Borrowings - current (2,310) - 841 (1,469)

Borrowings - non-current (4,404) - (328) (4,732)

Lease liability - current

& non current (150) (1,226) (350) (1,726)

Net Cash / (Debt) (343) (1,226) (3,134) (4,703)

--------------------------- ------------ --------- --------- --------------

Adjusted Net Cash /

(Debt)(2) (193) - (2,784) (2,977)

--------------------------- ------------ --------- --------- --------------

At 1 February Non-cash At 31 July

2023 changes Cashflow 2023

----------------------------- -------------- --------- --------- -----------

GBP'000 GBP'000 GBP'000 GBP'000

Cash at bank 3,224 - 2,739 5,963

Borrowings - current (2,793) - 1,336 (1,457)

Borrowings - non-current (3,408) - (615) (4,023)

Lease liabilities - current

& non-current (1,726) 31 (175) (1,870)

Net Cash / (Debt) (4,703) 31 3,285 (1,387)

----------------------------- -------------- --------- --------- -----------

Adjusted Net Cash /

(Debt)(2) (2,977) - 3,460 483

----------------------------- -------------- --------- --------- -----------

(2) Adjusted Net Cash / (Debt) i s considered to be a Key

Performance Indicator and consistent with how the Group measures

net cash / debt. It is calculated as cash at bank less borrowings.

Note this is an Alternative Performance Measure and is a non-IFRS

measure.

9. BUSINESS COMBINATION

On 3 April 2023 Cenergist Spain SL acquired all of the share

capital of Installatiebedrijf Vriend B.V. ("Vriend"). Vriend

provides low carbon solutions to customers in the Netherlands.

Background and Rationale

Vriend is a renowned multidisciplinary installer of sustainable

energy solutions with a focus on residential and commercial

projects. The acquisition represents the Group's first step on

their European acquisition strategy, providing the necessary

accreditations and foundations to expand the Group offering into

Northern Europe.

Consideration

The total consideration for the acquisition was EUR0.522

million. The consideration was structured as follows:

Initial consideration, payable in cash on completion of EUR0.485

million; and

Working capital adjustment of EUR0.037 million, paid within

three months of acquisition.

The initial estimates of the fair value of the assets acquired

and liabilities assumed of Vriend at the date of acquisition give

rise to goodwill of EUR0.376m, relating to accumulated "know how"

and expertise of the business and its staff. None of the goodwill

is expected to be deducted for income tax purposes.

Note that this assessment is not yet finalised.

10. EVENTS SUBSEQUENT TO PERIOD END

The Group has not identified any subsequent event to be

reported.

[3]

https://www.gov.uk/government/publications/quarterly-survey-for-q1-april-to-june-2023-to-2024/quarterly-survey-for-q1-april-to-june-2023-to-2024-summary-accessible-version

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFEAIELILIV

(END) Dow Jones Newswires

October 11, 2023 02:00 ET (06:00 GMT)

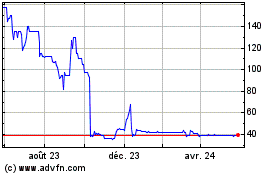

Eneraqua Technologies (LSE:ETP)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

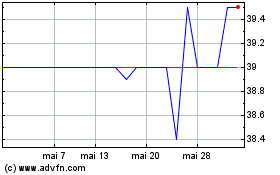

Eneraqua Technologies (LSE:ETP)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024