TIDMUOG

RNS Number : 9118N

United Oil & Gas PLC

28 September 2023

United Oil & Gas PLC / Index: AIM / Epic: UOG / Sector: Oil

& Gas

28 September 2023

United Oil & Gas Plc

("United" "the Group" or the "Company")

Half-year 2023 results

United Oil & Gas PLC (AIM: "UOG"), the full cycle oil and

gas company with a portfolio of production, development,

exploration and appraisal assets is pleased to announce its

unaudited financial and operating results for the half year ended

30 June 2023. A shareholder call will take place this morning,

details are below .

Brian Larkin, CEO commented:

"We are pleased to be able to report progress across our

portfolio as we seek to explore further opportunities for growth to

deliver greater value to our shareholders.

Looking at Egypt, we successfully drilled and brought 2

development wells onstream during the first half of 2023. Notably,

we maintained our excellent safety record throughout these

operations. Our active drilling programme continues with the

drilling of a further near field exploration well planned for the

fourth quarter of the year. Simultaneously, we continue to work

with our JV partners to optimise production from our existing well

stock through a comprehensive programme of workovers and well

intervention activity. Whilst the macroeconomic situation In Egypt

remains challenging, we do continue to be paid a portion of our

receivables in US dollars.

In Jamaica we are engaged in discussions with the Government and

with high-quality potential farm-in partners on our exciting

high-impact exploration asset. Identifying a partner with the right

skillset to complement our work is of paramount importance to

advancing this project and we expect to move forward to commercial

discussions with a preferred partner over the coming weeks.

Whilst Quattro have not yet completed their funding process and

are likely to require a further extension to the long stop date on

the sale agreement for licence P2519, we are hopeful that this

transaction will complete over the coming weeks, given the renewed

interest in the North Sea

We enter the last quarter of 2023 well placed, and will continue

to work hard on delivering on our strategy in order to return value

to our shareholders."

1H 2023 Operational summary

-- 1H 2023 Group net 22% working interest production averaged

1,051 bopd and 93 boepd gas with full year average net production

forecast to be in the range of 930 to 1,030 boepd.

-- In Egypt

- Active drilling programme continues with two wells drilled in

1H, and one additional exploration well planned for H2

- Successful ASH-8 development well brought onstream in March

- Successful ASD-3 development well brought onstream in May

- Zero - Lost Time Incident Frequency rate and Fatal Accident

Frequency rate. No environmental spills, Restricted Work Incidents

or Medical Treatment Incidents

- We continue to have a portion of our Egyptian receivable balance settled in USD

-- In Jamaica, discussions continuing with the Ministry and with

potential farm-in partners with commercial discussions with a

preferred partner expected to commence in Q4.

-- In the UK, whilst the current deadline for completion of the

deal with Quattro has been extended to 30th September, this is

likely to be extended further as Quattro have not yet completed

their funding process.

1H 2023 Financial summary

-- Group revenue for the first half of 2023 was $6.4m(1) (1H 2022:$9.8m)

-- Realised oil price of $78.19/bbl (1H 2022:$105.5/bbl)

-- Gross Profit (excluding Egypt tax gross up) $2.2m (1H 2022: $5.6m)

-- Cash Operating Expenses of $10.65/boe (1H 2022: $8.40/boe)

-- Profit After Tax of $0.6m (1H 2022: $2.4m)

-- Cash collections in the six-month period of $7.0m (1H 2022: $8.7m)

-- Repayments on BP Pre-payment facility of $1.2 (1H 2022: $1.6m)

-- A 30% reduction in Corporate G&A to $830k (1H 2022:

$1.2m) and on target to deliver the 15% full year reduction.

-- Group cash balances at period end were $0.6m (1H 2022: $3.8m)

(1) 22% working interest net of Government Take

1H 2023 Corporate summary

-- Jonathan Leather, Executive Director and Chief Operating

Officer stepped down from the Board on 31 August 2023. Jonathan

will continue to provide support to the company on the Jamaican

farm out process on a consultancy basis.

Outlook

-- In Egypt we look forward to drilling the ASD-S-1X near-field

exploration well, which we expect to spud in October. This is an

exciting exploration well located to the south of the prolific ASD

Field. The well is targeting an estimated gross in-place mean

volume of 10.1 million barrels of oil in multiple stacked reservoir

targets across the productive Abu Roash and Bahariya

reservoirs.

-- The ASD-S-1X exploration well will be followed by additional

development drilling on the Abu Sennan concession - likely

targeting an undrained crestal area that has been identified on the

ASH Field.

-- In Jamaica, we continue discussions with high-quality

potential partners and expect to commence commercial discussions

with a preferred party over the coming weeks. We will provide

further updates to the markets in due course.

-- In the UK, we are looking to complete the transaction with

Quattro on the P2519 licence containing the Maria discovery.

CEO Statement

The first half of the year saw us deliver positive results from

our Egyptian drilling programme, with notable success from both the

ASH-8 and ASD-3 development wells. The high initial rates at ASH-8

demonstrates the productivity and rapid payback, that can be

delivered from development wells drilled into this field. This

success was followed up with a good result from the ASD-3 well

which was drilled 1.1 km to the west of the prolific ASD-2 well and

was brought onto production In May. The results of ASD-3

significantly improved our understanding of the ASD field and has

led to a significant increase in our in-place volumetric estimates

for the field by 16% from 11.4 to 13.2 MMBO in the mid case. Both

new wells had strong initial production rates when they came online

and overall have performed in line with expectations. Our

year-to-date average production to September 2023 was 1,067 boepd

net on the Abu Sennan concession. We continue to work with the

operator and Joint Venture partners on initiatives to offset the

natural production decline in the wells and re-instate production

from temporarily shut in wells.

Safety will always be of the highest priority within our

business and we are pleased to report that during the period the

operator has achieved an excellent record of safety in Egypt and

has reported zero Lost Time Incidents, Medical Treatment Injuries,

Restricted Work Injury, Spills, fires or environmental

incidents.

In the short term, the macroeconomic issues in the Egyptian

economy have resulted in reduced USD liquidity, which in turn has

impacted our ability to repatriate funds from Egypt. Whilst we have

been successful in repatriating some USD the liquidity constraints

imposed by the Egyptian Central bank has resulted in increased

foreign exchange charges being incurred by the company.

As announced in January 2023, the Company has entered into an

agreement with Quattro Energy Limited ("Quattro") for the sale of

our UK North Sea licence that contains the Maria discovery. The

parties have agreed to extend the long stop date on the agreement

to the end of September to provide Quattro with sufficient time to

raise the additional funding needed to complete this transaction.

Whilst Quattro have not yet completed their funding process and are

likely to require a further extension to the long stop date on the

sale agreement for licence P2519, we are hopeful that this

transaction will complete over the coming weeks, given the renewed

interest in the North Sea.

From a financial perspective, we have continued to apply our

free cashflow from operations to fully fund our capital programme

and also the repayment of debt, with net debt reduced to $1.1m at

30 June and period end cash balances of $0.6m. We continue to

receive both USD and EGP in payment for our receivable balances

with our steady cashflows from the Egypt production being leveraged

to the current high commodity prices. We maintain a disciplined

approach to capital allocation in parallel to a close focus on

optimising G&A and operating costs. Our drilling and workover

program in Abu Sennan has yielded robust operational results,

positioning us well to maximize returns for all stakeholders.

Looking to the second half of the year, the third well of our

fully funded drilling programme in Egypt is the ASD-S-1X

exploration well which is due to spud in October. Although the spud

of the well experienced delays due to rig availability, we are

pleased to confirm that the ECDC-6 drilling rig has been secured by

the joint venture for this operation. This is an exciting

exploration well located to the south of the recently drilled ASD

Field. The exploration well is targeting 10.1 million barrels of

oil in place in multiple stacked reservoir targets across the

productive Abu Roash and Bahariya reservoirs. A successful outcome

on this well has the potential to increase production levels, add

reserves, and boost the longer-term value from the Abu Sennan

licence.

In Jamaica, we remain incredibly focussed on delivering a

farmout partner to participate alongside us in the drilling of an

exploration well on this highly prospective acreage. We are

continuing to make progress towards securing a partner to move

forward with us to the next stage of the licence and we expect to

commence commercial discussions with a preferred party over the

coming weeks. We remain confident that a successful outcome can be

ultimately delivered and further updates will be provided in due

course. In parallel to our farmout discussions, we continue to

engage with the Jamaican authorities as we work together to deliver

the long-term value of this licence to all stakeholders.

I would like to extend the Company's gratitude to United's

former Chief Operating Officer, Jonathan Leather, for his dedicated

eight years of service with United. While he embarks on new

endeavours outside our company, we are excited to continue building

upon the foundation of success we've achieved together. Jonathan

will continue to provide support to the Company on the Jamaican

farm out process on a consultancy basis.

Our strategy remains the same to create value by actively

managing our existing assets whilst growing our business through

additional high-margin opportunities. This growth strategy is

supported by four pillars;

- the strength of our assets;

- commitment to managing a responsible business;

- effective financial and risk management; and

- an experienced and capable team

United is well placed to deliver on our strategy and with solid

assets, a dynamic team, and supportive shareholders, we look

forward to embracing the opportunities towards continued growth and

success that lie ahead.

Brian Larkin

Chief Executive Officer

28 September 2023

Operations Update

Operations Update

Egypt, Abu Sennan (22% non-operated working interest, operated

by Kuwait Energy Egypt)

1H 2023 Production

Oil production from the Abu Sennan Licence in H1 2023 averaged

1,051 bopd (net to United's 22% working interest) with an

additional 93 boepd net gas. The exit rate from the first half was

1,011 bopd net, plus 111 boepd net gas with Group working interest

production forecast to average between 930 and 1,030 boepd for the

full year 2023.

2023 Work Programme

Two development wells, ASH-8 and ASD-3, were drilled in the

first half of the year. Both of these wells were successful and

came onstream in March and May respectively.

In parallel to the development drilling, a number of workovers

have also been completed, and we have enhanced production from

existing wells through low-cost interventions. Further workovers

are planned as we continue through the second half of 2023.

After producing for a number of months at rates in excess of

2,800 bopd (616 bopd net) and producing 390,000 barrels to end of

August, production from the ASH-8 well is now declining, and is

currently producing at a flow rate of 601 bopd (132 bopd net). This

decline is broadly in line with expectations and the performance of

the other production wells in the ASH Field. Based on our previous

experience of the field, the impact of the decline is expected to

be partially mitigated by the installation of artificial lift in

the well during H2, and by continued production-enhancing workover

activity across the Abu Sennan Licence.

The results of ASD-3 significantly improved our understanding of

the ASD field and has led to a significant increase in our in-place

volumetric estimates for the field by 16% from 11.4 to 13.2 MMBO in

the mid case . This well also had strong initial production rates

which have now declined in line with expectations.

We continue to work with the operator and Joint Venture partners

on initiatives including additional drilling, water injection, and

stimulation to offset the natural production decline in the wells

and re-instate production from temporarily shut in wells.

Additional drilling in 2H 2023 has now been agreed by the JV

partners and is expected to commence in October with the drilling

of the ASD-S-1X exploration well. This exciting exploration

prospect lies to the south of the prolific ASD Field and is

expected to take approximately 40 days to drill. The exploration

well is targeting a gross mean in-place volume of 10.1 million

barrels of oil in multiple stacked reservoir targets across the

productive Abu Roash and Bahariya reservoirs.

Once ASD-S-1X has been completed, additional development

drilling is planned and will likely target an undrained crestal

area that has been identified on the ASH Field. Subject to rig

availability, this well is expected to spud in Q1 2024.

Jamaica, Walton Morant Licence (100% working interest)

The farm-out campaign remains a key focus for United, as we seek

to take this potentially transformational project forward into the

next phase of the Licence. We have continued to engage with

potential partners to participate alongside us in drilling an

exploration well and have been encouraged by the quality of the

companies who have undertaken in-depth evaluations. The initial

deadline for indicative offers that was set at the end of 1H was

extended to allow these evaluations to be completed. Commercial

discussions with a preferred partner are now expected to commence

in Q4 . Additional updates will be provided in due course.

UK Central North Sea, Maria Discovery, Licence P2519 (100%

working interest)

United entered into a binding Asset Purchase Agreement ("APA")

on the licence with Quattro Energy Limited ("Quattro") on 18(th)

January 2023. This APA had a long-stop date of 31(st) July 2023,

and although the NSTA approval was received for this transaction,

Quattro had not completed the required fundraising by this

long-stop date.

After receiving further assurances from Quattro and a

non-refundable deposit of $0.1m, the parties subsequently agreed an

extension of the long stop date in the APA to 30(th) September

2023. It was also agreed that a further extension may be required

for all conditions precedent to be met to allow completion of the

sale, namely regulatory approvals to enable the transfer of funds

to United, and the Licence assignment to Quattro, with such

extension to be automatically granted on the satisfaction of the

Quattro funding condition being met by 30 September 2023. Whilst we

understand that Quattro has made progress towards completing their

funding process it is likely that they will require a further

extension to the long stop date to facilitate this process. A

further update will be provided in due course.

UK Onshore, Licence PL090 (26.25% non-operated working interest,

operated by Egdon Resources UK Ltd)

Licence PL090 contains the shut-in Waddock Cross Field, situated

in the onshore Wessex Basin, UK. Work continues on securing

planning and permitting consents, finalising the site facilities

and well designs, ahead of a potential 2024 drilling campaign.

There is clearly value within this asset, and United will continue

to evaluate all the options for realising this potential, including

the option of participating in a well in 2024.

Financial Update

Highlights

1H 2023 1H 2022

Net average production

volumes (boepd) 1,144 1,552

-------- --------

Oil price realised

($/bbl) $78.19 $105.5

-------- --------

Revenue(1) $6.4m $9.8m

-------- --------

Gross profit((2)

) $2.2m $5.6m

-------- --------

Profit after tax $0.6m $2.4m

-------- --------

Cash from operating

activities $4.4m $4.9m

-------- --------

Capital expenditure $3.5m $3.4m

-------- --------

Debt repayments $1.2m $1.6m

-------- --------

Cash operating

cost per boe $10.65 $8.40

-------- --------

(1) 22% working interest stated net of government take

(2) Gross profits excluding Egypt tax gross up

Group Production and Commodity Prices

Total group working interest production for 1H 2023 was 1,144

boepd. The average realised oil price was $78.19/bbl and the

average realised gas price was $2.61/mmbtu.

Revenues

Group Revenues for the six month period ending 30 June 2023 was

$6.4m (1H 2022 $9.8 m), due to a 26% reduction in average

production and a 26% reduction in realised oil prices in the

period. The entire revenue for the Group is generated from our 22%

interest in the Abu Sennan concession in Egypt and is stated after

accounting for government entitlements under each of the production

sharing contracts. The 1H 2023 average realised oil price per

barrel achieved was $78.19/bbl (representing a discount to Brent of

circa $2.37/bbl).

Group Operating costs, Depreciation, Depletion &

Amortisation ("DD&A"), and expenses

Cash Operating costs amounted to $10.65/boe (1H 2022:

$8.40/boe). The increase in the per barrel cost is being primarily

driven by the predominantly fixed nature of the cost base, and the

reduction in average daily production in the period. DD&A

charges on production and development assets amounted to $2.1m for

the six months to 30 June 2023.

Administrative Expenses

Group administrative expenses for the six month period ending 30

June 2023 was $1.6m (1H 2022 $1.8 m). Adjusted for the non-cash

items under IFRS Share Based payments and IFRS 16 leases, the

administrative expense is $1.4m (2022 $1.6m) Included in

Administrative expenses are foreign exchange losses of $0.5m (2022:

$0.2m) with the increase being due primarily to realised losses on

the devaluation of the Egyptian pound versus the USD during the

year and the additional costs to translate EGP to USD.

As previously announced in January 2023, the Group is currently

implementing a number of initiatives to further reduce General and

Administration costs whilst ensuring continuity of operational

capability. In 1H 2023 other Administrative Expenses have been

reduced by approximately 30% to $0.8m from $1.2m in 1H 2022. This

decrease has been delivered primarily through a reduction in

Corporate Headcount and reduction in the size of the Board. The

Company remains on track to deliver the overall 15% reduction for

the full year compared to 2022.

Derivative Financial Instrument

In 2022 the Group extended the final maturity date on the BP

facility from 30 September 2022 to 31 December 2023. This amendment

required the Group to recognise a fair value loss on the derivative

of $1.5m in the prior year period, rather than recognising the

charge over the remaining maturity of the facility. No additional

charge to the income statement in relation to the fair value of the

derivative arose in the period as the prevailing oil price remained

above $70 per barrel throughout the period.

Exploration Costs

There were no exploration costs written off in the period; $302K

has been spent assessing New Venture activities and has been

expensed as these costs are pre-licence.

Impairment

There were no impairment triggers in the period.

Taxation and other income

In Egypt under the terms of the Production Sharing Agreement all

corporate taxes are paid by EGPC who receive production

entitlements from the licence. The Egypt concession is subject to

corporate income tax at the standard rate of 40.55%. However,

responsibility for payment of corporate income taxes falls upon

EGPC on behalf of UOG Egypt Pty Ltd. The Group records a tax charge

with a corresponding increase in other income for the tax paid by

EGPC on its behalf. Due to accumulated tax- deductible balances

there was no tax due in the prior period.

Cash

US$'000

Opening Cash at 1 January

2023 1,345

Net cash inflow from

operations 3,463

Movements in working

capital 909

Exploration Expenditure (492)

Development Expenditure (2,992)

Repayment of Debt facility (1,158)

Exchange movements

and other (521)

Closing Cash at 30

June 2023 554

The continued effect of macroeconomic challenges on the broader

Egyptian economy has resulted in both a devaluation of the Egyptian

Pound and restrictions on outgoing US Dollar transfers by the

Central Bank of Egypt. This has resulted in businesses in Egypt

suffering from reduced and occasionally unpredictable USD

liquidity.

As previously announced, we have continued to receive a portion

of our USD receivable balances in USD with the remainder received

in EGP, the latter of which are primarily used to fund our active

drilling and operations programme in country. The Group continues

to manage its cash and working capital position through this period

with the continued support of our joint venture partners in Egypt

and our strategic long term financing partner BP.

Capital Expenditure

The Group continues to engage in an active work programme across

our portfolio of assets with forecast cash capital expenditure for

the full year 2023 of c. $6m of which $3.5m was incurred in 1H

2023, including $3.2m on the drilling programme in Egypt and

workover activity in addition to $0.3m on Jamaica and UK

assets.

Events today

Management is hosting a shareholder call at 1100 BST today.

Investors that wish to participate in the event,

please click on this link to register https://bit.ly/46rS2FF

Confirmation email with the details of the dialling in process

will be sent to your email address.

A presentation will be available today on www.uogplc.com.

S

This announcement contains inside information for the purposes

of Article 7 of Regulation 2014/596/EU which is part of domestic UK

law pursuant to the Market Abuse (Amendment) (EU Exit) regulations

(SI 2019/310).

Glossary:

1H- first half

bbl - barrel of crude oil

boe - barrel of oil equivalent

bopd - barrels of oil per day

boepd - barrels of oil equivalent per day

EGP - Egyptian pound

EGPC - Egyptian General Petroleum Corporation

JV - Joint Venture

mmbbls - million barrels of oil

m- million

NSTA - Noth Sea Transition Authority

USD - US Dollar

Enquiries

United Oil & Gas Plc (Company)

Brian Larkin, CEO brian.larkin@uogplc.com

Peter Dunne, CFO peter.dunne@uogplc.com

Beaumont Cornish Limited

(Nominated Adviser)

Roland Cornish | Felicity

Geidt | Asia Szusciak +44 (0) 20 7628 3396

Tennyson Securities (Joint

Broker)

Peter Krens +44 (0) 20 7186 9030

Optiva Securities Limited

(Joint Broker)

Christian Dennis +44 (0) 20 3137 1902

Camarco (Financial PR)

Andrew Turner | Emily Hall +44 (0) 20 3757 4983

| Sam Morris | uog@camarco.co.uk

Notes to Editors

United Oil & Gas is a high growth oil and gas company with a

portfolio of low-risk, cash generative production, development,

appraisal and exploration assets across Egypt, UK and a high impact

exploration licence in Jamaica.

The business is led by an experienced management team with a

strong track record of growing full cycle businesses, partnered

with established industry players and is well positioned to deliver

future growth through portfolio optimisation and targeted

acquisitions.

United Oil & Gas is listed on the AIM market of the London

Stock Exchange. For further information on United Oil and Gas

please visit www.uogplc.com

CONSOLIDATED INCOME STATEMENT

Period ended 30 June 2023

Note Period Period Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022

Unaudited Unaudited Audited

$ $ $

Revenue 6,401,660 9,782,239 15,831,237

Other income 1,167,603 3,360,093 5,181,458

Cost of sales 4 (4,159,685) (4,172,012) (8,143,910)

Gross profit 3,409,578 8,970,320 12,868,785

Administrative expenses:

------------------------------------ ----- ------------ ------------ --------------

Other administrative expenses (830,823) (1,167,226) (1,773,154)

Impairment of intangible

assets - - (483,611)

Exploration and New Venture

write offs (301,656) (122,793) (284,275)

Decommissioning provision

on impaired exploration licence - (290,609) -

Foreign exchange (losses)

/ gains (499,892) (158,346) (1,106,614)

(Loss) / gain on disposal

of business / non-current

assets held for sale - (21,768) -

------------------------------------ ----- ------------ ------------ --------------

Operating profit 1,777,207 7,209,578 9,221,131

Finance expense (10,690) (1,467,980) (1,690,896)

Profit before taxation 1,766,517 5,741,598 7,530,235

Taxation (1,167,603) (3,360,093) (5,181,458)

------------ ------------ --------------

Profit for the financial

period attributable to the

Company's equity shareholders 598,914 2,381,505 2,348,777

Earnings per share from continuing

operations expressed in cents

per share:

Basic 3 0.09 0.37 0.36

Diluted 3 0.09 0.35 0.36

------------ ------------ --------------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Period Period Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022

Unaudited Unaudited Audited

$ $ $

Profit for the financial

period 598,914 2,381,505 2,348,777

Foreign exchange difference 45,512 (241,389) 337,866

---------- ---------- --------------

Profit for the financial

period attributable to

the Company's equity shareholders 644,426 2,140,116 2,686,643

CONSOLIDATED BALANCE SHEET

On 30 JUNE 2023

Note 30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

$ $ $

NON-CURRENT ASSETS

Intangible assets 5 7,937,945 6,104,920 7,385,326

Property, plant and equipment 6 22,317,006 18,261,905 20,368,299

30,254,951 24,366,825 27,753,625

CURRENT ASSETS

Inventory 373,918 272,341 268,859

Trade and other receivables 7 3,789,268 6,334,151 4,469,493

Derivative financial instruments - - 120,168

Cash and cash equivalents 553,920 3,806,121 1,345,463

----------- ----------- -----------

4,717,106 10,412,613 6,203,983

CURRENT LIABILITIES

Trade and other payables (5,173,107) (3,923,213) (3,709,667)

Derivative financial instruments - (1,229,802) -

Borrowings 9 (1,728,712) (1,413,983) (2,964,225)

Lease liabilities (42,092) (28,517) (83,985)

(6,943,911) (6,595,515) (6,757,877)

NON-CURRENT LIABILITIES

Borrowings 9 - (709,753) -

Decommissioning Provisions (249,244) (274,262) (233,630)

Derivative financial instruments - (611,199) -

Lease liabilities (7,356) (24,495) (7,356)

----------- ----------- -----------

(256,600) (1,619,709) (240,986)

NET ASSETS 27,771,546 26,564,214 26,958,745

=========== =========== ===========

CAPITAL AND RESERVES ATTRIBUTABLE

TO EQUITY -

HOLDERS OF THE COMPANY

Share capital 8 8,839,679 8,416,182 8,839,679

Share premium 8 16,798,823 16,215,361 16,798,823

Share-based payment reserve 2,716,063 2,376,659 2,547,688

Merger reserve (2,697,357) (2,697,357) (2,697,357)

Translation reserve (962,625) (799,493) (1,008,137)

Retained earnings 3,076,963 3,052,862 2,478,049

----------- ----------- -----------

TOTAL EQUITY 27,771,546 26,564,214 26,958,745

=========== =========== ===========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Period ended 30 June 2023

Share-

based

Share Share payment Retained Translation Merger Total

capital premium reserve earnings reserve reserve equity

$ $ $ $ $ $ $

For the period ended

30 June 2023

Balance at 1 January

2023 8,839,679 16,798,823 2,547,688 2,478,049 (1,008,137) (2,697,357) 26,958,745

Profit for the period - - - 598,914 - - 598,914

Foreign exchange

difference - - - - 45,512 - 45,512

---------- ----------- ---------- ---------- ------------ ------------ -----------

Total comprehensive

income for the period - - - 598,914 45,512 - 644,426

Contributions by

and distributions

to owners:

Share based payments - - 168,375 - - - 168,375

Total contributions

by and distributions

to owners - - 168,375 - - - 168,375

---------- -----------

Balance at 30 June

2023 (Unaudited) 8,839,679 16,798,823 2,716,063 3,076,963 (962,625) (2,697,357) 27,771,546

---------- ----------- ---------- ---------- ------------ ------------ -----------

For the period ended

30 June 2022

Balance at 1 January

2022 8,416,182 16,215,361 2,247,465 671,357 (558,104) (2,697,357) 24,294,904

Profit for the period - - - 2,381,505 - - 2,381,505

Foreign exchange

difference - - - - (241,389) - (241,389)

---------- ----------- ---------- ---------- ------------ ------------ -----------

Total comprehensive

income for the period - - - 2,381,505 (241,389) - 2,140,116

Contributions by

and distributions

to owners:

Share based payments - - 129,194 - - - 129,194

Total contributions

by and distributions

to owners - - 129,194 - - - 129,194

---------- -----------

Balance at 30 June

2022 (Unaudited) 8,416,182 16,215,361 2,376,659 3,052,862 (799,493) (2,697,357) 26,564,214

---------- ----------- ---------- ---------- ------------ ------------ -----------

For the period ended

31 December 2022

Balance at 1 January

2022 8,416,182 16,215,361 2,247,465 201,543 (558,104) (2,697,357) 23,825,090

Profit for the period - - - 2,348,777 - - 2,348,777

Foreign exchange

difference - - - - 337,866 - 337,866

Total comprehensive

income for the year - - - 2,348,777 337,866 - 2,686,643

Contributions by

and distributions

to owners:

Foreign exchange

adjustment arising

on change of parent

company functional

currency to USD 283,278 523,376 53,516 (72,271) (787,899) - -

Shares issued 140,219 60,086 - - - - 200,305

Share-based payments - - 246,707 - - - 246,707

Balance at 31 December

2022 (Audited) 8,839,679 16,798,823 2,547,688 2,478,049 (1,008,137) (2,697,357) 26,958,745

CONSOLIDATED STATEMENT OF CASHFLOWS

Period ended 30 June 2023

Period ended 30 June 2023 Period ended 30 June 2022 Year ended 31 December

2022

Unaudited Unaudited Audited

$ $ $

Cash flows from operating

activities

Profit before taxation 1,766,517 5,741,598 7,530,235

Adjustments for:

Share-based payments 168,375 129,194 246,707

Depreciation & amortisation 2,185,290 1,860,040 3,309,940

Fair value loss on

derivatives - 1,457,545 1,562,467

Impairment, decommissioning

and NV costs - 413,403 483,611

Gain on non-current assets /

disposal groups held for

sale - 57,926 -

Interest expense 10,690 10,435 128,429

Foreign exchange movements 499,892 158,344 1,106,614

Tax paid (1,167,603) (3,417,339) (5,238,704)

-------------------------- -------------------------- --------------------------

3,463,161 6,411,146 9,129,299

(Increase) in inventories (105,058) (126,771) (123,289)

Decrease / (increase) in

trade and other receivables 680,225 (132,129) 732,529

(Decrease) / increase in

trade and other payables 334,163 (1,224,657) (1,032,853)

-------------------------- -------------------------- --------------------------

Net cash from operating

activities 4,372,491 4,927,589 8,705,686

Cash flows from investing

activities

Proceeds received on

disposal of non-current

assets - 3,887,275 4,887,275

Purchase of property, plant

& equipment (2,992,206) (2,138,247) (5,610,924)

Spend on exploration

activities (492,145) (1,318,314) (2,972,201)

Net cash used in investing

activities (3,484,351) 430,714 (3,695,850)

Cash flows from financing

activities

Issue of ordinary shares

(net of expenses) - - 200,305

Repayments on swap financing

arrangement (1,118,250) (710,824) (1,452,118)

Payments on oil price

derivatives - (922,286) (1,522,892)

Capital payments on lease (45,829) (46,195) (90,096)

Interest paid on lease (3,213) (3,888) (86,669)

-------------------------- -------------------------- --------------------------

Net cash used in financing

activities (1,167,292) (1,683,193) (2,951,470)

Increase / (decrease) in

cash and cash equivalents (279,152) 3,675,110 2,058,366

Cash and cash equivalents at

beginning of period / year 1,345,463 397,308 397,308

Effects of exchange rate

changes (512,391) (266,297) (1,110,211)

-------------------------- -------------------------- --------------------------

Cash and cash equivalents at

end of period / year 553,920 3,806,121 1,345,463

========================== ========================== ==========================

Notes to the financial information

Period ended 30 June 2023

1. GENERAL

The interim financial information for the period to 30 June 2023

is unaudited.

2. ACCOUNTING POLICIES

The interim financial information in this report has been

prepared on the basis of the accounting policies set out in the

audited financial statements for the period ended 31 December 2022,

which complied with International Financial Reporting Standards as

adopted for use in the European Union ("IFRS").

IFRS is subject to amendment and interpretation by the

International Accounting Standards Board ("IASB") and the IFRS

Interpretations Committee and there is an on-going process of

review and endorsement by the European Commission.

The financial information has been prepared on the basis of IFRS

that the Directors expect to be applicable as at 31 December

2023.

The Directors have adopted the going concern basis in preparing

the financial information. In assessing whether the going concern

assumption is appropriate, the Directors have taken into account

all relevant available information about the foreseeable

future.

The condensed financial information for the year ended 31

December 2022 set out in this interim report does not comprise the

Group's statutory accounts as defined in section 434 of the

Companies Act 2006.

The statutory accounts for the year ended 31 December 2022,

which were prepared under IFRS, have been delivered to the

Registrar of Companies. The auditors reported on these accounts;

their report was unqualified and did not contain a statement under

section 498(2) or 498(3) of the Companies Act 2006.

Foreign currency

The Group's presentation currency is USD with its functional

currency being the Egyptian Pound.

Going Concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the CEO's statement.

United regularly monitors its business activities, financial

position, cash flows and liquidity through the preparation and

review of detailed forecasts. Scenarios and sensitivities are also

regularly presented to the Board, including changes in commodity

prices and in production levels from the existing assets, plus

other factors which could affect the Group's future performance and

position. A base case forecast has been considered which uses

budgeted commitments and prevailing forward curve assumptions for

oil prices. The directors have also considered the potential

impacts of a delay in the payment of receivables in Egypt, a

reduction in forecasted revenue and an increase in forecast capital

expenditure in Egypt. The cashflow forecasts incorporates a

scenario whereby the sale of Maria P2519 to Quattro does not

complete in the period.

The likelihood of all these ' downside sensitivities ' taking

place simultaneously and lasting for the entire forecast period is

considered to be remote. If required, we have identified

appropriate mitigating actions, including the deferral of

additional uncommitted capital expenditure, seeking a restructuring

of debt arrangements and adjustment of the Group cost base, which

would be available to us and have been demonstrated as effective

strategies in previous periods of low oil prices. Our business in

Egypt remains stable given cash operating costs of less than

$11/boe, flexible drilling contracts and gas contracts that are

fixed price in nature. There are limited capital commitments in the

other assets in our portfolio. The forecasts outlined above show

that the Group will have sufficient financial resources for the 12

months from the date of approval of the interim financial

statements. Based on this analysis, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. Therefore, they

continue to use the going concern basis of accounting in preparing

the annual Financial Statements.

Revenue

Revenue comprises invoiced sales of hydrocarbons to customers,

excluding value added and similar taxes. Also disclosed within

revenue is tariff income recognised, excluding value added and

similar taxes, for gas transportation facilities provided to third

parties.

Revenue from hydrocarbon sales represents the Group's share of

sales from its producing interest in Egypt, at the point in time

when ownership of the oil has passed to the buyer. This includes

adjustments to invoiced quantities for entitlement share

adjustments calculated on a licence-by-licence basis that arise in

the period. The Group does not have performance obligations

subsequent to delivery.

Other Income - Tax Entitlement Volumes

Under the concession agreements in Egypt, income tax due on

taxable profit is paid on the Group's behalf by EGPC. To achieve

this through the agreements, the Group notionally receive a greater

share of hydrocarbon production in excess of the Group's

entitlement interest share of production equal to the amount

required to cover the tax payable. The oil is produced and sold on

the Group's behalf and proceeds remitted to the tax authorities.

This income does not fall within the definition of revenue and is

therefore shown as other income with an equal and opposite tax

charge recorded through current taxation.

Exploration and evaluation assets

The group accounts for oil and gas expenditure under the full

cost method of accounting.

Costs (other than payments to acquire the legal right to

explore) incurred prior to acquiring the rights to explore are

charged directly to the profit and loss account. All costs incurred

after the rights to explore an area have been obtained, such as

geological, geophysical, data costs and other direct costs of

exploration and appraisal are accumulated and capitalised as

intangible exploration and evaluation ("E&E") assets.

E&E costs are not amortised prior to the conclusion of

appraisal activities. At the completion of appraisal activities if

technical feasibility is demonstrated and commercial reserves are

discovered, then following development sanction, the carrying value

of the relevant E&E asset will be reclassified as a development

and production asset within tangible fixed assets.

If after completion of appraisal activities in an area, it is

not possible to determine technical feasibility or commercial

viability, then the costs of such unsuccessful exploration and

evaluation are impaired to the Income Statement. The costs

associated with any wells which are abandoned are fully amortised

when the abandonment decision is taken.

Development and production assets are accumulated generally on a

field by-field basis and represent the costs of developing the

commercial reserves discovered and bringing them into production,

together with the E&E expenditures incurred in finding

commercial reserves which have been transferred from intangible

E&E assets.

The net book values of development and production assets are

depreciated generally on a field-by-field basis using the unit of

production method based on the commercial proven and probable

reserves. Assets are not depreciated until production

commences.

Depreciation of production assets

Production assets are accumulated into cash generating units

(CGUs) and the net book values are depreciated on a prospective

basis using the unit-of production method by reference to the ratio

of production in the year and the related economic commercial

reserves, taking into account future development expenditures

necessary to bring those reserves into production.

The gain or loss arising on disposal or scrapping of an asset is

determined as the difference between the sales proceeds, net of

selling costs, and the carrying amount of the asset and is

recognised in the income statement.

Each asset's estimated useful life has been assessed with regard

to both its own physical life limitations and the present

assessment of economically recoverable reserves of the oil and gas

asset at which the item is located, and to possible future

variations in those assessments. Estimates of remaining useful

lives are made on a regular basis for all oil and gas assets,

machinery and equipment, with annual reassessments for major items.

Changes in estimates which affect unit production calculations are

accounted for prospectively.

Classification and measurement of financial liabilities

The Group's financial liabilities include borrowings, trade and

other payables and embedded derivative financial instruments.

Financial liabilities are initially measured at fair value, and,

where applicable, adjusted for transaction costs unless the Group

designated a financial liability at fair value through profit or

loss.

Subsequently, financial liabilities are measured at amortised

cost using the effective interest method except for derivatives and

financial liabilities designated at FVTPL, which are carried

subsequently at fair value with gains or losses recognised in

profit or loss.

All interest-related charges and, if applicable, changes in an

instrument's fair value that are reported in profit or loss are

included within finance costs or fair value gains/(losses) on

derivative financial instruments.

Embedded derivative financial instruments

A borrowing arrangement structured as a prepaid commodity swap

with monthly repayments over 30 months has embedded in it a

derivative that is indexed to the price of the commodity. This is

considered to be a separable embedded derivative of a loan

instrument.

At the date of issue, the fair value of the embedded derivative

is estimated by considering the derivative as a series of forward

contracts with modelling of the fixed and floating legs to

determine a repayment schedule and derive a net present value for

the forward contract embedded derivative.

This amount is recognised separately as a financial liability or

financial asset and measured at fair value through the income

statement. The residual amount of the loan is then recorded as a

liability on an amortised cost basis using the effective interest

method until extinguished upon conversion or at the instrument's

maturity date.

3. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

Basic and diluted earnings per share

Unaudited Unaudited Audited

Period ended Period ended Year ended

30 June 2023 30 June 2022 31 December 2022

Profit for the period ($) 598,914 2,381,505 2,348,777

Weighted average number of ordinary shares for the purposes

of basic earnings per share(number) 656,353,969 644,803,969 649,550,544

Dilutive shares - 37,200,000 6,803,425

Weighted average number of ordinary shares for the purposes

of diluted earnings per share(number) 656,353,969 682,003,969 656,353,969

Basic earnings per share from continuing operations (cents

per share) 0.09 0.37 0.36

Diluted earnings per share from continuing operations (cents

per share) 0.09 0.35 0.36

============== ============== ==================

4. COST OF SALES

Unaudited Unaudited Audited

Period ended Period ended Year ended

30 June 30 June 2022 31 December

2023 2022

$ $ $

Production Operating costs 2,026,203 2,360,166 4,930,038

Depreciation, depletion and

amortisation 2,133,482 1,811,846 3,213,872

Inventories - - -

4,159,685 4,172,012 8,143,910

============= ============== =============

5. INTANGIBLE ASSETS

Intangible assets comprise the Group's exploration and

evaluation projects which are pending determination.

Management review the intangible exploration assets for

indications of impairment at each balance sheet date based on IFRS

6 criteria. Commercial reserves have not yet been established and

the evaluation and exploration work is ongoing. The Directors do

not consider that any indications of impairment have arisen and

accordingly the assets continue to be carried at cost.

6. PROPERTY, PLANT AND EQUIPMENT

Property, Plant and Equipment assets primarily consist of the

group's producing assets in the Abu Senan concession in Egypt, plus

some office assets and right of use leased office space.

Management reviews the property, plant and equipment for

indications of impairment at each balance sheet date in accordance

with IAS 36. No indications of impairment have been identified at

either 30 June 2023 or 31 December 2022.

7. TRADE AND OTHER RECEIVABLES

Unaudited Unaudited Audited

30 June 2023 30 June 2022 31 December 2022

$ $ $

Trade receivables 2,640,577 1,545,991 3,549,051

Prepayments and deposit 34,802 6,739 6,941

Accrued income 1,078,232 3,732,373 873,206

Other tax receivables 35,657 49,048 40,295

Crown disposal proceeds due - 1,000,000 -

------------- ------------- -----------------

3,789,268 6,334,151 4,469,493

============= ============= =================

8. SHARE CAPITAL & SHARE PREMIUM

Allotted, issued, and fully paid:

30 June 2023

Share capital Share premium

No $ $

Ordinary shares of GBP0.01 each

Opening balance 656,353,969 8,839,679 16,798,823

At 30 June 656,353,969 8,839,679 16,798,823

30 June 2022

Share capital Share premium

No $ $

Ordinary shares of GBP0.01 each

Opening balance 644,803,969 8,416,182 16,215,361

At 30 June 644,803,969 8,416,182 16,215,361

31 December 2022

Share capital Share premium

No $ $

Ordinary shares of GBP0.01 each

Opening balance 644,803,969 8,416,182 16,215,361

Effect of Parent company functional currency change - 283,278 523,376

Allotments:

Share issued for cash (exercise of warrants) 11,550,000 140,219 60,086

At 31 December 656,353,969 8,839,679 16,798,823

9. BORROWINGS AND DERIVATIVES

Summary of borrowing arrangements:

In February 2020, the Group entered into a prepaid commodity

swap arrangement for $8m to part-finance the acquisition of

Rockhopper Egypt Pty Ltd. The funds were to be repaid through 30

monthly repayments which are structured as a fixed notional amount

with variations based on movements in oil prices. Due to the price

structure, the arrangement includes an embedded derivative (a

forward contract). For financial reporting purposes, this must be

separately accounted for at fair value at each balance sheet date.

The balance of proceeds that did not relate to the derivative were

treated as the opening carrying amount of the loan which will then

be measured at amortised cost over its life, with finance charges

recognised to give an even return over the loan life and repayments

of capital allocated appropriately.

In January 2022, the Group refinanced the swap arrangement, with

the remaining balance to be repaid through a further 24 monthly

repayments which are structured as a fixed notional amount with

variations based on movements in oil prices. The refinanced swap

arrangement is a substantial modification and has therefore been

accounted for as a termination of the old debt and commencement of

a new arrangement. This has again been accounted for as a loan at

amortised cost with an embedded derivative which is separately

accounted for at fair value.

The amount outstanding at the period end was c$1.7m (1H 2022:

$4m), included in current liabilities in the balance sheet.

10. EVENTS AFTER THE BALANCE SHEET DATE

There have been no events since the Balance Sheet date that have

any material impact on the half year results for the period ended

30 June 2023.

Glossary

Non-IFRS measures

The Group uses certain measures of performance that are not

specifically defined under IFRS or other generally accepted

accounting principles.

Cash-operating costs per barrel

Cash operating costs are defined as cost of sales less

depreciation, depletion and amortisation, and movements in

inventories. The cash operating costs are then divided by barrels

of oil equivalent produced to demonstrate the cash cost of

producing oil and gas from the Group's producing assets.

Period Year ended

Period ended ended 30 31 December

30 June 2023 June 2022 2022

Unaudited Unaudited Audited

$ $ $

Cost of Sales 4,159,685 4,172,012 8,143,910

Less:

Depreciation, depletion, and amortisation (2,133,482) (1,811,846) (3,213,872)

Inventories - - -

--------------- ------------ --------------

Cash Operating costs

* 2,026,203 2,360,166 4,930,038

--------------- ------------ --------------

Production (BOEPD)

* 1,051 1,552 1,312

--------------- ------------ --------------

Cash Operating cost per BOE ($) 10.65 8.40 10.29

--------------- ------------ --------------

EBITDAX

EBITDAX is a non-IFRS measure that represents earnings

(exclusive of Egypt income relating to tax entitlement volumes)

before Interest, tax, depreciation, amortisation, exploration

expense and impairment.

Exploration expense excluded as write off is one-off in nature

and not normal annual activity.

Presented to help users understand the cash profitability of the

Group.

Period Year ended

Period ended ended 30 31 December

30 June 2023 June 2022 2022

Unaudited Unaudited Audited

$ $ $

Operating Income (Excl. Egypt tax

gross-up) 609,604 3,849,486 9,221,131

Depreciation, Depletion & Amortisation 2,185,290 1,858,201 3,307,462

Exploration/NV, Impairment & Decommissioning

Expense 301,656 413,402 767,886

--------------- -------------- --------------

EBITDAX 3,096,550 6,121,089 13,296,479

--------------- -------------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKOBKKBKBDCB

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

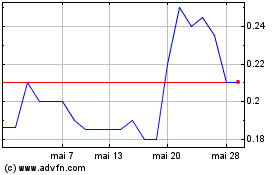

United Oil & Gas (LSE:UOG)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

United Oil & Gas (LSE:UOG)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025