A Bad Risk - Zacks Industry Rank Analysis

11 Mai 2011 - 2:00AM

Zacks

Industry Rank Analysis 5-11-11

There are all sorts of disasters in the world, and they happen all

the time. Recently, though, there seem to have been an awful lot of

them, from the earthquake and tsunami in Japan to the tornados

across the South.

Who pays for the damage caused? In large part it is the Property

and Casualty Insurance companies. However, big payouts from

disasters are not the only problem the industry faces. Insurance

companies collect money upfront in the form of premiums to have the

money available to pay out when disaster strikes. They actually

make most of their money from the investment of those funds while

they wait for disaster to strike.

For the most part insurance companies will park those funds in

fixed income securities like bonds. With the yield on 10-year

T-notes south of 3.2%, that is not nearly as profitable as it used

to be. For most insurance companies, the amount of premiums

collected is less than the combined amount of their policy payouts

and their overhead expenses (known in the industry as having a

combined ratio of over 100%).

However, normally they don’t lose that much on underwriting, but

when disasters strike...well, it is disastrous for their combined

ratios. The combination of high payouts and low investment yields

is a devastating one-two punch for the industry, and the result is

showing up in the Zacks rank.

Zacks Industry Classifications

The Zacks industry classifications are very fine, with 256

different industries tracked. It is not particularly noteworthy if

a single small industry shows up doing well -- a single firm with

good news can propel a one or two firm industry to the top (or

bottom) of the charts.

It is interesting when you see a cluster of similar industries at

the top of the list. The same holds true for the bottom of the

list. The definition of size that matters here is not the total

sales or market capitalization but the number of companies in the

“industry.”

Where the Pain Is

The Property and Casualty insurance industry is a very large one

with 60 firms. Large enough that I don’t have to go looking for

other related “industries,” although I would note that the Accident

and Health Insurance industry is not looking very healthy

either. Of those 60 firms, 15 hold the dreaded Zacks #5 Rank

(Strong Sell), and 16 hold a Zacks #4 Rank (Sell). In other words,

more than half of the industry is expected to do poorly over the

next month or so.

Note that there are almost as many on the number 5 list as on the

number 4 list. That is unusual in that there are three times as

many “number 4’s” as “number 5’s” in the Zacks Universe as a whole.

Only the worst 5% are stuck with the number 5 rank, and the next

15% get a number 4 rank.

In P&C Insurance, 25.0% have number 5 ranks and 26.7% have

number 4 ranks. Many of the weakest firms are not household names

because they sell insurance to other insurance companies, not

directly to individuals or (non-insurance) businesses. That

business is known as Reinsurance.

The industry is currently in 247th place out of the 256 industries

tracked, an improvement of one spot from last week. Due to the law

of large numbers it is unusual to have a very large industry like

this at either the top or bottom of the list. The average Zacks

rank for P&C insurance firms is 3.68, up from 3.65 last

week.

The first table shows the P&C Insurance stocks that hold the

enviable number 5 rank (Strong Sell). The second table shows

the number 4 rank (Sell) firms. Most of the firms are relatively

small cap, but there are several that are well into mid-cap

territory and which should be relatively easy to either short or

buy put options on.

Just avoiding the smaller-cap names is probably the best strategy.

The valuations on many of these firms look very reasonable,

particularly if you are willing to look out to 2012 earnings.

However, those earnings expectations are falling, and an estimate

in motion tends to stay in motion, thus the “true” P/E is likely

much higher than the numbers on the table suggest. Many have

extremely high (or infinite, shown as N/A) P/E ratios based on this

years earnings.

The very high payouts due to the disasters will fall in this year’s

earnings. For next year, the implicit expectation is that the level

of disasters will be more normal. Frankly I have no idea how many

earthquakes and hurricanes will hit next year, and more importantly

from the industry’s point of view, where.

Some big disasters can have a very high human toll, but almost no

effect on the industry, such as the earthquake in Haiti. Disasters

that hit in developed countries such as the US tend to have much

lower human costs, but much higher financial costs, which are what

matters to the industry.

The falling estimates for next year probably have more to do with

the low bond yields. Right now it looks like the business of taking

on risk from others is proving to be a bad risk. Down the road, the

combination of low yields and big payouts might remove enough

capacity to write insurance that premiums start to rise, but you

might want to wait a few months (or until the Zacks ranks start to

improve significantly) before jumping in.

Number 5 Ranked Firms

| Company |

Ticker |

Market Cap ($ mil) |

P/E Using Curr FY Est |

P/E Using Next FY Est |

% Change Curr FY Est - 4 wk |

% Change Next FY Est - 4 wk |

Current Price |

| Xl Group Plc |

XL |

$7,249 |

17.97 |

10.88 |

-7.79% |

-2.53% |

$23.45 |

| Everest Re Ltd |

RE |

$4,873 |

41.51 |

7.96 |

-38.35% |

-1.80% |

$89.87 |

| Transatlan Hldg |

TRH |

$3,014 |

57.9 |

8.1 |

3.82% |

-0.67% |

$48.35 |

| White Mtn Ins |

WTM |

$2,840 |

78.65 |

25.74 |

-65.71% |

-0.72% |

$353.92 |

| Aspen Ins Hldgs |

AHL |

$1,959 |

120 |

8.44 |

-71.85% |

-1.38% |

$27.75 |

| Endurance Splty |

ENH |

$1,747 |

26.51 |

8.65 |

-47.70% |

-2.66% |

$43.97 |

| Harleysville Gp |

HGIC |

$863 |

12.35 |

10.35 |

-14.91% |

-4.05% |

$31.87 |

| Argo Group Intl |

AGII |

$848 |

N/A |

11.14 |

-238.46% |

-7.61% |

$30.88 |

| Greenlight Cap |

GLRE |

$813 |

14.03 |

6.49 |

-25.33% |

0.00% |

$26.90 |

| Global Indemnty |

GBLI |

$747 |

14.92 |

16.69 |

0.00% |

0.00% |

$24.62 |

| Safety Ins Grp |

SAFT |

$685 |

15.02 |

13.73 |

-10.42% |

-0.50% |

$45.21 |

| Infinity Ppty |

IPCC |

$663 |

13.71 |

12.04 |

-13.53% |

-1.11% |

$53.47 |

| Emc Insurance |

EMCI |

$266 |

19.38 |

11.35 |

-49.52% |

-11.71% |

$20.54 |

| Amer Safety Ins |

ASI |

$196 |

18.28 |

9.99 |

-28.07% |

-3.85% |

$18.74 |

| Homeowners Chce |

HCII |

$48 |

8.64 |

9.61 |

0.00% |

0.00% |

$7.69 |

Number 4 Ranked Firms

| Company |

Ticker |

Market Cap ($ mil) |

P/E Using Curr FY Est |

P/E Using Next FY Est |

% Change Curr FY Est - 4 wk |

% Change Next FY Est - 4 wk |

Current Price |

| Partnerre Ltd |

PRE |

$5,366 |

N/A |

9.62 |

-243.48% |

-2.44% |

$79.44 |

| Arch Cap Gp Ltd |

ACGL |

$4,494 |

15.56 |

12.6 |

20.09% |

0.25% |

$101.74 |

| Axis Cap Hldgs |

AXS |

$4,038 |

N/A |

8.41 |

-125.69% |

-1.15% |

$34.39 |

| Markel Corp |

MKL |

$3,967 |

27.02 |

22.2 |

-7.06% |

-0.47% |

$408.12 |

| Hcc Ins Hldgs |

HCC |

$3,656 |

11.76 |

10.34 |

-8.08% |

0.00% |

$31.82 |

| Renaissancere |

RNR |

$3,651 |

61.76 |

8.34 |

-36.08% |

4.89% |

$69.12 |

| Allied World As |

AWH |

$2,397 |

13.11 |

9.85 |

-12.00% |

-1.37% |

$63.03 |

| Platinum Undrwt |

PTP |

$1,369 |

N/A |

8.21 |

56.84% |

0.00% |

$36.74 |

| Montpelier Re |

MRH |

$1,127 |

N/A |

7.61 |

-118.46% |

-1.24% |

$18.11 |

| Navigators Grp |

NAVG |

$775 |

15.41 |

14.37 |

-0.25% |

1.38% |

$49.23 |

| State Auto Finl |

STFC |

$639 |

47.63 |

13.67 |

-68.01% |

-4.28% |

$15.91 |

| Flagstone Reins |

FSR |

$565 |

N/A |

5.39 |

21.38% |

1.74% |

$8.22 |

| Donegal Grp -A |

DGICA |

$337 |

15.47 |

12.52 |

-5.56% |

0.00% |

$13.15 |

| Stewart Info Sv |

STC |

$196 |

77.1 |

9.06 |

-61.07% |

-10.98% |

$10.28 |

| Hallmark Finl |

HALL |

$168 |

24.99 |

12.81 |

11.11% |

5.41% |

$8.33 |

| Investors Title |

ITIC |

$89 |

20.74 |

18.93 |

-6.47% |

-2.37% |

$38.99 |

In evaluating the Zacks Industry Ranks, you want to see two

things: a good overall score (low, meaning more Zacks #1 and #2

Ranked stocks than #4 or #5 Ranked stocks) and some improvement the

relative position from the prior week. It is also helpful to

understand exactly what the Zacks Industry Rank is.

The Zacks Industry Rank is the un-weighted average of the

individual Zacks ranks of the firms in that industry. It does not

matter if the stock is the 800 lb gorilla that dominates the

industry or some very small niche player in the industry -- they

have the same influence on the industry rank.

Also, that means that the bigger the industry in terms of number of

firms, the less influence any given company has on the industry

rank. It also implies that small industries, with just two or three

firms, should be the ones found at either the top or the bottom of

the list. After all, if there are only two firms in the industry,

it is relatively easy to get a Zacks rank of 2.00 (i.e. one with a

Zacks Rank of #1 and the other with a #3). Right now, that industry

rank would be tied for 6th place among the 255 industries

tracked.

The same obviously goes for the bottom of the list as well. If

there are 50 firms in the industry, and it ends up at one of the

extremes, that means there has to be something pretty significant

going on. Thus, I do not always focus on the very highest rated

industries, but on the highest rated ones in which there are a

large number of firms.

Click here for the Zacks Industry Rank List:

http://www.zacks.com/zrank/zrank_inds.php

ARCH CAP GP LTD (ACGL): Free Stock Analysis Report

AXIS CAP HLDGS (AXS): Free Stock Analysis Report

MARKEL CORP (MKL): Free Stock Analysis Report

EVEREST RE LTD (RE): Free Stock Analysis Report

XL GROUP PLC (XL): Free Stock Analysis Report

Zacks Investment Research

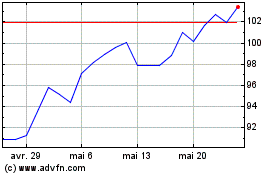

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Sept 2024 à Oct 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024