As filed with the Securities and Exchange Commission on November 7, 2024

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

_____________________

Avalo Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 45-0705648 |

(State or other Jurisdiction | | (I.R.S. employer identification number) |

of Incorporation or Organization) | | |

| | | | | | | | |

540 Gaither Road, Suite 400 Rockville, Maryland 20850 |

| (Address, including zip code, of registrant’s principal executive offices) |

Avalo Therapeutics, Inc. Fourth Amended and Restated 2016 Equity Incentive Plan

Avalo Therapeutics, Inc. Amended and Restated 2016 Employee Stock Purchase Plan

(Full title of the plans)

Christopher Sullivan, Chief Financial Officer

Avalo Therapeutics, Inc.

540 Gaither Road, Suite 400

Rockville, Maryland 20850

(410) 522-8707

(Name, address, including zip code, and telephone number, including area code, of agent for service)

COPIES TO:

| | | | | |

Andrew J. Gibbons, Esq. Alexander M. Donaldson, Esq. Wyrick Robbins Yates & Ponton LLP 4101 Lake Boone Trail, Suite 300 Raleigh, North Carolina 27607 (919) 781-4000

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☐ | (Do not check if smaller reporting company) | Smaller reporting company | | ☒ |

| | | | Emerging Growth Company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.☐

EXPLANATORY NOTE

This Registration Statement is being filed to register:

•an additional (i) 32,070 shares of common stock issuable pursuant to Section 3(a)(ii) of the Avalo Therapeutics, Inc. (the “Registrant”) Third Amended and Restated 2016 Equity Incentive Plan and (ii) 3,508,804 shares of common stock of the Registrant issuable pursuant to the Avalo Therapeutics, Inc. Fourth Amended and Restated 2016 Equity Incentive Plan (the “2016 Stock Plan”); and

•an additional (i) 174 shares of common stock of the Registrant pursuant to Section 3(a) of the Avalo Therapeutics, Inc. 2016 Employee Stock Purchase Plan and (ii) 233,920 shares of common stock of the Registrant issuable pursuant to the Avalo Therapeutics, Inc. Amended and Restated 2016 Employee Stock Purchase Plan (the “ESPP”);

all of which are securities of the same class for which Registration Statements on Form S-8 are effective. Accordingly, the contents of the previous Registration Statements on Form S-8 filed by the Registrant with the Securities and Exchange Commission (the “Commission”) on May 20, 2016 (File No. 333-211490), May 20, 2016 (File No. 333-211491), August 10, 2018 (File No. 333-226767), August 6, 2020 (File No. 333-241661), May 13, 2021 (File No. 333-256082), May 13, 2021 (File No. 333-256083), November 7, 2022 (File No. 333-268199), and May 4, 2023 (File No. 333-271655), including periodic and current reports filed after the previous Registration Statements on Form S-8 to maintain current information about the Registrant, are incorporated by reference into this Registration Statement pursuant to General Instruction E of Form S-8.

The additional shares are the result of (i) the annual automatic increase provision of Section 3(a)(ii) of the 2016 Plan (prior to its amendment and restatement on August 13, 2024) and Section 3(a) of the ESPP (prior to its amendment and restatement on August 13, 2024) and (iii) the increase in the shares reserved for issuance under each of the 2016 Plan and the ESPP approved by the stockholders of the Registrant on August 13, 2024.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| | | | | |

| Item 3. | Incorporation of Documents by Reference. |

The following documents previously filed by the Registrant with the Commission are incorporated herein by reference:

(b) The Registrant’s Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31 (as amended by Form 10-Q/A), June 30 and September 30, 2024, filed with the Commission on May 13 (and amended on July 11), August 12 and November 7, 2024, respectively, pursuant to Section 13(a) of the Exchange Act;

(c) The Registrant’s Current Reports on Form 8-K filed pursuant to Section 13(a) of the Exchange Act on January 31, March 28 (as amended by Forms 8-K/A filed on June 3 and June 24), May 23, June 24 (two filings), July 9, July 16, July 30, August 14, September 4, September 9, October 8, 2024; and

(d) The description of the Registrant’s common stock contained in Exhibit 4.16 to the Registrant’s Form 10-K for the fiscal year ended December 31, 2023, filed with the Commission on March 29, 2024, including any amendments or reports filed for the purpose of updating such description.

All documents or portions thereof filed, but not furnished, by the Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date hereof and prior to the filing of a post-effective amendment that indicates that all securities offered under this Registration Statement have been sold or which deregisters all securities then remaining unsold shall be considered incorporated by reference herein and to be a part hereof from the date the documents are filed. In no event, however, will any of the information, including exhibits, that we disclose under Item 2.02 or Item 7.01 of any report on Form 8-K that has been or may be, from time to time, furnished to the Commission, be incorporated by reference into or otherwise become a part of this Registration Statement.

Any statement contained in a document incorporated or considered incorporated by reference herein shall be deemed to be modified or superseded for purposes hereof to the extent that a statement contained herein (or in any other subsequently filed document that also is or is considered incorporated by reference herein) modifies or supersedes such statement. Any such statement so modified or superseded shall not be considered, except as so modified or superseded, to constitute a part hereof.

| | | | | |

| Item 6. | Indemnification of Directors and Officers. |

Section 145 of the Delaware General Corporation Law provides that a corporation has the power to indemnify a director, officer, employee, or agent of the corporation and certain other persons serving at the request of the corporation in related capacities against amounts paid and expenses incurred in connection with an action or proceeding to which he or she is or is threatened to be made a party by reason of such position, if such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, in any criminal proceeding, if such person had no reasonable cause to believe his or her conduct was unlawful. In the case of actions brought by or in the right of the corporation, no indemnification shall be made with respect to any matter as to which such person has been adjudged to be liable to the corporation unless and only to the extent that the adjudicating court determines that such indemnification is proper under the circumstances.

The Registrant’s Certificate of Incorporation and Bylaws provide that its directors and officers will be indemnified by the Registrant to the fullest extent authorized by the Delaware General Corporation Law. In addition, the Registrant’s Certificate of Incorporation provides, as permitted by Section 102(b)(7) of the Delaware General Corporation Law, that its directors will not be liable for monetary damages to the Registrant for breaches of their fiduciary duty as directors, unless they (i) violated their duty of loyalty to the Registrant or its stockholders, (ii) acted, or failed to act, in good faith, (iii) acted with intentional misconduct, (iv) knowingly or intentionally violated the law, (v) authorized unlawful payments of dividends, unlawful stock purchases or unlawful redemptions, or (vi) derived an improper personal benefit from their actions as directors.

The Registrant’s Bylaws also permit the Registrant to secure insurance on behalf of any officer, director, employee, or agent for any liability arising out of his or her actions, regardless of whether Delaware General Corporation Law would permit indemnification. The Registrant has purchased a policy of directors’ and officers’ liability insurance that insures its directors and officers.

In addition, the Registrant has also entered into an indemnification agreement with certain of its directors and officers. The indemnification agreements require the Registrant to indemnify and hold harmless and advance expenses to each indemnitee in respect of acts or omissions occurring prior to the time the indemnitee ceases to be an officer and/or director of the Registrant to the fullest extent permitted by applicable law. The rights provided in the indemnification agreements are in addition to the rights provided in the Registrant’s Certificate of Incorporation, Bylaws, and the Delaware General Corporation Law.

The following exhibits are filed as part of this Registration Statement:

| | | | | | | | |

Exhibit No. | | Description |

| | |

4.1 | | |

| 4.2 | | |

| 4.3 | | |

| 4.4 | | |

| 4.5 | | |

5.1* | | |

10.1 | | |

10.2 | | |

23.1* | | |

23.2* | | |

24.1* | | |

| 107* | | |

* Filed herewith.

[THE NEXT PAGE IS THE SIGNATURE PAGE]

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Rockville, State of Maryland, on the 7th day of November, 2024.

| | | | | | | | | | | |

| AVALO THERAPEUTICS, INC. | |

| | | |

| By: | /s/ Christopher Sullivan | |

| | Christopher Sullivan | |

| | Chief Financial Officer | |

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints Garry A. Neil and Christopher Sullivan, and each of them, his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | | | | |

| Signature | | Capacity | | Date | |

| | | | | |

/s/ Garry A. Neil, M.D. | | Chief Executive Officer, Director and Chairman | | November 7, 2024 | |

| Garry A. Neil, M.D. | | (Principal Executive Officer) | | | |

| | | | | |

/s/ Christopher Sullivan | | Chief Financial Officer | | November 7, 2024 | |

| Christopher Sullivan | | (Principal Financial and Accounting Officer) | | | |

| | | | | |

/s/ June Almenoff, M.D., Ph.D. | | Director | | November 7, 2024 | |

| June Almenoff, M.D., Ph.D. | | | | | |

| | | | | |

/s/ Mitchell Chan | | Director | | November 7, 2024 | |

| Mitchell Chan | | | | | |

| | | | | |

/s/ Jonathan Goldman, M.D. | | Director | | November 7, 2024 | |

| Jonathan Goldman, M.D. | | | | | |

| | | | | |

/s/ Aaron Kantoff | | Director | | November 7, 2024 | |

| Aaron Kantoff | | | | | |

| | | | | |

/s/ Gilla Kaplan, Ph.D. | | Director | | November 7, 2024 | |

| Gilla Kaplan, Ph.D. | | | | | |

| | | | | |

/s/ Samantha Truex | | Director | | November 7, 2024 | |

| Samantha Truex | | | | | |

| | | | | |

Exhibit 107

Calculation of Filing Fee Table

Form S-8

(Form Type)

Avalo Therapeutics, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | | Security Class Title | | Fee Calculation Rule | | Amount Registered(1)(2) | | Proposed Maximum Offering Price Per Share(3) | | Maximum Aggregate Offering Price(3) | | Fee Rate | | Amount of Registration Fee |

| Equity | | Common Stock, $0.001 par value per share | | Rules 457(c) and 457(h)(1) | | 3,774,968 | | $ | 13.18 | | | $ | 49,754,078 | | | $ | 0.0001531 | | | $ | 7,617 | |

| Total Offering Amounts | | | | | | | | | | $ | 7,617 | |

| Total Fee Offsets | | | | | | | | | | $ | — | |

| Net Fee Due | | | | | | | | | | $ | 7,617 | |

| | | | | | | | | | | | | | | |

| (1) | Consists of (i) 3,540,874 additional shares reserved for issuance under the Avalo Therapeutics, Inc. Fourth Amended and Restated 2016 Equity Incentive Plan (the “2016 Stock Plan”) and (ii) 234,094 additional shares reserved for issuance under the Avalo Therapeutics, Inc. 2016 Employee Stock Purchase Plan (the “ESPP”). An aggregate of 8,286 shares issuable under the 2016 Plan and an aggregate of 1,134 shares issuable under the ESPP (both amounts adjusted to give effect to previously effected reverse stock splits) had been previously registered pursuant to Registration Statement No. 333-211490, Registration Statement No. 333-211491, Registration Statement No. 333-226767, Registration Statement No. 333-241661, Registration Statement No. 333-256082, Registration Statement No. 333-256083, Registration Statement No. 333-268199 and Registration Statement No. 333-271655. |

| (2) | Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers any additional shares of Registrant’s common stock that become issuable under the 2016 Stock Plan by reason of any stock dividend, stock split, recapitalization, or other similar transaction that results in an increase in the number of outstanding shares of the Registrant’s common stock. |

| (3) | Estimated in accordance with Rules 457(c) and 457(h)(1) of the Securities Act solely for the purpose of calculating the registration fee based upon the average of the high and low prices of the Registrant’s common stock on the NASDAQ Capital Market on November 5, 2024. |

Exhibit 5.1

Wyrick Robbins Yates & Ponton LLP

4101 Lake Boone Trail, Suite 300

Raleigh, North Carolina 27607-7506

November 7, 2024

Avalo Therapeutics, Inc.

540 Gaither Road, Suite 400

Rockville, Maryland 20850

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We have examined the Registration Statement on Form S-8 filed on or about the date hereof by Avalo Therapeutics, Inc., a Delaware corporation (the “Registrant”), with the Securities and Exchange Commission (the “Registration Statement”), in connection with the registration under the Securities Act of 1933, as amended, of an aggregate of 3,774,968 shares of the Registrant’s common stock, $0.001 par value per share (the “Shares”). We understand that 3,540,874 of the Shares are to be issued pursuant to the Registrant’s Fourth Amended and Restated 2016 Equity Incentive Plan (the “Plan”) and that 234,094 Shares are to be issued pursuant to the Registrant’s Amended and Restated 2016 Employee Stock Purchase Plan (together, the “Plans”). In our examination, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals and the conformity with the original of all documents submitted to us as copies thereof.

As the Registrant’s legal counsel, we have examined the proceedings taken, and are familiar with the proceedings proposed to be taken, in connection with the sale of the Shares pursuant to the Plans.

It is our opinion that, upon completion of the proceedings being taken or contemplated by us, as the Registrant’s counsel, to be taken prior to the issuance of the Shares, the Shares, when issued in the manner referred to in the Registration Statement and in accordance with the Plans, will be validly issued, fully paid and nonassessable.

We consent to the use of this opinion as an exhibit to the Registration Statement and further consent to the use of our name wherever appearing in the Registration Statement, including the Prospectus constituting a part thereof, and any amendments thereto.

| | | | | | | | |

| |

| | Very truly yours, |

| | |

| | /s/ WYRICK ROBBINS YATES & PONTON LLP |

| | |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the Avalo Therapeutics, Inc. Amended and Restated 2016 Employee Stock Purchase Plan and the Avalo Therapeutics, Inc. Fourth Amended and Restated 2016 Equity Incentive Plan of our report dated March 29, 2024, with respect to the consolidated financial statements of Avalo Therapeutics, Inc. and subsidiaries included in its Annual Report (Form 10-K) for the year ended December 31, 2023, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Tysons, Virginia

November 7, 2024

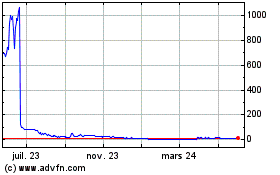

Avalo Therapeutics (NASDAQ:AVTX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

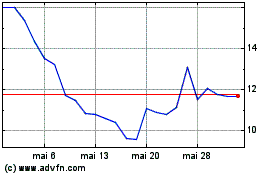

Avalo Therapeutics (NASDAQ:AVTX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024