Cemtrex Announces 1-For-35 Reverse Stock Split

21 Novembre 2024 - 10:15PM

- Cemtrex Inc. (NASDAQ: CETX, CETXP), an advanced security

technology and industrial services company, today announced that

its Board of Directors authorized the stockholders approved

1-for-35 reverse stock split (the “Reverse Stock Split”) of its

common stock, par value $0.001 per share (the “Common Stock”).

The Reverse Stock Split will become effective at

12:01 a.m. Eastern Time on November 26, 2024 (the “Effective

Time”). The Common Stock will continue to trade on The Nasdaq

Capital Market under the symbol “CETX” and will begin trading on a

post-split basis when the market opens on November 26, 2024. The

new CUSIP number for the Common Stock following the Reverse Stock

Split will be 15130G881.

The Reverse Stock Split is intended to enable

the Company to regain compliance with the minimum closing bid price

requirement for continued listing on Nasdaq.

At the Effective Time of the Reverse Stock

Split, every 35 shares of the Company’s issued and outstanding

Common Stock will be combined into one share of Common Stock issued

and outstanding, with no change to the par value of $0.001 per

share. No fractional shares of Common Stock will be issued as a

result of the Reverse Stock Split and instead each holder of Common

Stock who would otherwise be entitled to receive a fractional share

as a result of the Reverse Stock Split will receive one whole share

of Common Stock in lieu of such fractional share.

The principal effect of the Reverse Split will

be that (i) the number of shares of common stock issued and

outstanding will be reduced to one-thirty-fifth that amount, and

(ii) all outstanding options and warrants (other than the

Adjustable Warrants) entitling the holders thereof to purchase

shares of common stock will enable such holders to purchase, upon

exercise of their options or warrants, one-twentieth of the number

of shares of common stock which such holders would have been able

to purchase upon exercise of their options or warrants, immediately

preceding the Reverse Split at an exercise price equal to 35 times

the exercise price specified before the Reverse Split, resulting in

essentially the same aggregate price being required to be paid

therefor upon exercise thereof immediately preceding the Reverse

Split. Other awards under our 2020 Equity Compensation Plan would

be subject to proportionate adjustments.

ClearTrust, LLC is acting as transfer and

exchange agent for the Reverse Stock Split. Stockholders with

shares held in certificated form will receive from ClearTrust, LLC

instructions regarding the exchange of their certificates.

Stockholders that hold shares in book-entry form or hold their

shares in brokerage accounts are not required to take any action

and will see the impact of the Reverse Stock Split reflected in

their accounts, subject to brokers’ particular processes.

Beneficial holders of Common Stock are encouraged to contact their

bank, broker, custodian or other nominee with questions regarding

procedures for processing the Reverse Stock Split.

About Cemtrex

Cemtrex Inc. (CETX) is a company that owns two

operating subsidiaries: Vicon Industries Inc and Advanced

Industrial Services Inc.

Vicon Industries, a subsidiary

of Cemtrex Inc., is a global leader in advanced security and

surveillance technology to safeguard businesses, schools,

municipalities, hospitals and cities. Since 1967, Vicon delivers

mission-critical security surveillance systems, specializing in

engineering complete security solutions that simplify deployment,

operation and ongoing maintenance. Vicon provides security

solutions for some of the largest municipalities and businesses in

the U.S. and around the world, offering a wide range of

cutting-edge and compliant security technologies, from AI-driven

video analytics to fully integrated access control solutions. For

more information visit www.vicon-security.com.

AIS – Advanced Industrial

Services, a subsidiary of Cemtrex, Inc., is a premier

provider of industrial contracting services including

millwrighting, rigging, piping, electrical, welding. AIS Installs

high precision equipment in a wide variety of industrial markets

including automotive, printing & graphics, industrial

automation, packaging, and chemicals. AIS owns and operates a

modern fleet of custom designed specialty equipment to assure safe

and quick installation of your production equipment. Our talented

staff participates in recurring instructional training, provided to

ensure that the most current industry methods are being utilized to

provide an efficient and safe working environment. For more

information visit www.ais-york.com.

For more information visit www.cemtrex.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, including statements relating to the closing of

the offering, gross proceeds from the offering, our new product

offerings, expected use of proceeds, or any proposed fundraising

activities. These forward-looking statements are based on

management’s current expectations and are subject to certain risks

and uncertainties that could cause actual results to differ

materially from those set forth in or implied by such forward

looking statements. Statements made herein are as of the date of

this press release and should not be relied upon as of any

subsequent date. These risks and uncertainties are discussed under

the heading “Risk Factors” contained in our Form 10-K filed with

the Securities and Exchange Commission. All information in this

press release is as of the date of the release and we undertake no

duty to update this information unless required by law.

Investor RelationsChris

TysonExecutive Vice President – MZ North AmericaDirect:

949-491-8235CETX@mzgroup.uswww.mzgroup.us

Investor Relations

Chris Tyson

Executive Vice President – MZ North America

Direct: 949-491-8235

CETX@mzgroup.us

www.mzgroup.us

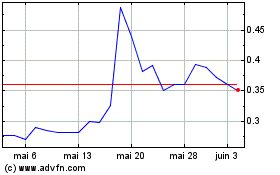

Cemtrex (NASDAQ:CETX)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Cemtrex (NASDAQ:CETX)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024