Consolidated Water Co. Ltd. (NASDAQ Global Select Market: CWCO), a

leading designer, builder and operator of advanced water supply and

treatment plants, announced today that on May 29, 2024 (the

“Settlement Date”) it settled the previously disclosed dispute

between the Company’s wholly-owned Dutch subsidiary, Consolidated

Water Coöperatief, U.A. (“CW-Coöperatief”) and the United Mexican

States (“Mexico”) relating to the termination by Mexican

governmental authorities of a public-private partnership agreement

(the “APP Contract”), under which CW-Coöperatief’s indirect Mexican

subsidiary Aguas de Rosarito, S.A.P.I. de C.V. (“AdR”) was to

develop, build and operate a desalination plant and its

accompanying pipelines in Playas de Rosarito, Baja California (the

“Project”). Under the settlement agreement, CW-Coöperatief’s

Mexican subsidiary N.S.C. Agua, S.A. de C.V. (“NSC”) will sell the

20.1 hectares of land on which the Project’s plant was to be

constructed, including related rights of way (the “Land”), and

certain documentation owned by NSC relating to the Project

(“Project Documentation”) for an aggregate price of MXN$616,144,000

(or approximately US$36,351,000 based upon the MXN$-US$ exchange

rate published by the Bank of Mexico on the Settlement Date).

The dispute arose when, on June 29, 2020,

Mexican governmental authorities sent a notice to AdR terminating

the APP Contract and inviting AdR to submit a request for the

reimbursement of Project-related expenses in accordance with the

APP Contract and Mexican law governing the APP Contract. AdR

disputed the lawfulness of the termination and submitted a

reimbursement request on August 28, 2020. On April 16, 2021,

CW-Coöperatief notified Mexico that a dispute had arisen between

CW-Coöperatief and Mexico under the Agreement on Promotion,

Encouragement and Reciprocal Protection of Investments between the

Kingdom of the Netherlands and Mexico (the “Treaty”), in connection

with the termination of the APP Contract and AdR’s reimbursement

request.

On February 7, 2022, CW-Coöperatief submitted a

Request for Arbitration to the International Centre for Settlement

of Investment Disputes (“ICSID”), requesting arbitration of the

dispute under the Treaty (the “Arbitration”). On May 10, 2022,

CW-Coöperatief and Mexico agreed to postpone the appointment of the

arbitral tribunal in the interest of facilitating discussions

between CW-Coöperatief and the Mexican government to settle the

dispute amicably. Subsequently, CW-Coöperatief and Mexico agreed to

successive extensions of this postponement. The settlement

agreement is a result of the discussions between CW-Coöperatief and

the Mexican government.

Under the settlement agreement entered into on

May 29, 2024, CW-Coöperatief was required to request that ICSID

discontinue the Arbitration within two business days of the date of

the settlement agreement. On the Settlement Date, CW-Coöperatief

sent the discontinuance request, and on May 31, 2024 ICSID issued

an order discontinuing the Arbitration. Under the terms of the

settlement agreement, Fondo Nacional de Infraestructura, a Mexican

trust that is a part of the state-owned Nacional de Obras y

Servicios Públicos, S.N.C. (the “Trust”), was required to purchase

the Land, on an “as-is” basis, from NSC for MXN$596,144,000 (or

approximately US$35,171,000, based upon the MXN$-US$ exchange rate

published by the Bank of Mexico on the Settlement Date). NSC and

AdR previously acquired the Land for approximately

US$24.2 million through a series of transactions that began in

2012. The closing day for the sale of the Land to the Trust is

scheduled on June 10, 2024.

Within ten business days of the closing day for

the sale of the Land to the Trust, the Mexican government and NSC

are required to execute an agreement on terms acceptable to NSC,

pursuant to which the Mexican government will pay at least

MXN$20,000,000 (or approximately US$1,180,000 based upon the

MXN$-US$ exchange rate published by the Bank of Mexico on the

Settlement Date) to purchase the Project Documentation.

Once the parties to the settlement agreement

have fully discharged their respective obligations described above:

(i) the parties will be released from all obligations owed to each

other in connection with the APP Contract, the dispute, and the

Arbitration; and (ii) no party to the settlement agreement may

institute any legal proceedings against another party thereto with

respect to the matters which have been addressed by the settlement

agreement.

About Consolidated Water Co. Ltd.

Consolidated Water Co. Ltd. develops and

operates advanced water supply and treatment plants and water

distribution systems. The Company designs, constructs and operates

seawater desalination facilities in the Cayman Islands, The Bahamas

and the British Virgin Islands, and designs, constructs and

operates water treatment and reuse facilities in the United States.

The Company recently entered the U.S. desalination market with a

contract to design, construct, operate and maintain a seawater

desalination plant in Hawaii.

The Company also manufactures and services a

wide range of products and provides design, engineering,

management, operating and other services applicable to commercial

and municipal water production, supply and treatment, and

industrial water and wastewater treatment. For more information,

visit cwco.com.

Cautionary Note Regarding Forward-Looking

Statements

This press release includes statements that may

constitute “forward-looking” statements, usually containing the

words “believe”, “estimate”, “project”, “intend”, “expect”,

“should”, “will” or similar expressions. These statements are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements

inherently involve risks and uncertainties that could cause actual

results to differ materially from the forward-looking statements.

Factors that would cause or contribute to such differences include,

but are not limited to (i) continued acceptance of the Company’s

products and services in the marketplace; (ii) changes in its

relationships with the governments of the jurisdictions in which it

operates; (iii) the outcome of its negotiations with the Cayman

government regarding a new retail license agreement; (iv) the

collection of its delinquent accounts receivable in The Bahamas;

and (v) various other risks, as detailed in the Company’s periodic

report filings with the SEC. The Company can offer no assurance

that the sales of the Land and the Project Documentation will be

consummated as required under the settlement agreement discussed

herein. For more information about risks and uncertainties

associated with the Company’s business, please refer to the

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and “Risk Factors” sections of the Company’s

SEC filings, including, but not limited to, its annual report on

Form 10-K and quarterly reports on Form 10-Q, copies of which may

be obtained by contacting the Company’s Secretary at the Company’s

executive offices or at the “Investors – SEC Filings” page of the

Company’s website at http://ir.cwco.com/docs. Except as otherwise

required by law, the Company undertakes no obligation to update or

revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise.

Company Contact: David W.

Sasnett Executive Vice President and CFO Tel (954) 509-8200 Email

Contact

Investor Relations Contact: Ron

Both or Grant Stude CMA Investor Relations Tel (949) 432-7566 Email

Contact

Media Contact: Tim Randall CMA

Media Relations Tel (949) 432-7572 Email Contact

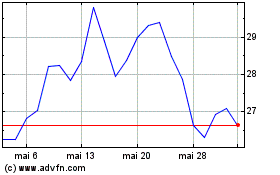

Consolidated Water (NASDAQ:CWCO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Consolidated Water (NASDAQ:CWCO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024