Global Hydrogen Energy LLC (“Global Hydrogen”), which seeks

to be a leader in the sustainable energy transition as a

next-generation industrial gas supplier, and Dune Acquisition

Corporation (Nasdaq: DUNEU, DUNE, DUNEW) (“Dune”), a special

purpose acquisition company, today announced that they have entered

into a definitive agreement for a business combination, which would

result in Global Hydrogen becoming a publicly listed company. The

combined company will be called Global Gas Corporation upon the

closing of the business combination and its common stock is

expected to be listed on Nasdaq under the new ticker symbol “HGAS”.

Headquartered in New York, Global Hydrogen is

led by Founder and Chief Executive Officer William B. Nance, who

has over a decade of hydrogen and industrial gas experience. Global

Hydrogen is a 100% minority-owned business that targets both

private and publicly-funded hydrogen development and carbon

recovery projects, including projects supported by local, county,

state, and national- level governments. Global Hydrogen primarily

targets renewable waste as feedstock to generate the industrial

gases it sells, and seeks arrangements with owners of wastewater

treatment plants, food waste processing facilities, agricultural

farms, and landfills as well as producers and distributors of

renewable natural gas.

William B. Nance, commented, “The transition to

a zero emission transportation future is underway. Global Hydrogen

sees a large addressable market for hydrogen and carbon recovery

infrastructure and rapidly growing demand for low carbon hydrogen

and recovered carbon dioxide and oxygen. The partnership we

announced with Dune will enable us to continue executing our

strategy providing attractively priced energy carrier molecules

near population centers, where they are needed most.”

Carter Glatt, Founder and Chief Executive

Officer of Dune, added, “We are excited to partner with William and

Global Hydrogen as they tackle global decarbonization efforts by

providing low carbon, clean hydrogen and carbon dioxide generated

from local waste biogas and renewable feedstock. With both public

and private sector support seeking to achieve net zero emission

targets, Global Hydrogen is operating at the heart of powerful

secular tailwinds and will be well-positioned to be a leader in the

clean economy.”

Transaction Overview:

Under the terms of the Unit Purchase Agreement,

Dune will complete a business combination with Global Hydrogen at a

pro forma combined enterprise value of approximately $112 million

(assuming no redemptions by Dune public stockholders and a Dune

common share value of $10 per share). The Board of Directors of

Dune has received an independent fairness opinion.

The Board of Directors of Dune and the managers

and unitholders of Global Hydrogen have each unanimously approved

the proposed business combination, which is expected to close in

the second half of 2023 and remains subject to approval by Dune’s

stockholders and customary closing conditions. Mr. Nance, who is

also a director of Dune, was recused from, and did not participate

in, the consideration or approval of the proposed business

combination by the Dune Board of Directors.

Additional information about the proposed

transaction, including a copy of the definitive purchase agreement,

will be provided in a Current Report on Form 8-K being filed by

Dune today with the U.S. Securities and Exchange Commission (the

“SEC”) and available at www.sec.gov.

Advisors

Winston & Strawn LLP and Sidley Austin LLP are serving as

legal advisors to Dune. Alston & Bird LLP is serving as legal

advisor to Global Hydrogen.

About Global Hydrogen

Headquartered in New York and founded in 2023,

Global Hydrogen seeks to be a leader in the sustainable energy

transition as a next- generation industrial gas supplier. Global

Hydrogen is a 100% minority-owned business that targets both

private and publicly-funded hydrogen development and carbon

recovery projects, including projects supported by local, county,

state, and national-level governments. Global Hydrogen primarily

targets renewable waste as feedstock to generate the industrial

gases it sells, and seeks arrangements with owners of wastewater

treatment plants, food waste processing facilities, agricultural

farms, and landfills as well as producers and distributors of

renewable natural gas. For additional information, visit

globalhydrogen.co.

About Dune Acquisition Corporation

Dune Acquisition Corporation was founded by its Chief Executive

Officer, Carter Glatt, to effect a merger, capital stock exchange,

asset acquisition, stock purchase, reorganization or similar

business combination with one or more businesses.

Additional Information and Where to Find It

The proposed business combination with Global

Hydrogen (the “Business Combination”) will be submitted to Dune’s

stockholders for their consideration. Dune intends to file a proxy

statement (the “Proxy Statement”) that will be sent to all holders

of Dune’s common stock in connection with the Business Combination.

This press release does not contain all the information that should

be considered concerning the proposed Business Combination and is

not intended to form the basis of any investment decision or any

other decision in respect of the Business Combination. Dune’s

stockholders, Global Hydrogen’s unitholders and other interested

persons are advised to read, when available, the preliminary Proxy

Statement and the amendments thereto and the definitive Proxy

Statement and other documents filed in connection with the proposed

Business Combination, as these materials will contain important

information about Global Hydrogen, Dune and the Business

Combination. When available, the definitive Proxy Statement and

other relevant materials for the proposed Business Combination will

be mailed to stockholders of Dune as of a record date to be

established for voting on the proposed Business Combination. Dune

stockholders and Global Hydrogen unitholders will also be able to

obtain copies of the preliminary Proxy Statement, the definitive

Proxy Statement and other documents filed with the SEC, without

charge, once available, at the SEC’s website at www.sec.gov, or by

directing a request to Dune’s secretary at 700 S. Rosemary Avenue,

Suite 204, West Palm Beach, FL 33401, (917) 742-1904.

Participants in Solicitation

Dune and its directors and executive officers

may be deemed participants in the solicitation of proxies from

Dune’s stockholders with respect to the Business Combination. A

list of the names of those directors and executive officers and a

description of their interests in Dune is contained in Dune’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2022, which was filed with the SEC on April 10, 2023 and is

available free of charge at the SEC’s website at www.sec.gov. To

the extent such holdings of Dune’s securities may have changed

since that time, such changes have been or will be reflected on

Statements of Change in Ownership on Form 4 filed with the

SEC. Additional information regarding the interests of such

participants will be contained in the Proxy Statement for the

proposed Business Combination when available. These documents can

be obtained free of charge from the sources indicated above.

Global Hydrogen and its managers and executive

officers may also be deemed to be participants in the solicitation

of proxies from Dune’s stockholders with respect to the proposed

Business Combination. A list of the names of such managers and

executive officers and information regarding their interests in the

proposed Business Combination will be included in the Proxy

Statement for the proposed Business Combination when available.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains certain

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “would,” “will,” “shall,” “seek,”

“result,” “become,” “target” or other similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters, but the absence of these words

does not mean a statement is not forward looking. Indications of,

and guidance or outlook on, future earnings, dividends or financial

position or performance are also forward looking statements. These

forward-looking statements include, but are not limited to: (1)

references with respect to the anticipated benefits of the proposed

Business Combination and anticipated closing timing; (2) the

anticipated capitalization and enterprise value of the combined

company following the consummation of the proposed Business

Combination; (3) current and future potential commercial and

customer relationships; and (4) anticipated demand for the combined

company’s product and service offerings. These statements are based

on various assumptions, whether or not identified in this press

release, and on the current expectations of Dune’s and Global

Hydrogen’s management and are not predictions of actual

performance. These forward-looking statements are provided for

illustrative purposes only and are not intended to serve as, and

must not be relied on by any investor as, a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability.

These forward-looking statements involve

significant risks and uncertainties that could cause the actual

results to differ materially, and potentially adversely, from those

expressed or implied in the forward-looking statements.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. Most of these factors are outside Dune’s and

Global Hydrogen’s control and are difficult to predict. Factors

that may cause such differences include, but are not limited to:

(i) the occurrence of any event, change, or other circumstances

that could give rise to the termination of the purchase agreement;

(ii) the outcome of any legal proceedings that may be instituted

against Dune and Global Hydrogen following the announcement of the

purchase agreement and the transactions contemplated thereby; (iii)

the inability of the parties to timely or successfully complete the

proposed Business Combination, including due to failure to obtain

approval of the stockholders of Dune, redemptions by Dune’s

stockholders, certain regulatory approvals or the satisfaction of

other conditions to closing in the purchase agreement; (iv) risks

relating to the uncertainty of the projected financial information

with respect to Global Hydrogen; (v) the occurrence of any event,

change or other circumstance that could give rise to the

termination of the purchase agreement or could otherwise cause the

transaction to fail to close; (vi) the impact of the COVID-19

pandemic on Global Hydrogen’s business and/or the ability of the

parties to complete the proposed Business Combination; (vii) the

inability to maintain the listing of Dune’s shares on the Nasdaq

Stock Market following the proposed Business Combination; (viii)

the risk that the proposed Business Combination disrupts current

plans and operations as a result of the announcement and

consummation of the proposed Business Combination; (ix) the ability

to recognize the anticipated benefits of the proposed Business

Combination, which may be affected by, among other things,

competition, the ability of Global Hydrogen to grow and manage

growth profitably, sell and expand its product and service

offerings, implement its growth strategy and retain its key

employees; (x) risks relating to Global Hydrogen’s operations and

business, including the combined company’s ability to raise

financing, hire employees, secure supplier, customer and other

commercial contracts, obtain licenses and information technology

and protect itself against cybersecurity risks; (xi) intense

competition and competitive pressures from other companies

worldwide in the industries in which the combined company will

operate; (xii) litigation and the ability to adequately

protect the combined company’s intellectual property rights; (xiii)

costs related to the proposed Business Combination; (xiv) changes

in applicable laws or regulations; and (xv) the possibility that

Global Hydrogen or Dune may be adversely affected by other

economic, business and/or competitive factors. The foregoing list

of factors is not exhaustive, and there may be additional risks

that neither Dune nor Global Hydrogen presently know or that Dune

and Global Hydrogen currently believe are immaterial that could

also cause actual results to differ from those contained in the

forward-looking statements. Additional information concerning

certain of these and other risk factors is contained in Dune’s most

recent filings with the SEC, including Dune’s Annual Report on Form

10-K for the fiscal year ended December 31, 2022 and in those

documents that Dune has filed, or will file, with the SEC. These

filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained herein. In addition,

forward-looking statements reflect Dune’s and Global Hydrogen’s

expectations, plans or forecasts of future events and views as of

the date of this press release. Dune and Global Hydrogen anticipate

that subsequent events and developments will cause Dune’s and

Global Hydrogen’s assessments to change. All subsequent written and

oral forward-looking statements concerning Dune and Global

Hydrogen, the Transactions or other matters attributable to Dune,

Global Hydrogen or any person acting on their behalf are expressly

qualified in their entirety by the cautionary statements above.

Readers are cautioned not to place undue reliance upon any

forward-looking statements, which speak only as of the date made.

While Dune and Global Hydrogen may elect to update these

forward-looking statements at some point in the future, each of

Dune or Global Hydrogen expressly disclaims any obligations or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in their expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based, except

as required by law. These forward-looking statements should not be

relied upon as representing Dune’s and Global Hydrogen’s

assessments as of any date subsequent to the date of this press

release. Accordingly, undue reliance should not be placed upon the

forward-looking statements.

Contacts

Dune Acquisition Corporationir@duneacq.com(917) 742-1904

Global Hydrogen Energy LLCir@globalhydrogen.co

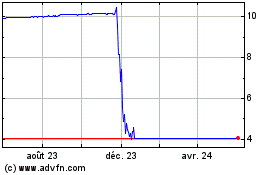

Dune Acquisition (NASDAQ:DUNE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Dune Acquisition (NASDAQ:DUNE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025