FARMERS NATIONAL BANC CORP /OH/ false 0000709337 0000709337 2024-01-24 2024-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 24, 2024

Farmers National Banc Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Ohio |

|

001-35296 |

|

34-1371693 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 20 South Broad Street, P.O. Box 555, Canfield, Ohio |

|

44406-0555 |

| (Address of principal executive offices) |

|

(Zip Code) |

(330) 533-3341

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange on which registered |

| Common Stock, No Par Value |

|

FMNB |

|

The NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On January 24, 2024, Farmers National Banc Corp. (the “Company”) announced earnings for the quarter and year ended December 31, 2023. A copy of the press release and certain financial information for those periods is attached as Exhibit 99.1 hereto and incorporated by reference herein.

Also on January 24, 2024, the Company first provided investors with a supplemental presentation regarding fourth quarter and year end earnings and other current financial information, attached as Exhibit 99.2 hereto and incorporated by reference herein.

Pursuant to General Instruction B.2 of Current Report on Form 8-K, the information in this Item 2.02 and Exhibits 99.1 and 99.2 are being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. Furthermore, the information in this Item 2.02 and Exhibits 99.1 and 99.2 shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended (the “Securities Act”) except as may be expressly set forth by specific reference in such filing.

| Item 7.01 |

Regulation FD Disclosure. |

On January 24, 2024, the Company first provided investors with a supplemental presentation regarding fourth quarter and year-end earnings and other current financial information, attached as Exhibit 99.2 hereto and incorporated by reference herein.

The presentation is furnished herein, as part of this Item 7.01, as Exhibit 99.2. Pursuant to General Instruction B.2 of Current Report on Form 8-K, the information in this Item 7.01 and Exhibit 99.2 shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section. Furthermore, the information in this Item 7.01 and Exhibit 99.2 shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act, except as may be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| Farmers National Banc Corp. |

|

|

| By: |

|

/s/ Kevin J. Helmick |

|

|

Kevin J. Helmick |

|

|

President and Chief Executive Officer |

Date: January 24, 2024

Exhibit 99.1

January 24, 2024

Press Release

| |

Source: Farmers |

National Banc Corp. |

Kevin J. Helmick, President and CEO

20 South Broad Street, P.O. Box 555

Canfield, OH 44406

330.533.3341

Email:

exec@farmersbankgroup.com

FARMERS NATIONAL BANC CORP. REPORTS

SOLID RESULTS FOR FOURTH QUARTER OF 2023

| |

• |

|

Earnings per diluted share of $0.39 ($0.41 excluding certain items,

non-GAAP) for the fourth quarter of 2023 |

| |

• |

|

164 consecutive quarters of profitability |

| |

• |

|

Recorded a $915,000 gain during the quarter by selling $5.8 million of nonaccrual/troubled commercial

loans |

| |

• |

|

Loan growth of $29.6 million, or 3.7% annualized, for the fourth quarter of 2023

|

| |

• |

|

Excluding impact of commercial loan sale - loan growth of $37.7 million, or 4.8% annualized, for fourth

quarter 2023 |

| |

• |

|

Continued strong asset quality with non-performing assets to total

assets of 0.30% as of December 31, 2023 |

| |

• |

|

Return on average assets of 1.17% for the fourth quarter of 2023 |

| |

• |

|

ROAE and ROATE (non-GAAP) of 18.0% and 43.8%, respectively, for the

fourth quarter of 2023 |

CANFIELD, Ohio (January 24, 2024) – Farmers National Banc Corp. (“Farmers” or the

“Company”) (NASDAQ: FMNB) today announced net income of $14.6 million, or $0.39 per diluted share, for the three months ended December 31, 2023, compared to $13.4 million, or $0.39 per diluted share, for the three months

ended December 31, 2022. Net income for the fourth quarter of 2023 included pretax items of $452,000 for acquisition related costs, a gain of $915,000 on the sale of commercial loans, $1.0 million in expense for severance/contract payouts

for staff resignations, and combined net losses of $217,000 on the sale of securities and the sale of other assets. Excluding these items (non-GAAP), net income for the fourth quarter of 2023 increased 7.8% to

$15.2 million from $14.1 million for the same period last year. Net income per diluted share excluding these items (non-GAAP), was $0.41 for the fourth quarter of 2023, compared to $0.42 per diluted

share for the fourth quarter of 2022.

Kevin J. Helmick, President and CEO, stated “Our solid fourth quarter results demonstrate our success

enhancing profitability throughout an extremely challenging operating environment. This is a testament to our team’s focus on supporting our customers, maintaining excellent asset quality, and controlling operating costs. We expect the economic

environment will remain fluid in 2024, but we believe Farmers is well positioned to navigate this period as a result of the value our team members provide our Ohio and Pennsylvania communities, as well as our continued focus on maintaining strong

asset quality and profitability.”

Balance Sheet

The Company’s total assets were $5.08 billion at December 31, 2023, compared to $4.97 billion at September 30, 2023 and

$4.08 billion at December 31, 2022. The increase from December was primarily due to the acquisition of Emclaire Financial Corp. (“Emclaire”) which added $977.6 million in assets in the first quarter of 2023. Loans have

increased by $793.4 million since December 31, 2022 and $29.6 million, or 3.7% annualized, since September 30, 2023. Emclaire was responsible for $740.7 million of the increase in loans since December 31, 2022. Growth

in the fourth quarter of 2023 was concentrated in commercial real estate.

The Company had securities available for sale of $1.30 billion at

December 31, 2023, compared to $1.21 billion at September 30, 2023, and $1.27 billion at December 31, 2022. The increase since December is due to the acquisition of Emclaire which added $127.0 million in available for

sale securities and a decrease in the amount of gross unrealized losses on the portfolio which totaled $266.5 million at December 31, 2022, compared to a gross unrealized loss of $217.1 million at December 31, 2023. The Company

also had sales and runoff from the portfolio during the twelve months ended December 31, 2023. Bond market volatility was extreme in 2023 and this volatility may remain in 2024. The Company expects that it will continue to allow the size of the

securities portfolio to shrink via runoff to optimize profitability and provide liquidity for future loan growth.

At December 31, 2023, deposits

totaled $4.18 billion compared to $4.26 billion at September 30, 2023 and $4.51 billion at December 31, 2022. During the fourth quarter of 2023, the Company allowed $254.3 million in brokered time deposits to mature and

replaced the funding with less expensive short term borrowings. In addition, public fund seasonality resulted in $95.3 million in shrinkage during the quarter offset by $15.3 million in growth in other deposit categories. The increase from

December 31, 2022, was driven by $875.8 million in deposits assumed in the acquisition of Emclaire offset by a decline in brokered time deposits of $138.1 million and runoff in other deposit categories.

Total stockholders’ equity increased to $404.4 million at December 31, 2023, from

$316.0 million at September 30, 2023, and $292.3 million at December 31, 2022. The year-over-year increase was primarily due to the acquisition of Emclaire and an increase in retained earnings and a decrease in the unrealized

loss from accumulated other comprehensive income. The increase in total stockholders’ equity since September 30, 2023, was primarily due to a decline in the accumulated other comprehensive loss which decreased $79.7 million as market

rates dropped rapidly during the fourth quarter of 2023.

Credit Quality

As of December 31, 2023, the Company’s non-performing loans totaled $15.1 million compared to

$18.4 million at September 30, 2023, and $14.8 million at December 31, 2022. The year-over-year increase was primarily due to the addition of Emclaire while the decrease since September 30 was due to the sale of non-performing loans. The non-performing loans to total loans ratio was 0.47% at December 31, 2023, 0.58% at September 30, 2023, and 0.62% at December 31, 2022.

Non-performing assets to total assets was 0.30% at December 31, 2023, 0.37% at September 30, 2023, and 0.36% at December 31, 2022. The Company also continues to experience low levels of

early-stage delinquencies, defined as loans 30-89 days delinquent. At December 31, 2023, these early-stage delinquencies totaled $16.7 million, or 0.52% of total loans compared to $13.3 million,

or 0.42% of total loans at September 30, 2023, and $9.6 million, or 0.40% of total loans, at December 31, 2022.

The Company recorded

provision for credit losses and unfunded commitments of $286,000 for the fourth quarter of 2023 compared to $243,000 for the third quarter of 2023 and $416,000 for the fourth quarter of 2022. Annualized net charge-offs as a percentage of average

loans were 0.10% for the three months ended December 31, 2023, compared to 0.10% for the same period in 2022. For the year ended December 31, 2023, net charge-offs as a percentage of average loans were 0.07% compared to 0.11% for last

year. The allowance for credit losses to total loans was 1.08% at December 31, 2023, compared to 1.10% at September 30, 2023, and 1.12% at December 31, 2022.

Net Interest Income

Net interest income for the three

months ended December 31, 2023, totaled $32.8 million in the fourth quarter of 2023 compared to $33.8 million in the third quarter of 2023 and $29.4 million for the fourth quarter of 2022. Earning assets were greater in the

fourth quarter of 2023 compared to the fourth quarter of 2022 due to the acquisition of Emclaire but this was partially offset by a decline of 21 basis point in the net interest margin. The net interest margin was 2.78% for the quarter ending

December 31, 2023, compared to 2.86% in the third quarter of 2023 and 2.99% for the fourth quarter of 2022. Excluding the impact of acquisition marks and related accretion and PPP interest and fees, the net interest margin (non-GAAP) for the fourth quarter of 2023 was 2.58% compared to 2.61% for the third quarter of 2023 and 2.97% for the fourth quarter of 2022. The decline in net interest margin between the fourth quarter of 2023 and

the fourth quarter of 2022 was due to increases in funding costs outstripping the increase in yields on earning assets. This increase in funding costs has been due to the rapid increase in deposit rates due to intense competition for deposits, the

Federal Reserve’s rate hiking cycle, and runoff of deposit balances which are being replaced with more costly wholesale funding.

Noninterest

Income

The Company recorded $12.2 million in noninterest income during the fourth quarter of 2023 compared to $8.2 million during the fourth

quarter of 2022. Service charges on deposit accounts increased to $1.7 million in the fourth quarter of 2023 compared to $1.2 million for the same period in 2022 primarily due to the acquisition of Emclaire. Bank owned life insurance

income, other mortgage banking fee income and debit card income have also increased in the fourth quarter of 2023 compared to the fourth quarter of 2022 due to the Emclaire acquisition. Trust fees increased by $283,000 in the fourth quarter of 2023

compared to the fourth quarter of 2022 as growth in this line of business continued. Insurance agency commissions also exhibited outstanding growth as insurance commissions increased by $407,000 for the quarter ending December 31, 2023 compared

to same quarter a year ago. Growth for the year in this business has been solid as pricing in the insurance business has been very strong and increased annuity sales have bolstered results. Investment commissions are up slightly for the quarter

ended December 31, 2023 compared to the quarter ended December 31, 2022, as markets have been resilient in 2023 and the Company begins to expand into Pennsylvania. Net gains on the sale of loans have increased by over $1.0 million

between the fourth quarter of 2022 and the fourth quarter of 2023. Of this increase, $915,000 was driven by the sale of commercial loans discussed previously. Traditional gains on the sale of mortgage loans remain sluggish due to high interest

rates. Other noninterest income increased $910,000 in the fourth quarter of 2023 compared to the prior year’s fourth quarter. This increase was primarily driven by higher income associated with the Company’s investments in SBIC funds. The

earnings on these funds can be volatile from period to period.

Noninterest Expense

The Company reported noninterest expense of $27.0 million for the three months ended December 31, 2023, compared to $21.1 million for the three

months ended December 31, 2022. The increase in expense is primarily due to the acquisition of Emclaire along with the $1.0 million in severance expense associated with staff resignations. Salaries and employee benefits increased

$3.5 million to $14.9 million in the fourth quarter of 2023 compared to $11.4 million during the same period in 2022. The acquisition of Emclaire, normal raise activity and the severance were the primary reasons for the increase.

Occupancy and equipment expense increased $1.1 million primarily due to the acquisition. FDIC and state and local taxes increased $474,000 due to the acquisition and the increase in the rate paid for FDIC insurance in 2023. Core processing

charges increased due to the acquisition. Merger related costs were $452,000 for the fourth quarter of 2023 compared to $584,000 in the fourth quarter of 2022. Other noninterest expense increased due to the acquisition.

Liquidity

At December 31, 2023, the Company’s

loan to deposit ratio was 76.6% and the Company’s average deposit balance per account (excluding collateralized deposits) was $23,678. The Company has access to an additional $819.5 million of FHLB borrowing capacity at December 31,

2023 along with $214.3 million of available for sale securities that are not pledged. With a deep and diverse deposit base and access to a large amount of additional funding capacity, the Company is well positioned to navigate the current

banking landscape.

About Farmers National Banc Corp.

Founded in 1887, Farmers National Banc Corp. is a diversified financial services company headquartered in Canfield, Ohio, with $5.1 billion in banking

assets. Farmers National Banc Corp.’s wholly-owned subsidiaries are comprised of The Farmers National Bank of Canfield, a full-service national bank engaged in commercial and retail banking with 64 banking locations in Mahoning, Trumbull,

Columbiana, Portage, Stark, Wayne, Medina, Geauga and Cuyahoga Counties in Ohio and Beaver, Butler, Allegheny, Jefferson, Clarion, Venango, Clearfield, Mercer, Elk and Crawford Counties in Pennsylvania, and Farmers Trust Company, which operates five

trust offices and offers services in the same geographic markets. Total wealth management assets under care at December 31, 2023 are $3.5 billion. Farmers National Insurance, LLC, a wholly-owned subsidiary of The Farmers National Bank of

Canfield, offers a variety of insurance products.

Non-GAAP Disclosure

This press release includes disclosures of Farmers’ tangible common equity ratio, return on average tangible assets, return on average tangible equity,

net income excluding costs related to acquisition activities and certain items, return on average assets excluding merger costs and certain items, return on average equity excluding merger costs and certain items, net interest margin excluding

acquisition marks and related accretion and PPP interest and fees and efficiency ratio less certain items, which are financial measures not prepared in accordance with generally accepted accounting principles in the United States (GAAP). A non-GAAP financial measure is a numerical measure of historical or future financial performance, financial position or cash flows that excludes or includes amounts that are required to be disclosed by GAAP. Farmers

believes that these non-GAAP financial measures provide both management and investors a more complete understanding of the underlying operational results and trends and Farmers’ marketplace performance.

The presentation of this additional information is not meant to be considered in isolation or as a substitute for the numbers prepared in accordance with GAAP. The reconciliations of non-GAAP financial

measures to their GAAP equivalents are included in the tables following Consolidated Financial Highlights below.

Cautionary Statements Regarding

Forward-Looking Statements

We make statements in this news release and our related investor conference call, and we may from time to time make other

statements, that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about Farmers’ financial condition, results of operations, asset quality trends and profitability.

Forward-looking statements are not historical facts but instead represent only management’s current expectations and forecasts regarding future events, many of which, by their nature, are inherently uncertain and outside of Farmers’

control. Forward-looking statements are preceded by terms such as “expects,” “believes,” “anticipates,” “intends” and similar expressions, as well as any statements related to future expectations of

performance or conditional verbs, such as “will,” “would,” “should,” “could” or “may.” Farmers’ actual results and financial condition may differ, possibly materially, from the anticipated

results and financial condition indicated in these forward-looking statements. Factors that could cause Farmers’ actual results to differ materially from those described in certain forward-looking statements include significant changes in

near-term local, regional, and U.S. economic conditions including those resulting from continued high rates of inflation, tightening monetary policy of the Board of Governors of the Federal Reserve, and possibility of a recession; Farmers’

failure to integrate Emclaire with Farmers in accordance with expectations; deviations from performance expectations related to Emclaire; continuing impacts from the length and extent of the economic impacts of the

COVID-19 pandemic; and the other factors contained in Farmers’ Annual Report on Form 10-K for the year ended December 31, 2022 and subsequent Quarterly Reports

on Form 10-Q filed with the Securities and Exchange Commission (SEC) and available on Farmers’ website (www.farmersbankgroup.com) and on the SEC’s website (www.sec.gov). Forward-looking statements

are not guarantees of future performance and should not be relied upon as representing management’s views as of any subsequent date. Farmers does not undertake any obligation to update the forward-looking statements to reflect the impact of

circumstances or events that may arise after the date of the forward-looking statements.

Farmers National Banc Corp. and Subsidiaries

Consolidated Financial Highlights

(Amounts in

thousands, except per share results) Unaudited

Consolidated Statements of Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

|

For the Twelve Months Ended |

|

| |

|

Dec. 31, |

|

|

Sept. 30, |

|

|

June 30, |

|

|

March 31, |

|

|

Dec. 31, |

|

|

Dec. 31, |

|

|

Dec. 31, |

|

|

Percent |

|

| |

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Change |

|

| Total interest income |

|

$ |

55,069 |

|

|

$ |

54,229 |

|

|

$ |

52,804 |

|

|

$ |

51,233 |

|

|

$ |

38,111 |

|

|

$ |

213,335 |

|

|

$ |

142,086 |

|

|

|

50.1 |

% |

| Total interest expense |

|

|

22,239 |

|

|

|

20,461 |

|

|

|

18,226 |

|

|

|

14,623 |

|

|

|

8,679 |

|

|

|

75,549 |

|

|

|

17,920 |

|

|

|

321.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

32,830 |

|

|

|

33,768 |

|

|

|

34,578 |

|

|

|

36,610 |

|

|

|

29,432 |

|

|

|

137,786 |

|

|

|

124,166 |

|

|

|

11.0 |

% |

| Provision (credit) for credit losses |

|

|

286 |

|

|

|

243 |

|

|

|

25 |

|

|

|

8,599 |

|

|

|

416 |

|

|

|

9,153 |

|

|

|

1,122 |

|

|

|

715.8 |

% |

| Noninterest income |

|

|

12,156 |

|

|

|

9,831 |

|

|

|

9,449 |

|

|

|

10,425 |

|

|

|

8,200 |

|

|

|

41,861 |

|

|

|

44,202 |

|

|

|

-5.3 |

% |

| Acquisition related costs |

|

|

452 |

|

|

|

268 |

|

|

|

442 |

|

|

|

4,313 |

|

|

|

584 |

|

|

|

5,475 |

|

|

|

4,070 |

|

|

|

34.5 |

% |

| Other expense |

|

|

26,520 |

|

|

|

27,448 |

|

|

|

25,944 |

|

|

|

26,409 |

|

|

|

20,511 |

|

|

|

106,321 |

|

|

|

90,341 |

|

|

|

17.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

17,728 |

|

|

|

15,640 |

|

|

|

17,616 |

|

|

|

7,714 |

|

|

|

16,121 |

|

|

|

58,698 |

|

|

|

72,835 |

|

|

|

-19.4 |

% |

| Income taxes |

|

|

3,151 |

|

|

|

2,326 |

|

|

|

2,650 |

|

|

|

639 |

|

|

|

2,765 |

|

|

|

8,766 |

|

|

|

12,238 |

|

|

|

-28.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

14,577 |

|

|

$ |

13,314 |

|

|

$ |

14,966 |

|

|

$ |

7,075 |

|

|

$ |

13,356 |

|

|

$ |

49,932 |

|

|

$ |

60,597 |

|

|

|

-17.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average diluted shares outstanding |

|

|

37,426 |

|

|

|

37,379 |

|

|

|

37,320 |

|

|

|

37,933 |

|

|

|

33,962 |

|

|

|

37,498 |

|

|

|

33,929 |

|

|

|

|

|

| Basic earnings per share |

|

|

0.39 |

|

|

|

0.36 |

|

|

|

0.40 |

|

|

|

0.19 |

|

|

|

0.39 |

|

|

|

1.34 |

|

|

|

1.79 |

|

|

|

|

|

| Diluted earnings per share |

|

|

0.39 |

|

|

|

0.36 |

|

|

|

0.40 |

|

|

|

0.19 |

|

|

|

0.39 |

|

|

|

1.33 |

|

|

|

1.79 |

|

|

|

|

|

| Cash dividends per share |

|

|

0.17 |

|

|

|

0.17 |

|

|

|

0.17 |

|

|

|

0.17 |

|

|

|

0.17 |

|

|

|

0.68 |

|

|

|

0.65 |

|

|

|

|

|

| Performance Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Interest Margin (Annualized) |

|

|

2.78 |

% |

|

|

2.86 |

% |

|

|

2.92 |

% |

|

|

3.07 |

% |

|

|

2.99 |

% |

|

|

2.91 |

% |

|

|

3.18 |

% |

|

|

|

|

| Efficiency Ratio (Tax equivalent basis) |

|

|

57.84 |

% |

|

|

60.11 |

% |

|

|

56.28 |

% |

|

|

62.53 |

% |

|

|

52.59 |

% |

|

|

59.24 |

% |

|

|

53.68 |

% |

|

|

|

|

| Return on Average Assets (Annualized) |

|

|

1.17 |

% |

|

|

1.06 |

% |

|

|

1.18 |

% |

|

|

0.56 |

% |

|

|

1.31 |

% |

|

|

0.99 |

% |

|

|

1.46 |

% |

|

|

|

|

| Return on Average Equity (Annualized) |

|

|

17.98 |

% |

|

|

14.49 |

% |

|

|

16.12 |

% |

|

|

7.71 |

% |

|

|

20.16 |

% |

|

|

13.97 |

% |

|

|

17.24 |

% |

|

|

|

|

| Dividends to Net Income |

|

|

43.68 |

% |

|

|

47.82 |

% |

|

|

42.54 |

% |

|

|

90.50 |

% |

|

|

43.10 |

% |

|

|

25.64 |

% |

|

|

36.31 |

% |

|

|

|

|

| Other Performance Ratios (Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on Average Tangible Assets |

|

|

1.22 |

% |

|

|

1.09 |

% |

|

|

1.23 |

% |

|

|

0.58 |

% |

|

|

1.34 |

% |

|

|

1.03 |

% |

|

|

1.50 |

% |

|

|

|

|

| Return on Average Tangible Equity |

|

|

43.77 |

% |

|

|

30.29 |

% |

|

|

33.55 |

% |

|

|

16.31 |

% |

|

|

32.81 |

% |

|

|

30.23 |

% |

|

|

24.31 |

% |

|

|

|

|

Consolidated Statements of Financial Condition

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Dec. 31, |

|

|

Sept. 30, |

|

|

June 30, |

|

|

March 31, |

|

|

Dec. 31, |

|

| |

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

103,658 |

|

|

$ |

93,923 |

|

|

$ |

116,063 |

|

|

$ |

128,001 |

|

|

$ |

75,551 |

|

| Debt securities available for sale |

|

|

1,299,701 |

|

|

|

1,210,736 |

|

|

|

1,316,878 |

|

|

|

1,355,449 |

|

|

|

1,268,025 |

|

| Other investments |

|

|

35,311 |

|

|

|

35,342 |

|

|

|

44,975 |

|

|

|

39,670 |

|

|

|

33,444 |

|

| Loans held for sale |

|

|

3,711 |

|

|

|

1,910 |

|

|

|

2,197 |

|

|

|

1,703 |

|

|

|

858 |

|

| Loans |

|

|

3,198,127 |

|

|

|

3,168,554 |

|

|

|

3,155,200 |

|

|

|

3,152,339 |

|

|

|

2,404,750 |

|

| Less allowance for credit losses |

|

|

34,440 |

|

|

|

34,753 |

|

|

|

34,957 |

|

|

|

36,011 |

|

|

|

26,978 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loans |

|

|

3,163,687 |

|

|

|

3,133,801 |

|

|

|

3,120,243 |

|

|

|

3,116,328 |

|

|

|

2,377,772 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other assets |

|

|

472,282 |

|

|

|

495,451 |

|

|

|

473,098 |

|

|

|

468,735 |

|

|

|

326,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

5,078,350 |

|

|

$ |

4,971,163 |

|

|

$ |

5,073,454 |

|

|

$ |

5,109,886 |

|

|

$ |

4,082,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing |

|

$ |

1,026,630 |

|

|

$ |

1,039,524 |

|

|

$ |

1,084,232 |

|

|

$ |

1,106,870 |

|

|

$ |

896,957 |

|

| Interest-bearing |

|

|

3,150,756 |

|

|

|

3,217,869 |

|

|

|

3,165,381 |

|

|

|

3,207,121 |

|

|

|

2,526,760 |

|

| Brokered time deposits |

|

|

0 |

|

|

|

254,257 |

|

|

|

21,135 |

|

|

|

82,169 |

|

|

|

138,051 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total deposits |

|

|

4,177,386 |

|

|

|

4,511,650 |

|

|

|

4,270,748 |

|

|

|

4,396,160 |

|

|

|

3,561,768 |

|

| Other interest-bearing liabilities |

|

|

443,663 |

|

|

|

88,550 |

|

|

|

388,437 |

|

|

|

292,324 |

|

|

|

183,211 |

|

| Other liabilities |

|

|

52,886 |

|

|

|

54,981 |

|

|

|

47,278 |

|

|

|

46,760 |

|

|

|

44,926 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

4,673,935 |

|

|

|

4,655,181 |

|

|

|

4,706,463 |

|

|

|

4,735,244 |

|

|

|

3,789,905 |

|

| Stockholders’ Equity |

|

|

404,415 |

|

|

|

315,982 |

|

|

|

366,991 |

|

|

|

374,642 |

|

|

|

292,295 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Stockholders’ Equity |

|

$ |

5,078,350 |

|

|

$ |

4,971,163 |

|

|

$ |

5,073,454 |

|

|

$ |

5,109,886 |

|

|

$ |

4,082,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Period-end shares outstanding |

|

|

37,503 |

|

|

|

37,489 |

|

|

|

37,457 |

|

|

|

37,439 |

|

|

|

34,055 |

|

| Book value per share |

|

$ |

10.78 |

|

|

$ |

8.43 |

|

|

$ |

9.80 |

|

|

$ |

10.01 |

|

|

$ |

8.58 |

|

| Tangible book value per share (Non-GAAP)* |

|

|

5.71 |

|

|

|

3.33 |

|

|

|

4.67 |

|

|

|

4.84 |

|

|

|

5.60 |

|

| * |

Tangible book value per share is calculated by dividing tangible common equity by outstanding shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

|

For the Twelve Months

Ended |

|

| |

|

Dec. 31, |

|

|

Sept. 30, |

|

|

June 30, |

|

|

March 31, |

|

|

Dec. 31, |

|

|

Dec. 31, |

|

|

Dec. 31, |

|

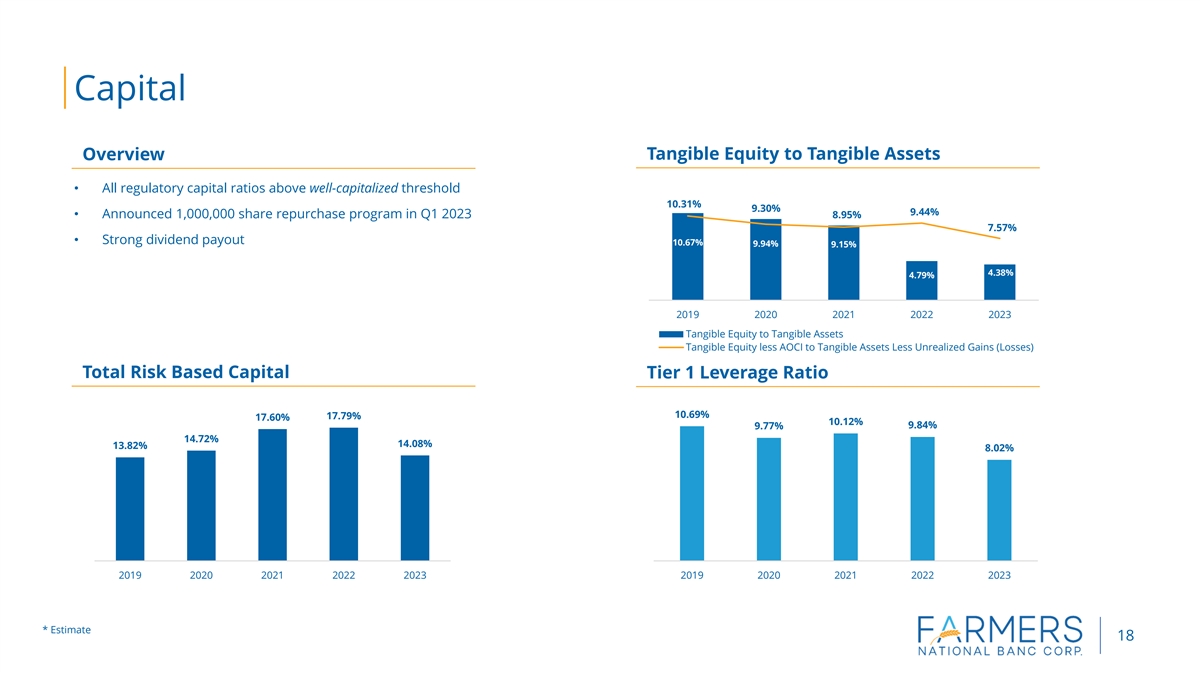

| Capital and Liquidity |

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Common Equity Tier 1 Capital Ratio (a) |

|

|

10.63 |

% |

|

|

10.37 |

% |

|

|

10.25 |

% |

|

|

10.04 |

% |

|

|

13.71 |

% |

|

|

|

|

|

|

|

|

| Total Risk Based Capital Ratio (a) |

|

|

14.08 |

% |

|

|

13.83 |

% |

|

|

13.76 |

% |

|

|

13.60 |

% |

|

|

17.79 |

% |

|

|

|

|

|

|

|

|

| Tier 1 Risk Based Capital Ratio (a) |

|

|

11.11 |

% |

|

|

10.86 |

% |

|

|

10.74 |

% |

|

|

10.54 |

% |

|

|

14.32 |

% |

|

|

|

|

|

|

|

|

| Tier 1 Leverage Ratio (a) |

|

|

8.02 |

% |

|

|

7.84 |

% |

|

|

7.68 |

% |

|

|

7.43 |

% |

|

|

9.84 |

% |

|

|

|

|

|

|

|

|

| Equity to Asset Ratio |

|

|

7.96 |

% |

|

|

6.36 |

% |

|

|

7.23 |

% |

|

|

7.33 |

% |

|

|

7.16 |

% |

|

|

|

|

|

|

|

|

| Tangible Common Equity Ratio (b) |

|

|

4.38 |

% |

|

|

2.61 |

% |

|

|

3.58 |

% |

|

|

3.69 |

% |

|

|

4.79 |

% |

|

|

|

|

|

|

|

|

| Net Loans to Assets |

|

|

62.30 |

% |

|

|

63.04 |

% |

|

|

61.50 |

% |

|

|

60.99 |

% |

|

|

58.25 |

% |

|

|

|

|

|

|

|

|

| Loans to Deposits |

|

|

76.56 |

% |

|

|

70.23 |

% |

|

|

73.88 |

% |

|

|

71.71 |

% |

|

|

67.52 |

% |

|

|

|

|

|

|

|

|

| Asset Quality |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-performing loans |

|

$ |

15,063 |

|

|

$ |

18,368 |

|

|

$ |

17,956 |

|

|

$ |

17,959 |

|

|

$ |

14,803 |

|

|

|

|

|

|

|

|

|

| Non-performing assets |

|

|

15,321 |

|

|

|

18,522 |

|

|

|

18,167 |

|

|

|

18,053 |

|

|

|

14,876 |

|

|

|

|

|

|

|

|

|

| Loans 30 - 89 days delinquent |

|

|

16,705 |

|

|

|

13,314 |

|

|

|

12,321 |

|

|

|

10,219 |

|

|

|

9,605 |

|

|

|

|

|

|

|

|

|

| Charged-off loans |

|

|

972 |

|

|

|

525 |

|

|

|

971 |

|

|

|

469 |

|

|

|

754 |

|

|

|

2,937 |

|

|

|

3,304 |

|

| Recoveries |

|

|

172 |

|

|

|

139 |

|

|

|

172 |

|

|

|

198 |

|

|

|

184 |

|

|

|

681 |

|

|

|

646 |

|

| Net Charge-offs |

|

|

800 |

|

|

|

386 |

|

|

|

799 |

|

|

|

271 |

|

|

|

570 |

|

|

|

2,256 |

|

|

|

2,658 |

|

| Annualized Net Charge-offs to Average Net Loans |

|

|

0.10 |

% |

|

|

0.05 |

% |

|

|

0.10 |

% |

|

|

0.03 |

% |

|

|

0.10 |

% |

|

|

0.07 |

% |

|

|

0.11 |

% |

| Allowance for Credit Losses to Total Loans |

|

|

1.08 |

% |

|

|

1.10 |

% |

|

|

1.11 |

% |

|

|

1.14 |

% |

|

|

1.12 |

% |

|

|

|

|

|

|

|

|

| Non-performing Loans to Total Loans |

|

|

0.47 |

% |

|

|

0.58 |

% |

|

|

0.57 |

% |

|

|

0.57 |

% |

|

|

0.62 |

% |

|

|

|

|

|

|

|

|

| Loans 30 - 89 Days Delinquent to Total Loans |

|

|

0.52 |

% |

|

|

0.42 |

% |

|

|

0.39 |

% |

|

|

0.32 |

% |

|

|

0.40 |

% |

|

|

|

|

|

|

|

|

| Allowance to Non-performing Loans |

|

|

228.64 |

% |

|

|

189.20 |

% |

|

|

194.68 |

% |

|

|

200.52 |

% |

|

|

182.25 |

% |

|

|

|

|

|

|

|

|

| Non-performing Assets to Total Assets |

|

|

0.30 |

% |

|

|

0.37 |

% |

|

|

0.36 |

% |

|

|

0.35 |

% |

|

|

0.36 |

% |

|

|

|

|

|

|

|

|

| (a) |

December 31, 2023 ratio is estimated |

| (b) |

This is a non-GAAP financial measure. A reconciliation to GAAP is shown

below |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

| |

|

|

|

| |

|

Dec. 31, |

|

|

Sept. 30, |

|

|

June 30, |

|

|

March 31, |

|

|

Dec. 31, |

|

| End of Period Loan Balances |

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

| Commercial real estate |

|

$ |

1,335,806 |

|

|

$ |

1,295,847 |

|

|

$ |

1,284,974 |

|

|

$ |

1,286,830 |

|

|

$ |

1,028,050 |

|

| Commercial |

|

|

346,354 |

|

|

|

357,691 |

|

|

|

362,664 |

|

|

|

361,845 |

|

|

|

293,643 |

|

| Residential real estate |

|

|

843,697 |

|

|

|

842,729 |

|

|

|

849,533 |

|

|

|

853,074 |

|

|

|

475,791 |

|

| HELOC |

|

|

142,441 |

|

|

|

140,772 |

|

|

|

138,535 |

|

|

|

137,319 |

|

|

|

132,179 |

|

| Consumer |

|

|

259,784 |

|

|

|

261,136 |

|

|

|

260,326 |

|

|

|

260,596 |

|

|

|

221,260 |

|

| Agricultural loans |

|

|

261,288 |

|

|

|

261,738 |

|

|

|

250,807 |

|

|

|

244,938 |

|

|

|

246,937 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total, excluding net deferred loan costs |

|

$ |

3,189,370 |

|

|

$ |

3,159,913 |

|

|

$ |

3,146,839 |

|

|

$ |

3,144,602 |

|

|

$ |

2,397,860 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

| |

|

|

|

| |

|

Dec. 31, |

|

|

Sept. 30, |

|

|

June 30, |

|

|

March 31, |

|

|

Dec. 31, |

|

| End of Period Customer Deposit Balances |

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

| Noninterest-bearing demand |

|

$ |

1,026,630 |

|

|

$ |

1,039,524 |

|

|

$ |

1,084,232 |

|

|

$ |

1,106,870 |

|

|

$ |

896,957 |

|

| Interest-bearing demand |

|

|

1,362,609 |

|

|

|

1,426,349 |

|

|

|

1,383,326 |

|

|

|

1,473,001 |

|

|

|

1,224,884 |

|

| Money market |

|

|

593,975 |

|

|

|

588,043 |

|

|

|

610,051 |

|

|

|

599,037 |

|

|

|

435,369 |

|

| Savings |

|

|

468,890 |

|

|

|

488,991 |

|

|

|

511,642 |

|

|

|

535,321 |

|

|

|

441,978 |

|

| Certificate of deposit |

|

|

720,259 |

|

|

|

714,486 |

|

|

|

660,362 |

|

|

|

599,762 |

|

|

|

424,529 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total customer deposits |

|

$ |

4,172,363 |

|

|

$ |

4,257,393 |

|

|

$ |

4,249,613 |

|

|

$ |

4,313,991 |

|

|

$ |

3,423,717 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

|

For the Twelve Months

Ended |

|

| |

|

|

|

|

|

|

| |

|

Dec. 31, |

|

|

Sept. 30, |

|

|

June 30, |

|

|

March 31, |

|

|

Dec. 31, |

|

|

Dec. 31, |

|

|

Dec. 31, |

|

| Noninterest Income |

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Service charges on deposit accounts |

|

$ |

1,677 |

|

|

$ |

1,712 |

|

|

$ |

1,501 |

|

|

$ |

1,432 |

|

|

$ |

1,203 |

|

|

$ |

6,322 |

|

|

$ |

4,716 |

|

| Bank owned life insurance income, including death benefits |

|

|

617 |

|

|

|

694 |

|

|

|

584 |

|

|

|

547 |

|

|

|

590 |

|

|

|

2,442 |

|

|

|

1,810 |

|

| Trust fees |

|

|

2,656 |

|

|

|

2,617 |

|

|

|

2,248 |

|

|

|

2,587 |

|

|

|

2,373 |

|

|

|

10,108 |

|

|

|

9,638 |

|

| Insurance agency commissions |

|

|

1,540 |

|

|

|

1,116 |

|

|

|

1,332 |

|

|

|

1,456 |

|

|

|

1,133 |

|

|

|

5,444 |

|

|

|

4,402 |

|

| Security gains (losses), including fair value changes for equity securities |

|

|

19 |

|

|

|

(624 |

) |

|

|

13 |

|

|

|

121 |

|

|

|

(366 |

) |

|

|

(471 |

) |

|

|

(454 |

) |

| Retirement plan consulting fees |

|

|

357 |

|

|

|

360 |

|

|

|

382 |

|

|

|

307 |

|

|

|

337 |

|

|

|

1,406 |

|

|

|

1,389 |

|

| Investment commissions |

|

|

589 |

|

|

|

520 |

|

|

|

476 |

|

|

|

393 |

|

|

|

508 |

|

|

|

1,978 |

|

|

|

2,183 |

|

| Net gains on sale of loans |

|

|

1,280 |

|

|

|

395 |

|

|

|

406 |

|

|

|

310 |

|

|

|

242 |

|

|

|

2,391 |

|

|

|

2,062 |

|

| Other mortgage banking fee income (loss), net |

|

|

139 |

|

|

|

185 |

|

|

|

234 |

|

|

|

153 |

|

|

|

98 |

|

|

|

711 |

|

|

|

291 |

|

| Debit card and EFT fees |

|

|

1,697 |

|

|

|

1,763 |

|

|

|

1,810 |

|

|

|

1,789 |

|

|

|

1,407 |

|

|

|

7,059 |

|

|

|

5,814 |

|

| Other noninterest income |

|

|

1,585 |

|

|

|

1,093 |

|

|

|

463 |

|

|

|

1,330 |

|

|

|

675 |

|

|

|

4,471 |

|

|

|

12,351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Noninterest Income |

|

$ |

12,156 |

|

|

$ |

9,831 |

|

|

$ |

9,449 |

|

|

$ |

10,425 |

|

|

$ |

8,200 |

|

|

$ |

41,861 |

|

|

$ |

44,202 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

|

For the Twelve Months

Ended |

|

| |

|

Dec. 31, |

|

|

Sept. 30, |

|

|

June 30, |

|

|

March 31, |

|

|

Dec. 31, |

|

|

Dec. 31, |

|

|

Dec. 31, |

|

| Noninterest Expense |

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Salaries and employee benefits |

|

$ |

14,871 |

|

|

$ |

14,233 |

|

|

$ |

13,625 |

|

|

$ |

14,645 |

|

|

$ |

11,385 |

|

|

$ |

57,374 |

|

|

$ |

45,013 |

|

| Occupancy and equipment |

|

|

3,896 |

|

|

|

3,810 |

|

|

|

3,859 |

|

|

|

3,869 |

|

|

|

2,753 |

|

|

|

15,434 |

|

|

|

11,379 |

|

| FDIC insurance and state and local taxes |

|

|

1,484 |

|

|

|

1,648 |

|

|

|

1,494 |

|

|

|

1,222 |

|

|

|

1,010 |

|

|

|

5,848 |

|

|

|

3,951 |

|

| Professional fees |

|

|

1,004 |

|

|

|

1,043 |

|

|

|

1,190 |

|

|

|

1,114 |

|

|

|

938 |

|

|

|

4,351 |

|

|

|

6,114 |

|

| Merger related costs |

|

|

452 |

|

|

|

268 |

|

|

|

442 |

|

|

|

4,313 |

|

|

|

584 |

|

|

|

5,475 |

|

|

|

4,070 |

|

| Advertising |

|

|

414 |

|

|

|

492 |

|

|

|

478 |

|

|

|

409 |

|

|

|

472 |

|

|

|

1,793 |

|

|

|

1,947 |

|

| Intangible amortization |

|

|

578 |

|

|

|

725 |

|

|

|

1,222 |

|

|

|

909 |

|

|

|

702 |

|

|

|

3,434 |

|

|

|

1,973 |

|

| Core processing charges |

|

|

1,057 |

|

|

|

1,274 |

|

|

|

1,144 |

|

|

|

1,164 |

|

|

|

742 |

|

|

|

4,639 |

|

|

|

3,348 |

|

| Other noninterest expenses |

|

|

3,216 |

|

|

|

4,223 |

|

|

|

2,932 |

|

|

|

3,077 |

|

|

|

2,509 |

|

|

|

13,448 |

|

|

|

16,616 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Noninterest Expense |

|

$ |

26,972 |

|

|

$ |

27,716 |

|

|

$ |

26,386 |

|

|

$ |

30,722 |

|

|

$ |

21,095 |

|

|

$ |

111,796 |

|

|

$ |

94,411 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Combination

|

|

|

|

|

| Consideration |

|

|

|

|

| Cash |

|

$ |

33,440 |

|

| Stock |

|

|

59,202 |

|

|

|

|

|

|

| Fair value of total consideration transferred |

|

$ |

92,642 |

|

|

|

|

|

|

| Fair value of assets acquired |

|

|

|

|

| Cash and cash equivalents |

|

$ |

20,265 |

|

| Securities available for sale |

|

|

126,970 |

|

| Other investments |

|

|

7,795 |

|

| Loans, net |

|

|

740,659 |

|

| Premises and equipment |

|

|

14,808 |

|

| Bank owned life insurance |

|

|

22,485 |

|

| Core deposit intangible |

|

|

19,249 |

|

| Current and deferred taxes |

|

|

17,708 |

|

| Other assets |

|

|

7,682 |

|

|

|

|

|

|

| Total assets acquired |

|

|

977,621 |

|

| Fair value of liabilities assumed |

|

|

|

|

| Deposits |

|

|

875,813 |

|

| Short-term borrowings |

|

|

75,000 |

|

| Accrued interest payable and other liabilities |

|

|

7,104 |

|

|

|

|

|

|

| Total liabilities |

|

|

957,917 |

|

|

|

|

|

|

| Net assets acquired |

|

$ |

19,704 |

|

| Goodwill created |

|

|

72,938 |

|

|

|

|

|

|

| Total net assets acquired |

|

$ |

92,642 |

|

|

|

|

|

|

Average Balance Sheets and Related Yields and Rates

(Dollar Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Three Months Ended |

|

| |

|

December 31, 2023 |

|

|

December 31, 2022 |

|

| |

|

AVERAGE |

|

|

|

|

|

YIELD/ |

|

|

AVERAGE |

|

|

|

|

|

YIELD/ |

|

| |

|

BALANCE |

|

|

INTEREST (1) |

|

|

RATE (1) |

|

|

BALANCE |

|

|

INTEREST (1) |

|

|

RATE (1) |

|

| EARNING ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans (2) |

|

$ |

3,188,581 |

|

|

$ |

44,868 |

|

|

|

5.63 |

% |

|

$ |

2,394,872 |

|

|

$ |

29,092 |

|

|

|

4.86 |

% |

| Taxable securities |

|

|

1,113,107 |

|

|

|

6,536 |

|

|

|

2.35 |

|

|

|

1,105,545 |

|

|

|

5,556 |

|

|

|

2.01 |

|

| Tax-exempt securities (2) |

|

|

411,860 |

|

|

|

3,235 |

|

|

|

3.14 |

|

|

|

453,917 |

|

|

|

3,580 |

|

|

|

3.15 |

|

| Other investments |

|

|

37,625 |

|

|

|

529 |

|

|

|

5.62 |

|

|

|

33,901 |

|

|

|

326 |

|

|

|

3.85 |

|

| Federal funds sold and other |

|

|

65,236 |

|

|

|

564 |

|

|

|

3.46 |

|

|

|

59,108 |

|

|

|

336 |

|

|

|

2.27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total earning assets |

|

|

4,816,409 |

|

|

|

55,732 |

|

|

|

4.63 |

|

|

|

4,047,343 |

|

|

|

38,890 |

|

|

|

3.84 |

|

| Nonearning assets |

|

|

163,905 |

|

|

|

|

|

|

|

|

|

|

|

33,154 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

4,980,314 |

|

|

|

|

|

|

|

|

|

|

$ |

4,080,497 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INTEREST-BEARING LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Time deposits |

|

$ |

712,485 |

|

|

$ |

6,291 |

|

|

|

3.53 |

% |

|

$ |

370,914 |

|

|

$ |

1,261 |

|

|

|

1.36 |

% |

| Brokered time deposits |

|

|

96,634 |

|

|

|

1,315 |

|

|

|

5.44 |

|

|

|

115,021 |

|

|

|

1,034 |

|

|

|

3.60 |

|

| Savings deposits |

|

|

1,068,465 |

|

|

|

2,918 |

|

|

|

1.09 |

|

|

|

871,584 |

|

|

|

879 |

|

|

|

0.40 |

|

| Demand deposits - interest bearing |

|

|

1,393,252 |

|

|

|

7,922 |

|

|

|

2.27 |

|

|

|

1,301,475 |

|

|

|

3,805 |

|

|

|

1.17 |

|

| Short term borrowings |

|

|

206,826 |

|

|

|

2,749 |

|

|

|

5.32 |

|

|

|

85,641 |

|

|

|

777 |

|

|

|

3.63 |

|

| Long term borrowings |

|

|

88,609 |

|

|

|

1,043 |

|

|

|

4.71 |

|

|

|

88,138 |

|

|

|

922 |

|

|

|

4.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest-bearing liabilities |

|

$ |

3,566,271 |

|

|

|

22,238 |

|

|

|

2.49 |

|

|

$ |

2,832,773 |

|

|

|

8,678 |

|

|

|

1.23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NONINTEREST-BEARING LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Demand deposits - noninterest bearing |

|

|

1,035,405 |

|

|

|

|

|

|

|

|

|

|

|

938,881 |

|

|

|

|

|

|

|

|

|

| Other liabilities |

|

|

54,306 |

|

|

|

|

|

|

|

|

|

|

|

43,904 |

|

|

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

324,332 |

|

|

|

|

|

|

|

|

|

|

|

264,939 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

4,980,314 |

|

|

|

|

|

|

|

|

|

|

$ |

4,080,497 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income and interest rate spread |

|

|

|

|

|

$ |

33,494 |

|

|

|

2.14 |

% |

|

|

|

|

|

$ |

30,212 |

|

|

|

2.61 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin |

|

|

|

|

|

|

|

|

|

|

2.78 |

% |

|

|

|

|

|

|

|

|

|

|

2.99 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Interest and yields are calculated on a tax-equivalent basis where

applicable. |

| (2) |

For 2023, adjustments of $86 thousand and $577 thousand, respectively, were made to tax equate income

on tax exempt loans and tax exempt securities. For 2022, adjustments of $72 thousand and $707 thousand, respectively, were made to tax equate income on tax exempt loans and tax exempt securities. These adjustments were based on a marginal

federal income tax rate of 21%, less disallowances. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Twelve Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, 2023 |

|

|

December 31, 2022 |

|

| |

|

AVERAGE |

|

|

|

|

|

YIELD/ |

|

|

AVERAGE |

|

|

|

|

|

YIELD/ |

|

| |

|

BALANCE |

|

|

INTEREST (1) |

|

|

RATE (1) |

|

|

BALANCE |

|

|

INTEREST (1) |

|

|

RATE (1) |

|

| EARNING ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans (2) |

|

$ |

3,155,858 |

|

|

$ |

172,161 |

|

|

|

5.46 |

% |

|

$ |

2,358,724 |

|

|

$ |

108,100 |

|

|

|

4.58 |

% |

| Taxable securities |

|

|

1,143,547 |

|

|

|

26,231 |

|

|

|

2.29 |

|

|

|

1,081,966 |

|

|

|

20,843 |

|

|

|

1.93 |

|

| Tax-exempt securities (2) |

|

|

419,557 |

|

|

|

13,283 |

|

|

|

3.17 |

|

|

|

465,855 |

|

|

|

14,952 |

|

|

|

3.21 |

|

| Other investments |

|

|

39,559 |

|

|

|

1,986 |

|

|

|

5.02 |

|

|

|

33,153 |

|

|

|

871 |

|

|

|

2.63 |

|

| Federal funds sold and other |

|

|

74,950 |

|

|

|

2,476 |

|

|

|

3.30 |

|

|

|

76,253 |

|

|

|

684 |

|

|

|

0.90 |