Amicus Therapeutics (Nasdaq: FOLD), a patient-dedicated global

biotechnology company focused on developing and commercializing

novel medicines for rare diseases, today announced financial

results for the third quarter ended September 30, 2024.

“The third quarter of the year was marked by the

excellent commercial performance of our two approved therapies and

continued financial discipline,” said Bradley Campbell, President

and Chief Executive Officer of Amicus Therapeutics, Inc. “Strong

patient demand for Galafold drove double digit revenue growth,

while the commercial launch of Pombiliti and Opfolda continues to

build momentum. We also announced a settlement of the Galafold

(migalastat) patent litigation with Teva, which is a major step

forward in ensuring Amicus can continue to support the Fabry

community with Galafold for many years to come. Importantly,

throughout the first nine months of the year, we’ve exceeded

expectations, which resulted in the achievement of non-GAAP

profitability for the full year 2024 as we closed the third

quarter. Amicus continues to be well positioned to drive

sustainable shareholder value and further our mission of delivering

great medicines for people living with rare diseases.”

Financial and Corporate

Highlights:

- Total revenue in the third

quarter 2024 was $141.5 million, a year-over-year increase

of 37% from total revenue of $103.5 million in the third quarter

2023. On a constant currency basis (CER)1, third quarter 2024 total

revenue growth was 36%.

|

(in thousands) |

Three Months Ended September 30, |

|

Year over Year % Growth |

|

Nine Months Ended September

30, |

|

Year over Year % Growth |

|

|

2024 |

|

2023 |

|

Reported |

|

at CER1 |

|

2024 |

|

2023 |

|

Reported |

|

at CER1 |

|

Galafold® |

$120,381 |

|

$100,733 |

|

20% |

|

19% |

|

$330,557 |

|

$281,177 |

|

18% |

|

18% |

|

Pombiliti® + Opfolda® |

$21,136 |

|

$2,768 |

|

664% |

|

658% |

|

$48,032 |

|

$3,097 |

|

1451% |

|

1442% |

|

Net Product Revenues |

$141,517 |

|

$103,501 |

|

37% |

|

36% |

|

$378,589 |

|

$284,274 |

|

33% |

|

33% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Galafold

(migalastat) net product sales were $120.4 million in the

third quarter 2024, a year-over-year increase of 20%, or 19% at

constant exchange rates1, reflecting continued strong demand. Given

strong performance in the first nine months of 2024, the Company is

raising its full year 2024 revenue growth guidance for Galafold to

+16% to +18% on a constant currency basis (CER)1.

-

Pombiliti (cipaglucosidase alfa-atga) + Opfolda (miglustat)

net product sales were $21.1 million in the third quarter

2024, a 33% increase from the second quarter of 2024. As of the end

of October, 203 patients have been treated or are scheduled to be

treated with commercial product in five markets (USA, Germany, UK,

Spain, and Austria). Given strong launch momentum, the Company is

raising its full year 2024 revenue guidance for Pombiliti + Opfolda

to $69 million to $71 million on a constant currency basis

(CER)1.

- Total

GAAP operating expenses of $106.6 million for the third

quarter 2024 decreased by 4% as compared to $110.6 million for the

third quarter 2023. Total non-GAAP operating

expenses of $82.6 million for the third quarter 2024

decreased by 8% as compared to $89.8 million for the third quarter

2023. Given continued financial discipline in the first nine months

of 2024, the Company is reducing its non-GAAP Operating Expense

guidance3 to $340 million to $350 million.

- GAAP net

loss was $6.7 million, or $0.02 per share, for the third

quarter 2024, and was reduced compared to a net loss of $21.6

million, or $0.07 per share, for the third quarter 2023.

- Non-GAAP

net income was $30.8 million, or $0.10 per share, for the

third quarter 2024, compared to a non-GAAP net loss of $4.0

million, or $0.01 per share, for the third quarter 20232. Non-GAAP

profitability was also achieved in the first nine months of

2024.

- Cash,

cash equivalents, and marketable securities totaled $249.8

million at September 30, 2024, compared to $286.2 million at

December 31, 2023.

- In October 2024, the Company

announced that it has entered into a License Agreement with Teva

Pharmaceuticals USA, Inc. and Teva Pharmaceuticals, Inc. allowing

Teva to market a generic version of Galafold® in the United States

beginning on January 30, 2037, if approved by the U.S. Food and

Drug Administration (FDA) and unless certain limited circumstances

customarily included in these types of agreements occur. Similar

patent litigation previously disclosed by the Company will continue

against Aurobindo (Aurobindo Pharma LTD and Aurobindo Pharma USA,

Inc.) as the remaining active party and the litigation stay remains

in place for Lupin (Lupin LTD and Lupin Pharmaceuticals,

Inc.).

2024 Financial Guidance:

|

|

Previous |

|

Updated |

| Total Revenue Growth1 |

26% to 31% |

→ |

30% to 32% |

| Galafold Revenue Growth1 |

14% to 18% |

→ |

16% to 18% |

| Pombiliti + Opfolda Revenue1 |

$62M to $67M |

→ |

$69M to $71M |

| Non-GAAP Operating Expense3 |

$345M to $360M |

→ |

$340M to $350M |

| |

|

|

|

Amicus is focused on the following key

strategic priorities in 2024:

-

Delivering double-digit Galafold revenue growth

-

Executing multiple successful launches of Pombiliti + Opfolda

-

Advancing ongoing studies to support medical and scientific

leadership in Fabry and Pompe diseases

-

Achieving full-year non-GAAP profitability4

1 At constant exchange rates (CER). In order to

illustrate underlying performance, Amicus discusses its results in

terms of CER growth. This represents growth calculated as if the

exchange rates had remained unchanged from those used in the

comparative period. Full-year revenue guidance utilizes actual

exchange rate as of December 31, 2023.2 Full reconciliation of GAAP

results to the Company’s non-GAAP adjusted measures for the

reporting period(s) appear in the tables to this press release.3 A

reconciliation of the differences between the non-GAAP expectation

and the corresponding GAAP measure is not available without

unreasonable effort due to high variability, complexity, and low

visibility as to the items that would be excluded from the GAAP

measure.4 Based on projections of Amicus’ non-GAAP Net (Loss)

Income under current operating plans, which includes successful

Pombiliti + Opfolda launch and continued Galafold growth. Amicus

defines non-GAAP Net (Loss) Income as GAAP Net (Loss) Income

excluding the impact of share-based compensation expense, changes

in fair value of contingent consideration, loss on impairment of

assets, depreciation and amortization, acquisition-related income

(expense), loss on extinguishment of debt, restructuring charges

and income taxes.

Conference Call and

Webcast

Amicus Therapeutics will host a conference call

and audio webcast today, November 6, 2024, at 8:30 a.m. ET to

discuss the third quarter 2024 financial results and corporate

updates. Participants and investors interested in accessing the

call by phone will need to register using the online registration

form. After registering, all phone participants will receive a

dial-in number along with a PIN number to access the event.

A live audio webcast and related presentation

materials can also be accessed via the Investors section of the

Amicus Therapeutics corporate website at ir.amicusrx.com. Web

participants are encouraged to register on the website 15 minutes

prior to the start of the call. An archived webcast and

accompanying slides will be available on the Company's website

shortly after the conclusion of the live event.

About

Galafold Galafold® (migalastat)

123 mg capsules is an oral pharmacological chaperone of

alpha-Galactosidase A (alpha-Gal A) for the treatment of Fabry

disease in adults who have amenable galactosidase alpha gene

(GLA) variants. In these patients, Galafold works by

stabilizing the body’s own dysfunctional enzyme so that it can

clear the accumulation of disease substrate. Globally, Amicus

Therapeutics estimates that approximately 35 to 50 percent of

people living with Fabry disease may have

amenable GLA variants, though amenability rates within

this range vary by geography. Galafold is approved in more than 40

countries around the world, including the U.S., EU, U.K., and

Japan.

U.S. INDICATIONS AND USAGEGalafold is indicated

for the treatment of adults with a confirmed diagnosis of Fabry

disease and an amenable galactosidase alpha gene (GLA) variant

based on in vitro assay data.

This indication is approved under accelerated approval based on

reduction in kidney interstitial capillary cell

globotriaosylceramide (KIC GL-3) substrate. Continued approval for

this indication may be contingent upon verification and description

of clinical benefit in confirmatory trials.

U.S. IMPORTANT SAFETY INFORMATION

ADVERSE REACTIONSThe most common adverse

reactions reported with Galafold (≥10%) were headache,

nasopharyngitis, urinary tract infection, nausea and pyrexia.

USE IN SPECIFIC POPULATIONSThere is

insufficient clinical data on Galafold use in pregnant women to

inform a drug-associated risk for major birth defects and

miscarriage. Advise women of the potential risk to a fetus.

It is not known if Galafold is present in human milk. Therefore,

the developmental and health benefits of breastfeeding should be

considered along with the mother’s clinical need for Galafold and

any potential adverse effects on the breastfed child from Galafold

or from the underlying maternal condition.

Galafold is not recommended for use in patients with severe

renal impairment or end-stage renal disease requiring dialysis.

The safety and effectiveness of Galafold have not been

established in pediatric patients.

To report Suspected Adverse Reactions, contact Amicus

Therapeutics at 1-877-4AMICUS or FDA at 1-800-FDA-1088

or www.fda.gov/medwatch.

For additional information about Galafold, including the full

U.S. Prescribing Information, please

visit https://www.amicusrx.com/pi/Galafold.pdf.

About Pombiliti +

OpfoldaPombiliti + Opfolda, is a two-component therapy

that consists of cipaglucosidase alfa-atga, a bis-M6P-enriched

rhGAA that facilitates high-affinity uptake through the M6P

receptor while retaining its capacity for processing into the most

active form of the enzyme, and the oral enzyme stabilizer,

miglustat, that’s designed to reduce loss of enzyme activity in the

blood.

U.S. INDICATIONS

AND USAGEPOMBILITI in combination

with OPFOLDA is indicated for the treatment of adult patients with

late-onset Pompe disease (lysosomal acid alpha-glucosidase [GAA]

deficiency) weighing ≥40 kg and who are not improving on their

current enzyme replacement therapy (ERT).

SAFETY INFORMATION

HYPERSENSITIVITY REACTIONS INCLUDING

ANAPHYLAXIS: Appropriate medical support measures, including

cardiopulmonary resuscitation equipment, should be readily

available. If a severe hypersensitivity reaction occurs, POMBILITI

should be discontinued immediately and appropriate medical

treatment should be initiated. INFUSION-ASSOCIATED REACTIONS

(IARs): If severe IARs occur, immediately discontinue POMBILITI and

initiate appropriate medical treatment. RISK OF ACUTE

CARDIORESPIRATORY FAILURE IN SUSCEPTIBLE PATIENTS: Patients

susceptible to fluid volume overload, or those with acute

underlying respiratory illness or compromised cardiac or

respiratory function, may be at risk of serious exacerbation of

their cardiac or respiratory status during POMBILITI infusion. See

PI for complete Boxed Warning. CONTRAINDICATION: POMBILITI

in combination with Opfolda is contraindicated in pregnancy.

EMBRYO-FETAL TOXICITY: May cause embryo-fetal

harm. Advise females of reproductive potential of the potential

risk to a fetus and to use effective contraception during treatment

and for at least 60 days after the last dose. Adverse

Reactions: Most common adverse reactions ≥ 5% are

headache, diarrhea, fatigue, nausea, abdominal pain, and pyrexia.

Please see full PRESCRIBING INFORMATION, including BOXED

WARNING, for POMBILITI (cipaglucosidase alfa-atga)

LINK and full PRESCRIBING INFORMATION for

OPFOLDA (miglustat)

LINK.

About Amicus Therapeutics

Amicus Therapeutics (Nasdaq: FOLD) is a global, patient-dedicated

biotechnology company focused on discovering, developing and

delivering novel high-quality medicines for people living with rare

diseases. With extraordinary patient focus, Amicus Therapeutics is

committed to advancing and expanding a pipeline of cutting-edge,

first- or best-in-class medicines for rare diseases. For more

information, please visit the Company’s website at

www.amicusrx.com, and follow on X and LinkedIn.

Non-GAAP Financial Measures In

addition to financial information prepared in accordance with U.S.

GAAP, this press release also contains adjusted financial measures

that we believe provide investors and management with supplemental

information relating to operating performance and trends that

facilitate comparisons between periods and with respect to

projected information. These adjusted financial measures are

non-GAAP measures and should be considered in addition to, but not

as a substitute for, the information prepared in accordance with

U.S. GAAP. We use these non-GAAP measures as key performance

measures for the purpose of evaluating operational performance and

cash requirements internally. We typically exclude certain GAAP

items that management does not believe affect our basic operations

and that do not meet the GAAP definition of unusual or

non-recurring items. Other companies may define these measures in

different ways. When we provide our expectation for non-GAAP

operating expenses and profitability on a forward-looking basis, a

reconciliation of the differences between the non-GAAP expectation

and the corresponding GAAP measure generally is not available

without unreasonable effort due to potentially high variability,

complexity and low visibility as to the items that would be

excluded from the GAAP measure in the relevant future period, such

as unusual gains or losses. The variability of the excluded items

may have a significant, and potentially unpredictable, impact on

our future GAAP results.

Forward Looking Statement

This press release contains "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995 relating to preclinical and clinical development

of our product candidates, the timing and reporting of results from

preclinical studies and clinical trials, the prospects and timing

of the potential regulatory approval of our product candidates,

commercialization plans, manufacturing and supply plans, financing

plans, and the projected revenues and cash position for the

Company. The inclusion of forward-looking statements should not be

regarded as a representation by us that any of our plans will be

achieved. Any or all of the forward-looking statements in this

press release may turn out to be wrong and can be affected by

inaccurate assumptions we might make or by known or unknown risks

and uncertainties. For example, with respect to statements

regarding the goals, progress, timing, and outcomes of discussions

with regulatory authorities and pricing and reimbursement

authorities, are based on current information. Actual results may

differ materially from those set forth in this release due to the

risks and uncertainties inherent in our business, including,

without limitation: the potential that results of clinical or

preclinical studies indicate that the product candidates are unsafe

or ineffective; the potential that it may be difficult to enroll

patients in our clinical trials; the potential that regulatory

authorities may not grant or may delay approval for our product

candidates; the potential that required regulatory inspections may

be delayed or not be successful and delay or prevent product

approval; the potential that we may not be successful in

negotiations with pricing and reimbursement authorities; the

potential that we may not be successful in commercializing Galafold

and/or Pombiliti and Opfolda in Europe, the UK, the US and other

geographies; the potential that preclinical and clinical studies

could be delayed because we identify serious side effects or other

safety issues; the potential that we may not be able to manufacture

or supply sufficient clinical or commercial products; and the

potential that we will need additional funding to complete all of

our studies, the manufacturing, and commercialization of our

products. With respect to statements regarding corporate financial

guidance and financial goals and the expected attainment of such

goals and projections of the Company's revenue, non-GAAP

profitability and cash position, actual results may differ based on

market factors and the Company's ability to execute its operational

and budget plans. In addition, all forward-looking statements are

subject to other risks detailed in our Annual Report on Form 10-K

for the year ended December 31, 2023, and on Form 10-Q for the

quarter ended September 30, 2024, to be filed today. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. All

forward-looking statements are qualified in their entirety by this

cautionary statement, and we undertake no obligation to revise or

update this news release to reflect events or circumstances after

the date hereof.

CONTACT:

Investors: Amicus Therapeutics Andrew

FaughnanVice President, Investor

Relationsafaughnan@amicusrx.com(609) 662-3809

Media: Amicus Therapeutics Diana Moore Head of

Global Corporate Affairs and Communicationsdmoore@amicusrx.com(609)

662-5079

FOLD-G TABLE

1

Amicus

Therapeutics, Inc.Consolidated Statements of

Operations(Unaudited)(in

thousands, except share and per share amounts)

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net product sales |

$ |

141,517 |

|

|

$ |

103,501 |

|

|

$ |

378,589 |

|

|

$ |

284,274 |

|

| Cost of goods sold |

|

13,279 |

|

|

|

9,946 |

|

|

|

38,107 |

|

|

|

26,002 |

|

| Gross profit |

|

128,238 |

|

|

|

93,555 |

|

|

|

340,482 |

|

|

|

258,272 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

26,160 |

|

|

|

40,704 |

|

|

|

79,172 |

|

|

|

117,352 |

|

|

Selling, general, and administrative |

|

75,106 |

|

|

|

65,651 |

|

|

|

236,711 |

|

|

|

205,031 |

|

|

Changes in fair value of contingent consideration payable |

|

— |

|

|

|

1,995 |

|

|

|

— |

|

|

|

2,583 |

|

|

Restructuring charges |

|

3,143 |

|

|

|

— |

|

|

|

9,188 |

|

|

|

— |

|

|

Loss on impairment of assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,134 |

|

|

Depreciation and amortization |

|

2,170 |

|

|

|

2,228 |

|

|

|

6,506 |

|

|

|

5,691 |

|

| Total operating expenses |

|

106,579 |

|

|

|

110,578 |

|

|

|

331,577 |

|

|

|

331,791 |

|

| Income (loss) from

operations |

|

21,659 |

|

|

|

(17,023 |

) |

|

|

8,905 |

|

|

|

(73,519 |

) |

| Other expense: |

|

|

|

|

|

|

|

|

Interest income |

|

1,081 |

|

|

|

1,471 |

|

|

|

3,991 |

|

|

|

5,407 |

|

|

Interest expense |

|

(12,692 |

) |

|

|

(12,986 |

) |

|

|

(37,640 |

) |

|

|

(37,322 |

) |

|

Other (expense) income |

|

(3,263 |

) |

|

|

3,833 |

|

|

|

(11,946 |

) |

|

|

(13,007 |

) |

| Income (loss) before income

tax |

|

6,785 |

|

|

|

(24,705 |

) |

|

|

(36,690 |

) |

|

|

(118,441 |

) |

| Income tax (expense)

benefit |

|

(13,514 |

) |

|

|

3,128 |

|

|

|

(34,155 |

) |

|

|

700 |

|

| Net loss attributable

to common stockholders |

$ |

(6,729 |

) |

|

$ |

(21,577 |

) |

|

$ |

(70,845 |

) |

|

$ |

(117,741 |

) |

| Net loss attributable to

common stockholders per common share — basic and diluted |

$ |

(0.02 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.40 |

) |

| Weighted-average common shares

outstanding — basic and diluted |

|

304,690,596 |

|

|

|

295,759,435 |

|

|

|

303,792,479 |

|

|

|

293,314,167 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TABLE 2

Amicus

Therapeutics, Inc.Consolidated Balance

Sheets(Unaudited)(in thousands,

except share and per share amounts)

| |

September 30, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

233,647 |

|

|

$ |

246,994 |

|

|

Investments in marketable securities |

|

16,110 |

|

|

|

39,206 |

|

|

Accounts receivable |

|

98,073 |

|

|

|

87,632 |

|

|

Inventories |

|

115,338 |

|

|

|

59,696 |

|

|

Prepaid expenses and other current assets |

|

35,306 |

|

|

|

49,533 |

|

| Total current assets |

|

498,474 |

|

|

|

483,061 |

|

|

Operating lease right-of-use assets, net |

|

23,144 |

|

|

|

26,312 |

|

|

Property and equipment, less accumulated depreciation of $29,324

and $25,429 at September 30, 2024 and December 31, 2023,

respectively |

|

30,438 |

|

|

|

31,667 |

|

|

Intangible assets, less accumulated amortization of $4,974 and

$2,510 at September 30, 2024 and December 31, 2023,

respectively |

|

18,026 |

|

|

|

20,490 |

|

|

Goodwill |

|

197,797 |

|

|

|

197,797 |

|

|

Other non-current assets |

|

18,678 |

|

|

|

18,553 |

|

| Total

Assets |

$ |

786,557 |

|

|

$ |

777,880 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

13,481 |

|

|

$ |

15,120 |

|

|

Accrued expenses and other current liabilities |

|

136,116 |

|

|

|

144,245 |

|

|

Operating lease liabilities |

|

8,541 |

|

|

|

8,324 |

|

| Total current liabilities |

|

158,138 |

|

|

|

167,689 |

|

|

Long-term debt |

|

389,494 |

|

|

|

387,858 |

|

|

Operating lease liabilities |

|

46,623 |

|

|

|

48,877 |

|

|

Other non-current liabilities |

|

13,477 |

|

|

|

13,282 |

|

| Total liabilities |

|

607,732 |

|

|

|

617,706 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

| Common stock, $0.01 par value,

500,000,000 shares authorized, 298,691,094 and 293,594,209 shares

issued and outstanding at September 30, 2024 and December 31, 2023,

respectively |

|

2,942 |

|

|

|

2,918 |

|

| Additional paid-in

capital |

|

2,905,760 |

|

|

|

2,836,018 |

|

| Accumulated other

comprehensive income (loss): |

|

|

|

|

Foreign currency translation adjustment |

|

25,159 |

|

|

|

5,429 |

|

|

Unrealized loss on available-for-sale securities |

|

(188 |

) |

|

|

(188 |

) |

| Warrants |

|

71 |

|

|

|

71 |

|

| Accumulated deficit |

|

(2,754,919 |

) |

|

|

(2,684,074 |

) |

| Total stockholders’

equity |

|

178,825 |

|

|

|

160,174 |

|

| Total Liabilities and

Stockholders’ Equity |

$ |

786,557 |

|

|

$ |

777,880 |

|

| |

|

|

|

|

|

|

|

TABLE 3

Amicus

Therapeutics, Inc.Reconciliation of Non-GAAP

Financial Measures(in

thousands)(Unaudited)

| |

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| Total operating

expenses - as reported GAAP |

$ |

106,579 |

|

$ |

110,578 |

|

$ |

331,577 |

|

$ |

331,791 |

|

Research and development: |

|

|

|

|

|

|

|

|

Stock-based compensation |

|

4,397 |

|

|

4,380 |

|

|

12,329 |

|

|

16,987 |

|

Selling, general and administrative: |

|

|

|

|

|

|

|

|

Stock-based compensation |

|

14,291 |

|

|

12,131 |

|

|

53,359 |

|

|

50,995 |

|

Loss on impairment of assets |

|

— |

|

|

— |

|

|

— |

|

|

1,134 |

|

Changes in fair value of contingent consideration

payable |

|

— |

|

|

1,995 |

|

|

— |

|

|

2,583 |

|

Restructuring Charges |

|

3,143 |

|

|

— |

|

|

9,188 |

|

|

— |

|

Depreciation and amortization |

|

2,170 |

|

|

2,228 |

|

|

6,506 |

|

|

5,691 |

| Total operating

expense adjustments to reported GAAP |

|

24,001 |

|

|

20,734 |

|

|

81,382 |

|

|

77,390 |

|

Total operating expenses - as adjusted |

$ |

82,578 |

|

$ |

89,844 |

|

$ |

250,195 |

|

$ |

254,401 |

|

|

|

|

|

|

|

|

|

|

|

|

|

TABLE 4

Amicus

Therapeutics, Inc.Reconciliation of Non-GAAP

Financial Measures(in thousands, except share and

per share amounts)(Unaudited)

| |

|

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

| GAAP net

loss |

|

$ |

(6,729 |

) |

|

$ |

(21,577 |

) |

|

$ |

(70,845 |

) |

|

$ |

(117,741 |

) |

| Share-based compensation |

|

|

18,688 |

|

|

|

16,511 |

|

|

|

65,688 |

|

|

|

67,982 |

|

| Changes in fair value of

contingent consideration payable |

|

|

— |

|

|

|

1,995 |

|

|

|

— |

|

|

|

2,583 |

|

| Depreciation and

amortization |

|

|

2,170 |

|

|

|

2,228 |

|

|

|

6,506 |

|

|

|

5,691 |

|

| Loss on impairment of assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,134 |

|

| Restructuring charges |

|

|

3,143 |

|

|

|

— |

|

|

|

9,188 |

|

|

|

— |

|

| Income tax expense (benefit) |

|

|

13,514 |

|

|

|

(3,128 |

) |

|

|

34,155 |

|

|

|

(700 |

) |

|

Non-GAAP net income (loss) |

|

$ |

30,786 |

|

|

$ |

(3,971 |

) |

|

$ |

44,692 |

|

|

$ |

(41,051 |

) |

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income (loss) attributable to common stockholders per

common share — basic and diluted |

|

$ |

0.10 |

|

|

$ |

(0.01 |

) |

|

$ |

0.15 |

|

|

$ |

(0.14 |

) |

|

Weighted-average common shares outstanding — basic and diluted |

|

|

304,690,596 |

|

|

|

295,759,435 |

|

|

|

303,792,479 |

|

|

|

293,314,167 |

|

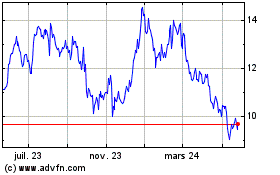

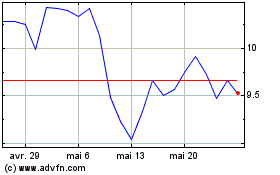

Amicus Therapeutics (NASDAQ:FOLD)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Amicus Therapeutics (NASDAQ:FOLD)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024