Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

22 Novembre 2023 - 10:37PM

Edgar (US Regulatory)

First Trust Global Tactical Commodity

Strategy Fund (FTGC)

Consolidated Portfolio of

Investments

September 30, 2023

(Unaudited)

Principal

Value

|

| Description

|

| Stated

Coupon

|

| Stated

Maturity

|

| Value

|

| U.S. TREASURY BILLS – 25.5%

|

| $170,000,000

|

| U.S. Treasury Bill

|

| (a)

|

| 10/12/23

|

| $169,751,021

|

| 175,000,000

|

| U.S. Treasury Bill

|

| (a)

|

| 11/09/23

|

| 174,022,819

|

| 170,000,000

|

| U.S. Treasury Bill

|

| (a)

|

| 11/16/23

|

| 168,875,875

|

| 170,000,000

|

| U.S. Treasury Bill

|

| (a)

|

| 12/14/23

|

| 168,174,697

|

|

|

| Total U.S. Treasury Bills

|

| 680,824,412

|

|

|

| (Cost $680,819,699)

|

|

|

|

|

|

|

| U.S. GOVERNMENT BONDS AND NOTES – 22.9%

|

| 150,000,000

|

| U.S. Treasury Note

|

| 0.25%

|

| 06/15/24

|

| 144,608,455

|

| 150,000,000

|

| U.S. Treasury Note

|

| 0.38%

|

| 09/15/24

|

| 142,951,938

|

| 175,000,000

|

| U.S. Treasury Note

|

| 1.00%

|

| 12/15/24

|

| 166,215,821

|

| 170,000,000

|

| U.S. Treasury Note

|

| 0.50%

|

| 03/31/25

|

| 158,478,515

|

|

|

| Total U.S. Government Bonds and Notes

|

| 612,254,729

|

|

|

| (Cost $614,120,935)

|

|

|

|

|

|

|

| Shares

|

| Description

|

| Value

|

| MONEY MARKET FUNDS – 28.5%

|

| 391,000,000

|

| Dreyfus Government Cash Management Fund, Institutional Shares - 5.22% (b)

|

| 391,000,000

|

| 371,500,000

|

| Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio - Institutional Class - 5.20% (b)

|

| 371,500,000

|

|

|

| Total Money Market Funds

|

| 762,500,000

|

|

|

| (Cost $762,500,000)

|

|

|

|

| Total Investments – 76.9%

| 2,055,579,141

|

|

| (Cost $2,057,440,634)

|

|

|

|

|

| Net Other Assets and Liabilities – 23.1%

|

| 618,593,837

|

|

| Net Assets – 100.0%

|

| $2,674,172,978

|

The following futures

contracts of the Fund’s wholly-owned subsidiary were open at September 30, 2023:

| Futures Contracts Long:

|

| Number

of

Contracts

|

| Notional

Value

|

| Expiration

Date

|

| Unrealized

Appreciation

(Depreciation)/

Value

|

| Brent Crude Oil Futures

|

| 983

|

| $90,632,600

|

| Oct–23

|

| $7,260,663

|

| Brent Crude Oil Futures

|

| 903

|

| 81,595,080

|

| Nov–23

|

| 472,012

|

| Cocoa Futures

|

| 2,091

|

| 71,470,380

|

| Dec–23

|

| (1,601,251)

|

| Coffee “C” Futures

|

| 652

|

| 35,733,675

|

| Dec–23

|

| (3,916,997)

|

| Copper Futures

|

| 1,242

|

| 116,049,375

|

| Dec–23

|

| (1,662,442)

|

| Corn Futures

|

| 3,845

|

| 91,655,187

|

| Dec–23

|

| (11,377,895)

|

| Cotton No. 2 Futures

|

| 2,136

|

| 93,076,200

|

| Dec–23

|

| 7,031,213

|

| Gasoline RBOB Futures

|

| 1,396

|

| 140,687,484

|

| Oct–23

|

| (3,426,117)

|

| Gasoline RBOB Futures

|

| 161

|

| 15,887,995

|

| Nov–23

|

| (648,692)

|

| Gold 100 Oz. Futures

|

| 1,232

|

| 229,903,520

|

| Dec–23

|

| (14,780,330)

|

| Kansas City Hard Red Winter Wheat Futures

|

| 1,555

|

| 51,606,563

|

| Dec–23

|

| (8,859,864)

|

| Lean Hogs Futures

|

| 849

|

| 24,374,790

|

| Dec–23

|

| (1,083,921)

|

| Live Cattle Futures

|

| 551

|

| 41,418,670

|

| Dec–23

|

| (20,409)

|

| LME Aluminum Futures

|

| 1,467

|

| 86,277,938

|

| Dec–23

|

| 6,155,490

|

| LME Lead Futures

|

| 1,340

|

| 72,728,500

|

| Dec–23

|

| (1,488,966)

|

| LME Nickel Futures

|

| 446

|

| 49,936,836

|

| Dec–23

|

| (5,893,626)

|

| LME Zinc Futures

|

| 947

|

| 62,803,856

|

| Dec–23

|

| 5,008,819

|

| Low Sulphur Gasoil “G” Futures

|

| 1,823

|

| 168,946,525

|

| Dec–23

|

| 9,941,251

|

| Natural Gas Futures

|

| 2,130

|

| 62,387,700

|

| Oct–23

|

| (2,901,836)

|

| Natural Gas Futures

|

| 1,989

|

| 65,875,680

|

| Nov–23

|

| (3,591,758)

|

First Trust Global Tactical Commodity

Strategy Fund (FTGC)

Consolidated Portfolio of

Investments (Continued)

September 30, 2023

(Unaudited)

| Futures Contracts Long: (Continued)

|

| Number

of

Contracts

|

| Notional

Value

|

| Expiration

Date

|

| Unrealized

Appreciation

(Depreciation)/

Value

|

| NY Harbor ULSD Futures

|

| 662

|

| $91,769,883

|

| Oct–23

|

| $8,710,972

|

| NY Harbor ULSD Futures

|

| 559

|

| 74,138,828

|

| Nov–23

|

| 4,059,949

|

| Silver Futures

|

| 679

|

| 76,217,750

|

| Dec–23

|

| (2,446,179)

|

| Soybean Futures

|

| 1,328

|

| 84,660,000

|

| Nov–23

|

| 3,038,600

|

| Soybean Meal Futures

|

| 3,249

|

| 123,851,880

|

| Dec–23

|

| (3,246,520)

|

| Soybean Oil Futures

|

| 5,334

|

| 178,678,332

|

| Dec–23

|

| 6,873,628

|

| Sugar #11 (World) Futures

|

| 3,808

|

| 112,936,141

|

| Feb–24

|

| 908,233

|

| Wheat Futures

|

| 664

|

| 17,977,800

|

| Dec–23

|

| (3,949,634)

|

| WTI Crude Futures

|

| 1,588

|

| 141,014,400

|

| Nov–23

|

| 14,405,449

|

| WTI Crude Futures

|

| 172

|

| 14,960,560

|

| Dec–23

|

| 34,778

|

|

|

| Total

|

| $2,569,254,128

|

|

|

| $3,004,620

|

| (a)

| Zero coupon bond.

|

| (b)

| Rate shown reflects yield as of September 30, 2023.

|

Valuation Inputs

The Fund is subject to

fair value accounting standards that define fair value, establish the framework for measuring fair value and provide a three-level hierarchy for fair valuation based upon the inputs to the valuation as of the

measurement date. The three levels of the fair value hierarchy are as follows:

| •

| Level 1 – Level 1 inputs are quoted prices in active markets for identical investments.

|

| •

| Level 2 – Level 2 inputs are observable inputs, either directly or indirectly. (Quoted prices for similar investments, valuations based on interest rates and yield curves, or valuations derived

from observable market data.)

|

| •

| Level 3 – Level 3 inputs are unobservable inputs that may reflect the reporting entity’s own assumptions about the assumptions that market participants would use in

pricing the investment.

|

The inputs or

methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

A summary of the inputs

used to value the Fund’s investments as of September 30, 2023 is as follows:

| ASSETS TABLE

|

|

| Total

Value at

9/30/2023

| Level 1

Quoted

Prices

| Level 2

Significant

Observable

Inputs

| Level 3

Significant

Unobservable

Inputs

|

U.S. Treasury Bills

| $ 680,824,412

| $ —

| $ 680,824,412

| $ —

|

U.S. Government Bonds and Notes

| 612,254,729

| —

| 612,254,729

| —

|

Money Market Funds

| 762,500,000

| 762,500,000

| —

| —

|

Total Investments

| 2,055,579,141

| 762,500,000

| 1,293,079,141

| —

|

Futures Contracts

| 77,297,246

| 77,297,246

| —

| —

|

Total

| $ 2,132,876,387

| $ 839,797,246

| $ 1,293,079,141

| $—

|

|

|

| LIABILITIES TABLE

|

|

| Total

Value at

9/30/2023

| Level 1

Quoted

Prices

| Level 2

Significant

Observable

Inputs

| Level 3

Significant

Unobservable

Inputs

|

Futures Contracts

| $ (74,292,626)

| $ (74,292,626)

| $ —

| $ —

|

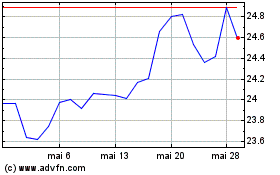

First Trust Global Tacti... (NASDAQ:FTGC)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

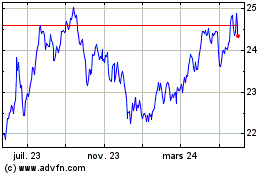

First Trust Global Tacti... (NASDAQ:FTGC)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024