FALSE000161272000016127202024-06-032024-06-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 5, 2024

NEXTDECADE CORPORATION

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Delaware | 001-36842 | 46-5723951 |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

1000 Louisiana Street, Suite 3300 | | |

Houston, Texas | | 77002 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (713) 574-1880

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class: | | Trading Symbol | | Name of each exchange on which registered: |

| Common Stock, $0.0001 par value | | NEXT | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

On August 5, 2024, Rio Grande LNG Train 4, LLC (“RG4”), a subsidiary of NextDecade Corporation (the “Company”), entered into a lump sum turnkey engineering, procurement and construction (“EPC”) agreement with Bechtel Energy, Inc. (“Bechtel”) for the construction of the fourth liquefaction train of the Rio Grande LNG liquefaction facility (the “Train 4 EPC Agreement”). Under the Train 4 EPC Agreement, Bechtel agreed to provide RG4 with services for the engineering, procurement and construction of one liquefaction train based on the design currently under construction in Phase 1, one 180,000m3 full containment LNG tank, a ground flare, utilities required for Train 4 and Train 5, and all related facilities and appurtenances thereto (collectively, “Train 4”). Except for certain specified owner and third-party work outlined in the Train 4 EPC Agreement, the work to be performed by Bechtel includes all of the work required to achieve ready for start-up, substantial completion and final completion of Train 4 in accordance with the requirements of the Train 4 EPC Agreement, including achieving specified minimum acceptance criteria and performance guarantees. Bechtel is obligated to perform its work in accordance with good engineering and construction practices and applicable laws, codes and standards. Bechtel bears risk of loss of Train 4 until substantial completion of Train 4, subject to exceptions with respect to uninsurable risks.

Bechtel’s scope of work does not include, and RG4 is responsible for, (a) specified RG4 permits, (b) feed gas supply, (c) provision of site access, (d) provision of operating personnel, and (e) work required (i) due to pre-existing hazardous materials discovered or released at the site or in any off-site right of way or easement, (ii) to complete specified RG4-provided items and RG4-provided information, (iii) due to erroneous legal description of the site or site surveys, (iv) due to unforeseen differing site conditions, or (v) in connection with other RG4 obligations or responsibilities set forth in the Train 4 EPC Agreement.

Payment for Work

RG4 agreed to pay to Bechtel a contract price of $4.327 billion (including Euro-denominated equipment priced at approximately €263.9 million) for the work under the Train 4 EPC Agreement. Payments under the Train 4 EPC Agreement will be made in accordance with the payment schedule set forth in the Train 4 EPC Agreement. The contract price and payment schedule, including milestones, may be amended only by change order. Excluded from the contract price are costs associated with foreign currency hedges (until full notice to proceed only, after which Bechtel assumes currency risk), wharfingers’ insurance, U.S. customs, tariffs and duties (up to certain caps and sub-caps totaling approximately $58.6 million), and operating spare parts. Prior to RG4’s issuance of full notice to proceed to Bechtel, RG4 is required to provide Bechtel with documentation demonstrating either (i) that it has sufficient funds to fulfill its payment obligations of the contract price under the Train 4 EPC Agreement as they become due thereunder, or (ii) that it has obtained firm commitments from lenders that are sufficient (when taken together with RG4’s funds) to fulfill such payment obligations.

Change Orders

Bechtel may obtain change order relief, including (as applicable) increases to the contract price, extensions of guaranteed dates for substantial completion and adjustments to performance guarantees and minimum acceptance criteria, for a specific list of events defined in the Train 4 EPC Agreement, including, among other things:

•a force majeure event or certain impacts from specified ongoing conflict events; however, Bechtel’s right to an increase to the contract price due to delays caused by one or more force majeure events is capped at $25,000,000 in the aggregate;

•a suspension of work ordered by RG4;

•certain changes in law (excluding changes to tax laws based upon Bechtel’s net income);

•acts or omissions of RG4, unless (a) caused, directly or indirectly, by Bechtel’s failure to perform its obligations under the agreement, or (b) expressly permitted by the Train 4 EPC Agreement;

•RG4 risk of loss events (i.e. uninsurable risks);

•errors in rely-upon information;

•RG4-directed changes to the scope of work; and

•discovery of pre-existing hazardous materials at the site or certain unforeseen subsurface soil conditions.

Liquidated Damages

Bechtel will be liable to RG4 for failure to achieve substantial completion by the guaranteed substantial completion date. Bechtel is required to pay “delay” liquidated damages for each day of delay that Bechtel fails to achieve substantial completion for Train 4 after the guaranteed substantial completion date of Train 4 (subject to change orders). The maximum amount of liquidated damages is limited as set forth in the Train 4 EPC Agreement.

In addition, if the RG4 liquefaction facility fails to achieve one or more performance guarantees for Train 4 after its guaranteed substantial completion date but meets specified minimum acceptance criteria and all other requirements for substantial completion, then Bechtel is required to pay “performance” liquidated damages for such failure.

Liability Limitations

Subject to certain exceptions, Bechtel’s maximum aggregate liability under the Train 4 EPC Agreement (including its liability for liquidated damages) is set forth in the Train 4 EPC Agreement.

Neither party will be liable to the other party or its affiliates for any special, indirect, incidental or consequential damages, or for any loss of profit, loss of use or similar claims, other than for the agreed liquidated damages or pursuant to indemnities against losses claimed by third parties.

Early Production Bonus

If Bechtel achieves substantial completion of Train 4 prior to its guaranteed substantial completion date, Bechtel will be entitled to receive an LNG production bonus for the early production of LNG from the time that LNG is first produced from Train 4 into the LNG storage tanks until the guaranteed substantial completion date. In addition, if Bechtel achieves substantial completion of Train 4 prior to the guaranteed substantial completion date, Bechtel will be entitled to receive a supplemental early production bonus which will accrue from the guaranteed substantial completion date of such train until the date of first commercial delivery under the first LNG contract to take commercial delivery from such train.

Warranty

Bechtel warrants in the Train 4 EPC Agreement that:

•the equipment required for the Train 4 liquefaction facility will be new and of suitable grade;

•the work and the equipment will meet the requirements of the Train 4 EPC Agreement, including in compliance with good engineering and construction practices and applicable laws, codes and standards, and free of defects in design, material and workmanship; and

•the work and the equipment will be free from encumbrances to title.

Until 18 months after substantial completion of Train 4 (subject to certain extensions), Bechtel will be liable for promptly correcting any work (other than structural work) that is found to be defective for Train 4. Bechtel will be liable for promptly correcting any structural work that is found to be defective for a period of 3 years after substantial completion of Train 4 (subject to certain extensions).

Force Majeure

Under the Train 4 EPC Agreement, if Bechtel experiences a force majeure event, it may be entitled to an extension of the date by which substantial completion is to be accomplished and an extension of the date by which it could earn the early production bonus. If any one or more force majeure events delay the critical path of the work for more than 30 days in the aggregate, Bechtel would be entitled to an adjustment of the contract price under the Train 4 EPC Agreement to compensate it for its reasonable expenses, up to a limit of $25 million in the aggregate for all force majeure events. A force majeure event is limited to an exclusive list of events identified in the Train 4 EPC Agreement which must also:

•delay or render impossible the affected party’s performance of its obligations in accordance with the terms of the Train 4 EPC Agreement;

•be beyond the reasonable control of the affected party, not due to its fault or negligence; and

•not be capable of being prevented or avoided by the affected party through the exercise of due diligence.

Termination and Suspension

In the event of an uncured default by Bechtel, RG4 may terminate the Train 4 EPC Agreement and take any of the following actions:

•take possession of the facility, equipment, construction equipment, work product and books and records;

•take assignment of certain subcontracts; and

•complete the work.

Following such a termination, if the cost to reach final completion exceeded the unpaid balance of the contract price, Bechtel would be liable for the difference, subject to Bechtel’s limitation of liabilities described above.

RG4 also has the right to terminate the Train 4 EPC Agreement for convenience. In the event of any such termination for convenience, Bechtel would be paid:

•the portion of the contract price for the work performed prior to termination, less that portion of the contract price paid previously; and

•actual costs reasonably incurred by Bechtel on account of such termination, plus a profit margin of 5% on such costs, but Bechtel is not entitled to received overhead or profit on work not performed.

RG4 may at any time, upon a written notice to Bechtel, suspend the work under the Train 4 EPC Agreement. In the event of such suspension, after issuance of notice to proceed, of substantially all of the work for an aggregate period exceeding 365 consecutive days, other than any suspension due to an event of force majeure or the fault or negligence of Bechtel or its subcontractors, Bechtel would be permitted to terminate the Train 4 EPC Agreement subject to giving 14 days’ notice. If RG4 suspends work under the Train 4 EPC Agreement, Bechtel may be entitled to a change order to recover the reasonable costs of the suspension, including demobilization and remobilization costs. Bechtel may also suspend or terminate the Train 4 EPC Agreement upon the occurrence of certain other specified events, including:

•failure by RG4 to pay any undisputed amounts;

•a single force majeure event causing suspension of substantially all of the work for a period exceeding 365 days; and

•failure by RG4 to issue full notice to proceed on or before December 15, 2026 (unless Bechtel is performing work under a limited notice to proceed).

Bechtel Performance Security

As a condition of Bechtel receiving any payment under the Train 4 EPC Agreement (other than payments for work performed under a limited notice to proceed), Bechtel must provide and maintain an irrevocable, standby letter of credit equal to 10% of the Train 4 EPC Agreement’s contract price, adjusted downward to 5% of the contract price upon substantial completion of Train 4 and payment of any performance bonus or liquidated damages for Train 4, before fully expiring upon expiration of the warranty period (unless RG4 has any claims against Bechtel). Additionally, Bechtel must provide a parent company guaranty from Bechtel Global Energy, Inc. in favor of RG4 before Bechtel is entitled to payment under the Train 4 EPC Agreement.

The foregoing description of the Train 4 EPC Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Train 4 EPC Agreement, a copy of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ending September 30, 2024. The Company intends to redact certain portions of the Train 4 EPC Agreement in accordance with Item 601 of Regulation S-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 8, 2024

| | | | | | | | | | | |

| NEXTDECADE CORPORATION | |

| | | |

| By: | /s/ Vera de Gyarfas | |

| | Name: Vera de Gyarfas | |

| | Title: General Counsel | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

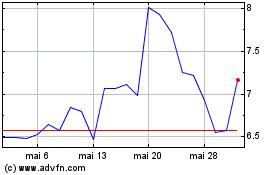

NextDecade (NASDAQ:NEXT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

NextDecade (NASDAQ:NEXT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024