false

0001554859

0001554859

2024-12-16

2024-12-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 16, 2024

SEMLER SCIENTIFIC, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36305 |

|

26-1367393 |

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

2340-2348 Walsh Avenue, Suite 2344

Santa Clara, CA |

|

95051 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: (877) 774-4211

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, $0.001 par value per share

|

|

SMLR |

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01. Other Events.

ATM Activity

On December 16, 2024, Semler Scientific, Inc., or Semler

Sci, filed with the Securities and Exchange Commission an additional prospectus supplement under its effective registration statement

on Form S-3 (File No. 333-280013) to register the offer and sale of up to an additional $50,000,000 of shares that can be sold

under its existing at-the-market offering program for which Cantor Fitzgerald & Co., or Cantor, acts as sales agent, which prospectus

supplement is in addition to the offer and sale of up to $100,000,000 of shares registered pursuant to the sales agreement prospectus

dated August 13, 2024 and the base prospectus as supplemented by the prospectus supplement dated November 25, 2024. Through

the date hereof, Semler Sci has issued and sold 1,916,804 shares of its common stock under the at-the market offering program for aggregate

gross proceeds of approximately $100.0 million. Pursuant to the prospectus supplement filed today, Semler Sci may sell additional shares

of common stock under the at-the-market offering program for the remaining aggregate offering price of up to $50.0 million.

Goodwin Procter LLP, counsel to Semler Sci, has issued a legal opinion

relating to the shares of Semler Sci’s common stock that may be issued pursuant to the at-the-market offering program under the

prospectus supplement. A copy of such legal opinion, including the consent included therein, is attached as Exhibit 5.1 hereto.

This current report on Form 8-K shall not constitute an offer

to sell or solicitation of an offer to buy Semler Sci’s shares of common stock described herein, nor shall there be any sale of

these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities law of such state or jurisdiction.

Bitcoin Activity

On December 16, 2024, Semler Sci issued a press release announcing

updates with respect to its bitcoin holdings, activity under its at-the-market equity offering programs, and “BTC Yield,”

a key performance indicator. A copy of the press release is filed as Exhibit 99.1 to this current report on Form 8-K and incorporated

by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

SEMLER SCIENTIFIC, INC. |

| |

|

|

| Date: December 16, 2024 |

By: |

/s/ Renae Cormier |

| |

|

Name: Renae Cormier |

| |

|

Title: Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) |

Exhibit 5.1

|

Goodwin Procter llp

525 Market Street

San Francisco, CA 94105

goodwinlaw.com

+1 415 733 6000 |

Semler Scientific, Inc.

2340-2348

Walsh Avenue, Suite 2344

Santa Clara,

California 95051

Re: Securities

Registered under Registration Statement on Form S-3

We have acted

as counsel to you in connection with your filing of a Registration Statement on Form S-3 (File No. 333-280013) (as amended

or supplemented, the “Registration Statement”) filed on June 6, 2024 with the Securities and Exchange Commission (the

“Commission”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration

of the offering by Semler Scientific, Inc., a Delaware corporation (the “Company”) of up to $150,000,000 of any combination

of securities of the types specified therein. The Registration Statement was declared effective by the Commission on August 13,

2024. Reference is made to our opinion letter dated June 6, 2024 and included as Exhibit 5.1 to the Registration Statement.

We are delivering

this supplemental opinion letter in connection with the prospectus supplement (the “Prospectus Supplement”) filed on December 16,

2024 by the Company with the Commission pursuant to Rule 424 under the Securities Act. The Prospectus Supplement relates to the

offering by the Company of up to $50,000,000 in shares (the “Shares”) of the Company’s common stock, par value $0.001

per share (“Common Stock”) covered by the Registration Statement. The Shares are being offered and sold by the sales agent

named in, and pursuant to, a sales agreement between the Company and such sales agent.

We have reviewed

such documents and made such examination of law as we have deemed appropriate to give the opinion set forth below. We have relied, without

independent verification, on certificates of public officials and, as to matters of fact material to the opinion set forth below, on

certificates of officers of the Company.

For purposes

of the opinion set forth below, we have assumed that the Shares are issued for a price per share equal to or greater than the minimum

price authorized by the Company’s board of directors (or a duly authorized committee of the board of directors) prior to the date

hereof (the “Minimum Price”) and that no event occurs that causes the number of authorized shares of Common Stock available

for issuance by the Company to be less than the number of then unissued Shares that may be issued for the Minimum Price.

For purposes

of the opinion set forth below, we refer to the following as “Future Approval and Issuance”: (a) the approval by the

Company’s board of directors (or a duly authorized committee of the board of directors) of the issuance of the Shares (the “Approval”)

and (b) the issuance of the Shares in accordance with the Approval and the receipt by the Company of the consideration (which shall

not be less than the par value of such Shares) to be paid in accordance with the Approval.

Semler Scientific, Inc.

December 16, 2024

Page 2

The opinion

set forth below is limited to the Delaware General Corporation Law.

Based on the

foregoing, we are of the opinion that the Shares have been duly authorized and, upon Future Approval and Issuance, will be validly issued,

fully paid and nonassessable.

This opinion

is being furnished to you for submission to the Commission as an exhibit to the Company’s Current Report on Form 8-K relating

to the Shares (the “Current Report”), which is incorporated by reference in the Registration Statement. We hereby consent

to the filing of this opinion letter as an exhibit to the Current Report and its incorporation by reference and the reference to our

firm in that report. In giving our consent, we do not admit that we are in the category of persons whose consent is required under Section 7

of the Securities Act or the rules and regulations thereunder.

| |

Very

truly yours, |

| |

|

| |

/s/

Goodwin Procter LLP |

| |

|

| |

GOODWIN

PROCTER LLP |

Exhibit 99.1

Semler

Scientific® Announces Updated BTC and ATM Activity;

Purchased

Additional 211 BTC; Now Holds 2,084 BTC; BTC Yield of 92.8%

Santa Clara,

CA – December 16, 2024 – Semler Scientific, Inc. (Nasdaq: SMLR), a pioneer

in developing and marketing technology products and services to healthcare providers to combat chronic diseases, today announced

updates regarding its bitcoin (BTC) activity and holdings, capital markets activity, and BTC Yield, a key performance indicator.

BTC Update

Between December 5,

2024 and December 15, 2024, Semler Scientific acquired 211 bitcoins for $21.5 million with proceeds generated from its at-the-market

(ATM) offering and operating cash flow at an average price of $101,890 per bitcoin, inclusive of fees and expenses. As of December 15,

2024, Semler Scientific held 2,084 bitcoins, which were acquired for an aggregate $168.6 million at an average purchase price of $80,916

per bitcoin, inclusive of fees and expenses.

ATM Update

As previously

disclosed in Semler Scientific’s registration statement on Form S-3 that became effective on August 13, 2024 (the S-3

Shelf), Semler Scientific entered into a Controlled Equity OfferingSM Sales Agreement with Cantor Fitzgerald & Co.

(Cantor), pursuant to which Semler Scientific may offer and sell from time to time its common stock in an ATM offering.

On December 16,

2024, Semler Scientific filed a second prospectus supplement to its S-3 Shelf to offer an additional $50.0 million of shares under its

existing ATM offering with Cantor, increasing the total amount offered under the ATM to $150.0 million. As of December 13,

2024, Semler Scientific has generated approximately $100.0 million of gross proceeds from sales under the ATM offering.

BTC Yield

as a Key Performance Indicator (KPI)

From October 1,

2024 to December 15, 2024, Semler Scientific’s BTC Yield was 67.0%. From July 1, 2024 (the quarter after Semler Scientific

adopted its bitcoin treasury strategy) to December 15, 2024, Semler Scientific’s BTC Yield was 92.8%.

Semler Scientific

uses BTC Yield as a KPI to help assess the performance of its strategy of acquiring bitcoin in a manner Semler Scientific believes is

accretive to stockholders. Semler Scientific believes this KPI can be used to supplement an investor’s understanding of Semler

Scientific’s decision to fund the purchase of bitcoin by issuing additional shares of its common stock.

BTC Yield

and Basic and Assumed Diluted Shares Outstanding

| | |

6/30/2024 | | |

9/30/2024 | | |

12/15/2024 | |

| Total

Bitcoin Holdings | |

| 877 | | |

| 1,018 | | |

| 2,084 | |

| | |

| | | |

| | | |

| | |

| Basic Shares Outstanding

(‘000) | |

| 6,987 | | |

| 7,120 | | |

| 9,267 | |

| Options

Outstanding | |

| 1,098 | | |

| 1,013 | | |

| 699 | |

| Assumed

Diluted Shares Outstanding (1) | |

| 8,086 | | |

| 8,133 | | |

| 9,967 | |

| BTC

Yield % (10/1/24 to 12/15/24) | |

| | | |

| | | |

| 67.0 | % |

| BTC

Yield % (7/1/24 to 12/15/24) | |

| | | |

| | | |

| 92.8 | % |

| (1) | Assumed

Diluted Shares Outstanding refers to the aggregate of Semler Scientific’s Basic Shares

outstanding as of the end of each period plus all the additional shares that would result

from the assumed exercise of all outstanding stock option awards. Assumed Diluted Shares

Outstanding is not calculated using the treasury method and does not take into account any

vesting conditions or the exercise price of any stock option awards. |

Important

Information about BTC Yield KPI

BTC Yield

is a KPI that represents the percentage change period-to-period of the ratio between Semler Scientific’s bitcoin holdings and its

Assumed Diluted Shares Outstanding. Assumed Diluted Shares Outstanding refers to the aggregate of Semler Scientific’s actual shares

of common stock outstanding as of the end of each period plus all additional shares that would result from the assumed exercise of all

outstanding stock option awards. Assumed Diluted Shares Outstanding is not calculated using the treasury method and does not take into

account any vesting conditions or the exercise price of any stock option awards.

Semler Scientific

uses BTC Yield as a KPI to help assess the performance of its strategy of acquiring bitcoin in a manner Semler Scientific believes is

accretive to stockholders. Semler Scientific believes this KPI can be used to supplement an investor’s understanding of its decision

to fund the purchase of bitcoin by issuing additional shares of its common stock. When Semler Scientific uses this KPI, management also

takes into account the various limitations of this metric.

Additionally,

this KPI is not, and should not be understood as, an operating performance measure or a financial or liquidity measure. In particular,

BTC Yield is not equivalent to a “yield” in the traditional financial context. It is not a measure of the return on investment

Semler Scientific’s stockholders may have achieved historically or can achieve in the future by purchasing stock of Semler Scientific,

or a measure of income generated by Semler Scientific’s operations or its bitcoin holdings, return on investment on its bitcoin

holdings, or any other similar financial measure of the performance of its business or assets.

The trading

price of Semler Scientific’s common stock is informed by numerous factors in addition to the amount of bitcoins Semler Scientific

holds and number of actual or potential shares of its stock outstanding. As a result, the market value of Semler Scientific’s shares

may trade at a discount or a premium relative to the market value of the bitcoin Semler Scientific holds. BTC Yield is not indicative

nor predictive of the trading price of Semler Scientific’s shares of common stock. As noted above, this KPI is narrow in its purpose

and is used by management to assist in assessing whether Semler Scientific is using equity capital in a manner accretive to stockholders

solely as it pertains to its bitcoin holdings.

In calculating

this KPI, Semler Scientific does not take into account the source of capital used for the acquisition of its bitcoin. Semler Scientific

notes in particular, it has acquired bitcoin using cash flow from operations, as well as proceeds from the sale of shares in the ATM

offering. Accordingly, this metric might overstate or understate the accretive nature of Semler Scientific’s use of equity capital

to buy bitcoin because not all bitcoin may be acquired using proceeds of equity offerings and not all issuances of equity may involve

the acquisition of bitcoin.

Semler Scientific’s

ability to achieve positive BTC Yield may depend on a variety of factors, including its ability to generate cash from operations in excess

of its fixed charges and other expenses, as well as factors outside of its control, such as the availability of debt and equity financing

on favorable terms. Past performance is not indicative of future results.

Semler Scientific

has historically not paid dividends on its shares of common stock, and by presenting this KPI, Semler Scientific makes no suggestion

that it intends to do so in the future. Ownership of common stock does not represent an ownership interest in the bitcoin Semler Scientific

holds.

Investors

should rely on the financial statements and other disclosures contained in Semler Scientific’s SEC filings. This KPI is merely

a supplement, not a substitute. It should be used only by sophisticated investors who understand its limited purpose and many limitations.

Forward-Looking

Statements

This press

release contains "forward-looking" statements. Such statements can be identified by, among other things, the use of forward-looking

language such as the words "believe," "goal," "may," "will," "intend," "expect,"

"anticipate," "estimate," "project," "would," "could" or words with similar meaning

or the negatives of these terms or by the discussion of strategy or intentions. The forward-looking statements in this release include

statements regarding acquiring and holding bitcoin; its BTC yield; and other express or implied statements regarding the ATM offering

and its healthcare business. Such forward-looking statements are subject to a number of risks and uncertainties that could cause Semler

Scientific's actual results to differ materially from those discussed here, such as risks investing in bitcoin, including bitcoin's volatility;

risk of implementing a bitcoin treasury strategy; along with those other risks related to its healthcare business and the risk factors

detailed in Semler Scientific's filings with the Securities and Exchange Commission. These forward-looking statements involve assumptions,

estimates, and uncertainties that reflect current internal projections, expectations or beliefs. There can be no assurance that such

statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

All forward-looking statements contained in this press release are qualified in their entirety by these cautionary statements and the

risk factors described above. Furthermore, all such statements are made as of the date of this press release and Semler Scientific assumes

no obligation to update or revise these statements unless otherwise required by law.

No Offer

or Solicitation

This press

release does not and shall not constitute an offer to sell or a solicitation of an offer to buy any securities of Semler Scientific, Inc.,

nor shall there be any offer, solicitation or sale of such securities, in any state or jurisdiction in which such an offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Any shares

of common stock offered in the ATM offering will be sold pursuant to Semler Scientific’s S-3 Shelf (Registration No. 333-280013),

the related prospectus, which was declared effective by the Securities and Exchange Commission (the SEC) on August 13, 2024, as

supplemented by the prospectus supplement filed on December 16, 2024. Copies of the prospectus supplement and accompanying prospectus

relating to the ATM offering may be obtained by visiting EDGAR on the SEC’s website at www.sec.gov. or may be obtained from Cantor

Fitzgerald & Co., Attention: Capital Markets, 110 East 59th Street, New York, New York 10022, or by email at prospectus@cantor.com.

About Semler

Scientific, Inc.:

Semler Scientific, Inc.

is a pioneer in developing and marketing technology products and services to healthcare providers

to combat chronic diseases. Its flagship product, QuantaFlo®, which is patented and cleared by the U.S. Food and Drug Administration

(FDA), is a rapid point-of-care test that measures arterial blood flow in the extremities. The QuantaFlo test aids in the diagnosis of

cardiovascular diseases, such as peripheral arterial disease (PAD), and Semler Scientific is seeking a new 510(k) clearance for

expanded indications. QuantaFlo is used by healthcare providers to evaluate their patient’s risk of mortality and major adverse

cardiovascular events (MACE). Semler Scientific also invests in bitcoin and has adopted Bitcoin as its primary treasury asset.

INVESTOR

CONTACT:

Renae Cormier

Chief Financial

Officer

ir@semlerscientific.com

SOURCE:

Semler Scientific, Inc.

v3.24.4

Cover

|

Dec. 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 16, 2024

|

| Entity File Number |

001-36305

|

| Entity Registrant Name |

SEMLER SCIENTIFIC, INC.

|

| Entity Central Index Key |

0001554859

|

| Entity Tax Identification Number |

26-1367393

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2340-2348 Walsh Avenue

|

| Entity Address, Address Line Two |

Suite 2344

|

| Entity Address, City or Town |

Santa Clara

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95051

|

| City Area Code |

877

|

| Local Phone Number |

774-4211

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

SMLR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

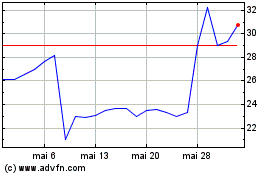

Semier Scientific (NASDAQ:SMLR)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

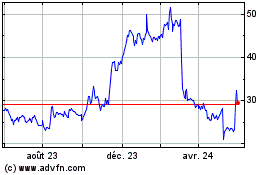

Semier Scientific (NASDAQ:SMLR)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025