Current Report Filing (8-k)

12 Juin 2023 - 10:41PM

Edgar (US Regulatory)

0001606268false00016062682023-06-072023-06-07iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 7, 2023

Via Renewables, Inc. |

(Exact Name of Registrant as Specified in its Charter) |

Delaware | | 001-36559 | | 46-5453215 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

12140 Wickchester Ln, Suite 100

Houston, Texas 77079

(Address of principal executive offices)

(713) 600-2600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbols(s) | | Name of exchange on which registered |

Class A common stock, par value $0.01 per share | | VIA | | The NASDAQ Global Select Market |

8.75% Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Stock, par value $0.01 per share | | VIASP | | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 7, 2023, the Board of Directors (the “Board”) of Via Renewables, Inc. (the “Company”), upon recommendation of the Nominating and Corporate Governance Committee of the Board, appointed A. Stephen Kennedy effective immediately, to serve as a Class II independent director. Mr. Kennedy will stand for reelection at the Company’s annual meeting of shareholders in 2025. There are no understandings or arrangements between Mr. Kennedy and any other person pursuant to which Mr. Kennedy was elected as a director. There are no relationships between Mr. Kennedy and the Company that would require disclosure pursuant to Item 404(a) of Regulation S-K.

The Board has appointed Mr. Kennedy to the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee.

As a non-employee director, Mr. Kennedy will participate in the non-employee director compensation arrangements described in the Company’s definitive proxy statement filed with the SEC on April 17, 2023.

In connection with his appointment, Mr. Kennedy and the Company entered into the Company’s standard form of indemnification agreement (the “Indemnification Agreement”). The Indemnification Agreement requires the Company to indemnify Mr. Kennedy to the fullest extent permitted under Delaware law against liabilities that may arise by reason of his service to the Company, and to advance expenses incurred as a result of any proceeding against him as to which he could be indemnified. The foregoing description is qualified in its entirety by reference to the full text of the Indemnification Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On June 7, 2023 Nick W. Evans, Jr., a member of the Board of the Company, notified the Company of his intention to resign from the Board effective as of June 9, 2023. Mr. Evans’s resignation is not due to any disagreement with the Company on any matter relating to the Company’s operations, policies, or practices.

The Board and its management express their deep appreciation to Mr. Evans for his dedicated service and many contributions to the Company during his tenure as a director.

Item 7.01 Regulation FD Disclosure.

On June 12, 2023, the Company issued a press release announcing the appointment of Mr. Kennedy. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference in this Item 7.01. The information contained in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” with the Securities and Exchange Commission nor incorporated by reference in any registration statement filed by the Company under the Securities Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

† Management contract, or compensatory plan or arrangement.

Exhibit Index

† Management contract, or compensatory plan or arrangement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: June 12, 2023

| Via Renewables, Inc. | |

| |

| By: | /s/ Mike Barajas | |

| Name: | Mike Barajas | |

| Title | Chief Financial Officer | |

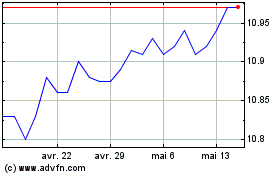

Via Renewables (NASDAQ:VIA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Via Renewables (NASDAQ:VIA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025