Alamos Gold Inc. (

TSX:AGI;

NYSE:AGI) (“Alamos” or the “Company”) today reported its

updated Mineral Reserves and Resources as of December 31, 2023. For

a detailed summary by asset, refer to the tables below.

Highlights

- Global Proven and Probable Mineral Reserves increased

2% to 10.7 million ounces of gold (202 million tonnes

(“mt”) grading 1.65 grams per tonne of gold (“g/t Au”)), with

grades increasing 1%, reflecting higher-grade additions at Island

Gold and Puerto Del Aire (“PDA”), and growth at Lynn Lake. Mineral

Reserve additions more than replaced depletion at a rate of 132%

- Island Gold’s Mineral Reserves increased 18% to 1.7

million ounces (5.2 mt grading 10.30 g/t Au), marking the

11th consecutive year of growth

- PDA’s Mineral Reserves increased 33% to 1.0 million

ounces (5.4 mt grading 5.61 g/t Au) with a 16% increase in

grades

- Lynn Lake’s Mineral Reserves increased 13% to 2.3

million ounces (47.6 mt grading 1.52 g/t Au)

- Island Gold’s Mineral Reserves and Resources increased

16% to 6.1 million ounces driven by significant high-grade

additions near existing infrastructure within the main zone and

recently defined zones in the hanging wall and footwall

- PDA Mineral Reserves and Resources increased 26% to 1.2

million ounces. A development plan incorporating the

larger and higher-grade Mineral Reserve is expected to be completed

later this quarter

- Global Measured and Indicated Mineral Resources

increased 12% to 4.4 million ounces of gold (108 mt

grading 1.27 g/t Au), with grades increasing 9% reflecting higher

grade additions at Island Gold and growth at Young-Davidson

- Global Inferred Mineral Resources increased 3% to 7.3

million ounces of gold (128 mt grading 1.77 g/t Au),

reflecting increases at Island Gold and Lynn Lake

- Gold price assumptions unchanged from 2022

with $1,400 per ounce used for estimating Mineral Reserves, and

$1,600 per ounce used for estimating Mineral Resources. Both remain

conservative relative to the three-year trailing average gold price

of nearly $1,850 per ounce

- Global exploration budget of $62 million in 2024, the

largest in the Company’s history following up on the broad based

exploration success in 2023. This includes $19 million

budgeted at the Mulatos District, $19 million at Island Gold, $12

million at Young-Davidson and $9 million at Lynn Lake

“Our global Mineral Reserve base continues to expand both in

size and quality. This reflects not only another strong year of

exploration success, but also the quality of our asset base. Global

Mineral Reserves have increased for five consecutive years for a

combined increase of 10%, after depletion of three million ounces,

with grades also increasing 9% driven by higher-grade additions at

Island Gold and PDA,” said John A. McCluskey, President and Chief

Executive Officer.

“Our global Mineral Resources also increased, and at higher

grades with another tremendous year of exploration success at

Island Gold the key driver. Island Gold’s Mineral Reserve and

Resource base achieved a new milestone, surpassing six million

ounces of gold and extending the mine life beyond 20 years. We also

expect the growth at PDA will support a significant mine life

extension at Mulatos as part of the development plan to be

completed later this quarter. Both Island Gold and Mulatos will

remain the primary focus of our 2024 exploration program with our

largest budget ever planned. The expanded budget reflects the

excellent potential for further growth we see at both assets, and

across our asset base,” Mr. McCluskey added.

An infographic is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/96109cb7-5315-453f-b428-cb84f4296b57

|

Proven and Probable Gold Mineral Reserves |

|

|

2023 |

2022 |

% Change |

|

|

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

|

|

(000’s) |

(g/t Au) |

(000’s) |

(000’s) |

(g/t Au) |

(000’s) |

(000’s) |

(g/t Au) |

(000’s) |

|

Young-Davidson |

43,911 |

2.31 |

3,261 |

44,208 |

2.35 |

3,335 |

-1% |

-2% |

-2% |

|

Island Gold |

5,210 |

10.30 |

1,725 |

4,225 |

10.78 |

1,464 |

23% |

-4% |

18% |

|

Mulatos Mine |

- |

- |

- |

2,872 |

1.17 |

108 |

|

|

|

|

Stockpiles |

- |

- |

- |

2,658 |

2.06 |

176 |

|

|

|

| La Yaqui

Grande |

11,318 |

1.33 |

483 |

16,531 |

1.25 |

667 |

|

|

|

| Puerto

Del Aire |

5,375 |

5.61 |

969 |

4,673 |

4.84 |

728 |

15% |

16% |

33% |

|

Total Mulatos |

16,693 |

2.71 |

1,452 |

26,734 |

1.95 |

1,679 |

-38% |

39% |

-14% |

|

MacLellan |

39,738 |

1.34 |

1,717 |

27,820 |

1.54 |

1,382 |

|

|

|

|

Gordon |

7,873 |

2.43 |

615 |

8,723 |

2.42 |

678 |

|

|

|

|

Total Lynn Lake |

47,610 |

1.52 |

2,332 |

36,542 |

1.75 |

2,060 |

30% |

-13% |

13% |

|

Ağı Dağı |

54,361 |

0.67 |

1,166 |

54,361 |

0.67 |

1,166 |

|

|

|

|

Kirazlı |

33,861 |

0.69 |

752 |

33,861 |

0.69 |

752 |

|

|

|

|

Total Türkiye |

88,222 |

0.68 |

1,918 |

88,222 |

0.68 |

1,918 |

- |

- |

- |

|

Alamos – Total |

201,647 |

1.65 |

10,688 |

199,932 |

1.63 |

10,455 |

1% |

1% |

2% |

|

|

|

|

|

|

|

|

|

|

|

|

Measured and Indicated Gold Mineral Resources (exclusive of

Mineral Reserves) |

|

Young-Davidson – Surface |

1,739 |

1.24 |

69 |

1,739 |

1.24 |

69 |

|

|

|

|

Young-Davidson – Underground |

9,914 |

3.32 |

1,057 |

8,643 |

3.40 |

944 |

|

|

|

|

Total Young-Davidson |

11,653 |

3.01 |

1,127 |

10,381 |

3.03 |

1,013 |

12% |

-1% |

11% |

|

Golden Arrow |

6,442 |

1.19 |

246 |

6,442 |

1.19 |

246 |

- |

- |

- |

|

Island Gold |

2,552 |

8.73 |

716 |

1,276 |

7.09 |

291 |

100% |

23% |

146% |

|

Mulatos Mine |

7,083 |

1.13 |

258 |

6,103 |

1.07 |

210 |

|

|

|

|

La Yaqui Grande |

1,073 |

0.87 |

30 |

1,506 |

0.87 |

42 |

|

|

|

|

Puerto Del Aire |

2,106 |

3.54 |

240 |

1,338 |

4.98 |

214 |

57% |

-29% |

12% |

|

Carricito |

1,355 |

0.83 |

36 |

1,355 |

0.83 |

36 |

|

|

|

|

Total Mulatos |

11,617 |

1.51 |

564 |

10,302 |

1.52 |

502 |

13% |

-1% |

12% |

|

Lynn Lake |

7,848 |

1.37 |

345 |

8,178 |

1.74 |

457 |

-4% |

-21% |

-25% |

|

Türkiye |

55,664 |

0.60 |

1,068 |

55,664 |

0.60 |

1,068 |

- |

- |

- |

|

Quartz Mountain |

12,156 |

0.87 |

339 |

12,156 |

0.87 |

339 |

- |

- |

- |

|

Alamos – Total |

107,932 |

1.27 |

4,405 |

104,399 |

1.17 |

3,917 |

3% |

9% |

12% |

|

|

|

|

|

|

|

|

|

|

|

|

Inferred Gold Mineral Resources |

|

Young-Davidson – Surface |

31 |

0.99 |

1 |

31 |

0.99 |

1 |

|

|

|

|

Young-Davidson – Underground |

1,350 |

3.31 |

144 |

1,586 |

2.89 |

147 |

|

|

|

|

Total Young-Davidson |

1,381 |

3.26 |

145 |

1,617 |

2.85 |

148 |

-15% |

14% |

-2% |

|

Golden Arrow |

2,028 |

1.07 |

70 |

2,028 |

1.07 |

70 |

|

|

|

|

Island Gold |

7,857 |

14.58 |

3,682 |

8,066 |

13.61 |

3,529 |

-3% |

7% |

4% |

| Mulatos

Mine |

571 |

0.92 |

17 |

560 |

0.92 |

17 |

|

|

|

| La Yaqui

Grande |

107 |

1.30 |

4 |

175 |

1.31 |

7 |

|

|

|

| Puerto

Del Aire |

73 |

5.97 |

14 |

139 |

5.90 |

26 |

-47% |

1% |

-46% |

|

Carricito |

900 |

0.74 |

22 |

900 |

0.74 |

22 |

|

|

|

|

Total Mulatos |

1,651 |

1.07 |

57 |

1,774 |

1.27 |

72 |

-7% |

-15% |

-21% |

|

Lynn Lake |

48,685 |

1.09 |

1,699 |

45,873 |

1.10 |

1,622 |

6% |

-1% |

5% |

|

Türkiye |

27,245 |

0.55 |

482 |

27,245 |

0.55 |

482 |

- |

- |

- |

|

Quartz Mountain |

39,205 |

0.91 |

1,147 |

39,205 |

0.91 |

1,147 |

- |

- |

- |

|

Alamos – Total |

128,052 |

1.77 |

7,282 |

125,809 |

1.75 |

7,070 |

2% |

1% |

3% |

Mineral Reserves

Global Proven and Probable Mineral Reserves total 10.7 million

ounces of gold as of December 31, 2023, a 2% increase from 10.5

million ounces at the end of 2022 with grades also increasing 1%.

This reflected increases at Island Gold, Lynn Lake and PDA which

more than offset mining depletion of 728,000 ounces in 2023.

Depletion in 2023 was higher than in 2022 reflecting the 15%

increase in production, as well as the stacking of lower

recovery/higher-grade stockpiled ore at Mulatos.

Island Gold continues to grow with an 18% increase in Mineral

Reserves to 1.7 million ounces, net of depletion, at slightly lower

grades of 10.30 g/t Au. This marked the 11th consecutive year that

Mineral Reserves have increased at Island Gold. The majority of the

growth was in proximity to existing underground infrastructure

within the main zone and multiple recently defined zones in the

hanging wall and footwall. Given the large and growing Mineral

Resource base, emerging opportunities in the hanging wall and

footwall, and with the deposit open laterally and at depth, this

long term trend of growth is expected to continue.

Mulatos District Mineral Reserves decreased 14% to 1.5 million

ounces while grades increased 39% to 2.71 g/t Au. This reflected

depletion of lower-grade open pit ore from the main Mulatos pit,

stockpiled ore and La Yaqui Grande, partly offset by higher-grade

additions from the PDA underground deposit. PDA continues its

significant pace of growth with a 33% increase in Mineral Reserves

to 1.0 million ounces, at 16% higher grades of 5.61 g/t Au. A

development plan incorporating the larger, higher-grade Mineral

Reserve at PDA is expected to be completed later this quarter and

outline a significant mine life extension at Mulatos.

Lynn Lake’s Mineral Reserve base increased 13% to 2.3 million

ounces as incorporated into the updated Feasibility Study completed

on the project in August 2023. The study outlined a larger,

longer-life, low-cost operation, with attractive economics and

significant exploration upside, including through a number of

satellite deposits in proximity to the planned mill.

Young-Davidson offset the majority of mining depletion in 2023

resulting in a small decrease in Mineral Reserves (74,000 ounces)

to 3.3 million ounces at slightly lower grades of 2.31 g/t Au. The

deposit remains open at depth and to the west, and drilling in 2024

will be focused on extending mineralization within the

Young-Davidson syenite, which hosts the majority of Mineral

Reserves and Resources. Drilling will also test the hanging wall

and footwall of the deposit where higher grades have been

previously intersected.

A detailed summary of Proven and Probable Mineral Reserves as of

December 31, 2023, is presented in Table 1 at the end of this press

release.

An infographic is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/4f3e66dc-a027-4f9f-b45d-b7a86310c698

Mineral Resources

Global Measured and Indicated Mineral Resources (exclusive of

Mineral Reserves) increased 12% to total 4.4 million ounces with

grades also increasing 9% to 1.27 g/t Au, as of December 31, 2023.

The majority of the increase was driven by the significant growth

in higher-grade Mineral Resources at Island Gold, along with

additions at Young-Davidson and Mulatos.

Global Inferred Mineral Resources increased 3% to total 7.3

million ounces with grades also increasing 1%, as of December 31,

2023, reflecting additions at Island Gold and Lynn Lake.

Detailed summaries of the Company’s Measured and Indicated

Mineral Resources and Inferred Mineral Resources as of December 31,

2023, are presented in Tables 3 and 4, respectively, at the end of

this press release.

Island Gold

Island Gold’s significant pace of growth continued with Mineral

Reserves and Resources increasing 16% across all categories to 6.1

million ounces, net of depletion. Combined Mineral Reserves and

Resources have now increased for eight consecutive years with

grades also increasing substantially over that time frame.

Including mining depletion to date, 7.5 million ounces have been

discovered at Island Gold as it continues to establish itself as

one of the highest-grade and fastest-growing deposits in the

world.

Mineral Reserves increased 18% to 1.7 million ounces in 2023,

net of mining depletion, at slightly lower grades of 10.30 g/t Au.

This marked the eleventh consecutive year of Mineral Reserve

growth. Mineral Reserve additions totaled 394,000 ounces, more than

offsetting mining depletion of 134,000 ounces. The increase was

driven by the conversion of existing Mineral Resources and

discovery of new Mineral Reserves, the majority of which are in

proximity to existing underground structure.

Converted Mineral Resources were also more than replaced at

higher grades reflecting significant additions near existing

infrastructure. This included a 146% increase in Measured and

Indicated Mineral Resources to 0.7 million ounces with grades

increasing 23% to 8.73 g/t Au. Inferred Mineral Resources also

increased 4% to 3.7 million ounces with grades increasing 7% to

14.58 g/t Au. The discovery cost of these high-grade Mineral

Resources additions averaged an attractive $7 per ounce over the

past year, and $13 per ounce over the past five years.

The growth in Mineral Reserves and Resources across all

categories was driven by an expanded underground exploration drill

program targeting high-grade additions in proximity to existing

underground infrastructure. This included zones within the main

Island Gold structure (C and E1E Zone), which hosts the majority of

Mineral Reserves and Resources, as well as emerging opportunities

outside of the main structure in the hanging wall and footwall.

Underground drilling was completed from existing drill bays,

providing improved access and allowing for more optimal drilling

orientations to define and expand the growing number of

sub-parallel and high-angle mineralized zones within the hanging

wall and footwall. Initial Mineral Reserves and Resources have been

declared and/or increased across a number of these recently defined

and expanding zones which have become significant contributors to

the overall growth of the deposit.

A total of 99,000 ounces of Mineral Reserves and 534,000 ounces

of Mineral Resources were added in these recently defined hanging

wall and footwall zones. This represented approximately 70% of the

total Mineral Reserve and Resource additions in 2023, before

depletion. These additions are expected to be low-cost to develop

and produce given their proximity to existing infrastructure. They

also provide increasing operational flexibility allowing for

multiple mining horizons from the same vertical and lateral

development levels.

Highlights from new additions in the hanging wall and footwall

include (Figure 2):

- NS1 Zone

(hanging wall): 92,000 ounces of total Mineral Reserves and

Resources, including 24,000 ounces of Mineral Reserves grading

11.12 g/t Au. NS1 was defined early 2023 and was being

developed and mined by the end of the year highlighting the near

term opportunities with these zones. The zone is a north-striking,

high-angle structure adjacent to main C-Zone. It has been defined

over an average strike of approximately 70 m, with vertical

continuity of 450 m, and remains open up and down dip

- NTH Zones

(footwall): 146,000 ounces of total Mineral

Reserves and Resources, including 53,000 ounces of Mineral Reserves

grading 11.98 g/t Au. The NTH Zones are located 10 to 150

m north of the main E1E-Zone and remain open in multiple

directions

- E1D Zone

(footwall): 332,000 ounces of Inferred Mineral Resources grading

15.63 g/t Au, a 149,000 ounce increase from 2022. Located

on average 30 m from the main E1E-Zone in Island East and remains

open in multiple directions

These zones and other targets within the hanging wall and

footwall represent significant opportunities for further growth.

There are nearly 2,000 previous drill hole intersections above 3

g/t Au outside of existing Mineral Reserves and Resources in the

hanging wall and footwall, highlighting the opportunity for further

near-mine, high-grade additions, as ongoing drilling further

defines these areas.

A total of $19 million has been budgeted for exploration at

Island Gold in 2024, up from $15 million spent in 2023 with both a

larger near mine and regional exploration program. Consistent with

the 2023 program, the majority of the 2024 mine exploration program

will be comprised of underground drilling with 41,000 m

planned.

The focus will be the definition of new Mineral Reserves and

Resources in proximity to existing production horizons and

infrastructure, as well as the conversion of the large existing

Mineral Resource base to Reserves. This includes drilling across

the strike extent of the main Island Gold Deposit (E1E and

C-Zones), as well as within the growing number of newly defined

hanging-wall and footwall zones. To support the underground

exploration drilling program, 460 m of underground exploration

drift development is planned to extend drill platforms on the 850,

945, and 1025 levels.

Additionally, 12,500 m of surface exploration drilling has been

budgeted targeting high potential areas within the Island West,

Main and East ore shoots, the up-plunge extension of the Island

West ore shoot, and evaluating the potential for high-grade

mineralized hanging wall structures near surface.

In addition to the exploration budget, 32,000 m of underground

delineation drilling has been planned and included in sustaining

capital for Island Gold which will be focused on the conversion of

the large Mineral Resource base to Mineral Reserves. Island Gold’s

Mineral Resources continue to convert to Reserves at a rate of

greater than 90% since the 2017 acquisition. The majority of

Mineral Resources are located within the same structure with

consistent controls on mineralization as existing Mineral Reserves.

This is expected to support a similar high rate of conversion as

exploration drifts are advanced closer to these Mineral Resources

blocks to allow for additional drilling from underground.

The regional exploration program has also been expanded to

10,000 m. The 2024 program will follow up on high-grade

mineralization intersected at the Pine-Breccia and 88-60 targets,

located 4 kilometres ("km") and 7 km, respectively, from the Island

Gold mine. Drilling will also be completed in proximity to the

past-producing Cline and Edwards mines, as well as at the Island

Gold North Shear target. A comprehensive data compilation project

will also commence across the broader 40,000 hectare Manitou land

package that was acquired in 2023 in support of future exploration

targeting.

Significant growth and upside to Phase 3+ Expansion

Study

The Phase 3+ Expansion Study (“Phase 3+ Study”) released in June

2022 was based on Mineral Reserves and Resources at the end of

2021, which totaled 5.1 million ounces and supported an 18 year

mine life. Since then, Mineral Reserves and Resources have

increased 21%, or 1.0 million ounces with grades also increasing,

highlighting the significant ongoing growth of the deposit, as well

as upside to the Phase 3+ Study.

Applying the same Mineral Resource conversion rate as the Phase

3+ Study, Island Gold’s mine life has been extended to more than 20

years, net of two years of depletion. With the main Island Gold

deposit open laterally and down-plunge, and a growing number of

opportunities being defined in the hanging wall and footwall, there

is excellent potential for this growth to continue.

An infographic is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/aed5a651-d087-405f-bfbb-4c76911f4c33

Mulatos District

Total Mulatos District Mineral Reserves decreased 14% to 1.5

million ounces, with grades increasing 39% to 2.71 g/t Au. This

reflected depletion of lower-grade open pit ore from the main

Mulatos pit, stockpiled ore, and La Yaqui Grande, partly offset by

higher-grade additions from the PDA underground deposit.

The PDA continues to grow with Mineral Reserves increasing 33%

to 1.0 million ounces at 16% higher grades of 5.61 g/t Au. This was

driven by a tightly spaced step out drill program which not only

expanded the size of the deposit, but also improved continuity and

better defined its geometry resulting in another increase in

grades. Over the past two years, PDA’s Mineral Reserves have more

than doubled, at 20% higher grades.

Combined Mineral Reserves and Resources also increased 26% in

2023 to total 1.2 million ounces. With the deposit open in multiple

directions, and another significant exploration program planned for

PDA in 2024, there is excellent potential for this growth to

continue. Over the past three years, discovery costs at PDA have

averaged $19 per ounce.

PDA is located adjacent to the Mulatos pit with the underground

deposit expected to be accessed from a ramp and development drifts

from within the pit. A development plan for PDA incorporating the

growth in Mineral Reserves is expected to be completed later this

quarter. This is expected to more than double the Mulatos District

mine life from the approximately four years remaining at La Yaqui

Grande.

Total Measured and Indicated Mineral Resources in the Mulatos

District increased 12% from the end of 2022 to 0.6 million ounces

grading 1.51 g/t Au. Inferred Mineral Resources decreased to 0.1

million ounces grading 1.07 g/t Au.

A total of $19 million has been budgeted at Mulatos for

exploration in 2024, similar to spending in 2023. The near-mine and

regional drilling program is expected to total 55,000 m. This

includes 27,000 m of surface exploration drilling at PDA and the

surrounding area.

Given the ongoing growth of the PDA deposit, other higher-grade

sulphide opportunities will be targeted within the Mulatos District

in 2024. This includes an initial 2,000 m of follow up drilling at

the previously mined Cerro Pelon deposit where high-grade

mineralization was intersected north of the mined-out open pit in

2015. This included 14.47 g/t Au over 50.30 m (15PEL012) and 9.65

g/t Au over 34.60 m (15PEL020).

Within the regional exploration program, 26,000 m has been

budgeted. Nearly half will be focused on the Capulin target located

4 km from the Mulatos pit where significant, wide intervals of

oxide and sulphide gold mineralization were intersected in 2023.

This included the previously reported 2.01 g/t Au over 82.45 m core

length (23REF012), and 2.73 g/t Au over 120.85 m core length,

including 9.31 g/t Au over 29.05 m (23REF022). The remainder of the

regional program will be focused on drilling at other high priority

targets, including Cerro Pelon West and South.

Young-Davidson

Young-Davidson’s Mineral Reserves decreased 74,000 ounces to 3.3

million ounces at slightly lower grades of 2.31 g/t Au. A total of

131,000 ounces were added through the conversion of existing

Mineral Resources which replaced 64% of mining depletion of 204,000

ounces in 2023.

Measured and Indicated Mineral Resources increased 11% to 1.1

million ounces grading 3.01 g/t Au. Inferred Mineral Resources were

down slightly to 0.1 million ounces grading 3.26 g/t Au.

Based on ongoing underground mining rates of 8,000 tonne per

day, the Mineral Reserve life of the Young-Davidson mine remains

approximately 15 years as of December 31, 2023. Young-Davidson has

maintained at least a 13-year Mineral Reserve life since 2011,

reflecting a strong track record of Mineral Resource conversion.

With the deposit open at depth and to the west, there is excellent

potential to further extend its Mineral Reserve life.

A total of $12 million has been budgeted for exploration at

Young-Davidson in 2024, up from $8 million spent in 2023. This

includes 21,600 m of underground exploration drilling, and 1,070 m

of underground exploration development to extend drill platforms on

multiple levels.

The majority of the underground exploration drilling program

will be focused on extending mineralization within the

Young-Davidson syenite, which hosts the majority of Mineral

Reserves and Resources. Drilling will also test the hanging wall

and footwall of the deposit where higher grades have been

previously intersected.

The regional program has been expanded with 7,000 m of surface

drilling planned in 2024, up from 5,000 m in 2023. The focus will

be on testing multiple near-surface targets across the 5,900

hectare Young-Davidson Property that could potentially provide

supplemental mill feed.

Golden Arrow

The Golden Arrow project is a past producing open pit operation

located near Matheson, Ontario and 95 km from Young-Davidson. The

project was acquired in 2021 and is expected to provide

supplemental mill feed as capacity becomes available at

Young-Davidson.

An initial Mineral Resource was declared on the Golden Arrow

project in 2022. This is unchanged over the past year and includes

Measured and Indicated Mineral Resources of 246,000 ounces (6.4 mt

grading 1.19 g/t Au) and Inferred Mineral Resources of 70,000

ounces (2.0 mt grading 1.07 g/t Au).

A total of $2 million has been budgeted at Golden Arrow with

5,000 m of drilling planned in 2024. The focus of the drilling will

be the conversion of existing Mineral Resources into Reserves, and

testing near-deposit and early stage exploration targets across the

property. Geotechnical and condemnation drilling will also be

conducted as part of a development plan for the project.

Lynn Lake

Mineral Reserves at Lynn Lake increased 13% to 2.3 million

ounces with grades averaging 1.52 g/t Au, as detailed in the

updated Feasibility Study completed in August 2023. Based on the

Feasibility Study, the Lynn Lake project has an expected Mineral

Reserve life of 17 years.

Measured and Indicated Mineral Resources decreased to 0.3

million ounces reflecting the conversion to Mineral Reserves.

Inferred Mineral Resources increased slightly to 1.7 million ounces

with the majority contained within the Burnt Timber and Linkwood

satellite deposits.

A total of $9 million has been budgeted for exploration at the

Lynn Lake project in 2024, up from $7 million spent in 2023. This

includes 15,500 m of drilling focused on the conversion of Mineral

Resources to Mineral Reserves at the Burnt Timber and Linkwood

deposits, and to evaluate the potential for Mineral Resources at

Maynard, an advanced stage greenfield target.

Burnt Timber and Linkwood contain Inferred Mineral Resources

totaling 1.6 million ounces grading 1.1 g/t Au (44 mt) as of

December 31, 2023. The Company sees excellent potential for this to

be converted into a smaller, higher quality Mineral Reserve which

could be incorporated into the Lynn Lake project given its

proximity to the planned mill. This represents potential production

and economic upside to the Feasibility Study. A development plan

outlining this upside is expected to be completed during the fourth

quarter of 2024.

Burnt Timber and Linkwood are accessible by an all-season gravel

road from Highway 397, 24 km and 28 km from the proposed MacLellan

mill, respectively. The Maynard target is located 5 km northwest of

the Linkwood deposit, 1 km from the all-season gravel road, and 20

km from the proposed MacLellan mill.

The Company will also continue evaluating and advancing a

pipeline of prospective exploration targets within the

58,000-hectare Lynn Lake Property in 2024.

Kirazlı, Ağı Dağı, Çamyurt and Quartz Mountain

Mineral Reserves and Resources for the Kirazlı, Ağı Dağı,

Çamyurt and Quartz Mountain projects are unchanged from a year

ago.

Qualified Persons

Chris Bostwick, FAusIMM, Alamos Gold’s Senior Vice President,

Technical Services, has reviewed and approved the scientific and

technical information contained in this news release. Chris

Bostwick is a Qualified Person within the meaning of Canadian

Securities Administrator’s National Instrument 43-101 (“NI

43-101”). The Qualified Persons for the National Instrument 43-101

compliant Mineral Reserve and Resource estimates are detailed in

the following table.

|

Mineral Resources QP |

Company |

Project |

|

Jeffrey Volk, CPG, FAusIMM |

Director - Reserves and Resources,Alamos Gold Inc. |

Young-Davidson, Lynn Lake, Golden Arrow |

|

Tyler Poulin, P.Geo |

Chief Production Geologist - Island Gold |

Island Gold |

|

Marc Jutras, P.Eng |

Principal, Ginto Consulting Inc. |

Mulatos Pits, PDA, La Yaqui Grande, Carricito, Ağı Dağı, Kirazli,

Çamyurt, Quartz Mountain |

| Mineral Reserves

QP |

Company |

Project |

|

Chris Bostwick, FAusIMM |

SVP Technical Services, Alamos Gold Inc. |

Young-Davidson, Lynn Lake, PDA |

|

Nathan Bourgeault, P.Eng |

Chief Mine Engineer - Island Gold |

Island Gold |

|

Herb Welhener, SME-QP |

VP, Independent Mining Consultants Inc. |

La Yaqui Grande, Ağı Dağı, Kirazli |

With the exception of Mr. Volk, Mr. Bostwick, Mr. Poulin, and

Mr. Bourgeault each of the foregoing individuals are independent of

Alamos Gold.

About Alamos

Alamos is a Canadian-based intermediate gold producer with

diversified production from three operating mines in North America.

This includes the Young-Davidson and Island Gold mines in northern

Ontario, Canada and the Mulatos mine in Sonora State, Mexico.

Additionally, the Company has a strong portfolio of growth

projects, including the Phase 3+ Expansion at Island Gold, and the

Lynn Lake project in Manitoba, Canada. Alamos employs more than

1,900 people and is committed to the highest standards of

sustainable development. The Company’s shares are traded on the TSX

and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Scott K. ParsonsSenior Vice President, Investor

Relations(416) 368-9932 x 5439

All amounts are in United States dollars, unless otherwise

stated.

The TSX and NYSE have not reviewed and do not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Note regarding Forward-Looking

Statements

This news release includes certain statements that constitute

forward-looking information within the meaning of applicable

Canadian and U.S. securities laws ("forward-looking statements").

All statements in this news release other than statements of

historical fact, which address events, results, outcomes or

developments that Alamos expects to occur are forward-looking

statements. Forward-looking statements are generally, but not

always, identified by the use of forward-looking terminology such

as "expect", "plan", “continue”, “trend”, "estimate", “target”,

“budget”, “prospective” or “potential” or variations of such words

and phrases and similar expressions or statements that certain

actions, events or results "may", "could", "would", "might" or

"will" be taken, occur or be achieved or the negative connotation

of such terms. Such statements in this news release include,

without limitation, statements with respect to planned exploration

programs, focuses, targets and budgets, potential drilling results

and related expectations, expected underground mining rates, costs

and expenditures, project economics, gold price assumptions,

potential mineralization, projected ore grades, changes in Mineral

Resources and conversion of Inferred Mineral Resources to Proven

and Probable Mineral Reserves, expected mine life, expected Mineral

Reserve life, production potential, development of the Lynn Lake

Project and exploration potential, expected increases in the value

of operations, expected development plan for Puerto Del Aire and

other information that is based on forecasts and projections of

future operational, geological or financial results, estimates of

amounts not yet determinable and assumptions of management.

A Mineral Resource that is classified as "Inferred" or

"Indicated" has a great amount of uncertainty as to its existence

and economic and legal feasibility. It cannot be assumed that any

or part of an "Indicated Mineral Resource" or "Inferred Mineral

Resource" will ever be upgraded to a higher category of Mineral

Resource. Investors are cautioned not to assume that all or any

part of mineral deposits in these categories will ever be converted

into Proven and Probable Mineral Reserves.

Alamos cautions that forward-looking statements are necessarily

based upon several factors and assumptions that, while considered

reasonable by management at the time of making such statements, are

inherently subject to significant business, economic, technical,

legal, political and competitive uncertainties and contingencies.

Known and unknown factors could cause actual results to differ

materially from those projected in the forward-looking statements,

and undue reliance should not be placed on such statements and

information.

These factors and assumptions include, but are not limited to:

the actual results of current exploration activities; conclusions

of economic and geological evaluations; changes in project

parameters as plans continue to be refined; operations may be

exposed to serious illness, new epidemics and/or pandemics; the

ongoing and potential future impact of COVID-19 or any other new

illness, epidemic or pandemic on the broader market; provincial and

federal orders or mandates (including with respect to mining

operations generally or auxiliary businesses or services required

for the Company’s operations) in Canada, Mexico, the United States

and Türkiye; the duration of any ongoing or new regulatory

responses to COVID-19 or any other new illness, epidemic or

pandemic; changes in national and local government legislation,

controls or regulations; failure to comply with environmental and

health and safety laws and regulations; labour and contractor

availability (and being able to secure the same on favourable

terms); ability to sell or deliver gold doré bars; disruptions in

the maintenance or provision of required infrastructure and

information technology systems; fluctuations in the price of gold

or certain other commodities such as, diesel fuel, natural gas, and

electricity; operating or technical difficulties in connection with

mining or development activities, including geotechnical challenges

and changes to production estimates (which assume accuracy of

projected ore grade, mining rates, recovery timing and recovery

rate estimates and may be impacted by unscheduled maintenance);

changes in foreign exchange rates (particularly the Canadian

dollar, U.S. dollar, Mexican peso and Turkish Lira); the impact of

inflation; employee and community relations; litigation and

administrative proceedings (including but not limited to the

investment treaty claim announced on April 20, 2021 against the

Republic of Türkiye by the Company’s wholly-owned Netherlands

subsidiaries, Alamos Gold Holdings Coöperatief U.A. and Alamos Gold

Holdings B.V. and the application for judicial review of the

positive Decision Statement issued by the Ministry of Environment

and Climate Change Canada commenced by the Mathias Colomb Cree

Nation (MCCN) in respect of the Lynn Lake Project and the MCCN’s

corresponding internal appeal of the Environment Act Licences

issued by the Province of Manitoba for the project); disruptions

affecting operations; availability of and increased costs

associated with mining inputs and labour; delays with the Phase 3+

Expansion Project at the Island Gold mine; delays in the

development or updating of mine plans; changes that may be required

to the intended method of accessing and mining the deposit at

Puerto Del Aire and changes related to the intended method of

processing any ore from the deposit at Puerto Del Aire;

expectations with respect to the Golden Arrow open pit project

providing supplemental mill feed to the mill at the Young-Davidson

mine not coming to fruition; inherent risks and hazards associated

with mining and mineral processing including environmental hazards,

industrial accidents, unusual or unexpected formations, pressures

and cave-ins; the risk that the Company’s mines may not

perform as planned; uncertainty with the Company's ability to

secure additional capital to execute its business plans; the

speculative nature of mineral exploration and development, risks in

obtaining and maintaining necessary licenses, permits and

authorizations, contests over title to properties; expropriation or

nationalization of property; political or economic developments in

Canada, Mexico, the United States, Türkiye and other jurisdictions

in which the Company may carry on business in the future; increased

costs and risks related to the potential impact of climate change;

the costs and timing of construction and development of new

deposits; effects of construction decisions, risk of loss due to

sabotage, protests and other civil disturbances; the impact of

global liquidity and credit availability and the values of assets

and liabilities based on projected future cash flows; and business

opportunities that may be pursued by the Company. The litigation

against the Republic of Türkiye, described above, results from the

actions of the Turkish government in respect of the Company’s

projects in the Republic of Türkiye. Such litigation is a

mitigation effort and may not be effective or successful. If

unsuccessful, the Company’s projects in Türkiye may be subject to

resource nationalism and further expropriation; the Company may

lose any remaining value of its assets and gold mining projects in

Türkiye and its ability to operate in Türkiye or to put any of the

Kirazli, Aği Daği or Çamyurt sites into production, resulting in

the Company removing those three projects from its Total Mineral

Reserves and Resources. Even if the litigation is successful, there

is no certainty as to the quantum of any damages award or recovery

of all, or any, legal costs. Any resumption of activities in

Türkiye, or even retaining control of its assets and gold mining

projects in Türkiye can only result from agreement with the Turkish

government. The investment treaty claim described above may have an

impact on foreign direct investment in the Republic of Türkiye

which may result in changes to the Turkish economy, including but

not limited to high rates of inflation and fluctuation in the

Turkish Lira which may also affect the Company’s relationship with

the Turkish government, the Company’s ability to effectively

operate in Türkiye, and which may have a negative effect on overall

anticipated project values.

For a more detailed discussion of such risks and other factors

that may affect the Company's ability to achieve the expectations

set forth in the forward-looking statements contained in this news

release, see the Company’s latest 40-F/Annual Information Form and

Management’s Discussion and Analysis, each under the heading “Risk

Factors”, available on the SEDAR+ website at www.sedarplus.ca or on

EDGAR at www.sec.gov. The foregoing should be reviewed in

conjunction with the information and risk factors and assumptions

found in this news release.

The Company disclaims any intention or obligation to update or

revise any forward-looking statements, whether written or oral, or

whether as a result of new information, future events or otherwise,

except as required by applicable law.

Note to U.S. Investors – Mineral Reserve

and Resource Estimates

Unless otherwise indicated, all Mineral Resource and Mineral

Reserve estimates included in this news release have been prepared

in accordance with National Instrument 43-101 - Standards of

Disclosure for Mineral Projects (“NI 43-101”) and the Canadian

Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM

Definition Standards on Mineral Resources and Mineral Reserves,

adopted by the CIM Council, as amended (the “CIM Standards”). NI

43-101 is a rule developed by the Canadian Securities

Administrators, which established standards for all public

disclosure an issuer makes of scientific and technical information

concerning mineral projects. Mining disclosure in the United States

was previously required to comply with SEC Industry Guide 7 (“SEC

Industry Guide 7”) under the United States Securities Exchange Act

of 1934, as amended. The U.S. Securities and Exchange Commission

(the “SEC”) has adopted final rules, to replace SEC Industry Guide

7 with new mining disclosure rules under sub-part 1300 of

Regulation S-K of the U.S. Securities Act (“Regulation S-K 1300”)

which became mandatory for U.S. reporting companies beginning with

the first fiscal year commencing on or after January 1, 2021. Under

Regulation S-K 1300, the SEC now recognizes estimates of “Measured

Mineral Resources”, “Indicated Mineral Resources” and “Inferred

Mineral Resources”. In addition, the SEC has amended its

definitions of “Proven Mineral Reserves” and “Probable Mineral

Reserves” to be substantially similar to international

standards.

Investors are cautioned that while the above terms are

“substantially similar” to CIM Definitions, there are differences

in the definitions under Regulation S-K 1300 and the CIM Standards.

Accordingly, there is no assurance any Mineral Reserves or Mineral

Resources that the Company may report as “Proven Mineral Reserves”,

“Probable Mineral Reserves”, “Measured Mineral Resources”,

“Indicated Mineral Resources” and “Inferred Mineral Resources”

under NI 43-101 would be the same had the Company prepared the

Mineral Reserve or mineral resource estimates under the standards

adopted under Regulation S-K 1300. U.S. investors are also

cautioned that while the SEC recognizes “Measured Mineral

Resources”, “Indicated Mineral Resources” and “Inferred Mineral

Resources” under Regulation S-K 1300, investors should not assume

that any part or all of the mineralization in these categories will

ever be converted into a higher category of Mineral Resources or

into Mineral Reserves. Mineralization described using these terms

has a greater degree of uncertainty as to its existence and

feasibility than mineralization that has been characterized as

Reserves. Accordingly, investors are cautioned not to assume that

any Measured Mineral Resources, Indicated Mineral Resources, or

Inferred Mineral Resources that the Company reports are or will be

economically or legally mineable.

Table 1: Total Proven and Probable

Mineral Reserves as of December 31, 2023

|

PROVEN AND PROBABLE GOLD RESERVES (as at December 31,

2023) |

|

|

Proven Reserves |

Probable Reserves |

Total Proven and Probable |

|

|

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

|

|

(000's) |

(g/t Au) |

(000's) |

(000's) |

(g/t Au) |

(000's) |

(000's) |

(g/t Au) |

(000's) |

|

Young-Davidson |

26,137 |

2.27 |

1,907 |

17,774 |

2.37 |

1,354 |

43,911 |

2.31 |

3,261 |

|

Island Gold |

780 |

10.42 |

261 |

4,431 |

10.27 |

1,464 |

5,210 |

10.30 |

1,725 |

|

La Yaqui Grande |

199 |

0. 94 |

6 |

11,119 |

1.33 |

477 |

11,318 |

1.33 |

483 |

|

Puerto Del Aire |

833 |

4.71 |

126 |

4,542 |

5.77 |

843 |

5,375 |

5.61 |

969 |

|

Total Mulatos |

1,032 |

3.98 |

132 |

15,661 |

2.62 |

1,320 |

16,693 |

2.71 |

1,452 |

|

MacLellan |

16,498 |

1.66 |

883 |

23,240 |

1.12 |

834 |

39,738 |

1.34 |

1,717 |

|

Gordon |

3,502 |

2.63 |

296 |

4,370 |

2.27 |

319 |

7,873 |

2.43 |

615 |

|

Total Lynn Lake |

20,000 |

1.83 |

1,179 |

27,610 |

1.30 |

1,153 |

47,610 |

1.52 |

2,332 |

|

Ağı Dağı |

1,450 |

0.76 |

36 |

52,911 |

0.66 |

1,130 |

54,361 |

0.67 |

1,166 |

|

Kirazlı |

670 |

1.15 |

25 |

33,191 |

0.68 |

727 |

33,861 |

0.69 |

752 |

|

Total Türkiye |

2,120 |

0.89 |

61 |

86,102 |

0.67 |

1,857 |

88,222 |

0.68 |

1,918 |

|

Alamos - Total |

50,069 |

2.20 |

3,540 |

151,578 |

1.47 |

7,148 |

201,647 |

1.65 |

10,688 |

|

PROVEN AND PROBABLE SILVER MINERAL RESERVES (as at December

31, 2023) |

|

|

Proven Reserves |

Probable Reserves |

Total Proven and Probable |

|

|

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

|

|

(000's) |

(g/t Ag) |

(000's) |

(000's) |

(g/t Ag) |

(000's) |

(000's) |

(g/t Ag) |

(000's) |

|

La Yaqui Grande |

- |

- |

- |

11,119 |

18.00 |

6,435 |

11,119 |

18.00 |

6,435 |

|

Puerto Del Aire |

833 |

10.57 |

283 |

4,542 |

5.46 |

797 |

5,375 |

6.25 |

1,080 |

|

MacLellan |

16,498 |

5.31 |

2,815 |

23,240 |

3.55 |

2,650 |

39,738 |

4.28 |

5,464 |

|

Ağı Dağı |

1,450 |

6.22 |

290 |

52,911 |

5.39 |

9,169 |

54,361 |

5.41 |

9,459 |

|

Kirazlı |

670 |

16.94 |

365 |

33,191 |

9.27 |

9,892 |

33,861 |

9.42 |

10,257 |

|

Alamos - Total |

19,451 |

6.00 |

3,753 |

125,002 |

7.20 |

28,943 |

144,454 |

7.04 |

32,696 |

Table 2: Project Life-of-Mine Mineral

Reserve Waste-to-Ore Ratios as of December 31,

2023

|

Project Life-of-Mine Mineral Reserve Waste-to-Ore

Ratiosas of December 31, 2023 |

|

Project |

Waste-to-Ore Ratio |

|

La Yaqui Grande Pit |

4.26 |

|

Ağı Dağı Pits |

1.03 |

|

Kirazlı Pit |

1.45 |

|

Lynn Lake Pits |

6.81 |

Table 3: Total Measured and Indicated

Mineral Resources as of December 31, 2023

|

MEASURED AND INDICATED GOLD MINERAL RESOURCES (as at

December 31, 2023) |

|

|

Measured Resources |

Indicated Resources |

Total Measured and Indicated |

|

|

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

|

|

(000's) |

(g/t Au) |

(000's) |

(000's) |

(g/t Au) |

(000's) |

(000's) |

(g/t Au) |

(000's) |

|

Young-Davidson - Surface |

496 |

1.13 |

18 |

1,242 |

1.28 |

51 |

1,739 |

1.24 |

69 |

|

Young-Davidson - Underground |

5,874 |

3.28 |

619 |

4,040 |

3.37 |

438 |

9,914 |

3.32 |

1,057 |

|

Total Young-Davidson |

6,370 |

3.11 |

637 |

5,282 |

2.88 |

489 |

11,653 |

3.01 |

1,127 |

|

Golden Arrow |

3,626 |

1.26 |

147 |

2,816 |

1.09 |

99 |

6,442 |

1.19 |

246 |

|

Island Gold |

385 |

10.81 |

134 |

2,167 |

8.36 |

582 |

2,552 |

8.73 |

716 |

|

Mulatos |

949 |

1.28 |

39 |

6,134 |

1.11 |

219 |

7,083 |

1.13 |

258 |

|

La Yaqui Grande |

- |

- |

- |

1,073 |

0.88 |

30 |

1,073 |

0.87 |

30 |

|

Puerto Del Aire |

326 |

3.29 |

35 |

1,780 |

3.59 |

205 |

2,106 |

3.54 |

240 |

|

Carricito |

58 |

0.82 |

2 |

1,297 |

0.82 |

34 |

1,355 |

0.83 |

36 |

|

Total Mulatos |

1,333 |

1.76 |

76 |

10,284 |

1.48 |

488 |

11,617 |

1.51 |

564 |

|

MacLellan |

786 |

1.63 |

41 |

3,200 |

1.52 |

156 |

3,986 |

1.54 |

197 |

|

Gordon |

571 |

0.84 |

15 |

1,286 |

1.20 |

50 |

1,857 |

1.09 |

65 |

|

Burnt Timber |

- |

- |

- |

1,021 |

1.40 |

46 |

1,021 |

1.40 |

46 |

|

Linkwood |

- |

- |

- |

984 |

1.16 |

37 |

984 |

1.17 |

37 |

|

Total Lynn Lake |

1,357 |

1.28 |

56 |

6,491 |

1.38 |

289 |

7,848 |

1.37 |

345 |

|

Ağı Dağı |

553 |

0.44 |

8 |

34,334 |

0.46 |

510 |

34,887 |

0.46 |

518 |

|

Kirazlı |

- |

- |

- |

3,056 |

0.42 |

42 |

3,056 |

0.43 |

42 |

|

Çamyurt |

513 |

1.00 |

16 |

17,208 |

0.89 |

492 |

17,721 |

0.89 |

508 |

|

Total Türkiye |

1,066 |

0.70 |

24 |

54,598 |

0.59 |

1,044 |

55,664 |

0.60 |

1,068 |

|

Quartz Mountain |

214 |

0.95 |

7 |

11,942 |

0.87 |

333 |

12,156 |

0.87 |

339 |

|

Alamos - Total |

14,352 |

2.34 |

1,081 |

93,580 |

1.10 |

3,324 |

107,932 |

1.27 |

4,405 |

|

MEASURED AND INDICATED SILVER MINERAL RESOURCES (as at

December 31, 2023) |

|

|

Measured Resources |

Indicated Resources |

Total Measured and Indicated |

|

|

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

|

|

(000's) |

(g/t Ag) |

(000's) |

(000's) |

(g/t Ag) |

(000's) |

(000's) |

(g/t Ag) |

(000's) |

|

La Yaqui Grande |

- |

- |

- |

1,073 |

9.32 |

322 |

1,073 |

9.32 |

322 |

|

Puerto Del Aire |

326 |

12.48 |

131 |

1,780 |

8.47 |

485 |

2,106 |

9.09 |

616 |

|

MacLellan |

786 |

3.09 |

78 |

3,200 |

3.44 |

354 |

3,986 |

3.37 |

432 |

|

Ağı Dağı |

553 |

1.59 |

28 |

34,334 |

2.19 |

2,417 |

34,887 |

2.18 |

2,445 |

|

Kirazlı |

- |

- |

- |

3,056 |

2.71 |

266 |

3,056 |

2.71 |

266 |

|

Çamyurt |

513 |

5.63 |

93 |

17,208 |

6.15 |

3,404 |

17,721 |

6.14 |

3,497 |

|

Alamos - Total |

2,178 |

4.71 |

330 |

60,651 |

3.72 |

7,247 |

62,829 |

3.75 |

7,577 |

Table 4: Total Inferred Mineral Resources

as of December 31, 2023

|

INFERRED GOLD MINERAL RESOURCES (as at December 31,

2023) |

|

|

Tonnes |

Grade |

Ounces |

|

|

(000's) |

(g/t Au) |

(000's) |

|

Young-Davidson - Surface |

31 |

0.99 |

1 |

|

Young-Davidson - Underground |

1,350 |

3.31 |

144 |

|

Total Young-Davidson |

1,381 |

3.26 |

145 |

|

Golden Arrow |

2,028 |

1.07 |

70 |

|

Island Gold |

7,857 |

14.58 |

3,682 |

|

Mulatos |

571 |

0.92 |

17 |

|

La Yaqui Grande |

107 |

1.30 |

4 |

|

Puerto Del Aire |

73 |

5.97 |

14 |

|

Carricito |

900 |

0.74 |

22 |

|

Total Mulatos |

1,651 |

1.07 |

57 |

|

MacLellan |

4,192 |

0.98 |

133 |

|

Gordon |

51 |

0.98 |

2 |

|

Burnt Timber |

23,438 |

1.04 |

781 |

|

Linkwood |

21,004 |

1.16 |

783 |

|

Total Lynn Lake |

48,685 |

1.09 |

1,699 |

|

Ağı Dağı |

16,760 |

0.46 |

245 |

|

Kirazlı |

7,694 |

0.61 |

152 |

|

Çamyurt |

2,791 |

0.95 |

85 |

|

Total Türkiye |

27,245 |

0.55 |

482 |

|

Quartz Mountain |

39,205 |

0.91 |

1,147 |

|

Alamos - Total |

128,052 |

1.77 |

7,282 |

|

INFERRED SILVER MINERAL RESOURCES (as at December 31,

2023) |

|

|

Tonnes |

Grade |

Ounces |

|

|

(000's) |

(g/t Ag) |

(000's) |

|

La Yaqui Grande |

107 |

4.85 |

17 |

|

Puerto Del Aire |

73 |

10.91 |

26 |

|

MacLellan |

4,192 |

1.49 |

201 |

| Ağı

Dağı |

16,760 |

2.85 |

1,536 |

|

Kirazlı |

7,694 |

8.71 |

2,155 |

|

Çamyurt |

2,791 |

5.77 |

518 |

|

Alamos - Total |

31,617 |

4.38 |

4,453 |

Notes to Mineral Reserve and Resource

Tables:

- The Company’s Mineral Reserves and Mineral Resources as at

December 31, 2023 are classified in accordance with the Canadian

Institute of Mining Metallurgy and Petroleum’s “CIM Standards on

Mineral Resources and Reserves, Definition and Guidelines” as per

Canadian Securities Administrator’s NI 43-101 requirements.

- Mineral Resources are not Mineral Reserves and do not have

demonstrated economic viability.

- Mineral Resources are exclusive of Mineral Reserves.

- Mineral Reserve cut-off grade for the La Yaqui Pit, the Kirazlı

Pit and the Ağı Dağı Pit are determined as a net of process value

of $0.10 per tonne for each model block.

- All Measured, Indicated and Inferred open pit Mineral Resources

are pit constrained.

- With the exceptions noted following, Mineral Reserve estimates

assumed a gold price of $1,400 per ounce and Mineral Resource

estimates assumed a gold price of $1,600 per ounce.

- Mineral Reserve estimates for MacLellan assumed a gold price of

$1,600 per ounce. Mineral Reserve Estimates for Gordon assumed a

gold price of $1,250 per ounce.

- Mineral Reserve estimates for development properties, Türkiye,

Quartz Mountain and Carricito assumed a gold of $1,250 per ounce

and Mineral Resource estimates assumed a gold price of $1,400 per

ounce.

- Metal prices, cut-off grades and metallurgical recoveries are

set out in the table below.

|

|

Mineral Resources |

Mineral Reserves |

|

|

|

Gold Price |

Cut-off |

Gold Price |

Cut-off |

Met Recovery |

|

Mulatos: |

|

|

|

|

|

|

Mulatos Main Open Pit |

$1,600 |

0.5 |

n/a |

n/a |

n/a |

|

PDA Underground |

$1,600 |

2.5 |

$1,400 |

3.0 |

85% |

|

La Yaqui Grande |

$1,600 |

0.3 |

$1,400 |

see notes |

75% |

|

Carricito |

$1,400 |

0.3 |

n/a |

n/a |

n/a |

|

Young-Davidson - Surface |

$1,400 |

0.5 |

n/a |

n/a |

n/a |

|

Young-Davidson - Underground |

$1,600 |

1.39 |

$1,400 |

1.59 |

91.8% |

|

Golden Arrow |

$1,600 |

0.64 |

n/a |

n/a |

91% |

|

Island Gold |

$1,600 |

3.75 |

$1,400 |

2.87-3.75 |

97.0% |

|

Lynn Lake - MacLellan |

$1,600 |

0.36 |

$1,600 |

0.36 |

91-92% |

|

Lynn Lake - Gordon |

$1,600 |

0.62 |

$1,250 |

0.80 |

92.4% |

|

Ağı Dağı |

$1,400 |

0.2 |

$1,250 |

see notes |

80% |

|

Kirazli |

$1,400 |

0.2 |

$1,250 |

see notes |

81% |

|

Çamyurt |

$1,400 |

0.2 |

n/a |

n/a |

78% |

|

Quartz Mountain |

$1,400 |

0.21 Oxide,0.6 Sulfide |

n/a |

n/a |

65-80% |

Figure 1: Island Gold Mine Main Structure

(C/E1E Zone) Longitudinal – 2023 Mineral Reserves and

Resources

An infographic is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/cc527a26-8b48-4cbd-b69f-ac5c49f8b169

Figure 2: Island Gold Mine Hanging Wall

and Footwall Zones – 2023 Mineral Reserves and

Resources

An infographic is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/71a96fa7-2259-41a2-8f24-b5323308fa9a

Figure 3: Puerto Del Aire Sulphide Gold

Mineralization Wireframes – 2023 Mineral Reserves and

Resources

An infographic is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/99722223-9ab9-45d8-9550-4da58daf0df4

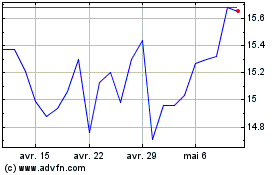

Alamos Gold (NYSE:AGI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Alamos Gold (NYSE:AGI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024