false

0001569187

0001569187

2024-05-10

2024-05-10

0001569187

us-gaap:CommonStockMember

2024-05-10

2024-05-10

0001569187

us-gaap:RedeemableConvertiblePreferredStockMember

2024-05-10

2024-05-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of The Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): May 10, 2024

ARMADA HOFFLER

PROPERTIES, INC.

(Exact name of registrant

as specified in its charter)

| Maryland |

|

001-35908 |

|

46-1214914 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| 222 Central Park Avenue, Suite 2100 |

|

|

| Virginia Beach, Virginia |

|

23462 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (757) 366-4000

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

|

AHH |

|

New York Stock Exchange |

| |

|

|

|

|

| 6.75% Series A Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share |

|

AHHPrA |

|

New York Stock Exchange |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On

May 10, 2024, Armada Hoffler Properties, Inc. (the “Company”) and Armada Hoffler,

L.P. entered into an amendment (the “Amendment”) to the ATM Equity Offering Sales

Agreement, dated March 10, 2020, as amended by Amendment No. 1, dated February 28, 2023, and by Amendment No. 2,

dated August 10, 2023 (as amended, the “Sales Agreement”), with Jefferies

LLC, Barclays Capital Inc., Barclays Bank PLC, Robert W. Baird & Co. Incorporated, Regions Securities LLC, Stifel, Nicolaus &

Company, Incorporated, TD Securities (USA) LLC, and The Toronto-Dominion Bank, for the offering, from time to time, of shares

of the Company’s common stock, $0.01 par value per share (“Common Stock”), and shares of the Company’s 6.75% Series A

Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share, having an aggregate offering price of up to $300,000,000 (the

“Offered Shares”). The purpose of the Amendment, among other things, was

to include (i) TD Securities (USA) LLC as an additional agent (for sales of Common Stock only) and forward seller, as the case may

be, and (ii) The Toronto-Dominion Bank as an additional forward purchaser. As of the date of the Amendment, Offered Shares having

an aggregate gross sales price of up to approximately $204 million remain to be sold under the Sales Agreement.

A copy of the Amendment is

filed as Exhibit 1.1 to this Current Report on Form 8-K. The description of the Amendment does not purport to be complete and

is qualified in its entirety by reference to the copy of the Amendment filed as an exhibit to this Current Report on Form 8-K and

incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

ARMADA HOFFLER PROPERTIES, INC. |

| |

|

| Date: May 10, 2024 |

By: |

/s/ Matthew T. Barnes-Smith |

| |

|

Matthew T. Barnes-Smith |

| |

|

Chief Financial Officer, Treasurer, and Corporate Secretary |

Exhibit 1.1

Armada Hoffler Properties, Inc.

Common Stock

($0.01 par value per share)

6.75% Series A Cumulative Redeemable Perpetual

Preferred Stock

($0.01 par value per share)

AMENDMENT NO. 3 TO

ATM EQUITY OFFERING SALES AGREEMENT

May 10, 2024

Jefferies LLC

520 Madison Avenue

New York, New York 10022

Barclays Capital Inc.

745 Seventh Avenue

New York, New York 10019

Robert W. Baird & Co. Incorporated

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Regions Securities LLC

615 South College Street, Suite 600

Charlotte, North Carolina 28202

Stifel, Nicolaus & Company, Incorporated

501 North Broadway, 10th Floor

Saint Louis, Missouri 63102

TD Securities (USA) LLC

1 Vanderbilt Avenue, 11th Floor

New York, NY 10017

As Agents

Jefferies LLC

520 Madison Avenue

New York, New York 10022

Barclays Bank PLC

c/o Barclays Capital Inc.

745 Seventh Avenue

New York, New York 10019

Robert W. Baird & Co. Incorporated

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Regions Securities LLC

615 South College Street, Suite 600

Charlotte, North Carolina 28202

Stifel, Nicolaus & Company, Incorporated

501 North Broadway, 10th Floor

Saint Louis, Missouri 63102

The Toronto-Dominion Bank

c/o TD Securities (USA) LLC

1 Vanderbilt Avenue, 11th Floor

New York, NY 10017

As Forward Purchasers

Ladies and Gentlemen:

Reference

is made to the ATM Equity Offering Sales Agreement, dated as of March 10, 2020, as amended by Amendment No. 1 to ATM Equity

Offering Sales Agreement, dated as of February 28, 2023, and Amendment No. 2 to ATM Equity Offering Sales Agreement, dated as

of August 10, 2023 (the “Agreement”), by and among Armada Hoffler Properties, Inc., a Maryland corporation

(the “Company”), and Armada Hoffler, L.P., a Virginia limited partnership (the “Operating Partnership”),

and each of Jefferies LLC, Barclays Capital Inc., Robert W. Baird & Co. Incorporated, Regions Securities LLC and Stifel,

Nicolaus & Company, Incorporated, as sales agent, forward seller and/or principal, and Jefferies LLC, Barclays Bank PLC,

Robert W. Baird & Co. Incorporated, Regions Securities LLC and Stifel, Nicolaus & Company, Incorporated, as Forward

Purchaser (together with the Company and the Operating Partnership, the “Original Parties”) related to the issuance

and sale of the Company’s common stock, par value $0.01 per share, and the Company’s 6.75% Series A Cumulative Redeemable

Perpetual Preferred Stock, $0.01 par value per share, pursuant to the terms thereof. Unless otherwise specified herein, capitalized terms

used but not defined herein shall have the meanings ascribed to such terms in the Agreement.

In

connection with the foregoing, the Original Parties, TD Securities (USA) LLC and The Toronto-Dominion Bank wish

to amend the Agreement through this Amendment No. 3 to ATM Equity Offering Sales Agreement (this

“Amendment”) to (i) add TD Securities (USA) LLC as a sales agent, forward seller and/or principal, as the

case may be, and The Toronto-Dominion Bank as a forward purchaser under the Agreement and (ii) make

certain other changes to the Agreement, in each case with effect on and after the date hereof (the “Effective Date”).

SECTION 1. Representation

and Warranty. Each of the Company and the Operating Partnership, jointly and severally, represents

and warrants to each Agent and Forward Purchaser that this Amendment has been duly authorized, executed and delivered by, and is a valid

and binding agreement of, the Company and the Operating Partnership.

SECTION 2. Amendments

to the Agreement and Other Agreements. The Original Parties, TD Securities (USA) LLC

and The Toronto-Dominion Bank agree, from and after the Effective Date, that:

| (a) | As of the date hereof, (i) each of TD Securities (USA) LLC and The Toronto-Dominion Bank is hereby

added as a party to the Agreement, and (ii) TD Securities (USA) LLC is hereby included within the defined term “Agents,”

and The Toronto-Dominion Bank is hereby included within the defined term “Forward Purchasers,” for all purposes hereunder

(including, for the avoidance of doubt, with respect to Sections 1 and 7 of this Amendment) and under the Agreement. |

| (b) | The first sentence of the first paragraph of the Agreement is hereby

amended and restated in its entirety to read as follows: |

Each of Armada Hoffler Properties, Inc.,

a Maryland corporation (the “Company”), and Armada Hoffler, L.P., a Virginia limited partnership (the “Operating

Partnership” and, together with the Company, the “Transaction Entities”), confirms its agreement with (i) each

of Jefferies LLC, Barclays Capital Inc., Robert W. Baird & Co. Incorporated, Regions Securities LLC, Stifel, Nicolaus &

Company, Incorporated and TD Securities (USA) LLC as sales agent, forward seller and/or principal (in any such capacity, each, an

“Agent,” and collectively, the “Agents”), and (ii) Jefferies LLC, Barclays Bank PLC, Robert

W. Baird & Co. Incorporated, Regions Securities LLC, Stifel, Nicolaus & Company, Incorporated and The Toronto-Dominion

Bank (in such capacities, each a “Forward Purchaser” and collectively, the “Forward Purchasers”)

on the terms set forth in this ATM Equity Offering Sales Agreement (the “Agreement”).

| (c) | The first sentence of the fourth paragraph of the Agreement is hereby amended and restated in its entirety

to read as follows: |

The Company proposes to (i) issue,

offer and sell shares (any such shares, “Common Primary Shares”) of its common stock, $0.01 par value per share (the

“Common Stock”), from time to time to or through any Agent, acting as sales agent for the Company and/or acting as

principal, (ii) issue, offer and sell shares of its 6.75% Series A Cumulative Redeemable Perpetual Preferred Stock, $0.01 par

value per share, (the “Series A Preferred Stock,” and, together with the Common Primary Shares, the “Primary

Shares”) through any Agent (other than TD Securities (USA) LLC, which shall not be considered an Agent with respect to the sales

of any Series A Preferred Stock; provided that nothing herein shall limit the right of TD Securities (USA) LLC to indemnification

by the Transaction Entities and other benefits pursuant to Sections 6 and 7), acting as sales agent for the Company and/or acting as principal,

and (iii) instruct any Agent, acting as forward seller, to offer and sell borrowed shares of Common Stock (any such shares, “Forward

Hedge Shares,” and together with the Primary Shares, the “Shares”), in each case, on the terms and subject

to the conditions set forth in this Agreement, any Confirmation and any Terms Agreement, as applicable.

| (d) | Section 1(zz) of the Agreement is hereby amended and restated in its entirety to read as follows: |

Money

Laundering Laws and OFAC. The operations of the Transaction Entities and the Subsidiaries are, and have been conducted at all

times, in compliance with applicable financial recordkeeping and reporting requirements of the Currency and Foreign Transactions Reporting

Act of 1970, as amended, the money laundering statutes of all applicable jurisdictions, the rules and regulations promulgated thereunder

and any related or similar applicable rules, regulations or guidelines, issued, administered or enforced by any governmental agency (collectively,

the “Money Laundering Laws”) and no action, suit or proceeding by or before any court or governmental agency, authority

or body or any arbitrator involving the Transaction Entities or any of the Subsidiaries with respect to the Money Laundering Laws is pending

or, to the knowledge of the Transaction Entities, threatened. None of the Transaction Entities, the Subsidiaries or, to the knowledge

of the Transaction Entities, any director, officer, agent, employee, affiliate or person acting on behalf of the Transaction Entities

or the Subsidiaries is currently subject to any U.S. sanctions (“Sanctions”) administered by the Office of Foreign

Assets Control of the U.S. Treasury Department (“OFAC”); and the Company will not directly or indirectly use the

proceeds of the offering and sale of the Shares or from the settlement of any Confirmation, as the case may be, or lend, contribute or

otherwise make available such proceeds to the Operating Partnership, any Subsidiary, joint venture partner or other person or entity,

for the purpose of financing the activities of any person currently subject to any U.S. sanctions administered by OFAC. For the past ten

years, the Transaction Entities and the Subsidiaries have not knowingly engaged in and are not now knowingly engaged in any dealings or

transactions prohibited by Sanctions with any person that at the time of the dealing or transaction is or was the subject or the target

of Sanctions or with any country or territory that is the subject or the target of Sanctions.

| (e) | The following sentence is hereby added to the end of Section 2(a)(i): |

Notwithstanding any other provision

of this Agreement, under no circumstances will TD Securities (USA) LLC have any obligation to sell any of the Company’s Series A

Preferred Stock or act as principal with respect to the sale of any of the Company’s Series A Preferred Stock.

| (f) | The first sentence of section 2(g) is hereby amended and restated in its entirety to read as follows: |

Each Settlement Date will occur on

the second business day that is also a Trading Day following the trade date on which such sales are made, unless an earlier day is (i) required

by applicable law or rules and regulations or (ii) industry practice for regular-way trading, and unless another date shall

be agreed to in writing by the Company and the applicable Agent.

| (g) | The following sentence is hereby added to the end of Section 6(a): |

In addition, and notwithstanding any

other provision of this Agreement, under no circumstances will TD Securities (USA) LLC have any liability under this Section 6 for

any loss, liability, claim, damage or expense arising out of the sale of the Company’s Series A Preferred Stock through or

to the other Agents pursuant to the terms of this Agreement except for a loss, liability, claim, damage or expense with respect to untrue

statements or omissions, or alleged untrue statements or omissions, made in the Registration Statement (or any amendment thereto), including

any information deemed to be a part thereof pursuant to Rule 430B, or in the General Disclosure Package or the Prospectus (or any

amendment or supplement thereto) in reliance upon and in conformity with information furnished to the Company by TD Securities (USA) LLC

in writing expressly for use therein.

| (h) | Section 10(a) is hereby amended and restated in its entirety to read as follows: |

Notices to the Agents shall be directed

to them at: c/o Jefferies LLC, 520 Madison Avenue, New York, New York 10022, Attention: General Counsel; c/o Barclays Capital Inc., 745

Seventh Avenue, New York, New York 10019, Attention: Syndicate Registration, Facsimile: (646) 834-8133; c/o Robert W. Baird &

Co. Incorporated, 777 East Wisconsin Avenue, Milwaukee, Wisconsin 53202, Attention: Syndicate Department, Facsimile: (414) 298-7474, with

a copy to the Legal Department; c/o Regions Securities LLC, 615 South College Street, Suite 600, Charlotte, North Carolina 28202,

Attention: ECM Team, with a copy to ECMDesk@regions.com; c/o Stifel, Nicolaus & Company, Incorporated, One South Street,

15th Floor, Baltimore, MD 21202, Attention: Syndicate Department, Facsimile: (443) 224-1273; TD Securities (USA) LLC, 1 Vanderbilt Avenue,

New York, NY 10017, Attn: Equity Capital Markets, Email: TDS_ATM@tdsecurities.com; and in each case with a copy also to Goodwin Procter

LLP, 100 Northern Avenue, Boston, Massachusetts, Facsimile: (617) 523-1231, Attention: Scott C. Chase, Esq.

| (i) | Section 10(b) is hereby amended and restated in its entirety to read as follows: |

Notices to the Forward Purchasers shall

be directed to: c/o Jefferies LLC, 520 Madison Avenue, New York, New York 10022, Attention: General Counsel, with copies to CorpEqDeriv@jefferies.com

and SETG-US@jefferies.com; c/o Barclays Capital Inc. 745 Seventh Avenue, New York, NY 10019, Attention: Ilya Blanter, Email: ilya.blanter@barclays.com;

c/o Robert W. Baird & Co. Incorporated, 777 East Wisconsin Avenue, Milwaukee, Wisconsin 53202, Attention: Syndicate Department,

Facsimile: (414) 298-7474, with a copy to the Legal Department; c/o Regions Securities LLC, 615 South College Street, Suite 600,

Charlotte, North Carolina 28202, Attention: ECM Team, with a copy to ECMDesk@regions.com; c/o Stifel, Nicolaus & Company, Incorporated

One South Street, 15th Floor, Baltimore, MD 21202, Attention: Syndicate Department, Facsimile: (443) 224-1273; The Toronto-Dominion Bank,

c/o TD Securities (USA) LLC, 1 Vanderbilt Avenue, New York, NY 10017, Attn: Global Equity Derivatives, Phone: (212) 827-7306, Email: TDUSA-GEDUSInvestorSolutionSales@tdsecurities.com;

michael.murphy3@tdsecurities.com; adriano.pierroz@tdsecurities.com and ryan.eurick@tdsecurities.com; and with a copy also to Goodwin Procter

LLP, 100 Northern Avenue, Boston, Massachusetts, Facsimile: (617) 523-1231, Attention: Scott C. Chase, Esq.

SECTION 3. Obligations

Binding upon New Parties to the Agreement. Except to the extent otherwise provided in this Amendment, TD Securities (USA) LLC

and The Toronto-Dominion Bank shall be considered an Agent and a Forward Purchaser, respectively, under the Agreement and shall be subject

to the obligations and entitled to the benefits thereof to the same extent as if they were a party to the Agreement in such capacities

from and after the date hereof.

SECTION 4. No Other

Amendments; References to Agreements. This Amendment and the Agreement as amended hereby contain the entire agreement and understanding

among the parties hereto with respect to the subject matter hereof and supersede all prior and contemporaneous agreements, understandings,

inducements and conditions, express or implied, oral or written, of any nature whatsoever with respect to the subject matter hereof. Except

as set forth in this Amendment, all other terms and provisions of the Agreement shall continue in full force and effect. All references

to the Agreement in the Agreement or in any other document executed or delivered in connection therewith shall, from the date hereof,

be deemed a reference to the Agreement as amended by this Amendment. Notwithstanding anything to the contrary contained herein, this Amendment

shall not have any effect on offerings or sales of Shares prior to the Effective Date or on the terms of the Agreement, and the rights

and obligations of the parties thereunder, insofar as they relate to such offerings or sales, including, without limitation, the representations,

warranties and agreements (including the indemnification and contribution provisions), as well as the definitions of “Agent”

and “Forward Purchaser” contained in the Agreement.

SECTION 5. Counterparts.

This Amendment may be executed in any number of counterparts, each of which shall be deemed to be an original, but all such counterparts

shall together constitute one and the same Amendment.

SECTION 6. GOVERNING

LAW. THIS AMENDMENT AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED

IN ACCORDANCE WITH THE LAWS OF, THE STATE OF NEW YORK WITHOUT REGARD TO ITS CHOICE OF LAW PROVISIONS.

SECTION 7. Consent

to Jurisdiction; Waiver of Immunity. Each of the Transaction Entities, the Agents and the Forward Purchasers agree that any legal

suit, action or proceeding arising out of or based upon this Amendment or the transactions contemplated hereby shall be instituted in

(i) the federal courts of the United States of America located in the City and County of New York, Borough of Manhattan or (ii) the

courts of the State of New York located in the City and County of New York, Borough of Manhattan (collectively, the “Specified

Courts”), and irrevocably submit to the exclusive jurisdiction (except for proceedings instituted in regard to the enforcement

of a judgment of any Specified Court, as to which such jurisdiction is non-exclusive) of the Specified Courts in any such suit, action

or proceeding. Service of any process, summons, notice or document by mail to a party’s address set forth in Section 10 of

the Agreement shall be effective service of process upon such party for any suit, action or proceeding brought in any Specified Court.

Each of the Transaction Entities, the Agents and the Forward Purchasers irrevocably and unconditionally waive any objection to the laying

of venue of any suit, action or proceeding in the Specified Courts and irrevocably and unconditionally waive and agree not to plead or

claim in any Specified Court that any such suit, action or proceeding brought in any Specified Court has been brought in an inconvenient

forum.

SECTION 8. Headings.

The Section headings herein are for convenience only and shall not affect the construction hereof.

SECTION 9. Successors

and Assigns. This Amendment shall be binding upon each party hereto and their successors and assigns and any successor or assign of

any substantial portion of the party’s respective businesses and/or assets.

[Signature Page Follows]

If the foregoing is in accordance with your understanding

of our agreement, please sign and return to the Company a counterpart hereof, whereupon this instrument, along with all counterparts,

will become a binding agreement among the parties hereto in accordance with its terms.

| |

Very truly yours, |

| |

|

| |

Armada Hoffler Properties, Inc. |

| |

|

| |

By: |

/s/ Louis S. Haddad |

| |

|

Name: Louis S. Haddad |

| |

|

Title: President and Chief Executive Officer |

| |

Armada Hoffler, L.P. |

| |

|

| |

By: |

Armada Hoffler Properties, Inc., its general partner |

| |

|

| |

By: |

/s/ Louis S. Haddad |

| |

|

Name: Louis S. Haddad |

| |

|

Title: President and Chief Executive Officer |

[Signature Page to

Amendment No. 3 to Equity Offering Sales Agreement]

Accepted as of the date hereof:

| Jefferies LLC |

|

Jefferies LLC |

| |

|

|

| By: |

/s/ Michael Magarro |

|

By: |

/s/ Michael Magarro |

| |

Name: Michael Magarro |

|

|

Name: Michael Magarro |

| |

Title: Managing Director |

|

|

Title: Managing Director |

| |

|

|

| As Agent |

|

As Forward Purchaser, solely as the recipient and/or beneficiary of certain representations, warranties, covenants and indemnities set forth in this Agreement |

| Robert W. Baird & Co. Incorporated |

|

Robert W. Baird & Co. Incorporated |

| |

|

|

| By: |

/s/ Christopher Walter |

|

By: |

/s/ Christopher Walter |

| |

Name: Christopher Walter |

|

|

Name: Christopher Walter |

| |

Title: Managing Director |

|

|

Title: Managing Director |

| |

|

|

| As Agent |

|

As Forward Purchaser, solely as the recipient and/or beneficiary of certain representations, warranties, covenants and indemnities set forth in this Agreement |

| Regions Securities LLC |

|

Regions Securities LLC |

| |

|

|

| By: |

/s/ Edward L. Armstrong |

|

By: |

/s/ Edward L. Armstrong |

| |

Name: Edward L. Armstrong |

|

|

Name: Edward L. Armstrong |

| |

Title: Managing Director - ECM |

|

|

Title: Managing Director - ECM |

| |

|

|

| As Agent |

|

As Forward Purchaser, solely as the recipient and/or beneficiary of certain representations, warranties, covenants and indemnities set forth in this Agreement |

[Signature Page to Amendment No. 3

to Equity Offering Sales Agreement]

| Barclays Capital Inc. |

|

Barclays Bank PLC |

| |

|

|

| By: |

/s/ Warren Fixmer |

|

By: |

/s/ Warren Fixmer |

| |

Name: Warren Fixmer |

|

|

Name: Warren Fixmer |

| |

Title: Managing Director |

|

|

Title: Managing Director |

| |

|

|

| As Agent |

|

As Forward Purchaser, solely as the recipient and/or

beneficiary of certain representations, warranties, covenants and indemnities set forth in this Agreement |

| Stifel, Nicolaus & Company, Incorporated |

|

Stifel, Nicolaus & Company, Incorporated |

| |

|

|

| By: |

/s/ Chad M. Gorsuch |

|

By: |

/s/ Chad M. Gorsuch |

| |

Name: Chad M. Gorsuch |

|

|

Name: Chad M. Gorsuch |

| |

Title: Managing Director |

|

|

Title: Managing Director |

| |

|

|

| As Agent |

|

As Forward Purchaser, solely as the recipient and/or

beneficiary of certain representations, warranties, covenants and indemnities set forth in this Agreement |

| TD Securities (USA) LLC |

|

The Toronto-Dominion Bank |

| |

|

|

| By: |

/s/ Brad Limpert |

|

By: |

/s/ Vanessa Simonetti |

| |

Name: Brad Limpert |

|

|

Name: Vanessa Simonetti |

| |

Title: Managing Director |

|

|

Title: Managing Director |

| |

|

|

| As Agent |

|

As Forward Purchaser, solely as the recipient and/or

beneficiary of certain representations, warranties, covenants and indemnities set forth in this Agreement |

[Signature Page to Amendment No. 3

to Equity Offering Sales Agreement]

v3.24.1.1.u2

Cover

|

May 10, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 10, 2024

|

| Entity File Number |

001-35908

|

| Entity Registrant Name |

ARMADA HOFFLER

PROPERTIES, INC.

|

| Entity Central Index Key |

0001569187

|

| Entity Tax Identification Number |

46-1214914

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

222 Central Park Avenue

|

| Entity Address, Address Line Two |

Suite 2100

|

| Entity Address, City or Town |

Virginia Beach

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23462

|

| City Area Code |

757

|

| Local Phone Number |

366-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

AHH

|

| Security Exchange Name |

NYSE

|

| Redeemable Convertible Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.75% Series A Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

AHHPrA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_RedeemableConvertiblePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

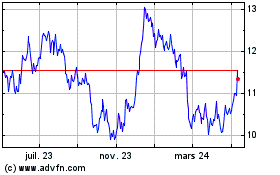

Armada Hoffler Properties (NYSE:AHH)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

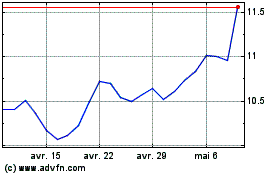

Armada Hoffler Properties (NYSE:AHH)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025