Current Report Filing (8-k)

22 Décembre 2022 - 10:02PM

Edgar (US Regulatory)

0001091748

false

0001091748

2022-12-20

2022-12-20

0001091748

us-gaap:CommonStockMember

2022-12-20

2022-12-20

0001091748

argo:Sec6.500SeniorNotesDue2042IssuedByArgoGroupU.s.Inc.AndGuaranteeWithRespectTheretoMember

2022-12-20

2022-12-20

0001091748

argo:DepositarySharesEachRepresenting11000thInterestIn7.00ResettableFixedRatePreferenceShareSeriesParValue1.00PerShareMember

2022-12-20

2022-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange

Act of 1934

Date of report (Date of earliest event reported): December 20, 2022

Argo Group International Holdings, Ltd.

(Exact Name of Registrant

as Specified in Charter)

| Bermuda |

|

001-15259 |

|

98-0214719 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

|

|

|

90 Pitts Bay Road

Pembroke HM 08

Bermuda |

|

|

|

P.O. Box HM 1282

Hamilton HM FX

Bermuda |

(Address, Including Zip Code,

of Principal

Executive Offices) |

|

|

|

(Mailing Address) |

Registrant’s

telephone number, including area code: (441) 296-5858

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common

Stock, par value of $1.00 per share |

|

ARGO |

|

New York Stock Exchange |

| 6.500% Senior Notes due 2042 issued by Argo Group U.S., Inc. and the Guarantee with respect thereto |

|

ARGD |

|

New York Stock Exchange |

| Depositary Shares, Each Representing a 1/1,000th Interest in a 7.00% Resettable Fixed Rate Preference Share, Series A, Par Value $1.00 Per Share |

|

ARGOPrA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.01. |

Entry into a Material Definitive Agreement. |

On December 20, 2022, each of Argo Group International Holdings, Ltd.,

Argo Group US, Inc., Argo International Holdings Limited (“AIH”) and Argo Underwriting Agency Limited (collectively,

the “Borrowers”) entered into Amendment No. 3 to the Credit Agreement (“Amendment No. 3”), with JPMorgan

Chase Bank, N.A., individually as a lender and as the administrative agent, and the other lender parties signatory thereto, which amends

the existing Credit Agreement, dated as of November 2, 2018, as amended (the “Credit Agreement”), among the Borrowers,

JPMorgan Chase Bank, N.A., as Administrative Agent and as a lender, and the other lenders party thereto.

Pursuant to Amendment No. 3, Goldman Sachs Bank USA was added

as a lender to the Credit Agreement and the Lenders’ Revolving Commitments were increased from $200 million to $220 million pursuant

to, and in accordance with Section 2.09(d) of the Credit Agreement. Amendment No. 3 also updated the minimum Tangible Net

Worth requirement.

Amendment No. 3 permits the sale of Argo Underwriting Agency Limited

(“AUA”) and its subsidiaries in accordance with the Share Purchase Agreement, dated as of September 8, 2022, between

AIH, as seller thereunder, and Ohio Farmers Insurance Company, as buyer thereunder. Amendment No. 3 also removes AIH and AUA as Borrowers

under the Credit Agreement upon the completion of such sale.

Amendment No. 3 also updates the benchmark provisions to replace

LIBOR with Term SOFR as a reference rate for purposes of calculating interest under the Credit Agreement.

All capitalized terms in this Item 1.01, unless defined herein, have

the meanings assigned to them in Amendment No. 3 or the Credit Agreement. The foregoing summary of Amendment No. 3 is not complete

and is qualified in its entirety by reference to the full text of Amendment No. 3, a copy of which is attached hereto as Exhibit 10.1

and incorporated herein by reference.

|

Item 2.03. |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth in

Item 1.01 above is incorporated herein by reference.

|

Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits:

|

No. |

|

Exhibit |

| |

|

| 10.1 |

|

Amendment No. 3 to the Credit Agreement, dated December 20, 2022, by and among Argo Group International Holdings, Ltd., Argo Group U.S., Inc., Argo International Holdings Limited and Argo Underwriting Agency Limited, as Borrowers, and JPMorgan Chase Bank, N.A., individually and as Administrative Agent, and the other financial institutions signatory thereto. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: December 22, 2022 |

ARGO GROUP INTERNATIONAL HOLDINGS, LTD. |

| |

|

|

| |

By: |

/s/ Scott Kirk |

| |

|

Name: Scott Kirk |

| |

|

Title: Chief Financial Officer |

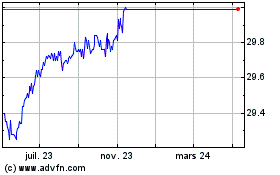

Argo (NYSE:ARGO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

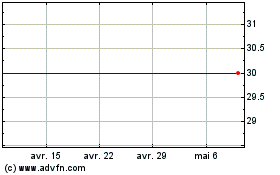

Argo (NYSE:ARGO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025