Archrock Announces Upsizing and Pricing of $700 Million of Senior Notes

12 Août 2024 - 10:45PM

Archrock, Inc. (NYSE: AROC) (“Archrock”) today announced the

pricing of an upsized private offering by Archrock Partners, L.P.

(“Archrock Partners”), a wholly-owned subsidiary of Archrock, of

$700 million aggregate principal amount of 6.625% senior notes due

2032 (the “Notes”). The Notes were priced at par. The offering is

expected to close on August 26, 2024, subject to the satisfaction

of customary closing conditions. Archrock Partners Finance Corp.

(“Finance Corp. and, together with Archrock Partners, the

“Issuers”), a wholly-owned subsidiary of Archrock Partners, will

serve as co-issuer of the Notes.

Concurrently with the pricing of this offering,

the Issuers commenced a tender offer (the “Tender Offer”) to

purchase for cash up to an aggregate principal amount of $200

million of their 6.875% Senior Unsecured Notes due 2027. The Tender

Offer is made only by and pursuant to the terms of the Offer to

Purchase, dated August 12, 2024. The Tender Offer is conditioned on

the consummation of this offering, but this offering is not

conditioned upon the completion of the Tender Offer.

Archrock intends to use the net proceeds from

the offering of the Notes to fund a portion of the cash

consideration for the previously announced acquisition of 100% of

the issued and outstanding membership interests of Total Operations

and Production Services, LLC (the “Acquisition”), to fund the

Tender Offer and to pay related fees and expenses. Archrock intends

to use any remaining net proceeds for general corporate purposes,

which may include the repayment of indebtedness, including a

portion of the outstanding borrowings under Archrock’s revolving

credit facility. The Acquisition is not conditioned on the

consummation of the offering and the offering is not conditioned on

the consummation of the Acquisition.

The Notes have not been registered under the

Securities Act of 1933, as amended (the “Securities Act”), or any

state securities laws and, unless so registered, may not be offered

or sold in the United States except pursuant to an exemption from,

or in a transaction not subject to, the registration requirements

of the Securities Act and the rules promulgated thereunder and

applicable state securities laws. The Notes will be offered only to

qualified institutional buyers in reliance on Rule 144A under the

Securities Act and non-U.S. persons in transactions outside the

United States in reliance on Regulation S under the Securities

Act.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy the securities

described herein, nor shall there be any sale of these securities

in any jurisdiction in which such an offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

About Archrock

Archrock is an energy infrastructure company

with a primary focus on midstream natural gas compression and a

commitment to helping its customers produce, compress and transport

natural gas in a safe and environmentally responsible way.

Headquartered in Houston, Texas, Archrock is a premier provider of

natural gas compression services to customers in the energy

industry throughout the U.S. and a leading supplier of aftermarket

services to customers that own compression equipment. For more

information on how Archrock embodies its purpose, WE POWER A

CLEANER AMERICA, please visit www.archrock.com.

About Archrock Partners

Archrock Partners is a leading provider of

natural gas compression services to customers in the oil and

natural gas industry throughout the United States. Archrock owns

all of the limited and general partnership interests in Archrock

Partners.

Forward-Looking Statements

All statements in this release (and oral

statements made regarding the subjects of this release) other than

historical facts are forward-looking statements within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements rely on a number of assumptions

concerning future events and are subject to a number of

uncertainties and factors that could cause actual results to differ

materially from such statements, many of which are outside Archrock

or Archrock Partners’ control. Forward-looking information

includes, but is not limited to: statements regarding Archrock

Partners’ proposed offering, the completion of such offering, the

intended use of net proceeds from the proposed offering, and the

impact of market conditions on such offering.

While Archrock and Archrock Partners believe

that the assumptions concerning future events are reasonable, they

caution that there are inherent difficulties in predicting certain

important factors that could impact the future performance or

results of its business. Among the factors that could cause results

to differ materially from those indicated by such forward-looking

statements are: local, regional and national economic conditions

and the impact they may have on Archrock Partners’ and its

customers; conditions in the oil and gas industry, including the

level of production of, demand for or price of oil or natural gas;

changes in safety, health, environmental and other regulations; the

financial condition of Archrock Partners’ customers; the failure of

any customer to perform its contractual obligations; and the

performance of Archrock.

These forward-looking statements are also

affected by the risk factors, forward-looking statements and

challenges and uncertainties described in Archrock’s Annual Report

on Form 10-K for the year ended December 31, 2023, as amended by

Amendment No. 1 on Form 10-K/A, Quarterly Report on Form 10-Q for

the quarter ended March 31, 2024, Quarterly Report on Form 10-Q for

the quarter ended June 30, 2024, and those reports set forth from

time to time in Archrock’s filings with the Securities and Exchange

Commission, which are available at www.archrock.com. Except as

required by law, Archrock and Archrock Partners expressly disclaim

any intention or obligation to revise or update any forward-looking

statements whether as a result of new information, future events or

otherwise.

SOURCE: Archrock, Inc.

For information, contact:

|

Archrock, Inc. |

|

INVESTORSMegan RepineVP of Investor

Relations281-836-8360investor.relations@archrock.com |

|

MEDIAAndrew Siegel / Jed RepkoJoele Frank212-355-4449 |

| |

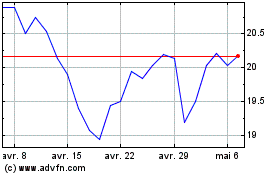

Archrock (NYSE:AROC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Archrock (NYSE:AROC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025