0000014693false00000146932024-01-082024-01-080000014693us-gaap:CommonClassAMember2024-01-082024-01-080000014693us-gaap:NonvotingCommonStockMember2024-01-082024-01-080000014693bfb:OnePointTwoPercentNotesDueinFiscalTwoThousandTwentySevenMember2024-01-082024-01-080000014693bfb:TwoPointSixPercentNotesDueinFiscalTwoThousandTwentyNineMember2024-01-082024-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 8, 2024

Brown-Forman Corporation

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-00123 | | 61-0143150 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | |

| 850 Dixie Highway, | Louisville, | Kentucky | | 40210 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | | | |

Registrant’s telephone number, including area code: (502) 585-1100

Not Applicable

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock (voting), $0.15 par value | BFA | New York Stock Exchange |

Class B Common Stock (nonvoting), $0.15 par value | BFB | New York Stock Exchange |

1.200% Notes due 2026 | BF26 | New York Stock Exchange |

2.600% Notes due 2028 | BF28 | New York Stock Exchange |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Retirement of Matthew E. Hamel as Executive Vice President, General Counsel and Secretary

On January 8, 2024, Matthew E. Hamel, Executive Vice President, General Counsel and Secretary of Brown-Forman Corporation (the “Company”), informed the Company of his intention to retire effective May 1, 2024. Following Mr. Hamel’s retirement, Michael E. Carr, Jr., who currently serves as the Company’s Vice President, Associate General Counsel – Regional & Corporate Development, will become General Counsel and Secretary of the Company effective May 1, 2024.

Item 7.01. Regulation FD Disclosure

In connection with the retirement of Mr. Hamel and the appointment of Mr. Carr, the Company issued a press release on January 10, 2024, a copy of which is attached as Exhibit 99.1 and incorporated by reference in Item 7.01 of this Current Report on Form 8-K.

The information furnished pursuant to this Item 7.01 (and the related information in Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Brown-Forman Corporation Press Release dated January 10, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| BROWN-FORMAN CORPORATION |

| (Registrant) |

| |

| |

| Date: January 10, 2024 | /s/ Matthew E. Hamel |

| Matthew E. Hamel |

| Executive Vice President, General Counsel and Corporate Secretary

|

BROWN-FORMAN ANNOUNCES GENERAL COUNSEL TRANSITION

Matt Hamel to Retire After 16-Year Company Career; Mike Carr Named Successor

January 10, 2024, LOUISVILLE, KY -- Brown-Forman Corporation announces today that Matt Hamel, executive vice president, general counsel and secretary, will retire on May 1. Mike Carr, vice president, associate general counsel for regional and corporate development, will succeed Hamel at that time.

As general counsel, Hamel has led Brown‐Forman’s legal, compliance, risk, and public affairs teams, overseeing activities related to corporate governance, SEC and Sarbanes-Oxley compliance, regulatory compliance, trade practices, trademarks, litigation, acquisitions, enterprise risk management, government relations, and more. He founded and leads a nationwide organization for general counsel and other senior governance professionals at publicly listed family-controlled companies.

Prior to joining Brown‐Forman in 2007, Hamel was with Dow Jones & Company, Dow Jones Reuters Business Interactive LLC (Factiva), and Colgate-Palmolive Company. He began his career at the law firm of White & Case.

“Matt has led the global expansion of Brown-Forman’s legal department, further deepened our strong culture of ethics and compliance, and helped root key business decisions in our values. His counsel is evident not only in our daily practices and thoughtful corporate and board governance, but also in the long-term positioning and strategy of our company,” said President and Chief Executive Officer Lawson Whiting. “We thank Matt for his years of service and wish him well in retirement.”

Mike Carr has been with Brown-Forman for more than a decade, serving in key roles such as associate general counsel of Europe and, currently, vice president, associate general counsel for regional and corporate development. Carr was instrumental in recent acquisitions that are key to the company’s long-term global growth. He played a leadership role stewarding a number of international route-to-consumer transformations and negotiating global agreements such as the Jack Daniel’s and Coca-Cola ready-to-drink relationship, as well as the recent acquisitions of Gin Mare and Diplomático.

Carr brings to the role a background in securities law, corporate law, corporate governance, commercial law, and mergers and acquisitions. Prior to joining Brown-Forman, Carr practiced corporate and securities law with Frost Brown Todd in Louisville, Kentucky, and Bass, Berry & Sims, PLC, in Nashville, Tennessee. Carr is a graduate of the University of Mississippi, where he received a Bachelor of Accountancy, Masters of Taxation, and Juris Doctorate.

“Mike’s deep expertise and influence spans every market where Brown-Forman conducts business. He has been instrumental in overseeing legal affairs and providing sound, strategic legal guidance for large and complex matters,” said Whiting. “His leadership capabilities and unique mix of experiences within Brown-Forman, coupled with his background as an attorney and certified public accountant, have prepared Mike well for this role. I look forward to partnering with Mike as we continue to grow the business for the long-term.”

As general counsel, Carr will serve as the primary legal advisor to the board of directors and the company and will lead the global compliance, legal, risk, and public affairs teams. He will also serve as secretary to the board of directors.

###

About Brown-Forman

For more than 150 years, Brown-Forman Corporation has enriched the experience of life by responsibly building fine quality beverage alcohol brands, including Jack Daniel's Tennessee Whiskey, Jack Daniel's Ready-to-Drinks, Jack Daniel's Tennessee Honey, Jack Daniel's Tennessee Fire, Jack Daniel's Tennessee Apple, Gentleman Jack, Jack Daniel's Single Barrel, Woodford Reserve, Old Forester, Coopers’ Craft, The GlenDronach, Benriach, Glenglassaugh, Slane, Herradura, el Jimador, New Mix, Korbel, Sonoma-Cutrer, Chambord, Fords Gin, Gin Mare, and Diplomático Rum. Brown-Forman’s brands are supported by approximately 5,600 employees globally and sold in more than 170 countries worldwide. For more information about the company, please visit brown-forman.com.

Important Information on Forward-Looking Statements:

This press release contains statements, estimates, and projections that are “forward-looking statements” as defined under U.S. federal securities laws. Words such as “aim,” “anticipate,” “aspire,” “believe,” “can,” “continue,” “could,” “envision,” “estimate,” “expect,” “expectation,” “intend,” “may,” “might,” “plan,” “potential,” “project,” “pursue,” “see,” “seek,” “should,” “will,” “would,” and similar words indicate forward-looking statements, which speak only as of the date we make them. Except as required by law, we do not intend to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. By their nature, forward-looking statements involve risks, uncertainties, and other factors (many beyond our control) that could cause our actual results to differ materially from our historical experience or from our current expectations or projections.

These risks and uncertainties include, but are not limited to:

•Our substantial dependence upon the continued growth of the Jack Daniel's family of brands

•Substantial competition from new entrants, consolidations by competitors and retailers, and other competitive activities, such as pricing actions (including price reductions, promotions, discounting, couponing, or free goods), marketing, category expansion, product introductions, or entry or expansion in our geographic markets or distribution networks

•Route-to-consumer changes that affect the timing of our sales, temporarily disrupt the marketing or sale of our products, or result in higher fixed costs

•Disruption of our distribution network or inventory fluctuations in our products by distributors, wholesalers, or retailers

•Changes in consumer preferences, consumption, or purchase patterns – particularly away from larger producers in favor of small distilleries or local producers, or away from brown spirits, our premium products, or spirits generally, and our ability to anticipate or react to them; further legalization of marijuana; bar, restaurant, travel, or other on-premise declines; shifts in demographic or health and wellness trends; or unfavorable consumer reaction to new products, line extensions, package changes, product reformulations, or other product innovation

•Production facility, aging warehouse, or supply chain disruption

•Imprecision in supply/demand forecasting

•Higher costs, lower quality, or unavailability of energy, water, raw materials, product ingredients, or labor

•Risks associated with acquisitions, dispositions, business partnerships, or investments – such as acquisition integration, termination difficulties or costs, or impairment in recorded value

•Impact of health epidemics and pandemics, and the risk of the resulting negative economic impacts and related governmental actions

•Unfavorable global or regional economic conditions and related economic slowdowns or recessions, low consumer confidence, high unemployment, weak credit or capital markets, budget deficits, burdensome government debt, austerity measures, higher interest rates, higher taxes, political instability, higher inflation, deflation, lower returns on pension assets, or lower discount rates for pension obligations

•Product recalls or other product liability claims, product tampering, contamination, or quality issues

•Negative publicity related to our company, products, brands, marketing, executive leadership, employees, Board of Directors, family stockholders, operations, business performance, or prospects

•Failure to attract or retain key executive or employee talent

•Risks associated with being a U.S.-based company with a global business, including commercial, political, and financial risks; local labor policies and conditions; protectionist trade policies, or economic or trade sanctions, including additional retaliatory tariffs on American whiskeys and the effectiveness of our actions to mitigate the negative impact on our margins, sales, and distributors; compliance with local trade practices and other regulations; terrorism, kidnapping, extortion, or other types of violence; and health pandemics

•Failure to comply with anti-corruption laws, trade sanctions and restrictions, or similar laws or regulations

•Fluctuations in foreign currency exchange rates, particularly a stronger U.S. dollar

•Changes in laws, regulatory measures, or governmental policies, especially those affecting production, importation, marketing, labeling, pricing, distribution, sale, or consumption of our beverage alcohol products

•Tax rate changes (including excise, corporate, sales or value-added taxes, property taxes, payroll taxes, import and export duties, and tariffs) or changes in related reserves, changes in tax rules or accounting standards, and the unpredictability and suddenness with which they can occur

•Decline in the social acceptability of beverage alcohol in significant markets

•Significant additional labeling or warning requirements or limitations on availability of our beverage alcohol products

•Counterfeiting and inadequate protection of our intellectual property rights

•Significant legal disputes and proceedings, or government investigations

•Cyber breach or failure or corruption of our key information technology systems or those of our suppliers, customers, or direct and indirect business partners, or failure to comply with personal data protection laws

•Our status as a family “controlled company” under New York Stock Exchange rules, and our dual-class share structure

For further information on these and other risks, please refer to our public filings, including the “Risk Factors” section of our annual report on Form 10-K and quarterly reports on form 10-Q filed with the Securities and Exchange Commission.

v3.23.4

Document and Entity Information

|

Jan. 08, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity Registrant Name |

Brown-Forman Corporation

|

| Entity Central Index Key |

0000014693

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-00123

|

| Entity Tax Identification Number |

61-0143150

|

| Entity Address, Address Line One |

850 Dixie Highway,

|

| Entity Address, City or Town |

Louisville,

|

| Entity Address, State or Province |

KY

|

| Entity Address, Postal Zip Code |

40210

|

| City Area Code |

(502)

|

| Local Phone Number |

585-1100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Class A [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock (voting), $0.15 par value

|

| Trading Symbol |

BFA

|

| Security Exchange Name |

NYSE

|

| Nonvoting Common Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class B Common Stock (nonvoting), $0.15 par value

|

| Trading Symbol |

BFB

|

| Security Exchange Name |

NYSE

|

| One Point Two Percent Notes Due in Fiscal Two Thousand Twenty Seven [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.200% Notes due 2026

|

| Trading Symbol |

BF26

|

| Security Exchange Name |

NYSE

|

| Two Point Six Percent Notes Due in Fiscal Two Thousand Twenty Nine [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.600% Notes due 2028

|

| Trading Symbol |

BF28

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_NonvotingCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_LongtermDebtTypeAxis=bfb_OnePointTwoPercentNotesDueinFiscalTwoThousandTwentySevenMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_LongtermDebtTypeAxis=bfb_TwoPointSixPercentNotesDueinFiscalTwoThousandTwentyNineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

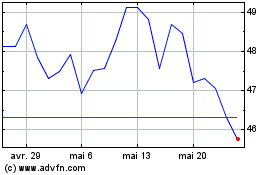

Brown Forman (NYSE:BF.B)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Brown Forman (NYSE:BF.B)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025