1934 Act Registration No. 1-31731

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Dated May 10, 2024

Chunghwa Telecom Co., Ltd.

(Translation of Registrant’s Name into English)

21-3 Xinyi Road Sec. 1,

Taipei, Taiwan, 100 R.O.C.

(Address of Principal Executive Office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of form 20-F or Form 40-F.)

Form 20-F ☒ Form 40-F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

(If “Yes” is marked, indicated below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable)

EXHIBIT INDEX

|

|

|

|

Exhibit |

|

Description |

|

99.1 |

|

Announcement on 2024/05/09: |

The Company will participate in investor conference held by Nomura in Japan |

|

|

|

|

99.2 |

|

Announcement on 2024/05/10: |

The Company announced consolidated financial statements for the three months ended March 31, 2024 approved by the Board of Directors |

|

|

|

|

99.3 |

|

Announcement on 2024/05/10: |

Chunghwa Telecom announced its operating results for April 2024 |

|

|

|

|

99.4 |

|

Announcement on 2024/05/10 |

April 2024 sales |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant Chunghwa Telecom Co., Ltd. has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Date: May 10, 2024 |

|

|

|

|

Chunghwa Telecom Co., Ltd. |

|

|

|

|

|

By: /s/Yu-Shen Chen |

|

Name: Yu-Shen Chen |

|

Title: Chief Financial Officer |

EXHIBIT 99.1

The Company will participate in investor conference held by Nomura in Japan

Date of events: 2024/05/13

Content:

1.Date of institutional investor conference: 2024/05/13

2.Time of institutional investor conference: 08:00 am (Taipei time)

3.Location of institutional investor conference: Tokyo

4.Outline of institutional investor conference: Please refer to

http://mops.twse.com.tw and https://www.cht.com.tw/chtir for the presentation of the investor conference.

5.Any other matters that need to be specified: None

EXHIBIT 99.2

The Company announced consolidated financial statements for the three months ended March 31, 2024 approved by the Board of Directors

Date of events: 2024/05/10

Contents:

1.Date of submission to the board of directors or approval by the board of directors: 2024/05/10

2.Date of approval by the audit committee: 2024/05/08

3.Start and end dates of financial reports or annual self-assessed financial information of the reporting period (XXXX/XX/XX~XXXX/XX/XX): 2024/01/01~2024/03/31

4.Operating revenue accumulated from 1/1 to end of the period (thousand NTD): 54,943,471

5.Gross profit (loss) from operations accumulated from 1/1 to end of the period (thousand NTD): 20,489,179

6.Net operating income (loss) accumulated from 1/1 to end of the period (thousand NTD): 11,924,220

7.Profit (loss) before tax accumulated from 1/1 to end of the period (thousand NTD): 11,987,740

8.Profit (loss) accumulated from 1/1 to end of the period (thousand NTD): 9,604,183

9.Profit (loss) during the period attributable to owners of parent accumulated from 1/1 to end of the period (thousand NTD): 9,391,419

10.Basic earnings (loss) per share accumulated from 1/1 to end of the period (NTD): 1.21

11.Total assets end of the period (thousand NTD): 528,378,358

12.Total liabilities end of the period (thousand NTD): 123,738,420

13.Equity attributable to owners of parent end of the period (thousand NTD): 392,503,575

14.Any other matters that need to be specified: None

EXHIBIT 99.3

Chunghwa Telecom announced its operating results for April 2024

Date of events: 2024/05/10

Contents:

1.Date of occurrence of the event: 2024/05/10

2.Company name: Chunghwa Telecom Co., Ltd.

3.Relationship to the Company (please enter "head office" or "subsidiaries"): Head office

4.Reciprocal shareholding ratios: N/A

Chunghwa Telecom announced its unaudited operating results on a consolidated basis for April 2024:

The Company's revenue was approximately NT$17.93 billion, income from operation was approximately NT$4.02 billion, net income attributable to stockholders of the parent was approximately NT$3.16 billion, EBITDA was approximately NT$7.32 billion and earnings per share was NT$0.41 for April 2024.

The Company's revenue was approximately NT$72.87 billion, income from operation was approximately NT$15.95 billion, net income attributable to stockholders of the parent was approximately NT$12.55 billion, EBITDA was approximately NT$29.15 billion and earnings per share was NT$1.62 for the four months ended April 30, 2024.

7.Any other matters that need to be specified: None

EXHIBIT 99.4

Chunghwa Telecom

May 10, 2024

This is to report the changes or status of 1) Sales volume 2) Funds lent to other parties 3) Endorsements and guarantees 4) Financial derivative transactions for the period of April 2024.

1) Sales volume (NT$ Thousand)

|

|

|

|

|

|

|

|

|

|

|

|

Period |

|

Items |

|

2024 |

|

2023 |

|

Changes |

|

% |

|

Apr. |

|

Net sales |

|

17,928,904 |

|

17,079,880 |

|

(+)849,024 |

|

(+)4.97 % |

|

Jan.-Apr. |

|

Net sales |

|

72,872,374 |

|

71,290,786 |

|

(+)1,581,588 |

|

(+)2.22 % |

|

2) Funds lent to other parties (NT$ thousand)

|

|

|

|

Lending Company |

Current Month |

Last Month |

Specified Amount |

Parent Company |

0 |

0 |

0 |

Subsidiaries |

0 |

0 |

0 |

3) Endorsements and guarantees (NT$ thousand)

|

|

|

|

Guarantor |

Increase (Decrease) |

Accumulated |

Limited Amount |

Parent Company |

0 |

0 |

0 |

Subsidiaries |

0 |

500,000 |

3,030,726 |

4) Financial derivative transactions accumulated from January to the reporting month (NT$ thousand)

a-1 Non-trading purpose (that does not meet the criteria for hedge accounting)

|

|

|

|

|

Forward Contract |

Margins Paid |

|

0 |

Premiums Received (Paid) |

|

0 |

|

|

|

Outstanding Position |

Total amount of contract |

183,595 |

Fair Value |

3,211 |

The amount of unrealized gain(loss) recognized this year |

2,729 |

|

|

|

Settled Position |

Total amount of contract |

161,794 |

The amount of realized gain(loss) recognized this year |

4,789 |

|

|

|

a-2 Non-trading purpose (that meets the criteria for hedge accounting)

|

|

|

|

|

Forward Contract |

Margins Paid |

|

0 |

Premiums Received (Paid) |

|

0 |

|

|

|

Outstanding Position |

Total amount of contract |

109,575 |

Fair Value |

1,275 |

The amount of unrealized gain(loss) recognized this year |

1,318 |

|

|

|

Settled Position |

Total amount of contract |

88,461 |

The amount of realized gain(loss) recognized this year |

1,551 |

|

|

|

b Trading purpose : None

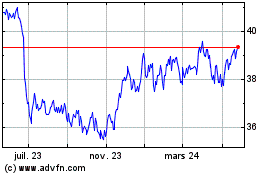

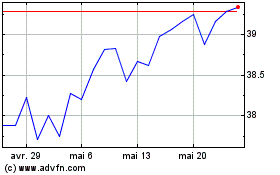

Chunghwa Telecom (NYSE:CHT)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Chunghwa Telecom (NYSE:CHT)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025