0001856525false00018565252024-06-042024-06-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

___________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 4, 2024

___________________________

Core & Main, Inc.

(Exact name of registrant as specified in its charter)

___________________________

| | | | | | | | |

| Delaware | 001-40650 | 86-3149194 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | |

| 1830 Craig Park Court | | |

St. Louis, Missouri | | 63146 |

| (Address of principal executive offices) | | (Zip Code) |

(314) 432-4700

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

___________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Class | | Trading Symbol | | Name of Each Exchange

on Which Registered |

| Class A common stock, par value $0.01 per share | | CNM | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Conditions

On June 4, 2024, Core & Main, Inc. (“Core & Main”) issued a press release announcing its results of operations for the fiscal first quarter ended April 28, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

On June 4, 2024, Core & Main posted to the “Investor Relations” section of its website the presentation that accompanied the earnings conference call. A copy of the investor presentation is attached hereto as Exhibit 99.2.

The information provided pursuant to this Item 2.02 and in Exhibit 99.1 and Exhibit 99.2 is being “furnished” herewith and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by Core & Main under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in such filings, except as shall be expressly set forth by specific reference in any such filings.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document)* |

* Filed herewith.

** Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Core & Main, Inc. |

| | |

| By: | /s/ Mark G. Whittenburg |

| Name: | Mark G. Whittenburg |

| Title: | General Counsel and Secretary |

Date: June 4, 2024

FOR IMMEDIATE RELEASE

Core & Main Announces Fiscal 2024 First Quarter Results

ST. LOUIS, June 4, 2024—Core & Main Inc. (NYSE: CNM), a leader in advancing reliable infrastructure with local service, nationwide, today announced financial results for the first quarter ended April 28, 2024.

Fiscal 2024 First Quarter Results (Compared with Fiscal 2023 First Quarter)

•Net sales increased 10.6% to $1,741 million

•Gross profit increased 6.6% to $468 million; gross profit margin decreased 100 basis points to 26.9%

•Net income decreased 24.1% to $101 million

•Diluted earnings per share decreased 2.0% to $0.49

•Adjusted EBITDA (Non-GAAP) decreased 1.4% to $217 million; Adjusted EBITDA margin (Non-GAAP) was 12.5%

•Net cash provided by operating activities was $78 million

•Net Debt Leverage (Non-GAAP) was 2.7x as of April 28, 2024

•Closed five acquisitions during and after the quarter: Eastern Supply, Dana Kepner, ACF West, EGW Utilities and Geothermal Supply Company

"Our first quarter results demonstrate the effectiveness of our strategy and resilient business model," said Steve LeClair, chair and CEO of Core & Main.

"End market demand was solid in the first quarter and our teams continue to make progress executing our product, customer and geographic expansion initiatives to drive above market growth. We were pleased to achieve low single-digit organic net sales growth, double-digit total net sales growth and strong operating cash flow for the quarter."

"With an addressable market totaling $39 billion across highly fragmented markets, we are actively managing a strong pipeline of M&A opportunities. Year-to-date, we have closed five acquisitions that offer expansion into new geographies, access to new product lines and the addition of key talent, while aligning with our strategy of advancing reliable infrastructure. The integrations of these businesses, including our largest acquisition to date, Dana Kepner, are progressing according to plan. M&A is an important component of our growth strategy and I'm proud of our team's ability to execute it so consistently."

LeClair concluded, "I am grateful for our associates' dedication to delivering outstanding service to our customers and I am excited about what we have accomplished so far this year. We are confident our strategy will drive ongoing value creation as we continue to execute our growth and capital allocation priorities. We have many levers for driving profitable growth, the cash flow to capitalize on it and the team to execute it."

Three Months Ended April 28, 2024

Net sales for the three months ended April 28, 2024 increased $167 million, or 10.6%, to $1,741 million compared with $1,574 million for the three months ended April 30, 2023. The increase in net sales was primarily attributable to an increase from acquisitions and slight improvements in our end-markets. The net sales for pipes, valves & fittings and storm drainage increased due to acquisitions and slight improvements in our end-markets. Net sales for fire protection products declined due to lower selling prices partially offset by acquisitions. Net sales of meter products benefited from higher volumes due to an increasing adoption of smart meter technology by municipalities, increased product availability, acquisitions and higher selling prices.

Gross profit for the three months ended April 28, 2024 increased $29 million, or 6.6%, to $468 million compared with $439 million for the three months ended April 30, 2023. Gross profit increased due to increased net sales partially offset by a decrease in gross profit as a percentage of net sales. Gross profit as a percentage of net sales for the three months ended April 28, 2024 was 26.9% compared with 27.9% for the three months ended April 30, 2023. The overall decrease in gross profit as a percentage of net sales was primarily attributable to larger prior year benefits from strategic inventory investments during an inflationary environment partially offset by execution of our gross margin initiatives and accretive acquisitions.

Selling, general and administrative ("SG&A") expenses for the three months ended April 28, 2024 increased $34 million, or 15.2%, to $257 million compared with $223 million during the three months ended April 30, 2023. The increase was primarily attributable to an increase of $22 million in personnel expenses along with higher facility and other distribution costs related to acquisitions and inflation. SG&A expenses as a percentage of net sales were 14.8% for the three months ended April 28, 2024 compared with 14.2% for the three months ended April 30, 2023. The increase was primarily attributable to investments in growth, inflationary cost impacts and acquisitions.

Net income for the three months ended April 28, 2024 decreased $32 million, or 24.1%, to $101 million compared with $133 million for the three months ended April 30, 2023. The decrease in net income was primarily attributable to a decrease in operating income resulting from higher SG&A and amortization expenses, and an increase in interest expense.

The Class A common stock basic and diluted earnings per share for the three months ended April 28, 2024 both decreased 2.0% to $0.49 compared with $0.50 for the three months ended April 30, 2023. The decrease in basic earnings per share was attributable to higher Class A share counts from exchanges of partnership interests of Core & Main Holdings, LP partially offset by an increase in net income attributable to Core & Main, Inc. Diluted earnings per share decreased due to a decline in net income partially offset by lower share counts following the share repurchase transactions executed throughout fiscal 2023.

Adjusted EBITDA for the three months ended April 28, 2024 decreased $3 million, or 1.4%, to $217 million compared with $220 million for the three months ended April 30, 2023. The decrease in Adjusted EBITDA was primarily attributable to higher SG&A expenses partially offset by higher gross profit. For a reconciliation of Adjusted EBITDA to net income or net income attributable to Core & Main, Inc., the most comparable GAAP financial metric, as applicable, see “Non-GAAP Financial Measures” below.

Liquidity and Capital Resources

Net cash provided by operating activities for the three months ended April 28, 2024 was $78 million compared with $120 million for the three months ended April 30, 2023. The $42 million decrease in cash provided by operating activities was primarily driven by higher income tax payments due to higher taxable income of Core & Main, Inc. following exchanges of partnership interests of Core & Main Holdings, LP throughout fiscal 2023, increased interest payments and more typical investment in working capital in the three months ended April 28, 2024.

Net debt, calculated as gross consolidated debt net of cash and cash equivalents, as of April 28, 2024 was $2,419 million. Net Debt Leverage (defined as the ratio of net debt to Adjusted EBITDA for the last 12 months) was 2.7x, an increase of 1.0x from April 30, 2023. The increase in Net Debt Leverage was primarily attributable to higher borrowings to fund investments in organic growth, acquisitions and share repurchases since April 30, 2023.

As of April 28, 2024, we had $241 million outstanding borrowings on our senior asset-based revolving credit facility ("Senior ABL Credit Facility"), which provides for borrowings of up to $1,250 million, subject to borrowing base availability. As of April 28, 2024, after giving effect to approximately $16 million of letters of credit issued under the Senior ABL Credit Facility, Core & Main LP would have been able to borrow approximately $993 million under the Senior ABL Credit Facility, subject to borrowing base availability.

Core & Main Announces Fiscal 2024 First Quarter Results

On February 9, 2024, we entered into an additional $750 million senior term loan, which matures on February 9, 2031 (the "2031 Senior Term Loan"). The 2031 Senior Term Loan requires quarterly principal payments, payable on the last business day of each fiscal quarter in an amount equal to approximately 0.25% of the original principal amount. The remaining balance is payable upon final maturity of the 2031 Senior Term Loan on February 9, 2031. The 2031 Senior Term Loan bears interest at a rate equal to (i) term secured overnight financing rate ("Term SOFR") plus, in each case, an applicable margin of 2.25% or (ii) an alternate base rate plus an applicable margin of 1.25%. The 2031 Senior Term Loan is subject to a Term SOFR "floor" of 0.00%.

On February 12, 2024, we entered into an instrument pursuant to which we will make payments to a third-party based upon a fixed interest rate of 3.913% and receive payments based upon the one-month Term SOFR rate. The interest rate swap has a starting notional amount of $750 million that increases to $1,500 million on July 27, 2026 through the instrument maturity on July 27, 2028. The instrument is intended to reduce our exposure to variable interest rates.

Fiscal 2024 Outlook

"We are narrowing and raising our expectation for fiscal 2024 net sales and Adjusted EBITDA to reflect recent acquisitions and our first quarter performance," LeClair continued. "End market demand has been solid and we expect this to continue through the end of the year. We expect sales volume to more than offset slight price deflation in fiscal 2024, yielding low single-digit average daily sales growth excluding acquisitions. We expect the M&A we completed through today will contribute 7% to 8% of our net sales growth in fiscal 2024. Taken altogether, we now expect net sales to range from $7.5 to $7.6 billion, and we expect Adjusted EBITDA to range from $935 to $975 million. We are confident in our ability to continue delivering strong performance in 2024. Our business model, commitment to driving shareholder value and ability to successfully navigate changes in the macro environment position us well for the long-term."

Conference Call & Webcast Information

Core & Main will host a live conference call and webcast on June 4, 2024 at 8:30 a.m. ET to discuss the company's financial results. The webcast will be accessible via the events calendar at ir.coreandmain.com. The conference call may also be accessed by dialing 833-470-1428 or +1-404-975-4839 (international). The passcode for the call is 988688. To ensure participants are connected for the full call, please dial in at least 10 minutes prior to the start of the call.

An archived version of the webcast will be available immediately following the call. A slide presentation highlighting Core & Main’s results will also be made available on the Investor Relations section of Core & Main’s website prior to the call.

About Core & Main

Based in St. Louis, Core & Main is a leader in advancing reliable infrastructure™ with local service, nationwide®. As a leading specialized distributor with a focus on water, wastewater, storm drainage and fire protection products and related services, Core & Main provides solutions to municipalities, private water companies and professional contractors across municipal, non-residential and residential end markets, nationwide. With more than 350 locations across the U.S., the company provides its customers local expertise backed by a national supply chain. Core & Main’s nearly 5,500 associates are committed to helping their communities thrive with safe and reliable infrastructure. Visit coreandmain.com to learn more.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this press release include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include information concerning Core & Main’s financial and operating outlook, as well as any other statement that does not directly relate to any historical or current fact. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “forecasts,” “expects,” “intends,” “plans,” “anticipates,” “projects,” “outlook,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “preliminary,” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements.

Core & Main Announces Fiscal 2024 First Quarter Results

Factors that could cause actual results and outcomes to differ from those reflected in forward-looking statements include, without limitation, declines, volatility and cyclicality in the U.S. residential and non-residential construction markets; slowdowns in municipal infrastructure spending and delays in appropriations of federal funds; our ability to competitively bid for municipal contracts; price fluctuations in our product costs; our ability to manage our inventory effectively, including during periods of supply chain disruptions; risks involved with acquisitions and other strategic transactions, including our ability to identify, acquire, close or integrate acquisition targets successfully; the fragmented and highly competitive markets in which we compete and consolidation within our industry; the development of alternatives to distributors of our products in the supply chain; our ability to hire, engage and retain key personnel, including sales representatives, qualified branch, district and regional managers and senior management; our ability to identify, develop and maintain relationships with a sufficient number of qualified suppliers and the potential that our exclusive or limited supplier distribution rights are terminated; the availability of freight; the ability of our customers to make payments on credit sales; changes in supplier rebates or other terms of our supplier agreements; our ability to identify and introduce new products and product lines effectively; the spread of, and response to, public health crises, and the inability to predict the ultimate impact on us; costs and potential liabilities or obligations imposed by environmental, health and safety laws and requirements; regulatory change and the costs of compliance with regulation; changes in stakeholder expectations in respect of environmental, social and governance and sustainability practices; exposure to product liability, construction defect and warranty claims and other litigation and legal proceedings; potential harm to our reputation; difficulties with or interruptions of our fabrication services; safety and labor risks associated with the distribution of our products; interruptions in the proper functioning of our and our third-party service providers' information systems, including from cybersecurity threats; impairment in the carrying value of goodwill, intangible assets or other long-lived assets; our ability to continue our customer relationships with short-term contracts; risks associated with importing and exporting our products internationally; our ability to maintain effective internal controls over financial reporting and remediate any material weaknesses; our indebtedness and the potential that we may incur additional indebtedness that might restrict our operating flexibility; the limitations and restrictions in the agreements governing our indebtedness, the Amended and Restated Limited Partnership Agreement of Core & Main Holdings, LP, as amended, and the Tax Receivable Agreements (each as defined in our Annual Report on Form 10-K for the fiscal year ended January 28, 2024); increases in interest rates; changes in our credit ratings and outlook; our ability to generate the significant amount of cash needed to service our indebtedness; our organizational structure, including our payment obligations under the Tax Receivable Agreements, which may be significant; our ability to sustain an active, liquid trading market for our Class A common stock; and risks related to other factors discussed under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended January 28, 2024.

Additional information concerning these and other factors can be found in our filings with the Securities and Exchange Commission. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Contact:

Investor Relations:

Robyn Bradbury, 314-995-9116

InvestorRelations@CoreandMain.com

Core & Main Announces Fiscal 2024 First Quarter Results

CORE & MAIN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Amounts in millions (except share and per share data), unaudited

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | April 28, 2024 | | April 30, 2023 |

| | | | |

| Net sales | | $ | 1,741 | | | $ | 1,574 | |

| Cost of sales | | 1,273 | | | 1,135 | |

| Gross profit | | 468 | | | 439 | |

| Operating expenses: | | | | |

| Selling, general and administrative | | 257 | | | 223 | |

| Depreciation and amortization | | 43 | | | 35 | |

| Total operating expenses | | 300 | | | 258 | |

| Operating income | | 168 | | | 181 | |

| Interest expense | | 34 | | | 17 | |

| | | | |

| Income before provision for income taxes | | 134 | | | 164 | |

| Provision for income taxes | | 33 | | | 31 | |

| Net income | | 101 | | | 133 | |

| Less: net income attributable to non-controlling interests | | 6 | | | 47 | |

| Net income attributable to Core & Main, Inc. | | $ | 95 | | | $ | 86 | |

| | | | |

| Earnings per share | | | | |

| Basic | | $ | 0.49 | | | $ | 0.50 | |

| Diluted | | $ | 0.49 | | | $ | 0.50 | |

| Number of shares used in computing EPS | | | | |

| Basic | | 192,194,061 | | | 171,597,317 | |

| Diluted | | 202,615,824 | | | 243,716,764 | |

Core & Main Announces Fiscal 2024 First Quarter Results

CORE & MAIN, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

Amounts in millions (except share and per share data), unaudited

| | | | | | | | | | | |

| April 28, 2024 | | January 28, 2024 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 30 | | | $ | 1 | |

| Receivables, net of allowance for credit losses of $13 and $12, respectively | 1,200 | | | 973 | |

| Inventories | 945 | | | 766 | |

| Prepaid expenses and other current assets | 48 | | | 33 | |

| Total current assets | 2,223 | | | 1,773 | |

| Property, plant and equipment, net | 160 | | | 151 | |

| Operating lease right-of-use assets | 206 | | | 192 | |

| Intangible assets, net | 971 | | | 784 | |

| Goodwill | 1,845 | | | 1,561 | |

| Deferred income taxes | 546 | | | 542 | |

| Other assets | 90 | | | 66 | |

| Total assets | $ | 6,041 | | | $ | 5,069 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Current maturities of long-term debt | $ | 23 | | | $ | 15 | |

| Accounts payable | 777 | | | 504 | |

| Accrued compensation and benefits | 68 | | | 106 | |

| Current operating lease liabilities | 61 | | | 55 | |

| Other current liabilities | 109 | | | 94 | |

| Total current liabilities | 1,038 | | | 774 | |

| Long-term debt | 2,401 | | | 1,863 | |

| Non-current operating lease liabilities | 145 | | | 138 | |

| Deferred income taxes | 92 | | | 48 | |

| Tax receivable agreement liabilities | 697 | | | 706 | |

| Other liabilities | 24 | | | 16 | |

| Total liabilities | 4,397 | | | 3,545 | |

| Commitments and contingencies | | | |

| Class A common stock, par value $0.01 per share, 1,000,000,000 shares authorized, 192,634,317 and 191,663,608 shares issued and outstanding as of April 28, 2024 and January 28, 2024, respectively | 2 | | | 2 | |

| Class B common stock, par value $0.01 per share, 500,000,000 shares authorized, 8,813,532 and 9,630,186 shares issued and outstanding as of April 28, 2024 and January 28, 2024, respectively | — | | | — | |

| Additional paid-in capital | 1,221 | | | 1,214 | |

| Retained earnings | 284 | | | 189 | |

| Accumulated other comprehensive income | 63 | | | 46 | |

| Total stockholders’ equity attributable to Core & Main, Inc. | 1,570 | | | 1,451 | |

| Non-controlling interests | 74 | | | 73 | |

| Total stockholders’ equity | 1,644 | | | 1,524 | |

| Total liabilities and stockholders’ equity | $ | 6,041 | | | $ | 5,069 | |

Core & Main Announces Fiscal 2024 First Quarter Results

CORE & MAIN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Amounts in millions, unaudited

| | | | | | | | | | | |

| Three Months Ended |

| April 28, 2024 | | April 30, 2023 |

| Cash Flows From Operating Activities: | | | |

| Net income | $ | 101 | | | $ | 133 | |

| Adjustments to reconcile net cash from operating activities: | | | |

| Depreciation and amortization | 46 | | | 37 | |

| | | |

| | | |

| Equity-based compensation expense | 3 | | | 2 | |

| Deferred income tax expense | 2 | | | — | |

| Other | 2 | | | — | |

| Changes in assets and liabilities: | | | |

| (Increase) decrease in receivables | (170) | | | (135) | |

| (Increase) decrease in inventories | (104) | | | 35 | |

| (Increase) decrease in other assets | (17) | | | (4) | |

| Increase (decrease) in accounts payable | 244 | | | 98 | |

| Increase (decrease) in accrued liabilities | (29) | | | (46) | |

| | | |

| Net cash provided by operating activities | 78 | | | 120 | |

| Cash Flows From Investing Activities: | | | |

| Capital expenditures | (7) | | | (10) | |

| Acquisitions of businesses, net of cash acquired | (564) | | | (64) | |

| | | |

| Other | (3) | | | — | |

| Net cash used in investing activities | (574) | | | (74) | |

| Cash Flows From Financing Activities: | | | |

| | | |

| | | |

| | | |

| Repurchase and retirement of partnership interests | — | | | (332) | |

| | | |

| Distributions to non-controlling interest holders | (4) | | | (10) | |

| Payments pursuant to Tax Receivable Agreements | (11) | | | (5) | |

| | | |

| | | |

| Borrowings on asset-based revolving credit facility | 585 | | | 130 | |

| Repayments on asset-based revolving credit facility | (774) | | | — | |

| Issuance of long-term debt | 750 | | | — | |

| Repayments of long-term debt | (6) | | | (4) | |

| | | |

| | | |

| Debt issuance costs | (12) | | | — | |

| Other | (3) | | | (1) | |

| Net cash provided by (used in) financing activities | 525 | | | (222) | |

| Increase (decrease) in cash and cash equivalents | 29 | | | (176) | |

| Cash and cash equivalents at the beginning of the period | 1 | | | 177 | |

| Cash and cash equivalents at the end of the period | $ | 30 | | | $ | 1 | |

| | | |

| Cash paid for interest (excluding effects of interest rate swap) | $ | 34 | | | $ | 28 | |

| Cash paid for taxes | 47 | | | 27 | |

Core & Main Announces Fiscal 2024 First Quarter Results

Non-GAAP Financial Measures

In addition to providing results that are determined in accordance with accounting principles generally accepted in the United States of America ("GAAP"), we present EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Operating Cash Flow Conversion and Net Debt Leverage, all of which are non-GAAP financial measures. These measures are not considered measures of financial performance or liquidity under GAAP and the items excluded therefrom are significant components in understanding and assessing our financial performance or liquidity. These measures should not be considered in isolation or as alternatives to GAAP measures such as net income or net income attributable to Core & Main, Inc., as applicable, cash provided by or used in operating, investing or financing activities or other financial statement data presented in our financial statements as an indicator of our financial performance or liquidity.

We define EBITDA as net income or net income attributable to Core & Main, Inc., as applicable, adjusted for non-controlling interests, depreciation and amortization, provision for income taxes and interest expense. We define Adjusted EBITDA as EBITDA as further adjusted for certain items management believes are not reflective of the underlying operations of our business, including but not limited to (a) loss on debt modification and extinguishment, (b) equity-based compensation, (c) expenses associated with the public offerings and (d) expenses associated with acquisition activities. Net income attributable to Core & Main, Inc. is the most directly comparable GAAP measure to EBITDA and Adjusted EBITDA. We define Adjusted EBITDA margin as Adjusted EBITDA divided by net sales. We define Operating Cash Flow Conversion as net cash provided by (used in) operating activities divided by Adjusted EBITDA for the period presented. We define Net Debt Leverage as total consolidated debt (gross of unamortized discounts and debt issuance costs), net of cash and cash equivalents, divided by Adjusted EBITDA for the last twelve months.

We use EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Operating Cash Flow Conversion and Net Debt Leverage to assess the operating results and effectiveness and efficiency of our business. Adjusted EBITDA includes amounts otherwise attributable to non-controlling interests as we manage the consolidated company and evaluate operating performance in a similar manner. We present these non-GAAP financial measures because we believe that investors consider them to be important supplemental measures of performance, and we believe that these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Non-GAAP financial measures as reported by us may not be comparable to similarly titled metrics reported by other companies and may not be calculated in the same manner. These measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. For example, EBITDA and Adjusted EBITDA:

•do not reflect the significant interest expense or the cash requirements necessary to service interest or principal payments on debt;

•do not reflect income tax expenses, the cash requirements to pay taxes or related distributions;

•do not reflect cash requirements to replace in the future any assets being depreciated and amortized; and

•exclude certain transactions or expenses as allowed by the various agreements governing our indebtedness.

EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Operating Cash Flow Conversion and Net Debt Leverage are not alternative measures of financial performance or liquidity under GAAP and therefore should be considered in conjunction with net income, net income attributable to Core & Main, Inc. and other performance measures such as gross profit or net cash provided by or used in operating, investing or financing activities and not as alternatives to such GAAP measures. In evaluating Adjusted EBITDA, you should be aware that, in the future, we may incur expenses similar to those eliminated in this presentation.

Core & Main Announces Fiscal 2024 First Quarter Results

No reconciliation of the estimated range for Adjusted EBITDA, Adjusted EBITDA margin or Operating Cash Flow Conversion for fiscal 2024 is included herein because we are unable to quantify certain amounts that would be required to be included in net income attributable to Core & Main, Inc. or cash provided by or used in operating activities, the most directly comparable GAAP measures, without unreasonable efforts due to the high variability and difficulty to predict certain items excluded from Adjusted EBITDA. Consequently, we believe such reconciliation would imply a degree of precision that would be misleading to investors. In particular, the effects of acquisition expenses cannot be reasonably predicted in light of the inherent difficulty in quantifying such items on a forward-looking basis. We expect the variability of these excluded items may have an unpredictable, and potentially significant, impact on our future GAAP financial results.

The following table sets forth a reconciliation of net income or net income attributable to Core & Main, Inc. to EBITDA and Adjusted EBITDA for the periods presented, as well as a calculation of Adjusted EBITDA margin for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in millions) | | Three Months Ended | | Twelve Months Ended |

| | | | April 28, 2024 | | April 30, 2023 | | April 28, 2024 | | April 30, 2023 |

| Net income attributable to Core & Main, Inc. | | | | $ | 95 | | | $ | 86 | | | $ | 380 | | | $ | 366 | |

| Plus: net income attributable to non-controlling interest | | | | 6 | | | 47 | | | 119 | | | 211 | |

| Net income | | | | 101 | | | 133 | | | 499 | | | 577 | |

Depreciation and amortization (1) | | | | 44 | | | 36 | | | 157 | | | 143 | |

| Provision for income taxes | | | | 33 | | | 31 | | | 130 | | | 129 | |

| Interest expense | | | | 34 | | | 17 | | | 98 | | | 70 | |

| EBITDA | | | | $ | 212 | | | $ | 217 | | | $ | 884 | | | $ | 919 | |

| Equity-based compensation | | | | 3 | | | 2 | | | 11 | | | 10 | |

Acquisition expenses (2) | | | | 2 | | | — | | | 8 | | | 5 | |

Offering expenses (3) | | | | — | | | 1 | | | 4 | | | 2 | |

| Adjusted EBITDA | | | | $ | 217 | | | $ | 220 | | | $ | 907 | | | $ | 936 | |

| | | | | | | | | | |

| Adjusted EBITDA Margin: | | | | | | | | | | |

| Net Sales | | | | $ | 1,741 | | | $ | 1,574 | | | $ | 6,869 | | | $ | 6,627 | |

| Adjusted EBITDA / Net Sales | | | | 12.5 | % | | 14.0 | % | | 13.2 | % | | 14.1 | % |

(1)Includes depreciation of certain assets which are reflected in “cost of sales” in our Statement of Operations.

(2)Represents expenses associated with acquisition activities, including transaction costs, post-acquisition employee retention bonuses, severance payments and expense recognition of purchase accounting fair value adjustments (excluding amortization).

(3)Represents costs related to secondary offerings reflected in SG&A expenses in our Statement of Operations.

Core & Main Announces Fiscal 2024 First Quarter Results

The following table sets forth a calculation of Net Debt Leverage for the periods presented:

| | | | | | | | | | | | | | |

| (Amounts in millions) | | As of |

| | April 28, 2024 | | April 30, 2023 |

Senior ABL Credit Facility due February 2029 | | $ | 241 | | | $ | 130 | |

Senior Term Loan due July 2028 | | 1,459 | | | 1,474 | |

Senior Term Loan due February 2031 | | 749 | | | — | |

Total Debt | | 2,449 | | | 1,604 | |

Less: Cash & Cash Equivalents | | (30) | | | (1) | |

Net Debt | | $ | 2,419 | | | $ | 1,603 | |

Twelve Months Ended Adjusted EBITDA | | 907 | | | 936 | |

Net Debt Leverage | | 2.7x | | 1.7x |

Core & Main Announces Fiscal 2024 First Quarter Results

Fiscal 2024 First Quarter Results JUNE 4, 2024

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 2 CAUTIONARY STATEMENTS Cautionary Note Regarding Forward-Looking Statements This presentation and accompanying discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, all statements other than statements of historical or current facts relating to our intentions, beliefs, assumptions or current expectations concerning, among other things, our future results of operations and financial position, business strategy and plans and objectives of management for future operations, including, among others, statements regarding expected growth, future capital expenditures, capital allocation and debt service obligations, and the anticipated impact on our business. Som e of the forward-looking statements can be identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” or the negative versions of these words o r other comparable terms. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be outside our control. We caution you that forward-looking statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of operations, financial condition, cash flows and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties discussed under the captions “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended January 28, 2024 and other factors discussed in our filings with the United States Securities and Exchange Commission, could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements. Furthermore, new risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this presentation. Factors that could cause actual results and outcomes to differ from those reflected in forward-looking statements include, without limitation: declines, volatility and cyclicality in the U.S. residential and non-residential construction markets; slowdowns in municipal infrastructure spending and delays in appropriations of federal funds; our ability to competitively bid for municipal contracts; price fluctuations in our product costs; our ability to manage our inventory effectively, including during periods of supply chain disruptions; risks involved with acquisitions and other strategic transactions, including our ability to identify, acquire, close or integrate acquisition targets successfully; the fragmented and highly competitive markets in which we compete and consolidation within our industry; the development of alternatives to distributors of our products in the supply chain; our ability to hire, engage and retain key personnel, including sales representatives, qualified branch, district and regional managers and senior management; our ability to identify, develop and maintain relationships with a sufficient number of qualified suppliers and the potential that our exclusive or limited supplier distribution rights are terminated; the availability of freight; the ability of our customers to make payments on credit sales; changes in supplier rebates or other terms of our supplier agreements; our ability to identify and introduce new products and product lines effectively; the spread of, and response to public health crises and the inability to predict the ultimate impact on us; costs and potential liabilities or obligations imposed by environmental, health and safety laws and requirements; regulatory change and the costs of compliance with regulation; changes in stakeholder expectations in respect of environmental, social and governance and sustainability pract ices; exposure to product liability, construction defect and warranty claims and other litigation and legal proceedings; potential harm to our reputation; difficu lties with or interruptions of our fabrication services; safety and labor risks associated with the distribution of our products; interruptions in the proper functioning of our and our third-party service providers’ information systems, including from cybersecurity threats; impairment in the carrying value of goodwill, intangible assets or other long-lived assets; our ability to continue our customer relationships with short-term contracts; risks associated with importing and exporting our products internationally; our ability to maintain effective internal controls over financial reporting and remediate any material weaknesses; our indebtedness and the potential that we may incur additional indebtedness that might restrict our operat ing flexibility; the limitations and restrictions in the agreements governing our indebtedness, the Amended and Restated Limited Partnership Agreement of Core & Main Holdings, LP as amended, and the Tax Receivable Agreements (each as defined in our Annual Report on Form 10-K); increases in interest rates; changes in our credit ratings and outlook; our ability to generate the significant amount of cash needed to service our indebtedness; our organizational structure, including our payment obligations under the Tax Receivable Agreements, which may be significant; our ability to sustain an active, liquid trading market for our Class A common stock; and risks related to other factors described under “Risk Factors” in our Annual Report on Form 10-K . These factors are not exhaustive, and new factors may emerge or changes to the foregoing factors may occur that could impact our business. Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, which speak only as of the date of this presentation. Use of Non-GAAP Financial Measures In addition to providing results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”), we present EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Operating Cash Flow Conversion and Net Debt Leverage, all of which are non-GAAP financial measures. These measures are not considered measures of financial performance or liquidity under GAAP and the items excluded therefrom are significant components in understanding and assessing our financial performance or liquidity. These measures should not be considered in isolation or as alternatives to GAAP measures such as net income or net income attributable to Core & Main, Inc., as applicable, cash provided by or used in operating, investing or financing activities, or other financial statement data presented in the financial statements as an indicator of our financial performance or liquidity. We use EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Operating Cash Flow Conversion and Net Debt Leverage to assess the operating results and effectiveness and efficiency of our business. We present these non-GAAP financial measures because we believe investors consider them to be important supplemental measures of performance, and we believe that these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Non-GAAP financial measures as reported by us may not be comparable to similarly titled metrics reported by other companies and may not be calculated in the same manner. These measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. Reconciliations of such non- GAAP measures to the most directly comparable GAAP measure and calculations of the non-GAAP measures are set forth in the appendix of this presentation. No reconciliation of the estimated range for Adjusted EBITDA, Adjusted EBITDA margin or Operating Cash Flow Conversion for fiscal 2024 are included herein because we are unable to quantify certain amounts that would be required to be included in net income attributable to Core & Main, Inc. or cash provided by or used in operating activities, the most directly comparable GAAP measures, without unreasonable efforts due to the high variability and difficulty to predict certain items excluded from Adjusted EBITDA. Consequently, we believe such reconciliation would imply a degree of precision that would be misleading to investors. In particular, the effects of acquisition expenses cannot be reasonably predicted in light of the inherent difficulty in quantifying such items on a forward-looking basis. We expect the variability of these excluded items may have an unpredictable, and potentially significant, impact on our future GAAP results. Presentation of Financial Information The accompanying financial information presents the results of operations, financial position and cash flows of Core & Main, Inc. (“Core & Main” or the “Company”) and its subsidiaries, which includes the consolidated financial information of Core & Main Holdings, LP, a Delaware limited partnership (“Holdings”), and its consolidated subsidiary, Core & Main LP, as the legal entity that conducts the operations of the Company. Core & Main is the primary beneficiary and general partner of Holdings and has decision making authority that significantly affects the economic performance of the entity. As a result, Core & Main consolidates the consolidated financial statements of Holdings. All intercompany balances and transactions have been eliminated in consolidation. The Company records non-controlling interests related to Partnership Interests (as defined in our Annual Report on Form 10- K) held by the Continuing Limited Partners (as defined in our Annual Report on Form 10-K) in Holdings. The Company’s fiscal year is a 52 or 53-week period ending on the Sunday nearest to January 31st. Quarters within the fiscal year include 13-week periods, unless a fiscal year includes a 53rd week, in which case the fourth quarter of the fiscal year will be a 14-week period. Each of the three months ended April 28, 2024, and three months ended April 30, 2023, included 13 weeks. The current fiscal year ending February 2, 2025 (“fiscal 2024”) includes 53 weeks.

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 3 TODAY’S PRESENTERS Steve LeClair Chair & CEO Mark Witkowski Chief Financial Officer Robyn Bradbury SVP, Finance & Investor Relations

Business Update STEVE LECLAIR

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 17% 5 CORE & MAIN SNAPSHOT Key Stats Market Reach(1) $11.5B Market Cap(1) $6.7B FY23 Net Sales $910M FY23 Adjusted EBITDA(2) 350+ Branches ~5,500 Employees 49 States 60K+ Customers ~5,000 Suppliers 200K+ SKUs Branch locations Market Share Product Mix $39B TAM(3) 67% 15% 10% 8% Pipes, Valves, & Fittings Storm Drainage Fire Protection Meters 42% 38% 20% Municipal Non-Residential Residential 50%50% New Construction Repair & Replacement Market Mix New Construction vs. Repair & Replace (1) As of April 28, 2024. (2) Adjusted EBITDA is a non-GAAP financial measure. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. (3) Based on independent third-party research and management estimates. Leader in Advancing Reliable Infrastructure with Local Service, Nationwide $1.1B FY23 Operating Cash Flow Headquarters

© Core & Main All Rights Reserved. Confidential and Proprietary Information. ▪ End market demand healthy with backlog and bidding activity both trending positively ▪ Beginning to see projects funded by the Infrastructure Investment and Jobs Act in certain parts of the country 6 BUSINESS UPDATE End Markets Growth Initiatives Margins Cash Flow & Capital Allocation ▪ Strong execution across organic growth initiatives to deliver above market growth ▪ Recent acquisitions driving robust contribution to net sales growth ▪ As expected, underlying product margins impacted by normalizing inventory costs ▪ Continue to benefit from margin initiatives and M&A synergies ▪ Achieved positive operating cash flow in a historically lower cash generation quarter ▪ Continue to prioritize investments in growth, deploying >$600M of capital to close 5 acquisitions during and after the quarter ▪ Maintain ample liquidity to continue executing growth strategies

© Core & Main All Rights Reserved. Confidential and Proprietary Information. Status Closed February 2024 Closed March 2024 Closed April 2024 Closed April 2024 Closed May 2024 # of Locations 2 21 6 1 1 Geography Virginia, Pennsylvania Arizona, Colorado, Connecticut, Massachusetts, Nevada, Rhode Island, Texas, Wyoming Oregon, Washington, Idaho, Utah Texas Kentucky Product Lines Storm Drainage Pipes, Valves & Fittings Storm Drainage Meters Geosynthetics & Erosion Control Pipes, Valves & Fittings Meters Pipes, Valves & Fittings 7 DRIVING SUSTAINABLE GROWTH THROUGH M&A Eastern Supply EGW UtilitiesDana Kepner Geothermal SupplyACF West

Financial Results MARK WITKOWSKI

© Core & Main All Rights Reserved. Confidential and Proprietary Information. $220 $217 Q1'23 Q1'24 $0.50 $0.49 Q1'23 Q1'24 $439 $468 Q1'23 Q1'24 $1,574 $1,741 Q1'23 Q1'24 9 Q1 2024 FINANCIAL RESULTS Net Sales Gross Profit Adjusted EBITDA(1) Diluted Earnings Per Share ($ in Millions, Except Per Share Amounts) (1) Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. 27.9%% Margin 14.0% +11% (100 bps) (150 bps) 12.5% 26.9% % Margin(1) +7% (2%)(1%)

© Core & Main All Rights Reserved. Confidential and Proprietary Information. Operating Cash Flow Capital Structure 10 CASH FLOW & BALANCE SHEET ($ in Millions) (1) Adjusted EBITDA is a non-GAAP financial measure. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. (2) Represents operating cash taxes paid to the IRS and other state & local taxing authorities. Does not inc lude the portion of our tax obligation distributed to non-controlling interest holders as a financing cash outflow. (3) Carries interest at term secured overnight financing rate ("Term SOFR") plus a margin ranging from 125 to 175 basis points, depending on borrowing capacity. (4) Net Debt Leverage represents gross consolidated debt net of cash & cash equivalents divided by Adjusted EBITDA for the last twelve months, which is a non-GAAP financial measure. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. (5) Does not give pro forma effect to acquisitions in either the current or prior year period. (6) The notional amount decreases to $800 million on July 27, 2024 and $700 million on July 27, 2025 through the instrument maturity on July 27, 2026. (7) The notional amount increases to $1,500 million on July 27, 2026 through the instrument maturity on July 27, 2028. Facility Maturity Interest Rate Q1’23 Q1’24 Senior ABL Credit Facility 2/9/29 S + 125(3) $130 $241 Senior Term Loan due 2028 7/27/28 S + 200 1,474 1,459 Senior Term Loan due 2031 2/9/31 S + 225 - 749 Total Debt $1,604 $2,449 Net Debt Leverage(4)(5) 1.7x 2.7x Q1’23 Q1’24 Δ Adjusted EBITDA(1) $220 $217 ($3) Working Capital (52) (76) (24) Cash Taxes(2) (27) (47) (20) Cash Interest (18) (21) (3) Other (3) 5 8 Operating Cash Flow $120 $78 ($42) Interest Rate SwapsLiquidity ABL Facility Available Cash & Cash Equivalents Summary of Terms Swap #1 Swap #2 Term SOFR Swap Rate 0.693% 3.913% Notional Amount $900(6) $750(7) Maturity 7/27/26 7/27/28 $1,109 $1,023 Q1'23 Q1'24

© Core & Main All Rights Reserved. Confidential and Proprietary Information. FISCAL 2024 OUTLOOK 11 Metric Outlook Net Sales % Growth vs. FY23 $7.5B - $7.6B +12% to +13% Adjusted EBITDA % Growth vs. FY23 $935M - $975M +3% to +7% Adjusted EBITDA Margin 12.5% - 12.8% Operating Cash Flow Conversion(1) 60% - 70% Considerations (1) Defined as net cash provided by (used in) operating activities divided by Adjusted EBITDA for the period presented. ▪ Narrowing sales outlook due to contribution from recent acquisitions ▪ Continue to expect end market volumes to grow low single- digits in FY24 ▪ Organic growth initiatives expected to deliver 200 – 400 bps of above market growth ▪ Initiative performance expected to partially offset gross margin normalization ▪ Narrowing expectation for Adjusted EBITDA due to Q1 gross margin performance and recent acquisitions

Appendix

© Core & Main All Rights Reserved. Confidential and Proprietary Information. CAPITAL ALLOCATION FRAMEWORK 13 Priority Uses for Capital Organic Growth & Operational Initiatives M&A Share Repurchases or Dividends Capital Allocation Framework ▪ Expect future capital expenditures to average ~0.5% – 0.6% of net sales ▪ Maintain a robust M&A pipeline and a disciplined approach to sourcing, acquiring and integrating businesses ▪ Deploy surplus capital towards share repurchases and/or dividends, subject to Board approval Operating Cash Flow Target ~60 –70% of Adjusted EBITDA Maintain Flexible Balance Sheet with Net Debt Leverage Target of 1.5x – 3.0x

© Core & Main All Rights Reserved. Confidential and Proprietary Information. PRODUCT & SERVICE OFFERING 14

© Core & Main All Rights Reserved. Confidential and Proprietary Information. ▪ Landscape & Construction Supplies ▪ UPSCO ▪ Midwest Pipe Supply ▪ Foster Supply ▪ D'Angelo Company ▪ Enviroscape ▪ Granite Water Works ▪ Lee Supply Company ▪ Minnesota Pipe & Equipment ▪ STL Fab & Supply ▪ DOT Sales ▪ Finish Line Systems ▪ DCL Fabrication & Supply ▪ Maskell Pipe & Supply ▪ Long Island Pipe Supply ▪ J&J Supply / Erosion Resources & Supply ▪ R&B Company ▪ Water Works Supply ▪ Triple T Pipe & Supply ▪ Pacific Pipe ▪ L&M Bag and Supply ▪ CES Industrial Piping Supply ▪ Catalone Pipe & Supply ▪ Dodson Engineered Products ▪ Lock City Supply ▪ Earthsavers Erosion Control ▪ Inland Water Works Supply ▪ Trumbull ▪ Distributors ▪ Lanier Municipal Supply Co. ▪ Eastern Supply ▪ Dana Kepner ▪ ACF West ▪ EGW Utilities ▪ Geothermal Supply Company 15 COMPOUNDING GROWTH THROUGH M&A ▪ Significant opportunity to fill existing geographies and product lines or expand into new geographies and product lines ▪ Ability to access attractive markets, new technologies and product innovations ▪ Diligent assessment of macro growth trends and competitive landscape ▪ Our size, scale and differentiated capabilities drives immediate synergistic value with a focus on people, process and strategy ▪ Past synergies have driven highly attractive returns on capital and support shareholder value creation ▪ Successful track record of retaining and promoting management and associates of acquired companies ▪ Our “local service, nationwide” philosophy incentivizes acquired companies to be entrepreneurial, making decisions grounded in a customer-centric approach ~$1.7B of Capital Deployed on 35+ Acquisitions Since 2017 Maximize Market Presence Drive Value Creation Leverage Entrepreneurial Culture 2017 2018 2019 2020 2021 2022 2023 2024 YTD

© Core & Main All Rights Reserved. Confidential and Proprietary Information. Pipes, Valves & Fittings Meters $55B to expand access to clean drinking water $13.5B $50B to protect against droughts, floods, heat and wildfires, in addition to major investments in weatherization and cybersecurity $2.5B Pipes, Valves & Fittings Storm Drainage $110B to repair roads and bridges and support major transformational projects $1.0B Storm Drainage Erosion Control $25B to create more modern, resilient and sustainable airport infrastructure $0.2B Fire Protection CNM Serviceable Opportunity / Representative Product Lines 16 CRITICAL INVESTMENTS FROM THE INFRASTRUCTURE INVESTMENT & JOBS ACT

© Core & Main All Rights Reserved. Confidential and Proprietary Information. RECONCILIATION OF NON-GAAP MEASURES 17 (1) Includes depreciation of certain assets which are reflected in “cost of sales” in our Statement of Operations. (2) Represents expenses associated with acquisition activities, including transaction costs, post-acquisition employee retention bonuses, severance payments and expense recognition of purchase accounting fair value adjustments (excluding amortization). (3) Represents costs related to our initial public offering and subsequent secondary offerings reflected in SG&A expenses in our Statement of Operations. ($ in Millions) Adjusted EBITDA & Adjusted EBITDA Margin Three Months Ended Twelve Months Ended April 28, 2024 April 30, 2023 April 28, 2024 January 28, 2024 April 30, 2023 Net income attributable to Core & Main, Inc. 95$ 86$ 380$ 371$ 366$ Plus: net income attributable to non-controlling interest 6 47 119 160 211 Net income 101 133 499 531 577 Depreciation and amortization (1) 44 36 157 149 143 Provision for income taxes 33 31 130 128 129 Interest expense 34 17 98 81 70 EBITDA 212$ 217$ 884$ 889$ 919$ Equity-based compensation 3 2 11 10 10 Acquisition expenses (2) 2 - 8 6 5 Offering expenses (3) - 1 4 5 2 Adjusted EBITDA 217$ 220$ 907$ 910$ 936$ Adjusted EBITDA Margin: Net Sales 1,741$ 1,574$ 6,869$ 6,702$ 6,627$ Adjusted EBITDA / Net Sales 12.5% 14.0% 13.2% 13.6% 14.1%

© Core & Main All Rights Reserved. Confidential and Proprietary Information. RECONCILIATION OF NON-GAAP MEASURES 18 ($ in Millions) Net Debt Leverage April 28, 2024 April 30, 2023 Senior ABL Credit Facility due February 2029 241$ 130$ Senior Term Loan due July 2028 1,459 1,474 Senior Term Loan due February 2031 749 - Total Debt 2,449 1,604 Less: Cash & Cash Equivalents (30) (1) Net Debt 2,419$ 1,603$ Adjusted EBITDA 907 936 Net Debt Leverage 2.7x 1.7x As of

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

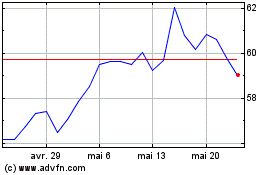

Core and Main (NYSE:CNM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Core and Main (NYSE:CNM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024