Crescent Energy Company (NYSE: CRGY) (“Crescent” or the

“Company”) today announced that S&P Global Ratings (“S&P”)

and Fitch Ratings, Inc. (“Fitch”) have taken positive ratings

actions on Crescent, pending the closing of the previously

announced acquisition of SilverBow Resources, Inc. (“SilverBow”) on

May 16, 2024. In addition, Moody’s Ratings (“Moody’s”) reaffirmed

its stable outlook. In their releases, the agencies recognized the

transaction’s compelling strategic and financial rationale, citing

potential for improved scale with complementary Eagle Ford assets,

stable free cash flow generation and balance sheet strength.

- Moody’s affirmed Crescent's Ba3 Corporate Family Rating (CFR)

and B1 senior unsecured notes' ratings, and its stable outlook (May

20, 2024)

- S&P affirmed Crescent’s B+ rating and revised its outlook

to Positive, reflecting the combined company’s increased size,

scale, and lower pro-forma cost structure once the transaction has

closed (May 20, 2024)

- Fitch placed Crescent’s Long-Term Issuer Default Ratings (IDRs)

of 'B+' on Rating Watch Positive (RWP) and affirmed the Company’s

first-lien secured reserve-based loan facility (RBL) at 'BB+'/

'RR1' and its senior unsecured notes at 'BB-'/ 'RR3' (May 17,

2024)

As announced on May 16, 2024, Crescent entered into a definitive

agreement to acquire SilverBow in a transaction valued at

approximately $2.1 billion. Under the terms of the agreement,

SilverBow shareholders who elect to receive stock will receive

3.125 shares of Crescent Class A common stock for each share of

SilverBow common stock. The transaction is structured as a

cash-election merger with shareholders able to elect to receive $38

per share in cash up to a maximum total cash consideration of $400

million. The transaction, which will be subject to customary

closing conditions, including approvals by shareholders of each

company and typical regulatory agencies, is targeted to close by

the end of the third quarter of this year.

Securities and credit ratings are not recommendations to buy,

sell or hold securities, they may be subject to revision or

withdrawal at any time by the assigning rating organization, and

each such rating should be evaluated independently of any other

rating.

About Crescent Energy

Company

Crescent is a differentiated U.S. energy company committed to

delivering value for shareholders through a disciplined growth

through acquisition strategy and consistent return of capital.

Crescent’s portfolio of low-decline, cash-flow oriented assets

comprises both mid-cycle unconventional and conventional assets

with a long reserve life and deep inventory of high-return

development locations in the Eagle Ford and Uinta basins.

Crescent’s leadership is an experienced team of investment,

financial and industry professionals that combines proven

investment and operating expertise. For more than a decade,

Crescent and its predecessors have executed on a consistent

strategy focused on cash flow, risk management and returns. For

additional information, please visit www.crescentenergyco.com.

No Offer or Solicitation

This communication relates to a proposed business combination

transaction (the “Transaction”) between Crescent Energy Company

(“Crescent”) and SilverBow Resources, Inc. (“SilverBow”). This

communication is for informational purposes only and does not

constitute an offer to sell or the solicitation of an offer to buy

any securities or a solicitation of any vote or approval, in any

jurisdiction, pursuant to the Transaction or otherwise, nor shall

there be any sale, issuance, exchange or transfer of the securities

referred to in this document in any jurisdiction in contravention

of applicable law. No offer of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended.

Important Additional Information About

the Transaction

In connection with the Transaction, Crescent will file with the

U.S. Securities and Exchange Commission (“SEC”) a registration

statement on Form S-4, that will include a joint proxy statement of

Crescent and SilverBow and a prospectus of Crescent. The

Transaction will be submitted to Crescent’s stockholders and

SilverBow’s stockholders for their consideration. Crescent and

SilverBow may also file other documents with the SEC regarding the

Transaction. The definitive joint proxy statement/prospectus will

be sent to the stockholders of Crescent and SilverBow. This

document is not a substitute for the registration statement and

joint proxy statement/prospectus that will be filed with the SEC or

any other documents that Crescent or SilverBow may file with the

SEC or send to stockholders of Crescent or SilverBow in connection

with the Transaction. INVESTORS AND SECURITY HOLDERS OF CRESCENT

AND SILVERBOW ARE URGED TO READ THE REGISTRATION STATEMENT AND THE

JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT

BECOMES AVAILABLE AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED

OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

TRANSACTION AND RELATED MATTERS.

Investors and security holders will be able to obtain free

copies of the registration statement and the joint proxy

statement/prospectus (when available) and all other documents filed

or that will be filed with the SEC by Crescent or SilverBow through

the website maintained by the SEC at http://www.sec.gov. Copies of

documents filed with the SEC by Crescent will be made available

free of charge on Crescent’s website at

https://ir.crescentenergyco.com, or by directing a request

to Investor Relations, Crescent Energy Company, 600 Travis Street,

Suite 7200, Houston, TX 77002, Tel. No. (713) 332-7001. Copies of

documents filed with the SEC by SilverBow will be made available

free of charge on SilverBow’s website at https://sbow.com

under the “Investor Relations” tab or by directing a request to

Investor Relations, SilverBow Resources, Inc., 920 Memorial City

Way, Suite 850, Houston, TX 77024, Tel. No. (281) 874-2700.

Participants in the Solicitation

Regarding the Transaction

Crescent, SilverBow and their respective directors and executive

officers may be deemed to be participants in the solicitation of

proxies in respect to the Transaction.

Information regarding Crescent’s directors and executive

officers is contained in the Crescent’s Annual Report on 10-K for

the year ended December 31, 2023 filed with the SEC on March 4,

2024. You can obtain a free copy of this document at the SEC’s

website at http://www.sec.gov or by accessing Crescent’s website at

https://ir.crescentenergyco.com. Information regarding

SilverBow’s executive officers and directors is contained in the

proxy statement for SilverBow’s 2024 Annual Meeting of Stockholders

filed with the SEC on April 9, 2024 and certain of its Current

Reports on Form 8-K. You can obtain a free copy of this document at

the SEC’s website at www.sec.gov or by accessing the SilverBow’s

website at https://sbow.com.

Investors may obtain additional information regarding the

interests of those persons and other persons who may be deemed

participants in the Transaction by reading the joint proxy

statement/prospectus regarding the Transaction when it becomes

available. You may obtain free copies of this document as described

above.

Important Additional Information About

the SilverBow Annual Meeting

SilverBow, its directors and certain of its executive officers

and employees are or will be participants in the solicitation of

proxies from shareholders in connection with SilverBow’s 2024

Annual Meeting. SilverBow has filed the Definitive Proxy Statement

with the SEC on April 9, 2024 in connection with the solicitation

of proxies for the 2024 Annual Meeting, together with a WHITE proxy

card.

The identity of the participants, their direct or indirect

interests, by security holdings or otherwise, and other information

relating to the participants are available in the Definitive Proxy

Statement (available here) in the section entitled “Security

Ownership of Board of Directors and Management” and Appendix F. To

the extent holdings of SilverBow’s securities by SilverBow’s

directors and executive officers changes from the information

included in this communication, such information will be reflected

on Statements of Change in Ownership on Forms 3, 4 or 5 filed with

the SEC. These documents are available free of charge as described

below.

SHAREHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT

AND ANY OTHER DOCUMENTS TO BE FILED BY SILVERBOW WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION. Shareholders are able to obtain,

free of charge, copies of all of the foregoing documents, any

amendments or supplements thereto at the SEC’s website

(http://www.sec.gov). Copies of the foregoing any amendments or

supplements thereto are also available, free of charge, at the

“Investor Relations” section of SilverBow’s website

(https://www.sbow.com/investor-relations).

Forward-Looking Statements and

Cautionary Statements

The foregoing contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. All statements, other

than statements of historical fact, included in this communication

that address activities, events or developments that Crescent or

SilverBow expects, believes or anticipates will or may occur in the

future are forward-looking statements. Words such as “estimate,”

“project,” “predict,” “believe,” “expect,” “anticipate,”

“potential,” “create,” “intend,” “could,” “may,” “foresee,” “plan,”

“will,” “guidance,” “look,” “outlook,” “goal,” “future,” “assume,”

“forecast,” “build,” “focus,” “work,” “continue” or the negative of

such terms or other variations thereof and words and terms of

similar substance used in connection with any discussion of future

plans, actions, or events identify forward-looking statements.

However, the absence of these words does not mean that the

statements are not forward-looking. These forward-looking

statements include, but are not limited to, statements regarding

the Transaction, pro forma descriptions of the combined company and

its operations, integration and transition plans, synergies,

opportunities and anticipated future performance, and the impact of

the Transaction on the credit rating(s) of Crescent’s or SilverBow’

securities. There are a number of risks and uncertainties that

could cause actual results to differ materially from the

forward-looking statements included in this communication. These

include the expected timing and likelihood of completion of the

Transaction, including the timing, receipt and terms and conditions

of any required governmental and regulatory approvals of the

Transaction that could reduce anticipated benefits or cause the

parties to abandon the Transaction, the ability to successfully

integrate the businesses, the occurrence of any event, change or

other circumstances that could give rise to the termination of the

merger agreement, the possibility that stockholders of Crescent may

not approve the issuance of new shares of common stock in the

Transaction or that stockholders of SilverBow may not approve the

merger agreement, the risk that the parties may not be able to

satisfy the conditions to the Transaction in a timely manner or at

all, risks related to disruption of management time from ongoing

business operations due to the Transaction, the risk that any

announcements relating to the Transaction could have adverse

effects on the market price of Crescent’s common stock or

SilverBow’s common stock, the risk that the Transaction and its

announcement could have an adverse effect on the ability of

Crescent and SilverBow to retain customers and retain and hire key

personnel and maintain relationships with their suppliers and

customers and on their operating results and businesses generally,

the risk the pending Transaction could distract management of both

entities and they will incur substantial costs, the risk that

problems may arise in successfully integrating the businesses of

the companies, which may result in the combined company not

operating as effectively and efficiently as expected, the risk that

the combined company may be unable to achieve synergies or it may

take longer than expected to achieve those synergies and other

important factors that could cause actual results to differ

materially from those projected. All such factors are difficult to

predict and are beyond Crescent’s or SilverBow’s control, including

those detailed in Crescent’s annual reports on Form 10-K, quarterly

reports on Form 10-Q and current reports on Form 8-K that are

available on its website at https://ir.crescentenergyco.com

and on the SEC’s website at http://www.sec.gov, and those detailed

in SilverBow’s annual reports on Form 10-K, quarterly reports on

Form 10-Q and current reports on Form 8-K that are available on

SilverBow’s website at https://sbow.com and on the SEC’s

website at http://www.sec.gov. All forward-looking statements are

based on assumptions that Crescent or SilverBow believe to be

reasonable but that may not prove to be accurate. Any

forward-looking statement speaks only as of the date on which such

statement is made, and Crescent and SilverBow undertake no

obligation to correct or update any forward-looking statement,

whether as a result of new information, future events or otherwise,

except as required by applicable law. Readers are cautioned not to

place undue reliance on these forward-looking statements that speak

only as of the date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240522340785/en/

Crescent Energy Investor Relations Contacts

IR@crescentenergyco.com

Crescent Energy Media Contacts

Media@crescentenergyco.com

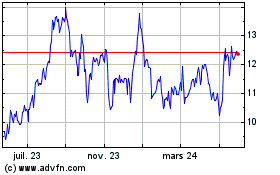

Crescent Energy (NYSE:CRGY)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

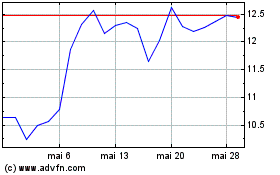

Crescent Energy (NYSE:CRGY)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025