Community Health Systems, Inc. (NYSE: CYH) (the “Company”) today

announced financial and operating results for the three and nine

months ended September 30, 2023.

The following highlights the financial and operating results for

the three months ended September 30, 2023.

- Net operating revenues totaled $3.086 billion.

- Net loss attributable to Community Health Systems, Inc.

stockholders was $(91) million, or $(0.69) per share (diluted),

compared to $(42) million, or $(0.32) per share (diluted), for the

same period in 2022. Excluding the adjusting items as presented in

the table in footnote (e) on page 15, net loss attributable to

Community Health Systems, Inc. stockholders was $(0.33) per share

(diluted), compared to $(0.52) per share (diluted) for the same

period in 2022.

- Adjusted EBITDA was $360 million.

- Net cash provided by operating activities was $29 million

for the three months ended September 30, 2023, compared to $137

million for the same period in 2022.

- On a same-store basis, admissions increased 3.7 percent and

adjusted admissions increased 4.2 percent, compared to the same

period in 2022.

Commenting on the results, Tim L. Hingtgen, chief executive

officer of Community Health Systems, Inc., said, "Strong volume

growth in admissions, adjusted admissions, ER visits and clinic

appointments during the quarter reflect successful execution of

many of our key strategies, including investments in service lines,

physician recruitment, capacity optimization programs, and the

maturity of our transfer center services. Our local management

teams are focused on ensuring access to health services for their

communities and our healthcare workers continue to deliver

high-quality care for their patients.”

Three Months Ended September 30, 2023

Net operating revenues for the three months ended September 30,

2023, totaled $3.086 billion, a 2.0 percent increase compared to

$3.025 billion for the same period in 2022. On a same-store basis,

net operating revenues increased 5.1 percent for the three months

ended September 30, 2023, compared to the same period in 2022. Net

operating revenues for the three months ended September 30, 2023,

reflect a 0.5 percent increase in admissions and a 0.4 percent

increase in adjusted admissions, compared to the same period in

2022. On a same-store basis, admissions increased 3.7 percent and

adjusted admissions increased 4.2 percent for the three months

ended September 30, 2023, compared to the same period in 2022.

Net loss attributable to Community Health Systems, Inc.

stockholders was $(91) million, or $(0.69) per share (diluted), for

the three months ended September 30, 2023, compared to $(42)

million, or $(0.32) per share (diluted), for the same period in

2022. Excluding the adjusting items as presented in the table in

footnote (e) on page 15, net loss attributable to Community Health

Systems, Inc. stockholders was $(0.33) per share (diluted) for the

three months ended September 30, 2023, compared to $(0.52) per

share (diluted) for the same period in 2022. During the three

months ended September 30, 2023, pandemic relief funds did not

materially impact net loss attributable to Community Health

Systems, Inc. stockholders. During the three months ended September

30, 2022, pandemic relief funds had a positive impact on net loss

attributable to Community Health Systems, Inc. stockholders (both

on a consolidated and adjusted basis) of approximately $84 million,

or $0.65 on a per share (diluted) basis.

Adjusted EBITDA for the three months ended September 30, 2023,

was $360 million compared to $400 million for the same period in

2022. During the three months ended September 30, 2023, pandemic

relief funds did not materially impact Adjusted EBITDA. During the

three months ended September 30, 2022, pandemic relief funds had a

positive impact on Adjusted EBITDA of approximately $115

million.

The increase in net loss attributable to Community Health

Systems, Inc. stockholders and the decrease in Adjusted EBITDA for

the three months ended September 30, 2023, compared to the same

period in 2022, is primarily due to unfavorable changes in payor

mix, a reduction in pandemic relief funds recognized, higher costs

for supplemental reimbursement programs, and increased rates for

outsourced medical specialists, partially offset by stronger

inpatient volumes and reduced expense for contract labor.

Nine months Ended September 30, 2023

Net operating revenues for the nine months ended September 30,

2023, totaled $9.308 billion, a 2.6 percent increase compared to

$9.069 billion for the same period in 2022. On a same-store basis,

net operating revenues increased 5.3 percent for the nine months

ended September 30, 2023, compared to the same period in 2022. Net

operating revenues for the nine months ended September 30, 2023,

reflect a 0.9 percent increase in admissions and a 2.4 percent

increase in adjusted admissions, compared to the same period in

2022. On a same-store basis, admissions increased 4.4 percent and

adjusted admissions increased 6.1 percent for the nine months ended

September 30, 2023, compared to the same period in 2022.

Net loss attributable to Community Health Systems, Inc.

stockholders was $(180) million, or $(1.38) per share (diluted),

for the nine months ended September 30, 2023, compared to $(369)

million, or $(2.86) per share (diluted), for the same period in

2022. Excluding the adjusting items as presented in the table in

footnote (e) on page 15, net loss attributable to Community Health

Systems, Inc. stockholders was $(0.98) per share (diluted) for the

nine months ended September 30, 2023, compared to $(2.92) per share

(diluted) for the same period in 2022. During the nine months ended

September 30, 2023, pandemic relief funds did not materially impact

net loss attributable to Community Health Systems, Inc.

stockholders. During the nine months ended September 30, 2022,

pandemic relief funds had a positive impact on net loss

attributable to Community Health Systems, Inc. stockholders (both

on a consolidated and adjusted basis) of approximately $125

million, or $0.97 on a per share (diluted) basis.

Adjusted EBITDA for the nine months ended September 30, 2023,

was $1.068 billion compared to $1.062 billion for the same period

in 2022. During the nine months ended September 30, 2023, pandemic

relief funds did not materially impact Adjusted EBITDA. During the

nine months ended September 30, 2022, pandemic relief funds had a

positive impact on Adjusted EBITDA of approximately $171

million.

The decrease in net loss attributable to Community Health

Systems, Inc. stockholders and the increase in Adjusted EBITDA for

the nine months ended September 30, 2023, compared to the same

period in 2022, is primarily due to stronger inpatient and

outpatient volumes, increased reimbursement rates, higher acuity,

an increase in non-patient revenue, and reduced expense for

contract labor, partially offset by unfavorable changes in payor

mix, a reduction in pandemic relief funds recognized, increased

salaries and benefits expense, higher costs for professional

liability insurance, and increased rates for outsourced medical

specialists.

Other

During 2023, through the date of this press release, the Company

has completed the divestiture of three hospitals and the sale of a

majority interest in another hospital. On January 1, 2023, the

Company completed the divestiture of one hospital (in respect of

which the Company received proceeds at a preliminary closing on

December 31, 2022). On April 1, 2023, the Company completed the

divestiture of one hospital (in respect of which the Company

received proceeds at a preliminary closing on March 31, 2023). On

July 1, 2023, the Company completed the divestiture of one hospital

(in respect of which the Company received proceeds at a preliminary

closing on June 30, 2023). On September 1, 2023, the Company

completed the sale of a majority interest in one hospital.

Financial and statistical data for 2023 and 2022 presented in this

press release includes the operating results of divested or closed

businesses for the periods prior to the consummation of the

respective divestiture or closure. Same-store operating results and

statistical information include operating results of businesses

operated in the comparable current year and prior year periods and

exclude businesses divested or closed in 2022 and the nine months

ended September 30, 2023.

Information About Non-GAAP Financial Measures

This press release presents Adjusted EBITDA, a non-GAAP

financial measure, which is EBITDA adjusted to add back net income

attributable to noncontrolling interests and to exclude loss (gain)

from early extinguishment of debt, impairment and (gain) loss on

sale of businesses, expense related to the Business Transformation

Costs (as defined in footnote (c) to the Financial Highlights,

Financial Statements and Selected Operating Data below), gain on

sale of equity interests in Macon Healthcare, LLC, expense related

to government and other legal matters and related costs, income

during the fourth quarter of 2021 associated with the settlement of

litigation for the recovery of amounts of certain professional

liability claims settled in 2020 covered by third-party insurance

policies, expense related to employee termination benefits and

other restructuring charges, the impact of a change in estimate to

increase the professional liability claims accrual recorded during

the fourth quarter of 2022 with respect to claims incurred in prior

years related to divested locations and the gain on sale by

HealthTrust Purchasing Group, L.P. (“HealthTrust”) of a majority

interest in CoreTrust Holdings, LLC (“CoreTrust”) completed during

the fourth quarter of 2022. For information regarding why the

Company believes Adjusted EBITDA provides useful information to

investors, and for a reconciliation of Adjusted EBITDA to net loss

attributable to Community Health Systems, Inc. stockholders, see

footnote (c) to the Financial Highlights, Financial Statements and

Selected Operating Data below.

Additionally, this press release presents adjusted net loss

attributable to Community Health Systems, Inc. stockholders per

share (diluted), a non-GAAP financial measure, to reflect the

impact on net loss attributable to Community Health Systems, Inc.

stockholders per share (diluted) from the selected items used in

the calculation of Adjusted EBITDA. For information regarding why

the Company believes this non-GAAP financial measure provides

useful information to investors, and for a reconciliation of this

non-GAAP financial measure to net loss attributable to Community

Health Systems, Inc. stockholders per share (diluted), see footnote

(e) to the Financial Highlights, Financial Statements and Selected

Operating Data below.

The non-GAAP financial measures set forth above are not

measurements of financial performance under U.S. GAAP, and should

not be considered in isolation or as a substitute for any financial

measure calculated in accordance with U.S. GAAP. Additionally, the

calculation of these non-GAAP financial measures may not be

comparable to similarly titled measures disclosed by other

companies.

Included on pages 16, 17, 18, 19 and 20 of this press release

are tables setting forth the Company’s 2023 updated annual earnings

guidance. The 2023 guidance is based on the Company’s historical

operating performance, current trends and other assumptions the

Company believes are reasonable at this time as more specifically

discussed below.

About Community Health Systems, Inc.

Community Health Systems, Inc. is one of the nation’s largest

healthcare companies. The Company’s affiliates are leading

providers of healthcare services, developing and operating

healthcare delivery systems in 43 distinct markets across 15

states. As of October 25, 2023, the Company’s subsidiaries own or

lease 76 affiliated hospitals with over 12,000 beds and operate

more than 1,000 sites of care, including physician practices,

urgent care centers, freestanding emergency departments,

occupational medicine clinics, imaging centers, cancer centers and

ambulatory surgery centers.

The Company’s headquarters are located in Franklin, Tennessee, a

suburb south of Nashville. Shares in Community Health Systems, Inc.

are traded on the New York Stock Exchange under the symbol “CYH.”

More information about the Company can be found on its website at

www.chs.net.

Community Health Systems, Inc. will hold a conference call on

Thursday, October 26, 2023, at 10:00 a.m. Central, 11:00 a.m.

Eastern, to review financial and operating results for the third

quarter ended September 30, 2023. Investors will have the

opportunity to listen to a live internet broadcast of the

conference call by clicking on the Investor Relations link of the

Company’s website at www.chs.net. For those who cannot listen to

the live broadcast, a replay will be available shortly after the

call and will continue to be available for approximately 30 days.

Copies of this press release and conference call slide show, as

well as the Company’s Current Report on Form 8-K (including this

press release), will be available on the Company’s website at

www.chs.net.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Financial Highlights

(a)(b)

(In millions, except per share

amounts)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net operating revenues

$

3,086

$

3,025

$

9,308

$

9,069

Net (loss) income (f)

(52

)

-

(70

)

(267

)

Net loss attributable to Community Health

Systems,

Inc. stockholders

(91

)

(42

)

(180

)

(369

)

Adjusted EBITDA (c)

360

400

1,068

1,062

Net cash provided by operating

activities

29

137

120

291

Loss per share attributable to Community

Health

Systems, Inc. stockholders:

Basic (f)

$

(0.69

)

$

(0.32

)

$

(1.38

)

$

(2.86

)

Diluted (e), (f)

(0.69

)

(0.32

)

(1.38

)

(2.86

)

Weighted-average number of shares

outstanding (d):

Basic

131

129

130

129

Diluted

131

129

130

129

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Condensed Consolidated

Statements of Loss (a)(b)

(In millions, except per share

amounts)

(Unaudited)

Three Months Ended September

30,

2023

2022

% of Net

% of Net

Operating

Operating

Amount

Revenues

Amount

Revenues

Net operating revenues

$

3,086

100.0

%

$

3,025

100.0

%

Operating costs and expenses:

Salaries and benefits

1,338

43.4

%

1,352

44.7

%

Supplies

489

15.8

%

492

16.3

%

Other operating expenses

853

27.7

%

828

27.4

%

Lease cost and rent

79

2.6

%

80

2.6

%

Pandemic relief funds

-

-

%

(115

)

(3.8

)

%

Depreciation and amortization

128

4.1

%

137

4.5

%

Impairment and (gain) loss on sale of

businesses, net (f)

26

0.8

%

47

1.6

%

Total operating costs and expenses

2,913

94.4

%

2,821

93.3

%

Income from operations (f)

173

5.6

%

204

6.7

%

Interest expense, net

208

6.8

%

217

7.2

%

Loss (gain) from early extinguishment of

debt

-

-

%

(78

)

(2.6

)

%

Equity in earnings of unconsolidated

affiliates

(2

)

(0.1

)

%

(5

)

(0.2

)

%

(Loss) income before income taxes

(33

)

(1.1

)

%

70

2.3

%

Provision for income taxes

19

0.6

%

70

2.3

%

Net (loss) income (f)

(52

)

(1.7

)

%

-

-

%

Less: Net income attributable to

noncontrolling interests

39

1.2

%

42

1.4

%

Net loss attributable to Community Health

Systems,

Inc. stockholders

$

(91

)

(2.9

)

%

$

(42

)

(1.4

)

%

Loss per share attributable to

Community

Health Systems, Inc. stockholders:

Basic (f)

$

(0.69

)

$

(0.32

)

Diluted (e), (f)

$

(0.69

)

$

(0.32

)

Weighted-average number of shares

outstanding (d):

Basic

131

129

Diluted

131

129

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Condensed Consolidated

Statements of Loss (a)(b)

(In millions, except per share

amounts)

(Unaudited)

Nine Months Ended September

30,

2023

2022

% of Net

% of Net

Operating

Operating

Amount

Revenues

Amount

Revenues

Net operating revenues

$

9,308

100.0

%

$

9,069

100.0

%

Operating costs and expenses:

Salaries and benefits

4,040

43.4

%

3,972

43.8

%

Supplies

1,499

16.1

%

1,477

16.3

%

Other operating expenses

2,524

27.1

%

2,511

27.7

%

Lease cost and rent

240

2.6

%

236

2.6

%

Pandemic relief funds

-

-

%

(171

)

(1.9

)

%

Depreciation and amortization

384

4.1

%

398

4.4

%

Impairment and (gain) loss on sale of

businesses, net (f)

(9

)

(0.1

)

%

54

0.6

%

Total operating costs and expenses

8,678

93.2

%

8,477

93.5

%

Income from operations (f)

630

6.8

%

592

6.5

%

Interest expense, net

621

6.7

%

652

7.1

%

Loss (gain) from early extinguishment of

debt

-

-

%

(73

)

(0.8

)

%

Equity in earnings of unconsolidated

affiliates

(5

)

(0.1

)

%

(11

)

(0.1

)

%

Income before income taxes

14

0.2

%

24

0.3

%

Provision for income taxes

84

1.0

%

291

3.2

%

Net loss (f)

(70

)

(0.8

)

%

(267

)

(2.9

)

%

Less: Net income attributable to

noncontrolling interests

110

1.1

%

102

1.2

%

Net loss attributable to Community Health

Systems,

Inc. stockholders

$

(180

)

(1.9

)

%

$

(369

)

(4.1

)

%

Loss per share attributable to

Community

Health Systems, Inc. stockholders:

Basic (f)

$

(1.38

)

$

(2.86

)

Diluted (e), (f)

$

(1.38

)

$

(2.86

)

Weighted-average number of shares

outstanding (d):

Basic

130

129

Diluted

130

129

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Condensed Consolidated

Statements of Comprehensive Loss

(In millions)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net (loss) income

$

(52

)

$

-

$

(70

)

$

(267

)

Other comprehensive (loss) income, net of

income taxes:

Net change in fair value of

available-for-sale debt securities, net of tax

(3

)

(6

)

(1

)

(20

)

Amortization and recognition of

unrecognized pension cost components, net of tax

-

-

-

1

Other comprehensive loss

(3

)

(6

)

(1

)

(19

)

Comprehensive loss

(55

)

(6

)

(71

)

(286

)

Less: Comprehensive income attributable to

noncontrolling interests

39

42

110

102

Comprehensive loss attributable to

Community Health

Systems, Inc. stockholders

$

(94

)

$

(48

)

$

(181

)

$

(388

)

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Selected Operating Data

(a)

(Dollars in millions)

(Unaudited)

Three Months Ended September

30,

Consolidated

Same-Store

2023

2022

%

Change

2023

2022

%

Change

Number of hospitals (at end of period)

76

81

76

76

Licensed beds (at end of period)

12,494

13,309

12,494

12,443

Beds in service (at end of period)

10,621

11,559

10,621

10,712

Admissions

109,043

108,509

0.5

%

108,872

104,954

3.7

%

Adjusted admissions

249,988

248,950

0.4

%

249,743

239,721

4.2

%

Patient days

459,838

497,034

474,268

480,535

Average length of stay (days)

4.3

4.6

4.4

4.6

Occupancy rate (average beds in

service)

46.8

%

46.7

%

48.4

%

48.7

%

Net operating revenues

$

3,086

$

3,025

2.0

%

$

3,081

$

2,931

5.1

%

Net inpatient revenues as a % of net

operating

revenues

46.5

%

46.3

%

46.5

%

46.4

%

Net outpatient revenues as a % of net

operating

revenues

53.5

%

53.7

%

53.5

%

53.6

%

Income from operations (f)

$

173

$

204

-15.2

%

Income from operations as a % of net

operating revenues

5.6

%

6.7

%

Depreciation and amortization

$

128

$

137

Equity in earnings of unconsolidated

affiliates

$

(2

)

$

(5

)

Net loss attributable to Community

Health

$

(91

)

$

(42

)

-116.7

%

Systems, Inc. stockholders

Net loss attributable to Community

Health

Systems, Inc. stockholders as a % of

net

operating revenues

-2.9

%

-1.4

%

Adjusted EBITDA (c)

$

360

$

400

-10.0

%

Adjusted EBITDA as a % of net operating

revenues

11.7

%

13.2

%

Net cash provided by operating

activities

$

29

$

137

-78.8

%

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Selected Operating Data

(a)

(Dollars in millions)

(Unaudited)

Nine Months Ended September

30,

Consolidated

Same-Store

2023

2022

%

Change

2023

2022

%

Change

Number of hospitals (at end of period)

76

81

76

76

Licensed beds (at end of period)

12,494

13,309

12,494

12,443

Beds in service (at end of period)

10,621

11,559

10,621

10,712

Admissions

327,466

324,681

0.9

%

323,679

309,921

4.4

%

Adjusted admissions

745,207

727,677

2.4

%

736,684

694,024

6.1

%

Patient days

1,453,905

1,546,477

1,449,317

1,478,304

Average length of stay (days)

4.5

4.8

4.5

4.7

Occupancy rate (average beds in

service)

49.3

%

49.0

%

49.9

%

50.6

%

Net operating revenues

$

9,308

$

9,069

2.6

%

$

9,210

$

8,750

5.3

%

Net inpatient revenues as a % of net

operating

revenues

46.9

%

46.9

%

46.8

%

47.0

%

Net outpatient revenues as a % of net

operating

revenues

53.1

%

53.1

%

53.2

%

53.0

%

Income from operations (f)

$

630

$

592

6.4

%

Income from operations as a % of net

operating revenues

6.8

%

6.5

%

Depreciation and amortization

$

384

$

398

Equity in earnings of unconsolidated

affiliates

$

(5

)

$

(11

)

Net loss attributable to Community

Health Systems, Inc. stockholders

$

(180

)

$

(369

)

51.2

%

Net loss attributable to Community

Health Systems, Inc. stockholders as a

%

of net operating revenues

-1.9

%

-4.1

%

Adjusted EBITDA (c)

$

1,068

$

1,062

0.6

%

Adjusted EBITDA as a % of net operating

revenues

11.5

%

11.7

%

Net cash provided by operating

activities

$

120

$

291

-58.8

%

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(In millions, except share

data)

(Unaudited)

September 30, 2023

December 31, 2022

ASSETS

Current assets

Cash and cash equivalents

$

91

$

118

Patient accounts receivable

2,160

2,040

Supplies

325

353

Prepaid income taxes

98

99

Prepaid expenses and taxes

249

237

Other current assets

325

235

Total current assets

3,248

3,082

Property and equipment

9,367

9,639

Less accumulated depreciation and

amortization

(4,207

)

(4,274

)

Property and equipment, net

5,160

5,365

Goodwill

3,943

4,166

Deferred income taxes

49

49

Other asset, net

2,274

2,007

Total assets

$

14,674

$

14,669

LIABILITIES AND STOCKHOLDERS’

DEFICIT

Current liabilities

Current maturities of long-term debt

$

22

$

21

Current operating lease liabilities

121

148

Accounts payable

837

773

Accrued liabilities:

Employee compensation

513

637

Accrued interest

184

189

Other

472

418

Total current liabilities

2,149

2,186

Long-term debt (g)

11,820

11,614

Deferred income taxes

344

354

Long-term operating lease liabilities

560

605

Other long-term liabilities

694

644

Total liabilities

15,567

15,403

Redeemable noncontrolling interests in

equity of consolidated subsidiaries

329

541

STOCKHOLDERS’ DEFICIT

Community Health Systems, Inc.

stockholders’ deficit:

Preferred stock, $.01 par value per share,

100,000,000 shares authorized; none issued

-

-

Common stock, $.01 par value per share,

300,000,000 shares authorized; 136,772,094

shares issued and outstanding at September

30, 2023, and 134,703,717 shares

issued and outstanding at December 31,

2022

1

1

Additional paid-in capital

2,170

2,084

Accumulated other comprehensive loss

(23

)

(21

)

Accumulated deficit

(3,611

)

(3,431

)

Total Community Health Systems, Inc.

stockholders’ deficit

(1,463

)

(1,367

)

Noncontrolling interests in equity of

consolidated subsidiaries

241

92

Total stockholders’ deficit

(1,222

)

(1,275

)

Total liabilities and stockholders’

deficit

$

14,674

$

14,669

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Condensed Consolidated

Statements of Cash Flows

(In millions)

(Unaudited)

Nine Months Ended September

30,

2023

2022

Cash flows from operating activities

Net loss

$

(70

)

$

(267

)

Adjustments to reconcile net loss to net

cash provided by

operating activities:

Depreciation and amortization

384

398

Deferred income taxes

22

290

Stock-based compensation expense

16

14

Impairment and (gain) loss on sale of

businesses, net (f)

(9

)

54

Loss (gain) from early extinguishment of

debt

-

(73

)

Other non-cash expenses, net

132

140

Changes in operating assets and

liabilities, net of effects of

acquisitions and divestitures:

Patient accounts receivable

(119

)

93

Supplies, prepaid expenses and other

current assets

(100

)

(94

)

Accounts payable, accrued liabilities and

income taxes

(69

)

(90

)

Other

(67

)

(174

)

Net cash provided by operating

activities

120

291

Cash flows from investing activities

Acquisitions of facilities and other

related businesses

(35

)

(9

)

Purchases of property and equipment

(357

)

(284

)

Proceeds from disposition of hospitals and

other ancillary operations

123

3

Proceeds from sale of property and

equipment

27

30

Purchases of available-for-sale debt

securities and equity securities

(126

)

(73

)

Proceeds from sales of available-for-sale

debt securities and equity securities

221

62

Distribution of CoreTrust proceeds

-

121

Purchases of investments in unconsolidated

affiliates

(8

)

(18

)

Increase in other investments

(51

)

(39

)

Net cash used in investing activities

(206

)

(207

)

Cash flows from financing activities

Repurchase of restricted stock shares for

payroll tax withholding requirements

(4

)

(8

)

Deferred financing costs and other

debt-related costs

-

(73

)

Proceeds from noncontrolling investors in

joint ventures

4

10

Redemption of noncontrolling investments

in joint ventures

(1

)

(2

)

Distributions to noncontrolling investors

in joint ventures

(108

)

(105

)

Other borrowings

30

35

Issuance of long-term debt

-

1,535

Proceeds from ABL Facility

2,290

-

Repayments of long-term indebtedness

(2,152

)

(1,683

)

Net cash provided by (used in) financing

activities

59

(291

)

Net change in cash and cash

equivalents

(27

)

(207

)

Cash and cash equivalents at beginning of

period

118

507

Cash and cash equivalents at end of

period

$

91

$

300

__________

For footnotes, see pages 13, 14 and

15.

Footnotes to Financial

Highlights, Financial Statements and Selected Operating

Data

(a)

Both financial and statistical results include the operating

results of divested or closed businesses for the periods prior to

the consummation of the respective divestiture or closing.

Same-store operating results and statistical information include

operating results of businesses operated in the comparable current

year and prior year periods and exclude businesses divested or

closed in 2022 and the nine months ended September 30, 2023. There

were no discontinued operations reported for 2023 and 2022.

(b)

The following table provides information needed to calculate

loss per share, which is adjusted for income attributable to

noncontrolling interests (in millions):

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net loss attributable to Community Health

Systems, Inc. stockholders:

Net (loss) income

$

(52

)

$

-

$

(70

)

$

(267

)

Less: Income attributable to

noncontrolling interests, net of taxes

39

42

110

102

Net loss attributable to Community Health

Systems, Inc.

stockholders — basic and diluted

$

(91

)

$

(42

)

$

(180

)

$

(369

)

(c)

EBITDA is a non-GAAP financial measure

which consists of net loss attributable to Community Health

Systems, Inc. before interest, income taxes, and depreciation and

amortization. Adjusted EBITDA, also a non-GAAP financial measure,

is EBITDA adjusted to add back net income attributable to

noncontrolling interests and to exclude loss (gain) from early

extinguishment of debt, impairment and (gain) loss on sale of

businesses, expense from third-party consulting costs associated

with significant process and systems redesign across multiple

functions (the “Business Transformation Costs”) as part of the

Company’s previously disclosed multi-year initiative to modernize

and consolidate technology platforms and associated processes, gain

on sale of equity interests in Macon Healthcare, LLC, expense

related to government and other legal matters and related costs,

income during the fourth quarter of 2021 associated with the

settlement of litigation for the recovery of amounts of certain

professional liability claims settled in 2020 covered by

third-party insurance policies, expense related to employee

termination benefits and other restructuring charges, the impact of

a change in estimate to increase the professional liability claims

accrual recorded during the fourth quarter of 2022 with respect to

claims incurred in prior years related to divested locations and

the gain on sale by HealthTrust of a majority interest in CoreTrust

completed during the fourth quarter of 2022. The Company has from

time to time sold noncontrolling interests in certain of its

subsidiaries or acquired subsidiaries with existing noncontrolling

interest ownership positions. The Company believes that it is

useful to present Adjusted EBITDA because it adds back the portion

of EBITDA attributable to these third-party interests. The Company

reports Adjusted EBITDA as a measure of financial performance.

Adjusted EBITDA is a key measure used by management to assess the

operating performance of the Company’s hospital operations and to

make decisions on the allocation of resources. Adjusted EBITDA is

also used to evaluate the performance of the Company’s executive

management team and is one of the primary metrics used in

connection with determining short-term cash incentive compensation

and the achievement of vesting criteria with respect to

performance-based equity awards. In addition, management utilizes

Adjusted EBITDA in assessing the Company’s consolidated results of

operations and operational performance and in comparing the

Company’s results of operations between periods.

Footnotes to Financial

Highlights, Financial Statements and Selected Operating Data

(Continued)

The Company believes it is useful to

provide investors and other users of the Company’s financial

statements this performance measure to align with how management

assesses the Company’s results of operations. Adjusted EBITDA also

is comparable to a similar metric called Consolidated EBITDA, as

defined in the Company’s asset-based loan facility (the “ABL

Facility”) and the Company’s existing note indentures, which is a

key component in the determination of the Company’s compliance with

certain covenants under the ABL Facility and such note indentures

(including the Company’s ability to service debt and incur capital

expenditures), and is used to determine the interest rate and

commitment fee payable under the ABL Facility (although Adjusted

EBITDA does not include all of the adjustments described in the ABL

Facility). Adjusted EBITDA includes the Adjusted EBITDA

attributable to hospitals that were divested during the course of

such year, but in each case solely to the extent relating to the

period prior to the consummation of the applicable divestiture.

Adjusted EBITDA is not a measurement of

financial performance under U.S. GAAP. It should not be considered

in isolation or as a substitute for net income, operating income,

or any other performance measure calculated in accordance with U.S.

GAAP. The items excluded from Adjusted EBITDA are significant

components in understanding and evaluating financial performance.

The Company believes such adjustments are appropriate as the

magnitude and frequency of such items can vary significantly and

are not related to the assessment of normal operating performance.

Additionally, this calculation of Adjusted EBITDA may not be

comparable to similarly titled measures disclosed by other

companies.

The following table reflects the

reconciliation of Adjusted EBITDA, as defined, to net loss

attributable to Community Health Systems, Inc. stockholders as

derived directly from the condensed consolidated financial

statements (in millions):

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net loss attributable to Community

Health

Systems, Inc. stockholders

$

(91

)

$

(42

)

$

(180

)

$

(369

)

Adjustments:

Provision for income taxes

19

70

84

291

Depreciation and amortization

128

137

384

398

Net income attributable to noncontrolling

interests

39

42

110

102

Interest expense, net

208

217

621

652

Loss (gain) from early extinguishment of

debt

-

(78

)

-

(73

)

Impairment and (gain) loss on sale of

businesses, net

26

47

(9

)

54

Expense from government and other legal

matters and related costs

24

5

33

5

Expense from business transformation

costs

6

-

13

-

Expense related to employee termination

benefits and other restructuring charges

1

2

12

2

Adjusted EBITDA

$

360

$

400

$

1,068

$

1,062

(d)

The following table sets forth components

reconciling the basic weighted-average number of shares to the

diluted weighted-average number of shares (in millions):

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Weighted-average number of shares

outstanding - basic

131

129

130

129

Add effect of dilutive securities:

Stock awards and options

-

-

-

-

Weighted-average number of shares

outstanding - diluted

131

129

130

129

Footnotes to Financial

Highlights, Financial Statements and Selected Operating Data

(Continued)

The Company generated a net loss

attributable to Community Health Systems, Inc. stockholders for

each of the three and nine-month periods ended September 30, 2023

and 2022, so the effect of dilutive securities is not considered

because their effect would be antidilutive. If the Company had

generated net income, the effect of stock awards and options on the

diluted shares calculation would have been an increase of 224,178

shares and 565,641 shares during the three months ended September

30, 2023 and 2022, respectively, and 298,184 shares and 1,305,604

shares during the nine months ended September 30, 2023 and 2022,

respectively.

(e)

The following supplemental table

reconciles net loss attributable to Community Health Systems, Inc.

stockholders, as reported, on a per share (diluted) basis, to net

loss attributable to Community Health Systems, Inc. stockholders

per share (diluted) with the adjustments described herein (total

per share amounts may not add due to rounding). The Company

believes that the presentation of non-GAAP adjusted net loss

attributable to Community Health Systems, Inc. stockholders per

share (diluted) presents useful information to investors by

highlighting the impact on net loss attributable to Community

Health Systems, Inc. stockholders per share (diluted) of selected

items used in calculating Adjusted EBITDA which may not reflect the

Company’s underlying operating performance and assisting in

comparing the Company’s results of operations between periods.

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net loss per share (diluted), as

reported

$

(0.69

)

$

(0.32

)

$

(1.38

)

$

(2.86

)

Adjustments:

Loss (gain) from early extinguishment of

debt

-

(0.53

)

-

(0.42

)

Impairment and (gain) loss on sale of

businesses, net

0.18

0.28

0.05

0.33

Expense from government and other legal

matters and related costs

0.14

0.03

0.20

0.03

Expense from business transformation

costs

0.04

-

0.08

-

Expense related to employee termination

benefits and other restructuring charges

0.01

0.01

0.07

0.01

Net loss per share (diluted), excluding

adjustments

$

(0.33

)

$

(0.52

)

$

(0.98

)

$

(2.92

)

(f)

Both income from operations and net (loss)

income included a net non-cash expense of $26 million and $47

million for the three months ended September 30, 2023 and 2022,

respectively, and a net non-cash income of $9 million and expense

of $54 million for the nine months ended September 30, 2023 and

2022, respectively, primarily from gains and losses on the sale of

certain businesses during such periods and also impairment charges

to reduce the value of certain long-lived assets at businesses the

Company identified for closure, sale or sold. These impairment

charges do not have an impact on the calculation of the Company’s

financial covenants under the ABL Facility.

(g)

The maximum aggregate principal amount

under the ABL Facility is $1.0 billion, subject to borrowing base

capacity. At September 30, 2023, the Company had outstanding

borrowings of $230 million and approximately $679 million of

additional borrowing capacity (after taking into consideration $82

million of outstanding letters of credit) under the ABL

Facility.

Regulation FD Disclosure

Set forth below is selected information concerning the Company’s

projected consolidated operating results for the year ending

December 31, 2023. These projections update selected guidance

provided on February 15, 2023, and are based on the Company’s

historical operating performance, current trends and other

assumptions that the Company believes are reasonable at this time.

The 2023 guidance should be considered in conjunction with the

assumptions included herein. See pages 18, 19 and 20 for a list of

factors that could affect the future results of the Company or the

healthcare industry generally. The following is provided as

guidance to analysts and investors:

2023 Projection Range

Net operating revenues (in millions)

$

12,400

to

$

12,500

Adjusted EBITDA (in millions)

$

1,450

to

$

1,500

Net loss per share - diluted

$

(1.00

)

to

$

(0.90

)

Weighted-average diluted shares (in

millions)

130

to

131

The following assumptions were used in developing the 2023

guidance provided above:

- The Company’s projections exclude the following:

- Effect of debt refinancing activities, including gains and

losses from early extinguishment of debt;

- Impairment of goodwill and long-lived assets;

- Previously recorded pandemic relief funds and the potential

recognition of additional pandemic relief funds;

- The impact of any potential future divestitures;

- Gains or losses from the sales of businesses;

- Employee termination benefits and restructuring costs;

- Resolution of government investigations or other significant

legal settlements;

- Costs incurred in connection with divestitures;

- Expense for third-party consulting costs associated with

significant process and systems redesign across multiple functions

as part of the Company's previously disclosed business

transformation initiative; and

- Other significant gains or losses that neither relate to the

ordinary course of business nor reflect the Company’s underlying

business performance.

Other assumptions used in the above guidance:

• Expressed as a percentage of net operating revenues,

depreciation and amortization of approximately 4.2% for 2023.

Additionally, this is a fixed cost and the percentages may vary

based on changes in net operating revenues. Such amounts exclude

the possible impact of any future hospital fixed asset

impairments.

• Interest expense is estimated to be between $815 million and

$835 million while cash paid for interest, which excludes the

amortization of deferred financing costs, is expected to be $760

million to $780 million. Total fixed rate debt is expected to

average approximately 99% of total debt during 2023.

• Expressed as a percentage of net operating revenues, net

income attributable to noncontrolling interests of approximately

1.1% to 1.2% for 2023.

• Expressed as a percentage of net operating revenues, provision

for income taxes of approximately 0.8% to 0.9% for 2023.

A reconciliation of the Company’s projected 2023 Adjusted

EBITDA, a forward-looking non-GAAP financial measure, to the

Company’s projected net loss attributable to Community Health

Systems, Inc. stockholders, the most directly comparable GAAP

financial measure, is shown below (in millions):

Year Ending

December 31, 2023

Low

High

Net loss attributable to Community Health

Systems, Inc.

stockholders (1)

$

(130

)

$

(118

)

Adjustments:

Depreciation and amortization

510

530

Interest expense, net

835

815

Provision for income taxes

95

123

Net income attributable to noncontrolling

interests

140

150

Adjusted EBITDA (1)

$

1,450

$

1,500

(1)

The Company does not include in this

reconciliation the impact of certain items not included in the

Company’s forecast set forth above that would be included in a

reconciliation of historical net loss attributable to Community

Health Systems, Inc. stockholders to Adjusted EBITDA such as, but

not limited to, losses (gains) from early extinguishment of debt,

impairment and (gain) loss on sale of businesses and expense from

government and other legal matters and related costs, in light of

the fact that such items are not determinable, and/or the inherent

difficulty in quantifying such projected amounts, on a

forward-looking basis.

- Capital expenditures are projected as follows (in

millions):

2023

Guidance

Total

$

450

to

$

500

- Net cash provided by operating activities are projected as

follows (in millions):

2023

Guidance

Total

$

400

to

$

450

- Diluted weighted-average shares outstanding are projected to be

approximately 130 million to 131 million for 2023.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Exchange Act of 1934, as

amended, and the Private Securities Litigation Reform Act of 1995

that involve risk and uncertainties. All statements in this press

release other than statements of historical fact, including

statements regarding projections, expected operating results, and

other events that depend upon or refer to future events or

conditions or that include words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “estimates,” “thinks,” and similar

expressions, are forward-looking statements. Although the Company

believes that these forward-looking statements are based on

reasonable assumptions, these assumptions are inherently subject to

significant economic and competitive uncertainties and

contingencies, which are difficult or impossible to predict

accurately and may be beyond the control of the Company.

Accordingly, the Company cannot give any assurance that its

expectations will in fact occur and cautions that actual results

may differ materially from those in the forward-looking statements.

A number of factors could affect the future results of the Company

or the healthcare industry generally and could cause the Company’s

expected results to differ materially from those expressed in this

press release.

These factors include, among other things:

- general economic and business conditions, both nationally and

in the regions in which we operate, including the current negative

macroeconomic conditions, ongoing inflationary pressures that have

significantly increased and may continue to significantly increase

our expenses, the current high interest rate environment, ongoing

challenging labor market conditions and labor shortages,

geopolitical instability, including the current and/or potential

future adverse impact of such economic conditions and other factors

on our net operating revenues (including our service mix, revenue

mix, payor mix and/or patient volumes) and our ability to collect

outstanding receivables, as well as the potential impact on us of

financial and capital market instability and/or disruptions to the

banking system due to bank failures and other factors, including

any potential impact on our ability to access and or obtain the

return of cash and cash equivalents, and/or our ability to access

credit, liquidity and capital market sources on acceptable terms or

at all;

- the impact of current or future federal and state health reform

initiatives, including the Patient Protection and Affordable Care

Act, as amended by the Health Care and Education Reconciliation Act

of 2010 (the “Affordable Care Act”), and the potential for changes

to the Affordable Care Act, its implementation or its

interpretation (including through executive orders and court

challenges);

- the extent to and manner in which states support increases,

decreases or changes in Medicaid programs, implement health

insurance exchanges or alter the provision of healthcare to state

residents through legislation, regulation or otherwise;

- the future and long-term viability of health insurance

exchanges and potential changes to the beneficiary enrollment

process;

- risks associated with our substantial indebtedness, leverage

and debt service obligations, including our ability to refinance

such indebtedness on acceptable terms or to incur additional

indebtedness, and our ability to remain in compliance with debt

covenants;

- demographic changes;

- changes in, or the failure to comply with, federal, state or

local laws or governmental regulations affecting our business;

- potential adverse impact of known and unknown legal, regulatory

and governmental proceedings and other loss contingencies,

including governmental investigations and audits, and federal and

state false claims act litigation;

- our ability, where appropriate, to enter into and maintain

provider arrangements with payors and the terms of these

arrangements, which may be further affected by the increasing

consolidation of health insurers and managed care companies and

vertical integration efforts involving payors and healthcare

providers;

- changes in, or the failure to comply with, contract terms with

payors and changes in reimbursement policies or rates paid by

federal or state healthcare programs or commercial payors;

- any security breaches, cyber-attacks, loss of data, other

cybersecurity threats or incidents, and any actual or perceived

failures to comply with legal requirements governing the privacy

and security of health information or other regulated, sensitive or

confidential information, or legal requirements regarding data

privacy or data protection;

- any potential impairments in the carrying value of goodwill,

other intangible assets, or other long-lived assets, or changes in

the useful lives of other intangible assets;

- changes in inpatient or outpatient Medicare and Medicaid

payment levels and methodologies;

- the effects related to the implementation of the sequestration

spending reductions pursuant to both the Budget Control Act of 2011

and the Pay-As-You-Go Act of 2010 and the potential for future

deficit reduction legislation;

- increases in the amount and risk of collectability of patient

accounts receivable, including decreases in collectability which

may result from, among other things, self-pay growth and

difficulties in recovering payments for which patients are

responsible, including co-pays and deductibles;

- the efforts of insurers, healthcare providers, large employer

groups and others to contain healthcare costs, including the trend

toward value-based purchasing;

- the impact of competitive labor market conditions and the

shortage of nurses, including in connection with our ability to

hire and retain qualified nurses, physicians, other medical

personnel and key management, and increased labor expenses as a

result of such competitive labor market conditions, inflation and

competition for such positions;

- the inability of third parties with whom we contract to provide

hospital-based physicians and the effectiveness of our efforts to

mitigate such non-performance including through acquisitions of

outsourced medical specialist businesses, engagement with new or

replacement providers, employment of physicians and re-negotiation

or assumption of existing contracts;

- any failure to obtain medical supplies or pharmaceuticals at

favorable prices;

- liabilities and other claims asserted against us, including

self-insured professional liability claims;

- competition;

- trends toward treatment of patients in less acute or specialty

healthcare settings, including ambulatory surgery centers or

specialty hospitals or via telehealth;

- changes in medical or other technology;

- any failure of our ongoing process of redesigning and

consolidating key business functions, including through the

implementation of a new core enterprise resource planning system,

to proceed as expected or to be completed successfully;

- changes in U.S. GAAP;

- the availability and terms of capital to fund any additional

acquisitions or replacement facilities or other capital

expenditures;

- our ability to successfully make acquisitions or complete

divestitures, our ability to complete any such acquisitions or

divestitures on desired terms or at all, the timing of the

completion of any such acquisitions or divestitures, and our

ability to realize the intended benefits from any such acquisitions

or divestitures;

- the impact that changes in our relationships with joint venture

or syndication partners could have on effectively operating our

hospitals or ancillary services or in advancing strategic

opportunities;

- our ability to successfully integrate any acquired hospitals

and/or outpatient facilities, or to recognize expected synergies

from acquisitions;

- the impact of severe weather conditions and climate change, as

well as the timing and amount of insurance recoveries in relation

to severe weather events;

- our ability to obtain adequate levels of insurance, including

cyber, general liability, professional liability, and directors and

officers liability insurance;

- timeliness of reimbursement payments received under government

programs;

- effects related to pandemics, epidemics, or outbreaks of

infectious diseases, including the impact of any future

developments related to COVID-19 and the COVID-19 pandemic on our

business, results of operations, financial condition, and/or cash

flows;

- any failure to comply with our obligations under license or

technology agreements;

- challenging economic conditions in non-urban communities in

which we operate;

- the concentration of our revenue in a small number of

states;

- our ability to realize anticipated cost savings and other

benefits from our current strategic and operational cost savings

initiatives;

- any changes in or interpretations of income tax laws and

regulations; and

- the risk factors set forth in our Annual Report on Form 10-K

for the year ended December 31, 2022, filed with the Securities and

Exchange Commission (the “SEC”) on February 17, 2023 and other

filings filed with the SEC.

The consolidated operating results for the three and nine months

ended September 30, 2023, are not necessarily indicative of the

results that may be experienced for any future periods. The Company

cautions that the projections for calendar year 2023 set forth in

this press release are given as of the date hereof based on

currently available information. The Company undertakes no

obligation to revise or update any forward-looking statements

(including such guidance), or to make any other forward-looking

statements, whether as a result of new information, future events

or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231025718246/en/

Investor Contact:

Kevin Hammons President and Chief Financial Officer (615)

465-7000

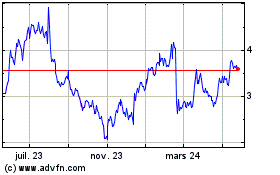

Community Health Systems (NYSE:CYH)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

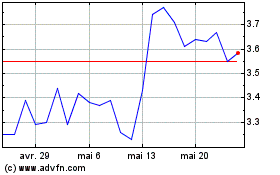

Community Health Systems (NYSE:CYH)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025