0001108109false00011081092024-12-312024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 31, 2024 (December 31, 2024) |

COMMUNITY HEALTH SYSTEMS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-15925 |

13-3893191 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4000 Meridian Boulevard |

|

Franklin, Tennessee |

|

37067 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 615 465-7000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $.01 par value |

|

CYH |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 31, 2024, CHSPSC, LLC, a wholly-owned subsidiary of Community Health Systems, Inc. (the “Company”), entered into a consultancy agreement (the “Consulting Agreement”) with Lynn T. Simon, M.D., the Company’s retiring President, Healthcare Innovation and Chief Medical Officer. As previously disclosed in a Current Report on Form 8-K filed by the Company on September 11, 2024, Dr. Simon is retiring as an executive officer effective December 31, 2024. Pursuant to the Consulting Agreement, Dr. Simon will advise the Company’s management team on innovation in healthcare, including identifying strategies, business opportunities and new technologies for the Company, and other matters as requested by Tim L. Hingtgen, Chief Executive Officer and/or his designee. The term of the Consulting Agreement will be January 1, 2025 to December 31, 2027. During the term of the Consulting Agreement, Dr. Simon will be entitled to receive consulting fees of $25,000 per month and will be subject to certain restrictions on competing, solicitation and conflicts of interest with CHSPSC, LLC or its affiliates. She will continue to vest in previously granted stock options and restricted stock of the Company in accordance with the applicable time-vesting schedule.

The foregoing summary of the Consulting Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Consulting Agreement, which is filed as Exhibit 10.1 hereto and incorporated into this report by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

COMMUNITY HEALTH SYSTEMS, INC.

(Registrant) |

|

|

|

|

Date: |

December 31, 2024 |

By: |

/s/ Tim L. Hingtgen |

|

|

|

Tim L. Hingtgen

Chief Executive Officer

(principal executive officer) |

CONSULTANCY AGREEMENT

Lynn Simon, MD

This Consultancy Agreement (“Agreement”) is between CHSPSC, LLC a Delaware limited liability company (“CHSPSC”), and Dr. Lynn Simon (“Consultant”).

1. Work to Be Performed. It is necessary and/or advisable to promote the interests of CHSPSC and associated entities that the Consultant serve as Innovation Consultant and provide ongoing consulting services related to matters of identifying strategies, business opportunities and new technologies for the company, as well as other assignments as requested by Tim Hingtgen, CEO. Consultant is not entitled to this Consultancy but for this offer by CHSPSC.

2. Term of Agreement. The services called for under this Agreement shall commence on January 1, 2025, and extend through December 31, 2027. The hours worked on a daily or weekly basis shall be as mutually agreed upon between Consultant and CHSPSC, but shall in no event require Consultant to work, on average, more than eight hours per week.

3. Terms of Payment. From January 1, 2025 to December 31, 2027, CHSPSC shall pay Consultant a gross amount of $25,000 per month. Each monthly installment shall be paid, in arrears, on the 1st business day of each month following the month of service. The timing and amount of any payments are subject to any deductions pursuant to Section 7.

4. Reimbursement of Expenses. CHSPSC shall reimburse Consultant for any reasonable expenses paid or incurred by Consultant while traveling on behalf of CHSPSC. However, no expense shall be incurred on behalf of or paid or reimbursed by CHSPSC unless approved in advance by CHSPSC.

5. Payroll Taxes. CHSPSC shall neither pay nor withhold federal, state, or local income tax or payroll tax of any kind on behalf of Consultant or the employees of Consultant. Consultant shall not be treated as an employee for the services performed hereunder for federal, state, or local tax purposes.

6. Workers’ Compensation. As an independent contractor, Consultant is not eligible for workers’ compensation coverage.

7. Independent Contractor Status; Post Employment Vesting and Benefits. Consultant expressly represents and warrants to CHSPSC that Consultant (i) is not and shall not be construed to be an employee of CHSPSC and that Consultant’s status shall be that of an independent contractor for which Consultant is solely responsible for her actions and inactions, (ii) shall not act as an employee or agent of CHSPSC, and (iii) is not authorized to enter into contracts or agreements on behalf of CHSPSC or to otherwise create obligations or liabilities of CHSPSC to third parties.

Consultant was an employee of CHSPSC through December 31, 2024, and as such participated in certain benefit arrangements. The parties acknowledge and agree that as long as this Agreement shall remain in effect as provided in Section 2 of this Agreement, and/or in the event of death and/or disability of Consultant, Consultant shall remain eligible for any earned incentive compensation per her 2024 incentive compensation plan. Furthermore, she will continue to vest in any previously granted options and/or restricted stock in

Community Health Systems, Inc. in accordance with the vesting schedule applicable to any such options or restricted stock at the time of grant and as amended and approved under this Consultancy Agreement.

As to Consultant’s medical/health insurance, CHSPSC agrees that Consultant and her spouse, may continue to enroll in COBRA medical/health insurance benefits provided by CHS/CHSI to its employees located in Franklin, Tennessee by paying, from and after January 1, 2025 through December 31, 2027, the monthly premium amount charged by CHSPSC to its employees who elect “employee and spouse” medical coverage. Consultant acknowledges that this retiree benefit will be taxable to Consultant and that the amount of income assigned to this benefit shall be the difference between the COBRA rate, as determined from time to time, and the premiums paid by Consultant. Consultant may continue until such time as she becomes eligible to participate in a government (state or federal) sponsored program that has at least comparable benefits and/or can be purchased at comparable cost as the benefits are made available. CHSPSC agrees that Consultant may continue coverage under the vision and/or the dental plan by paying the monthly premium charged to employees.

8. Background Checks. Consultant agrees that implementation of this Agreement may require additional background checks (e.g. regulatory databases, criminal) at the discretion of CHSPSC. Consultant further agrees to any authorizations that are required by CHSPSC to perform any background checks.

9. Confidential Matters and Proprietary Information. Consultant recognizes that during the course of performance of the Agreement, she may acquire knowledge of confidential business information and/or trade secrets (“confidential information”). Consultant agrees to keep all such confidential information in a secure place and not to publish, communicate, use, or disclose, directly or indirectly, for his/her own benefit or for the benefit of another, either during or after performance of the Agreement, any such confidential business information or trade secrets. Upon termination or expiration of this Agreement, Consultant shall deliver all records, data, information, and other documents produced or acquired during the performance of this Agreement, and all copies thereof, to CHSPSC. Such material shall remain the property of CHSPSC. This obligation of confidentiality shall not apply to information that is available to the Consultant from third parties on an unrestricted basis. Consultant will notify CHSPSC immediately upon receipt of any subpoena or other legal process.

10. Covenant Not to Compete; Conflicts of Interest. Consultant hereby covenants and agrees with CHSPSC that commencing on the date hereof and continuing through the term of this Agreement, Consultant will not, unless waived by the Chief Executive Officer in his sole discretion, or designee, directly or indirectly, anywhere in the United States:

(a) Accept an offer of employment, serve as a consultant in a same or similar capacity as her current or previous position(s) with CHSPSC, or act as an agent for or as an officer, director, employee, or other representative of any hospital, medical center, network, healthcare system or other healthcare providers or facilities located within fifty (50) miles of a facility or business that competes with CHSPSC or any other CHS affiliates;

(b) Interfere with, solicit, disrupt, or attempt to disrupt any past, present, or prospective relationship, contractual or otherwise, between CHSPSC (or any other CHS affiliate) and any physician, supplier, or employee of CHSPSC (or any other CHS affiliate);

(c) Employ, solicit for employment, or advise or recommend to any other person that they employ or solicit for employment, any employee of CHSPSC (or any other CHS affiliate); or

(d) Discuss with any hospital, medical center, network, healthcare system or other healthcare providers, the present or future availability of services or products by a business, if Consultant has or expects to acquire a proprietary interest in such business or is or expects to be an executive, officer, or director of such business, where such services or products are competitive with the services or products offered by CHS or any affiliated entities as of the Effective Date of this Agreement.

In connection with the foregoing provisions of this Section 10, Consultant represents that the limitations set forth herein are reasonable and properly required for the adequate protection of CHSPSC. If a judicial determination is made that any of the provisions of this Section 10 constitutes an unreasonable or otherwise unenforceable restriction against Consultant, the parties hereto hereby agree that any judicial authority construing this Agreement shall modify Section 10 hereof to the extent necessary to protect CHSPSC’s interests, in accordance with Section 13(c). The time period during which the prohibitions set forth in this Section 10 shall apply shall be tolled and suspended as to Consultant for a period equal to the aggregate quantity of time during which Consultant violates such prohibitions in any respect.

11. Reports. Consultant, when directed, shall provide written reports with respect to the services rendered thereunder.

12. Liability and Indemnification. Consultant agrees to indemnify, hold harmless, and defend CHSPSC for, from, and against any claims, demands, actions, settlements, judgments, costs, or damages, including reasonable attorneys’ fees and court costs, arising out of or related to this Agreement to the extent such claims, demands, actions, settlements, judgments, costs, or damages relate to the gross negligence or intentional misconduct of Consultant, his/her agents, representatives, and employees. This provision shall apply during the term of this Agreement and shall survive the termination of this Agreement.

13. Miscellaneous.

(a) Entire Agreement. Except for any award agreements evidencing grants of any options or restricted stock in Community Health Systems, Inc. referred to in Section 7, this Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior oral or written agreements, if any, between the parties. Neither party has made any representations that are not contained in this Agreement.

(b) Amendment. This Agreement may be amended only in writing by an agreement of the parties signed by Consultant and CHSPSC and identified as an amendment to this Agreement.

(c) Severability. If any provision or part of any provision of this Agreement is deemed to be unenforceable by a court of competent jurisdiction, then the parties agree that such provision shall be severed from the Agreement and the remainder of the Agreement shall remain in full force and effect. The parties further agree that, to the extent a court of competent jurisdiction deems any provision of this Agreement unenforceable, such court shall have the power to modify the terms of the Agreement by adding, deleting, or changing in its discretion any language necessary to make such provision enforceable to the maximum extent permitted by law, and the parties expressly agree to be bound by any such provision as reformed by the court.

(d) Waiver. No waiver of any provisions of this Agreement shall be effective unless the waiver is in writing and duly executed by Consultant and an Officer of CHSPSC.

(e) Successors. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, executors, administrators, personal representatives, successors, and assigns; provided, however, that Consultant shall not have the right to assign this Agreement to any other party.

(f) Choice of Law and Venue. This Agreement shall be governed by Tennessee law without regard to the application of the conflicts-of-interest laws of the State of Tennessee or any other jurisdiction and without the benefit of any rule of construction under which a contract is construed against the drafter. Venue for any action arising out of or related to this Agreement shall lie with the courts of competent jurisdiction located in Williamson County, Tennessee, and/or, if jurisdiction lies therein, the United States District Court for the Middle District of Tennessee, and Consultant agrees to submit to the jurisdiction of such courts and waives any defense of lack of personal jurisdiction and any right to jury trial.

(g) References. The heading and caption references of this Agreement are provided for convenience only and are intended to have no effect in construing or interpreting this Agreement. References to the male gender shall include references to the female gender and vice versa, as applicable according to the context; references to the singular tense shall include references to the plural tense and vice versa, as applicable according to the context.

(h) Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed to be an original document and all of which, taken together, shall be deemed to constitute a single original document.

Notices. Any notice or other communications under this Agreement shall be in writing, signed by the party making the same, and shall be delivered personally or sent by certified or registered mail, postage prepaid, as follows:

If to Consultant: Lynn Simon, MD

[Address on file]

If to CHSPSC: CHSPSC, LLC

Attention: General Counsel

4000 Meridian Boulevard

Franklin, TN 37067

All such notices shall be deemed given on the date personally delivered or, if mailed, three days after the date of mailing.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of this 31st day of December, 2024.

|

|

CONSULTANT |

CHSPSC, LLC |

/s/ Lynn Simon Lynn Simon |

By: /s/ Matt Hayes Matt Hayes Executive Vice President & Chief Human Resource Officer |

|

|

For convenience, this Agreement may be signed and electronically transmitted between the Parties and be as effective as a signed, paper agreement.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

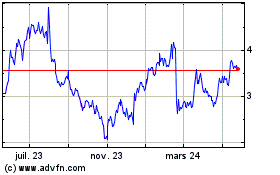

Community Health Systems (NYSE:CYH)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

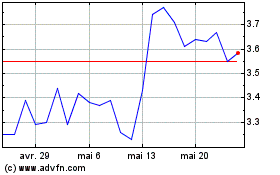

Community Health Systems (NYSE:CYH)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025