false

0001842022

false

false

false

false

false

0001842022

2024-12-31

2024-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 31, 2024

Commission File Number: 1-40392

DT Midstream, Inc.

| Delaware |

38-2663964 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S Employer

Identification No.) |

Registrant's address of principal executive offices:

500 Woodward Ave., Suite 2900, Detroit, Michigan 48226-1279

Registrant’s telephone number, including

area code: (313) 402-8532

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Exchange on which Registered |

| Common stock, par value $0.01 |

|

DTM |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under Exchange Act (17 CFR 240.12b-2).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. o

| Item 2.01 |

Completion of Acquisition or Disposition of Assets |

On December

31, 2024, DT Midstream, Inc. (the “Company”) successfully closed the previously announced acquisition by the Company and its

wholly-owned subsidiary, DTM Interstate Transportation, LLC (“DTM Transportation” and together with the Company, the “DTM

Parties”) in which, pursuant to the purchase and sale agreement dated November 19, 2024 (the “Purchase Agreement”) by

and among the DTM Parties, ONEOK Partners Intermediate Limited Partnership (“ONEOK Intermediate”) and Border Midwestern Company

(“Border Midwestern,” and together with ONEOK Intermediate, the “ONEOK Parties”), DTM Transportation acquired

100% of the equity interests of each of Guardian Pipeline, L.L.C., Midwestern Gas Transmission Company and Viking Gas Transmission Company

(each of which own certain pipelines and related assets in the Midwestern United States) from the ONEOK Parties, effective as of 11:59

PM Central Time on December 31, 2024, for a purchase price of $1.2 billion (the “Transaction”).

The foregoing

description of the Purchase Agreement and the Transaction do not purport to be complete and are

subject to and qualified in their entirety by reference to the copy of the Purchase Agreement, a copy of which was previously filed

with the Securities and Exchange Commission as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on November 19, 2024

and is incorporated herein by reference.

No pro

forma financial statements depicting the Transaction are required to be included as the Transaction does not exceed 20% significance under

any of the three significance tests under Regulation S-X 3-05.

| Item 7.01 |

Regulation FD Disclosure |

On December

31, 2024, the Company issued a press release regarding the closing of the Transaction. A copy of the press release is attached as Exhibit

99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

In accordance

with General Instruction B.2 of Form 8-K, the information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall

not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

Forward-Looking Statements:

This Current Report on Form 8-K

contains forward-looking statements, within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act and the

Private Securities Litigation Reform Act of 1995, that are subject to various assumptions, risks and uncertainties. It should be read

in conjunction with the “Forward-Looking Statements” section in the Company’s Form 10-K (which section is incorporated

by reference herein), and in conjunction with other SEC reports filed by the Company that discuss important factors that could cause the

Company’s actual results to differ materially.

Forward-looking statements are not guarantees of future

results and conditions, but rather are subject to numerous assumptions, risks, and uncertainties that may cause actual future results

to be materially different from those contemplated, projected, estimated, or budgeted. Many factors may impact forward-looking statements

of the Company including, but not limited to, the following: changes in general economic conditions, including increases in interest rates

and associated Federal Reserve policies, a potential economic recession, and the impact of inflation on our business; industry changes,

including the impact of consolidations, alternative energy sources, technological advances, infrastructure constraints and changes in

competition; global supply chain disruptions; actions taken by third-party operators, processors, transporters and gatherers; changes

in expected production from Expand Energy and other third parties in our areas of operation; demand for natural gas gathering, transmission,

storage, transportation and water services; the availability and price of natural gas to the consumer compared to the price of alternative

and competing fuels; our ability to successfully and timely implement our business plan; our ability to complete organic growth projects

on time and on budget; our ability to finance, complete, or successfully integrate acquisitions; the price and availability of debt and

equity financing; our ability to realize the anticipated benefits of the Transaction and our ability to manage the risks of the Transaction;

restrictions in our existing and any future credit facilities and indentures; the effectiveness of our information technology and operational

technology systems and practices to prevent, detect and defend against evolving cyber attacks on United States critical infrastructure;

changing laws regarding cybersecurity and data privacy, and any cybersecurity threat or event; operating hazards, environmental risks,

and other risks incidental to gathering, storing and transporting natural gas; geologic and reservoir risks and considerations; natural

disasters, adverse weather conditions, casualty losses and other matters beyond our control; the impact of outbreaks of illnesses, epidemics

and pandemics, and any related economic effects; the impacts of geopolitical events, including the conflicts in Ukraine and the Middle

East; labor relations and markets, including the ability to attract, hire and retain key employee and contract personnel; large customer

defaults; changes in tax status, as well as changes in tax rates and regulations; the effects and associated cost of compliance with existing

and future laws and governmental regulations, such as the Inflation Reduction Act; changes in environmental laws, regulations or enforcement

policies, including laws and regulations relating to climate change and greenhouse gas emissions; ability to develop low carbon business

opportunities and deploy greenhouse gas reducing technologies; changes in insurance markets impacting costs and the level and types of

coverage available; the timing and extent of changes in commodity prices; the success of our risk management strategies; the suspension,

reduction or termination of our customers’ obligations under our commercial agreements; disruptions due to equipment interruption

or failure at our facilities, or third-party facilities on which our business is dependent; the effects of future litigation; and the

risks described in our Annual Report on Form 10-K for the year ended December 31, 2023 and our reports and registration statements filed

from time to time with the SEC.

The above list of factors is not exhaustive. New factors

emerge from time to time. Any forward-looking statements speak only as of the date on which such statements are made. The Company expressly

disclaims any current intention to update any forward-looking statements contained in this report as a result of new information or future

events or developments.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 31, 2024

| |

DT MIDSTREAM, INC.

(Registrant) |

| |

by |

| |

|

/s/ Jeffrey A. Jewell |

| |

|

Name: Jeffrey A. Jewell |

| |

|

Title: Executive Vice President and Chief Financial Officer |

DT Midstream Announces Closing of Midwest Pipeline Acquisition

DETROIT, Dec. 31, 2024 – DT Midstream, Inc. (NYSE: DTM)

today announced that it has successfully closed on the acquisition of a portfolio of three FERC-regulated natural gas transmission pipelines

from ONEOK, Inc. (NYSE: OKE), effective as of 11:59 p.m. CT on Dec. 31, 2024, for a total cash consideration of $1.2 billion.

“The bolt-on acquisition of these premier pipelines is

fully aligned with our pure play natural gas strategy,” said David Slater, DT Midstream President and CEO. “This acquisition

also increases the revenue contribution from our pipeline segment, supported by take-or-pay contracts with strong credit quality utility

customers.”

“We are happy to have on board the team members that

support these assets, both in field operations and in DT Midstream’s new Tulsa office,” added Slater.

DT Midstream has acquired 100% operating ownership in Guardian

Pipeline, Midwestern Gas Transmission and Viking Gas Transmission. The acquired pipelines have a total capacity of more than 3.7 Bcf/d

with approximately 1,300 miles across seven states in the attractive Midwest market region.

# # #

About DT Midstream

DT Midstream (NYSE: DTM) is an owner, operator and developer of natural

gas interstate and intrastate pipelines, storage and gathering systems, compression, treatment and surface facilities. The company transports

clean natural gas for utilities, power plants, marketers, large industrial customers and energy producers across the Southern, Northeastern

and Midwestern United States and Canada. The Detroit-based company offers a comprehensive, wellhead-to-market array of services, including

natural gas transportation, storage and gathering. DT Midstream is transitioning towards net zero greenhouse gas emissions by 2050, including

a goal of achieving 30% of its carbon emissions reduction by 2030.

Forward-looking Statements

This release contains statements which, to the extent they are not

statements of historical or present fact, constitute “forward-looking statements” under the securities laws. These forward-looking

statements are intended to provide management’s current expectations or plans for our future operating and financial performance,

business prospects, outcomes of regulatory proceedings, market conditions, and other matters, based on what we believe to be reasonable

assumptions and on information currently available to us.

Forward-looking statements can be identified by the use of words such

as “believe,” “expect,” “expectations,” “plans,” “strategy,” “prospects,”

“estimate,” “project,” “target,” “anticipate,” “will,” “should,”

“see,” “guidance,” “outlook,” “confident” and other words of similar meaning. The absence

of such words, expressions or statements, however, does not mean that the statements are not forward-looking. In particular, express or

implied statements relating to future earnings, cash flow, results of operations, uses of cash, tax rates and other measures of financial

performance, future actions, conditions or events, potential future plans, strategies or transactions of DT Midstream, and other statements

that are not historical facts, are forward-looking statements.

Forward-looking statements are not guarantees of future results and

conditions, but rather are subject to numerous assumptions, risks, and uncertainties that may cause actual future results to be materially

different from those contemplated, projected, estimated, or budgeted. Many factors may impact forward-looking statements of DT Midstream

including, but not limited to, the following: changes in general economic conditions, including increases in interest rates and associated

Federal Reserve policies, a potential economic recession, and the impact of inflation on our business; industry changes, including the

impact of consolidations, alternative energy sources, technological advances, infrastructure constraints and changes in competition; global

supply chain disruptions; actions taken by third-party operators, processors, transporters and gatherers; changes in expected production

from Expand Energy and other third parties in our areas of operation; demand for natural gas gathering, transmission, storage, transportation

and water services;

the availability and price of natural gas to the consumer compared to the price of alternative and competing fuels;

our ability to successfully and timely implement our business plan; our ability to complete organic growth projects on time and on budget;

our ability to finance, complete, or successfully integrate acquisitions; the price and availability of debt and equity financing; our

ability to realize the anticipated benefits of the transaction described herein (“Transaction”), and our ability to manage

the risks of the Transaction; restrictions in our existing and any future credit facilities and indentures; the effectiveness of our information

technology and operational technology systems and practices to detect and defend against evolving cyber attacks on United States critical

infrastructure; changing laws regarding cybersecurity and data privacy, and any cybersecurity threat or event; operating hazards, environmental

risks, and other risks incidental to gathering, storing and transporting natural gas; geologic and reservoir risks and considerations;

natural disasters, adverse weather conditions, casualty losses and other matters beyond our control; the impact of outbreaks of illnesses,

epidemics and pandemics, and any related economic effects; the impacts of geopolitical events, including the conflicts in Ukraine and

the Middle East; labor relations and markets, including the ability to attract, hire and retain key employee and contract personnel; large

customer defaults; changes in tax status, as well as changes in tax rates and regulations; the effects and associated cost of compliance

with existing and future laws and governmental regulations, such as the Inflation Reduction Act; changes in environmental laws, regulations

or enforcement policies, including laws and regulations relating to climate change and greenhouse gas emissions; ability to develop low

carbon business opportunities and deploy greenhouse gas reducing technologies; changes in insurance markets impacting costs and the level

and types of coverage available; the timing and extent of changes in commodity prices; the success of our risk management strategies;

the suspension, reduction or termination of our customers’ obligations under our commercial agreements; disruptions due to equipment

interruption or failure at our facilities, or third-party facilities on which our business is dependent; the effects of future litigation;

and the risks described in our Annual Report on Form 10-K for the year ended December 31, 2023 and our reports and registration statements

filed from time to time with the SEC.

The above list of factors is not exhaustive. New factors emerge from

time to time. We cannot predict what factors may arise or how such factors may cause actual results to vary materially from those stated

in forward-looking statements, see the discussion under the section entitled “Risk Factors” in our Annual Report for the year

ended December 31, 2023, filed with the SEC on Form 10-K and any other reports filed with the SEC. Given the uncertainties and risk factors

that could cause our actual results to differ materially from those contained in any forward-looking statement, you should not put undue

reliance on any forward-looking statements.

Any forward-looking statements speak only as of the date on which such

statements are made. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements,

whether as a result of new information, subsequent events or otherwise.

Investor Relations

Todd Lohrmann, DT Midstream, 313.774.2424

investor_relations@dtmidstream.com

v3.24.4

Cover

|

Dec. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 31, 2024

|

| Entity File Number |

1-40392

|

| Entity Registrant Name |

DT Midstream, Inc.

|

| Entity Central Index Key |

0001842022

|

| Entity Tax Identification Number |

38-2663964

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

500 Woodward Ave., Suite 2900

|

| Entity Address, City or Town |

Detroit

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48226-1279

|

| City Area Code |

(313)

|

| Local Phone Number |

402-8532

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01

|

| Trading Symbol |

DTM

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

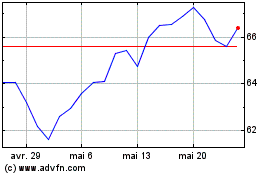

DT Midstream (NYSE:DTM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

DT Midstream (NYSE:DTM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025