Met or exceeded all guidance targets for the

full year

Continued to make excellent progress in

developing its world-class Blue Creek growth project

Outlines favorable guidance for 2025

Warrior Met Coal, Inc. (NYSE:HCC) (“Warrior” or the “Company”)

today announced results for the fourth quarter and full-year 2024.

Warrior is the leading dedicated U.S.-based producer and exporter

of high-quality steelmaking coal for the global steel industry.

Warrior reported net income for the fourth quarter of 2024 of

$1.1 million, or $0.02 per diluted share, compared to net income of

$128.9 million, or $2.47 per diluted share, in the fourth quarter

of 2023. Adjusted net income per share for the fourth quarter of

2024 was $0.15 per diluted share compared to $2.49 per diluted

share in the fourth quarter of 2023. The Company reported Adjusted

EBITDA of $53.2 million in the fourth quarter of 2024, compared to

Adjusted EBITDA of $163.7 million in the fourth quarter of

2023.

For the full year, Warrior reported net income of $250.6 million

and adjusted net income of $257.7 million, or net income of $4.79

per diluted share and adjusted net income of $4.92 per diluted

share in 2024, compared to net income of $478.6 million and

adjusted net income of $498.9 million, or net income of $9.20 per

diluted share and adjusted net income of $9.59 per diluted share,

in 2023. The Company reported Adjusted EBITDA of $447.9 million for

the full year 2024 compared to $698.9 million for the full year

2023.

Fourth Quarter and Full Year Highlights

- Recorded 6% increase in sales volumes and 8% increase in

production volumes for the full year, run rates not seen since 2019

and record high annual production for Mine 4 of 2.8 million short

tons;

- Generated $367.4 million of cash from operating activities

during 2024, enabling the second highest annual amount spent on

capital expenditures and mine development of $488.3 million for the

growth of the business;

- Began production at the world-class Blue Creek growth project

on time and on budget;

- Commenced two additional continuous miner units at Blue Creek

in the fourth quarter for a total of three developing the first

longwall panel and produced 209 thousand short tons from the mine

for the year;

- Completed the installation of the clean coal storage silos at

the rail loadout at Blue Creek, began construction on the dry

slurry processing system, and made significant progress on the

preparation plant, the overland clean coal belt and the barge

loadout in the fourth quarter. All remaining development progress

milestones remain on track, with the preparation plant expected to

be completed in the middle of 2025 and the longwall startup is

expected no later than the second quarter of 2026;

- Invested $104.1 million in the continued development of Blue

Creek, which brings the year-to-date project spend to $350.5

million and the total project spend to $716.5 million, all

self-funded; and

- Provided favorable company performance outlook in 2025

guidance, despite expected weak market conditions.

“During the fourth quarter of 2024, we delivered a strong

operational and financial performance despite high-quality

steelmaking coal prices reaching the lowest levels since 2021 due

to a confluence of excess Chinese steel exports into our customers'

markets, weaker demand and ample supply of steelmaking coals,” said

Walt Scheller, CEO of Warrior. “Looking back over the last twelve

months, 2024 was an extremely successful year for our company as we

met or exceeded all guidance targets, achieved sales and production

volume run rates not seen since 2019 and produced the first tons

from our world-class Blue Creek growth project. We also generated

cash from operations of $367.4 million in 2024, which was used to

both further the development of Blue Creek and return $43.8 million

to stockholders via dividends.”

“Since the launch of the development of Blue Creek nearly three

years ago, the project team continues to do an excellent job of

managing capital spending and staying on schedule,” Scheller said.

“Importantly, we remain confident with our total project capital

expenditure estimate of $995 million to $1.075 billion to complete

the project. Blue Creek has started to take delivery of the

longwall shields, and we expect to have all shields on site in the

first half of 2025. In addition, all major preparation plant

equipment is on-site awaiting installation. We continue to expect

that Blue Creek will be a significant and exciting driver of our

next stage of growth when global steel prices rebound.”

With the addition of Blue Creek, Warrior expects to increase its

annual High Vol A production by 4.8 million short tons, enhance its

already advantageous position on the global cost curve, drive its

cash costs further into the first quartile globally, improve its

profitability and cash flow generation and cement its position as a

leading pure play steelmaking coal producer.

Operating Results

Sales volumes in the fourth quarter of 2024 were 1.9 million

short tons, compared to 1.5 million short tons in the fourth

quarter of 2023, representing a 23% increase. The sales mix from

Mine No. 4 was abnormally 8% higher than the prior year comparable

period. Sales volumes for the full year 2024 were 8.0 million short

tons, or an increase of 6% compared to 2023, which was near the

high end of our guidance range. The higher sales volumes were

driven by higher production from both Mine No. 4 and Mine No. 7

operating at higher capacity levels in 2024 compared to 2023.

The Company produced 2.1 million short tons of met coal in the

fourth quarter of 2024 compared to 2.0 million short tons in the

fourth quarter of 2023. For the full year 2024, the Company

produced 8.2 million short tons, or an increase of 8% compared to

2023, which exceeded our guidance for the full year and achieved

run rates last achieved in 2019. Mine 4 achieved record high annual

production and Blue Creek produced 209 thousand short tons.

Inventory levels increased to 1.1 million short tons at the end of

December 31, 2024 from 915 thousand short tons as of September 30,

2024, primarily due to steelmaking coal production from Blue

Creek.

Additional Financial Results

Total revenues were $297.5 million in the fourth quarter of

2024, which compares to total revenues of $363.8 million in the

fourth quarter of 2023. The average net selling price of the

Company's steelmaking coal decreased 34% from $234.56 per short ton

in the fourth quarter of 2023 to $154.54 per short ton in the

fourth quarter of 2024 as a result of the weak pricing environment.

Warrior's average gross selling price realization was approximately

86% of the Platts Premium Low Vol FOB Australian index price for

the fourth quarter and 89% for the full year 2024.

For the full year 2024, total revenues were $1.5 billion, or a

decrease of 9% compared to 2023, driven by a 14% decrease in our

average net selling prices of the Company's steelmaking coal offset

partially by a 6% increase in sales volumes.

Cost of sales for the fourth quarter of 2024 was $228.8 million

compared to $186.8 million for the fourth quarter of 2023. Cash

cost of sales (free-on-board port) for the fourth quarter of 2024

were $225.6 million, or 77.4% of mining revenues, compared to

$185.0 million, or 51.4% of mining revenues for the same period of

2023. Cash cost of sales (free-on-board port) per short ton

decreased to $119.55 in the fourth quarter of 2024 from $120.69 in

the fourth quarter of 2023, primarily attributable to lower

steelmaking coal prices and its effect on our variable cost

structure, primarily for wages, transportation and royalties. For

the full year 2024, cash cost of sales (free-on-board port) per

short ton was $125.29 and was at the low end of Warrior's guidance

range.

Selling, general and administrative expenses for the fourth

quarter of 2024 were $17.6 million, or 5.9% of total revenues and

were higher than the same period last year of 3.6% of total

revenues, primarily due to higher employee-related costs. For the

full year 2024, selling, general and administrative expenses of

$63.1 million were within Warrior's guidance range compared to

$51.8 million in 2023.

Depreciation and depletion expense for the fourth quarter of

2024 were $39.2 million, or 13.2% of total revenues and were higher

than the same period last year of 7.0% of total revenues primarily

due to depreciation expense recognized on additional assets placed

into service at Blue Creek. Warrior achieved net interest income of

$6.2 million during the fourth quarter of 2024, compared to net

interest income of $7.8 million in the fourth quarter of 2023. For

the full year 2024, interest income earned of $33.0 million

exceeded Warrior's guidance range and interest expense of $4.3

million was within our guidance range.

Income tax expense was $0.8 million in the fourth quarter of

2024 on pre-tax income of $2.0 million compared to income tax

expense of $12.4 million in the fourth quarter of 2023. Our

effective income tax rate for the full year 2024 was approximately

12% compared to 13% in 2023.

Cash Flow and Liquidity

The Company generated cash flows from operating activities in

the fourth quarter of 2024 of $54.2 million, compared to $245.1

million in the fourth quarter of 2023. Capital expenditures and

mine development for the fourth quarter of 2024 were $142.2

million, primarily reflecting the development of the Blue Creek

growth project. Capital expenditures for the development of Blue

Creek were $104.1 million for the fourth quarter of 2024, $350.5

million for the full year 2024, which was within our guidance

range, and $716.5 million project-to-date. Free cash flows in the

fourth quarter of 2024 were negative $88.0 million compared to free

cash flows of $62.6 million in the fourth quarter of 2023.

Net working capital, excluding cash, for the fourth quarter of

2024 increased by $2.5 million from the third quarter of 2024,

primarily reflecting lower net accounts payable, higher inventories

and lower steelmaking coal prices.

Cash flows used in financing activities for the fourth quarter

of 2024 were $3.5 million, primarily due to payments of financing

lease obligations of $4.7 million and the payment of the regular

quarterly dividend of $3.3 million offset by proceeds received from

financing lease obligations of $4.5 million.

The Company generated $367.4 million of cash flows from

operating activities for the full year 2024 compared to $701.1

million in 2023. Capital expenditures and mine development costs

for the full year 2024 were $488.3 million, which was within our

guidance range. Cash flows used in financing activities for the

full year 2024 were $68.5 million, primarily due to the payment of

regular and special cash dividends of $43.8 million and payments on

capital lease obligations of $17.4 million.

The existing operations, excluding the investments made for Blue

Creek, generated strong cash flows from operations of $367.4

million and free cash flows of $260.5 million (cash flow from

operations of $367.4 million less existing operations capital

expenditures of $106.9 million) in 2024 that funded our future

growth while returning cash to stockholders in the medium term.

The Company’s total liquidity as of December 31, 2024 was $654.7

million, consisting of cash and cash equivalents of $491.5 million,

short-term investments of $5.1 million, net of $9.5 million posted

as collateral, long-term investments of $44.6 million and available

liquidity under its Second Amended and Restated Credit Facility

(the "ABL Facility") of $113.5 million.

Capital Allocation

On February 11, 2025, the Board of Directors (the "Board")

declared a regular quarterly cash dividend of $0.08 per share,

which the Company plans to distribute on March 3, 2025 to

stockholders of record as of the close of business on February 24,

2025.

Any future special dividends or stock repurchases from excess

cash flows will be at the discretion of the Board and subject to

consideration of several factors including business and market

conditions, future financial performance, and other strategic

investment opportunities. The Company will also seek to optimize

its capital structure to improve returns to stockholders while

allowing flexibility for the Company to pursue very selective

strategic growth opportunities that can provide compelling

stockholder returns.

Company Outlook

The Company's outlook for 2025 is subject to many risks that may

impact performance, such as market conditions in the steel and

steelmaking coal industries and overall global economic and

competitive conditions, all as more fully described under

Forward-Looking Statements. The Company's guidance for the full

year 2025 is outlined below.

Coal sales

8.2 - 9.0 million short tons

Coal production

7.8 - 8.6 million short tons

Cash cost of sales (free-on-board

port)

$117 - $127 per short ton

Capital expenditures for sustaining

existing mines

$90 - $100 million

Capital expenditures for Blue Creek

project

$225 - $250 million

Mine development costs for Blue Creek

project

$95 - $110 million

Depreciation and depletion

$185 - $210 million

Selling, general and administrative

expenses

$65 - $75 million

Interest expense

$4 - $6 million

Interest income

$10 - $15 million

Income tax expense rate

10% - 15%

Key factors that may affect outlook include:

- Three planned longwall moves (one in Q2 and two in Q3),

- HCC index pricing, geography of sales and freight rates,

- Exclusion of other non-recurring costs,

- New labor contract, and

- Inflationary pressures.

The Company's guidance for its capital expenditures consists of

sustaining capital spending of approximately $90-$100 million,

including regulatory gas requirements and final 4 North bunker

construction, and discretionary capital spending of $225-$250

million for the development of the Blue Creek reserves.

The Company's production and sales guidance contains

approximately 1.0 million short tons of High Vol A steelmaking coal

in 2025 from the continuous miner units from the Blue Creek

reserves, which are expected to be sold in the second half of 2025

when the preparation plant comes online.

Environmental, Social and Governance Sustainability

The Company recently published its annual corporate

environmental, social and governance sustainability report for

2024, which is located at

http://www.warriormetcoal.com/corporate-sustainability/. The report

was prepared in accordance with the codified standards of the

Sustainability Accounting Standards Board. The Company is committed

to transparency and open conversations surrounding environmental,

social and governance topics. Although Warrior's underground

steelmaking coal operations have a minimal environmental impact

compared to surface-mined thermal coal, the Company strives to be

an environmental steward by focusing on preservation of the

environment, monitoring energy use, reducing greenhouse gas (GHG)

emissions and effective land reclamation.

Use of Non-GAAP Financial Measures

This release contains the use of certain non-GAAP financial

measures. These non-GAAP financial measures are provided as

supplemental information for financial measures prepared in

accordance with GAAP. Management believes that these non-GAAP

financial measures provide additional insights into the performance

of the Company, and they reflect how management analyzes Company

performance and compares that performance against other companies.

These non-GAAP financial measures may not be comparable to other

similarly titled measures used by other entities. The definition of

these non-GAAP financial measures and a reconciliation of non-GAAP

to GAAP financial measures is provided in the financial tables

section of this release.

Conference Call

The Company will hold a conference call to discuss its fourth

quarter 2024 results today, February 13, 2025, at 4:30 p.m. ET. To

listen to the event live or access an archived recording, please

visit http://investors.warriormetcoal.com/. Analysts and investors

who would like to participate in the conference call should dial

1-844-340-9047 (domestic) or 1-412-858-5206 (international) 10

minutes prior to the start time and reference the Warrior Met Coal

conference call. Telephone playback will also be available from

6:30 p.m. ET February 13, 2025, until 6:30 p.m. ET on February 20,

2025. The replay will be available by calling: 1-877-344-7529

(domestic) or 1-412-317-0088 (international) and entering passcode

8614909.

About Warrior

Warrior is a U.S.-based, environmentally and socially minded

supplier to the global steel industry. It is dedicated entirely to

mining non-thermal metallurgical (met) steelmaking coal used as a

critical component of steel production by metal manufacturers in

Europe, South America and Asia. Warrior is a large-scale, low-cost

producer and exporter of premium quality met coal, also known as

hard-coking coal (HCC), operating highly efficient longwall

operations in its underground mines based in Alabama. The HCC that

Warrior produces from the Blue Creek coal seam contains very low

sulfur and has strong coking properties. The premium nature of

Warrior’s HCC makes it ideally suited as a base feed coal for steel

makers. For more information, please visit

www.warriormetcoal.com.

Forward-Looking Statements

This press release contains, and the Company’s officers and

representatives may from time to time make, forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

historical facts, included in this press release that address

activities, events or developments that the Company expects,

believes or anticipates will or may occur in the future are

forward-looking statements, including statements regarding 2025

guidance, sales and production growth, ability to maintain cost

structure, demand, pricing trends, profitability and cash flow

generation, management of liquidity, and expenses, competitive

advantage, the Company's future ability to create value for

stockholders, as well as statements regarding inflationary

pressures, the terms of any new labor contract, expected capital

expenditures, and the development of, and anticipated production

from, the Blue Creek project. The words “believe,” “expect,”

“anticipate,” “plan,” “intend,” “estimate,” “project,” “target,”

“foresee,” “should,” “would,” “could,” “potential,” “outlook,”

“guidance” or other similar expressions are intended to identify

forward-looking statements. However, the absence of these words

does not mean that the statements are not forward-looking. These

forward-looking statements represent management’s good faith

expectations, projections, guidance, or beliefs concerning future

events, and it is possible that the results described in this press

release will not be achieved. These forward-looking statements are

subject to risks, uncertainties and other factors, many of which

are outside of the Company’s control, that could cause actual

results to differ materially from the results discussed in the

forward-looking statements, including, without limitation,

fluctuations or changes in the pricing or demand for the Company’s

coal (or met coal generally) by the global steel industry; the

impact of global pandemics, such as the novel coronavirus

("COVID-19") pandemic, on its business and that of its customers,

including the risk of a decline in demand for the Company's met

coal due to the impact of any such pandemic on steel manufacturers;

the impact of inflation on the Company, the impact of geopolitical

events, including the effects of the Russia-Ukraine war and the

Israel-Hamas war; the inability of the Company to effectively

operate its mines and the resulting decrease in production; the

inability of the Company to transport its products to customers due

to rail performance issues or the impact of weather and mechanical

failures at the McDuffie Terminal at the Port of Mobile; federal

and state tax legislation; changes in interpretation or assumptions

and/or updated regulatory guidance regarding the Tax Cuts and Jobs

Act of 2017; legislation and regulations relating to the Clean Air

Act and other environmental initiatives; regulatory requirements

associated with federal, state and local regulatory agencies, and

such agencies’ authority to order temporary or permanent closure of

the Company’s mines; operational, logistical, geological, permit,

license, labor and weather-related factors, including equipment,

permitting, site access, operational risks and new technologies

related to mining and labor strikes or slowdowns; the timing and

impact of planned longwall moves; the Company’s obligations

surrounding reclamation and mine closure; inaccuracies in the

Company’s estimates of its met coal reserves; any projections or

estimates regarding Blue Creek, including the expected returns from

this project, if any, and the ability of Blue Creek to enhance the

Company's portfolio of assets, the Company's expectations regarding

its future tax rate as well as its ability to effectively utilize

its net operating losses to reduce or eliminate its cash taxes; the

Company's ability to develop Blue Creek; the Company’s ability to

develop or acquire met coal reserves in an economically feasible

manner; significant cost increases and fluctuations, and delay in

the delivery of raw materials, mining equipment and purchased

components; competition and foreign currency fluctuations;

fluctuations in the amount of cash the Company generates from

operations, including cash necessary to pay any special or

quarterly dividend; the Company’s ability to comply with covenants

in its ABL Facility or indenture relating to its senior secured

notes; integration of businesses that the Company may acquire in

the future; adequate liquidity and the cost, availability and

access to capital and financial markets; failure to obtain or renew

surety bonds on acceptable terms, which could affect the Company’s

ability to secure reclamation and coal lease obligations; costs

associated with litigation, including claims not yet asserted; and

other factors described in the Company’s Form 10-K for the year

ended December 31, 2024 and other reports filed from time to time

with the Securities and Exchange Commission (the “SEC”), which

could cause the Company’s actual results to differ materially from

those contained in any forward-looking statement. The Company’s

filings with the SEC are available on its website at

www.warriormetcoal.com and on the SEC's website at www.sec.gov.

Any forward-looking statement speaks only as of the date on

which it is made, and, except as required by law, the Company does

not undertake any obligation to update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise. New factors emerge from time to time,

and it is not possible for the Company to predict all such

factors.

WARRIOR MET COAL, INC.

CONDENSED STATEMENTS OF

OPERATIONS

($ in thousands, except per

share)

For the three months

ended

December 31,

For the twelve months

ended

December 31,

2024

2023

2024

2023

Revenues:

Sales

$

291,614

$

359,580

$

1,499,980

$

1,647,992

Other revenues

5,851

4,224

25,240

28,633

Total revenues

297,465

363,804

1,525,220

1,676,625

Costs and expenses:

Cost of sales (exclusive of items shown

separately below)

228,808

186,811

1,007,297

910,269

Cost of other revenues (exclusive of items

shown separately below)

15,958

4,683

45,449

37,486

Depreciation and depletion

39,167

25,573

153,982

127,356

Selling, general and administrative

17,626

12,991

63,078

51,817

Business interruption

115

190

524

8,291

Total costs and expenses

301,674

230,248

1,270,330

1,135,219

Operating (loss) income

(4,209

)

133,556

254,890

541,406

Interest expense

(813

)

(1,647

)

(4,271

)

(17,960

)

Interest income

6,973

9,464

33,047

40,699

Loss on early extinguishment of debt

—

—

—

(11,699

)

Other expenses

—

(146

)

—

(1,027

)

Income before income tax expense

$

1,951

$

141,227

$

283,666

$

551,419

Income tax expense

815

12,351

33,063

72,790

Net income

$

1,136

$

128,876

$

250,603

$

478,629

Basic and diluted net income per

share:

Net income per share—basic

$

0.02

$

2.48

$

4.79

$

9.21

Net income per share—diluted

$

0.02

$

2.47

$

4.79

$

9.20

Weighted average number of shares

outstanding—basic

$

52,330

52,019

52,287

51,973

Weighted average number of shares

outstanding—diluted

52,405

52,122

52,345

52,045

Dividends per share:

$

0.08

$

0.07

$

0.82

$

1.16

WARRIOR MET COAL, INC.

QUARTERLY SUPPLEMENTAL

FINANCIAL DATA AND RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

QUARTERLY SUPPLEMENTAL FINANCIAL

DATA:

For the three months

ended

December 31,

For the twelve months

ended

December 31,

(short tons in thousands)(1)

2024

2023

2024

2023

Tons sold

1,887

1,533

7,975

7,518

Tons produced

2,108

1,970

8,247

7,646

Average net selling price

$

154.54

$

234.56

$

188.09

$

219.21

Cash cost of sales (free on board port)

per short ton(2)

$

119.55

$

120.69

$

125.29

$

120.29

Cost of production %

68

%

61

%

64

%

60

%

Transportation and royalties %

32

%

39

%

36

%

40

%

Cash margin per ton (3)

$

34.99

$

113.87

$

62.80

$

98.92

(1) 1 short ton is equivalent to 0.907185

metric tons.

RECONCILIATION OF CASH COST OF SALES

(FREE-ON-BOARD PORT) TO COST OF SALES REPORTED UNDER U.S.

GAAP:

(In thousands)

For the three months

ended

December 31,

For the twelve months

ended

December 31,

2024

2023

2024

2023

Cost of sales

$

228,808

$

186,811

$

1,007,297

$

910,269

Asset retirement obligation accretion and

valuation adjustments

(1,136

)

(490

)

(3,243

)

(2,109

)

Stock compensation expense

(2,089

)

(1,310

)

(4,866

)

(3,841

)

Cash cost of sales (free-on-board

port)(2)

$

225,583

$

185,011

$

999,188

$

904,319

(2) Cash cost of sales (free-on-board

port) is based on reported cost of sales and includes items such as

freight, royalties, labor, fuel and other similar production and

sales cost items, and may be adjusted for other items that,

pursuant to GAAP, are classified in the Condensed Statements of

Operations as costs other than cost of sales, but relate directly

to the costs incurred to produce met coal. Our cash cost of sales

per short ton is calculated as cash cost of sales divided by the

short tons sold. Cash cost of sales per short ton is a non-GAAP

financial measure which is not calculated in conformity with U.S.

GAAP and should be considered supplemental to, and not as a

substitute or superior to financial measures calculated in

conformity with GAAP. We believe cash cost of sales per ton is a

useful measure of performance and we believe it aids some investors

and analysts in comparing us against other companies to help

analyze our current and future potential performance. Cash cost of

sales per ton may not be comparable to similarly titled measures

used by other companies.

(3) Cash margin per ton is defined as

average net selling price less cash cost of sales (free-on-board

port) per short ton.

WARRIOR MET COAL, INC.

QUARTERLY SUPPLEMENTAL

FINANCIAL DATA AND RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(CONTINUED)

RECONCILIATION OF ADJUSTED EBITDA TO

AMOUNTS REPORTED UNDER U.S. GAAP:

For the three months

ended

December 31,

For the twelve months

ended

December 31,

(In thousands)

2024

2023

2024

2023

Net income

$

1,136

$

128,876

$

250,603

$

478,629

Interest (income) expense, net

(6,160

)

(7,817

)

(28,776

)

(22,739

)

Income tax expense

815

12,351

33,063

72,790

Depreciation and depletion

39,167

25,573

153,982

127,356

Asset retirement obligation accretion and

valuation adjustments

1,538

1,649

5,435

4,535

Stock compensation expense

7,009

3,767

22,070

18,300

Other non-cash accretion and valuation

adjustments

7,761

(1,036

)

9,114

205

Non-cash mark-to-market loss (gain) on gas

hedges

1,835

—

1,835

(1,227

)

Loss on early extinguishment of debt

—

—

—

11,699

Business interruption

115

190

524

8,291

Other expenses

—

146

—

1,027

Adjusted EBITDA (4)

$

53,216

$

163,699

$

447,850

$

698,866

Adjusted EBITDA margin (5)

17.9

%

45.0

%

29.4

%

41.7

%

Adjusted EBITDA per short ton (6)

$

28.20

$

106.78

$

56.16

$

92.96

(4) Adjusted EBITDA is defined as net

income before net interest (income) expense, income tax expense,

depreciation and depletion, non-cash asset retirement obligation

accretion and valuation adjustments, non-cash stock compensation

expense, other non-cash accretion and valuation adjustments,

non-cash mark-to-market loss (gain) on gas hedges, loss on early

extinguishment of debt, business interruption expenses, and other

expenses. Adjusted EBITDA is not a measure of financial performance

in accordance with GAAP, and we believe items excluded from

Adjusted EBITDA are significant to a reader in understanding and

assessing our financial condition. Therefore, Adjusted EBITDA

should not be considered in isolation, nor as an alternative to net

income, income from operations, cash flows from operations or as a

measure of our profitability, liquidity, or performance under GAAP.

We believe that Adjusted EBITDA presents a useful measure of our

ability to incur and service debt based on ongoing operations.

Furthermore, analogous measures are used by industry analysts to

evaluate our operating performance. Investors should be aware that

our presentation of Adjusted EBITDA may not be comparable to

similarly titled measures used by other companies.

(5) Adjusted EBITDA margin is defined as

Adjusted EBITDA divided by total revenues.

(6) Adjusted EBITDA per ton is defined as

Adjusted EBITDA divided by short tons sold.

RECONCILIATION OF ADJUSTED NET INCOME

TO AMOUNTS REPORTED UNDER U.S. GAAP:

(In thousands, except per share

amounts)

For the three months

ended

December 31,

For the twelve months

ended

December 31,

2024

2023

2024

2023

Net income

$

1,136

$

128,876

$

250,603

$

478,629

Asset retirement obligation valuation

adjustments, net of tax

188

1,300

188

3,576

Other non-cash valuation adjustments, net

of tax

6,458

(817

)

6,458

162

Business interruption, net of tax

102

150

463

6,537

Loss on early extinguishment of debt, net

of tax

—

—

—

9,225

Other expenses, net of tax

—

115

—

810

Adjusted net income (7)

$

7,884

$

129,624

$

257,712

$

498,939

Weighted average number of basic shares

outstanding

52,330

52,019

52,287

51,973

Weighted average number of diluted shares

outstanding

52,405

52,122

52,345

52,045

Adjusted basic net income per share:

$

0.15

$

2.49

$

4.93

$

9.60

Adjusted diluted net income per share:

$

0.15

$

2.49

$

4.92

$

9.59

(7) Adjusted net income is defined as net

income net of asset retirement obligation accretion and valuation

adjustment, other non-cash accretion and valuation adjustments,

business interruption expenses, idle mine expenses, loss on early

extinguishment of debt and other expenses, net of tax (based on

each respective period's effective tax rate). Adjusted net income

is not a measure of financial performance in accordance with GAAP,

and we believe items excluded from adjusted net income are

significant to the reader in understanding and assessing our

results of operations. Therefore, adjusted net income should not be

considered in isolation, nor as an alternative to net income under

GAAP. We believe adjusted net income is a useful measure of

performance and we believe it aids some investors and analysts in

comparing us against other companies to help analyze our current

and future potential performance. Adjusted net income may not be

comparable to similarly titled measures used by other

companies.

WARRIOR MET COAL, INC.

CONDENSED STATEMENTS OF CASH

FLOWS

($ in thousands)

For the three months

ended

December 31,

For the twelve months

ended

December 31,

2024

2023

2024

2023

OPERATING ACTIVITIES:

Net income

$

1,136

$

128,876

$

250,603

$

478,629

Non-cash adjustments to reconcile net

income to net cash provided by operating activities

45,254

31,854

176,860

216,762

Changes in operating assets and

liabilities:

Trade accounts receivable

11,760

169,899

(42,642

)

53,601

Income tax receivable

—

(7,833

)

7,833

(7,833

)

Inventories

(10,401

)

(66,409

)

(18,495

)

(30,785

)

Prepaid expenses and other receivables

3,223

(332

)

(504

)

(847

)

Accounts payable

(8,697

)

(6,850

)

(2,551

)

215

Accrued expenses and other current

liabilities

1,610

1,860

1,207

(8,645

)

Other

10,322

(5,974

)

(4,863

)

11

Net cash provided by operating

activities

54,207

245,091

367,448

701,108

INVESTING ACTIVITIES:

Purchases of property, plant and

equipment, and other

(130,679

)

(180,854

)

(457,221

)

(491,674

)

Mine development costs

(11,516

)

(1,601

)

(31,060

)

(33,112

)

Acquisition, net of cash acquired

—

—

—

(2,421

)

Purchases of investments

—

—

(49,721

)

—

Net cash used in investing activities

(142,195

)

(182,455

)

(538,002

)

(527,207

)

FINANCING ACTIVITIES:

Net cash used in financing activities

(3,524

)

(11,250

)

(68,511

)

(265,184

)

Net (decrease) increase in cash and cash

equivalents

(91,512

)

51,386

(239,065

)

(91,283

)

Cash, cash equivalents and restricted cash

at beginning of period

590,644

686,811

738,197

829,480

Cash, cash equivalents and restricted cash

at end of period

$

499,132

$

738,197

$

499,132

$

738,197

RECONCILIATION OF FREE CASH FLOW TO

AMOUNTS REPORTED UNDER U.S. GAAP:

(In thousands)

For the three months

ended

December 31,

For the twelve months

ended

December 31,

2024

2023

2024

2023

Net cash provided by operating

activities

$

54,207

$

245,091

$

367,448

$

701,108

Purchases of property, plant and equipment

and mine development costs

(142,195

)

(182,455

)

(488,281

)

(524,786

)

Free cash flow (8)

$

(87,988

)

$

62,636

$

(120,833

)

$

176,322

Free cash flow conversion (9)

(165.3

)%

38.3

%

(27.0

)%

25.2

%

(8) Free cash flow is defined as net cash

provided by operating activities less purchases of property, plant

and equipment and mine development costs. Free cash flow is not a

measure of financial performance in accordance with GAAP, and we

believe items excluded from net cash provided by operating

activities are significant to the reader in understanding and

assessing our results of operations. Therefore, free cash flow

should not be considered in isolation, nor as an alternative to net

cash provided by operating activities under GAAP. We believe free

cash flow is a useful measure of performance and we believe it aids

some investors and analysts in comparing us against other companies

to help analyze our current and future potential performance. Free

cash flow may not be comparable to similarly titled measures used

by other companies.

(9) Free cash flow conversion is defined

as free cash flow divided by Adjusted EBITDA.

WARRIOR MET COAL, INC.

CONDENSED BALANCE

SHEETS

($ in thousands)

December 31,

2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

491,547

$

738,197

Short-term investments

14,622

9,030

Trade accounts receivable

140,867

98,225

Income tax receivable

—

7,833

Inventories, net

207,590

183,949

Prepaid expenses and other receivables

32,436

31,932

Total current assets

887,062

1,069,166

Restricted cash

7,585

—

Mineral interests, net

72,245

80,442

Property, plant and equipment, net

1,549,470

1,179,609

Deferred income taxes

3,210

5,854

Long-term investments

44,604

—

Other long-term assets

27,340

21,987

Total assets

$

2,591,516

$

2,357,058

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

40,178

$

36,245

Accrued expenses

85,369

81,612

Short term financing lease liabilities

13,208

11,463

Other current liabilities

31,675

18,350

Total current liabilities

170,430

147,670

Long-term debt

153,612

153,023

Asset retirement obligations

72,138

71,666

Long-term financing lease liabilities

6,217

8,756

Deferred income taxes

63,835

74,531

Other long-term liabilities

34,467

26,966

Total liabilities

500,699

482,612

Stockholders’ Equity:

Common stock, $0.01 par value per share

(Authorized -140,000,000 shares, 54,533,374 issued and 52,311,533

outstanding as of December 31, 2024 and 54,240,764 issued and

52,018,923 outstanding as of December 31, 2023)

545

542

Preferred stock, $0.01 par value per share

(10,000,000 shares authorized, no shares issued and

outstanding)

—

—

Treasury stock, at cost (2,221,841 shares

as of December 31, 2024, and December 31, 2023)

(50,576

)

(50,576

)

Additional paid in capital

289,808

279,332

Retained earnings

1,851,040

1,645,148

Total stockholders’ equity

2,090,817

1,874,446

Total liabilities and stockholders’

equity

$

2,591,516

$

2,357,058

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213088475/en/

For Investors: Dale W. Boyles, 205-554-6129

dale.boyles@warriormetcoal.com

For Media: D'Andre Wright, 205-554-6131

dandre.wright@warriormetcoal.com

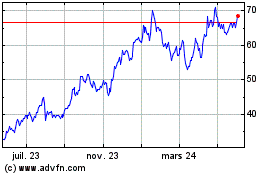

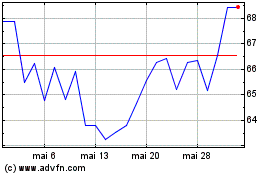

Warrior Met Coal (NYSE:HCC)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Warrior Met Coal (NYSE:HCC)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025