Horace Mann Educators Corporation (NYSE:HMN), the largest

financial services company focused on helping America’s educators

and a core small-cap value equity in the Financials sector, today

reported financial results for the three months and full year ended

December 31, 2023:

- Diversified business delivered full-year net income of $45

million, or $1.09 per share, and core earnings* of $64 million, or

$1.54 per share, with reported book value of $28.78 and adjusted

book value* of $36.29 at year end; fourth-quarter net income was

$0.95 per share, with core earnings of $0.84 per share

- Total revenue rose 8% for the year and 16% for the fourth

quarter with net premiums and contract charges earned up 3% and

record net premiums written and contract deposits* up 6% for the

year and fourth quarter, total net investment income up 11% for the

year and 17% for the fourth quarter

- Property & Casualty segment results improved over 2022 with

fourth-quarter segment profit of $9 million; Supplemental &

Group Benefits and Life & Retirement segments continued to

deliver strong results

- Full-year 2024 EPS estimated at $3.00-$3.30 as Property &

Casualty segment expected to return to full-year profitability;

reflects higher year-over-year corporate interest expense following

the 2023 senior debt offering

($ in millions, except per share

amounts)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

% Change

2023

2022

% Change

Total revenues

$

402.9

$

346.4

16.3

%

$

1,491.9

$

1,381.6

8.0

%

Net income (loss)

39.5

(16.7

)

N.M.

45.0

19.8

127.3

%

Net investment gains (losses), after

tax

4.6

(10.0

)

N.M.

(18.8

)

(44.5

)

N.M.

Other expense - goodwill and intangible

asset

impairments, after tax

—

(3.8

)

N.M.

—

(3.8

)

N.M.

Core earnings (loss)*

34.9

(2.9

)

N.M.

63.8

68.1

-6.3

%

Adjusted core earnings*

37.8

(1.5

)

N.M.

72.0

79.8

-9.8

%

Per diluted share:

Net income (loss)

0.95

(0.40

)

N.M.

1.09

0.47

131.9

%

Net investment gains (losses), after

tax

0.11

(0.25

)

N.M.

(0.45

)

(1.07

)

N.M.

Other expense - goodwill and intangible

asset

impairments, after tax

—

(0.09

)

N.M.

—

(0.09

)

N.M.

Core earnings (loss) per diluted

share*

0.84

(0.06

)

N.M.

1.54

1.63

-5.5

%

Adjusted core earnings (loss) per diluted

share*

0.91

(0.04

)

N.M.

1.74

1.91

-8.9

%

Book value per share

28.78

26.85

7.2

%

Adjusted book value per share*

36.29

36.40

-0.3

%

Tangible book value per share*

30.79

30.58

0.7

%

N.M. - Not meaningful.

* These measures are not based on

accounting principles generally accepted in the United States of

America (non-GAAP). They are reconciled to the most directly

comparable GAAP measures in the Appendix to the Investor

Supplement. An explanation of these measures is contained in the

Glossary of Selected Terms included as an exhibit in the Company’s

reports filed with the Securities and Exchange Commission.

“We enter 2024 focused on helping all educators protect what

they have today and prepare for a successful tomorrow while we also

help school districts and other municipal employers attract and

retain employees by providing more comprehensive benefits,” said

Horace Mann President & CEO Marita Zuraitis. “We are

diversifying to expand our reach in our core markets while managing

our businesses to deliver consistent and reliable value to

shareholders with a solid balance sheet and a compelling

dividend.

“We remain highly confident in our ability to achieve the

company’s long-term objectives of expanding our share of the

education market and achieving a sustainable double-digit ROE in

2025.” Zuraitis added. “We are executing on our plan. In

particular, 2023 results and our 2024 guidance clearly reflect the

benefit of the property and casualty rate and non-rate underwriting

actions we are taking. Our expectations for 2024 keep us on track

to a core return on equity for the year near 9%.”

Details of the company’s guidance and outlook are included in

the Q4 2023 investor presentation available on the

Quarterly Results page of

investors.horacemann.com.

Reporting Segment Results

Horace Mann reports financial results in three reporting

segments: (1) Property & Casualty, (2) Life & Retirement,

and (3) Supplemental & Group Benefits. The retail business,

consisting of the Property & Casualty and Life & Retirement

segments, provides insurance and financial services to individual

educators through exclusive agents and direct capabilities. The

Supplemental & Group Benefits segment provides worksite direct

and employer-sponsored benefits through employers. These worksite

offerings help school districts attract and retain staff.

Horace Mann adopted the Financial Accounting Standards Board’s

Accounting Standard Update 2018-12 Financial Services - Insurance:

Targeted Improvements to the Accounting for Long-Duration Contracts

as of January 1, 2023, with a January 1, 2021 transition date. The

company’s 2022 results have been recast to reflect the ASU and are

reflected in this release on that basis.

Property & Casualty segment results reflect benefit of

rate and non-rate actions

(All comparisons vs. same period in 2022, unless noted

otherwise)

The Property & Casualty segment primarily markets private

passenger auto insurance and residential home insurance. Horace

Mann offers standard auto coverages, including liability, collision

and comprehensive. Property coverage includes both homeowners and

renters policies. For both auto and property coverage, Horace Mann

offers educators a discounted rate and the Educator Advantage®

package of features. The Property & Casualty segment

represented 46% of total revenues in 2023.

($ in millions)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

Change

2023

2022

Change

Property & Casualty net premiums

written*

$

176.0

$

153.5

14.7

%

$

684.4

$

617.5

10.8

%

Property & Casualty net income (loss)

/

core earnings (loss)*

8.8

(25.0

)

135.2

%

(35.5

)

(44.4

)

20.0

%

Property & Casualty combined ratio

100.9

%

128.0

%

-27.1 pts

113.3

%

115.3

%

-2.0 pts

Property & Casualty underlying loss

ratio*

71.1

%

81.6

%

-10.5 pts

71.2

%

71.3

%

-0.1 pts

Property & Casualty expense ratio

26.9

%

29.4

%

-2.5 pts

27.0

%

27.4

%

-0.4 pts

Property & Casualty catastrophe

losses

2.9

%

8.0

%

-5.1 pts

15.1

%

13.0

%

2.1 pts

Property & Casualty underlying

combined ratio*

98.0

%

111.0

%

-13.0 pts

98.2

%

98.7

%

-0.5 pts

Auto combined ratio

112.7

%

143.6

%

-30.9 pts

111.7

%

119.0

%

-7.3 pts

Auto underlying loss ratio*

84.7

%

99.8

%

-15.1 pts

81.7

%

82.8

%

-1.1 pts

Property combined ratio

80.1

%

101.0

%

-20.9 pts

116.1

%

108.8

%

7.3 pts

Property underlying loss ratio*

47.0

%

49.9

%

-2.9 pts

52.2

%

50.1

%

2.1 pts

Including a profit of $8.8 million in the fourth quarter, the

Property & Casualty segment’s net loss for the full year was in

line with the company’s recent guidance, reflecting elevated

catastrophe and non-catastrophe weather activity for much of the

year. Property & Casualty net premiums written were up 10.8%

for the year and 14.7% for the quarter. Segment net investment

income was up 20.7% for the year and 32.9% for the quarter.

The year-over-year improvement in the fourth-quarter combined

ratio demonstrated the benefit of the company’s rate and non-rate

underwriting actions as well as catastrophe losses below our

five-year average for the fourth quarter. Catastrophe losses for

the quarter were $5.0 million, pretax, and catastrophe losses for

the full-year were $97.6 million, pretax, In total, there were

seven events designated as catastrophes by Property Claims Services

(PCS) in this year’s fourth quarter versus 13 events in last year’s

fourth quarter.

The year-over-year increase in average written premiums for auto

policies improved again in the fourth quarter to 16.7%. The

fourth-quarter auto underlying loss ratio improved 15.1 points

year-over-year to 84.7%, but reflected typical seasonality in auto

loss trends even as the benefit of rate and non-rate underwriting

actions begins to be seen.

The year-over-year increase in average written premiums for

property policies was 13.2% in the fourth quarter, as rate

increases taken over the past two years and inflation adjustments

to coverage values continue to take effect. The fourth-quarter

property underlying loss ratio improved to 47.0%.

Life & Retirement segment full-year net income of $72

million

(All comparisons vs. same period in 2022, unless noted

otherwise)

The Life & Retirement segment markets 403(b) tax-qualified

fixed, fixed indexed and variable annuities; the Horace Mann

Retirement Advantage® open architecture platform for 403(b)(7) and

other defined contribution plans; and other retirement products to

educators as well as traditional term and whole life insurance

products. Horace Mann is one of the largest participants in the

K-12 educator portion of the 403(b) tax-qualified annuity market,

measured by 403(b) net premiums written on a statutory accounting

basis. The Life & Retirement segment represented 36% of total

revenues in 2023.

($ in millions)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

Change

2023

2022

Change

Life & Retirement net income

$

19.2

$

6.7

N.M.

$

71.5

$

63.8

12.1

%

Life & Retirement core earnings*

19.2

10.5

82.9

%

71.5

67.6

5.8

%

Life & Retirement adjusted core

earnings*

19.2

8.8

118.2

%

68.2

66.9

1.9

%

Life annualized sales*

2.7

3.1

-12.9

%

9.3

9.3

—

%

Life mortality costs

16.4

14.9

10.1

%

69.4

68.6

1.2

%

Net annuity contract deposits*

108.3

105.0

3.1

%

455.9

429.3

6.2

%

Annuity assets under management(1)

5,186.9

4,837.9

7.2

%

Total assets under administration(2)

8,687.1

8,120.3

7.0

%

(1)

Amount reported as of December 31, 2023

excludes $711.7 million of assets under management held under

modified coinsurance reinsurance.

(2)

Includes Annuity AUM, Brokerage and

Advisory AUA, and Recordkeeping AUA.

Life & Retirement segment net income for the full year was

ahead of recent guidance, as segment net investment income rose

13.6% in the fourth-quarter and 9.3% for the full-year, benefiting

from higher returns on floating rate securities. The net interest

spread on our fixed annuity business remained near our longer-term

targeted range of 220 to 230 basis points. The spread was affected

by lower limited partnership returns as well as higher FHLB

borrowing costs as credit spreads tightened year over year. The net

dollar contribution from our FHLB funding agreements remained

stable compared with 2022, with FHLB borrowing costs reflected in

interest credited.

For the Retirement business, net annuity contract deposits were

up 6.2% for the year to $455.9 million. Educators continue to begin

their relationship with Horace Mann through 403(b) retirement

savings products, including the company’s attractive annuity

products, which provide encouraging cross-sell opportunities.

Horace Mann currently has $5.2 billion in annuity assets under

management, including $2.2 billion of fixed annuities, $2.6 billion

of variable annuities and $0.4 billion of fixed indexed annuities.

Assets under administration, which includes Horace Mann Retirement

Advantage® and other advisory and recordkeeping assets, continue to

benefit from the strong equity markets.

Life annualized sales were $9.3 million for the year. Life

insurance in force rose to $20.5 billion at year-end.

Supplemental & Group Benefits segment full-year net

income of $55 million

(All comparisons vs. same period in 2022, unless noted

otherwise)

The Supplemental & Group Benefits segment markets

employer-sponsored group solutions for districts and other public

employers, as well as worksite direct products typically

distributed through the employer channel. The worksite business

provides group term life, disability and specialty health insurance

along with supplemental products including cancer, heart, hospital,

supplemental disability and accident coverages. The Supplemental

& Group Benefits segment represented 19% of total revenues in

2023.

($ in millions)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

Change

2023

2022

Change

Supplemental & Group Benefits net

income /

core earnings*

$

13.3

$

17.0

-21.8

%

$

54.9

$

65.9

-16.7

%

Supplemental & Group Benefits

adjusted

core earnings*

16.2

20.1

-19.4

%

66.4

78.3

-15.2

%

Pretax profit margin(1)

23.3

%

30.9

%

-7.6 pts

24.3

%

28.5

%

-4.2 pts

Net premiums earned

$

64.6

$

68.3

-5.4

%

$

259.8

$

275.5

-5.7

%

Worksite direct products sales*

4.4

3.4

29.4

%

15.1

9.2

64.1

%

Employer-sponsored products sales*

1.1

1.1

—

%

11.1

6.9

60.9

%

Worksite direct products benefit ratio

36.3

%

16.9

%

19.4 pts

29.1

%

23.0

%

6.1 pts

Employer-sponsored products benefit

ratio

36.2

%

33.3

%

2.9 pts

41.4

%

41.8

%

-0.4 pts

(1)

Measured to total revenues.

Supplemental & Group Benefits segment full-year net income

was $54.9 million, at the top end of recent guidance. The full-year

benefit ratio for the worksite direct product line continued to

move toward the longer-term target although utilization remains

below historical levels. The full-year benefit ratio for the

employer-sponsored product lines was in line with the prior year

but also remains below the longer-term target.

The non-cash impact of amortization of intangible assets under

purchase accounting reduced full-year 2023 core earnings by $14.6

million, pretax, vs. $15.7 million in 2022. Segment net investment

income rose 31.6% in the fourth-quarter and 16.8% for the

full-year.

Total segment sales for the year were $26.2 million, up 62.7%

over the prior year, with worksite direct supplemental product

sales of $15.1 million and employer-sponsored products of $11.1

million. Fourth-quarter sales reflected normal seasonality in this

business area. Persistency remains relatively stable for the

segment.

Consolidated Results

The Corporate & Other segment reduced total revenues by

$20.6 million in 2023, largely due to realized investment losses

related to proactive repositioning of the portfolio to enhance book

yield. Interest expense was $8.6 million for the fourth quarter of

2023 compared to $5.9 million for the fourth quarter of 2022.

Total net investment income rose 11% in 2023

(All comparisons vs. same period in 2022, unless noted

otherwise)

Horace Mann’s investment strategy is primarily focused on

generating income to support product liabilities, and balances

principal protection and risk. Total net investment income includes

net investment income on the investment portfolio managed by Horace

Mann, as well as accreted investment income on the deposit asset on

reinsurance related to the company’s reinsurance of policy

liabilities related to legacy individual annuities written in 2002

or earlier.

($ in millions)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

Change

2023

2022

Change

Pretax net investment income - investment

portfolio

$

90.9

$

74.1

22.7

%

$

339.9

$

297.4

14.3

%

Pretax investment income - deposit

asset

on reinsurance

26.1

26.1

—

%

104.9

103.5

1.4

%

Total pretax net investment income

117.0

100.2

16.8

%

444.8

400.9

11.0

%

Pretax net investment gains (losses)

5.7

(12.7

)

N.M

(24.0

)

(56.5

)

N.M.

Pretax net unrealized investment gains

(losses) on fixed

maturity securities

(417.6

)

(571.9

)

N.M.

Investment yield, excluding limited

partnership interests,

pretax - annualized

4.94

%

4.01

%

0.93 pts

4.74

%

4.26

%

0.48 pts

N.M. - Not meaningful.

For the full year, total net investment income rose 11.0% and

net investment income on the managed portfolio increased 14.3%,

ahead of recent guidance due to strong fourth-quarter results. The

full-year increase reflected the benefit of the higher interest

rate environment on floating rate investments. Investment yield on

the portfolio excluding limited partnership interests was 4.74%,

with new money yields continuing to exceed portfolio yields in the

core fixed maturity securities portfolio.

The fixed maturity securities portfolio was in a net unrealized

investment loss position of $417.6 million pretax at December 31,

2023, primarily due to higher interest rates. Net investment gains

were $4.6 million after tax for the quarter.

Adjusted book value per share of $36.29 at year end

At December 31, 2023, shareholders’ equity was $1.18 billion, or

$28.78 per share, as the net unrealized investment losses on fixed

maturity securities continued to reflect the higher interest rate

environment. Excluding the unrealized losses and effect of net

reserve remeasurements attributable to discount rates*,

shareholders’ equity was $1.48 billion, or $36.29 per share*.

During 2023, Horace Mann repurchased 196,934 shares at an average

price of $32.85. As of December 31, 2023, $34.9 million remained

authorized for future repurchases under the share repurchase

program.

At December 31, 2023, total debt was $546.0 million, reflecting

$300.0 million of 7.25% senior notes issued in September 2023. The

net proceeds from the sale of the 2028 Senior Notes were used to

fully repay the $249.0 million balance on the company’s revolving

credit facility. The ratio of debt-to-capital excluding net

unrealized investment gains/losses and effect of net reserve

remeasurements attributable to discount rates* was 26.9% at

December 31, 2023, which aligns with levels appropriate for the

company’s current financial strength ratings.

Quarterly webcast

Horace Mann’s senior management will discuss the company’s

fourth-quarter and full-year financial results with investors on

February 8, 2024 at 11:00 a.m. Eastern Time. The conference call

will be webcast live at investors.horacemann.com and available

later in the day for replay.

About Horace Mann

Horace Mann Educators Corporation (NYSE: HMN) is the largest

financial services company focused on helping America’s educators

and others who serve the community achieve lifelong financial

success. The company offers individual and group insurance and

financial solutions tailored to the needs of the educational

community. Founded by Educators for Educators® in 1945, Horace Mann

is headquartered in Springfield, Illinois. For more information,

visit horacemann.com.

Safe Harbor Statement and Non-GAAP Measures

Certain statements included in this news release, including

those regarding our earnings outlook, expected catastrophe losses,

our investment strategies, our plans to implement additional rate

actions, our plans relating to share repurchases and dividends, our

efforts to enhance customer experience and expand our products and

solutions to more educators, our strategies to create sustainable

long-term growth and double-digit ROEs, our strategy to achieve a

larger share of the education market, and other business

strategies, constitute forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995. Forward-looking statements are made based on management’s

current expectations and beliefs concerning future developments and

their potential effects upon Horace Mann and its subsidiaries.

Horace Mann cautions investors that such statements are subject to

risks and uncertainties, many of which are difficult to predict and

generally beyond Horace Mann’s control, that could cause actual

results to differ materially from those expressed in, or implied or

projected by, the forward-looking statements included in this

document. Certain important factors that could cause actual results

to differ, possibly materially, from expectations or estimates

reflected in such forward-looking statements can be found in the

“Risk Factors” and “Forward-Looking Information” sections included

in Horace Mann’s Annual Reports on Form 10-K and Quarterly Reports

on Form 10-Q filed with the Securities and Exchange Commission

(SEC). The forward-looking statements herein are subject to the

risk, among others, that we will be unable to execute our strategy

because of market or competitive conditions or other factors.

Horace Mann does not undertake to update any particular

forward-looking statement included in this document if we later

become aware that such statement is not likely to be achieved.

Information contained in this news release include measures

which are based on methodologies other than accounting principles

generally accepted in the United States of America (GAAP).

Reconciliations of non-GAAP measures to the closest GAAP measures

are contained in the Appendix to the Investor Supplement and

additional descriptions of the non-GAAP measures are contained in

the Glossary of Selected Terms included as an exhibit to Horace

Mann’s SEC filings.

HORACE MANN EDUCATORS

CORPORATION

Financial Highlights

(Unaudited)

($ in millions, except per share

data)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

% Change

2023

2022

% Change

Earnings Summary

Net income (loss)

$

39.5

$

(16.7

)

N.M.

$

45.0

$

19.8

127.3

%

Net investment gains (losses), after

tax

4.6

(10.0

)

N.M.

(18.8

)

(44.5

)

N.M.

Other expense - goodwill and intangible

asset impairments, after tax

—

(3.8

)

N.M.

—

(3.8

)

N.M.

Core earnings (loss)*

34.9

(2.9

)

N.M.

63.8

68.1

-6.3

%

Adjusted core earnings (loss)*

37.8

(1.5

)

N.M.

72.0

79.8

-9.8

%

Per diluted share:(1)

Net income (loss)

$

0.95

$

(0.40

)

N.M.

$

1.09

$

0.47

131.9

%

Net investment gains (losses), after

tax

0.11

(0.25

)

N.M.

(0.45

)

(1.07

)

N.M.

Other expense - goodwill and intangible

asset

impairments, after tax

—

(0.09

)

N.M.

—

(0.09

)

N.M.

Core earnings (loss)*

0.84

(0.06

)

N.M.

1.54

1.63

-5.5

%

Adjusted core earnings (loss)*

0.91

(0.04

)

N.M.

1.74

1.91

-8.9

%

Weighted average number of shares and

equivalent

shares (in millions) - Basic

41.3

41.4

-0.2

%

41.3

41.6

-0.7

%

Weighted average number of shares and

equivalent

shares (in millions) - Diluted

41.5

41.6

-0.2

%

41.4

41.8

-1.0

%

Return on Equity

Net income return on equity - LTM(2)

4.0

%

1.6

%

4.0

%

1.6

%

Net income return on equity -

annualized

14.2

%

(6.1

)%

Core return on equity - LTM*(3)

4.3

%

4.5

%

4.3

%

4.5

%

Core return on equity - annualized*

9.5

%

(0.8

)%

Adjusted core return on equity -

LTM*(4)

4.9

%

5.2

%

4.9

%

5.2

%

Adjusted core return on equity -

annualized*

10.3

%

(0.4

)%

Financial Position

Per share:(5)

Book value

$

28.78

$

26.85

7.2

%

Effect of net unrealized investment

(losses) on

fixed maturity securities

(8.04

)

(10.99

)

N.M.

Per share impact of net reserve

remeasurements attributable to discount

rates*

0.53

1.44

N.M.

Adjusted book value*

$

36.29

$

36.40

-0.3

%

Dividends paid

$

0.33

$

0.32

3.1

%

$

1.32

$

1.28

3.1

%

Ending number of shares outstanding (in

millions)(5)

40.8

40.9

-0.2

%

Total assets

$

14,045.5

$

13,306.1

5.6

%

Short-term debt

—

249.0

-100.0

%

Long-term debt

546.0

249.0

119.3

%

Total shareholders’ equity

1,175.3

1,098.3

7.0

%

N.M. - Not meaningful.

(1)

Calculated using basic shares when in a

net loss or core loss position.

(2)

Based on last twelve months net income and

average quarter-end shareholders’ equity.

(3)

Based on last twelve months core earnings

and average quarter-end shareholders’ equity which has been

adjusted to exclude the fair value adjustment for investments, net

of the related impact on deferred policy acquisition costs and

applicable deferred taxes.

(4)

Based on last twelve months adjusted core

earnings and average quarter-end shareholders’ equity which has

been adjusted to exclude the fair value adjustment for investments,

net of the related impact on deferred policy acquisition costs and

applicable deferred taxes.

(5)

Ending shares outstanding were 40,836,734

at December 31, 2023 and 40,904,312 at December 31, 2022.

HORACE MANN EDUCATORS

CORPORATION

Consolidated Statements of

Operations and Data (Unaudited)

($ in millions, except per share

data)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

Change

2023

2022

Change

Consolidated Statements of

Operations

Net premiums and contract charges

earned

$

274.5

$

259.1

5.9

%

$

1,057.1

$

1,027.7

2.9

%

Net investment income

117.0

100.2

16.8

%

444.8

400.9

11.0

%

Net investment gains (losses)

5.7

(12.7

)

N.M.

(24.0

)

(56.5

)

N.M.

Other income

5.7

(0.2

)

N.M.

14.0

9.5

47.4

%

Total revenues

402.9

346.4

16.3

%

1,491.9

1,381.6

8.0

%

Benefits, claims and settlement

expenses

181.5

201.3

-9.8

%

769.1

747.0

3.0

%

Interest credited

53.6

47.5

12.8

%

205.7

173.4

18.6

%

Operating expenses

82.5

86.1

-4.2

%

318.1

315.5

0.8

%

DAC amortization expense

25.8

22.5

14.7

%

101.2

88.2

14.7

%

Intangible asset amortization expense

3.7

4.2

-11.9

%

14.8

16.8

-11.9

%

Interest expense

8.6

5.9

45.8

%

29.7

19.4

53.1

%

Other expense - goodwill and intangible

asset impairments

—

4.8

N.M.

—

4.8

N.M.

Total benefits, losses and expenses

355.7

372.3

-4.5

%

1,438.6

1,365.1

5.4

%

Income (loss) before income taxes

47.2

(25.9

)

N.M.

53.3

16.5

N.M.

Income tax expense (benefit)

7.7

(9.2

)

N.M.

8.3

(3.3

)

N.M.

Net income (loss)

$

39.5

$

(16.7

)

N.M.

$

45.0

$

19.8

127.3

%

Net Premiums Written and Contract

Deposits*

Property & Casualty

$

176.0

$

153.5

14.7

%

$

684.4

$

617.5

10.8

%

Life & Retirement

140.5

136.8

2.7

%

573.3

544.8

5.2

%

Supplemental & Group Benefits

63.7

67.9

-6.2

%

259.8

274.7

-5.4

%

Total

$

380.2

$

358.2

6.1

%

$

1,517.5

$

1,437.0

5.6

%

Segment Net Income (Loss)

Property & Casualty

$

8.8

$

(25.0

)

135.2

%

$

(35.5

)

$

(44.4

)

20.0

%

Life & Retirement

19.2

6.7

186.6

%

71.5

63.8

12.1

%

Supplemental & Group Benefits

13.3

17.0

-21.8

%

54.9

65.9

-16.7

%

Corporate & Other(1)

(1.8

)

(15.4

)

88.3

%

(45.9

)

(65.5

)

29.9

%

Consolidated net income

$

39.5

$

(16.7

)

N.M.

$

45.0

$

19.8

127.3

%

Net investment losses

Before tax

$

5.7

$

(12.7

)

N.M.

$

(24.0

)

$

(56.5

)

N.M.

After tax

4.6

(10.0

)

N.M.

(18.8

)

(44.5

)

N.M.

Per share, diluted

$

0.11

$

(0.25

)

N.M.

$

(0.45

)

$

(1.07

)

N.M.

N.M. - Not meaningful.

(1)

Corporate & Other includes interest

expense on debt and the impact of net investment gains and losses

and other Corporate level items. The Company does not allocate the

impact of corporate level transactions to the insurance segments

consistent with how management evaluates the results of those

segments. See detail for this segment on page 11.

HORACE MANN EDUCATORS

CORPORATION

Business Segment Overview

(Unaudited)

($ in millions)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

% Change

2023

2022

% Change

Property & Casualty

Net premiums written*

$

176.0

$

153.5

14.7

%

$

684.4

$

617.5

10.8

%

Net premiums earned

171.5

155.7

10.1

%

645.6

608.2

6.1

%

Net investment income

11.3

8.5

32.9

%

37.9

31.4

20.7

%

Other income

0.5

0.7

-28.6

%

2.8

3.4

-17.6

%

Losses and loss adjustment expenses

(LAE)

127.0

153.5

-17.3

%

557.0

534.3

4.2

%

Operating expenses (includes

amortization

expense)

46.1

45.8

0.7

%

174.6

166.9

4.6

%

Loss before income taxes

10.2

(34.4

)

129.7

%

(45.3

)

(58.2

)

22.2

%

Net income (loss) / core income

(loss)*

8.8

(25.0

)

135.2

%

(35.5

)

(44.4

)

20.0

%

Net investment income, after tax

9.2

7.0

31.4

%

31.1

26.4

17.8

%

Catastrophe losses

After tax

3.9

9.8

-60.2

%

77.1

63.2

22.0

%

Before tax

5.0

12.4

-59.7

%

97.6

80.0

22.0

%

Prior years’ reserve development, before

tax(1)

Auto

—

14.0

N.M.

—

28.0

N.M.

Property and other

—

—

N.M.

—

(6.0

)

N.M.

Total

—

14.0

N.M.

—

22.0

N.M.

Operating statistics:

Loss and loss adjustment expense ratio

74.0

%

98.6

%

-24.6 pts

86.3

%

87.9

%

-1.6 pts

Expense ratio

26.9

%

29.4

%

-2.5 pts

27.0

%

27.4

%

-0.4 pts

Combined ratio

100.9

%

128.0

%

-27.1 pts

113.3

%

115.3

%

-2.0 pts

Effect on the combined ratio of:

Catastrophe losses

2.9

%

8.0

%

-5.1 pts

15.1

%

13.0

%

2.1 pts

Prior years’ reserve development(1)

—

%

9.0

%

-9.0 pts

—

%

3.6

%

-3.6 pts

Combined ratio excluding the effects

of

catastrophe losses and prior years’

reserve

development (underlying combined

ratio)*

98.0

%

111.0

%

-13.0 pts

98.2

%

98.7

%

-0.5 pts

Risks in force (in thousands)

526

538

-2.2

%

Auto(2)

358

367

-2.5

%

Property

168

171

-1.8

%

Household Retention - LTM

Auto(3)

86.3

%

87.0

%

-0.7 pts

Property(3)

90.3

%

89.6

%

0.7 pts

N.M. - Not meaningful.

(1)

(Favorable) unfavorable.

(2)

Includes assumed risks in force of 4.

(3)

Retention is based on retained households.

History has been restated to reflect this change.

HORACE MANN EDUCATORS

CORPORATION

Business Segment Overview

(Unaudited)

($ in millions)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

Change

2023

2022

Change

Life & Retirement

Net premiums written and contract

deposits*

$

140.5

$

136.8

2.7

%

$

573.3

$

544.8

5.2

%

Net premiums and contract charges

earned

38.4

35.1

9.4

%

151.7

144.0

5.3

%

Net investment income

95.8

84.3

13.6

%

369.9

338.3

9.3

%

Other income

4.9

3.6

36.1

%

17.0

17.0

—

%

Death benefits / mortality cost(1)

16.4

14.9

10.1

%

69.4

68.6

1.2

%

Interest credited

52.4

46.9

11.7

%

201.8

172.1

17.3

%

Change in reserves

15.8

15.5

1.9

%

53.8

52.9

1.7

%

Operating expenses

26.0

27.8

-6.5

%

98.7

102.4

-3.6

%

DAC amortization expense

6.2

5.9

5.1

%

28.1

23.0

22.2

%

Intangible asset amortization expense

—

0.3

-100.0

%

0.2

1.1

-81.8

%

Other expense - goodwill and intangible

asset impairments

—

4.8

N.M.

—

4.8

N.M.

Income before income taxes

22.3

6.9

N.M.

86.6

74.4

16.4

%

Income tax expense

3.1

0.2

N.M.

15.1

10.6

42.5

%

Net income

19.2

6.7

N.M.

71.5

63.8

12.1

%

Core earnings*

19.2

10.5

82.9

%

71.5

67.6

5.8

%

Adjusted core earnings*

19.2

8.8

118.2

%

68.2

66.9

1.9

%

Life policies in force (in thousands)

162

162

—

%

Life insurance in force

$

20,476

$

20,030

2.2

%

Lapse ratio - 12 months(1)

4.3

%

4.0

%

0.3 pts

Annuity contracts in force (in

thousands)

223

228

-2.2

%

Horace Mann Retirement Advantage®

contracts in

force (in thousands)

19

17

11.8

%

Total Persistency - LTM

91.5

%

93.7

%

-2.2 pts

N.M. - Not meaningful.

(1)

Ordinary life insurance.

HORACE MANN EDUCATORS

CORPORATION

Business Segment Overview

(Unaudited)

($ in millions)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

Change

2023

2022

Change

Supplemental & Group

Benefits

Net premiums and contract charges

earned

$

64.6

$

68.3

-5.4

%

$

259.8

$

275.5

-5.7

%

Net investment income

10.4

7.9

31.6

%

38.9

33.3

16.8

%

Other income

(2.9

)

(5.0

)

42.0

%

(11.1

)

(13.4

)

17.2

%

Benefits, settlement expenses and change

in reserves

22.3

17.4

28.2

%

88.9

91.2

-2.5

%

Interest credited

1.2

0.6

100.0

%

3.9

1.3

N.M.

Operating expenses (includes DAC

amortization expense)

28.2

27.2

3.7

%

110.5

103.2

7.1

%

Intangible asset amortization expense

3.7

3.9

-5.1

%

14.6

15.7

-7.0

%

Income before income taxes

16.7

22.1

-24.4

%

69.7

84.0

-17.0

%

Net income / core earnings*

13.3

17.0

-21.8

%

54.9

65.9

-16.7

%

Adjusted core earnings*

16.2

20.1

-19.4

%

66.4

78.3

-15.2

%

Benefit ratio(1)

36.2

%

26.2

%

10.0 pts

35.7

%

33.5

%

2.2 pts

Operating expense ratio(2)

39.1

%

38.4

%

0.7 pts

38.4

%

35.0

%

3.4 pts

Pretax profit margin(3)

23.3

%

30.9

%

-7.6 pts

24.3

%

28.5

%

-4.2 pts

Worksite Direct products benefit ratio

36.3

%

16.9

%

19.4 pts

29.1

%

23.0

%

6.1 pts

Worksite Direct premium persistency

(rolling 12 months)

91.4

%

90.4

%

1.0 pts

91.4

%

90.4

%

1.0 pts

Employer-sponsored products benefit

ratio

36.2

%

33.3

%

2.9 pts

41.4

%

41.8

%

-0.4 pts

N.M. - Not meaningful.

(1)

Ratio of benefits to net premiums

earned.

(2)

Ratio of operating expenses to total

revenues.

(3)

Ratio of income before taxes to total

revenues.

($ in millions)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

Change

2023

2022

Change

Corporate & Other(1)

Components of loss before tax:

Net investment gains (losses)

$

5.7

$

(12.7

)

N.M.

$

(24.0

)

$

(56.5

)

N.M.

Interest expense

(8.6

)

(5.9

)

-45.8

%

(29.7

)

(19.4

)

-53.1

%

Other operating expenses, net investment

income

and other income

0.9

(1.9

)

147.4

%

(4.0

)

(7.8

)

48.7

%

Loss before income taxes

(2.0

)

(20.5

)

90.2

%

(57.7

)

(83.7

)

31.1

%

Net loss

(1.8

)

(15.4

)

88.3

%

(45.9

)

(65.5

)

29.9

%

Core loss*

(6.4

)

(5.4

)

-18.5

%

(27.1

)

(21.0

)

-29.0

%

N.M. - Not meaningful.

(1)

The Corporate & Other segment includes

interest expense on debt and the impact of investment gains and

losses and other corporate level items. The Company does not

allocate the impact of corporate level transactions to the

insurance segments consistent with how management evaluates the

results of those segments

HORACE MANN EDUCATORS

CORPORATION

Business Segment Overview

(Unaudited)

($ in millions)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

% Change

2023

2022

% Change

Investments

Life & Retirement

Fixed maturity securities, at fair value

(amortized

cost, net 2023, $4,293.5; 2022,

$4,404.7)

$

3,960.3

$

3,960.1

—

%

Equity securities, at fair value

62.8

75.6

-16.9

%

Short-term investments

36.5

70.4

-48.2

%

Policy loans

140.5

138.4

1.5

%

Limited partnership interests

816.1

697.2

17.1

%

Other investments

86.7

62.0

39.8

%

Total Life & Retirement

investments

5,102.9

5,003.7

2.0

%

Property & Casualty

Fixed maturity securities, at fair value

(amortized

cost, net 2023, $659.6; 2022, $591.6)

640.8

551.3

16.2

%

Equity securities, at fair value

16.5

16.7

-1.2

%

Short-term investments

49.1

18.2

N.M.

Limited partnership interests

200.6

190.1

5.5

%

Other investments

1.0

1.0

—

%

Total Property & Casualty

investments

908.0

777.3

16.8

%

Supplemental & Group Benefits

Fixed maturity securities, at fair value

(amortized

cost, net 2023, $699.6; 2022, $760.4)

634.0

673.4

-5.9

%

Equity securities, at fair value

5.9

6.3

-6.3

%

Short-term investments

45.3

20.0

126.5

%

Policy loans

0.9

0.9

—

%

Limited partnership interests

122.1

96.4

26.7

%

Other investments

8.2

7.6

7.9

%

Total Supplemental & Group Benefits

investments

816.4

804.6

1.5

%

Corporate & Other

Fixed maturity securities, at fair value

(amortized

cost, net 2023, $0.2; 2022, $0.2)

0.2

0.2

—

%

Equity securities, at fair value

1.0

1.0

—

%

Short-term investments

2.0

0.8

150.0

%

Total Corporate & Other

investments

3.2

2.0

60.0

%

Total investments

$

6,830.5

$

6,587.6

3.7

%

Net investment income - investment

portfolio

Before tax

$

90.9

$

74.1

22.7

%

$

339.9

$

297.4

14.3

%

After tax

72.0

58.9

22.2

%

269.6

236.6

13.9

%

Investment income - deposit asset on

reinsurance

Before tax

$

26.1

26.1

—

%

$

104.9

103.5

1.4

%

After tax

20.7

20.6

0.5

%

82.9

81.7

1.5

%

N.M. - Not meaningful.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240207363192/en/

Heather J. Wietzel, Vice President, Investor Relations

217-788-5144 | investorrelations@horacemann.com

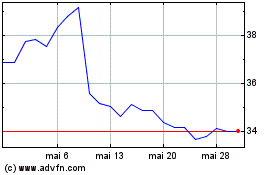

Horace Mann Educators (NYSE:HMN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Horace Mann Educators (NYSE:HMN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025